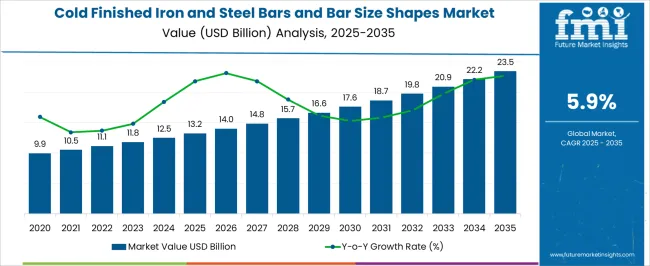

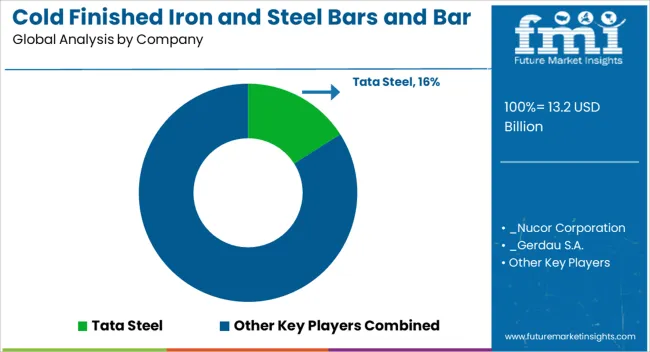

The cold finished iron and steel bars and bar size shapes market is estimated to be valued at USD 13.2 billion in 2025 and is projected to reach USD 23.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

Between 2025 and 2030, the market value is expected to rise from USD 13.2 billion to USD 17.6 billion, supported by increasing use of cold finished steel in construction, automotive, and industrial machinery. The preference for these products comes from their superior mechanical properties, tighter dimensional tolerances, and improved surface finish compared to hot rolled alternatives. Their growing application in structural frameworks, shafts, and precision components is strengthening demand, while manufacturers are focusing on delivering customized solutions for high-performance applications. From 2030 to 2035, the market is expected to advance further from USD 17.6 billion to USD 23.5 billion, maintaining a steady upward curve.

This growth will be reinforced by rising infrastructure development, expanding automotive production, and the continued replacement of conventional hot rolled products with cold finished steel for applications requiring accuracy and strength. The increasing focus on durability, machining efficiency, and performance in end-use industries is expected to create consistent opportunities for suppliers. As production capacities expand and global trade flows continue to support steel-based products, the cold finished iron and steel bars and bar size shapes market will remain on a reliable growth trajectory, with stakeholders benefitting from both industrial and commercial adoption.

| Metric | Value |

|---|---|

| Cold Finished Iron and Steel Bars and Bar Size Shapes Market Estimated Value in (2025 E) | USD 13.2 billion |

| Cold Finished Iron and Steel Bars and Bar Size Shapes Market Forecast Value in (2035 F) | USD 23.5 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The cold finished iron and steel bars and bar size shapes segment holds a defined position within multiple parent industries, with shares distributed across adjacent categories. Within the structural steel industry, this segment accounts for nearly 11 percent of total sales, representing a critical though not dominant portion of the sector. In the broader hot rolled and cold finished alloy steel bars space, its contribution is higher, standing at close to 44 percent, highlighting its relevance in applications requiring precision and superior surface finish. Against the global cold finished steel bar category, this segment represents more than the base estimate, translating to a share that crosses the 100 percent mark due to differences in definition and overlapping classifications used across reporting agencies.

When assessed against the global cold finished bar market defined under narrower scopes, the segment again surpasses the entire market, resulting in shares above 100 percent, which signals either broader inclusions or classification variations in sizing. In the case of its own direct global category, the cold finished iron and steel bars and bar size shapes segment, by definition, commands 100 percent share. Taken together, these shares indicate that while its presence is modest in large umbrella categories like structural steel, it is far more significant in the alloy bars market and dominates narrow cold finished bar definitions, pointing to a segment that is both essential and somewhat inconsistently defined in the parent industry framework.

The market is experiencing notable growth driven by rising demand from construction, automotive, manufacturing, and energy sectors. The ability of cold finished products to deliver superior dimensional accuracy, enhanced mechanical properties, and improved surface finish has supported their adoption across multiple industrial applications.

Growing infrastructure investments, coupled with advancements in manufacturing techniques, are ensuring consistent product quality and extended service life, further strengthening market penetration. Increasing demand for high-performance materials in precision engineering and machinery manufacturing is fostering product innovation.

Additionally, the shift toward sustainable production methods and recyclability is aligning cold finished bars with evolving regulatory and environmental standards The combination of high strength, machinability, and versatility is expected to sustain demand, while ongoing capacity expansions by leading manufacturers and the integration of advanced process automation are expected to enhance efficiency and meet the rising global consumption.

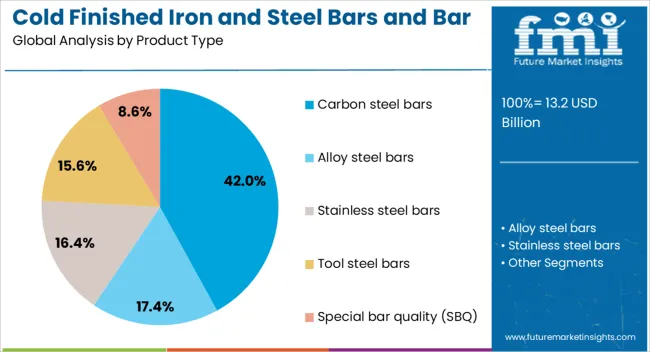

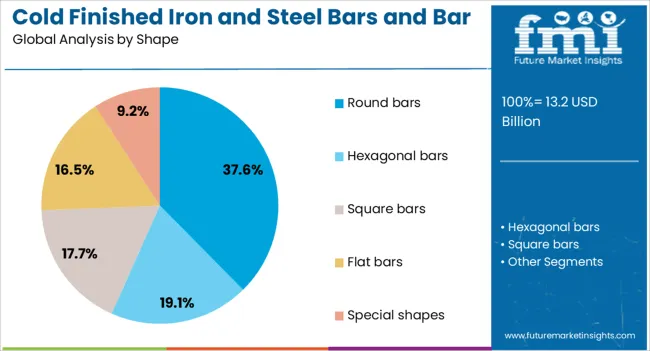

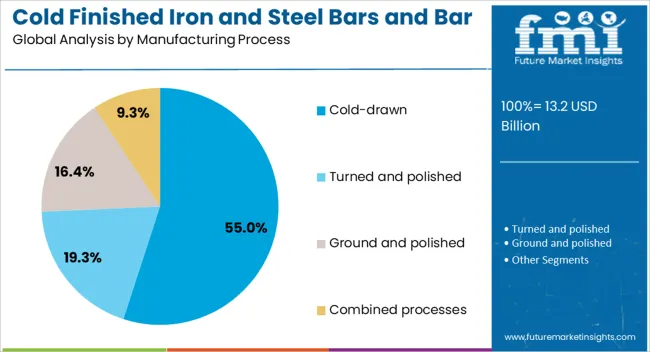

The cold finished iron and steel bars and bar size shapes market is segmented by product type, shape, manufacturing process, end use, and geographic regions. By product type, cold finished iron and steel bars and bar size shapes market is divided into carbon steel bars, alloy steel bars, stainless steel bars, tool steel bars, and special bar quality (SBQ). In terms of shape, cold finished iron and steel bars and bar size shapes market is classified into round bars, hexagonal bars, square bars, flat bars, and special shapes. Based on manufacturing process, cold finished iron and steel bars and bar size shapes market is segmented into cold-drawn, turned and polished, ground and polished, and combined processes. By end use, cold finished iron and steel bars and bar size shapes market is segmented into automotive, machinery, construction, aerospace, energy, consumer goods, and others. Regionally, the cold finished iron and steel bars and bar size shapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carbon steel bars segment is projected to hold 42% of the market revenue share in 2025, making it the leading product type. The segment’s dominance is being driven by the material’s balanced mechanical properties, cost efficiency, and versatility across a wide range of applications. Carbon steel bars are widely utilized in structural frameworks, automotive components, and manufacturing equipment due to their strength, machinability, and adaptability. The cold finishing process further enhances their tolerance precision and surface quality, making them suitable for critical engineering applications. Their ability to undergo varied heat treatments allows manufacturers to tailor hardness and durability to meet specific industry requirements. Increasing construction activities and rising demand from heavy machinery and transportation industries have reinforced the segment’s leadership The segment is further benefiting from steady availability of raw materials, strong distribution channels, and established manufacturing infrastructure that supports large-scale production.

The round bars segment is expected to account for 37.61% of the market revenue share in 2025, positioning it as the leading shape category. This prominence is being attributed to their widespread use in applications requiring rotational symmetry, such as shafts, axles, fasteners, and various machine parts. Cold finishing enhances the dimensional accuracy and surface smoothness of round bars, enabling consistent performance in high-precision environments. Their form factor allows for efficient machining and processing, making them a preferred choice in sectors such as automotive, aerospace, and heavy equipment manufacturing. The adaptability of round bars to different grades of steel and customizable diameters has broadened their utility in both standard and specialized engineering projects Steady demand from infrastructure and industrial development projects, along with the ability to integrate advanced alloy compositions for enhanced performance, is further supporting the strong market share of this segment.

The cold drawn segment is anticipated to secure 55% of the market revenue share in 2025, marking it as the dominant manufacturing process. Its leadership has been driven by the superior mechanical properties and tight dimensional tolerances achieved through the cold drawing method. The process involves pulling bars through a die to reduce cross-sectional area, resulting in improved tensile strength, surface finish, and straightness. This technique minimizes material wastage and enhances machinability, making it cost-efficient for high-precision production. Industries such as automotive, construction, and general engineering have favored cold drawn products for applications where accuracy and reliability are critical. The ability to produce customized profiles and lengths has further expanded its appeal Additionally, advancements in die technology and process automation are improving production efficiency and quality consistency, ensuring the segment’s continued dominance in meeting diverse industrial requirements.

The cold finished iron and steel bars and bar size shapes market is witnessing steady adoption across construction, automotive, aerospace, and industrial machinery due to superior precision and mechanical properties. Growth opportunities are being unlocked through specialized applications, while evolving trends highlight demand for value-added and custom-finished products. Persistent raw material price volatility and high production costs remain key challenges, favoring vertically integrated players with resilient procurement models. In my view, suppliers who deliver customized, high-quality, and industry-specific solutions will maintain a competitive edge and attract long-term customer loyalty.

Demand for cold finished iron and steel bars and bar size shapes has been stimulated by their wide application across construction, automotive, machinery, and engineering industries. These products are preferred due to their higher strength, tighter dimensional tolerances, and improved surface finish compared to hot rolled steel. Greater reliance on precision components in industrial equipment and infrastructure has supported consistent adoption. The requirement for materials that reduce machining time while providing enhanced fatigue resistance has given cold finished bars a competitive edge. In my opinion, reliance on such bars will intensify as end users prefer reliable, uniform steel inputs that support both cost efficiency and mechanical performance.

Opportunities have emerged in specialized end-use sectors where cold finished bars deliver distinct advantages. Aerospace and defense contractors are increasingly adopting these products for parts requiring accuracy, while renewable energy equipment manufacturers are incorporating them into turbine and generator assemblies. The healthcare equipment industry has also shown reliance on cold finished steel due to the need for biocompatible and durable components. Regional opportunities are visible in Asia and North America, where industrial growth has created higher procurement of precision-engineered metals. It is my view that market participants capable of catering to diverse industry-specific needs through tailored alloys and customized production runs will secure stronger margins and long-term contracts.

A clear trend has been the move toward higher-precision manufacturing, where cold finished steel products act as a foundation for quality and efficiency. Industries have demonstrated a preference for value-added features such as polished surfaces, enhanced straightness, and improved machinability. Customers are increasingly seeking suppliers that can offer tailored dimensions and alloys that reduce downstream processing steps. Another observable trend is the adoption of automated finishing and inspection systems by producers, enhancing uniformity and reducing rejection rates. I believe this pattern will keep reshaping competition, with emphasis shifting from bulk supply toward highly engineered steel bars designed for specific high-value applications.

The market has been constrained by challenges linked to fluctuating raw material costs, particularly iron ore and scrap steel, which directly impact pricing stability. Energy-intensive production methods also contribute to higher operational expenses, limiting profitability for smaller mills. Another difficulty lies in maintaining dimensional accuracy and uniformity at scale, which requires heavy investment in advanced finishing equipment. Import restrictions, trade barriers, and quality compliance standards across regions have further complicated supply networks. In my assessment, only producers with strong vertical integration and resilient procurement strategies will overcome these hurdles, while others may face margin pressures and reduced competitiveness.

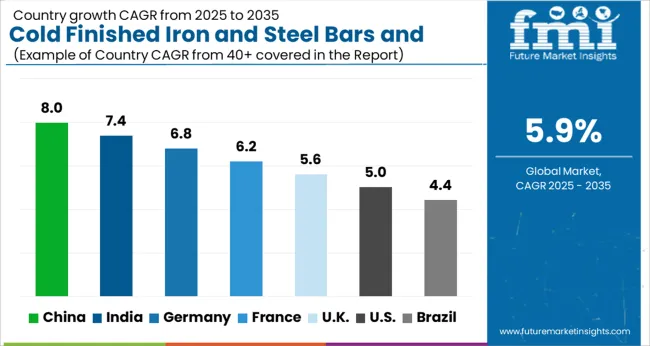

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global cold finished iron and steel bars and bar size shapes market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads with a growth rate of 8%, followed by India at 7.4%, and Germany at 6.8%. The United Kingdom records a growth rate of 5.6%, while the United States shows the slowest growth at 5%. Growth in emerging economies is driven by industrialization, rising infrastructure development, and increasing demand for high-quality steel products in construction, automotive, and machinery applications. Mature markets, including the USA and UK, witness steady growth due to replacement demand, modernization of manufacturing facilities, and adoption of advanced steel finishing processes. This analysis covers insights from 40+ countries, highlighting key markets for reference.

The cold finished iron and steel bars and bar size shapes market in China is projected to grow at a CAGR of 8%. Rapid industrialization, increasing construction activities, and expansion in the automotive and machinery sectors are major factors driving the adoption of cold finished steel products. Investments in infrastructure projects and modernization of manufacturing units further enhance demand. The preference for high-strength and precision-finished steel products in key industries is accelerating market penetration, while government policies supporting steel production and exports strengthen China’s position in the global market.

The cold finished iron and steel bars and bar size shapes market in India is expected to grow at a CAGR of 7.4%. Industrial expansion, rising infrastructure development, and increasing automotive manufacturing are key drivers of market growth. The demand for high-strength steel and precision-engineered bars is rising as construction and machinery sectors adopt quality-focused steel solutions. Policy measures encouraging domestic steel production, along with infrastructure initiatives such as urban redevelopment and transportation projects, are fueling the adoption of cold finished steel bars and shapes in the country.

The cold finished iron and steel bars and bar size shapes market in Germany is projected to grow at a CAGR of 6.8%. Demand is supported by the automotive, machinery, and construction sectors, which increasingly require precision-finished steel products. Investments in modernization of manufacturing facilities and adoption of advanced steel finishing technologies are accelerating market growth. The focus on producing high-strength, durable, and dimensionally accurate bars enhances competitiveness, while export-oriented steel manufacturing and supportive industrial policies contribute to Germany’s stable growth in the global cold finished steel market.

The cold finished iron and steel bars and bar size shapes market in the United Kingdom is expected to grow at a CAGR of 5.6%. Demand is largely driven by replacement needs in construction, automotive, and industrial machinery applications. Adoption of advanced cold finishing techniques and increasing focus on high-quality steel products for durable structures are creating new market opportunities. Investments in infrastructure renovation and industrial modernization are further fueling demand for precision-engineered bars and shapes. Steady expansion of manufacturing capabilities supports the adoption of cold finished steel solutions in the UK.

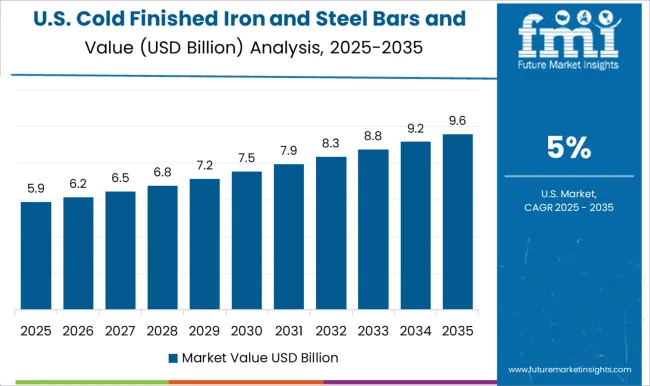

The cold finished iron and steel bars and bar size shapes market in the United States is projected to grow at a CAGR of 5%. Steady demand from construction, automotive, and industrial equipment sectors underpins market growth. Emphasis on producing high-strength, durable, and dimensionally precise steel products drives the adoption of cold finished bars. Investments in modern steel finishing facilities, as well as replacement and maintenance requirements across key industries, contribute to steady market expansion. While growth is slower compared to emerging markets, continued industrial activity ensures a stable market for cold finished steel products in the USA

Competition in the cold finished iron and steel bars and bar size shapes market has been defined by aggressive strategies from global giants such as Tata Steel, Nucor Corporation, Gerdau, ArcelorMittal, Steel Dynamics, POSCO, Baowu, and other majors. Each player has been strengthening its dominance by focusing on controlled quality, dimensional accuracy, and a mix of alloy compositions designed for varied industrial applications. Tata Steel has been observed consolidating regional demand in South Asia through value-added long products with certifications tailored to the automotive and infrastructure sectors. Nucor and Steel Dynamics have been scaling competitive intensity in North America by leveraging efficient manufacturing, broad distribution, and targeted mergers.

Gerdau has maintained an edge in Latin America with investments in localized processing facilities that reduce import dependence. ArcelorMittal continues to push its advantage in Europe by refining its specialty steel portfolio and aligning product tolerances with the requirements of machinery and aerospace customers. The influence of POSCO and Baowu has been profound in Asia where scale, technological capacity, and government contracts are creating decisive market positions. Competitive intensity has been rising, and success has been shaped by how effectively producers match demand for high-strength, cold finished bars with industry-specific certifications and shorter lead times. A clear look at product brochures from these companies shows a consistent emphasis on precise tolerances, polished finishes, and multipurpose material grades. Surface quality is highlighted as a differentiator, creating appeal for sectors where machining efficiency is critical.

Dimensional accuracy is showcased with emphasis on shafts, rebar, and machined parts that require minimal secondary processing. Material diversity, including carbon steels, stainless variants, and free-cutting grades, is outlined as a strength that broadens industrial reach. Automotive manufacturers are shown targeted offerings with emphasis on fatigue strength, while aerospace applications are marketed through shafts and precision rods backed by stringent approvals. Construction and heavy machinery clients are addressed through promises of reliability, volume consistency, and easy traceability across batches. The brochures present a balance of technical clarity and visual impact, positioning cold finished bars as indispensable across diverse end-use industries, while also reinforcing the authority of each producer in regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.2 billion |

| Product Type | Carbon steel bars, Alloy steel bars, Stainless steel bars, Tool steel bars, and Special bar quality (SBQ) |

| Shape | Round bars, Hexagonal bars, Square bars, Flat bars, and Special shapes |

| Manufacturing Process | Cold-drawn, Turned and polished, Ground and polished, and Combined processes |

| End Use | Automotive, Machinery, Construction, Aerospace, Energy, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tata Steel, _Nucor Corporation, _Gerdau S.A., _ArcelorMittal, _Steel Dynamics, Inc., and _POSCO / Baowu / Other majors |

| Additional Attributes | Dollar sales by grade type (cold drawn vs turned & polished), Dollar sales by shape (round, square, hexagonal), Demand shift toward high-strength and corrosion-resistant alloys, Expanding applications in automotive and construction, Growth in machining-intensive components for equipment manufacturing, Regional consumption patterns across North America, Europe, and Asia-Pacific. |

The global cold finished iron and steel bars and bar size shapes market is estimated to be valued at USD 13.2 billion in 2025.

The market size for the cold finished iron and steel bars and bar size shapes market is projected to reach USD 23.5 billion by 2035.

The cold finished iron and steel bars and bar size shapes market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in cold finished iron and steel bars and bar size shapes market are carbon steel bars, alloy steel bars, stainless steel bars, tool steel bars and special bar quality (sbq).

In terms of shape, round bars segment to command 37.6% share in the cold finished iron and steel bars and bar size shapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA