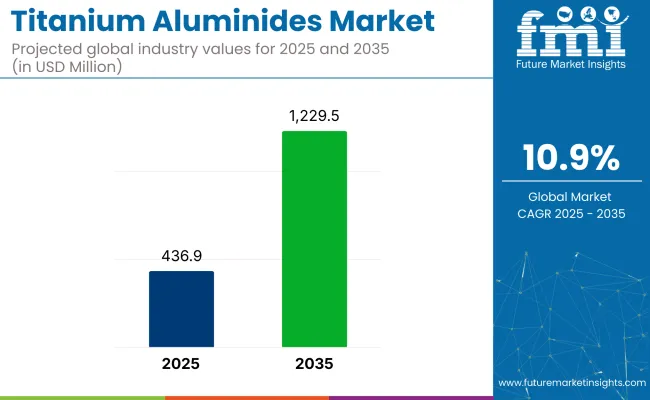

The titanium aluminides (TiAl) market is expected to expand from USD 436.95 million in 2025 to USD 1,229.54 million by 2035. This market is expected to grow at a CAGR of 10.9% during the forecast period.

The market growth is primarily driven by increasing demand in aerospace and defense industries, where TiAl alloys offer critical advantages in high-temperature performance, corrosion resistance, and reduced weight. Additionally, the expanding automotive sector's focus on lightweight materials, particularly in high-performance vehicles, is also contributing significantly to the growth of the TiAl market.

Titanium aluminides (TiAl) are essential materials in the aerospace industry, providing lightweight and high-temperature stability necessary for advanced jet engines and critical applications. The company has consistently emphasized their strategic focus on developing high-performance materials for aerospace, defense, and industrial markets.

Titanium and other alloys play a vital role in enhancing performance and meeting the evolving needs of these industries. The growing demand for TiAl alloys reflects their significance in advancing aerospace technologies and supporting innovations in high-efficiency, high-performance applications.

The titanium aluminide (TiAl) market represents a small yet specialized segment within its parent markets. Within the titanium alloy market, TiAl is estimated to hold approximately 5-7% of the total market share, as titanium alloys include a variety of other compositions. In the broader high-performance alloys market, TiAl contributes roughly 2-3%, given the dominance of other alloys like nickel-based superalloys.

Within the advanced materials market, TiAl’s share is again minimal, estimated at less than 1%, as it competes with numerous other advanced materials. In the aerospace materials market, TiAl holds a more significant share, around 10-15%, due to its application in engine components. In the automotive materials market, its contribution is small, around 1-2%, as other materials dominate automotive manufacturing.

In regions like East Asia, China and India are expected to be key drivers of growth, with aerospace modernization programs and expanding automotive industries increasing the demand for advanced materials. VSMPO-AVISMA Corporation and ATIare among the key players advancing TiAl alloy technologies to meet these growing needs.

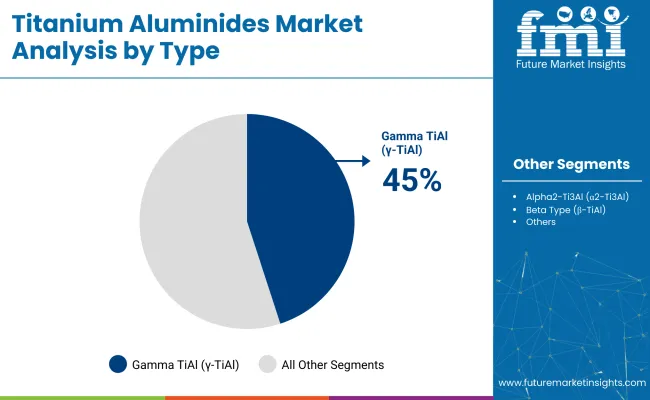

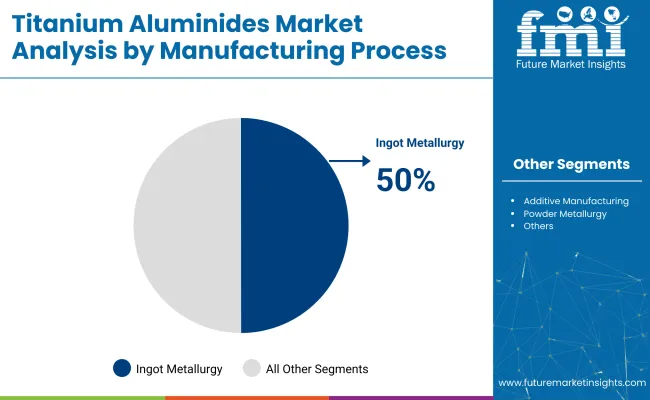

The TiAl market is growing rapidly, with gamma TiAl (γ-TiAl) expected to dominate in 2025, accounting for 45% of the market share. Ingot metallurgy is set to lead the manufacturing process with a 50% share, driven by its precision and high-quality production.

Gamma TiAl (γ-TiAl) is expected to dominate the market in 2025, holding an estimated 45% market share.

The ingot metallurgy process, which includes methods such as vacuum arc remelting (VAR) and plasma arc melting (PAM), is projected to capture a 50% market share in 2025.

The aerospace & defense sector is projected to dominate the TiAl market in 2025, holding a 50% market share.

The TiAl market is driven by rising demand for lightweight, high-performance materials in aerospace, defense, and automotive applications. However, high production costs and the complex manufacturing process remain key challenges, prompting innovation in cost-effective solutions and production efficiency.

Rising Demand for Lightweight, High-Performance Materials Driving Growth

The market is driven by the increasing demand for lightweight, high-performance materials across aerospace, automotive, and industrial sectors. TiAl alloys provide a unique combination of high-temperature strength, low density, and resistance to corrosion, making them ideal for demanding applications such as turbine blades in aircraft engines.

As industries increasingly prioritize fuel efficiency, reduced emissions, and performance improvements, the demand for TiAl alloys is expected to continue rising, especially in aerospace and high-performance automotive applications.

High Production Costs and Limited Material Availability Hindering Market Growth

Despite the growing demand, the market faces challenges related to high production costs and the limited availability of raw materials. The complex manufacturing processes required to produce TiAl alloys, particularly in ingot metallurgy and powder metallurgy, contribute to these high costs.

Additionally, the sourcing of high-purity titanium and aluminum remains a constraint in scaling production to meet rising demand. To overcome these challenges, companies are optimizing manufacturing processes and developing cost-effective alternatives, but price sensitivity and material scarcity remain significant hurdles.

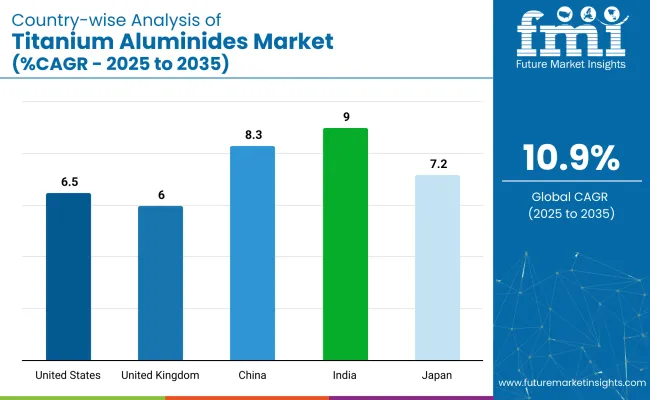

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 6% |

| China | 8.3% |

| India | 9% |

| Japan | 7.2% |

India’s momentum is driven by increasing demand in its automotive and aerospace sectors, coupled with rapid industrialization and infrastructure development. China follows closely, with a projected 8.3% CAGR, supported by its growing aerospace and automotive industries, and a strong focus on developing advanced materials. Developed economies such as Japan (7.2%), the United Kingdom (6%), and the United States (6.5%) are expanding at a steady 0.95-1.03x rate.

The United States leads the demand for TiAl, driven by its aerospace and automotive industries. Japan benefits from technological innovation in alloy production, while the United Kingdom focuses on fuel-efficient, lightweight materials. As the market adds over USD 350 million by 2035, both high-growth regions like India and China and stable demand from OECD countries will shape its trajectory.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The USA titanium aluminides (TiAl) market is estimated to grow at a 6.5% CAGR during the study period (2025 to 2035). The growth is primarily driven by advancements in the aerospace and automotive industries, where TiAl is valued for its high-temperature resistance and light weight.

The USA aerospace sector, being one of the largest globally, is increasingly adopting TiAl for manufacturing components like turbine blades and exhaust systems in jet engines. Furthermore, the automotive industry in the USA is focusing on reducing vehicle weight to improve fuel efficiency, which is bolstering the demand for lightweight, high-performance materials such as TiAl.

The ongoing development of electric vehicles (EVs) and hybrid systems is also contributing to this demand, as TiAl provides superior thermal stability and strength, making it ideal for battery components and powertrain systems.

The UK titanium aluminides (TiAl) market is projected to grow at a CAGR of 6% during the study period. The UK has a well-established aerospace industry, which has significantly contributed to the demand for TiAl alloys, particularly for turbine engines and other high-performance components.

The UK's emphasis on sustainable and energy-efficient solutions in transportation is further accelerating the market, as TiAl offers the necessary properties of lightweight construction and high-temperature endurance required for modern aircraft engines. Additionally, research and development initiatives in the UK are continuously improving the production processes of TiAl, enhancing its applications in both aerospace and automotive sectors.

China’s titanium aluminides (TiAl) market is set to grow at a CAGR of 8.3% from 2025 to 2035. The country’s aerospace industry is a significant driver, with the Chinese government heavily investing in military and commercial aircraft. The rising demand for high-performance alloys for jet engines and turbine blades is expected to fuel the TiAl market.

Moreover, China’s rapid industrialization and push towards more sustainable technologies in automotive manufacturing are further contributing to this market expansion. The government’s focus on the "Made in China 2025" initiative, which aims to boost domestic manufacturing and technological advancements, is expected to increase the adoption of advanced materials like TiAl. The automotive sector is increasingly using TiAl to reduce the weight of vehicles and improve fuel efficiency, thus meeting stricter environmental regulations.

India’s titanium aluminides (TiAl) market is expected to grow at an impressive 9% CAGR during the forecast period. The country's aerospace industry is rapidly expanding, with increasing demand for TiAl in turbine engines and other high-performance applications. The Indian government’s initiatives to strengthen its aerospace and defense sectors are fostering the use of advanced materials like TiAl.

India is also witnessing a rise in domestic automotive production, with an increasing focus on lightweight, fuel-efficient vehicles. TiAl’s superior properties, such as heat resistance and lightweight nature, are making it a key material for components in electric vehicles (EVs) and hybrid technologies.

Japan’s titanium aluminides (TiAl) market is projected to grow at a CAGR of 7.2% from 2025 to 2035. Japan's aerospace sector plays a pivotal role in driving the demand for TiAl, with major companies investing in advanced propulsion systems and high-efficiency engines. The country is known for its innovative technological developments in aviation, and TiAl is increasingly being used in turbine blades and other engine components due to its strength and resistance to extreme temperatures.

In addition, Japan's automotive industry is focused on lightweight materials for fuel efficiency, and TiAl's high-performance properties are being leveraged for automotive applications. The country's commitment to innovation and environmental sustainability is fueling the adoption of TiAl alloys in both the automotive and aerospace industries.

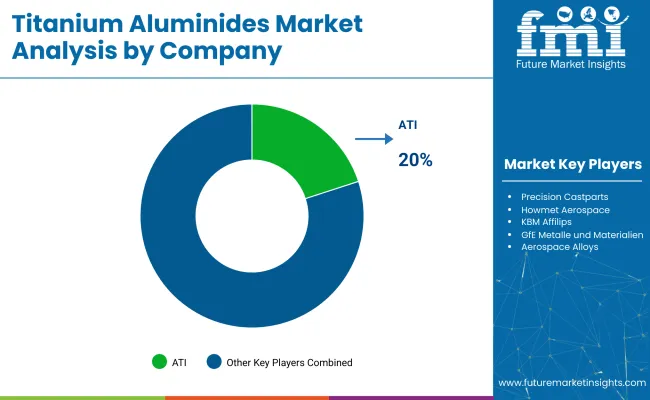

Key players like ATI, VSMPO-AVISMA Corporation, and Precision Castparts dominate the market with advanced technologies, global distribution networks, and industry expertise. ATI provides titanium and alloy products for aerospace, defense, and industrial applications.

VSMPO-AVISMA, a leading global titanium producer, focuses on high-quality aerospace products. Precision Castparts specializes in complex metal components for aerospace, power generation, and defense, emphasizing casting and forging innovation. Other key players like Howmet Aerospace, KBM Affilips, and GfEMetalle und Materialien deliver high-performance alloys.

Companies such as AMG Advanced Metallurgical Group, Alcoa, and Western Superconducting Technologies contribute to TiAl production, addressing the growing demand in aerospace and automotive sectors. Carpenter Technology, American Elements, and Toho Titanium ensure continued market growth with innovative solutions.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 436.95 million |

| Projected Market Size (2035) | USD 1,229.54 million |

| CAGR (2025 to 2035) | 10.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and tons for volume |

| Type Segmentation | Gamma TiAl (γ- TiAl ), Alpha2-Ti3Al (α2-Ti3Al), Orthorhombic Ti2AlNb (O-Ti2AlNb), Beta Type (β- TiAl ), Others |

| Manufacturing Process Segmentation | Ingot metallurgy (VAR, EBM, PAM, VIM), Powder metallurgy (Gas atomization, PREP, Mechanical alloying), Additive manufacturing (PBF, DED, Others), Others |

| End-Use Industry Segmentation | Aerospace & Defense (Commercial Aviation, Military Aviation, Space Applications), Automotive (Passenger Vehicles, Commercial Vehicles, Racing & High-Performance Vehicles), Industrial (Power Generation, Chemical Processing, Oil & Gas, Others), Healthcare (Orthopedic Implants, Dental Applications, Others), Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | ATI, VSMPO-AVISMA Corporation, Precision Castparts, Howmet Aerospace, KBM Affilips, GfE Metalle und Materialien, AMG Advanced Metallurgical Group, Alcoa Corporation, Western Superconducting Technologies, Carpenter Technology Corporation, American Elements, Toho Titanium, Titanium Metals Corporation, Stanford Advanced Materials, Aerospace Alloys, 6 K, Arconic Corporation, Daido Steel, Kobe Steel |

| Additional Attributes | Dollar sales by type, manufacturing process, and end-use industry, growing demand in aerospace and automotive sectors, technological advancements in TiAl production methods, increasing adoption of TiAl in high-performance applications, regional growth trends in industrial and healthcare sectors. |

The market is segmented into Gamma TiAl (γ-TiAl), Alpha2-Ti3Al (α2-Ti3Al), Orthorhombic Ti2AlNb (O-Ti2AlNb), Beta Type (β-TiAl), and Others.

The market is segmented into Ingot Metallurgy (Vacuum arc remelting (VAR), Electron beam melting (EBM), Plasma arc melting (PAM), Vacuum induction melting (VIM)), Powder Metallurgy (Gas atomization, Plasma rotating electrode process (PREP), Mechanical alloying), Additive Manufacturing (Powder bed fusion (PBF), Direct energy deposition (DED), Others), and Others.

The market is segmented into Aerospace & Defense (Commercial Aviation, Military Aviation, Space Applications), Automotive (Passenger Vehicles, Commercial Vehicles, Racing & High-Performance Vehicles), Industrial (Power Generation, Chemical Processing, Oil & Gas, Others), Healthcare (Orthopedic Implants, Dental Applications, Others), and Others.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East, and Africa (MEA).

The market is projected to reach USD 436.95 million in 2025.

The market is expected to grow to USD 1,229.54 million by 2035.

The Market is expected to grow at a CAGR of 10.9% from 2025 to 2035.

Aerospace & defense is the leading segment, holding a 50% share in 2025.

India has the highest CAGR in the market at 9%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Strips Market Size and Share Forecast Outlook 2025 to 2035

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium Dioxide Color Market Trends - Applications & Industry Demand 2025 to 2035

Titanium-Free Food Color Alternatives Market

Titanium Market

Titanium Dioxide Market

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Anodized Titanium Market Growth - Trends & Forecast 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Extra Low Interstitial Titanium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA