The Chemotherapy-Induced Nausea And Vomiting Therapeutics Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Estimated Value in (2025 E) | USD 6.9 billion |

| Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Chemotherapy-Induced Nausea and Vomiting Therapeutics market is witnessing steady growth, driven by the increasing prevalence of cancer and the widespread use of chemotherapy as a standard treatment. Despite advances in oncology, nausea and vomiting remain among the most distressing side effects, creating high demand for effective therapeutic solutions. Continuous innovations in antiemetic drug development, particularly the use of targeted receptor antagonists and combination regimens, are improving patient quality of life and treatment adherence.

The rising burden of cancer cases worldwide, coupled with increasing healthcare access in developing regions, is contributing to the market’s expansion. Hospitals and specialty centers are adopting advanced therapeutics to reduce complications and improve treatment outcomes, further enhancing demand. Moreover, patient-centric approaches and supportive care strategies are pushing healthcare providers to integrate nausea and vomiting therapeutics into routine cancer management.

Growing investment in clinical research, regulatory approvals for newer agents, and wider distribution networks are also strengthening the market outlook As oncology treatment protocols evolve, effective control of chemotherapy-induced nausea and vomiting is expected to remain a vital aspect of comprehensive cancer care.

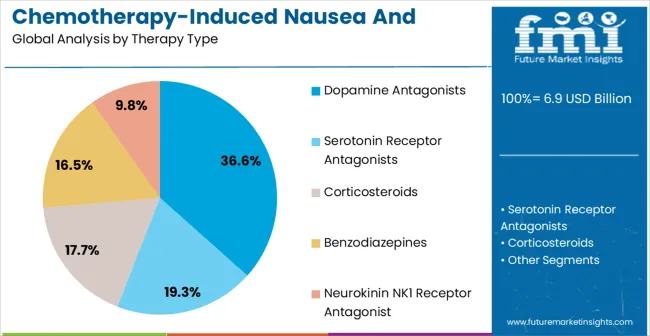

The chemotherapy-induced nausea and vomiting therapeutics market is segmented by therapy type, distribution channel, route of administration, and geographic regions. By therapy type, chemotherapy-induced nausea and vomiting therapeutics market is divided into Dopamine Antagonists, Serotonin Receptor Antagonists, Corticosteroids, Benzodiazepines, and Neurokinin NK1 Receptor Antagonist.

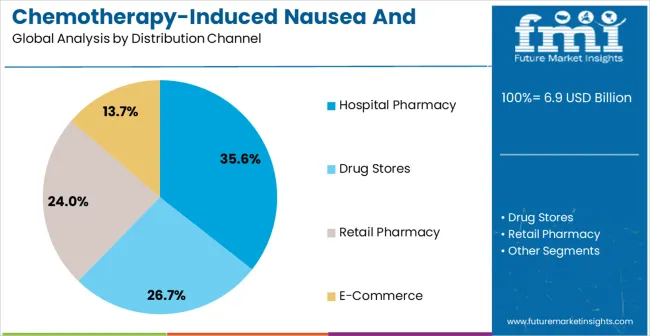

In terms of distribution channel, chemotherapy-induced nausea and vomiting therapeutics market is classified into Hospital Pharmacy, Drug Stores, Retail Pharmacy, and E-Commerce. Based on route of administration, chemotherapy-induced nausea and vomiting therapeutics market is segmented into Oral and Intravenous.

Regionally, the chemotherapy-induced nausea and vomiting therapeutics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dopamine antagonists segment is projected to hold 36.6% of the market revenue in 2025, positioning it as the leading therapy type. Growth in this segment is being driven by the widespread availability, proven efficacy, and relatively low cost of dopamine antagonists compared to newer therapeutic agents. These drugs are frequently used in both prophylactic and rescue therapy for chemotherapy patients, reducing acute nausea and vomiting episodes effectively.

Their established role in clinical practice, supported by strong physician familiarity and patient accessibility, contributes to continued market leadership. Moreover, their broad availability across hospital and retail pharmacies ensures widespread adoption, particularly in emerging economies where cost constraints are significant.

Although newer classes of antiemetics are being introduced, dopamine antagonists remain a cornerstone in combination regimens due to their complementary mechanism of action The affordability and reliability of this therapy type ensure continued use, with ongoing research aimed at improving formulations and reducing side effects further strengthening the market outlook for dopamine antagonists.

The hospital pharmacy segment is expected to account for 35.6% of the market revenue in 2025, establishing itself as the leading distribution channel. Growth is being driven by the critical role hospitals play in administering chemotherapy and associated supportive treatments. Patients undergoing chemotherapy often rely on hospital pharmacies for immediate access to antiemetic drugs, ensuring timely intervention during treatment cycles.

Hospital pharmacies are preferred for their ability to dispense prescription-only medications, provide physician oversight, and manage drug safety protocols. The growing prevalence of cancer worldwide and the increasing number of hospital-based oncology centers are reinforcing this trend. In addition, hospital pharmacies serve as key distribution hubs for novel and specialized therapeutics that may not yet be widely available in retail settings.

Their integration with oncology care teams allows for effective patient monitoring, dosage adjustments, and coordinated treatment approaches As the complexity of cancer treatment increases, the reliance on hospital pharmacies for comprehensive care and access to advanced antiemetics is expected to sustain their dominant position in the market.

The oral route of administration is anticipated to hold 57.1% of the market revenue in 2025, making it the dominant method of delivery. This preference is primarily driven by patient convenience, ease of administration, and the ability to manage symptoms outside clinical settings. Oral formulations empower patients to maintain adherence to prescribed regimens without requiring hospital visits, thereby improving quality of life during chemotherapy cycles.

The availability of a wide range of oral antiemetics, including tablets and capsules, has further facilitated accessibility. Additionally, oral formulations often provide cost advantages compared to injectable therapies, broadening their appeal across both developed and developing markets. The increasing focus on outpatient care and home-based cancer management has further accelerated adoption of oral routes.

Pharmaceutical advancements in extended-release formulations and combination therapies are improving effectiveness and reducing dosing frequency, supporting patient compliance As healthcare systems continue to emphasize patient-centered care and cost-efficient models, the oral segment is expected to maintain its leadership, reinforced by growing demand for self-administered therapeutic solutions.

Cancer is a leading cause of death worldwide, accounting nearly 1.4 million new cases in 2025. The most common cause of cancer is lung cancer accounting about 1.59 million deaths, globally. Other prominent cancers are liver cancer, breast cancer, stomach cancer, esophageal and stomach cancer.

In 2025, nearly 8.2 million deaths occurred from aforementioned indication, globally. Cancer can be treated by surgery, chemotherapy, radiation therapy, hormone therapy, targeted therapy, precision medicine and stem cell transplantation.

The most common treatment for cancer is chemotherapy; it uses drugs to kill cancer cells that cause pain and other problems. Chemotherapy may be used in combination with other cancer treatments. Chemotherapy given before surgery and radiation therapy to make the tumor cell smaller is known as neo-adjuvant chemotherapy and chemotherapy given after treatment with surgery or radiation therapy is known as adjuvant chemotherapy.

Chemotherapy, not only kills the cancer cells but also attacks healthy cells that leads to side effects such as fatigue, hair loss, nausea, and vomiting. Chemotherapy-Induced Nausea and Vomiting (CINV) is one of the most serious side effects that is taken into account.

Chemotherapy-induced nausea and vomiting are classified as acute, that occurs within 24 hours of the treatment; anticipatory, that is triggered due to some exposed stimuli; other are refractory; delayed and breakthrough. Incidence, timing, and intensity of chemotherapy-induced nausea and vomiting vary on chemotherapeutic agents and patient factors. CINV occurs in about 80% of patients and has a severe impact on patient’s life.

Antiemetics are less effective in controlling nausea and vomiting because the intensity is high than actual vomiting. Proper antiemetics can prevent CINV in about 60%-70% of patients. Nowadays due to research and development in the field of cancer therapeutics, many treatment options are available to manage and treat CINV by addressing antiemetic property to an individual patient.

Conventionally Chemotherapy-Induced Nausea and Vomiting was managed with dopamine receptor antagonists only. Currently, multiple options are available that is used in the prevention and management of CINV.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK. | 5.5% |

| Japan | 4.9% |

The Chemotherapy-Induced Nausea And Vomiting Therapeutics Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK. continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Chemotherapy-Induced Nausea And Vomiting Therapeutics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%.

The USA Chemotherapy-Induced Nausea And Vomiting Therapeutics Market is estimated to be valued at USD 2.6 billion in 2025 and is anticipated to reach a valuation of USD 2.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 351.8 million and USD 195.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Therapy Type | Dopamine Antagonists, Serotonin Receptor Antagonists, Corticosteroids, Benzodiazepines, and Neurokinin NK1 Receptor Antagonist |

| Distribution Channel | Hospital Pharmacy, Drug Stores, Retail Pharmacy, and E-Commerce |

| Route Of Administration | Oral and Intravenous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

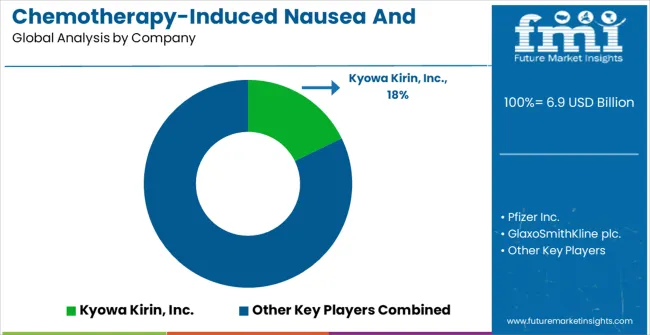

| Key Companies Profiled | Kyowa Kirin, Inc., Pfizer Inc., GlaxoSmithKline plc., AbbVie Inc. (Allergan plc), Merck & Co., Inc., Bausch Health Companies Inc., Novartis AG, Ono Pharmaceutical Co., Ltd., Camurus AB, and Heron Therapeutics, Inc. |

The global chemotherapy-induced nausea and vomiting therapeutics market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the chemotherapy-induced nausea and vomiting therapeutics market is projected to reach USD 13.0 billion by 2035.

The chemotherapy-induced nausea and vomiting therapeutics market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in chemotherapy-induced nausea and vomiting therapeutics market are dopamine antagonists, serotonin receptor antagonists, corticosteroids, benzodiazepines and neurokinin nk1 receptor antagonist.

In terms of distribution channel, hospital pharmacy segment to command 35.6% share in the chemotherapy-induced nausea and vomiting therapeutics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Postoperative Nausea and Vomiting (PONV) Management Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fucosidosis Therapeutics Market - Growth & Innovations 2025 to 2035

Market Leaders & Share in Alzheimer’s Therapeutics

Alzheimer’s Therapeutics Market Analysis by Disease Class into Cholinesterase Inhibitors, NMDA Receptor Antagonists and Combinations Through 2035.

Sarcoidosis Therapeutics Market

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA