The titanium dioxide (TiO₂) color market refers to the segment of the global titanium dioxide industry focused on its use as a white pigment and opacifier across multiple sectors such as paints and coatings, plastics, cosmetics, paper, textiles, and food products. Renowned for its brightness, high refractive index, UV resistance, and non-reactive nature, titanium dioxide remains the industry standard for white coloration and opacity enhancement.

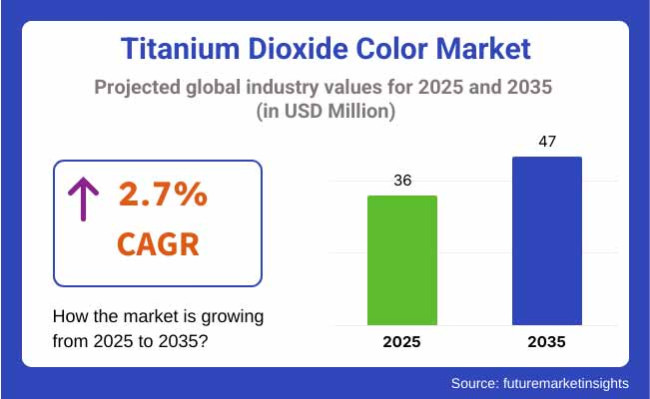

In 2025, the global titanium dioxide color market is projected to reach approximately USD 36 million, and is expected to grow to around USD 47 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 2.7% over the forecast period.

Growth is fueled by the expanding construction and automotive sectors, cosmetics and personal care industry innovation, and rising demand for UV-resistant pigments in functional coatings and packaging. Regulatory scrutiny in food and cosmetics is shifting the market toward high-purity and coatedTiO₂ grades.

The Asia-Pacific region holds the largest share of the global market, with urbanization, infrastructure development, and upsurging plastic and paint production contributing to China, India, Japan, and Southeast Asia. As the largest TiO₂ pigment producer and consumer, Chinese government policies promote the production of environmental-friendly and chloride-process production.

North America continues to be an important market. Low-VOC paints, UV-blocking sunscreens, and other FDA-compliant food-grade TiO₂ are enjoying increased USA demand. Pressure from regulators about limits on TiO₂ in products that can be ingested is driving formulators to transparency and innovation.

Europe is a continent that is sensitive to all things regulatory and sustainable, particularly in countries like Germany, France and the UK that will lobby for safer, recyclables and lower-mission uses. The chronic instability of TiO₂ was a major motivator for the EU to declare TiO₂ a suspected carcinogen by inhalation and resulted in further studies of encapsulated and/or coated TiO₂, which has had a great impact on the cosmetic and paint industries.

Challenges

Regulatory Pressure, Health Concerns, and Environmental Impact

The Titanium Dioxide (TiO₂) Colour Market is grappling with stricter regulations amid rising scrutiny from organizations such as the European Food Safety Authority (EFSA), which banned TiO₂ as a food additive (E171) for the reasons of safety, citing concerns over potential genotoxicity.

Although, it is highly regarded as safe; it is commercially and cosmetically used, which, because of its inhalation (especially in powdered forms) and ecotoxicological risk, resulted suspicion against the consumer.[4] Moreover, nano-sized TiO₂ particles have provoked concerns about their possible bioaccumulation and lack of long-term safety data, hindering their application to sunscreens, pharmaceuticals, and coatings.

Opportunities

Durable Performance, Whitening Efficiency, and Next-Gen Hybrid Formulations

TiO₂ is one of the most potent and economic white, opacificator, and opacifier, which can be greatly appreciated of its high refractive index, UV stability, and chemical inertness. Demand remains driven by its essential role in paints, coatings, plastics, cosmetics, pharmaceuticals and paper.

These innovations target coated, non-nanoTiO₂ grades, hybrid organic-inorganic colorants, and encapsulated TiO₂ that limit the risk of exposure without compromising on-performance. Moreover, rising consumption of UV-blocking coatings, wear-resistant architectural paints, and high-opacity plastics are expected to encourage growth across applications. Regulatory-compliant low dust TiO₂ grades have also seen increasing demand.

The TiO₂ color market between 2020 and 2024 was impacted by raw material volatility, European regulatory bans in food applications, and rising cost-pressure in capital-intensive applications such as coatings and plastics. However, demand remained stable in paints, building materials, and cosmetics, where TiO₂ has few suitable substitutes.

In the 2025 to 2035 period, the market will transition towards sustainable sourcing, safer formulation practices, and multi-functional TiO₂-based products, including UV protection, antimicrobial coatings, and smart pigments. Improvements in surface treatment, particle engineering, and low-eco footprint manufacturing processes will allow it to remain relevant in non-food segments.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Ban on TiO ₂ in food (EU) and warning labels for inhalable forms |

| Technology Innovations | Use of rutile and anatase grades in paints, sunscreens, and plastics |

| Market Adoption | Strong in automotive coatings, construction paints, and personal care |

| Sustainability Trends | Initial efforts in wastewater treatment and energy-efficient milling |

| Market Competition | Dominated by Chemours , Kronos, Tronox , Venator , LB Group |

| Consumer Trends | Focused on brightness, UV blocking, and price-performance |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Emergence of globally harmonized labeling , non- nano certifications, and safe-by-design TiO ₂ variants |

| Technology Innovations | Development of encapsulated TiO ₂, non-toxic coatings, and hybrid natural- TiO ₂ pigment blends |

| Market Adoption | Expansion into 3D printing, UV-resistant textiles, anti-bacterial coatings, and smart glass |

| Sustainability Trends | Acceleration of green TiO ₂ production, carbon footprint labeling , and circular pigment recovery |

| Market Competition | Entry of nano -safe pigment innovators, TiO ₂ recyclers, and regulatory-compliant cosmetic pigment brands |

| Consumer Trends | Shift toward safety, low-exposure TiO ₂, vegan-certified pigments, and transparent labeling |

This is owing to the fact that it is the communication market participant lookup that accounts for colorful pigment consumption of the color in paint coatings, plastics, cosmetics, food esseinces, etc. Demand for ultra-pure grades of titanium dioxide (TiO₂) is being supported by strict quality and safety regulations, particularly in pharmaceuticals and cosmetics.

The regulation of the use of nanoparticles is very much driving the innovation of surface-treated as well as non-nanoTiO₂ varieties. The considerable opacity, UV stability, and brightness continue to support strong demand in packaging and coating applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

UK Titanium Dioxide Color market is at a moderate growth in with the changing policies related to food-grade and nano-form TiO₂ usages. TiO₂ continues to be in demand in paints, bakery glaze, sunscreen, and paper manufacturing, though the uncertainty caused by changing EU-aligned policies necessitates a watching brief.

Paint compositions with low environmental impact and green packaging materials are driving the need for high-durability, non-toxic pigment solutions. TiO₂ remains relevant in the industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.5% |

After the reopening of some TiO₂ forms as possible inhalation risks, TiO₂ as an approved food addition across the China EU Titanium Dioxide Color context has led to cautious yet continued development significantly in non-food industrial end-use. Demand for food and supplement uses is limited, but robust in coatings, building materials, and vehicle paint.

Germany, Italy, and France lead the way in developing safer, encapsulated TiO₂ pigments that have good optical performance and lower regulatory risk.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 2.3% |

TiO₂ in Japan's lenses for food and cosmetics, exterior automotive surfaces, and electronic casings are all extensive - Japan's Titanium Dioxide Color market is mature and technology is well developed. Japanese manufacturers prize high-purity TiO₂ for its consistent color and long-lasting durability in consumer-facing products.

The market also benefits from the research on multifunctional TiO₂ pigments bearing antibacterial or photocatalytic activities for hygiene-based applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

Due to the wide use of TiO₂ as a whitening and UV blocking agent, the cosmetic and personal care industries are prominent in South Korea's Titanium Dioxide Color market.

Demand is also rising for industrial coatings and flexible electronics. In line with national sustainability objectives, the nation is investing in research and development (R&D) for TiO₂ applications with lower environmental footprint.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

| Application type | Market Share (2025) |

|---|---|

| Candy / Confectionery | 45% |

Among various applications, the candy and confectionery segment continues to account for over 35% of the total application-based market share in the titanium dioxide color market. This is because candy is highly visual, and appearance is an important factor in the purchase decision-making process. Whether it is in the shiny outer coating of sugary confections, the white base of mints, or in the shiny shell of chocolate-covered confections, titanium dioxide helps make color brighter, more opaque and the general look of the finish.

In confectionery, titanium dioxide is primarily used as an opacifier and white pigment. It has good light scattering properties that would help to enhance, making the colors more saturating - whether by artificial or natural coloring agents. Manufacturers have used titanium dioxide as a preferred option because it is neutral in flavor, chemically stable, and able to maintain visual consistency when storage conditions change. This is especially important for shelf-stable confections, which are supposed to be as alluring after months of travel and retail exposure.

High-surface-area forms of titanium dioxide are employed to impart brightness and masking in sugar coatings, licorice, gums, hard candies, and chocolate dragees. These products rely on strict color consistency for their brand, especially in multi color mixes where slight variations can impact customer perception and brand integrity.

In food mastery, for example, titanium dioxide is a high-quality element used to accomplish food configurations, for example, the coated jellybeans or sugar pearls utilized for cake designs, wherein titanium dioxide gives the base tone that keeps on getting different colors, accordingly it is one of the essential mixtures for accomplishing high expertise and tasteful conclusion.

Consumer trends also support the use of titanium dioxide in confectionery. In impulse-buy items like seasonally themed desserts, limited-release sweets and novelty chocolates, consumers expect visual stimulation. The ability to create bold white bases and dynamic toppings is essential for brands looking to stand out in crowded in-store aisles, particularly during seasonal periods such as Halloween, Easter, and Christmas.

In addition, the growing global demand for Westerns candies with unique taste attributes in strongly growing economies such as India, Brazil, and the Middle East, is driving a rise in the closer of titanium dioxide in newer manufacturing geographies.

This segment is also witnessing innovation in the form of hybrid color systems, where either titanium dioxide is blended with natural pigments to lower overall usage while increasing the overall color vibrancy. These techniques are gaining popularity among clean-label brands trying to keep up aesthetic appeal without compromising perceived healthiness.

Despite local regulatory hurdles, the confectionery and candy segment will continue to retain its significant share in titanium dioxide color sales worldwide. In regions such as the USA, Canada, India and most of South East Asia, titanium dioxide remains food approved and is an in-spec ingredient within product formulation.

Retro handlers also included: As producers transition into meeting localisation requirements specifications, coupled with next-generation titanium dioxide innovations, demand from the confectionery sector is likely to remain on an upward trajectory, perpetuated by unquenchable consumer desires for visual aesthetics and a luxury presentation.

| Application type | Market Share (2025) |

|---|---|

| Bakery, Snacks, & Cereal | 34% |

Titanium dioxide is among the most common ingredients used and typically used within bakery for icing, fondant or glazes as well as sprinklers decorative purpose. These ingredients serve double duty as taste boosters and powerful visual elements that become the essence of a product’s marketability.

Titanium dioxide helps to create a pure, white background for colored icings, adds brilliance to multi-colored decorations, and helps to give pastries, cupcakes, and cookies a luxurious, polished appearance. Aesthetics represent a key point of differentiation for baked products within artisanal and commercial contexts alike, especially where baked products are invoked as celebratory and indulgent products.

In breakfast cereals, it is used in sugar coatings and marshmallow inclusions. Cereals like frosted flakes or puffy marshmallow varieties generally have white or bright-colored coatings relying on titanium dioxide for consistency and light reflection.

Illustrative behaviour is essential in appealing to younger sections of the population, which are likely to be the key household purchasers. Brands rely on that playing face to gain a strong shelf presence, still a deal-maker or deal-breaker in the aggressive cereal shelf.

The snack category including rice cakes, coated nuts, granola bars and extruded snacks - also benefits from titanium dioxide’s ability to mask imperfections and deliver a smooth, homogeneous appearance. This is especially important in private-label or bulk snack manufacturing where natural ingredient variability could lead to inconsistency otherwise. By the addition of titanium dioxide, manufacturers achieve a uniform look that meets consumer expectations for the product quality and dilution.

The clean-label trend has brought a little sophistication into this space. So as people scrutinize ingredient panels more and more, cereal and bakery companies have had to curtail or do away with artificial additives, like titanium dioxide. Owing to such pressure, some brands have resorted to partial replacement with vegetable starches or calcium carbonate.

But these substitutes often fail to match the degree of brightness, opacity, and heat stability exhibited by titanium dioxide, especially in the case of baked goods that are subjected to high-temperature processing or require extended shelf life.

To counter this, manufacturers have been pursuing two paths: in higher-regulatory-pressure markets, they reformulate with alternative materials, making the absence of titanium dioxide a selling point. They continue to use titanium dioxide in other parts of the world where they pump R & D to improve its safety profile by particle size control, surface treatment, or encapsulation methods.

For its part, the United States Food and Drug Administration (FDA) has approved the use of titanium dioxide as a food additive, but only in small concentrations of less than 1%, allowing American manufacturers to continue using titanium dioxide in food while trying to respond to public concern by being transparent and educating people.

In the meantime, innovations in micro dispersion technology allowed producers to achieve the desired effect with lower levels of the ingredient titanium dioxide. Combined, these developments decrease cost and improve sustainability by reducing the total interrogation materials. Moreover, the application in digital design for food decoration such as edible ink printing, as well as automatic icing systems, has further boosted the demand for high-performance light-scattering pigments, further consolidating the position of titanium dioxide in new paradigms of production.

An Expanding Environment Shift in Consumer Preferences toward upscale bakery products, artisanal cereals, and novelty snacks foots the bill; the titanium dioxide color segment remains a beneficiary of the changing consumer environment. With manufacturer engineers both toeing the line of visual aesthetic while pursuing clean-label imperatives, titanium dioxide remains one of the most valuable tools in the creation of branded and marketable baked and snack foods.

Factors such as steady growth of food processing across the globe along with increasing disposable incomes and growing demands among consumers for visually appealing edible outcomes will improve the market for crystalized fruit as a segment.

The titanium dioxide (Tio₂) color market is growing steadily because of the increasing demand for white pigmentation in paints & coatings, plastics, paper, cosmetics, pharmaceuticals, and food applications. TiO₂ is an important additive that improves the color, reflects light, and provides durability of products, synonymous with high opacity, brightness, and UV resistance. Some of the key growth drivers include booming construction and automotive activity, demand for high-efficacy pigments, uptake in sunscreen and toothpaste, and at times of regulatory focus in food-grade alternatives to TiO₂.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| The Chemours Company | 18-22% |

| Tronox Holdings plc | 14-18% |

| Venator Materials PLC | 12-16% |

| Kronos Worldwide, Inc. | 10-14% |

| LB Group ( Lomon Billions Group) | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| The Chemours Company | In January 2025, Chemours expanded its Ti -Pure™ TiO ₂ product line with low-VOC and high-durability grades, targeting architectural coatings, automotive plastics, and FDA-compliant food packaging. |

| Tronox Holdings plc | As of April 2024, Tronox launched a new chloride-process TiO ₂ pigment series with improved UV shielding, dispersion properties, and color retention, optimized for plastics and sunscreen formulations. |

| Venator Materials PLC | In October 2023, Venator introduced its TIOXIDE® range for food-grade and pharmaceutical excipients, focusing on EU-regulated alternatives amid E171 bans and expanding cosmetics-grade TiO ₂ in Asia. |

| Kronos Worldwide, Inc. | In March 2024, Kronos rolled out multi-purpose TiO ₂ pigments for decorative coatings and laminates, offering better whiteness, gloss retention, and chemical resistance. |

| LB Group ( Lomon Billions Group) | As of August 2023, LB Group expanded its sulfate -process TiO ₂ capacity with high-volume production for emulsion paints, masterbatches , and adhesives, especially in India and Southeast Asia. |

Key Market Insights

The Chemours Company (18-22%)

Chemours dominates the TiO₂ pigment market with its Ti-Pure™ line, offering specialized grades for industrial coatings, plastic packaging, and even regulated food-contact materials, supported by a strong North American and EMEA footprint.

Tronox Holdings plc (14-18%)

Tronox focuses on chloride-route TiO₂ that delivers enhanced dispersion, weatherability, and high reflectivity, ideal for outdoor paints, solar reflective materials, and UV-protective cosmetics.

Venator Materials PLC (12-16%)

Venator has a diversified portfolio including food, pharma, and personal care-grade TiO₂, and is actively developing safer alternatives for regions with strict regulatory oversight, particularly in Europe.

Kronos Worldwide, Inc. (10-14%)

Kronos serves the architectural, industrial, and paper industries, offering TiO₂ grades that balance opacity, tint strength, and dispersibility, with a strong position in North America and Western Europe.

LB Group (Lomon Billions Group) (8-12%)

LB Group is a rapidly expanding player, offering cost-effective, sulfate-route TiO₂ for bulk applications in Asia-Pacific, benefiting from economies of scale and government-supported infrastructure demand.

Other Key Players (26-32% Combined)

Several regional manufacturers and specialty pigment providers are contributing to innovation in nano-TiO₂, food-safe alternatives, and customized dispersion systems, including:

The overall market size for titanium dioxide color market was USD 36 million in 2025.

The titanium dioxide color market is expected to reach USD 47 million in 2035.

Growing use in paints, coatings, and plastics, rising demand for high-opacity pigments, and increasing applications in cosmetics and food products will drive market growth.

The top 5 countries which drives the development of titanium dioxide color market are USA, European Union, Japan, South Korea and UK

Candy and confectionery expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 8: North America Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 15: Europe Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 16: Europe Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 20: Asia Pacific Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Table 21: MEA Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 24: MEA Market Volume (Tonnes) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 8: Global Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Market Attractiveness by Application, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 14: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 20: North America Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 23: North America Market Attractiveness by Application, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 26: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 32: Latin America Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Europe Market Value (US$ Billion) by Application, 2023 to 2033

Figure 38: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 39: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 40: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 41: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Europe Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 44: Europe Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 45: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 46: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 47: Europe Market Attractiveness by Application, 2023 to 2033

Figure 48: Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Asia Pacific Market Value (US$ Billion) by Application, 2023 to 2033

Figure 50: Asia Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 51: Asia Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 52: Asia Pacific Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 53: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Asia Pacific Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 56: Asia Pacific Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 57: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 58: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 59: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 61: MEA Market Value (US$ Billion) by Application, 2023 to 2033

Figure 62: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 63: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 64: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 65: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: MEA Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 68: MEA Market Volume (Tonnes) Analysis by Application, 2018 to 2033

Figure 69: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: MEA Market Attractiveness by Application, 2023 to 2033

Figure 72: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Dioxide Market

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium-Free Food Color Alternatives Market

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Titanium Strips Market Size and Share Forecast Outlook 2025 to 2035

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Colorectal Cancer Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Titanium Aluminides (TiAl) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Colorimeter Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Colored BIPV Market Report – Trends, Demand & Growth through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA