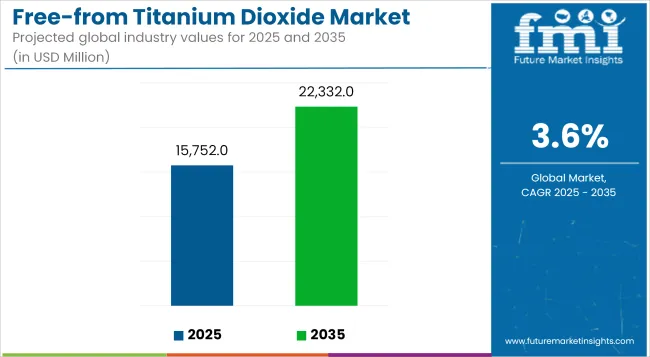

In 2025, the global free-from titanium dioxide market size is assessed at USD 15,752 million and is forecasted to witness substantial expansion, reaching USD 22,332 million by 2035, reflecting a CAGR of 3.6%. This trajectory has been shaped by heightened regulatory interventions banning titanium dioxide in food and supplements in regions such as the EU, alongside a parallel rise in consumer mistrust toward synthetic additives.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 15,752 million |

| Industry Value (2035F) | USD 22,332 million |

| CAGR (2025 to 2035) | 3.6% |

As brands recalibrate their ingredient portfolios, a structural market shift is being observed in favor of naturally derived whiteners and texturizers. The market has been characterized by a pronounced reformulation wave, with manufacturers across food, pharma, and personal care sectors systematically phasing out TiO₂. Clean-label strategies have gained material traction, reinforced by scientific controversies surrounding potential genotoxicity of nanoparticles.

However, the transition is not without operational and sensory formulation challenges. Natural alternatives often require higher loading levels, leading to cost surges and texture or flavor compromises. Nonetheless, momentum remains strong, with starches, calcium carbonate, and rice-based derivatives being explored for their opacity and safety credentials.

Industry efforts have been intensified around microencapsulation, dispersion optimization, and novel ingredient platforms to overcome technical gaps. Companies are actively pursuing patent-protected solutions and collaborative R&D pipelines to accelerate adoption readiness.

Over the next decade, regulatory enforcement is expected to deepen in North America and parts of Asia, prompting widespread substitution. By 2035, free-from titanium dioxide formulations are projected to become the default across premium and mass-market categories.

Market participants will likely focus on scaling bio-based alternatives and educating B2B buyers on functional equivalency and performance assurance. Clean-label positioning will be further solidified by the integration of transparency tools, such as blockchain tracking and on-pack labeling claims. This transformation is anticipated to be most prominent in bakery, confectionery, oral care, and nutraceuticals, which are high-sensitivity application areas.

The encapsulation-based delivery systems segment is projected to capture approximately 14.2% of the free-from titanium dioxide market by 2025. This emerging area is gaining relevance for its role in improving dispersion, opacity, and stability of natural colorant replacements without overloading formulations.

As food and pharmaceutical manufacturers move away from TiO₂, the need to preserve product integrity, especially in sensitive dosage formats and visually appealing SKUs, has catalyzed investments into encapsulation and microemulsion platforms. Companies such as Sensient Technologies and Colorcon have commercialized patented dispersion systems targeting opaque coatings and whiteners.

These innovations are particularly vital in tablets, candies, and bakery icings where uniformity and brightness are critical. In Europe, developments are closely aligned with EFSA’s guidance on nanomaterials and safety standards, pushing firms toward compliant microencapsulation materials like modified starches and maltodextrin derivatives.

The technology is also being tailored for halal, kosher, and allergen-free certifications to broaden its applicability. While initial costs are higher, adoption is increasing among multinationals prioritizing functional performance and clean-label alignment. As regulatory clarity advances in North America and East Asia, this segment is expected to see sustained commercialization through co-branded ingredient solutions, enabling faster reformulation cycles and enhanced consumer trust.

Pharmaceutical-grade alternatives to titanium dioxide are anticipated to account for 11.5% of the global market share by 2025, with continued growth driven by the scrutiny of excipient safety in solid oral dosage forms. Following the European Medicines Agency's call for TiO₂ substitution in drug products post-2022, manufacturers have accelerated the switch to compliant opacifiers such as calcium phosphate, iron oxides, and rice-based whiteners.

Key companies like Evonik and Colorcon have been at the forefront of launching pharmacopeia-compliant solutions specifically designed for tablet coatings and encapsulated drugs. This segment is deeply influenced by GMP protocols and global harmonization efforts across USP, Ph. Eur., and JP standards.

The US FDA has not yet imposed a ban but is actively reviewing dossiers, compelling American formulators to prepare for a regulatory pivot. In Japan, where clean-label momentum in pharma is rising, companies are integrating free-from TiO₂ APIs in both OTC and prescription lines.

Long-term opportunities lie in pediatric and geriatric formulations where safety, visual clarity, and mouthfeel are particularly important. By 2035, the segment will likely be driven by B2B education, clinical safety validation, and cross-functional collaborations between excipient suppliers, CDMOs, and pharmacovigilance teams.

Complexity and Cost of Reformulation

Titanium dioxide removal is not simple for manufacturers, primarily because product texture, color, and shelf life are required. Reformulation to titanium dioxide removal is normally a long R&D process, or additional manufacturing cost. Further, consumer acceptability of new formulation remains challenging even now, particularly for heritage brands whose taste and appearance profile is established.

Growing Demand for Clean-Label Products

And since reformulation is such a hurdle, with consumers increasingly demanding clean-label and additive-free products, there's a huge opportunity. With brands under pressure to think outside the box by consumer pressure to be open about ingredients, natural and safe alternatives are flourishing. Advances in microencapsulation and nano-formulation technology are also making appearance- and function-friendly alternatives possible without compromising product performance.

The USA free-from TiO₂ market is growing as the food, pharmaceutical, and cosmetics sectors are reacting to mounting regulatory pressure. Although the FDA has not banned TiO₂, clean label demand from consumers is forcing producers to shift to natural substitutes in the shape of calcium carbonate and plant whiteners.

Regulatory convergence with global markets, as well as technology developments in alternative coatings, will power development within the next few years.

Pharmaceutical Innovation: The pharma industry is quickly restructuring pill coatings, and cellulose ethers and silica-based coatings are the cool kid on the block today. TiO₂'s long-term pharma safety scandals might even hasten the switch.

Clean Beauty Trends: The personal care space is substituting TiO₂ with mineral whiteners and encapsulated ones in sunscreens, foundation, and toothpaste. This presents regulatory compliance with evolving safety expectations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

UK free-from TiO₂ market is going well in the aftermath of strong enforcement of the EU ban on food and beverage applications of TiO₂. Pharmaceuticals and cosmetics are reformulating portfolios in anticipation of clean-label legislation.

Regulatory-Driven Market Growth: The UK Food Standards Agency (FSA) is considering the safety of TiO₂, pending restrictions on which are forcing reformulation across the board.

Food and Beverages Alternatives Growth: UK confectionery is employing rice starch and calcium carbonate to increase product attractiveness, with clean-label accreditation creating consumer confidence.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The European Union is taking the world by storm when it comes to TiO₂-freeness, with strict regulations prohibiting its application in food and promoting alternatives in medicine and cosmetics. Economies such as Germany, France, and Italy are pioneering innovation in TiO₂ alternatives.

Pharmaceutical Industry Shift: Local pharmaceutical giants are moving to silica and polymer-based coatings, not only passing the safety test but also improving drug stability.

Cosmetics and Sunscreen Market: EU cosmetics firms favour zinc oxide and silica as lead UV-protection and whitening actives because of consumer and sustainability pressures.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.3% |

Japan's alternative market for TiO₂ is increasing based on the strength of its powerhouse pharma, food, and cosmetics business. Regulatory trends involve preferring natural whiteners, especially in confections and skin care.

Technological Innovation: Japan dominates nano-structured whiteners with the ability to mimic TiO₂ properties with no safety risk. These technologies drive increasing relevance in pharmaceuticals and cosmetics.

Sustainable Ingredients and Packaging: Japanese firms employ biodegradable whiteners to drive environmental objectives, and the increased popularity of products in overseas markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The market of South Korea's non-TiO₂ rises with the implementation of strict safety laws and customers' growing awareness. The best-selling mass market cosmetics of South Korea is a leader in shifting towards non-TiO₂ products.

Food and Pharma Industry Regulatory Compliance:The pharma and food industries witness the shift towards clean-label goods with companies reformulating opacifiers and coatings for consumer confidence and safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

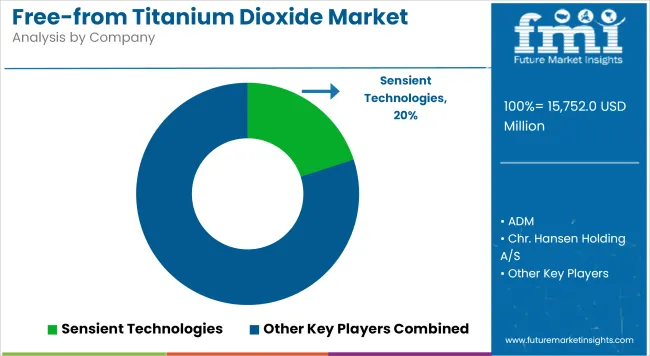

The free-from Titanium Dioxide Market is expanding strongly with surging consumer demand for organic and natural food and beverages, cosmetics, and personal care. The competition is driven by local and foreign players coming up with innovative, titanium dioxide-free offerings to cater to changing consumer trends.

Key players are giving sustainability, clean-labeling, and openness of production and sourcing operations high priority. The competitive landscape is witnessing incumbent companies line-shifting and new entrants keen on producing titanium dioxide-free offerings.

The global free-from titanium dioxide market size was estimated at USD 15,752 million in 2025.

While specific projections for 2035 are scarce, the market is expected to reach approximately USD 22,332 million by 2035.

The demand is driven by its extensive use as a white pigment in paints, coatings, plastics, and cosmetics. Its properties, such as high refractive index and UV resistance, make it valuable in these applications.

The top 5 countries contributing to the free-from titanium dioxide market are China, the United States, India, Germany, and Japan.

On the basis of application, the paints and coatings segment commands a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Titanium Aluminides (TiAl) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium-Free Food Color Alternatives Market

Titanium Market

Titanium Dioxide Color Market Trends - Applications & Industry Demand 2025 to 2035

Titanium Dioxide Market

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Anodized Titanium Market Growth - Trends & Forecast 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Extra Low Interstitial Titanium Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA