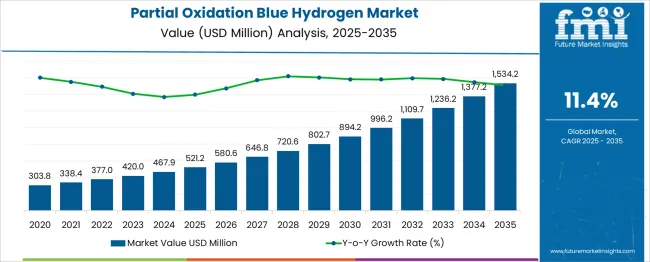

The Partial Oxidation Blue Hydrogen Market is estimated to be valued at USD 521.2 million in 2025 and is projected to reach USD 1534.2 million by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period. From 2025 to 2030, the market will more than double to USD 894.2 million. Key growth years include USD 580.6 million in 2026, USD 646.8 million in 2027, USD 720.6 million in 2028, and USD 802.7 million in 2029. Companies positioned to gain market share during this period are those with proven large-scale gas reforming technology, robust carbon capture integration, and strategic partnerships with utility and refining sectors.

Scalability, process efficiency, and regulatory compliance will serve as primary differentiation points. Conversely, vendors dependent on pilot-scale operations or those without clear carbon management frameworks risk losing relevance. As infrastructure investments increase, competition will sharpen around lifecycle costs, reliability, and readiness for integration into existing energy networks. Between 2025 and 2030, success will hinge on operational uptime, plant deployment timelines, and the ability to meet emission targets under evolving national frameworks. Early movers with turnkey capabilities and strong execution records are best positioned to capture a significant share in this expanding market.

| Metric | Value |

|---|---|

| Partial Oxidation Blue Hydrogen Market Estimated Value in (2025 E) | USD 521.2 million |

| Partial Oxidation Blue Hydrogen Market Forecast Value in (2035 F) | USD 1534.2 million |

| Forecast CAGR (2025 to 2035) | 11.4% |

The partial oxidation blue hydrogen market sits within a multi-tiered structure of the global clean energy ecosystem, anchored primarily under the low-carbon hydrogen and broader hydrogen economy segments. As of 2025, the global hydrogen economy is witnessing exponential diversification, with blue hydrogen produced via processes such as steam methane reforming and partial oxidation accounting for approximately 18–22% of total hydrogen output.

Within the low-carbon hydrogen segment, blue hydrogen holds a substantial 35–40% share, outpacing green hydrogen in some industrial applications due to existing natural gas infrastructure. Of this blue hydrogen contribution, the partial oxidation method specifically commands a growing 10–12% share, benefiting from advancements in carbon capture integration and greater feedstock flexibility.

Positioned within the expansive clean energy technology market, which includes solar, wind, storage, and hydrogen systems, partial oxidation blue hydrogen represents a focused yet strategic 0.5–0.8% share. This may seem marginal, but it reflects a high-value, high-growth subsegment that aligns with decarbonization roadmaps for heavy industry, refining, and ammonia production. The structured rise of this submarket indicates that its performance is not isolated but influenced by policy-driven demand for low-emission fuels, investment in CCS infrastructure, and transitional strategies away from pure fossil-based hydrogen. Its parent markets provide both the foundation and the ceiling for its growth trajectory.

The use of partial oxidation in hydrogen production has been recognized for its ability to utilize heavier hydrocarbons efficiently, offering a cost-effective pathway for producing blue hydrogen when integrated with carbon capture and storage. Increasing regulatory pressure to decarbonize large-scale industrial operations, along with investments in sustainable refinery processes, has catalyzed interest in this technology. The market outlook remains optimistic as advancements in gas purification, catalyst efficiency, and carbon sequestration are enabling higher yields and cleaner outputs.

Strategic collaborations between energy companies, chemical manufacturers, and governments are further accelerating deployment. As demand for low-carbon hydrogen continues to rise across refineries, chemicals, and heavy industry, partial oxidation has emerged as a viable and scalable production route that aligns with decarbonization goals while leveraging existing petrochemical infrastructure..

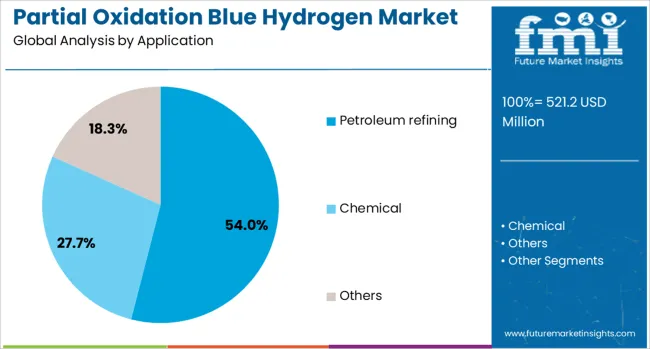

The partial oxidation blue hydrogen market is segmented by application and geographic regions. By application of the partial oxidation blue hydrogen market is divided into Petroleum refining, Chemical, and Others. Regionally, the partial oxidation blue hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The petroleum refining application segment is projected to account for 54% of the Partial Oxidation Blue Hydrogen market revenue share in 2025, establishing it as the leading application. This dominance has been driven by the substantial hydrogen demand within refineries for processes such as hydrocracking and desulfurization. As regulatory bodies impose stricter emissions standards on fuel production, refineries are under growing pressure to integrate low-carbon hydrogen sources into their operations.

Partial oxidation offers an effective method for generating blue hydrogen from refinery by-products and heavy hydrocarbons, while facilitating seamless incorporation into existing hydrogen networks. The ability to pair this method with carbon capture technology has enabled refineries to lower their overall emissions footprint without overhauling legacy systems.

Moreover, ongoing upgrades to hydrogen reforming units and integration of cleaner feedstocks have positioned refineries as primary adopters of this technology. The alignment of policy incentives, operational needs, and technological compatibility has firmly anchored petroleum refining as the top contributor to revenue in this segment..

The partial oxidation blue hydrogen segment is expanding as industries seek low-carbon hydrogen using natural gas combined with carbon capture systems. This technology partially combusts hydrocarbon fuels with oxygen to generate syngas that is purified into hydrogen. It integrates well with carbon capture infrastructure and can process heavier feedstocks than other methods. Technological and policy support in regions pursuing decarbonization boosts project deployment.

Adoption is supported by performance advantages, lower process complexity, reduced capex and simplified oxygen systems compared to alternative reforming routes. As heavy industries look for reliable transitional hydrogen pathways, partial oxidation production is gaining traction as a scalable and adaptable option. Its alignment with existing gas infrastructure and CCS frameworks positions it as a key enabler of early-stage hydrogen markets.

Partial oxidation offers cost efficiencies over alternative blue hydrogen production methods. Unlike steam methane reforming or autothermal reforming, it does not require pre‑generated steam, reducing equipment complexity and enabling simpler process layouts. Energy recovery from reaction heat generates needed steam, lowering operational costs and improving process efficiency under carbon capture regimes. This simpler architecture also allows for smaller reactor footprints and reduced capital investment, especially when oxygen compression is optimized. Partial oxidation tolerates a broad range of natural gas feedstocks and impurities, increasing flexibility for industrial end users such as refineries or chemical plants. These economic and operational advantages make it attractive for integration into existing facilities seeking low-carbon hydrogen without a major infrastructure overhaul.

Growth in partial oxidation-based blue hydrogen is strongly tied to partnerships between energy majors, industrial gas suppliers, and CCS developers. Leading organizations are investing in projects that co-locate POX units with carbon capture and storage facilities to streamline deployment and compliance. Supportive government policies and funding initiatives are incentivizing low‑carbon hydrogen pathways, especially in regions targeting industrial decarbonization. Chemical manufacturers adopting on-site hydrogen generation are integrating POX units to secure a hydrogen supply and reduce reliance on external suppliers. Investment in industrial clusters where partial oxidation units feed hydrogen into refinery, fertilizer or steel processes bolsters scale economies. As CCS infrastructure matures, partial oxidation becomes more viable in transitional hydrogen ecosystems.

Partial oxidation blue hydrogen remains under climate scrutiny due to questions around lifecycle emissions and methane leakage. Critics argue that blue hydrogen can result in higher overall greenhouse gas footprints than burning natural gas directly, particularly when fugitive methane and CCS inefficiencies are accounted for. Partial oxidation production still relies on fossil hydrocarbon feedstocks and requires energy-intensive oxygen generation, raising carbon intensity even with capture. Community and environmental groups have challenged blue hydrogen projects on the grounds that they prolong fossil fuel dependency. Regulatory uncertainty around hydrogen tax credits and attribution of emissions also complicates project economics and public trust. Until carbon capture performance is proven at high scale, public and investor confidence may remain cautious.

Advances in reactor design, catalytic materials, and process monitoring are enhancing partial oxidation system reliability and performance. Innovations in catalyst formulations aim to improve conversion efficiency and reduce carbon monoxide and methane slip. Integrated digital control systems and diagnostic tools help operators optimize stoichiometry, temperature, and capture readiness in real time. Specialized heat-resistant materials and reactor design improvements extend service life under high temperature conditions typical of POX systems. Breakthroughs in non‑catalytic and catalytic reactor variants enable broader feedstock flexibility, including heavier hydrocarbons and biomass-derived fuels. As technology improves stability and reduces maintenance overhead, operational risk declines. These enhancements pave the way for scaling POX-based blue hydrogen in industrial plants and chemical processing clusters where reliability and uptime are critical.

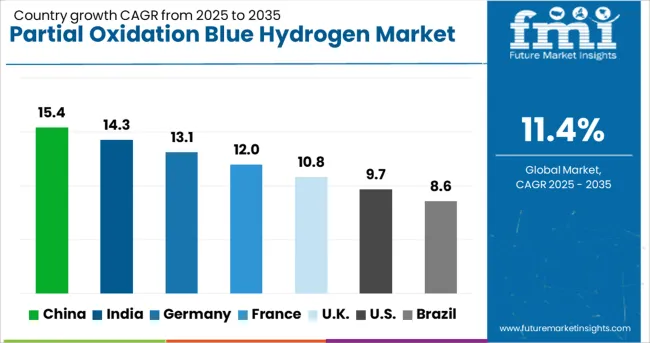

| Country | CAGR |

|---|---|

| China | 15.4% |

| India | 14.3% |

| Germany | 13.1% |

| France | 12.0% |

| UK | 10.8% |

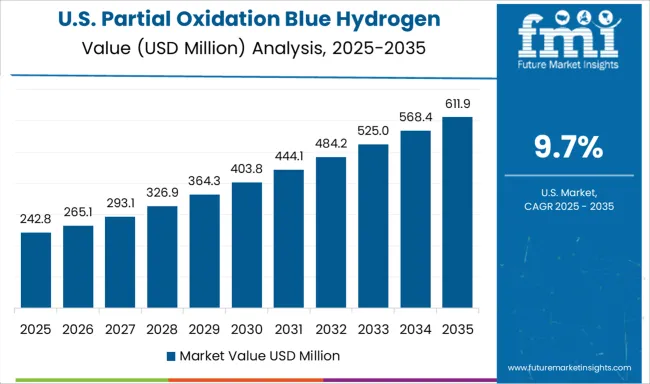

| USA | 9.7% |

| Brazil | 8.6% |

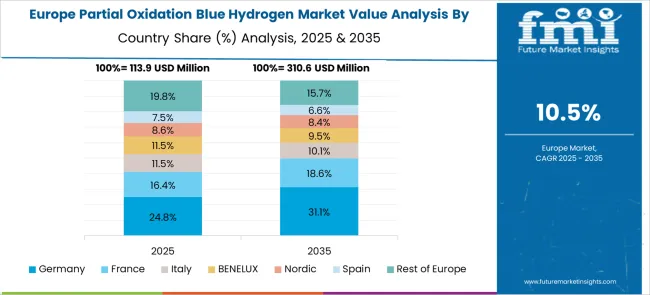

The partial oxidation blue hydrogen market is expected to grow at a CAGR of 11.4% through 2035, fueled by global efforts to reduce carbon emissions while leveraging existing fossil fuel infrastructure. China leads this momentum with a growth rate of 15.4%, driven by large-scale hydrogen production facilities and aggressive decarbonization goals. India, growing at 14.3%, is expanding hydrogen capacity through national energy missions and industrial integration. Germany follows at 13.1%, supported by strong regulatory frameworks, public-private collaborations, and its national hydrogen strategy. The UK, with a growth rate of 10.8%, is advancing low-carbon hydrogen production to support energy transition initiatives. Meanwhile, the USA, growing at 9.7%, is commercializing blue hydrogen technologies through federal funding and private sector innovation, particularly in refining and heavy industries. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China achieved a CAGR of 15.4% in the partial oxidation blue hydrogen market, primarily driven by its coal-to-hydrogen transition and the scaling of low-emission fuel technologies in heavy industries. Industrial parks in provinces like Inner Mongolia and Shanxi integrated partial oxidation units into existing syngas infrastructure to produce hydrogen with reduced emissions. Refining and chemical companies focused on adopting advanced gasification and carbon capture to meet regulatory expectations for cleaner processes. Equipment suppliers designed systems for high-pressure operations with better feedstock flexibility, particularly for low-quality coal and petroleum residues. Central government support under long-term energy plans encouraged investment in blue hydrogen as a bridge toward lower-carbon fuels. Multiple state-owned enterprises participated in pilot projects combining partial oxidation with pre-combustion capture. Cross-border equipment deals with European firms further enhanced process reliability. Deployment was most active in areas with industrial hydrogen demand and ready access to CO₂ storage capacity.

India recorded a CAGR of 14.3% in the partial oxidation blue hydrogen market, driven by growing energy security goals and demand for clean hydrogen across fertilizer and steel sectors. Public and private firms invested in modular partial oxidation units capable of producing hydrogen from petcoke, refinery off-gas, and other carbon-intensive fuels. Industrial clusters in Gujarat and Maharashtra emerged as early adopters due to high hydrogen consumption and infrastructure availability. The Ministry of Petroleum and Natural Gas supported commercial pilots through financial incentives and R&D partnerships. Private developers partnered with engineering firms to reduce emissions via oxygen-blown gasification coupled with CO₂ removal. Feedstock sourcing remained localized to minimize supply disruptions. Operators prioritized continuous production cycles for integration with ammonia and methanol units. The presence of deep saline formations allowed for localized carbon storage development, improving project feasibility.

Germany posted a CAGR of 13.1% in the partial oxidation blue hydrogen market, shaped by the country’s push for industrial decarbonization in petrochemicals and metallurgy. Industrial hubs in North Rhine-Westphalia and Saxony adopted partial oxidation as a transition pathway where green hydrogen was not yet economically viable. Facilities incorporated steam-oxygen gasification along with pre-treatment systems to handle varied feedstock. Blue hydrogen was routed into regional blending projects for refining and long-distance pipeline pilots. Utility firms collaborated with heavy industry to reduce emissions from high-temperature processes. Projects featured continuous capture systems that funneled CO₂ to pipeline-ready compression units. The integration of low-carbon hydrogen in steel and ammonia plants was driven by existing demand and asset readiness. Equipment suppliers designed units with rapid ramp-up functionality and minimal shutdown frequency to match seasonal industrial demand patterns.

The United Kingdom recorded a CAGR of 10.8% in the partial oxidation blue hydrogen market, with emphasis on industrial zones and energy resilience planning. Projects clustered around Teesside and Humberside utilized partial oxidation for converting heavy hydrocarbons into hydrogen while capturing and storing resulting carbon. Refining companies led early adoption, aiming to decarbonize internal hydrogen use. Government funding under hydrogen roadmap initiatives supported infrastructure upgrades, including pipelines and CO₂ shipping routes. Project developers employed oxygen-enriched partial oxidation for higher hydrogen yield, while optimizing for pressure swings and long cycle times. Companies worked with offshore storage providers to connect coastal facilities to depleted reservoirs. Stakeholder coordination included port authorities, gas grid operators, and engineering firms. Systems were scaled to meet medium-range industrial loads without requiring complete retrofits of existing assets, which accelerated adoption timelines and reduced capital outlay.

The United States observed a CAGR of 9.7% in the partial oxidation blue hydrogen market, influenced by fossil fuel diversification efforts and the reconfiguration of hydrogen supply chains. Energy companies in Texas and Louisiana introduced large-scale partial oxidation units to process petroleum coke and residual oils, leveraging existing infrastructure and proximity to carbon storage basins. Public-private initiatives under federal clean hydrogen programs provided capital support and regulatory clearance for multi-phase buildouts. Oil and gas operators upgraded gasification reactors for integration with advanced CO₂ scrubbing systems. Emphasis was placed on load-following capabilities to ensure supply stability in grid-adjacent uses. Regional hubs deployed shared hydrogen storage and distribution networks to serve multiple industrial users. Commercial buyers included refineries, fuel cell producers, and chemical processors. Carbon intensity metrics influenced offtake agreements, motivating firms to monitor emission capture performance closely.

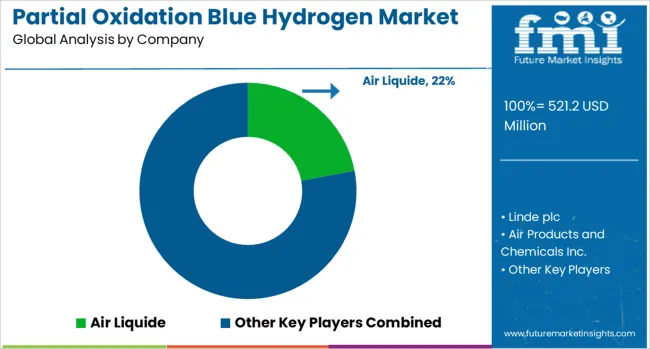

The partial oxidation blue hydrogen market is gaining momentum as nations pursue low-carbon hydrogen production pathways that balance scale, cost, and carbon mitigation. In this process, heavy hydrocarbons or natural gas are partially oxidized to produce hydrogen, with CO₂ captured and stored (CCS) to reduce emissions. Blue hydrogen produced via partial oxidation is seen as a transitional solution, bridging fossil fuel infrastructure with decarbonized energy systems. Air Liquide is a major force in hydrogen production technologies and operates several large-scale facilities using partial oxidation combined with CCS.

Their expertise in industrial gas systems, carbon capture, and pipeline delivery supports integration with refineries and chemical plants. Linde plc brings proprietary technologies like HyCO (hydrogen and carbon monoxide) plants tailored for blue hydrogen applications, often embedded within petrochemical clusters for circular carbon usage and process efficiency. Air Products and Chemicals Inc., a pioneer in hydrogen supply chains, is leading several mega-scale blue hydrogen projects globally, including hubs in North America and the Middle East. Shell and ExxonMobil, leveraging decades of experience in gas-to-liquids (GTL) and syngas processing, are now advancing blue hydrogen through their global energy portfolios, emphasizing large-scale production, sequestration partnerships, and hydrogen-as-fuel strategies. As regulatory frameworks and carbon pricing mature, companies with integrated CCS infrastructure, process efficiency, and downstream hydrogen distribution will be central to scaling partial oxidation blue hydrogen on commercial terms.

As verified by Energy Global and The Chemical Engineer, Shell Catalysts & Technologies officially launched the Shell Blue Hydrogen Process, which integrates its proprietary Shell Gas Partial Oxidation (SGP) technology with ADIP ULTRA solvent-based carbon capture. It delivers up to 99% CO₂ capture, reduces the levelized cost of hydrogen by 22%, and lowers operating expenses by 34% compared to traditional ATR-based blue hydrogen processes

As confirmed by Technip Energies and Casale official sources, they jointly license oxidative reforming technologies, i.e., ATR combined with Partial Oxidation (POx) under the BlueH₂ by T.EN™ suite. These processes, including the ROX™ flow scheme, enable ultra-blue hydrogen generation at scale, with up to 99% carbon capture, optimized steam production, and improved cost efficiency

| Item | Value |

|---|---|

| Quantitative Units | USD 521.2 Million |

| Application | Petroleum refining, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Linde plc, Air Products and Chemicals Inc., Shell, ExxonMobil, and Others |

| Additional Attributes | Dollar sales by partial oxidation (POx) blue hydrogen type including catalytic and non-catalytic variants; by application in petroleum refineries, chemical manufacturing, and power generation; by geographic region including North America, Europe, and Asia‑Pacific; demand driven by decarbonization mandates, energy security, and industrial hydrogen use; innovation in advanced POx reactor designs, catalyst formulations, and CCS integration; costs influenced by air separation unit CAPEX, feedstock quality, and carbon capture efficiency; emerging use cases in hydrogen-for-ammonia/methanol synthesis and backup power systems. |

The global partial oxidation blue hydrogen market is estimated to be valued at USD 521.2 million in 2025.

The market size for the partial oxidation blue hydrogen market is projected to reach USD 1,534.2 million by 2035.

The partial oxidation blue hydrogen market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in partial oxidation blue hydrogen market are petroleum refining, chemical and others.

In terms of , segment to command 0.0% share in the partial oxidation blue hydrogen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Partially Hydrolyzed Guar Gum Market Size and Share Forecast Outlook 2025 to 2035

Partially Hydrogenated Oil Market Analysis by Nature, Grade, Application, End User, and Distribution Channel Through 2035

Removable Partial Dentures Market Analysis by Cast Metal Partial Dentures, Flexible Partial Dentures, and Tooth Flipper through 2035

Activated Partial Thromboplastin Test Market

Oxidation Stability Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA