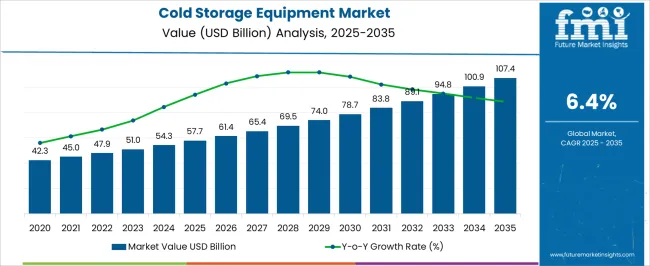

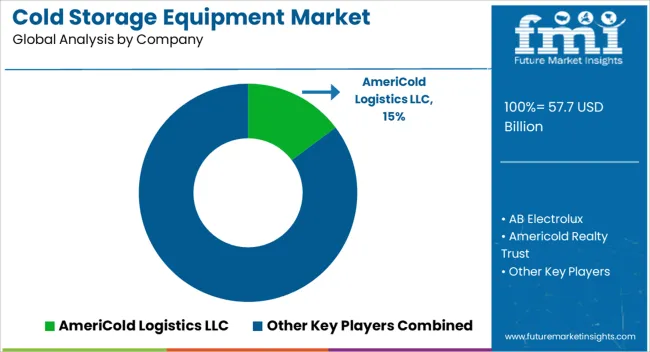

The Cold Storage Equipment Market is estimated to be valued at USD 57.7 billion in 2025 and is projected to reach USD 107.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. This growth, supported by a steady CAGR of 6.4%, is driven by the increasing demand for cold storage solutions across the food, pharmaceutical, and retail sectors.

During the first five years (2025 to 2030), the market will rise from USD 57.7 billion to USD 78.7 billion, adding USD 21 billion, which accounts for 42.2% of the total incremental growth, with a 5-year multiplier of 1.36x. The second phase (2030 to 2035) contributes USD 28.7 billion, representing 57.8% of incremental growth, reflecting stronger momentum as global food production, distribution needs, and regulatory requirements increase.

Annual increments grow from USD 4.4 billion in early years to USD 5.5 billion by 2035, signaling accelerated growth driven by the rise in e-commerce, perishable goods handling, and supply chain modernization. Manufacturers focusing on energy-efficient systems, automation, and sustainable refrigeration will capture the largest share of this USD 49.7 billion opportunity.

| Metric | Value |

|---|---|

| Cold Storage Equipment Market Estimated Value in (2025 E) | USD 57.7 billion |

| Cold Storage Equipment Market Forecast Value in (2035 F) | USD 107.4 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The cold storage equipment market is expanding steadily, driven by the increasing demand for food preservation and pharmaceutical storage solutions. The growth of frozen food consumption and the need for temperature-sensitive vaccine storage have heightened the importance of reliable cold storage systems.

Advances in refrigeration technology have improved energy efficiency and reduced operational costs, encouraging wider adoption in retail, healthcare, and logistics sectors. The rise in cold chain infrastructure investments globally has supported market expansion, especially in emerging regions.

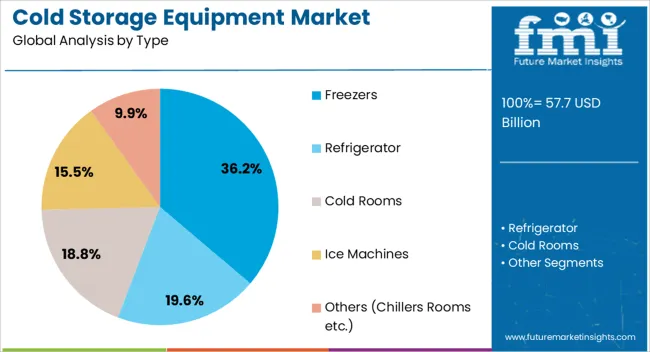

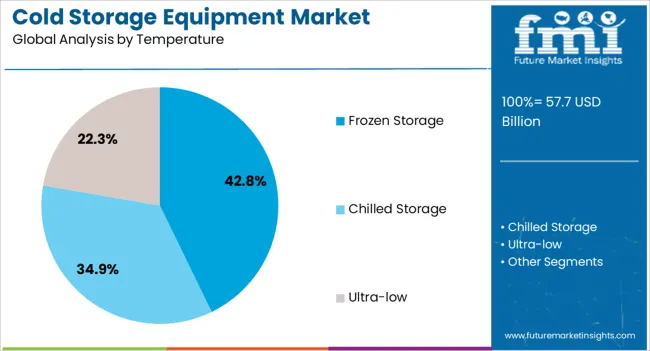

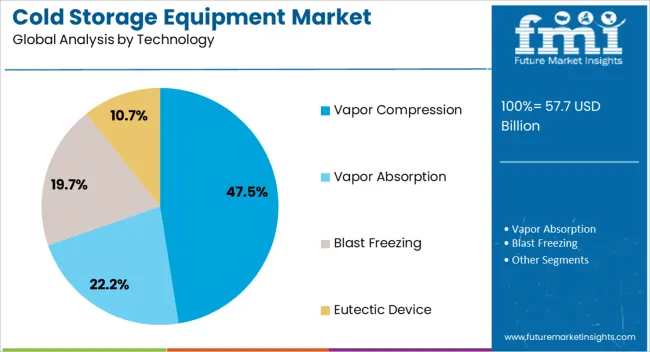

Consumers’ preference for fresh and frozen products year-round has further stimulated demand. The market is expected to continue growing as stricter regulatory standards for food safety and pharmaceutical storage become widespread. Segmental growth is anticipated to be led by freezers as the preferred equipment type, frozen storage in temperature classification, and vapor compression technology due to its efficiency and widespread application.

The cold storage equipment market is segmented by type, temperature, technology, applicationend-use, and geographic regions. By type of the cold storage equipment market is divided into Freezers, Refrigerator, Cold Rooms, Ice Machines, and Others (Chillers Rooms etc.). In terms of temperature of the cold storage equipment market is classified into Frozen Storage, Chilled Storage, and Ultra-low.

Based on technology of the cold storage equipment market is segmented into Vapor Compression, Vapor Absorption, Blast Freezing, and Eutectic Device. By application of the cold storage equipment market is segmented into Food & Beverages, Pharmaceuticals, Chemicals, Floriculture, and Others (Retail & Distribution Centers etc.).

By end-use of the cold storage equipment market is segmented into Cold Storage Facilities & Warehouses, Food Processing & Distribution Centers, Pharmaceutical & Biotechnology Companies, Supermarkets & Hypermarkets, Restaurants & Catering Services, and Others. Regionally, the cold storage equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Freezers segment is projected to contribute 36.2% of the cold storage equipment market revenue in 2025, retaining its position as the leading equipment type. This segment’s growth is fueled by the widespread use of freezers in food retail, processing, and pharmaceutical sectors for maintaining product integrity over extended periods.

Freezers are essential for frozen storage applications that require consistent low temperatures. The segment benefits from technological advancements that enhance temperature control and reduce energy consumption.

Additionally, the increasing demand for frozen ready-to-eat meals and frozen raw materials in the food industry has reinforced the need for efficient freezer solutions. As cold chain requirements grow more complex, freezers will remain a critical component of cold storage infrastructure.

The Frozen Storage segment is expected to hold 42.8% of the cold storage equipment market revenue in 2025, maintaining its leading share in temperature classifications. This segment’s growth is attributed to the surge in frozen food consumption and the pharmaceutical industry's need for subzero temperature storage.

Frozen storage ensures product quality and safety by preventing microbial growth and enzymatic reactions. Increasing consumer demand for convenience foods and the global distribution of vaccines have driven the expansion of frozen storage facilities.

Moreover, improvements in insulation and refrigeration technologies have enhanced the reliability of frozen storage units. As supply chains become more sophisticated, frozen storage will continue to be the most critical temperature range in cold storage equipment.

The Vapor Compression technology segment is projected to account for 47.5% of the cold storage equipment market revenue in 2025, establishing itself as the leading refrigeration technology. This technology is favored due to its proven efficiency, cost-effectiveness, and ability to maintain precise temperature control.

Vapor compression systems are widely used across commercial and industrial cold storage applications, providing reliable cooling performance. Technological enhancements have focused on reducing environmental impact by using eco-friendly refrigerants and improving energy consumption.

The maturity and scalability of vapor compression technology have made it the default choice for most cold storage equipment manufacturers. As demand for sustainable and efficient refrigeration solutions increases, vapor compression technology is expected to retain its dominance in the market.

The cold storage equipment market is driven by the rising demand for reliable storage solutions in the food and logistics industries. Opportunities in e-commerce and logistics, along with trends in automation and IoT integration, are reshaping the market. However, challenges related to high energy consumption and operational costs persist. By 2025, overcoming these obstacles with efficient solutions and cost-effective practices will be crucial for sustaining growth in the market.

The cold storage equipment market is expanding due to the increasing demand for reliable storage solutions in the food industry. With the rise in global food production and consumption, efficient storage is essential to maintain product quality, prevent spoilage, and reduce waste. Cold storage equipment plays a crucial role in preserving perishable goods. By 2025, the demand for refrigerated storage in food processing, distribution, and retail sectors will continue to drive the market’s growth.

Opportunities in the cold storage equipment market are growing with the expansion of the e-commerce and logistics sectors. As online grocery shopping and food delivery services become more prevalent, there is a need for efficient cold storage solutions in warehouses and distribution centers. By 2025, the demand for cold storage in e-commerce and logistics will surge, especially in regions experiencing a rise in demand for temperature-sensitive products and real-time inventory management.

Emerging trends in the cold storage equipment market include the integration of automation and IoT technology in storage systems. Automation helps streamline operations, reduce labor costs, and increase efficiency in managing inventory. Additionally, IoT-enabled systems allow for real-time monitoring of temperatures, humidity levels, and equipment performance. By 2025, these innovations will drive growth in the market, as industries look to improve operational efficiency and ensure optimal conditions for stored products.

Despite growth, challenges related to high energy consumption and operational costs persist in the cold storage equipment market. Cold storage facilities require significant energy to maintain low temperatures, leading to high operational costs. Additionally, increasing energy costs globally place pressure on businesses to find more efficient and cost-effective solutions. By 2025, addressing these challenges through energy-efficient technologies and sustainable practices will be essential for ensuring continued market growth.

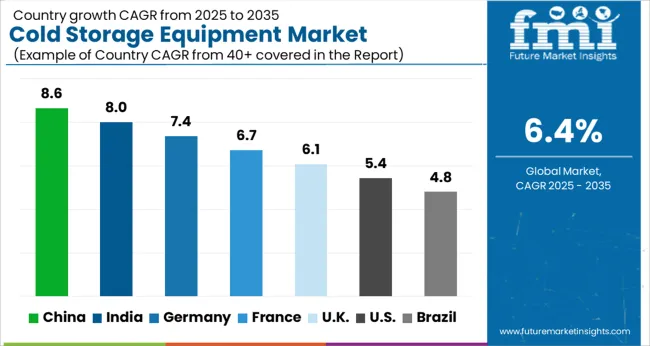

The global cold storage equipment market is projected to grow at a 6.4% CAGR from 2025 to 2035. China leads with a growth rate of 8.6%, followed by India at 8%, and France at 6.7%. The United Kingdom records a growth rate of 6.1%, while the United States shows the slowest growth at 5.4%. These varying growth rates are driven by factors such as increasing demand for temperature-sensitive storage solutions in the food, pharmaceuticals, and logistics industries.

Emerging markets like China and India are seeing higher growth due to rapid industrialization, urbanization, and expanding cold chain logistics infrastructure, while more mature markets like the USA and the UK experience steady growth driven by technological advancements, sustainability trends, and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cold storage equipment market in China is growing rapidly, with a projected CAGR of 8.6%. China’s booming food processing, pharmaceutical, and logistics sectors are driving significant demand for cold storage solutions. The country’s rapid industrialization and increasing demand for temperature-sensitive goods, particularly in e-commerce and food distribution, are key drivers of the market. Additionally, China’s growing focus on improving its cold chain logistics infrastructure to meet the increasing demand for fresh and frozen products, along with government support for sustainable and energy-efficient storage technologies, is accelerating market growth.

The cold storage equipment market in India is projected to grow at a CAGR of 8%. India’s expanding food processing, pharmaceutical, and logistics industries are key drivers of demand for cold storage solutions. The country’s rapidly growing demand for fresh produce, dairy products, and pharmaceuticals, along with an expanding e-commerce sector, is fueling the need for efficient cold storage systems. Additionally, India’s focus on improving its agricultural supply chain and reducing post-harvest losses is contributing to the increased adoption of cold storage equipment in both urban and rural areas.

The cold storage equipment market in France is projected to grow at a CAGR of 6.7%. France’s strong demand for cold storage solutions in the food and beverage, pharmaceuticals, and logistics industries is contributing to steady market growth. The country’s growing emphasis on sustainability, energy efficiency, and compliance with regulatory standards for food safety is further accelerating the adoption of cold storage technologies. Additionally, the expanding e-commerce sector and rising consumer demand for fresh, frozen, and temperature-sensitive goods are driving the need for advanced cold storage solutions.

The cold storage equipment market in the United Kingdom is projected to grow at a CAGR of 6.1%. The UK’s growing demand for cold storage solutions in the food, beverage, and pharmaceutical sectors is driving steady market growth. The country’s focus on reducing food waste, improving supply chain efficiency, and meeting regulatory standards for food safety and temperature control is further contributing to the market’s expansion. Additionally, the rise in e-commerce, particularly in the online grocery and frozen food sectors, is increasing the need for advanced cold storage equipment.

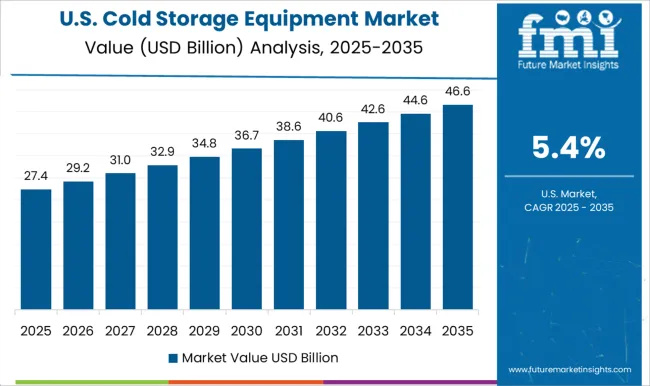

The cold storage equipment market in the United States is expected to grow at a CAGR of 5.4%. The USA remains a key market driven by demand for cold storage solutions across industries such as food and beverage, pharmaceuticals, and logistics. The increasing consumer preference for fresh, organic, and frozen products, along with the country’s expanding e-commerce and online grocery markets, is contributing to steady market growth. Additionally, the USA government’s focus on food safety standards and reducing food waste further accelerates the adoption of advanced cold storage technologies.

The Cold Storage Equipment Market is increasingly shaped by players leveraging automation, sustainability, and global expansion to maintain competitive edges. NewCold is setting the pace through massive automated “cold cube” warehouses, the UK’s largest, for instance, minimizing labor and land use while boosting efficiency, particularly in high-turn, large-scale frozen food supply operations. Lineage dominates via aggressive acquisitions and scale: it towers above rivals in global refrigerated warehousing capacity, backed by a successful multi-billion-dollar IPO and a technology-forward operation pace. Americold similarly pursues asset expansion in key regions, recently investing in a Houston-based facility to reinforce its share in the retail cold storage supply chain.

Public and private warehousing specialists, such as those serving e-grocery, foodservice, and pharmaceutical sectors, are differentiating through advanced IoT-equipped equipment, cloud-based temperature monitoring, and energy-efficient designs that align with growing regulatory pressure and sustainability targets. Cleantech innovators like Ecotutu in Nigeria are forging new paths with solar-powered, off-grid cooling solutions tailored for smallholder farmers, combining affordability with environmental consciousness. Across the board, these firms are adopting a multipronged strategic toolbox, automation for throughput and cost control, capex-fueled acquisition for scale, IoT and data systems for real-time control, energy-efficient technologies to lower operating costs, and tailored solutions for underserved markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 57.7 Billion |

| Type | Freezers, Refrigerator, Cold Rooms, Ice Machines, and Others (Chillers Rooms etc.) |

| Temperature | Frozen Storage, Chilled Storage, and Ultra-low |

| Technology | Vapor Compression, Vapor Absorption, Blast Freezing, and Eutectic Device |

| Application | Food & Beverages, Pharmaceuticals, Chemicals, Floriculture, and Others (Retail & Distribution Centers etc.) |

| End-Use | Cold Storage Facilities & Warehouses, Food Processing & Distribution Centers, Pharmaceutical & Biotechnology Companies, Supermarkets & Hypermarkets, Restaurants & Catering Services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmeriCold Logistics LLC, AB Electrolux, Americold Realty Trust, Carrier Corporation, Daikin Industries, Ltd., Dover Corporation, Frigidaire, Hussmann Corporation, Ingersoll Rand Inc., Johnson Controls International plc., Lennox International Inc., Mitsubishi Electric Corporation, Swire Cold Storage, Thermo King Corporation, and United Technologies Corporation (UTC) |

| Additional Attributes | Dollar sales by equipment type and application, demand dynamics across food and beverage, pharmaceuticals, and logistics sectors, regional trends in cold storage equipment adoption, innovation in energy-efficient and temperature-controlled technologies, impact of regulatory standards on food safety and energy usage, and emerging use cases in e-commerce and vaccine distribution. |

The global cold storage equipment market is estimated to be valued at USD 57.7 billion in 2025.

The market size for the cold storage equipment market is projected to reach USD 107.4 billion by 2035.

The cold storage equipment market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in cold storage equipment market are freezers, refrigerator, cold rooms, ice machines and others (chillers rooms etc.).

In terms of temperature, frozen storage segment to command 42.8% share in the cold storage equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Organ Static Cold Storage (SCS) Solution Market Size and Share Forecast Outlook 2025 to 2035

PU-PIR-PUR Sandwich Panel for Cold Storage Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA