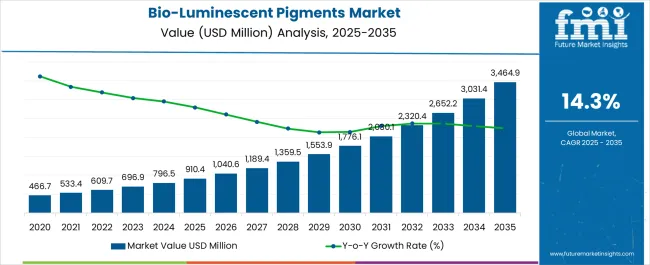

The global bio-luminescent pigments market is projected to grow from USD 910.4 million in 2025 to approximately USD 3,464.9 million by 2035, recording an absolute increase of USD 2,540.98 million over the forecast period. This translates into a total growth of 279.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 14.3% between 2025 and 2035. The overall market size is expected to grow by nearly 3.8X during the same period, supported by the rising adoption of sustainable beauty solutions and increasing demand for innovative cosmetic applications.

Between 2025 and 2030, the Bio-Luminescent Pigments market is projected to expand from USD 909.82 million to USD 1,772.5 million, resulting in a value increase of USD 862.68 million, which represents 34.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of sustainable beauty technologies, increasing consumer demand for innovative cosmetic solutions, and growing awareness about the benefits of bio-based pigments. Manufacturers are expanding their production capabilities to address the growing complexity of bio-luminescent formulation requirements.

From 2030 to 2035, the market is forecast to grow from USD 1,772.5 million to USD 3,450.8 million, adding another USD 1,678.3 million, which constitutes 66.0% of the overall ten-year expansion. This period is expected to be characterized by advancement of bio-engineering technologies for pigment production, integration of sustainable manufacturing processes, and development of sophisticated application platforms across different cosmetic categories. The growing adoption of eco-friendly and cruelty-free beauty products will drive demand for more advanced bio-luminescent pigment capabilities.

Between 2020 and 2025, the Bio-Luminescent Pigments market experienced rapid expansion, driven by technological breakthroughs in biotechnology and marine biology applications in beauty and personal care. The market developed as consumers became increasingly aware of sustainable beauty benefits and cosmetic brands recognized the potential of bio-luminescent pigments to differentiate their offerings and enhance product innovation.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 910.4 million |

| Projected Value (2035F) | USD 3,464.9 million |

| CAGR (2025 to 2035) | 14.3% |

Market expansion is being supported by the rapid advancement of biotechnology and increasing consumer demand for sustainable cosmetic solutions that address environmental concerns, regulatory requirements, and aesthetic innovation. Modern consumers seek products that are environmentally responsible and scientifically advanced, moving away from synthetic alternatives toward bio-based formulations that deliver superior visual effects and environmental benefits.

The growing sophistication of biotechnology applications, including marine organism cultivation, genetic engineering, and sustainable extraction methods, is enabling more efficient production and driving demand for bio-luminescent pigment platforms. Beauty brands are increasingly investing in sustainable technologies to offer differentiated products that can provide unique visual effects while maintaining environmental responsibility and regulatory compliance.

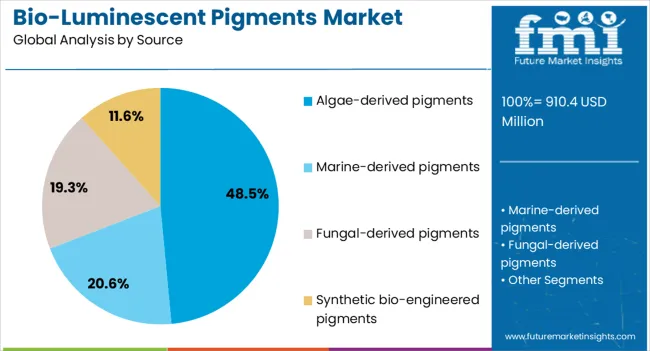

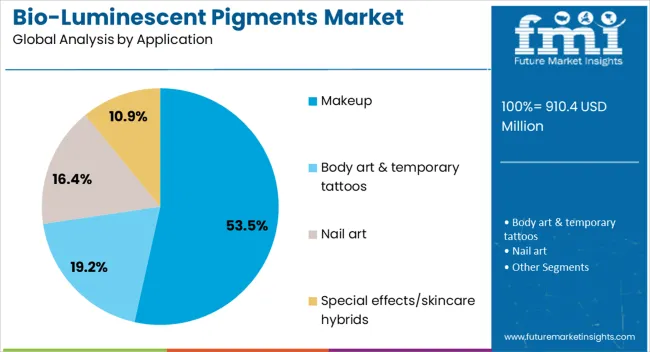

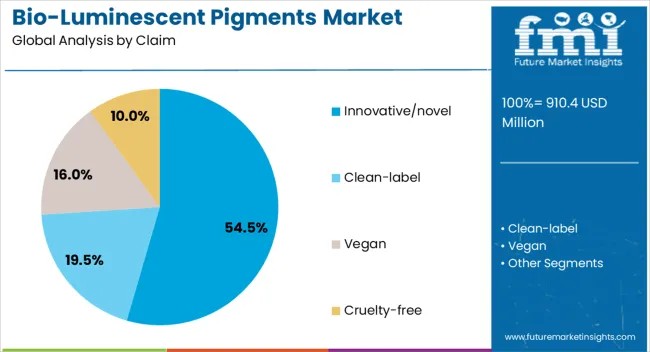

The market is segmented by source, application, product form, channel, and claim. By source, the market is divided into marine-derived pigments, fungal-derived pigments, algae-derived pigments, and synthetic bio-engineered pigments. Based on application, the market is categorized into makeup (eyes, lips, face), body art & temporary tattoos, nail art, and special effects/skincare hybrids. In terms of product form, the market is segmented into powder pigments, liquid dispersions, gel-based pigments, and encapsulated pigments. By channel, the market is classified into e-commerce, specialty beauty retail, pharmacies, and professional/artists' supply. Regionally, the market is divided into major countries including China, USA, India, UK, Germany, and Japan.

Algae-derived pigments are projected to account for 48.5% of the bio-luminescent pigments market in 2025, establishing their position as the leading source methodology in the global marketplace. This dominant market share is fundamentally supported by the sustainable cultivation capabilities of algae, combined with advanced bio-engineering techniques that enable efficient extraction and processing of luminescent compounds from marine microorganisms.

The preference for algae-based pigments stems from their renewable nature, scalable production potential, and superior luminescent properties that provide consistent color performance and light emission characteristics. This methodology offers the highest level of sustainability by utilizing naturally occurring organisms that can be cultivated in controlled environments without environmental impact, enabling production of pigments that address both performance and ecological concerns.

The market leadership of algae-derived pigments is further reinforced by increasing regulatory support for sustainable cosmetic ingredients and the growing availability of cultivation technologies that make this approach economically viable for large-scale production. The segment benefits from partnerships between biotechnology companies and cosmetic manufacturers, creating comprehensive platforms that combine sustainable production with advanced application capabilities.

Makeup applications are expected to represent 53.5% of bio-luminescent pigments demand in 2025, establishing their dominance in the global market landscape. This commanding market position reflects the growing demand for innovative cosmetic effects and the desire for unique visual experiences that can enhance personal expression and aesthetic appeal.

The makeup segment benefits from the sophisticated application capabilities that can utilize bio-luminescent properties to create dynamic color effects, light-responsive formulations, and interactive cosmetic experiences. Modern bio-luminescent makeup products feature personalized combinations of pigments that respond to environmental conditions, providing unique visual effects that change based on lighting conditions and user interaction.

The segment's growth is further supported by the expanding special effects makeup industry, increasing popularity of festival and event cosmetics, and the effectiveness of bio-luminescent formulations in creating memorable visual experiences. Advanced application techniques enable the creation of makeup products that provide both traditional color coverage and innovative light-emitting effects that enhance user satisfaction and brand differentiation.

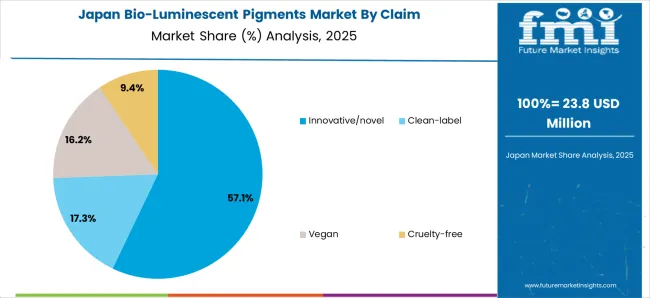

Innovative/novel claims are projected to contribute 54.5% of the bio-luminescent pigments market in 2025, representing the primary positioning strategy for these advanced cosmetic ingredients. This claim category aligns perfectly with the cutting-edge nature of bio-luminescent technology, enabling brands to communicate the revolutionary aspects of light-emitting cosmetic formulations to consumers seeking unique beauty experiences.

The competitive advantage of innovative positioning lies in its ability to differentiate products through technological advancement and visual uniqueness, creating premium market positioning and justifying higher price points through superior performance and novelty value. This approach creates strong brand recognition while enabling companies to establish market leadership in emerging cosmetic technologies.

Innovative claims offer consumers assurance of receiving products that represent the latest developments in cosmetic science, combining sustainability with technological advancement to deliver unprecedented visual effects and application experiences.

The Bio-Luminescent Pigments market is advancing rapidly due to technological innovation in biotechnology and increasing consumer demand for sustainable beauty solutions. However, the market faces challenges including high development costs for bio-engineering platforms, need for specialized production facilities, and varying regulatory requirements across different regions. Standardization of production processes and environmental safety protocols continue to influence market development patterns.

The growing deployment of sophisticated biotechnology systems including genetic engineering, marine organism cultivation, and bio-processing technologies is enabling more efficient production and consistent quality control of bio-luminescent pigments. These technologies provide comprehensive capabilities that enhance production scalability and enable continuous optimization of pigment properties based on application requirements and performance specifications.

Modern cosmetic brands are incorporating comprehensive sustainability messaging, environmental responsibility, and clean beauty positioning to create holistic product profiles that appeal to environmentally conscious consumers. Integration of sustainable sourcing, ethical production methods, and biodegradable formulations provides deeper market appeal and enables predictive consumer adoption approaches.

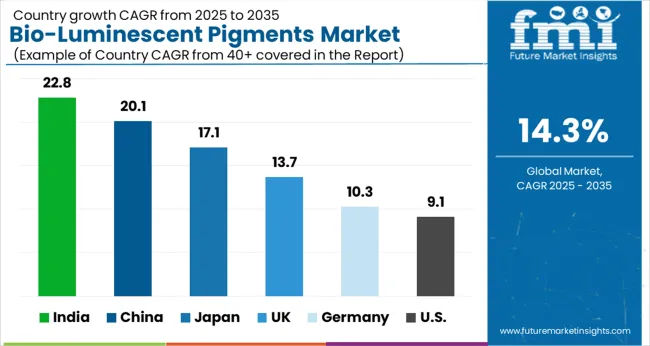

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 22.8% |

| China | 20.1% |

| Japan | 17.1% |

| UK | 13.7% |

| Germany | 10.3% |

| USA | 9.1% |

The bio-luminescent pigments market is growing rapidly across key regions, with India leading at a 22.8% CAGR through 2035, driven by rising disposable income, increasing beauty consciousness, and growing adoption of innovative cosmetic technologies. China follows at 20.1%, supported by strong manufacturing infrastructure and consumer acceptance of advanced beauty solutions. Japan grows at 17.1%, emphasizing technological innovation and premium cosmetic demand. The UK records 13.7% growth with focus on innovative beauty trends. Germany shows 10.3% growth driven by quality and sustainable approach preferences. The USA demonstrates steady 9.1% growth with mature market adoption and established specialty retail channels.

Revenue from bio-luminescent pigments in India is projected to exhibit the highest growth rate with a CAGR of 22.8% through 2035, driven by rapid beauty industry modernization, increasing disposable income among urban consumers, and growing acceptance of innovative cosmetic technologies. The country's expanding beauty and personal care market, combined with high smartphone penetration and social media influence, creates an ideal environment for innovative beauty solutions. Major international and domestic beauty brands are establishing comprehensive distribution networks and local partnerships to serve the growing demand for advanced cosmetic products.

Revenue from bio-luminescent pigments in China is expanding at a CAGR of 20.1%, supported by advanced manufacturing infrastructure, strong consumer adoption of innovative beauty products, and significant investment in biotechnology research and development. The country's sophisticated production ecosystem and integration of biotechnology across various manufacturing sectors create a favorable environment for bio-luminescent pigment production. Major technology companies and beauty manufacturers are developing comprehensive bio-engineering platforms that combine advanced production with innovative application capabilities.

Revenue from bio-luminescent pigments in Japan is growing at a CAGR of 17.1%, driven by the country's leadership in beauty technology innovation, sophisticated consumer preferences, and strong emphasis on cosmetic quality and performance. Japanese consumers demonstrate high acceptance of technology-driven beauty solutions and willingness to invest in premium innovative products. The market benefits from advanced research capabilities, established beauty industry infrastructure, and consumer culture that values precision and innovation in cosmetic applications.

Demand for bio-luminescent pigments in the UK is projected to grow at a CAGR of 13.7%, supported by strong consumer interest in innovative beauty solutions, established premium cosmetic market, and growing emphasis on sustainable beauty products. British consumers demonstrate high willingness to invest in advanced cosmetic products that promise superior visual effects through sustainable innovation. The market is characterized by focus on environmental responsibility, transparency in production processes, and integration with ethical beauty positioning.

Demand for bio-luminescent pigments in Germany is expanding at a CAGR of 10.3%, driven by consumer preference for scientifically-validated cosmetic ingredients, established quality standards, and growing acceptance of biotechnology-driven innovation. German consumers value precision, safety, and transparency in cosmetic products, creating strong demand for bio-luminescent solutions that demonstrate clear scientific backing and measurable performance. The market benefits from rigorous testing standards, comprehensive regulatory framework, and consumer culture that prioritizes proven effectiveness over novelty claims.

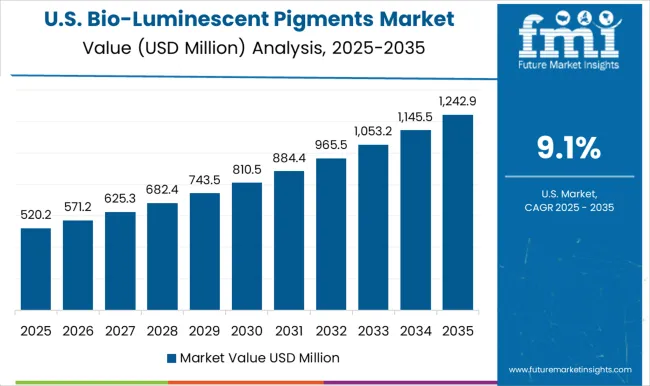

Demand for bio-luminescent pigments in the USA is growing at a CAGR of 9.1%, characterized by diverse consumer segments, established beauty industry infrastructure, and steady adoption of innovative cosmetic solutions. The American market demonstrates strong interest in technology-driven beauty innovations while maintaining focus on performance, safety, and proven results. Market growth is supported by significant investment in biotechnology startups, established distribution networks, and consumer willingness to experiment with advanced cosmetic solutions.

The bio-luminescent pigments market is characterized by competition among biotechnology-focused ingredient suppliers, established cosmetic companies, and specialized bio-engineering platform providers. Companies are investing in advanced biotechnology capabilities, comprehensive production facilities, sustainable manufacturing processes, and innovative application development to deliver effective, safe, and environmentally responsible bio-luminescent solutions. Strategic partnerships, technological innovation, and sustainability positioning are central to strengthening product portfolios and market presence.

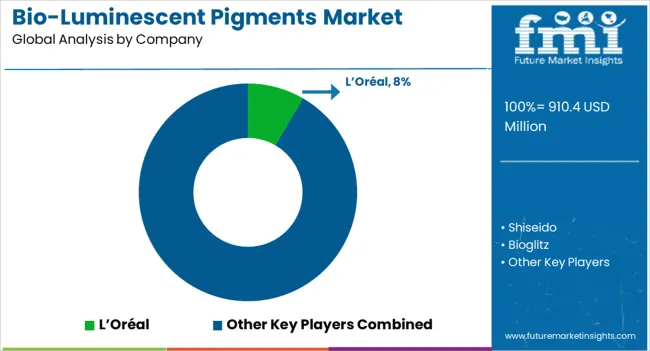

L'Oréal leads the market with an 8% global value share in 2025, focusing on scientifically-backed innovation through comprehensive research and development and advanced application integration. Shiseido emphasizes premium positioning and sophisticated technology integration. BASF Care Creations provides comprehensive ingredient solutions through established chemical industry expertise. Croda focuses on sustainable production and ethical sourcing methodologies.

Symrise delivers advanced biotechnology through specialty chemical capabilities and premium market positioning. Givaudan Active Beauty leverages fragrance and flavor industry expertise for cosmetic applications. Bioglitz provides specialized bio-luminescent solutions through focused market positioning. ProTec Ingredia offers comprehensive ingredient platforms with sustainable positioning. Starlite Cosmetics focuses on specialty applications and professional market segments. Ronald Britton Ltd provides niche solutions through specialized production capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 910.4 million |

| Source | Marine-derived pigments, Fungal-derived pigments, Algae-derived pigments, Synthetic bio-engineered pigments |

| Application | Makeup (eyes, lips, face), Body art & temporary tattoos, Nail art, Special effects/skincare hybrids |

| Product Form | Powder pigments, Liquid dispersions, Gel-based pigments, Encapsulated pigments |

| Channel | E-commerce, Specialty beauty retail, Pharmacies, Professional/artists' supply |

| Claims | Innovative/novel, Clean-label, Vegan, Cruelty-free |

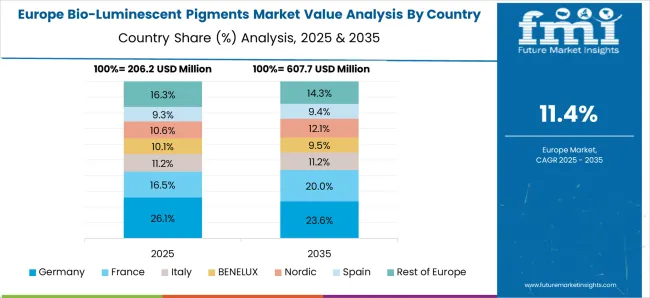

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, Japan, United Kingdom, Germany, India and 40+ countries |

| Key Companies Profiled | L'Oréal, Shiseido, BASF Care Creations, Croda, Symrise, Givaudan Active Beauty, Bioglitz, ProTec Ingredia, Starlite Cosmetics, and Ronald Britton Ltd |

The global bio-luminescent pigments market is estimated to be valued at USD 910.4 million in 2025.

The market size for the bio-luminescent pigments market is projected to reach USD 3,464.9 million by 2035.

The bio-luminescent pigments market is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in bio-luminescent pigments market are innovative/novel, clean-label, vegan and cruelty-free.

In terms of source, algae-derived pigments segment to command 48.5% share in the bio-luminescent pigments market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Ultramarine Pigments Market

Quinacridone Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phosphorescent Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phthalocyanine Pigments Market

Algae-Based Eco-Pigments Market Size and Share Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA