The Quinacridone Pigments Market is estimated to be valued at USD 430.3 million in 2025 and is projected to reach USD 823.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 311.1 million to USD 403.3 million, driven by high-value applications in automotive coatings, printing inks, and specialty paints. Early adopters focused on high-performance pigments with superior color stability, lightfastness, and chemical resistance, establishing the product’s credibility across niche applications.

From 2025 to 2030, the market enters the scaling phase, growing from USD 430.3 million to USD 595.1 million. Broader adoption is fueled by increasing demand in industrial coatings, decorative paints, and high-end printing inks. Standardization in production processes, improved manufacturing efficiency, and expanding applications in electronics and plastics drive accelerated uptake. Strategic partnerships with paint manufacturers and ink formulators enhance market penetration, while sustainability initiatives encourage the use of high-performance pigments with low environmental impact.

The consolidation phase begins between 2030 and 2035, as the market reaches USD 823.0 million. Leading manufacturers consolidate market share through innovation, cost optimization, and global distribution networks. Smaller players focus on niche segments or specialty formulations. Growth stabilizes with steady adoption, incremental product enhancements, and sustained demand from end-use industries, reflecting a mature and competitive market environment.

| Metric | Value |

|---|---|

| Quinacridone Pigments Market Estimated Value in (2025 E) | USD 430.3 million |

| Quinacridone Pigments Market Forecast Value in (2035 F) | USD 823.0 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Quinacridone Pigments market is demonstrating robust expansion, supported by the growing demand for weather-resistant and lightfast pigments across several industrial applications. As environmental regulations intensify and industries transition away from heavy-metal-based pigments, quinacridone variants are gaining prominence due to their exceptional chemical stability, high tinting strength, and broad color range.

This class of pigments is being increasingly adopted in sectors such as automotive, plastics, paints and coatings, and inks where longevity and performance are critical. The market is also benefiting from advancements in pigment dispersion technologies and increasing focus on eco-friendly, non-toxic coloring solutions that align with global sustainability initiatives.

Additionally, heightened investments in R&D by pigment manufacturers to develop tailor-made pigment grades for specialized applications is expected to further stimulate market growth As industries place more emphasis on quality, compliance, and colorfastness, the market for quinacridone pigments is poised to register consistent growth across developed and developing economies.

The quinacridone pigments market is segmented by color, form, end-use industry, and geographic regions. By color, quinacridone pigments market is divided into Red, Violet/Blue, and Pink. In terms of form, quinacridone pigments market is classified into Powder Form and Dispersions/Suspensions.

Based on end-use industry, the quinacridone pigments market is segmented into the Paint and Coatings Industry, Plastics Industry, Printing and Packaging Industry, Textile Industry, and Cosmetics Industry. Regionally, the quinacridone pigments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The red color subsegment is expected to hold 46.2% of the total revenue share in the quinacridone pigments market in 2025, making it the dominant color category. This dominance can be attributed to the red pigment’s superior opacity, UV resistance, and widespread applicability in exterior and high-visibility coatings. Its chemical structure provides excellent durability and dispersion properties, making it ideal for applications where consistent performance under harsh environmental conditions is essential.

The increasing use of red quinacridone pigments in automotive topcoats, architectural paints, and high-end plastics has significantly contributed to its market share. Additionally, the formulation compatibility of red variants with both solvent-based and water-based systems has enhanced their adoption across environmentally regulated regions.

The subsegment’s growth has also been influenced by consistent demand in printing inks and industrial coatings, where vibrant, long-lasting coloration is critical. With continued innovation in pigment technology and rising demand for premium aesthetic finishes, the red color segment is expected to maintain its leading position.

The powder form segment is anticipated to account for 52.7% of the quinacridone pigments market revenue in 2025, securing its place as the most widely used form. This dominance is supported by the powder form’s ease of integration into various formulation systems and its suitability for high-volume manufacturing environments. Powdered pigments are favored for their high pigment concentration, longer shelf life, and lower transportation costs, making them a cost-efficient choice for industrial users.

Their use is prevalent in paints, inks, and plastics, where consistent color strength and dispersion are critical. Furthermore, advancements in powder coating technologies and pigment micronization have enabled better control over particle size, improving application properties and surface finish.

The flexibility of powdered quinacridone pigments in both solvent-borne and waterborne systems has reinforced their position in regulatory-compliant formulations. Their efficient processing and compatibility with automated dispersion systems make the powder form highly preferred across high-output production lines, thereby driving sustained demand in this segment.

The paint and coatings industry is projected to capture 49.6% of the overall revenue share in the quinacridone pigments market in 2025, establishing itself as the largest end-use sector. The widespread use of quinacridone pigments in this industry stems from their excellent weather resistance, lightfastness, and color vibrancy, all of which are critical in exterior and decorative coatings.

As construction and automotive sectors expand globally, the demand for premium, high-durability coatings continues to rise, thereby enhancing the consumption of high-performance pigments. Paint formulators are increasingly selecting quinacridone pigments to comply with strict environmental and safety regulations, particularly in waterborne coatings that require stable pigment dispersion and long-term performance.

Additionally, the growing preference for aesthetics and sustainable formulations in architectural paints and protective coatings is supporting the shift toward organic pigment classes. With rapid infrastructure development and rising consumer demand for superior finishes, the paint and coatings industry is expected to remain the leading driver of quinacridone pigment adoption.

The quinacridone pigments market is witnessing steady growth due to their high color strength, excellent lightfastness, and chemical resistance, making them suitable for coatings, plastics, inks, and automotive applications. Rising demand from automotive paints, decorative coatings, and printing inks drives consumption, while innovations in eco-friendly and high-performance formulations further support adoption. North America and Europe lead due to advanced industrial and automotive sectors, whereas Asia-Pacific is emerging rapidly owing to industrial growth and expanding consumer goods production. Manufacturers focus on developing high-purity, environmentally sustainable pigments that meet stringent regulatory standards. Strategic collaborations with chemical suppliers, coating manufacturers, and research institutions are enabling customized solutions for niche applications. Market expansion is also fueled by the trend toward vibrant, durable colors in consumer and industrial products, offering opportunities for differentiation through premium and functional pigment solutions.

Producing quinacridone pigments with high purity and consistent particle size is technically challenging. Variations in synthesis processes, raw material quality, and reaction conditions can impact pigment performance, including color strength, transparency, and dispersibility. High-performance applications, such as automotive coatings and industrial inks, require pigments with precise chromaticity and chemical stability. Meeting these specifications often involves stringent quality control, advanced filtration, and post-processing techniques, which increase manufacturing complexity and costs. Additionally, maintaining uniformity across large production batches is critical to prevent color deviations that could affect brand reputation. Companies investing in state-of-the-art production facilities, robust process controls, and analytical testing gain a competitive advantage. Until manufacturing processes are fully optimized, production efficiency, pigment consistency, and high purity remain critical challenges for suppliers in meeting the demands of industrial and high-performance applications.

Quinacridone pigments must adhere to environmental and chemical safety regulations, such as REACH in Europe, TSCA in the United States, and other regional standards. Restrictions on hazardous chemicals, volatile organic compounds (VOCs), and heavy metal content influence formulation, synthesis, and disposal processes. Compliance adds operational complexity, requiring investment in waste management, emission control, and documentation systems. Increasing consumer demand for eco-friendly coatings and inks also drives the development of sustainable quinacridone pigments with low environmental impact. Manufacturers that align with global regulatory frameworks gain market credibility and access to international markets. Until harmonized global environmental standards emerge, producers must navigate diverse regional regulations while maintaining high-quality, safe, and environmentally responsible pigment production.

The automotive and industrial coatings segments offer significant growth opportunities for quinacridone pigments. Demand for durable, vibrant, and UV-stable colors in automotive paints, protective coatings, and decorative finishes drives premium pigment adoption. The trend toward electric vehicles and high-end consumer products emphasizes aesthetic appeal and longevity, encouraging manufacturers to innovate with high-chroma, transparent, and metallic-compatible quinacridone pigments. Coating formulators value pigments with excellent dispersibility and chemical resistance for long-lasting performance. Expanding industrial sectors in Asia-Pacific, Latin America, and the Middle East provide additional opportunities for market penetration. Companies that invest in application-specific solutions, R&D for high-performance formulations, and collaboration with OEMs and coating manufacturers can capture premium market segments, driving revenue growth and brand differentiation.

The quinacridone pigments market is competitive, featuring multinational chemical companies and regional specialty pigment manufacturers. Differentiation is based on pigment quality, purity, particle size control, and customization for specific applications. Supply chain stability for precursor chemicals, solvents, and catalysts is crucial to maintain consistent production schedules. Raw material price fluctuations, geopolitical issues, and logistics challenges can affect costs and delivery times. Companies investing in backward integration, local sourcing, and strategic partnerships strengthen supply chain resilience and ensure reliable supply to coating, plastic, and ink manufacturers. Until supply chain robustness and production scalability improve, market competitiveness will remain driven by reliability, product innovation, and the ability to meet high-performance pigment requirements for industrial and specialty applications.

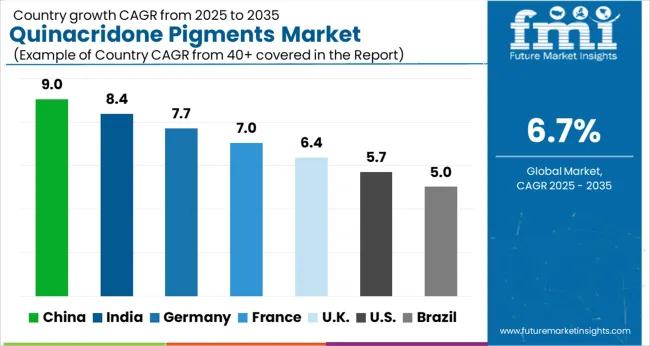

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global Quinacridone Pigments Market is projected to grow at a CAGR of 6.7% through 2035, supported by increasing demand across paints, coatings, and printing applications. Among BRICS nations, China has been recorded with 9.0% growth, driven by large-scale production and deployment in industrial coatings and printing inks, while India has been observed at 8.4%, supported by rising utilization in paints and specialty coatings. In the OECD region, Germany has been measured at 7.7%, where production and adoption for coatings, paints, and printing applications have been steadily maintained. The United Kingdom has been noted at 6.4%, reflecting consistent use in industrial and decorative coatings, while the USA has been recorded at 5.7%, with production and utilization across paints, printing, and specialty coatings being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The quinacridone pigments market in China is expanding at a CAGR of 9.0%, driven by rising demand in coatings, inks, and plastics applications. These high-performance pigments offer excellent color stability, lightfastness, and chemical resistance, making them ideal for automotive coatings, industrial paints, and decorative finishes. Growing construction and automotive industries in China increase consumption of colorful and durable coatings, boosting pigment demand. Local manufacturers are investing in R&D to enhance pigment performance and develop sustainable production methods. The availability of raw materials and supportive government policies for the chemical sector further strengthen market growth. Adoption in printing inks, plastics, and high-end consumer goods also contributes to demand. Technological improvements, such as dispersion technology and environmentally friendly formulations, improve product efficiency and reduce waste. Overall, China remains a key growth region for quinacridone pigments due to industrial expansion and innovation.

The quinacridone pigments market in India is growing at a CAGR of 8.4%, supported by the expanding paints, coatings, and printing inks industries. High-quality pigments are increasingly adopted for industrial coatings, automotive paints, and decorative applications due to their lightfastness and chemical resistance. India’s growing infrastructure, automotive manufacturing, and consumer goods sectors boost demand for durable and vibrant pigments. Domestic pigment manufacturers are investing in advanced production techniques and high-performance formulations to meet global standards. Regulatory compliance and environmental norms are encouraging manufacturers to adopt safer and more sustainable pigment production processes. Adoption in plastics, textiles, and high-end printing inks further increases market penetration. Technological developments in pigment dispersion and formulation optimization improve application efficiency. Rising consumer preference for premium and color-consistent products ensures steady growth in the quinacridone pigments market across India.

The quinacridone pigments market in Germany is growing at a CAGR of 7.7%, driven by stringent quality requirements in coatings, printing, and plastics industries. These pigments are valued for their exceptional lightfastness, chemical resistance, and color intensity, making them suitable for automotive, industrial, and decorative applications. Germany’s established chemical manufacturing sector focuses on producing high-purity and sustainable pigments. Technological innovations in pigment dispersion, color consistency, and eco-friendly formulations further enhance market growth. Adoption in specialty printing inks, plastics, and high-end coatings continues to rise due to increasing industrial demand. Regulatory frameworks promoting environmental compliance and product safety encourage sustainable manufacturing practices. Collaboration between pigment manufacturers and end-user industries strengthens market adoption. Germany’s emphasis on R&D and advanced chemical processing positions it as a significant contributor to the global quinacridone pigments market.

The quinacridone pigments market in the United Kingdom is expanding at a CAGR of 6.4%, supported by demand from coatings, plastics, and printing ink industries. High-quality pigments offering color stability, chemical resistance, and lightfastness are increasingly adopted in automotive paints, decorative coatings, and industrial applications. Domestic and international manufacturers focus on developing eco-friendly and high-performance pigments to meet regulatory standards. Growth in construction, automotive, and consumer goods sectors drives demand for vibrant and durable pigment solutions. Technological advancements in dispersion, formulation optimization, and manufacturing efficiency improve application consistency. Rising awareness of environmental compliance and product safety further strengthens market prospects. The UK market benefits from innovation in sustainable pigment production and collaboration between manufacturers and end-users. As industries prioritize durability, aesthetics, and sustainability, the quinacridone pigments market in the United Kingdom is poised for steady expansion.

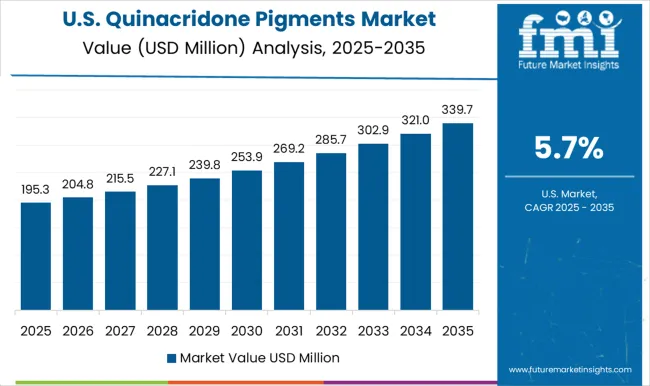

The quinacridone pigments market in the United States is growing at a CAGR of 5.7%, driven by the coatings, printing, and plastics industries. These pigments are preferred for their vibrant color, chemical stability, and lightfastness, which are essential in automotive coatings, industrial paints, and decorative applications. Rising demand for durable, high-performance, and environmentally friendly pigments encourages manufacturers to innovate in production processes and formulations. Adoption in specialty printing inks, plastics, and consumer goods continues to expand. Regulatory compliance and environmental standards drive the development of sustainable pigments with reduced hazardous content. Collaboration with end-user industries supports tailored solutions for diverse applications. Technological improvements in dispersion, pigment particle size control, and color consistency further enhance adoption. The United States remains a key growth region in the global quinacridone pigments market due to industrial demand, innovation, and regulatory support.

The quinacridone pigments market is expanding due to increasing demand from coatings, inks, plastics, and automotive industries seeking high-performance, durable, and vibrant colorants. Quinacridone pigments are valued for their excellent lightfastness, chemical resistance, and strong tinting strength, making them ideal for applications requiring long-lasting, vivid colors.

Key suppliers in this market include BASF SE and Clariant AG, recognized for their innovative pigment technologies and broad global distribution networks. DIC Corporation and Huntsman Corporation provide high-quality pigments catering to diverse industries, including paints, plastics, and printing inks. Lanxess AG and Kronos Worldwide, Inc. specialize in high-performance pigments with superior stability and versatility.

Other major market players include Sun Chemical Corporation, Sudarshan Chemical Industries Ltd., and Heubach GmbH, which focus on sustainable production processes, consistent quality, and customized pigment solutions. Trust Chem Co., Ltd., Synthron, Ferro Corporation, and Dainichiseika Color & Chemicals Mfg. Co., Ltd. offer advanced quinacridone pigments with enhanced dispersibility and application performance. Asian suppliers like Tokan Material Technology Co., Ltd. and Trust Chem Europe B.V. are also strengthening their market presence through strategic partnerships and regional expansions.

The market growth is driven by rising consumer preference for high-quality colored products, stricter regulatory standards, and the increasing adoption of eco-friendly and solvent-free pigment solutions. Innovations in pigment chemistry and coatings technology continue to enhance the demand for quinacridone pigments, positioning these suppliers at the forefront of the global colorant industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 430.3 Million |

| Color | Red, Violet/Blue, and Pink |

| Form | Powder Form and Dispersions/Suspensions |

| End-Use Industry | Paint and Coatings Industry, Plastics Industry, Printing and Packaging Industry, Textile Industry, and Cosmetics Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASFSE, ClariantAG, DICCorporation, HuntsmanCorporation, LanxessAG, KronosWorldwide,Inc., SunChemicalCorporation, SudarshanChemicalIndustriesLtd., HeubachGmbH, TrustChemCo.,Ltd., Synthron, FerroCorporation, DainichiseikaColor&ChemicalsMfg.Co.,Ltd., TokanMaterialTechnologyCo.,Ltd., and TrustChemEuropeB.V |

| Additional Attributes | Dollar sales vary by pigment type, including red, violet, and pink quinacridone pigments; by application, such as coatings, plastics, inks, and paints; by end-use industry, spanning automotive, construction, packaging, and consumer goods; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising demand for high-performance, durable, and color-stable pigments across multiple industries. |

The global quinacridone pigments market is estimated to be valued at USD 430.3 million in 2025.

The market size for the quinacridone pigments market is projected to reach USD 823.0 million by 2035.

The quinacridone pigments market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in quinacridone pigments market are red, violet/blue and pink.

In terms of form, powder form segment to command 52.7% share in the quinacridone pigments market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Ultramarine Pigments Market

Phosphorescent Pigments Market Size and Share Forecast Outlook 2025 to 2035

Phthalocyanine Pigments Market

Algae-Based Eco-Pigments Market Size and Share Forecast Outlook 2025 to 2035

Bio-Luminescent Pigments Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA