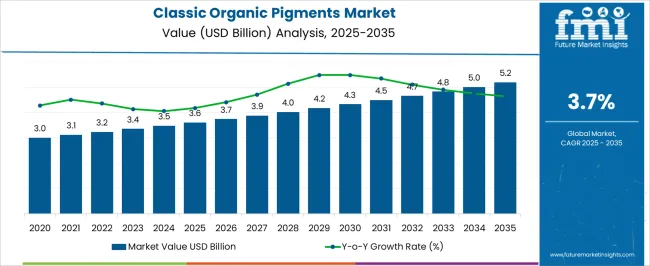

The Classic Organic Pigments Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 3.6 billion to USD 4.3 billion, driven by increasing demand in industries such as paints and coatings, textiles, and plastics. Year-on-year analysis reveals gradual growth, with values reaching USD 3.7 billion in 2026 and USD 3.9 billion in 2027, driven by continued demand for vibrant and durable colors in consumer and industrial products.

By 2028, the market is forecasted to reach USD 4.0 billion, advancing to USD 4.2 billion in 2029 and USD 4.3 billion by 2030. Growth will be further fueled by innovations in pigment formulations, enhanced durability, and eco-friendly production methods, as well as increasing regulatory pressure for non-toxic and sustainable products. These dynamics position the classic organic pigments market as an essential component in various industries, offering significant opportunities for growth, particularly in the realm of environmentally responsible color solutions.

| Metric | Value |

|---|---|

| Classic Organic Pigments Market Estimated Value in (2025 E) | USD 3.6 billion |

| Classic Organic Pigments Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The classic organic pigments market is gaining traction due to the growing need for environmentally sustainable and high-purity color solutions across multiple industrial applications. These pigments, primarily derived from synthetic organic compounds, are widely recognized for their excellent color strength, stability, and resistance to heat and chemicals.

Regulatory pressures on heavy metal content, combined with the push for low-VOC and APEO-free formulations, have encouraged a shift toward organic alternatives in coatings and printing applications. Moreover, advancements in pigment dispersion technologies and surface modification techniques have enabled manufacturers to enhance color fastness, viscosity control, and compatibility with aqueous and solvent-borne systems.

Increased demand from construction, automotive, and packaging industries, along with expanded production capacities across Asia-Pacific, are contributing to sustained market growth. In the coming years, organic pigments are expected to play a central role in next-generation colorant systems due to their ability to meet stringent performance and safety standards while supporting circular economy goals through recyclability and lower environmental impact.

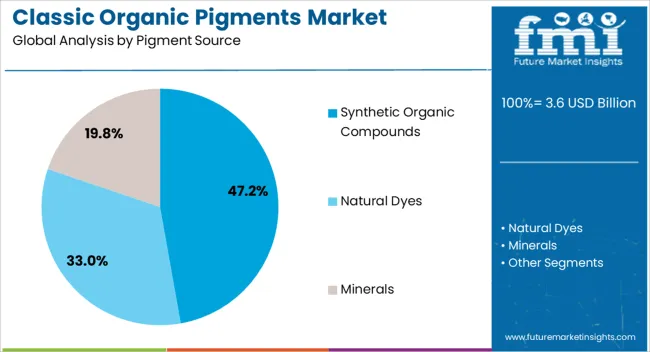

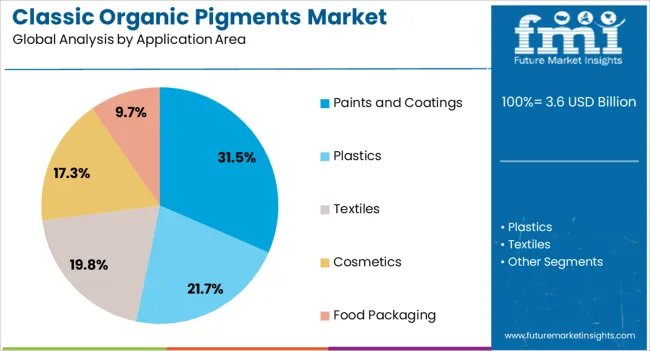

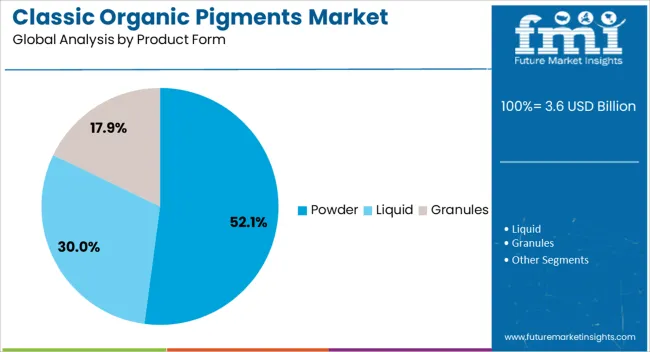

The classic organic pigments market is segmented by pigment source, application area, product form, end user industry, color type, and geographic regions. By pigment source, the classic organic pigments market is divided into Synthetic Organic Compounds, Natural Dyes, and Minerals. In terms of the application area, the classic organic pigments market is classified into Paints and Coatings, Plastics, Textiles, Cosmetics, and Food Packaging. Based on the product form, the classic organic pigments market is segmented into Powder, Liquid, and Granules. By end user industry, the classic organic pigments market is segmented into Construction, Art and Craft, Automotive, Food and Beverage, and Personal Care. By color type, the classic organic pigments market is segmented into Red, Black, Yellow, Blue, and Green. Regionally, the classic organic pigments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Synthetic organic compounds are projected to account for 47.2% of the total revenue share in the classic organic pigments market in 2025, establishing them as the dominant pigment source. This leadership is driven by the molecular flexibility and wide chromatic range that synthetic compounds offer, enabling the production of a diverse spectrum of vivid and durable shades. These compounds are chemically engineered to enhance their lightfastness, thermal stability, and solubility characteristics, making them ideal for demanding industrial applications.

Their structural uniformity supports precise color matching and consistency across large-scale manufacturing runs. As industries increasingly prioritize performance and regulatory compliance, synthetic organic pigments have been widely integrated into formulations for automotive coatings, industrial paints, and flexible packaging.

Their compatibility with advanced dispersion systems and suitability for both waterborne and solvent-based technologies has reinforced their position in the global pigment supply chain. The capacity for customization through functional group modifications continues to enhance their value across specialized end-use segments.

The paints and coatings application area is expected to represent 31.5% of the revenue share in the classic organic pigments market in 2025, emerging as the leading application segment. This growth is attributed to the strong demand for decorative and protective coatings that deliver both aesthetic appeal and functional performance.

Organic pigments are widely used in architectural paints, automotive finishes, and industrial coatings due to their excellent tinting strength, opacity, and resistance to weathering and UV degradation. The ability to achieve vibrant colors without compromising on environmental safety standards has made organic pigments the preferred choice in low-VOC and eco-labeled paint systems.

Rapid urbanization, growth in construction activities, and refurbishment trends across commercial and residential infrastructure are supporting the expansion of coatings that require stable and sustainable pigment solutions. Additionally, the adaptability of these pigments to various resin systems and coating formulations ensures consistent performance in both interior and exterior environments, solidifying their importance in the sector.

The powder product form is projected to capture 52.1% of the revenue share in the classic organic pigments market in 2025, making it the most widely adopted form. This preference is due to the ease of transportation, extended shelf life, and cost-effectiveness associated with powder pigments. Their high pigment concentration and minimal moisture content offer superior dispersion in both water-based and solvent-based systems.

The powder form facilitates precise dosage control and uniform mixing, which are critical for applications requiring color consistency across batches. Industries such as paints, plastics, and printing inks rely on powdered pigments for their ability to integrate seamlessly into manufacturing workflows without compromising on performance or quality.

Additionally, powdered pigments are favored for their storage stability and reduced risk of microbial contamination. The segment’s dominance is further strengthened by the availability of a broad range of shades and particle sizes tailored to specific end-use requirements, ensuring widespread applicability across various industrial and commercial domains.

The classic organic pigments market is driven by increasing demand for eco-friendly and safe alternatives in various industries. Opportunities are expanding with the growing applications of these pigments in multiple sectors, while emerging trends point toward a preference for bright, long-lasting colors. However, challenges such as high production costs and limited raw material availability persist. By 2025, overcoming these barriers through improved supply chain strategies and cost reduction measures will be essential for maintaining growth in the organic pigments market.

The growth of the classic organic pigments market is largely driven by the increasing demand for eco-friendly, non-toxic, and safe colorants. As regulations on harmful chemicals tighten and consumer awareness of environmental issues rises, industries like textiles, paints, and plastics are shifting toward organic pigments. These pigments offer safer alternatives while still providing vibrant colors and excellent performance. By 2025, the demand for classic organic pigments will continue to grow, fueled by the growing consumer preference for environmentally responsible and health-conscious choices.

Opportunities in the classic organic pigments market are growing due to their expanding applications across various industries. Beyond traditional uses in textiles and paints, organic pigments are finding increased use in packaging, automotive coatings, and even food products. As industries seek to adopt safer alternatives for colorants, the demand for organic pigments in niche markets like cosmetics and personal care is also on the rise. By 2025, expanding applications in emerging markets will drive growth and open new opportunities for manufacturers.

Emerging trends in the classic organic pigments market include the rising demand for bright, long-lasting, and durable colorants. Consumers and manufacturers are increasingly prioritizing color longevity and vibrancy in their products. Organic pigments, known for their superior stability, are being preferred over synthetic alternatives in various sectors. By 2025, these trends will continue to gain momentum, as industries in need of high-performance and stable pigments turn to organic solutions, driving innovation in color technology.

Despite growth, challenges such as high production costs and limited availability of raw materials remain in the classic organic pigments market. The production of organic pigments requires specialized manufacturing processes and higher-quality raw materials, which can make them more expensive compared to synthetic alternatives. Additionally, the availability of some key ingredients is constrained, particularly as demand increases. By 2025, addressing these supply chain limitations and reducing production costs will be critical to meeting market demand while maintaining competitive pricing.

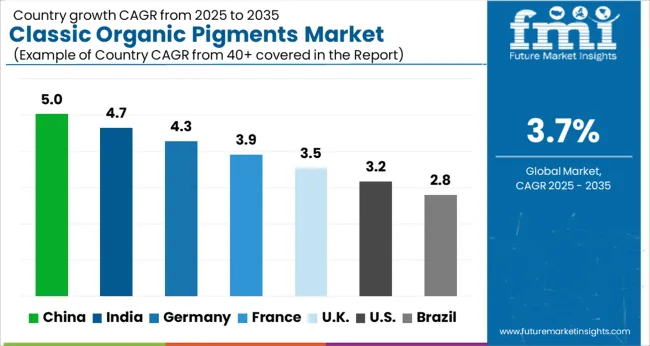

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.7% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.2% |

| Brazil | 2.8% |

The global classic organic pigments market is projected to grow at a 3.7% CAGR from 2025 to 2035. China leads with a growth rate of 5%, followed by India at 4.7%, and Germany at 4.3%. The United Kingdom records a growth rate of 3.5%, while the United States shows the slowest growth at 3.2%. These varying growth rates are driven by increasing demand for organic pigments in industries such as paints and coatings, textiles, plastics, and printing inks. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, increasing manufacturing activities, and the rising adoption of environmentally friendly and sustainable products, while more mature markets like the USA and the UK see steady growth driven by regulatory standards, technological advancements, and increasing demand for high-quality pigments in various applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The classic organic pigments market in China is growing rapidly, with a projected CAGR of 5%. China’s strong industrial base, coupled with the increasing demand for organic pigments in industries such as paints, coatings, textiles, and printing inks, is driving market growth. The country’s growing focus on environmental sustainability, along with government regulations promoting the use of eco-friendly and non-toxic pigments, further accelerates the adoption of organic pigments. Additionally, China’s rapidly expanding manufacturing sector and increasing demand for high-quality consumer products are contributing to the growth of the market for classic organic pigments.

The classic organic pigments market in India is projected to grow at a CAGR of 4.7%. India’s increasing demand for organic pigments in the textile, paints and coatings, and printing ink industries is a key driver of market growth. The country’s expanding manufacturing base, coupled with its growing emphasis on sustainability and eco-friendly products, continues to contribute to the demand for organic pigments. India’s large population, combined with rising disposable incomes, is fueling the demand for high-quality, sustainable consumer goods, which further accelerates the market growth. Additionally, the Indian government’s focus on promoting green technologies in manufacturing contributes to the adoption of organic pigments.

The classic organic pigments market in Germany is projected to grow at a CAGR of 4.3%. Germany’s demand for organic pigments is driven by the growing need for high-quality pigments in industries such as automotive, paints and coatings, and textiles. The country’s strong focus on environmental sustainability and green technologies continues to push the adoption of organic pigments in manufacturing. Additionally, Germany’s stringent regulatory standards for environmental protection and product safety further drive the demand for eco-friendly organic pigments. The growing automotive industry, combined with the increasing demand for sustainable and non-toxic pigments, continues to fuel market growth in Germany.

The classic organic pigments market in the United Kingdom is projected to grow at a CAGR of 3.5%. The UK’s increasing demand for organic pigments in paints, coatings, and textiles is contributing to steady market growth. The country’s strong regulatory support for environmentally friendly products, along with a growing preference for sustainable solutions, is driving the adoption of organic pigments. Additionally, the UK market benefits from rising consumer awareness about the environmental impact of chemical pigments and growing interest in eco-friendly alternatives. The country’s expanding manufacturing sector and the rise of eco-conscious brands continue to support market growth in the organic pigments sector.

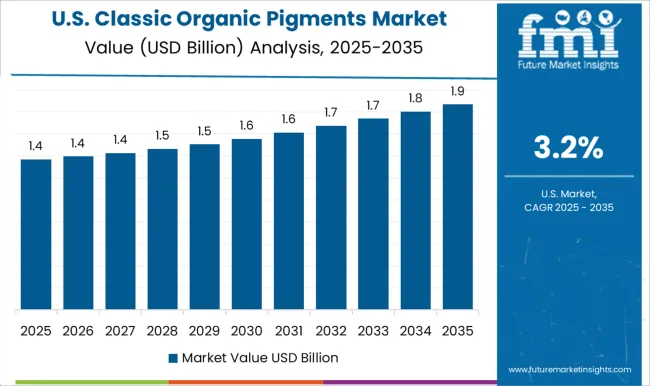

The classic organic pigments market in the United States is expected to grow at a CAGR of 3.2%. The USA market is driven by the increasing demand for high-quality pigments in the paints, coatings, and plastics industries, particularly in automotive and construction applications. The growing focus on sustainability, coupled with stringent regulatory standards for chemical products, is accelerating the adoption of organic pigments in the USA Additionally, the rise in demand for eco-friendly products in consumer goods, coupled with technological advancements in pigment formulations, continues to support market growth. The increasing preference for natural, non-toxic, and renewable pigments in the manufacturing sector further contributes to the market expansion.

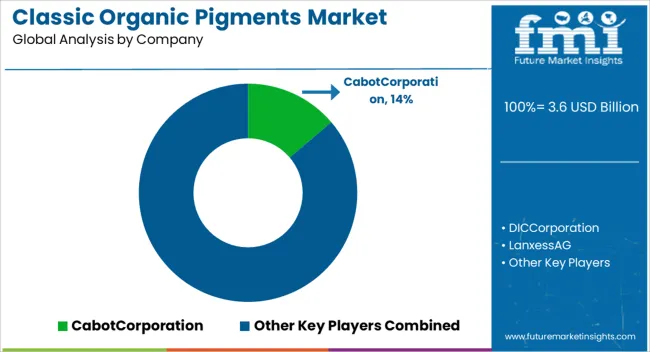

The classic organic pigments market is dominated by Cabot Corporation, which leads with its wide range of high-performance organic pigments used in industries such as coatings, plastics, textiles, and printing. Cabot’s dominance is supported by its advanced pigment technology, strong global presence, and commitment to providing color solutions that meet the growing demand for vibrant and durable pigments in various applications. Key players such as Sun Chemical Corporation, BASF SE, and Clariant AG maintain significant market shares by offering organic pigments with superior color intensity, lightfastness, and eco-friendly properties. These companies focus on continuous innovation to meet the growing demand for sustainable, non-toxic pigment solutions across various industries.

Emerging players like DIC Corporation, Huntsman Corporation, and Ferro Corporation are expanding their market presence by offering specialized organic pigments for niche applications, such as automotive coatings, decorative paints, and industrial inks. Their strategies include improving product performance, developing customized color solutions, and focusing on environmental sustainability. Market growth is driven by the increasing demand for organic pigments in environmentally conscious sectors, the rise in decorative coatings, and the growing trend for high-quality, sustainable products. Innovations in pigment formulations, green chemistry, and advanced production methods are expected to continue shaping competitive dynamics and fuel further growth in the global classic organic pigments market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Pigment Source | Synthetic Organic Compounds, Natural Dyes, and Minerals |

| Application Area | Paints and Coatings, Plastics, Textiles, Cosmetics, and Food Packaging |

| Product Form | Powder, Liquid, and Granules |

| End User Industry | Construction, Art and Craft, Automotive, Food and Beverage, and Personal Care |

| Color Type | Red, Black, Yellow, Blue, and Green |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CabotCorporation, DICCorporation, LanxessAG, SunChemicalCorporation, ClariantAG, BASFSE, HuntsmanCorporation, ToyocolorCoLtd, FerroCorporation, ChromafloTechnologies, TroyCorporation, TiarcoChemical, KremerPigmentsGmbHCo.KG, and BodenheimerPigments |

| Additional Attributes | Dollar sales by pigment type and application, demand dynamics across paints & coatings, plastics, and printing inks sectors, regional trends in classic organic pigment adoption, innovation in sustainable and high-performance formulations, impact of regulatory standards on environmental compliance, and emerging use cases in eco-friendly packaging and automotive coatings. |

The global classic organic pigments market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the classic organic pigments market is projected to reach USD 5.2 billion by 2035.

The classic organic pigments market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in classic organic pigments market are synthetic organic compounds, natural dyes and minerals.

In terms of application area, paints and coatings segment to command 31.5% share in the classic organic pigments market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Organic Fruit Powder Market Size, Growth, and Forecast for 2025 to 2035

Organic Condiments Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA