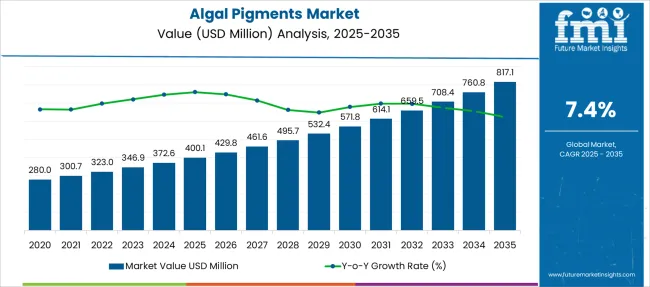

The Algal Pigments Market is estimated to be valued at USD 400.1 million in 2025 and is projected to reach USD 817.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Algal Pigments Market Estimated Value in (2025 E) | USD 400.1 million |

| Algal Pigments Market Forecast Value in (2035 F) | USD 817.1 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

The algal pigments market is gaining significant traction owing to the rising demand for natural and sustainable colorants across the food, cosmetic, and pharmaceutical industries. Algal pigments are increasingly preferred as safe alternatives to synthetic dyes, driven by shifting consumer preferences toward clean-label and plant-based ingredients.

Stringent regulations on artificial additives and the global push toward environmentally friendly solutions have further accelerated market adoption. Technological advancements in microalgae cultivation, extraction techniques, and scalability have enhanced product availability and cost-efficiency.

The future outlook remains positive as manufacturers explore diverse applications, ranging from functional foods and dietary supplements to biotechnological and biomedical uses. The market is expected to benefit from continuous research investments and expanding end-user awareness regarding the health benefits of algal-derived compounds.

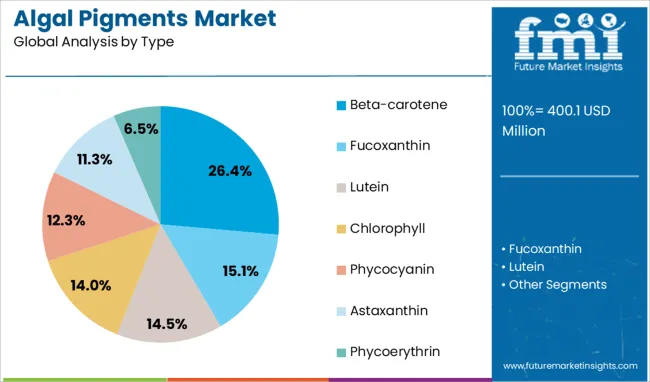

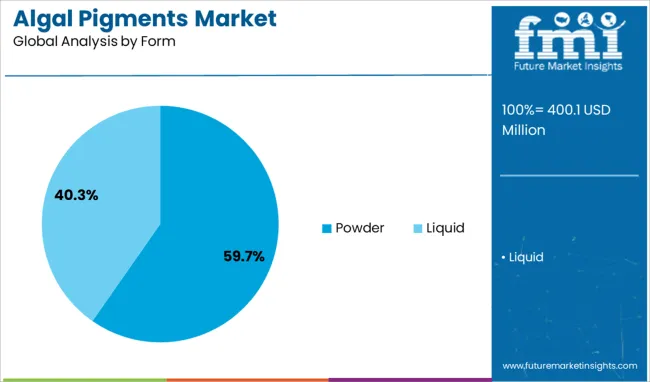

The algal pigments market is segmented by type, form, source, application and geographic regions. The algal pigments market is divided by type into Beta-carotene, Fucoxanthin, Lutein, Chlorophyll, Phycocyanin, Astaxanthin, and Phycoerythrin. In terms of the form of the algal pigments, the market is classified into Powder and Liquid.

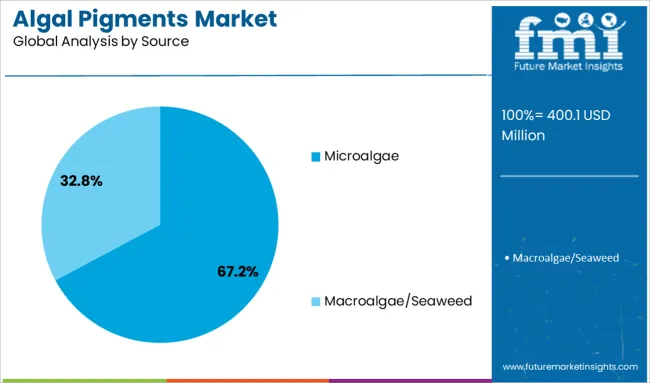

Based on the source of the algal pigments, the market is segmented into Microalgae and Macroalgae/Seaweed. By application of the algal pigments, the market is segmented into Food & Beverages, Pharmaceuticals, Cosmetics, Aquaculture, Nutraceuticals, and Others. Regionally, the algal pigments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The beta-carotene segment accounted for 26.4% of the algal pigments market by type, reflecting strong demand for its dual role as a natural colorant and provitamin A source. Beta-carotene derived from algae is increasingly utilized in nutraceuticals, beverages, and cosmetics due to its antioxidant properties and health-enhancing benefits.

Regulatory support for natural additives and the preference for plant-based alternatives have bolstered its commercial usage. This segment has also benefited from improved extraction efficiency and the stable performance of algal beta-carotene under various processing conditions.

Growing awareness of beta-carotene's role in eye health and immune function is driving its inclusion in fortified products. The segment is expected to witness steady growth as brands continue replacing synthetic carotenoids with algal-based sources for cleaner labeling and improved market appeal.

The powder form dominates the algal pigments market with a 59.7% share, primarily due to its high stability, longer shelf life, and ease of incorporation into diverse formulations. Powdered algal pigments are widely used in processed foods, beverages, and dietary supplements, where uniform blending and controlled dosing are critical.

This format is favored by manufacturers for its reduced transportation costs, compact storage, and compatibility with dry mixes. Technological enhancements in spray drying and encapsulation have further improved pigment quality and bioavailability in powdered form.

Market growth for this segment is being driven by expanding applications in functional foods and personalized nutrition solutions. The adaptability and cost-effectiveness of powdered algal pigments are expected to support continued dominance in commercial and industrial uses.

Microalgae hold a commanding 67.2% share in the algal pigments market by source, highlighting their versatility, high yield potential, and richness in bioactive compounds. Microalgae are the preferred source due to their rapid growth cycles, controlled cultivation conditions, and minimal land and water requirements compared to traditional agricultural sources.

The ability to produce a wide spectrum of pigments, including beta-carotene, astaxanthin, and phycocyanin, underpins their market leadership. Innovations in photobioreactor technology and downstream processing have further enhanced microalgal productivity and pigment purity.

As sustainability and traceability become key procurement criteria, microalgae offer an eco-friendly and scalable solution for natural pigment production. This segment is poised for sustained expansion as industries increasingly prioritize renewable and non-GMO sources in product development.

The algal pigments market is expanding steadily due to growing adoption in food, dietary supplements, cosmetics, and pharmaceuticals. Natural pigments like beta‑carotene, astaxanthin, phycocyanin, and chlorophyll are in demand for their vibrant hues and functional benefits. Adoption is supported by regulatory shifts against synthetic dyes, improvements in cultivation and extraction methods, and rising acceptance in color and wellness applications across regions.

Regulatory oversight of color additives is tightening in key markets, making approval processes more rigorous and resource‑intensive for producers. Authorities like the USA FDA and European agencies now mandate comprehensive safety data, purity verification, and traceability for natural food and cosmetic colorants. These requirements can delay product launches significantly, especially for newer pigment types such as phycocyanin or phycoerythrin. Companies must invest in toxicology studies, stability testing, and documentation to secure approvals. For smaller producers or startups particularly in India or emerging economies these barriers raise entry costs and may limit participation. In cosmetics or nutraceutical applications, standards differ by region, requiring localized compliance efforts. As a result, companies must navigate overlapping jurisdictional demands while managing the expense and complexity of diverse testing protocols.

Demand is rising for naturally derived pigments that deliver both color and potential health benefits. Ingredients such as astaxanthin and phycocyanin offer antioxidant, anti‑inflammatory, or immune‑supportive effects attractive to dietary supplement, beverage, and skincare formulators. This dual functionality opens new partnerships with food and cosmetics brands seeking shelf‑stable, visually appealing additives with added value. Fast growth is expected in the nutraceutical segment, projected to hold over one‑third of the total market value in 2025. Asia Pacific presents a particularly strong opportunity, with rapidly growing market demand and increasing production capacity. Producers able to deliver high‑purity, well‑tested algal pigments stand to gain traction across multiple industry channels, particularly in premium or clean‑label oriented brands.

Innovations in algae cultivation and extraction methods are reshaping production economics. Techniques such as closed photobioreactors, precision fermentation, and ultrasonic or supercritical fluid extraction enable higher yields, greater pigment purity, and consistent quality, even outside traditional open‑pond systems. Genetic strain improvement and process monitoring systems now permit year‑round operations with fewer contaminants. These methods reduce reliance on seasonal algae growth cycles and lower downstream processing costs. Companies adopting such platforms can supply pigments at scale, improving margins and reliability. This is particularly important for sensitive pigments like phycocyanin or phycoerythrin, which require controlled conditions to maintain stability. Broader uptake of these technologies supports market expansion, provided investment and process expertise are available.

The expense of producing algal pigments remains a major constraint especially for high‑value pigments. Infrastructure for controlled algae growth (e.g., photobioreactors), nutrient inputs, and downstream extraction equipment requires substantial investment. Energy and labor overheads further raise unit costs compared to synthetic colorants. In regions like India or Latin America, production cost sensitivity limits industrial scale unless offset by premium pricing. Meanwhile, smaller-form pigments like phycocyanin exhibit rapid growth potential but require stringent purity protocols that add to production complexity. These cost pressures restrict price competitiveness in lower-margin food and fabric dye applications. Suppliers must balance investment in efficiency improvements with the ability to offer competitive pricing across various market segments

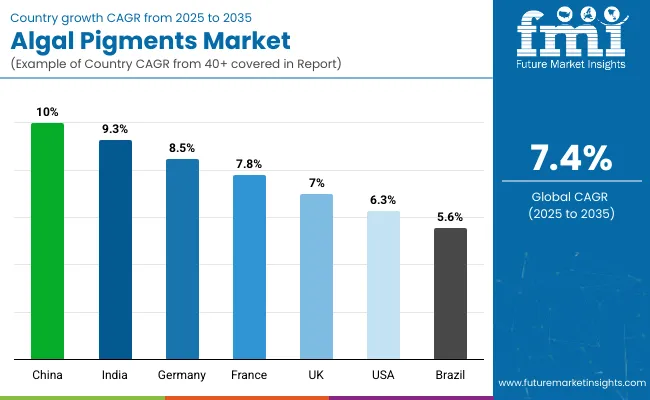

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The global algal pigments market is projected to grow at a CAGR of 7.4% through 2035, supported by rising demand in food colorants, cosmetics, and nutraceuticals. Among BRICS nations, China leads with 10.0% growth, driven by large-scale cultivation of microalgae and pigment extraction for domestic and export use. India follows at 9.3%, where academic research and production clusters have supported commercial pigment output. In the OECD region, Germany reports 8.5% growth, aided by established biotech infrastructure and demand from food-grade ingredient manufacturers.

France, growing at 7.8%, has maintained steady use in skincare formulations and dietary supplements. The United Kingdom, at 7.0%, reflects ongoing incorporation into functional foods, beverages, and personal care products. Market progress has been shaped by extraction method regulations, labeling requirements, and concentration guidelines. This report includes insights on 40+ countries; the top five markets are shown here for reference.

A CAGR of 10.0% has been recorded in China for algal pigments, supported by increased deployment in food coloring, cosmetics, and nutraceutical applications. Production zones have broadened cultivation and extraction capacity for high-yield microalgae strains.

Food processors have relied on beta-carotene and phycocyanin derived from algae for clean-label product formulations. Cosmetic firms have integrated algal-based colors in skincare and makeup ranges due to improved product stability. Dietary supplement producers have sourced algae pigments for antioxidant blends and immunity-focused products.

Exports of pigment concentrates have expanded through dedicated supply clusters. Consistent investments have been seen in closed-system cultivation to ensure purity and color density. Regional manufacturers have scaled filtration and drying operations for higher throughput. Adoption in beverages and dairy alternatives has also contributed to elevated pigment demand.

In India, the algal pigments market has grown at a 9.3% CAGR, with strong traction across functional foods, herbal supplements, and dairy products. Local cultivators have expanded open-pond and photobioreactor systems to boost spirulina and chlorella output. Food manufacturers have selected algal extracts for non-synthetic coloring in bakery and confectionery segments. Ayurvedic product makers have included natural pigments in immunity tonics and herbal tablets.

Startups in health beverages have preferred phycocyanin for its solubility and color intensity. Regulatory acceptance of natural colors has promoted wider use in children’s foods and organic labels. Pigment processors have optimized filtration and stabilization for local climate conditions. Trade bodies have facilitated pigment export to neighboring regions. Packaged food producers have preferred algae-derived hues for ready-to-drink categories and dairy substitutes.

Germany has achieved a 8.5% CAGR in the algal pigments sector, where growth has been observed in clean-label formulations, personal care blends, and functional confectionery. Producers have incorporated pigments in oral supplements and wellness-focused gummies. Cosmetic companies have turned to algae for pigment-rich, stable formulations used in cruelty-free skincare. Beverage manufacturers have adopted algal colors to meet non-synthetic branding requirements.

Stringent ingredient standards have led to the sourcing of purified extracts, particularly for child-safe formulations. Specialized contract processors have enhanced spray-drying and encapsulation techniques to protect pigment integrity. Bakery manufacturers have introduced algae-based pigments in frostings and fillings. Industry clusters have promoted pigment R&D through collaborative pilot programs. Enhanced traceability protocols have been integrated across the pigment supply chain to ensure quality and uniformity.

France has recorded a CAGR of 7.8% in the algal pigments market, with demand led by organic product ranges, health-oriented supplements, and sustainable cosmetics. Nutrition firms have incorporated algae pigments in ready-to-consume energy blends. Algae-based colorants have been utilized by skincare manufacturers looking for plant-derived alternatives. Artisanal food producers have explored natural pigments for gourmet applications like macarons and plant-based cheeses.

Distribution of pigment concentrates has increased across organic retail networks. Supplement manufacturers have added algae derivatives to vitamin mixes and antioxidant capsules. Local pigment blenders have optimized blends to comply with food-grade purity standards. Bakery and dessert firms have selected chlorophyll-based pigments for seasonal and themed products. Stable color retention and ease of blending have made algae pigments an attractive choice for formulators.

The United Kingdom has experienced a CAGR of 7.0% in algal pigments, driven by increased use in beverage enhancers, specialty food items, and sustainable packaging inks. Algal-derived colors have been adopted by producers of functional waters and sports drinks. Specialty chocolate and snack makers have used pigments to meet clean-ingredient expectations. Print and labeling companies have sourced algae-based inks for edible packaging solutions.

Natural pigment blends have been integrated into superfood powders and capsule formulations. Regional importers have worked with European pigment refiners to ensure steady availability of high-intensity extracts. Local formulators have developed multi-use pigments suitable for both edible and cosmetic use. The demand has also grown among vegan-friendly brands seeking cruelty-free, plant-based pigment alternatives. Blends with high solubility and consistency have been prioritized.

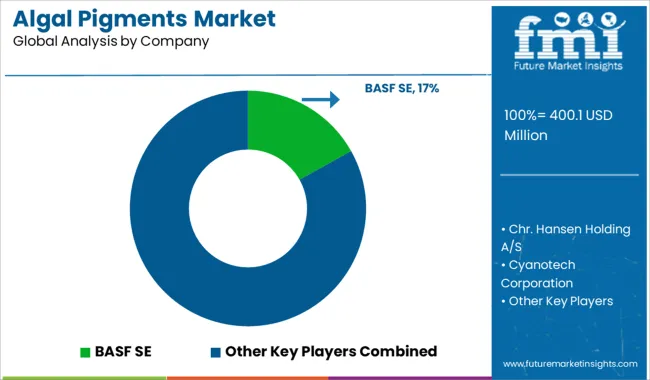

The single-mode optical fiber market is driven by key global manufacturers offering high-performance fiber solutions for telecommunications, data centers, and broadband infrastructure. Corning stands as a dominant player, known for its The algal pigments market is led by a combination of global life sciences companies and specialized producers that extract high-value pigments such as astaxanthin, phycocyanin, and beta-carotene from microalgae and cyanobacteria for use in food, cosmetics, nutraceuticals, and feed industries.

BASF SE holds a prominent position through its advanced capabilities in natural colorants and nutritional ingredients, supplying high-purity algal pigments suited for dietary supplements and functional foods. Chr. Hansen Holding A/S is another major player, offering food-grade microalgae-based pigments used in beverages, dairy, and confectionery applications, known for their safety and stability profiles.

Cyanotech Corporation specializes in the cultivation of Spirulina and Haematococcus pluvialis in Hawaii, producing premium astaxanthin and phycocyanin for health and wellness sectors. DDW The Color House and Sensient Technologies Corporation are key suppliers of natural color solutions, leveraging algal pigments for clean-label and plant-based product formulations in the food and beverage industry.

DIC Corporation and Naturex (part of Givaudan) also contribute with scalable extraction processes and pigment formulations optimized for high tinting strength and application versatility. In India, E.I.D. - Parry (India) Limited is recognized for its microalgae production expertise, especially in natural beta-carotene, while FMC Corporation and Döhler GmbH supply algae-derived pigments focused on both nutritional and functional coloration. These suppliers are expanding capacity and refining cultivation and extraction technologies to meet the growing demand for safe, sustainable, and natural color alternatives across regulated markets.

In January 2025, Algaia S.A. launched a new line of enhanced-stability algal pigments designed for beverage applications. The pigments meet clean-label and regulatory standards while offering improved performance. This innovation was confirmed in a March 2025 Meticulous Research® press release via PR Newswire.

| Item | Value |

|---|---|

| Quantitative Units | USD 400.1 Million |

| Type | Beta-carotene, Fucoxanthin, Lutein, Chlorophyll, Phycocyanin, Astaxanthin, and Phycoerythrin |

| Form | Powder and Liquid |

| Source | Microalgae and Macroalgae/Seaweed |

| Application | Food & Beverages, Pharmaceuticals, Cosmetics, Aquaculture, Nutraceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Chr. Hansen Holding A/S, Cyanotech Corporation, DDW The Color House, DIC Corporation, E.I.D. - Parry (India) Limited, Naturex (part of Givaudan), Sensient Technologies Corporation, FMC Corporation, and Döhler GmbH |

| Additional Attributes | Dollar sales by algal pigment type including beta-carotene, astaxanthin, fucoxanthin, and phycocyanin, by application in food, nutraceuticals, cosmetics, and aquaculture, and by region; demand driven by clean-label trends and natural colorant use; innovation in bio-extraction and algae cultivation; costs tied to production scalability; emerging uses in textiles and pharmaceuticals. |

The global algal pigments market is estimated to be valued at USD 400.1 million in 2025.

The market size for the algal pigments market is projected to reach USD 817.1 million by 2035.

The algal pigments market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in algal pigments market are beta-carotene, fucoxanthin, lutein, chlorophyll, phycocyanin, astaxanthin and phycoerythrin.

In terms of form, powder segment to command 59.7% share in the algal pigments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Algal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algal Proteins Market

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Ultramarine Pigments Market

Quinacridone Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phosphorescent Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phthalocyanine Pigments Market

Algae-Based Eco-Pigments Market Size and Share Forecast Outlook 2025 to 2035

Bio-Luminescent Pigments Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA