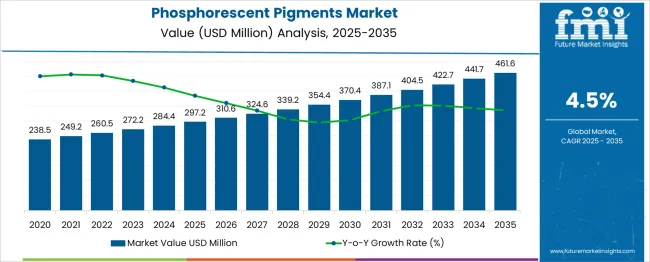

The Phosphorescent Pigments Market is estimated to be valued at USD 297.2 million in 2025 and is projected to reach USD 461.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The CAGR highlights a stable yet strong growth trajectory supported by increasing demand across safety signage, consumer goods, and specialty coatings. From 2025 to 2030, the market moves from USD 297.2 million to approximately USD 378 million, contributing nearly USD 80 million, driven by stringent safety regulations requiring glow-in-the-dark materials for emergency exits, road markings, and low-light environments. Yearly gains during this phase remain steady, averaging 4.3–4.6%, with industrial applications and novelty products driving incremental demand.

The second half (2030–2035) accelerates slightly, adding USD 83 million to reach USD 461.2 million, as phosphorescent pigments see wider adoption in architectural coatings, apparel, and consumer electronics for aesthetic and functional purposes. Market dynamics will favor companies innovating strontium aluminate-based pigments offering higher brightness and longer afterglow, as well as eco-compliant, heavy-metal-free formulations. With consistent CAGR-driven growth across both developed and emerging markets, the industry positions itself as a key enabler for enhanced visibility, product differentiation, and compliance in diverse end-use sectors.

| etric | Value |

|---|---|

| Phosphorescent Pigments Market Estimated Value in (2025 E) | USD 297.2 million |

| Phosphorescent Pigments Market Forecast Value in (2035 F) | USD 461.6 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The phosphorescent pigments market holds a modest but well-defined role across its parent markets. Within the specialty pigments market, it constitutes around 1–2%, reflecting strong competition from fluorescent, metallic, and pearlescent pigment types widely used in coatings and plastics. In the functional coatings & inks market, phosphorescent pigments contribute approximately 2–3%, mainly through niche glow‑in‑the‑dark inks, safety paints, and printed materials. Within the safety & signage materials market, its share rises to about 8–10%, as glow pigments are critical for exit signage, pathway marking, and emergency wayfinding applications.

In the consumer goods & novelty products market, phosphorescent pigments represent roughly 3–4%, serving a niche in toys, novelty items, and decorative paints where visual glow effects are desired. Within the industrial marking & illuminated surfaces market, including applications like warehouse aisle indicators and nighttime outdoor visuals, their contribution is near 5–6%. Market growth is driven by demand for safety-rated materials and novel visual effects. With rising interest in long-duration glow formulations and high-luminance pigments like strontium aluminate, phosphorescent pigments continue to underpin specialized lighting and marking products across industrial and consumer arenas.

The phosphorescent pigments market is witnessing robust demand due to growing applications in safety, decorative, and functional product categories. Industries such as paints and coatings, plastics, and textiles are increasingly integrating these pigments to enhance visibility, aesthetic appeal, and product utility in low-light or dark environments.

Advancements in pigment stability, brightness, and recharge cycles are improving their adoption across end-user verticals, especially in energy-efficient and low-maintenance applications. Global regulations on safety signage and nighttime visibility have encouraged manufacturers to incorporate long-lasting glow materials into infrastructure and consumer goods.

With increasing focus on non-toxic and eco-safe materials, particularly in construction and consumer products, the market is expected to expand further through product innovation and regulatory alignment.

The phosphorescent pigments market is segmented by product, end-user, and geographic regions. The phosphorescent pigments market is divided into Strontium aluminate and Zinc sulfide. In terms of end-users, the phosphorescent pigments market is classified into Paints & coatings, Printing inks, Plastics, Construction materials, and Others. Regionally, the phosphorescent pigments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

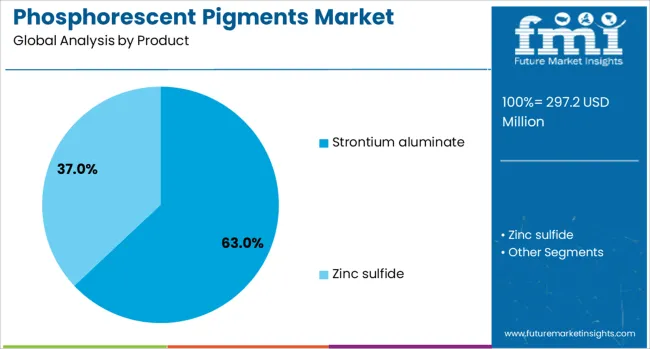

Strontium aluminate is projected to account for 63.00% of the global phosphorescent pigments market in 2025, making it the leading product segment. Its dominance has been driven by superior afterglow duration, brightness intensity, and thermal stability compared to traditional zinc sulfide pigments.

The non-radioactive and non-toxic nature of strontium aluminate makes it well-suited for widespread use in consumer-facing products, safety markings, and architectural applications. Its ability to charge quickly under various light sources and retain glow properties over extended periods has enabled its preference across regulatory-compliant and performance-driven markets.

Manufacturers are increasingly investing in microencapsulation and dispersion technologies to enhance the integration of strontium aluminate in diverse matrices.

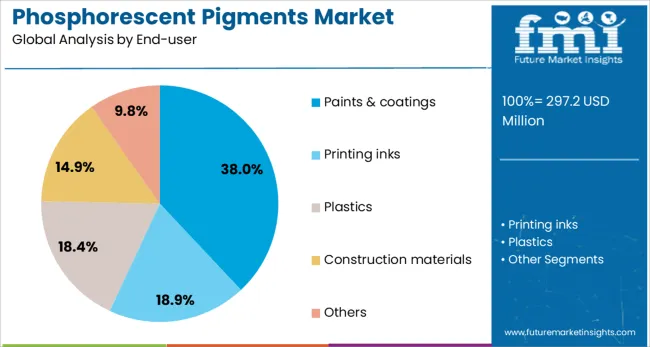

The paints & coatings industry is expected to capture 38.00% of the phosphorescent pigments market revenue in 2025, making it the dominant end-user segment. This growth is supported by increased demand for high-visibility markings in civil infrastructure, road safety, and industrial settings.

Architectural coatings are also incorporating phosphorescent pigments for both decorative and safety purposes, especially in emergency exits, stairways, and low-light pathways. Innovations in water-based and UV-resistant paint formulations have enhanced compatibility with phosphorescent materials, driving their uptake.

Additionally, the trend towards smart and functional coatings in urban development and public infrastructure has further expanded the use cases for glow-in-the-dark pigment-infused paints.

Phosphorescent pigments such as strontium aluminate and zinc sulfide are widely incorporated into safety signage, decorative coatings, textiles, and luminescent consumer goods due to their capacity to glow in low-light conditions. Demand has been reinforced by regulations requiring high-visibility materials in emergency, industrial, and infrastructure applications. Manufacturers have focused on enhancing brightness, afterglow duration, and formulation purity. Product development now emphasizes eco-friendly photoluminescent compounds, improved durability, and compatibility with diverse substrates. Growth in decorative and safety sectors, coupled with technological innovation in pigment chemistry and applications, continues to expand usage across industrial and consumer domains.

Adoption of phosphorescent pigments has been accelerated by growing mandates for high-visibility and safety-compliant coatings in public infrastructure, emergency pathways, signage, and industrial environments. Demand for glow-in-the-dark materials that retain luminosity for hours after activation has increased, especially in safety-critical installations. Technological advances in pigment chemistry, particularly the adoption of strontium aluminate-based luminescent compounds, have delivered brightness and persistence that outperform legacy zinc sulfide formulas, driving preference for modern formulations. Applications in decorative and consumer sectors, including watches, textiles, and novelty products, have also supported adoption. Growing awareness of photoluminescent technologies and expanding specification requirements are reinforcing demand worldwide

Expansion has been constrained by elevated production costs associated with high-grade phosphorescent pigments, particularly those based on rare-earth-doped strontium aluminate, which require specialized synthesis and quality control protocols. Lower-cost zinc sulfide variants remain in decline due to inferior performance, but continue to attract interest where cost sensitivity dominates. Limited awareness of phosphorescent pigment benefits in certain regions and industries has hindered application. Recycling or reuse of coated substrates poses challenges, raising lifecycle cost concerns for asset owners. Regulatory scrutiny over heavy-metal dopants and pigment safety also requires additional compliance testing and certification processes, increasing time-to-market and reducing accessibility in some applications.

Significant expansion opportunities exist in decorative consumer products such as glow-in-the-dark paints, fashion textiles, and novelty goods, where visual appeal and functional lighting effects drive differentiation. Growth in emergency escape signage, pathway marking in aviation, rail, and maritime sectors presents recurring demand for durable phosphorescent coatings. Collaboration with textile and polymer manufacturers for pigmentation of flexible substrates creates new application zones. Development of water-based or solvent-free phosphorescent systems is gaining relevance among environmentally conscious end-users. Demand for custom color variants and tailored afterglow durations presents an opportunity for pigment providers. Emerging markets undergoing infrastructure modernization offer new regions for the adoption of safety-compliant luminescent coatings

Recent trends include the adoption of longer-lasting strontium aluminate pigments doped with europium and dysprosium to deliver sustained brightness under low-light exposure. Blending of phosphorescent with fluorescent or reflective pigments is being used to optimize dual-mode visibility in both daylight and darkness. Research into microencapsulation and nanoparticle-enabled pigment dispersion is improving compatibility with coatings, plastics, and textiles. Integration of photoluminescent materials into smart applications such as sensors, wearables, and responsive signage is emerging. Advances in eco-friendly manufacturing, including solventless and low-energy synthesis routes, are encouraging adoption within regulated sectors. Cross-industry partnerships between pigment suppliers and fabricators are supporting tailored solutions for medical, safety, and aesthetic uses

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

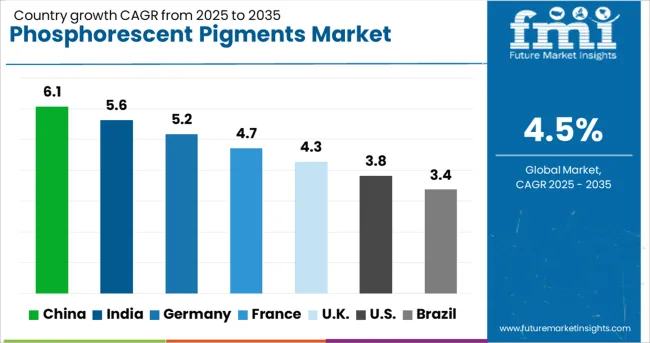

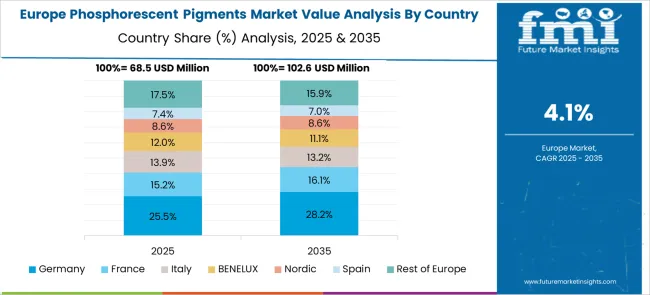

The phosphorescent pigments market is projected to grow at a CAGR of 4.5% through 2035, supported by rising demand in safety signage, emergency guidance systems, specialty coatings, and consumer novelty products. China leads with 6.1%, fueled by infrastructure mandates and export-led industrial use. India follows at 5.6%, driven by safety and architectural applications in growing commercial and public sectors. Among developed markets, France records 4.7%, while the UK posts 4.3%, both reflecting strict regulatory standards and steady demand in infrastructure and heritage projects. The United States grows at 3.8%, influenced by performance coatings, entertainment applications, and compliance-driven safety signage. The analysis covers more than 40 countries, with the top five highlighted below.

China is projected to grow at a 6.1% CAGR through 2035, driven by mandatory safety signage regulations in industrial and public buildings. Large infrastructure projects require photoluminescent materials for emergency pathways and hazard indicators. Domestic manufacturers are scaling up production of strontium-aluminate pigments offering extended afterglow and enhanced brightness. Decorative applications in architectural coatings, entertainment venues, and urban landscaping are gaining momentum. Technology upgrades focus on improving weather resistance and minimizing brightness decay for outdoor environments. Export opportunities remain strong, with China emerging as a major supplier to Southeast Asia and Africa, driven by cost-efficiency and performance standards. Strategic partnerships with global firms enable technology transfers and support for premium-grade pigment lines.

India is expected to register a CAGR of 5.6% through 2035, propelled by urban infrastructure upgrades and regulatory measures mandating safety signage in commercial complexes and public spaces. Demand is expanding in entertainment, hospitality, and decorative sectors through luminous paints and novelty products. Local manufacturers are focusing on zinc sulfide and strontium aluminate formulations to address both cost-sensitive and premium markets. Emphasis on brightness duration and moisture resistance supports performance under India’s varied climatic conditions. Rapid growth in the e-commerce segment for glow-based consumer goods and art applications further reinforces adoption. Strategic collaborations with coating manufacturers are facilitating integration of phosphorescent pigments into architectural paints, decorative panels, and industrial markings.

France is expected to register a CAGR of 4.7% through 2035, driven by strict building safety norms requiring photoluminescent exit signage and evacuation pathways in public and commercial spaces. The preference for high-performance strontium aluminate pigments aligns with European EN standards, ensuring extended brightness and superior durability. Adoption extends to decorative and architectural applications, including façade coatings and interior finishes for premium spaces. Domestic and European suppliers are investing in UV-stable pigment formulations to improve longevity in outdoor conditions. Demand for glow-based design elements in hospitality and experiential retail environments adds a creative dimension to the market. Public infrastructure modernization and compliance requirements are sustaining steady growth, while niche applications in theme parks and public art projects enhance market diversity.

The United Kingdom is projected to achieve a CAGR of 4.3% through 2035, supported by fire safety regulations requiring glow signage in commercial buildings, heritage structures, and transportation systems. Decorative applications are expanding in luxury interiors, art installations, and entertainment venues. Manufacturers are introducing eco-friendly phosphorescent pigments with high afterglow intensity suitable for solvent- and water-based coatings. Integration of these pigments in modular flooring systems, wall panels, and safety strips is gaining attention in urban design projects. Public and private sector partnerships for infrastructure safety upgrades are further driving demand. Emphasis on aesthetic versatility and compliance standards ensures that premium pigment grades remain a core focus for British suppliers.

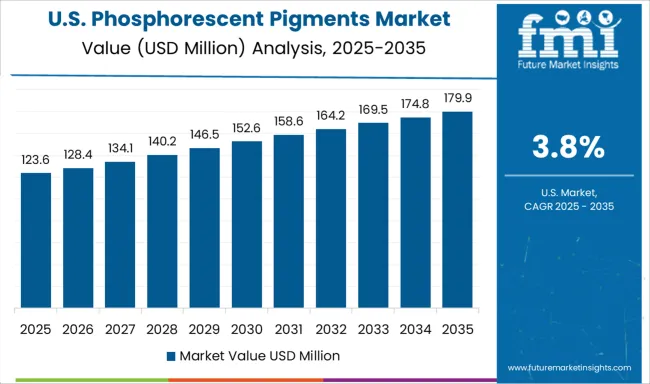

The United States is forecasted to grow at 3.8% CAGR through 2035, driven by compliance with NFPA and OSHA safety regulations mandating photoluminescent exit signs in commercial and industrial facilities. The entertainment industry including theme parks, theaters, and event spaces remains a significant consumer of glow pigments. Manufacturers are focusing on advanced encapsulation techniques to improve pigment stability against moisture and abrasion, essential for outdoor installations. Growth in smart home décor and creative DIY markets contributes to niche demand for pigment-infused paints and resin products. Partnerships between pigment suppliers and coating manufacturers are enabling the development of products that combine performance with design flexibility, supporting applications across safety-critical and decorative segments.

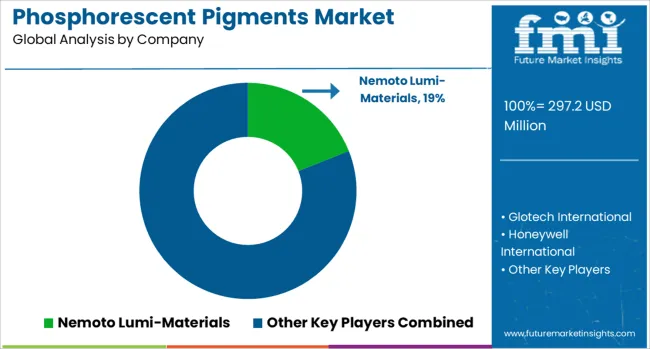

The phosphorescent pigments market is dominated by global and regional companies offering advanced luminescent materials for applications in safety signage, paints and coatings, plastics, textiles, and specialty consumer goods. Nemoto Lumi-Materials leads the market with a comprehensive portfolio of rare-earth doped pigments, widely used in high-performance glow-in-the-dark products. Glotech International and LuminoChem Ltd. specialize in long-duration glow pigments tailored for industrial coatings and decorative applications. Honeywell International leverages its expertise in specialty chemicals to provide phosphorescent materials with enhanced thermal stability and brightness retention. Radiant Color and United Mineral & Chemical Corp. focus on pigments for automotive and industrial coatings, while Tavco Chemicals and Next Generation offer cost-effective solutions targeting signage and consumer applications.

GloNation, Glow Inc., and Allureglow International cater to niche markets for novelty items, sports equipment, and emergency lighting. RTP Company integrates phosphorescent pigments into polymer compounds for plastics, whereas RC Tritec serves the watch and luxury segment with premium-grade luminescent materials. Asian suppliers such as Lightleader and GTA emphasize competitive pricing and high-volume production for global distribution. Competitive differentiation relies on glow intensity, duration, weather resistance, and compliance with safety regulations such as ASTM and EN standards. Barriers to entry include raw material purity, proprietary processing technology, and performance consistency. Strategic priorities include improving pigment particle engineering for longer afterglow, developing eco-friendly formulations free from radioactive elements, and expanding applications in smart materials and energy-efficient signage systems.

Key strategies in the phosphorescent pigments sector focus on diversifying applications across safety signage, consumer goods, and automotive components to enhance market penetration. Manufacturers are prioritizing R&D to improve pigment brightness, color stability, and extended afterglow properties. Strategic partnerships with coating and plastic producers are being adopted to integrate pigments into functional and decorative products.

Expansion into emerging economies through localized production facilities is emphasized to reduce costs and meet regional demand. Companies are also investing in environmentally compliant formulations and performance testing for regulatory adherence. Product differentiation through custom particle sizes and advanced encapsulation technologies is becoming a competitive priority.

| Item | Value |

|---|---|

| Quantitative Units | USD 297.2 Million |

| Product | Strontium aluminate and Zinc sulfide |

| End-user | Paints & coatings, Printing inks, Plastics, Construction materials, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nemoto Lumi-Materials, Glotech International, Honeywell International, LuminoChem Ltd., Radiant Color, United Mineral, Chemical Corp., Next Generation, Tavco Chemicals, GloNation, GTA, RTP Company, RC Tritec, Glow Inc., Lightleader, and Allureglow International |

| Additional Attributes | Dollar sales by pigment type (strontium aluminate, zinc sulfide) and application (paints and coatings, plastics, construction materials, textiles). Demand dynamics are driven by increasing use in safety signage, architectural coatings, and consumer goods requiring night visibility. Regional trends highlight Asia-Pacific as a key production hub, while North America and Europe lead in regulatory-compliant high-performance pigments for industrial and safety-critical uses. Innovation focuses on enhanced brightness pigments, nano-engineered particles for improved dispersion in coatings and plastics, and hybrid pigments with multi-color afterglow capabilities. Environmental priorities center on non-toxic, heavy-metal-free formulations and low-energy manufacturing processes for sustainable pigment production. |

The global phosphorescent pigments market is estimated to be valued at USD 297.2 million in 2025.

The market size for the phosphorescent pigments market is projected to reach USD 461.6 million by 2035.

The phosphorescent pigments market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in phosphorescent pigments market are strontium aluminate and zinc sulfide.

In terms of end-user, paints & coatings segment to command 38.0% share in the phosphorescent pigments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Ultramarine Pigments Market

Quinacridone Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phthalocyanine Pigments Market

Algae-Based Eco-Pigments Market Size and Share Forecast Outlook 2025 to 2035

Bio-Luminescent Pigments Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA