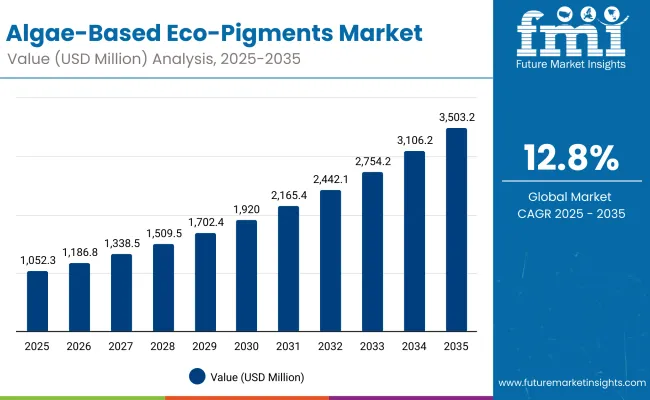

The algae-based eco-pigments market has been projected to reach USD 1,052.3 million in 2025 and USD 3,503.2 million by 2035, reflecting an absolute increase of USD 2,450.9 million over the period. This expansion represents a CAGR of 12.8%, highlighting robust momentum in sustainable pigment innovation. The decade-long rise is expected to be fueled by increasing regulatory scrutiny on synthetic pigments, alongside accelerating adoption of natural alternatives across beauty and personal care.

Algae-Based Eco-Pigments Market Key Takeaways

| Metric | Value |

|---|---|

| Algae-Based Eco-Pigments Market Estimated Value In ( 2025E ) | USD 1,052.3 million |

| Algae-Based Eco-Pigments Market Forecast Value in (2035F) | USD 3,503.2 million |

| Forecast CAGR (2025 to 2035) | 12.80% |

During the first half of the forecast, between 2025 and 2030, the market is anticipated to grow from USD 1,052.3 million to USD 1,920.0 million, adding USD 867.7 million, which accounts for over one-third of the decade’s incremental growth.

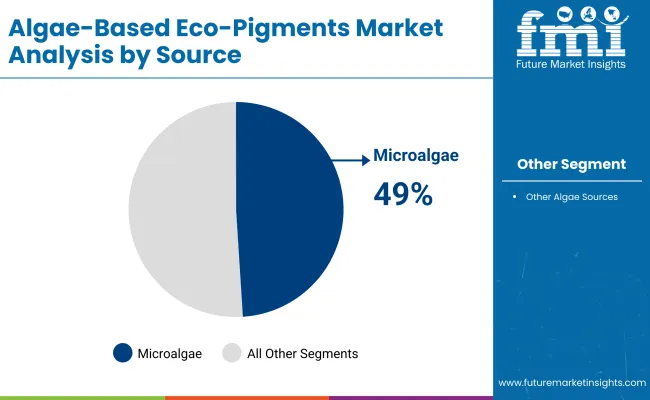

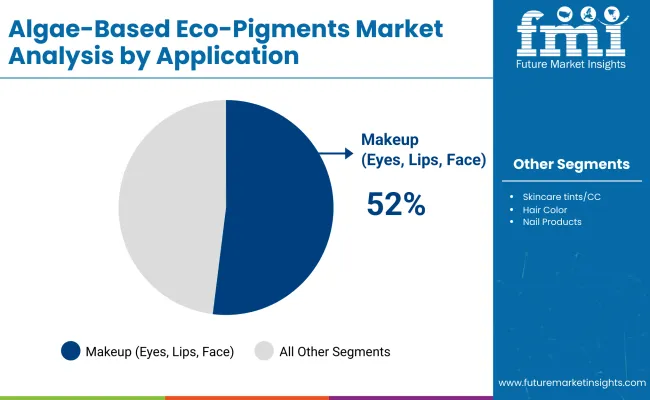

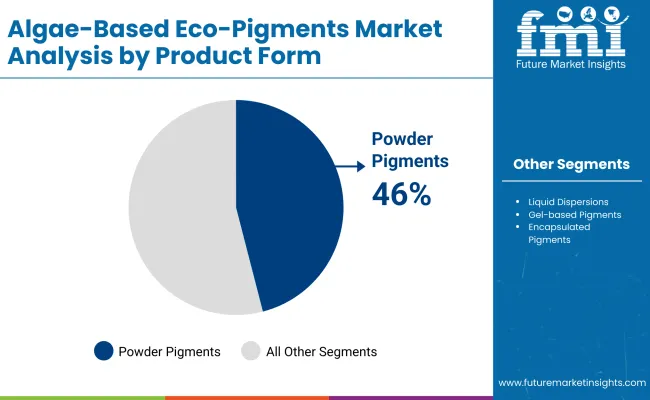

This period is projected to be marked by consistent uptake in mainstream cosmetic applications, where product transparency and eco-labeled formulations are increasingly prioritized. Microalgae are expected to dominate the source segment with 49.0% share in 2025, while powder pigments are projected to lead product forms with 52.0% share, benefiting from versatility and ease of formulation.

The second phase, covering 2030 to 2035, is expected to add USD 1,583.2 million as the market surges from USD 1,920.0 million to USD 3,503.2 million. This later-stage acceleration is anticipated to be shaped by expansion into e-commerce-driven distribution and growth in Asia, particularly China and India, where CAGRs of 19.6% and 22.5% respectively are forecasted. By 2035, broader adoption of engineered algae pigments and encapsulated technologies is likely to further solidify long-term market potential.

From 2020 to 2024, the algae-based eco-pigments market was in its early adoption phase, with value expansion reinforced by demand for sustainable cosmetic colorants. By 2025, the market is forecasted to reach USD 1,052.3 million, setting the foundation for rapid scale-up toward USD 3,503.2 million in 2035. Growth will be shaped by accelerated adoption in natural makeup and skincare categories, where microalgae and powder pigments are anticipated to dominate due to performance and formulation versatility.

The competitive landscape is expected to evolve from fragmented participation toward structured leadership, as players like Sensient Cosmetic Technologies and BASF advance bio-engineered pigment technologies. While specialty beauty retail and e-commerce will account for the bulk of distribution in the near term, digital-first channels are projected to redefine access and brand positioning over the decade.

China and India will deliver the highest growth rates, supported by industrial scale and consumer preference for eco-certified products. Competitive advantage is anticipated to shift from raw pigment supply toward integrated innovation ecosystems combining sustainability, scalability, and application-specific performance.

Growth in the algae-based eco-pigments market is being driven by rising consumer preference for natural and sustainable colorants in beauty and personal care formulations. Strong momentum is being created by regulatory pressure against synthetic pigments, which are increasingly being scrutinized for safety and environmental impact.

Greater adoption is being facilitated by the alignment of algae-based pigments with claims such as vegan, reef-safe, and plastic-free, which are gaining traction in premium and mass-market segments alike. Expanding applications across makeup, skincare, and hair color are being supported by advancements in bioengineering, ensuring improved pigment stability and broader color ranges.

Rapid growth in digital commerce is enabling eco-certified brands to reach wider audiences, accelerating market penetration. Asia is projected to play a pivotal role, as China and India demonstrate double-digit growth supported by consumer demand for green formulations. Competitive differentiation is expected to emerge through innovation in encapsulation and engineered algae strains.

The algae-based eco-pigments market has been segmented across multiple dimensions to highlight the areas driving adoption and revenue growth. Segmentation has been carried out by Source, Application, and Product Form, reflecting the categories most relevant to consumer preferences and industry innovation.

Each segment is expected to showcase distinct growth patterns influenced by sustainability trends, evolving beauty standards, and technological advancements in algae cultivation and pigment extraction. While microalgae, makeup applications, and powder pigments are currently positioned as leading categories, other sub-segments are anticipated to gain momentum over the forecast period as demand diversifies.

This structured segmentation provides clarity on current market dominance and future opportunities that are likely to reshape competitive strategies and investment priorities through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| Microalgae | 49% |

| Others | 51.0% |

The source segment is anticipated to be anchored by microalgae, which are projected to contribute 49.0% of market share in 2025, valued at USD 588.9 million. Adoption is being driven by their superior pigment concentration, natural origin, and alignment with eco-labeling trends. The “Others” category is expected to capture 51.0% of value at USD 536.67 million, benefiting from diversified algae sources.

Rising demand for transparent ingredient sourcing and sustainability-focused cosmetics is expected to reinforce the relevance of microalgae pigments. As engineered algae strains gain traction in later years, the competitive dynamic within this segment is likely to shift toward enhanced functionality and scalability. Long-term differentiation is projected to emerge through efficiency in cultivation and bio-extraction processes.

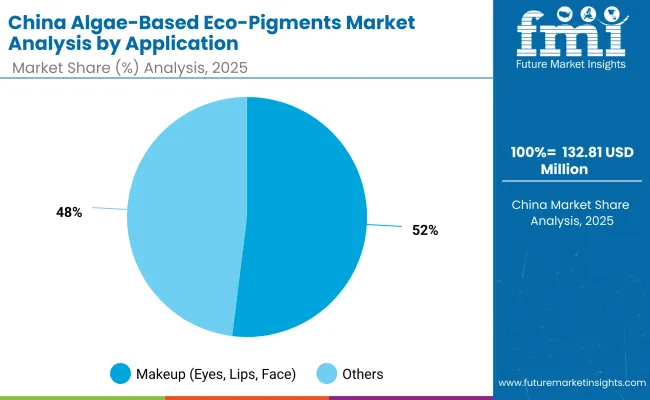

| Segment | Market Value Share, 2025 |

|---|---|

| Makeup (eyes, lips, face) | 52% |

| Others | 48.0% |

The application segment is expected to be dominated by makeup, which is projected to command 52.0% share in 2025, equivalent to USD 566.7 million. Pigments derived from algae are increasingly being positioned as sustainable and safer alternatives in lipsticks, eyeliners, and facial cosmetics, thereby driving widespread adoption.

The “Others” category, capturing 48.0% share or USD 505.1 million, will also remain significant, supported by growing use in skincare and multipurpose products. The appeal of algae-based pigments in enhancing both performance and sustainability credentials is anticipated to support long-term integration into mainstream product lines. Continuous consumer demand for clean beauty is expected to reinforce makeup as the leading driver of segmental growth through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| Powder pigments | 46% |

| Others | 54.0% |

The product form segment is projected to be led by powder pigments, which are expected to achieve 46.0% share in 2025, amounting to USD 533.3 million. Their durability, ease of formulation, and stability across makeup categories are driving preference. The “Others” category, representing 54.0% share or USD 568.24 million, is being reinforced by liquid dispersions and emerging gel-based formats.

As consumer trends move toward versatile and hybrid applications, broader innovation across pigment formats is expected. Powder pigments, however, are likely to sustain leadership through their compatibility with existing cosmetic manufacturing. Advancements in encapsulation and delivery methods are projected to enhance performance across all forms, ensuring steady diversification in the product form landscape.

The algae-based eco-pigments market is being shaped by sustainability imperatives, regulatory pressures, and evolving consumer preferences, even as challenges related to production scale, formulation consistency, and competitive pricing remain significant barriers to wider commercialization across beauty, personal care, and allied industries.

Regulatory Endorsement of Eco-Certified Ingredients

A significant driver is being established through regulatory frameworks that increasingly prioritize safe, non-toxic, and eco-certified pigments. Algae-derived pigments are being positioned as compliant alternatives to synthetic dyes facing tighter restrictions in key markets.

Governments and certification agencies are expected to accelerate demand by incentivizing clean-label products, thereby creating both compliance advantages and marketing leverage for early adopters. This dynamic is anticipated to not only reduce dependency on chemical pigments but also reinforce algae-based pigments as the default choice for brands seeking global reach and consumer trust.

High Bioprocessing and Cultivation Costs

Market scalability is being constrained by the high costs associated with microalgae cultivation, extraction, and stabilization. Bioprocessing facilities require significant capital investment, while fluctuations in algae yield add uncertainty to supply chains. Without economies of scale, pricing pressure is being imposed on eco-pigment producers, limiting competitiveness against entrenched synthetic pigments.

Unless cost curves are flattened through industrial symbiosis, technological breakthroughs, or strategic partnerships, profitability risks may deter broader market participation. This structural restraint is anticipated to slow immediate expansion, particularly among smaller companies unable to absorb high input costs, while simultaneously leaving space for large players to dominate.

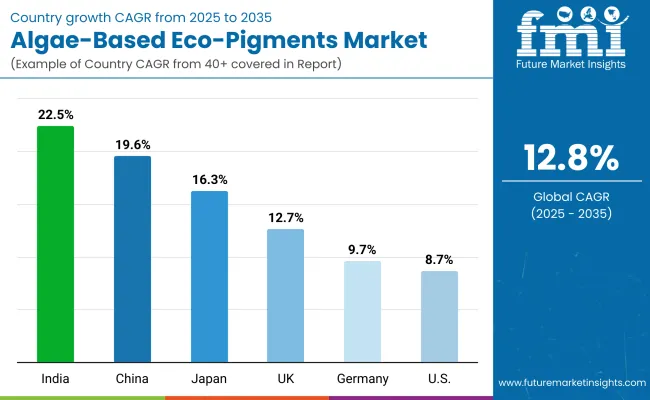

| Country | CAGR |

|---|---|

| China | 19.6% |

| USA | 8.7% |

| India | 22.5% |

| UK | 12.7% |

| Germany | 9.7% |

| Japan | 16.3% |

The algae-based eco-pigments market is expected to display varied growth trajectories across major economies, shaped by differences in sustainability adoption, industrial modernization, and consumer behavior. Asia is projected to remain the primary growth hub, with India advancing at the fastest CAGR of 22.5% through 2035. Expansion in India is anticipated to be supported by rising demand for clean-label products, evolving beauty standards, and government-backed initiatives encouraging sustainable sourcing.

China is forecasted to record a 19.6% CAGR, propelled by large-scale investments in algae bioprocessing, expanding cosmetic industries, and regulatory preference for eco-certified ingredients. Japan, at 16.3%, is expected to benefit from heightened consumer awareness of reef-safe and vegan claims, alongside strong innovation in hybrid beauty formulations.

Europe is set to remain steady, with the UK (12.7%) and Germany (9.7%) contributing through strict compliance mandates and demand for sustainable cosmetic innovation. The USA, growing at 8.7%, is anticipated to experience more moderate expansion, influenced by mature market conditions but supported by niche premium beauty segments that emphasize transparency and natural formulations.

Together, these countries represent the structural backbone of the algae-based eco-pigments industry, with Asia’s momentum expected to outpace other regions, while Europe and North America provide long-term stability through regulatory alignment and consumer trust.

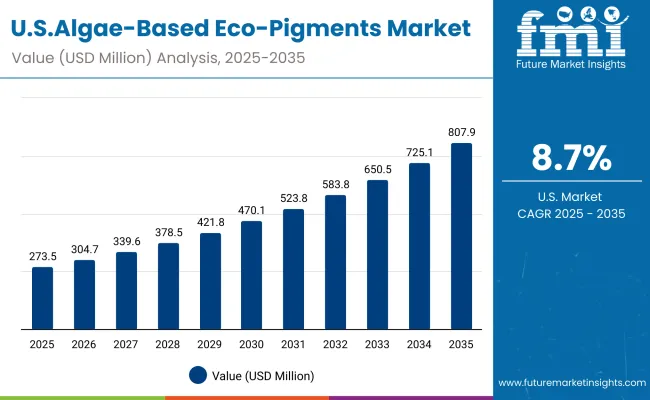

| Year | USA Algae-Based Eco-Pigments Market (USD Million) |

|---|---|

| 2025 | 273.50 |

| 2026 | 304.79 |

| 2027 | 339.66 |

| 2028 | 378.52 |

| 2029 | 421.82 |

| 2030 | 470.08 |

| 2031 | 523.86 |

| 2032 | 583.80 |

| 2033 | 650.59 |

| 2034 | 725.02 |

| 2035 | 807.96 |

The algae-based eco-pigments market in the United States is projected to grow at a CAGR of 11.9%, rising from USD 273.50 million in 2025 to USD 807.96 million by 2035. Expansion is being propelled by increasing consumer demand for eco-certified and sustainable beauty products. Regulatory scrutiny of synthetic pigments is expected to accelerate substitution, particularly in makeup and skincare formulations. Continuous investment in algae bioprocessing and formulation technologies is forecasted to enhance pigment quality and scalability.

The algae-based eco-pigments market in the United Kingdom is projected to expand at a CAGR of 12.7% from 2025 to 2035, reflecting steady integration of sustainable pigments across the beauty and personal care landscape. Expansion is being guided by regulatory mandates on ingredient transparency, as well as consumer demand for reef-safe and vegan formulations. The country’s cosmetic industry is positioned as a strong adopter of clean-label products, with algae pigments expected to gain traction in both premium and mass-market lines. Strategic partnerships between suppliers and local brands are anticipated to accelerate commercialization.

The algae-based eco-pigments market in India is forecasted to grow at a CAGR of 22.5%, the fastest among major economies, during 2025 to 2035. Growth is being fueled by rising consumer preference for herbal and natural cosmetics, supported by cultural affinity for plant- and algae-derived ingredients.

Large-scale adoption is expected to be driven by expanding e-commerce ecosystems, which provide broad access to eco-certified products. Supportive government initiatives promoting sustainable raw materials and clean beauty manufacturing are anticipated to further strengthen market prospects.

The algae-based eco-pigments market in China is projected to advance at a CAGR of 19.6% between 2025 and 2035, supported by large-scale industrialization of algae cultivation and pigment extraction. Cosmetic manufacturers in China are increasingly investing in bio-based innovation to capture growing consumer demand for eco-certified beauty products.

The country is expected to emerge as a hub for mass production of algae pigments, providing cost advantages and export opportunities. Local regulatory frameworks favoring natural and safe formulations are anticipated to accelerate penetration into both domestic and international markets.

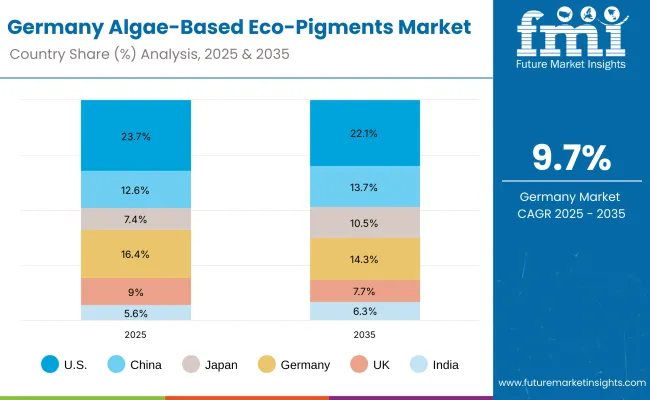

| Countries | 2025 |

|---|---|

| USA | 23.7% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 9.0% |

| India | 5.6% |

| Countries | 2035 |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 10.5% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

The algae-based eco-pigments market in Germany is expected to grow at a CAGR of 9.7% from 2025 to 2035, driven by strict sustainability regulations and heightened consumer demand for natural formulations. German cosmetic companies are recognized for early adoption of eco-labels and innovation in clean beauty products.

Algae-based pigments are being increasingly integrated into premium skincare and makeup categories, supported by the country’s strong R&D infrastructure. Export-driven opportunities are anticipated as German brands expand eco-certified product lines to other European markets.

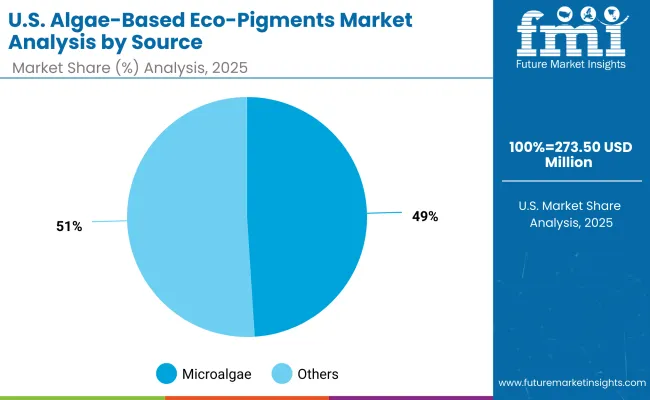

| Segment | Market Value Share, 2025 |

|---|---|

| Microalgae | 49% |

| Others | 51.0% |

The algae-based eco-pigments market in the United States is projected at USD 273.50 million in 2025. Microalgae contribute 49.0% (USD 134.0 million), while other algae-based sources hold a slightly larger 51.0% (USD 139.49 million). This marginal lead for the “Others” category underscores the ongoing diversification of pigment sourcing, as broader algae strains are being cultivated to meet growing cosmetic formulation requirements.

The competitive balance reflects both the established performance of microalgae and the expanding role of alternative sources in ensuring cost efficiency and product availability. Advanced bioengineering and cultivation methods are expected to further improve yields across multiple algae types, thereby strengthening the overall supply chain.

| Segment | Market Value Share, 2025 |

|---|---|

| Makeup (eyes, lips, face) | 52% |

| Others | 48.0% |

The algae-based eco-pigments market in China is projected at USD 132.81 million in 2025. Makeup applications contribute 52.0% (USD 69.1 million), while other applications hold 48.0% (USD 63.75 million). This marginal dominance of the makeup category reflects the rapid growth of color cosmetics in China, where algae-derived pigments are being integrated into lip, eye, and face products to meet clean beauty expectations.

Consumer preference for eco-certified and vegan-friendly formulations is anticipated to accelerate this trend. The strong presence of domestic brands, coupled with government support for sustainable raw materials, is expected to sustain growth across all application areas.

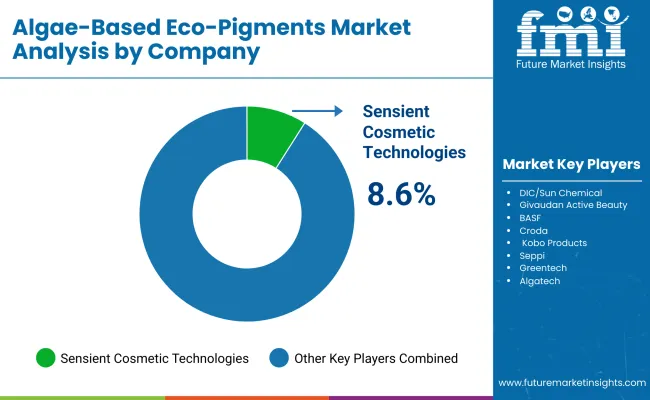

| Company | Global Value Share 2025 |

|---|---|

| Sensient Cosmetic Technologies | 8.6% |

| Others | 91.4% |

The algae-based eco-pigments market is moderately fragmented, with global leaders, emerging innovators, and regionally focused specialists competing for growth across beauty and personal care applications. Sensient Cosmetic Technologies is recognized as the dominant player, holding 8.6% of the global market share in 2025, making it the only company with measurable scale in this segment. In 2024, the company’s share was estimated at around 8.2%, indicating steady growth momentum supported by innovation in algae-derived colorants and partnerships with major cosmetic brands.

Other prominent players active in this space include DIC/Sun Chemical, Givaudan Active Beauty, BASF, Croda, Kobo Products, Seppic, Greentech, Algatech, and Colorchem. These companies are investing in bioprocessing, encapsulation technologies, and sustainable sourcing to strengthen their portfolios. While they hold smaller shares individually, their collective contribution represents over 91.4% of the market, highlighting a competitive environment where scale is still being established.

Competitive differentiation is increasingly being shaped by capabilities in bioengineering of algae strains, eco-certification, and integration into hybrid beauty formulations. Partnerships with cosmetic manufacturers are expected to expand, with algae pigments positioned as the preferred solution for vegan, reef-safe, and natural claims. As demand accelerates, focus is anticipated to shift from pigment performance alone toward supply chain resilience, certification, and application versatility, defining long-term leadership in this market.

Key Developments in Algae-Based Eco-Pigments Market

| Item | Value |

|---|---|

| Quantitative | USD 1,052.3 million (2025); USD 3,503.2 million (2035); CAGR 12.8% (2025 to 2035) |

| Source | Microalgae; Other algae sources (incl. macroalgae, cyanobacteria, engineered algae pigments) |

| Application | Makeup (eyes, lips, face); Skincare tints/CC; Hair color; Nail products |

| Product Form | Powder pigments; Liquid dispersions; Gel-based pigments; Encapsulated pigments |

| Channel | Specialty beauty retail; E-commerce; Pharmacies; B2B color suppliers |

| Claims (Compliance Focus) | Vegan; Natural/organic; Plastic-free; Reef-safe |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered (Key) | China; United States; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | Sensient Cosmetic Technologies; DIC/Sun Chemical; Givaudan Active Beauty; BASF; Croda; Kobo Products; Seppic; Greentech; Algatech; Colorchem |

| Additional Attributes | USD 566.7 million (2025) Makeup vs USD 505.1 million Others (Application); USD 533.3 million Powder vs USD 568.24 million Others (Product Form); USD 588.9 million Microalgae vs USD 536.67 million Others (Source); fast-growth countries: India 22.5% CAGR, China 19.6%, Japan 16.3%, UK 12.7%, Germany 9.7%, USA 8.7%; demand reinforced by eco-certifications (vegan, reef-safe, plastic-free); distribution led by E-commerce 54% and Specialty retail 46% in 2025; competitive landscape headed by Sensient Cosmetic Technologies 8.6% global share (2025) with diversified challengers. |

The global Algae-Based Eco-Pigments Market is estimated to be valued at USD 1,052.3 million in 2025.

The market size for the Algae-Based Eco-Pigments Market is projected to reach USD 3,503.2 million by 2035.

The Algae-Based Eco-Pigments Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product forms in the Algae-Based Eco-Pigments Market are powder pigments, liquid dispersions, gel-based pigments, and encapsulated pigments.

In terms of application, makeup (eyes, lips, face) is expected to command 52% share in 2025, making it the leading segment.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA