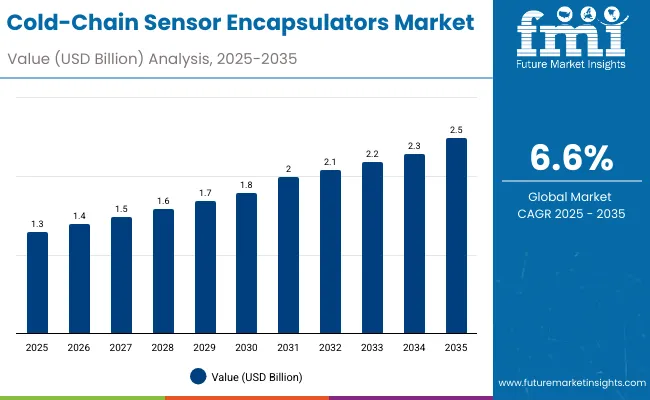

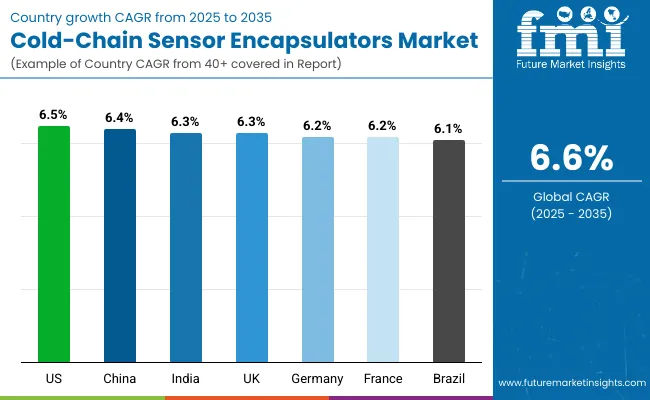

The cold-chain sensor encapsulators market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, advancing at a CAGR of 6.6%. Demand is fueled by growth in pharmaceutical logistics, biologic transport, and perishable food monitoring. Temperature sensors dominate due to reliability and precision in fluctuating environments.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, market growth of USD 0.6 billion will arise from healthcare logistics modernization. Between 2030 and 2035, an additional USD 0.6 billion will be driven by high-accuracy IoT and AI-based tracking adoption. Asia-Pacific remains the fastest-growing region.

From 2020 to 2024, market momentum surged as biologic drugs and temperature-sensitive vaccines demanded reliable data logging. Epoxy and silicone encapsulants ensured device durability under temperature fluctuations.

By 2035, the market will reach USD 2.5 billion, supported by intelligent packaging systems integrating wireless sensing and blockchain traceability. Asia-Pacific leads due to expanding pharma logistics, while North America strengthens automation and regulatory validation for temperature-controlled networks.

Market growth stems from the increasing need for real-time temperature tracking and protection of encapsulated sensors from moisture and mechanical stress. Pharmaceutical and biologic shipments require encapsulated devices to maintain performance through transport extremes.

As vaccine logistics and high-value perishables expand globally, manufacturers invest in high-reliability encapsulants that ensure longevity, data accuracy, and compliance with Good Distribution Practices (GDP).

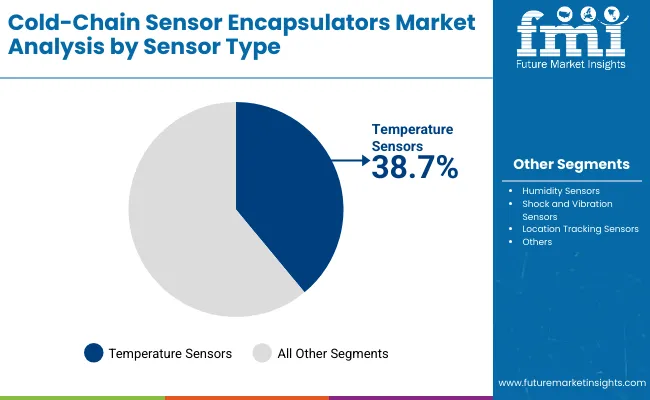

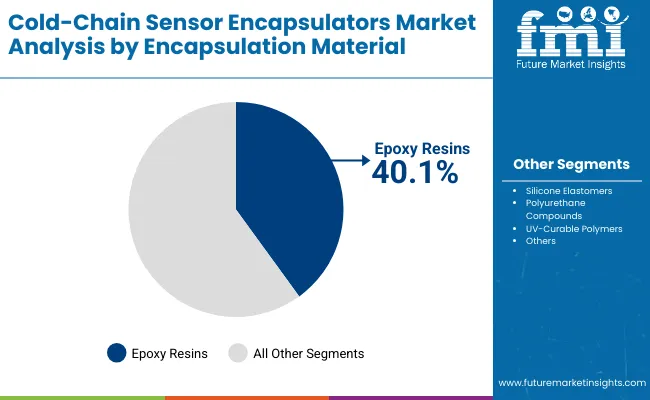

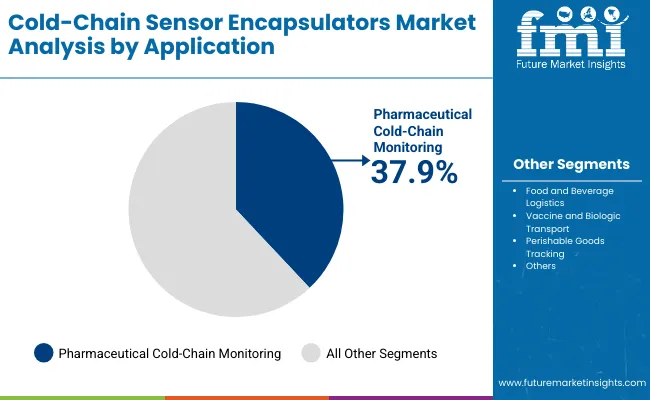

The market is segmented by sensor type, encapsulation material, application, end-use industry, and region. Sensor types include temperature, humidity, shock, and location tracking sensors. Encapsulation materials comprise epoxy resins, silicone elastomers, polyurethane compounds, and UV-curable polymers. Applications include pharmaceutical cold-chain monitoring, biologic transport, and perishable food logistics.

Temperature sensors will hold 38.7% share in 2025, as they remain the backbone of cold-chain data integrity. These sensors ensure regulatory compliance across pharmaceuticals and food logistics.

By 2035, smart temperature sensing combined with wireless connectivity and predictive analytics will drive product upgrades globally.

Epoxy resins will account for 40.1% share in 2025, favored for thermal stability, adhesion, and protection against vibration. Their strong dielectric resistance ensures long sensor lifespan.

R&D in low-viscosity, rapid-curing epoxies compatible with miniaturized sensors will enhance adoption.

Pharmaceutical cold-chain monitoring will represent 37.9% share in 2025, driven by the surge in vaccine and biologic shipments.

Smart encapsulated sensors with remote diagnostics and energy efficiency will expand global deployment by 2035.

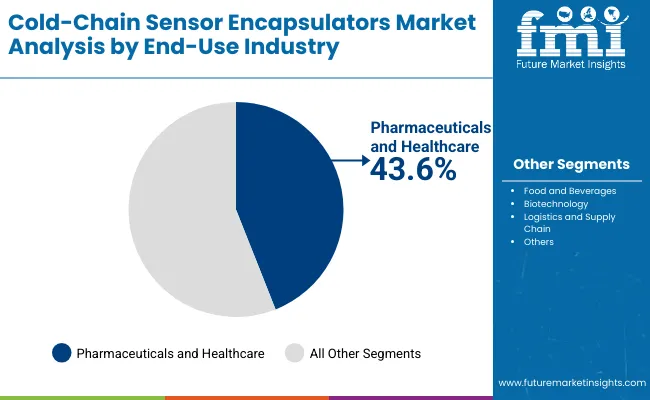

The pharmaceuticals and healthcare segment will account for 43.6% share in 2025, supported by stringent temperature control mandates.

Future growth will rely on encapsulated sensors integrated into automated, cloud-based supply systems.

Global growth of temperature-sensitive pharmaceuticals and biologics drives market expansion. Encapsulation ensures sensor durability and performance in extreme conditions.

High encapsulation material costs and the complexity of miniaturized sensor integration restrain smaller manufacturers.

Smart encapsulation combining flexible substrates and bio-compatible materials opens pathways in medical logistics and food traceability.

Trends include IoT-enabled encapsulated sensors, self-healing polymers, and battery-less monitoring solutions for vaccine cold chains.

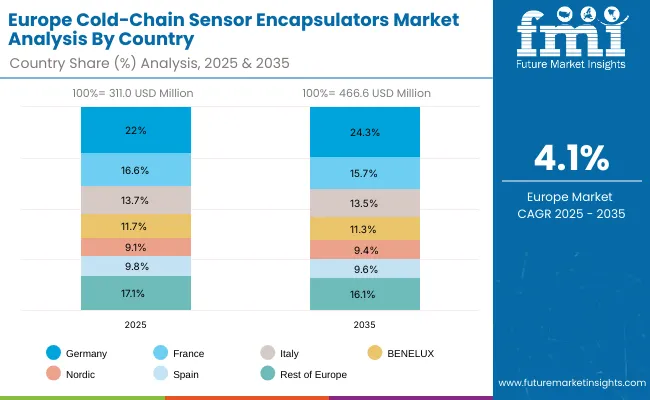

The global cold-chain sensor encapsulators market is expanding steadily as smart logistics and connected supply chains become vital for healthcare, food, and biologics industries. Asia-Pacific leads adoption with rapid digitalization of pharma and food logistics, while North America focuses on compliance, cloud integration, and traceability. Europe is emphasizing advanced encapsulation materials and temperature resilience standards. Continuous innovation in resin technology, IoT connectivity, and miniaturized sensors is redefining product safety and performance across the global cold chain.

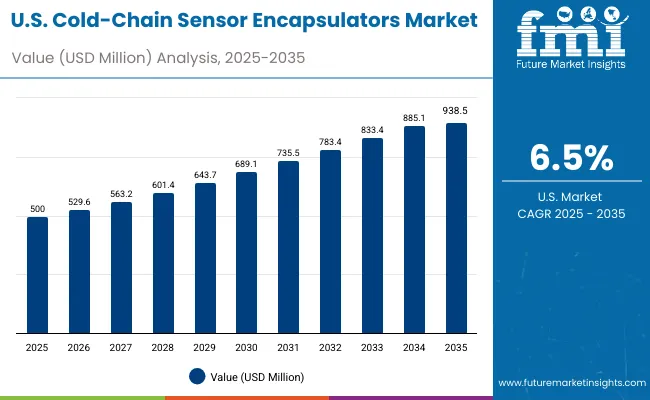

The USA market will grow at a CAGR of 6.5% from 2025 to 2035, driven by rapid growth in biologics and temperature-sensitive pharmaceuticals. Expansion in biopharma logistics networks and cold storage infrastructure is boosting encapsulated sensor deployment. The FDA’s increasing focus on temperature validation and traceability standards is reinforcing market adoption. Rising investment in smart encapsulation manufacturing, cloud-based monitoring, and sensor integration is further advancing USA leadership in cold-chain technology.

Germany will expand at a CAGR of 6.2%, propelled by stringent EU pharmaceutical distribution norms and advanced material engineering. High-quality epoxy and resin encapsulants dominate due to their superior temperature resistance and mechanical durability. R&D in cold-chain sensor technology is intensifying as Germany maintains its edge in industrial-grade precision. Strong pharmaceutical exports and strict environmental standards ensure sustained demand for encapsulated sensors within European logistics networks.

The UK market will grow at a CAGR of 6.3%, supported by modernization of cold-chain logistics and life-science exports. Rising investments in temperature-controlled distribution for vaccines and biologics are driving the need for reliable encapsulation systems. Cloud-based monitoring platforms enhance real-time accuracy, while advanced polymer encapsulants improve mechanical integrity and protection. Innovation in sustainable materials and smart sensors is accelerating market competitiveness in the UK

China will grow at a CAGR of 6.4%, driven by massive investment in pharmaceutical logistics and temperature-controlled food transport. The expansion of domestic biopharma and vaccine exports is increasing demand for high-performance encapsulation materials. Partnerships between local manufacturers and global sensor suppliers are strengthening the country’s cold-chain technology base. Rapid development in logistics automation and material science is ensuring wider adoption of smart encapsulated sensors.

India will grow at a CAGR of 6.3%, supported by vaccine cold-chain modernization and rising food safety regulations. National healthcare distribution networks are integrating smart, encapsulated sensors to improve data accuracy and regulatory compliance. Government incentives for R&D in biopolymers and encapsulant technology are fostering innovation. As logistics firms adopt connected systems for vaccine and dairy supply chains, sensor encapsulators are becoming key reliability enablers.

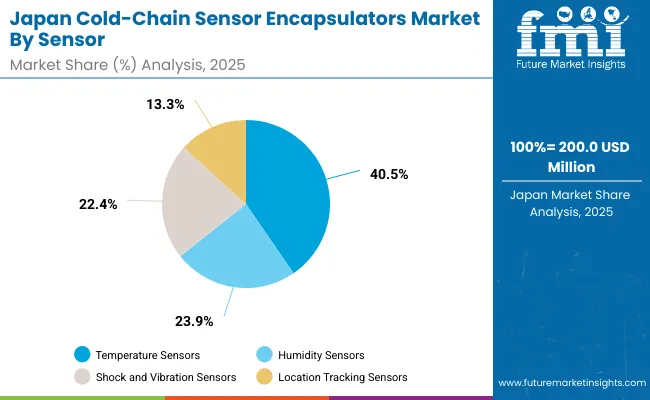

Japan will grow at a CAGR of 6.9%, leveraging its precision manufacturing and advanced material expertise. The market is dominated by high-grade polymer encapsulants used in ultra-sensitive temperature sensors. Automation in pharmaceutical packaging and logistics is improving cold-chain accuracy. Japan’s focus on robotics, reliability, and compact design supports continuous innovation in encapsulation materials tailored for extreme temperature variations.

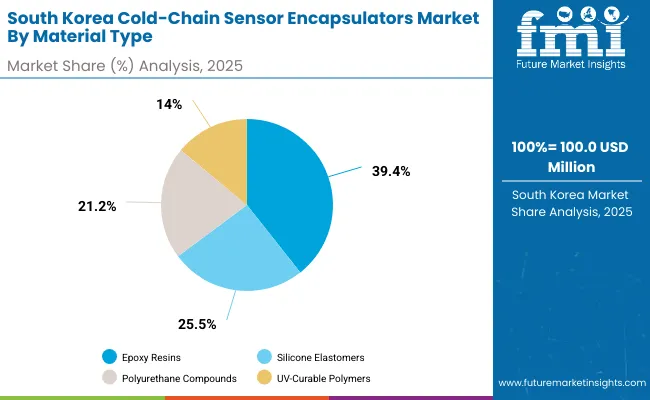

South Korea will lead with a CAGR of 7.0%, driven by integration of IoT, AI, and 5G technologies in logistics. The country’s smart manufacturing ecosystem supports miniaturized and real-time responsive encapsulated sensors. Polyurethane and silicone encapsulants are evolving to enhance performance in harsh thermal environments. Strong synergy between semiconductor precision engineering and cold-chain logistics is positioning South Korea as a pioneer in next-generation sensor encapsulation technology.

Japan’s cold-chain sensor encapsulators market, valued at USD 200.0 million in 2025, is dominated by temperature sensors due to their critical role in pharmaceutical and food logistics monitoring. Humidity sensors follow closely, ensuring moisture control during storage and transit. Shock and vibration sensors enhance damage prevention in sensitive shipments, while location tracking sensors integrate with IoT networks for real-time visibility. Japan’s robust cold-chain infrastructure and emphasis on product integrity continue to strengthen advanced encapsulation sensor adoption.

South Korea’s cold-chain sensor encapsulators market, valued at USD 100.0 million in 2025, is led by epoxy resins for their superior adhesion and thermal protection in sensor encapsulation. Silicone elastomers hold a strong share, ensuring flexibility and low-temperature durability across food and biotech applications. Polyurethane compounds contribute to insulation and mechanical strength, while UV-curable polymers are gaining adoption for fast, energy-efficient curing. The nation’s innovation-driven packaging and cold logistics expansion underpin material advancements in encapsulation performance.

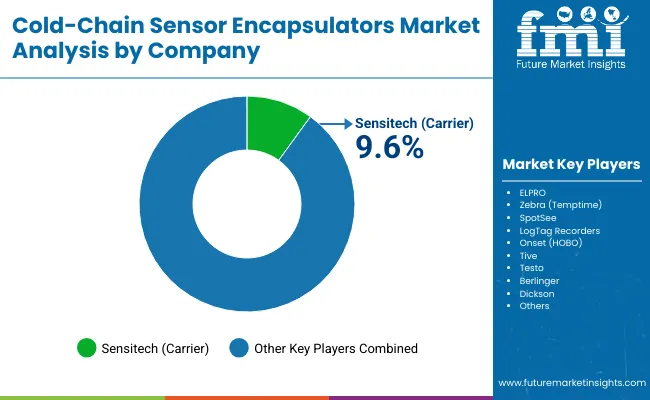

The market is moderately consolidated, with key players Sensitech (Carrier), ELPRO, Zebra (Temptime), SpotSee, LogTag Recorders, Onset (HOBO), Tive, Testo, Berlinger, and Dickson.

Sensitech leads with advanced logistics integration, while ELPRO focuses on GMP-compliant monitoring systems. Zebra and SpotSee emphasize real-time analytics for food and biologic logistics. Competitive differentiation revolves around data accuracy, reliability, and material durability.

Key Developments of Cold-Chain Sensor Encapsulators Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Sensor Type | Temperature, Humidity, Shock, Location Tracking Sensors |

| By Encapsulation Material | Epoxy, Silicone, Polyurethane, UV-Curable Polymers |

| By Application | Pharma Cold-Chain, Food Logistics, Vaccine Transport, Perishables |

| By End-Use Industry | Pharmaceuticals, Food & Beverages, Biotechnology, Logistics |

| Key Companies Profiled | Sensitech (Carrier), ELPRO, Zebra (Temptime), SpotSee, LogTag Recorders, Onset (HOBO), Tive, Testo, Berlinger, Dickson |

| Additional Attributes | Growth driven by biologic logistics expansion, IoT integration, and encapsulant innovation. |

The market will be valued at USD 1.3 billion in 2025.

The market will reach USD 2.5 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Epoxy resins will dominate with a 40.1% share in 2025.

Pharmaceuticals and healthcare will anchor demand with a 43.6% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

NOx Sensor Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA