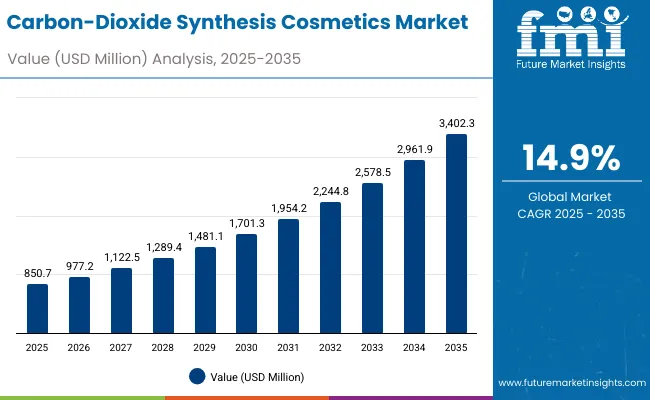

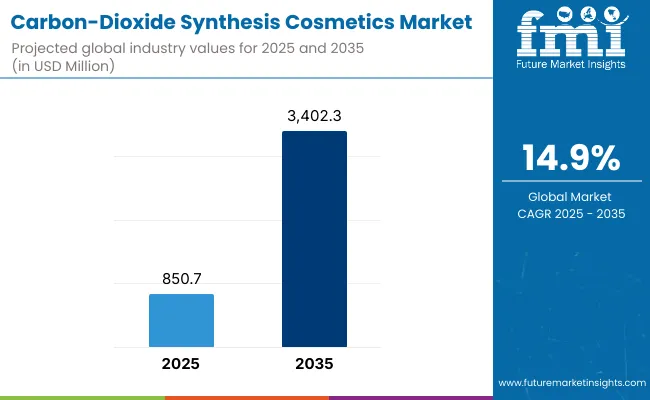

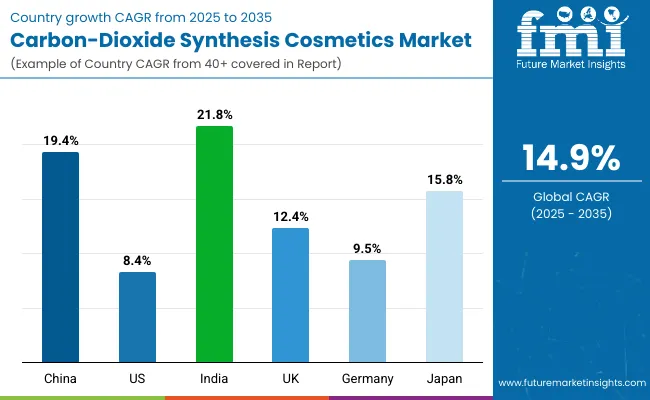

The Global Carbon-Dioxide Synthesis Cosmetics Market is expected to record a valuation of USD 850.7 million in 2025 and USD 3,402.3 million in 2035, with an increase of USD 2,551.6 million, which equals a growth of nearly 300% over the decade. The overall expansion represents a CAGR of 14.9% and a 4X increase in market size.

Global Carbon-Dioxide Synthesis Cosmetics Market Key Takeaways

| Metric | Value |

|---|---|

| Global Carbon-Dioxide Synthesis Cosmetics Market Estimated Value in (2025E) | USD 850.7 million |

| Global Carbon-Dioxide Synthesis Cosmetics Market Forecast Value in (2035F) | USD 3,402.3 million |

| Forecast CAGR (2025 to 2035) | 14.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 850.7 million to USD 1,701.3 million, adding USD 850.6 million, which accounts for around one-third of the total decade growth. This phase records steady adoption in sustainable skincare innovations, driven by consumer preference for carbon-negative claims, eco-certified sourcing, and bio-actives developed using CO₂-capture technologies.

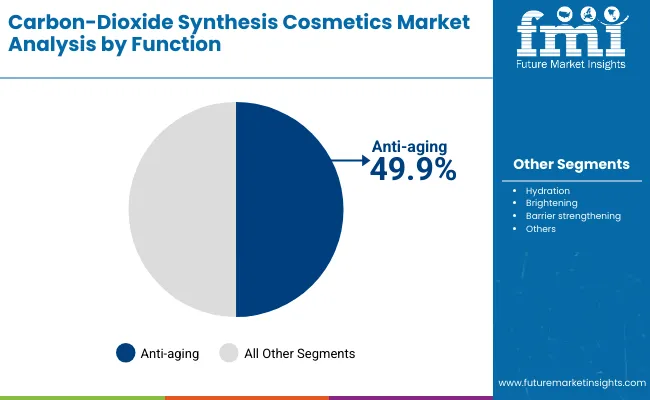

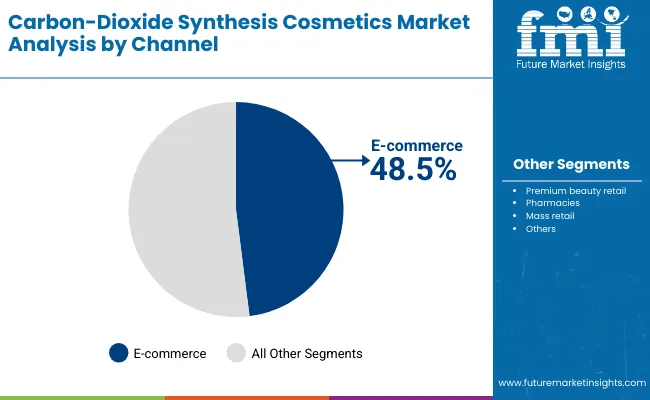

E-commerce dominates distribution during this period, contributing 48.5% of sales in 2025, as digital-native beauty shoppers accelerate adoption of green cosmetic products with transparent claims. Anti-aging emerges as the core function, holding a 49.9% value share in 2025, reflecting the rising influence of climate-conscious aging consumers.

The second half from 2030 to 2035 contributes USD 1,701.0 million, equal to 67% of total growth, as the market jumps from USD 1,701.3 million to USD 3,402.3 million. This acceleration is powered by widespread deployment of CO₂-based bio-synthesis platforms, large-scale algae fixation facilities, and advanced synthetic CO₂ compounds integrated into serums and creams.

By 2035, mid-market and premium segments converge as carbon-negative and vegan claims become industry standards, while advanced retail ecosystems push premium beauty retail beyond its current share. Software-like enablers, including digital traceability and blockchain certification platforms, play a role in maintaining eco-claims authenticity, strengthening consumer trust, and unlocking recurring brand loyalty.

From 2020 to 2024, the Global Carbon-Dioxide Synthesis Cosmetics Market expanded from niche-scale pilot projects to early-stage commercialization, with global revenues increasing steadily as sustainability-driven consumers sought alternatives to petrochemical-based cosmetics.

During this period, the competitive landscape was dominated by European and USA-based players with strong sustainability credentials, including BASF, Symrise, and Croda, which controlled over 60% of the market through investments in green chemistry, synthetic biology, and algae fixation platforms.

Carbon-negative claims became a core differentiator, enabling early entrants to command premium price points and capture mindshare among eco-conscious consumers. Service-based models were negligible, and adoption was concentrated in select premium beauty and e-commerce channels.

Demand for carbon-dioxide synthesis cosmetics expands significantly in 2025 to USD 850.7 million, and the revenue mix begins to shift as e-commerce consolidates its dominance and premium beauty retailers increasingly stock CO₂-based innovations. Traditional cosmetic giants such as BASF and Evonik face competition from biotech disruptors like LanzaTech and Algatech, which are leveraging CO₂ capture and algae fixation to create new bio-active ingredients.

Digital-first brands emphasize clean-label and eco-certification, often verified through blockchain-backed traceability systems. Competitive advantage in this market is shifting from product-level innovation to ecosystem integration, where sustainability claims, carbon-negative certifications, and circular value chains provide both growth momentum and resilience.

Advances in carbon capture, synthetic biology, and algae fixation technologies have transformed the ability of cosmetics companies to develop bio-actives and oils using CO₂ as a feedstock. This shift has improved ingredient sustainability while enabling performance on par with, or exceeding, traditional petrochemical and plant-based alternatives.

Anti-aging products, supported by CO₂-based peptides and antioxidants, have gained early traction as consumers demand both efficacy and climate responsibility. E-commerce has amplified market penetration by providing global visibility to carbon-negative and eco-certified brands.

The growth of clean-label and vegan claims has also fueled demand. Consumers increasingly expect beauty products to align with climate-conscious lifestyles, and brands are integrating CO₂-based compounds to meet this requirement. Innovations in CO₂-extracted oils and fixation-derived extracts are expanding their use beyond serums into creams, lotions, and barrier-strengthening masks. Moreover, regulatory incentives in Europe and Asia-Pacific are encouraging large-scale investment into circular cosmetic ingredient production, which enhances market adoption.

Segment growth is expected to be led by carbon-negative claims, anti-aging functions, and e-commerce channels, supported by strong CAGR in emerging regions such as India (21.8%) and China (19.4%). While the USA and Germany provide stability through established retail infrastructure, Asia-Pacific countries are driving incremental growth by embracing new green chemistry technologies. Overall, the market is growing because it addresses two converging consumer needs: visible skin benefits and measurable sustainability outcomes.

The Global Carbon-Dioxide Synthesis Cosmetics Market is segmented by source technology, function, product type, channel, and claim. Source technologies include CO₂-captured bio-actives, algae fixation extracts, synthetic CO₂-based compounds, and CO₂-extracted oils, highlighting the breadth of sustainable innovation driving adoption.

Function segmentation covers hydration, anti-aging, brightening, and barrier strengthening, reflecting the core areas where eco-active performance is most valued. Product types include serums, creams/lotions, masks, and oils, offering multiple applications that blend mainstream cosmetic formats with sustainability-driven differentiation.

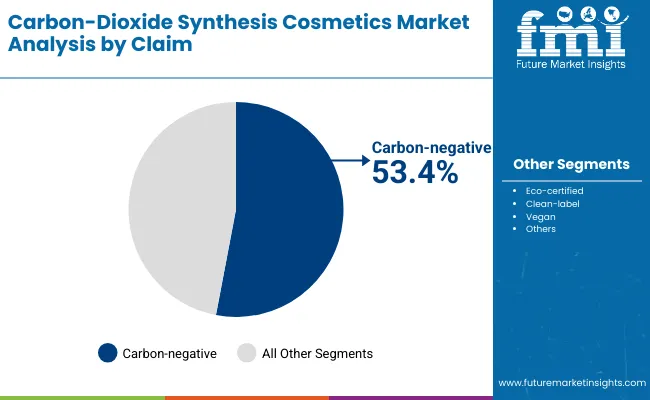

Channel segmentation spans e-commerce, premium beauty retail, pharmacies, and mass retail, indicating the diverse pathways through which consumers access these products. Claims are classified into carbon-negative, eco-certified, clean-label, and vegan, with carbon-negative dominating early adoption due to strong consumer resonance. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with country-level analysis highlighting China, India, Japan, USA, Germany, and UK as high-priority growth markets.

| Claim | Value Share % 2025 |

|---|---|

| Carbon-negative | 53.4% |

| Others | 46.6% |

The carbon-negative segment is projected to contribute 53.4% of the Global Carbon-Dioxide Synthesis Cosmetics Market revenue in 2025, maintaining its lead as the dominant claim category. This growth is driven by rising consumer awareness around climate change, and the preference for products that actively reduce or offset carbon emissions. Beauty shoppers increasingly demand measurable sustainability outcomes, and carbon-negative certification offers a transparent and powerful differentiator.

The segment’s strength is further supported by growing investments from global cosmetics leaders and biotech innovators in carbon capture and utilization pathways. Brands are incorporating CO₂-derived peptides, oils, and extracts to substantiate their claims. As regulatory frameworks evolve in Europe and Asia-Pacific to reward low-carbon products, carbon-negative cosmetics are expected to remain the backbone of this market, reshaping competitive positioning and creating new consumer loyalty models.

| Function | Value Share % 2025 |

|---|---|

| Anti-aging | 49.9% |

| Others | 50.1% |

The anti-aging segment is forecasted to hold 49.9% of the Global Carbon-Dioxide Synthesis Cosmetics Market share in 2025, led by its application in serums, creams, and oils designed for mature skin. This dominance is explained by consumer willingness to invest in high-efficacy, premium-priced solutions that combine visible results with climate-conscious values. Anti-aging products are also the most adaptable format for integrating CO₂-based bio-actives, such as antioxidants, peptides, and barrier-strengthening compounds.

Their appeal extends beyond traditional anti-wrinkle care to holistic skin health, including hydration, brightening, and protection from environmental stressors. The segment’s growth is further bolstered by the Asian markets, particularly China, Japan, and India, where anti-aging rituals are deeply embedded in cultural beauty practices. With the addition of CO₂-derived bio-synthesis ingredients, anti-aging products provide both performance and eco-conscious assurance, securing their dominance through 2035.

| Channel | Value Share % 2025 |

|---|---|

| E-commerce | 48.5% |

| Others | 51.5% |

The e-commerce segment is projected to account for 48.5% of the Global Carbon-Dioxide Synthesis Cosmetics Market revenue in 2025, establishing itself as a critical distribution channel. Online platforms have become the preferred space for consumers to discover, evaluate, and purchase eco-certified, clean-label, and carbon-negative cosmetics. Transparency tools such as digital certifications, blockchain-tracked sourcing, and AI-powered product recommendations amplify the visibility of CO₂-derived innovations.

The segment’s momentum is further supported by the rise of direct-to-consumer brands and subscription models, enabling startups and biotech-backed cosmetic innovators to bypass traditional retail constraints. Social media and digital storytelling reinforce the credibility of eco-claims, while partnerships with major e-commerce platforms enhance global reach. By 2035, e-commerce is expected to dominate even further, cementing its role as the driver of adoption for carbon-negative and vegan beauty products.

Rising Adoption of Carbon-Negative and Eco-Certified Claims

One of the strongest growth drivers is the rising adoption of carbon-negative claims, which already account for 53.4% of the global market in 2025. Unlike conventional sustainability labels, carbon-negative directly appeals to consumers who want tangible climate impact attached to their purchase. This trend is not only consumer-driven but also supported by global retailers and regulators that increasingly demand measurable sustainability credentials.

Large beauty groups such as BASF, Evonik, and Croda are investing in CO₂-captured bio-actives and synthetic CO₂-based compounds precisely to validate such claims. As eco-certified and clean-label products expand their visibility on e-commerce platforms, brands offering carbon-negative credentials enjoy premium positioning and price resilience, reinforcing this as a primary growth engine for the decade.

Biotechnology Integration in Anti-aging Formulations

Anti-aging, holding a 49.9% market share in 2025, is being transformed by the integration of CO₂-derived peptides, antioxidants, and algae fixation extracts. Unlike traditional formulations, these biotech-enabled ingredients provide a dual benefit: visible skin improvements and environmental responsibility. Consumers in China, Japan, and India-markets with double-digit CAGRs-are particularly receptive to anti-aging routines tied to eco-conscious values.

For instance, CO₂-extracted oils are being used in high-performance serums to reinforce skin barriers while maintaining vegan and clean-label positioning. The ability of biotechnology to merge efficacy with sustainability is creating an entirely new premium tier within anti-aging, making it one of the most critical growth drivers.

High Production Costs of CO₂-Based Compounds

Despite strong consumer pull, the production of CO₂-based bio-actives, fixation extracts, and synthetic compounds remains significantly cost-intensive compared to conventional petrochemical or botanical ingredients. Carbon capture infrastructure, algae cultivation systems, and specialized reactors for CO₂ conversion require large upfront capital investment.

Smaller beauty brands, especially in mass retail channels, struggle to absorb these costs, limiting adoption outside premium and niche categories. This cost barrier is particularly evident in developing markets, where consumers remain price-sensitive despite growing environmental awareness.

Regulatory Ambiguity in Eco-Claims

While carbon-negative and eco-certified claims drive growth, regulatory frameworks for CO₂-derived cosmetics are not yet harmonized globally. For example, Europe has strong incentives and recognition mechanisms for carbon accounting, while the USA and several Asia-Pacific markets lack standardized certification protocols.

This inconsistency exposes brands to risks of greenwashing accusations, consumer mistrust, and compliance challenges. Companies investing heavily in traceability systems face uneven ROI across regions, and delays in regulatory clarity may slow market momentum, particularly in mass retail and pharmacy distribution channels.

Blockchain and Digital Traceability for Eco-Claims

A major trend reshaping the market is the integration of digital traceability systems-including blockchain and AI-based certification platforms-into the cosmetics supply chain. As carbon-negative and vegan claims gain traction, consumers demand proof of authenticity.

Brands are adopting end-to-end transparency tools that verify CO₂ capture, algae cultivation, and extraction methods. For example, digital QR codes embedded in packaging allow buyers to track the carbon savings and origin of each serum or cream. This not only strengthens consumer trust but also helps companies defend their claims in markets with tightening regulatory scrutiny.

Expansion of E-commerce as the Testing Ground for Green Innovation

With e-commerce already capturing 48.5% of market sales in 2025, it is emerging as the primary testing ground for carbon-negative innovations. Startups and biotech-backed brands bypass traditional premium retail by launching directly online with eco-certified products. Digital-native consumers, particularly millennials and Gen Z, use online platforms to discover, compare, and validate claims such as clean-label and vegan.

Subscription models are gaining popularity, where consumers commit to recurring deliveries of CO₂-derived serums or masks, reinforcing both loyalty and recurring revenues. This trend positions e-commerce not just as a channel, but as an innovation incubator where carbon-dioxide synthesis cosmetics can rapidly scale before moving into pharmacies and mass retail.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.4% |

| USA | 8.4% |

| India | 21.8% |

| UK | 12.4% |

| Germany | 9.5% |

| Japan | 15.8% |

The country-wise CAGR outlook highlights a clear divergence in growth momentum for the Global Carbon-Dioxide Synthesis Cosmetics Market between emerging and mature markets. India (21.8%) and China (19.4%) are forecasted to lead global expansion, driven by rapid adoption of eco-certified, vegan, and carbon-negative skincare products. Rising disposable incomes, urbanization, and a younger consumer base prioritizing sustainability are fueling demand for CO₂-derived serums, creams, and oils.

China, in particular, benefits from strong government incentives around carbon neutrality, while India’s expanding middle-class consumer segment is adopting clean-label beauty faster than previous generations. Japan (15.8%) also demonstrates strong growth, where innovation in algae fixation and anti-aging rituals intersects with cultural preferences for advanced skincare, making it a high-value innovation hub.

In contrast, developed Western markets such as the USA (8.4%), Germany (9.5%), and the UK (12.4%) are expected to record more moderate but stable growth. These markets are already advanced in terms of premium beauty adoption, but their expansion is constrained by higher market saturation and slower regulatory adoption of carbon-negative frameworks.

Nevertheless, consumer pressure for transparency, combined with the strong presence of established players like BASF, Symrise, and Croda, sustains steady demand. The USA is also witnessing significant online traction, with e-commerce platforms enabling niche carbon-dioxide synthesis cosmetic brands to find dedicated consumer bases.

Overall, while developed regions provide stability and premium validation, the high double-digit CAGR in Asia-Pacific is set to drive the majority of incremental growth for this market over the forecast period.

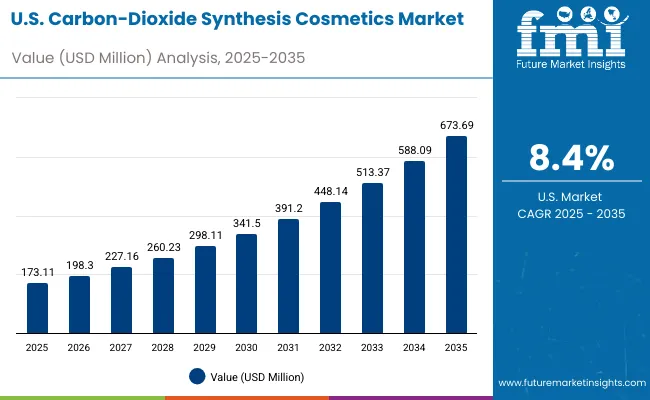

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 173.11 |

| 2026 | 198.30 |

| 2027 | 227.16 |

| 2028 | 260.23 |

| 2029 | 298.11 |

| 2030 | 341.50 |

| 2031 | 391.20 |

| 2032 | 448.14 |

| 2033 | 513.37 |

| 2034 | 588.09 |

| 2035 | 673.69 |

The Global Carbon-Dioxide Synthesis Cosmetics Market in the United States is projected to grow at a CAGR of 8.4%, led by increased consumer adoption of carbon-negative and clean-label claims. Premium beauty retail and e-commerce are driving early adoption, particularly among millennial and Gen Z consumers who demand transparency and measurable eco-impact.

Anti-aging remains the top functional driver, with serums and creams integrating CO₂-derived peptides and oils to meet rising demand for performance-based sustainability. Pharmaceutical and dermatology-backed cosmetic brands are also experimenting with CO₂-based actives in barrier-strengthening formulations. Strategic partnerships with eco-certification bodies and supply chain traceability providers are reinforcing brand credibility.

The Global Carbon-Dioxide Synthesis Cosmetics Market in the United Kingdom is expected to grow at a CAGR of 12.4%, supported by consumer demand for eco-certified and vegan cosmetic products. The UK market benefits from strong regulatory support, with carbon and sustainability labeling increasingly emphasized across the cosmetics industry. Premium retail chains and pharmacies are expanding their CO₂-based product portfolios, while e-commerce provides broader accessibility to clean-label brands.

Anti-aging and hydration functions dominate, particularly in serums and creams that highlight eco-certified sourcing. Heritage-driven beauty brands in the UK are repositioning themselves with sustainability at the core of their narratives, blending tradition with cutting-edge CO₂-derived innovations.

India is witnessing rapid growth in the Global Carbon-Dioxide Synthesis Cosmetics Market, which is forecast to expand at a CAGR of 21.8% through 2035 - the highest among major markets. Rising awareness among urban consumers and growing disposable incomes are fueling demand for eco-certified, vegan, and carbon-negative beauty products.

Tier-2 cities are seeing accelerated adoption as local retailers and e-commerce platforms introduce affordable CO₂-derived creams, serums, and oils. Anti-aging and brightening claims resonate strongly in India, with cultural preferences favoring multifunctional products. Local startups are partnering with global biotech suppliers to integrate algae fixation extracts and CO₂-extracted oils into clean-label cosmetic launches.

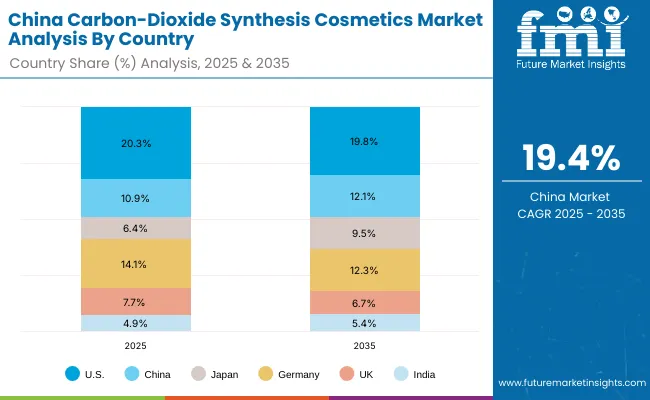

The Global Carbon-Dioxide Synthesis Cosmetics Market in China is expected to grow at a CAGR of 19.4%, among the highest globally. China’s momentum is fueled by anti-aging and hydration functions, with a strong preference for serums and creams incorporating CO₂-captured bio-actives. Government-driven sustainability targets and consumer eco-consciousness are accelerating adoption of carbon-negative and eco-certified products.

Domestic cosmetic leaders are integrating CO₂-extracted oils into mainstream beauty lines, while cross-border e-commerce introduces premium eco-certified products from Europe. Young, urban consumers increasingly use digital platforms to validate eco-claims, making traceability and blockchain verification critical in brand strategies.

| Country | 2025 Share (%) |

|---|---|

| USA | 20.3% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 4.9% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.1% |

| Japan | 9.5% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

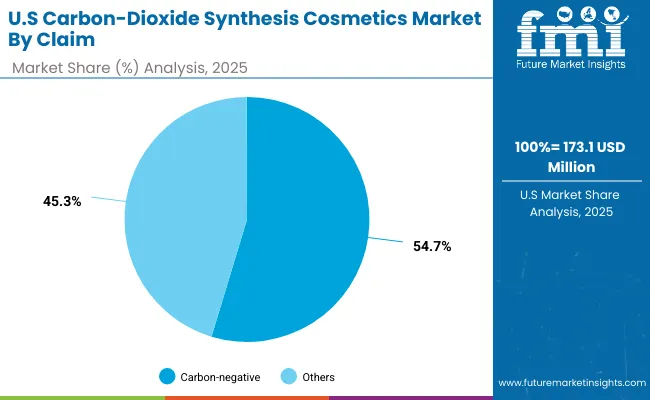

| USA by Claim | Value Share % 2025 |

|---|---|

| Carbon-negative | 54.7% |

| Others | 45.3% |

The Global Carbon-Dioxide Synthesis Cosmetics Market in the United States is projected at USD 173.1 million in 2025. Carbon-negative contributes 54.7%, while other claims hold 45.3%, showing a strong consumer inclination toward sustainability-driven formulations. The dominance of carbon-negative products stems from USA consumers’ demand for measurable eco-impact alongside product performance. Premium retailers and e-commerce channels are reinforcing this preference by highlighting transparency, certifications, and traceable sourcing.

A key catalyst for growth in the USA is the rising influence of dermatology-backed cosmetic solutions and barrier-strengthening serums developed using CO₂-derived oils and peptides. With digital-native consumers demanding authenticity, blockchain-backed traceability and eco-label validation are becoming mandatory in brand strategies. By 2035, this trend is expected to consolidate the USA as a stable but steadily expanding market, driven by premium adoption and ecosystem trust.

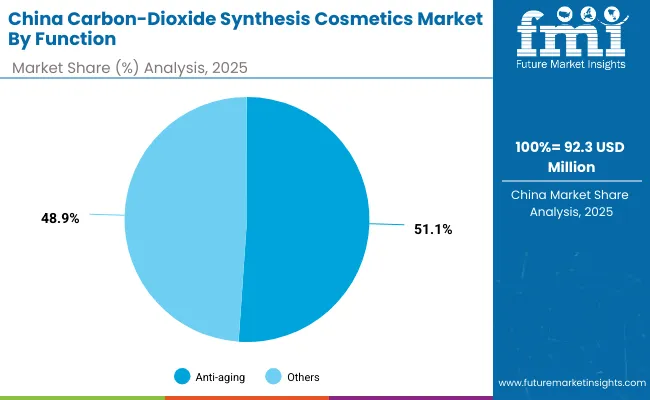

| China by Function | Value Share % 2025 |

|---|---|

| Anti-aging | 51.1% |

| Others | 48.9% |

The Global Carbon-Dioxide Synthesis Cosmetics Market in China is valued at USD 92.3 million in 2025, with anti-aging leading at 51.1%, followed by other functions at 48.9%. The dominance of anti-aging reflects China’s demographic structure and cultural emphasis on skincare routines that prioritize longevity and skin health. Anti-aging serums and creams incorporating CO₂-captured bio-actives and algae fixation extracts are particularly favored among urban middle-class and premium consumers.

China’s momentum is reinforced by government carbon neutrality initiatives, which create an enabling environment for companies to scale carbon-negative and eco-certified formulations. Domestic beauty brands are leveraging CO₂-extracted oils to compete with multinational giants, while cross-border e-commerce introduces European eco-certified offerings. As consumer sophistication increases, digital verification of eco-claims through apps and QR code systems is becoming central to trust-building in the Chinese market.

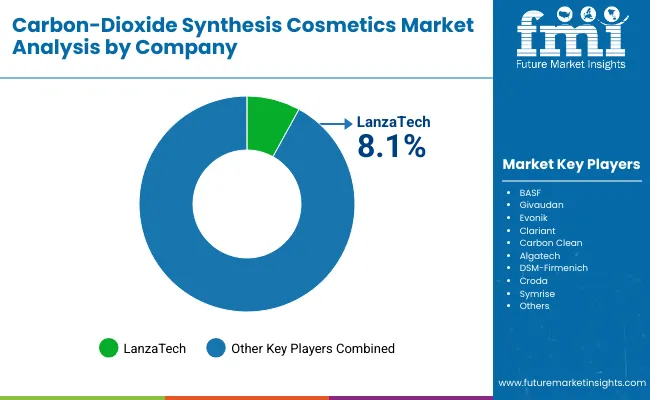

| Company | Global Value Share 2025 |

|---|---|

| LanzaTech | 8.1% |

| Others | 91.9% |

The Global Carbon-Dioxide Synthesis Cosmetics Market is moderately fragmented, with global chemical majors, biotech innovators, and specialty ingredient providers competing across diverse product categories. LanzaTech, holding 8.1% of global share in 2025, leads with its pioneering carbon capture technology, converting CO₂ emissions into bio-active ingredients now used in serums and creams. This early-mover advantage positions it as a benchmark for carbon-negative product innovation.

Large multinational players such as BASF, Evonik, Clariant, DSM-Firmenich, Croda, and Symrise are driving scale by integrating CO₂-derived compounds into their broader cosmetics ingredient portfolios. Their strategies emphasize advanced research in synthetic CO₂-based compounds and algae fixation extracts, often backed by collaborations with biotech startups. These firms leverage established distribution and brand partnerships to quickly scale carbon-negative formulations in both premium and mass markets.

Niche innovators such as Carbon Clean and Algatech focus on specialization-Carbon Clean in industrial-scale CO₂ capture adapted for cosmetic ingredients, and Algatech in algae fixation extracts for anti-aging and hydration formulations. Their regional adaptability and deep R&D pipelines make them critical disruptors despite smaller global scale.

Competitive differentiation is shifting away from traditional cosmetic claims toward integrated sustainability ecosystems. Companies are competing not just on ingredient efficacy but also on lifecycle carbon accounting, eco-certifications, blockchain traceability, and recurring partnerships with digital-first brands. This transition underscores that future leadership will depend less on raw ingredient innovation alone, and more on the ability to combine science, certification, and transparency into scalable consumer-facing solutions.

Key Developments in Global Carbon-Dioxide Synthesis Cosmetics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 850.7 Million |

| Source Technology | CO₂-captured bio-actives, Algae CO₂ fixation extracts, Synthetic CO₂-based compounds, CO₂-extracted oils |

| Function | Hydration, Anti-aging, Brightening, Barrier strengthening |

| Product Type | Serums, Creams/lotions, Masks, Oils |

| Channel | E-commerce, Premium beauty retail, Pharmacies, Mass retail |

| Claim | Carbon-negative, Eco-certified, Clean-label, Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LanzaTech , BASF, Givaudan , Evonik , Clariant , Carbon Clean, Algatech , DSM- Firmenich , Croda , Symrise |

| Additional Attributes | Dollar sales by function and channel, growth of carbon-negative and eco-certified claims, rising adoption of CO₂-derived bio-actives in anti-aging and hydration products, sector-specific traction in e-commerce and premium retail, expansion of vegan and clean-label positioning, integration of blockchain and digital traceability for eco-claims, regional trends influenced by climate-neutrality initiatives, and innovations in algae fixation and CO₂-extracted oils. |

The Global Carbon-Dioxide Synthesis Cosmetics Market is estimated to be valued at USD 850.7 million in 2025.

The market size for the Global Carbon-Dioxide Synthesis Cosmetics Market is projected to reach USD 3,402.3 million by 2035.

The Global Carbon-Dioxide Synthesis Cosmetics Market is expected to grow at a 14.9% CAGR between 2025 and 2035.

The key product types in the Global Carbon-Dioxide Synthesis Cosmetics Market are serums, creams/lotions, masks, and oils.

In terms of claims, the carbon-negative segment is set to command 53.4% share in the Global Carbon-Dioxide Synthesis Cosmetics Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BDO Synthesis Catalyst Market Size and Share Forecast Outlook 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gene Synthesis Market Growth – Trends & Forecast 2025 to 2035

cDNA Synthesis Market

Peptide Synthesis Market Analysis – Trends, Share & Growth 2025 to 2035

Butynediol Synthesis Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Spinal Osteosynthesis Units Market Trends – Industry Forecast 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Automated Radiosynthesis Modules Market

Digital Breast Tomosynthesis (DBT) Equipment Market is segmented by product, and end user from 2025 to 2035

Biomimetic Collagen Synthesis Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA