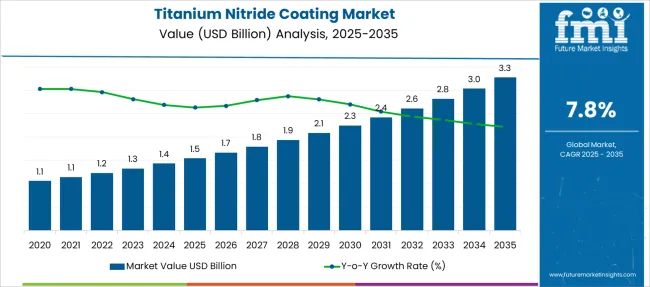

The Titanium Nitride Coating Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Titanium Nitride Coating Market Estimated Value in (2025 E) | USD 1.5 billion |

| Titanium Nitride Coating Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The titanium nitride coating market is growing steadily due to increasing demand for surface enhancement solutions across various industrial sectors. This coating improves hardness, wear resistance, and corrosion protection which extends the life of tools and components. Manufacturing industries, particularly automotive and metalworking, have intensified adoption to improve product performance and reduce maintenance costs.

Advances in coating technologies and process optimization have enhanced coating uniformity and efficiency. Increasing use of coated cutting tools in machining and fabrication processes has driven market expansion.

Environmental regulations promoting longer-lasting and more sustainable tooling have also supported growth. The market is expected to benefit from ongoing innovation and broader adoption in end-use industries focused on improving durability and operational efficiency. Segment growth is expected to be led by Physical Vapor Deposition as the dominant coating process, Cutting Tools as the primary application, and the Automotive industry as a leading end-user segment.

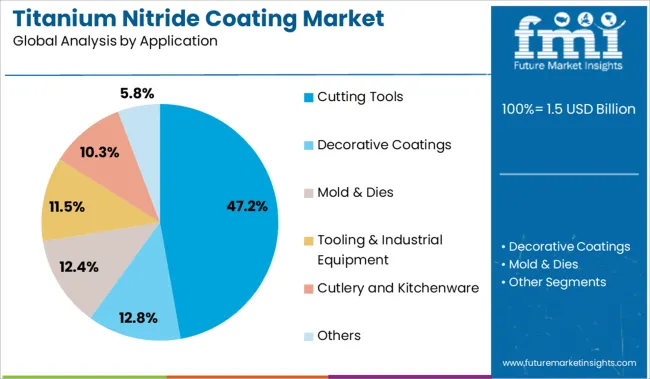

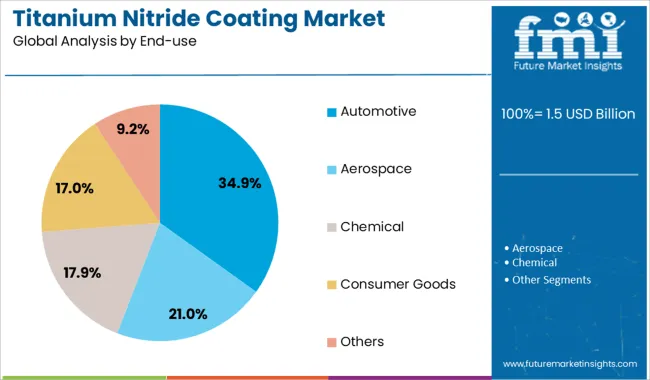

The market is segmented by Coating Process, Application, and End-use and region. By Coating Process, the market is divided into Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD). In terms of Application, the market is classified into Cutting Tools, Decorative Coatings, Mold & Dies, Tooling & Industrial Equipment, Cutlery and Kitchenware, and Others. Based on End-use, the market is segmented into Automotive, Aerospace, Chemical, Consumer Goods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Physical Vapor Deposition segment is projected to hold 53.7% of the titanium nitride coating market revenue in 2025, establishing its lead as the preferred coating process. This is driven by PVD’s ability to produce high-quality, uniform coatings with excellent adhesion and controlled thickness. The low environmental impact and energy efficiency of PVD compared to traditional methods have increased its appeal.

Its suitability for coating complex geometries and small components makes it widely applicable in tool manufacturing. Industry demand for coatings that can withstand high temperatures and mechanical stresses has bolstered PVD adoption.

As manufacturers seek improved surface properties and longer tool life, the PVD process is expected to maintain its dominant position.

The Cutting Tools application segment is forecasted to contribute 47.2% of the market revenue in 2025, sustaining its position as the largest application area. Growth in this segment is due to the critical need for coatings that enhance tool performance in high-speed machining and metal cutting operations. Titanium nitride coatings provide improved wear resistance and reduce friction which extends tool life and enhances productivity.

The increasing complexity of machining processes and demand for precision components have accelerated the adoption of coated cutting tools.

Additionally, the rise in automotive and aerospace manufacturing has increased demand for high-performance tools. This segment is expected to continue driving the market as manufacturers seek to optimize cutting tool efficiency and reduce operational costs.

The Automotive segment is projected to account for 34.9% of the titanium nitride coating market revenue in 2025, maintaining its leadership among end-users. Growth is attributed to the industry’s focus on enhancing component durability and reducing wear in manufacturing tools and automotive parts. The demand for lightweight and high-strength materials in vehicles has led to increased use of coated tools and components to ensure manufacturing precision and performance.

Automotive manufacturers prioritize coatings that improve resistance to abrasion and corrosion in both production and end-use environments.

Expanding automotive production and modernization of manufacturing processes continue to support the segment’s growth. The Automotive sector is expected to remain a key driver of titanium nitride coating adoption due to ongoing innovation and quality standards.

Demand is fueled by applications in cutting tools, aerospace, automotive, and healthcare sectors, driven by TiN’s superior hardness, wear and corrosion resistance. High process costs, raw material price volatility, and the availability of alternative coatings act as constraints. The market is expected to expand as standalone 5G applications and emerging industries embrace TiN coating, enabling vendors specializing in advanced PVD and CVD processes to capture long‑term growth.

Adoption of titanium nitride coatings has been driven by a rising need for surface resilience, wear resistance, and operational durability in high-performance industries. Components exposed to extreme pressure, temperature, and friction—such as engine parts, cutting tools, and aerospace fasteners—have increasingly relied on TiN to extend product lifecycle and reduce downtime. Manufacturers operating in sectors with narrow tolerance thresholds have integrated TiN-coated tools to maintain process consistency, minimize component degradation, and support machining efficiency. The compound's golden finish and hardness have also enabled use in surgical instruments and dental implants, where biocompatibility is prioritized. Preference has shifted toward physical vapor deposition and chemical vapor deposition methods offering reliable adhesion, uniform coating thickness, and high substrate compatibility. Industrial users have continued to favor TiN over conventional plating or anodization due to its ability to reduce maintenance and improve productivity. Market penetration has grown across North America, Europe, and Asia-Pacific, where machining intensity and high-output production are concentrated.

Titanium nitride coatings have demonstrated growth potential in emerging sectors that demand both aesthetic appeal and functional enhancement. Use in consumer electronics, precision optics, and decorative metal components has expanded beyond industrial applications. Coatings have gained popularity in luxury goods, jewelry, and interior fixtures where abrasion resistance and surface luster are required. In the medical domain, adoption has increased in orthopedic and surgical tools due to TiN’s hypoallergenic and inert characteristics. Semiconductor and microelectronic components now benefit from TiN’s role as a barrier layer against diffusion and oxidation. Asia-Pacific countries, particularly India, South Korea, and China, have scaled manufacturing capabilities in these sectors, driving regional demand. Coating providers who offer precision control, advanced multilayer configurations, and customized finishes are well-positioned to capture new business. As industries focus on material longevity and cost-efficient production, TiN’s hybrid functional-decorative appeal is expected to unlock broader cross-sector adoption.

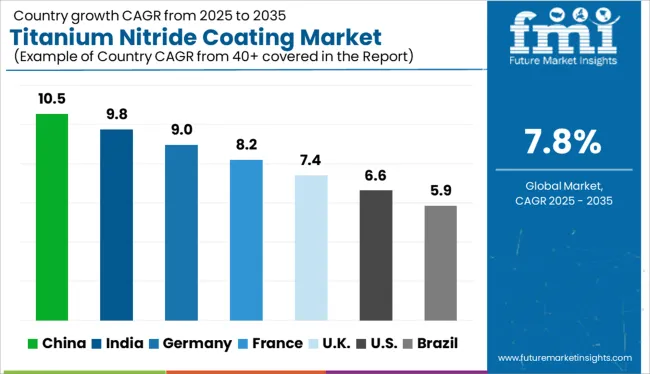

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

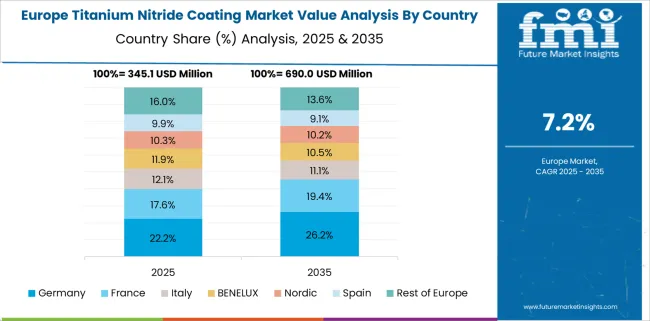

The global titanium nitride (TiN) coating market is set to grow at a 7.8% CAGR from 2025 to 2035. Of the 40 countries studied, China leads with 10.5%, followed by India at 9.8% and Germany at 9%. France and the United Kingdom trail at 8.2% and 7.4% respectively. These growth rates suggest an above-average trajectory in China and India due to widespread integration in tooling, electronics, and biomedical sectors. Germany’s momentum is tied to precision machining and aerospace engineering. France’s growth is powered by defense-grade coatings and localized manufacturing. The UK’s adoption reflects moderate but stable demand across orthopedic implants and advanced industrial tooling.

China’s titanium nitride coating market is forecast to register a 10.5% CAGR, driven by surging demand from the cutting tools, semiconductor, and optics industries. Manufacturers are investing in plasma-assisted deposition and PVD coating facilities for scalability. Domestic producers have enhanced capacity for vacuum sputtering and ion plating to meet metallurgical requirements in medical and automotive applications. Key regional hubs such as Suzhou and Shenzhen lead in deposition equipment manufacturing and coating customization.

India is projected to experience a 9.8% CAGR in the titanium nitride coating segment, with increased uptake across automotive, medical implants, and high-wear industrial components. Local demand is supported by rapid tooling upgrades and import substitution strategies. Several coating service providers now offer multi-layer TiN-TiCN hybrid solutions tailored for high-friction applications. The government's support for indigenous defense manufacturing also contributes to coating standardization and equipment upgrades.

The titanium nitride market in Germany is expected to grow at a CAGR of 9%, driven by consistent investment in advanced surface treatment systems for engineering, aerospace, and biomedical tools. Renowned for high-precision tooling requirements, German manufacturers rely heavily on TiN coatings to enhance tool lifespan and maintain thermal stability during high-speed machining. Companies like CemeCon and Oerlikon Balzers have advanced thin-film deposition systems tailored for aerospace tolerances.

The titanium nitride coating market in France is growing steadily at 8.2% CAGR, supported by strong demand from defense and industrial manufacturing sectors. Leading defense contractors employ TiN coatings to enhance resistance to corrosion and erosion in mission-critical parts. French toolmakers have incorporated PVD coating services in-house, expanding local capacity. Growth is also seen in luxury goods finishing, with gold-colored TiN replacing traditional electroplating for environmentally aligned production.

The United Kingdom titanium nitride market is advancing at a 7.4% CAGR, showing stable demand in medical, dental, and industrial machinery components. Private healthcare equipment manufacturers favor TiN for its antimicrobial and biocompatible properties, especially in orthopedic implants and surgical tools. Tool refurbishing companies are expanding PVD service offerings in Birmingham and Manchester. Academic collaborations on nano-coatings for wear resistance are expanding experimental applications in defense and aerospace.

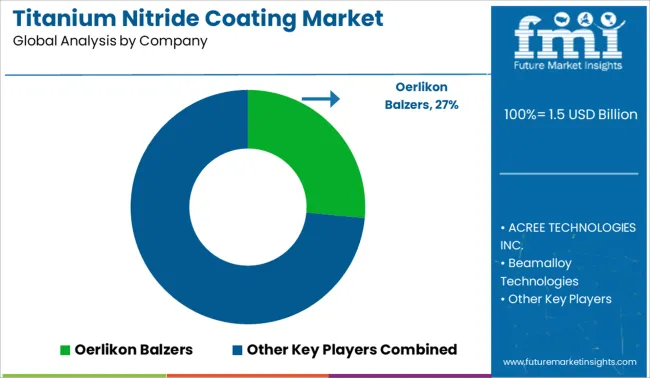

The titanium nitride coating market is moderately consolidated, with Oerlikon Balzers leading at 26.5% market share. The company dominates through its global presence, proprietary PVD technologies, and strong brand positioning in tooling and precision applications. Tier 1 leadership is exclusive to Oerlikon, reflecting its scale and innovation depth. Tier 2 suppliers such as voestalpine eifeler group, NISSIN ELECTRIC Co., Ltd., and Wallwork Heat Treatment Ltd offer high-performance coatings for industrial tooling, automotive, and aerospace sectors with regional strengths. Tier 3 players like ACREE Technologies Inc., SurfTech, Calico Coatings, and BryCoat Inc. cater to niche needs with contract-based services and custom formulations. Market traction is driven by demand for wear resistance, thermal stability, and reduced friction in manufacturing and machining processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Coating Process | Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) |

| Application | Cutting Tools, Decorative Coatings, Mold & Dies, Tooling & Industrial Equipment, Cutlery and Kitchenware, and Others |

| End-use | Automotive, Aerospace, Chemical, Consumer Goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oerlikon Balzers, ACREE TECHNOLOGIES INC., Beamalloy Technologies, BryCoat Inc., Calico Coatings, NISSIN ELECTRIC Co., Ltd., Surface Engineering Technologies LLC, SurfTech., Vergason Technology, Inc, voestalpine eifeler group, and Wallwork Heat Treatment Ltd |

| Additional Attributes | Dollar sales by coating type (PVD, CVD, thermal spray), Dollar sales by substrate material (steel, aluminum, titanium, plastic), Trends in wear resistance and corrosion protection adoption, Use of TiN coatings in cutting tools, medical implants, and automotive components, Growth of TiN-coated components in aerospace, semiconductor, and medical device applications, Regional patterns of TiN coating technology adoption and formulation. |

The global titanium nitride coating market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the titanium nitride coating market is projected to reach USD 3.3 billion by 2035.

The titanium nitride coating market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in titanium nitride coating market are physical vapor deposition (pvd) and chemical vapor deposition (cvd).

In terms of application, cutting tools segment to command 47.2% share in the titanium nitride coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Aluminides (TiAl) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium Dioxide Color Market Trends - Applications & Industry Demand 2025 to 2035

Titanium-Free Food Color Alternatives Market

Titanium Market

Titanium Dioxide Market

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Anodized Titanium Market Growth - Trends & Forecast 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Metal Nitride Nanoparticles Market

Silicon Nitride Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Nitride Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA