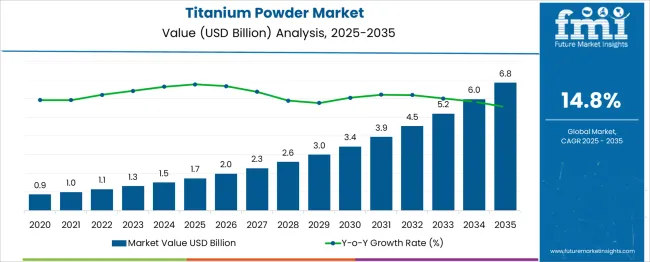

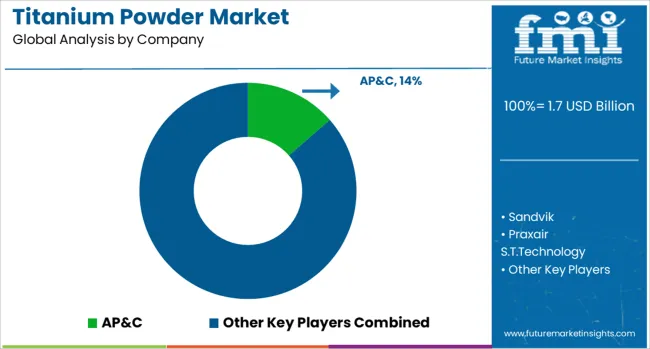

The Titanium Powder Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period. Cost reductions from plasma atomization and increased recycling of aerospace-grade scrap are improving feedstock economics. As OEMs prioritize strength-to-weight optimization and corrosion resistance, titanium powder demand is expected to scale aggressively, supported by broader industrial digitalization and defense spending.

| Metric | Value |

|---|---|

| Titanium Powder Market Estimated Value in (2025 E) | USD 1.7 billion |

| Titanium Powder Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

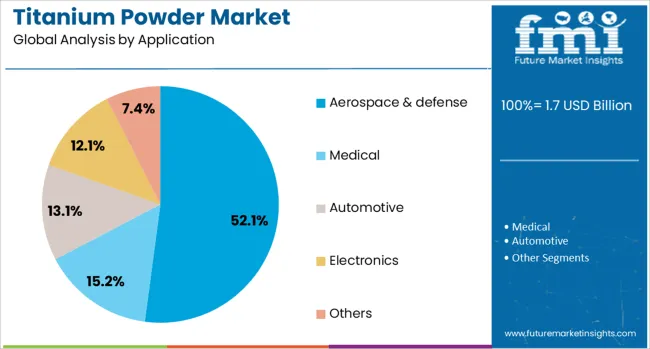

The titanium powder market is overwhelmingly dominated by the aerospace and defense sector, which accounts for roughly 45–50% of global demand. Titanium powder is favored in aerospace manufacturing due to its exceptional strength-to-weight ratio, resistance to corrosion, and ability to withstand extreme operating conditions. Aircraft structural components, turbine parts, and defense hardware rely heavily on titanium powders for performance-critical applications. The automotive sector follows with about 20–25%, especially in electric vehicles and high-performance models where lightweight but strong materials are essential. Titanium powders enable efficient engine parts, exhaust systems, and suspension components. The medical devices and healthcare industry represents roughly 15% of usage; titanium powder is increasingly used in customized 3D‑printed implants, dental and orthopedic devices, and surgical instruments due to its biocompatibility and strength. Around 10% of demand comes from industrial and petrochemical applications, where titanium’s resistance to corrosive environments makes it ideal for valves, heat exchangers, and other long-lasting equipment. The remaining 5–8% is attributed to consumer electronics and miscellaneous applications, including products like electronic housings, advanced prototyping, and emerging wearables.

The titanium powder market is gaining strong momentum due to its critical role in advanced manufacturing, driven by the need for lightweight, corrosion-resistant, and high-performance materials. The integration of additive manufacturing technologies in high-precision industries has amplified the demand for titanium powder, particularly in applications requiring superior strength-to-weight ratios and biocompatibility.

The market is being further supported by the growing focus on sustainable production methods and the recyclability of titanium materials, which align with global carbon reduction strategies. Key end-use sectors including aerospace, medical implants, and automotive components are transitioning toward titanium powder-based fabrication to enhance performance and reduce material waste.

Additionally, the development of new alloy formulations and the availability of finer particle size distributions are contributing to the broader adoption of titanium powder in powder metallurgy and 3D printing applications. Continued investment in aerospace R&D and the expansion of defense and space programs worldwide are expected to accelerate the growth of the titanium powder market in the coming years.

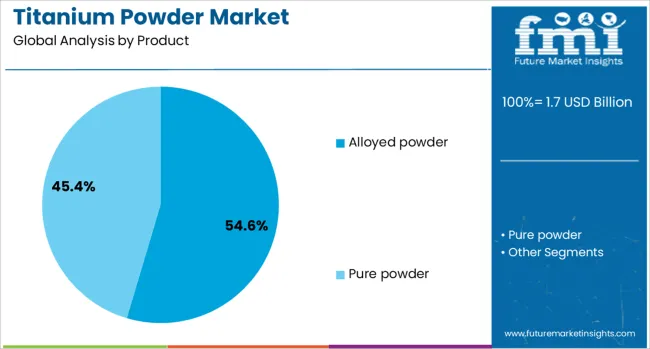

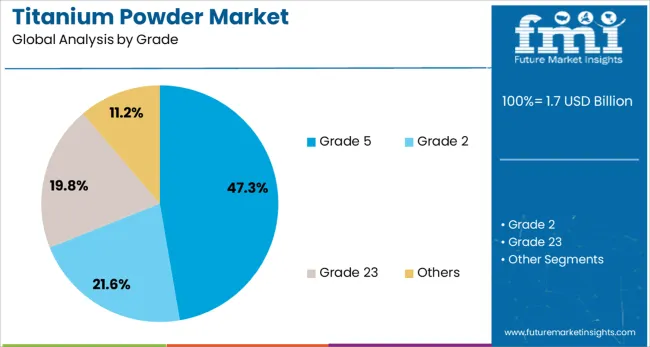

The titanium powder market is segmented by product, grade, application, and geographic regions. The titanium powder market is divided into Alloyed powder and Pure powder. The titanium powder market is classified by grade into Grade 5, Grade 2, Grade 23, and Others. Based on the application, the titanium powder market is segmented into Aerospace & defense, Medical, Automotive, Electronics, and Others. Regionally, the titanium powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Alloyed powder is expected to account for 54.6% of the titanium powder market revenue share in 2025, positioning it as the leading product category. The dominance of this segment is driven by its enhanced mechanical properties, including improved tensile strength, fatigue resistance, and thermal stability, which make it suitable for demanding engineering applications.

Alloyed powders are being increasingly used in the production of aerospace components, turbine parts, and structural elements where performance under extreme conditions is critical. The flexibility in alloy composition allows manufacturers to tailor material characteristics according to specific application needs, contributing to widespread industrial adoption.

The segment’s growth is also being supported by advancements in powder production techniques such as gas atomization and plasma rotating electrode processes, which ensure consistent quality and purity. The increasing compatibility of alloyed powders with additive manufacturing technologies and the ability to meet stringent industry standards have made this product type a preferred choice in the high-performance materials market.

Grade 5 is projected to hold 47.3% of the titanium powder market revenue share in 2025, making it the most utilized grade across various applications. The segment’s leadership is driven by its optimal combination of strength, corrosion resistance, and thermal performance, which is essential for critical components in aerospace, marine, and medical industries.

Grade 5 titanium, also known as Ti-6Al-4V, offers superior machinability and excellent biocompatibility, making it highly suitable for surgical implants and orthopedic devices. The material's adaptability to powder-based manufacturing methods and its consistent performance under dynamic stress conditions have led to its widespread usage in additive manufacturing environments.

Manufacturers have favored Grade 5 for its compliance with international specifications and its ability to deliver lightweight yet durable end-products. Continued innovation in post-processing and surface finishing technologies has further supported the scalability of Grade 5 titanium powder in both prototyping and full-scale production, reinforcing its dominant position in the market.

The aerospace and defense segment is anticipated to contribute 52.1% of the titanium powder market revenue share in 2025, reflecting its strong dependence on high-strength and lightweight materials. The segment's prominence is attributed to the increasing adoption of titanium powder in the production of aircraft structures, engine components, and defense-grade hardware where durability, performance, and weight reduction are critical.

Titanium’s excellent strength-to-weight ratio and resistance to fatigue and extreme temperatures make it an ideal material for both military and commercial aerospace applications. Additive manufacturing technologies have enabled the production of complex geometries using titanium powder, reducing material wastage and production lead times.

The global expansion of defense budgets, rising space exploration initiatives, and commercial aircraft fleet modernization programs have significantly driven the demand for titanium-based components. Regulatory compliance with safety and performance standards has further encouraged the use of high-purity titanium powders in mission-critical defense applications, positioning this segment for sustained growth.

Growing industrial and additive manufacturing usage is boosting titanium powder adoption. Expansion is supported by specialized powder grades for aerospace, personalized medical implants, and regional recycling partnerships in metal powders.

Titanium powder is being specified by aerospace, medical device and motorsport industries for production of high-strength parts with low weight and corrosion resistance. Titanium powder-based additive manufacturing allows component complexity, material efficiency and shorter supply chains for custom implants, engine parts and structural components. The ability to produce near-net-shape parts using powder bed fusion or directed energy deposition is being favored for lightweight structural hardware. Aerospace OEMs and contract manufacturers are choosing powder with controlled size distribution and purity grade to meet regulatory and certification criteria. Demand is strongest among firms pursuing high-performance boundaries with minimized waste and streamlined logistics.

Opportunities are being unlocked through development of high-purity, spherical or alloyed titanium powder grades tailored for specific additive manufacturing systems and end-use applications. Partnerships between powder producers, powder recyclers and additive machine builders are enabling integrated supply systems with closed-loop recycling and quality assurance. Providers offering powder-as-a-service agreements—including powder sampling, reuse analytics and replenishment—are reducing barriers for new users. Regional powder blending and recycling centres located near aerospace or implant production clusters are improving lead time and traceability. Collaborative programs with medical implant firms or aerospace tier suppliers for pilot production runs help validate powder performance and expand adoption in regulated and advanced manufacturing sectors.

The aerospace and medical sectors are driving growing use of titanium powder for additive manufacturing applications. Aerospace designers favor titanium for high-strength, lightweight parts produced through 3D printing, while medical device firms use biocompatible powders to produce patient-specific implants with better osseointegration. Titanium alloy powders now account for nearly half of powder produced globally, with alloyed grades having higher market growth than pure titanium. Market share from aerospace and medical applications dominates global revenue. Suppliers that can ensure high sphericity, low oxygen content, and consistent particle size distribution gain preference. Hospitals and aircraft OEMs often require advanced quality testing and powder certification. Manufacturers who align supply with these standards and offer traceable process control are well-positioned to capture rapidly growing premium segments.

High production costs and handling challenges limit broader penetration of titanium powder in cost-sensitive segments. Powder production demands energy-intensive atomization, precision alloying, and clean-room conditions. Price per kilogram remains significantly higher than steel or aluminum powders, and storage requires inert environments to avoid oxidation. Recycling efficiency is low due to contamination sensitivity. These factors make titanium powder uneconomical for low-margin manufacturing sectors. Smaller manufacturers and OEMs may avoid adoption due to high entry and operational costs. Until economies of scale improve or new lower-cost extraction methods emerge, adoption will remain focused on aerospace, medical, and premium industrial applications where performance justifies expense.

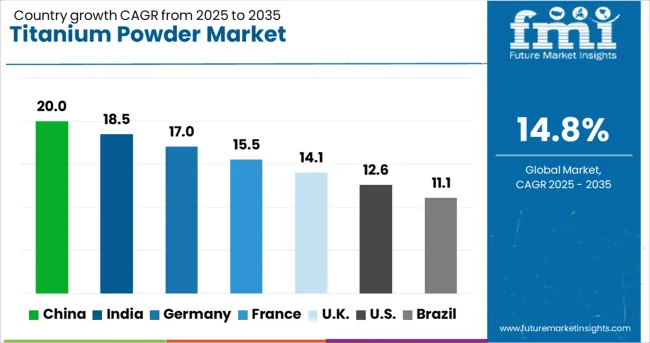

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

China, a BRICS member, is projected to grow at a 20.0% CAGR from 2025 to 2035, supported by expanded domestic output of aerospace-grade powders and increased use in metal 3D printing across aviation and defense sectors. India, also part of BRICS, follows at 18.5%, where titanium powder is increasingly utilized in biomedical implants and alloy preparation across emerging metallurgy hubs. Among OECD nations, Germany records a 17.0% growth rate, with strong demand from powder metallurgy firms supplying high-performance parts for automotive turbo systems and industrial gas turbines. France, growing at 15.5%, shows increasing application in additive manufacturing for lightweight structural components used in rail and maritime industries. The United Kingdom, with a 14.1% CAGR, maintains steady growth through advanced usage of titanium powder in orthopedic devices and satellite-grade structural assemblies. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

A CAGR of 20.0% has been recorded in China due to rising demand across aerospace, metal additive manufacturing, and industrial production. Titanium powder is being produced through gas atomization and hydride-dehydride methods to meet application-specific requirements. High purity variants are being distributed to aircraft, defense, and 3D printing sectors. Equipment upgrades are being carried out to support consistent particle size and controlled flow properties. Domestic manufacturing lines are being expanded to supply coatings, structural brackets, and engine housings. Technical standards are being aligned with overseas client expectations to support exports. Increased downstream consumption is being observed across marine and precision tooling industries.

India has been witnessing a CAGR of 18.5%, driven by increased applications in medical, aerospace, and metal component manufacturing. Titanium powders are being adopted for producing structural parts in both civilian and defense sectors. Processing techniques are being standardized to support production of orthopedic implants, dental parts, and precision fasteners. Atomization units are being set up to ensure control over particle morphology and composition. Strong demand is being registered for corrosion-resistant materials used in chemical and marine systems. Compact parts are being formed using press-and-sinter and metal injection molding routes. Larger volumes are being prepared for domestic assembly lines and public sector engineering units.

With a CAGR of 17.0%, Germany has been expanding its titanium powder usage in automotive, aerospace, and electronic tooling segments. Specialized atomization systems are being used to produce powders suitable for high-stress and high-temperature environments. Titanium components are being designed for reduced mass and increased fatigue life in engine and turbine applications. Medical-grade powders are being manufactured with narrow particle distribution and high purity. Multiple production lines are being calibrated to serve additive manufacturing needs in industrial plants. Certification standards are guiding part validation processes across end-use sectors. Equipment inserts, heat shields, and tool parts are among key application areas.

France has posted a CAGR of 15.5 % owing to expanding use of titanium powder in compact part manufacturing and marine engineering. Demand is being driven by industries requiring low-density, corrosion-resistant materials for extreme conditions. Titanium is being used in both powder-based cladding and sintered assemblies. Additive manufacturing hubs are scaling up usage of gas-atomized powders for complex structural parts. Medical producers are utilizing powder compaction methods to produce implants and connectors. Powder refinement systems are being adjusted for consistent size control. Engineering firms are placing repeat orders for titanium parts used in offshore, naval, and airborne machinery.

A CAGR of 14.1 % has been observed in the United Kingdom due to consistent demand from aerospace, defense, and biomedical sectors. Titanium powder is being adopted in the production of parts that require strength, corrosion resistance, and biocompatibility. Powder-bed fusion and binder jetting processes are being supported through local supply of spherical powders. Defense contractors are sourcing compact parts with performance advantages over conventional metalworking. Titanium is also being used in long-lasting joint replacements and dental frameworks. Additive manufacturing systems are being operated under controlled conditions to ensure powder reuse and part reliability. Industrial demand continues to grow for powder-based components in high-load environments.

The titanium powder market is composed of a diverse set of global manufacturers and specialized material producers, segmented into Tier 1, Tier 2, and Tier 3 suppliers based on production scale, technological capabilities, and end-use specialization. Tier 1 suppliers are large, vertically integrated companies with advanced atomization and powder metallurgy technologies.

These firms serve high-performance applications in aerospace, defense, medical implants, and additive manufacturing (3D printing). Their titanium powders are characterized by precise particle size control, high purity, and excellent flowability—essential for critical components where strength-to-weight ratio and corrosion resistance are vital. These suppliers also invest heavily in R&D, focusing on the development of spherical titanium powders optimized for laser and electron beam powder bed fusion processes.

Tier 2 suppliers cater to industrial and automotive sectors, offering cost-effective titanium powders for applications such as metal injection molding (MIM), thermal spraying, and conventional powder metallurgy. These manufacturers may not operate at the same scale as Tier 1 players but often provide customized particle distributions, alloy blends, and surface treatments suited for mid-range performance requirements. They are crucial for enabling broader industrial adoption of titanium in components where high strength and corrosion resistance are required without the need for aerospace-grade specifications.

Tier 3 suppliers operate at a smaller, often regional level, offering titanium powder for prototyping, research, or lower-spec applications. These firms typically serve educational institutions, R&D labs, and niche markets. The overall market is driven by rising demand for lightweight, high-performance materials across aerospace, biomedical, and emerging additive manufacturing industries, with suppliers focused on purity, consistency, and cost-efficiency.

On June 19, 2024, PyroGenesis Canada Inc. officially announced receipt of a second signed order from a Spanish aerospace client for titanium metal powder produced using its NexGen™ plasma atomization system. The specified particle size was 20–63 µm, suitable for additive manufacturing processes like DMLS/SLM. The company expects to qualify for a long-term supply contract following this engagement.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product | Alloyed powder and Pure powder |

| Grade | Grade 5, Grade 2, Grade 23, and Others |

| Application | Aerospace & defense, Medical, Automotive, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AP&C, Sandvik, Praxair S.T.Technology, Kymera International, AdvancedMetallurgicalGroup, TronoxInc.(CristalMetals), ECKARTTLS, IperionX, OSAKATitaniumTechnologies, GlobalTitanium, ADMAProducts, NorthSteel, MEPCO, BLT, and N.V. |

| Additional Attributes | Dollar sales by product type such as pure and alloyed powders, by titanium grade including Grade 2 and Grade 5, and by application in aerospace, medical implants, automotive, and electronics; demand fueled by 3D printing adoption, lightweight design needs, and biocompatibility; innovation in atomization processes and alloy refinement; cost driven by raw material sourcing and powder purity; and emerging use in high‑performance and custom parts. |

The global titanium powder market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the titanium powder market is projected to reach USD 6.8 billion by 2035.

The titanium powder market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in titanium powder market are alloyed powder and pure powder.

In terms of grade, grade 5 segment to command 47.3% share in the titanium powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Strips Market Size and Share Forecast Outlook 2025 to 2035

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Titanium Aluminides (TiAl) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium Dioxide Color Market Trends - Applications & Industry Demand 2025 to 2035

Titanium-Free Food Color Alternatives Market

Titanium Market

Titanium Dioxide Market

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Anodized Titanium Market Growth - Trends & Forecast 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Extra Low Interstitial Titanium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA