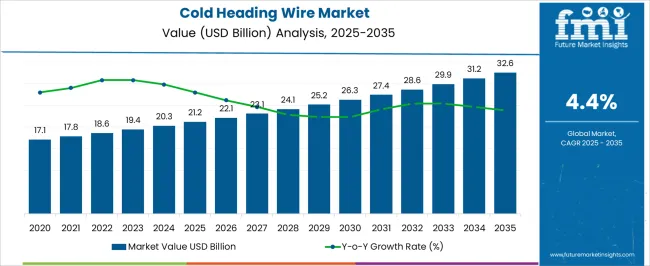

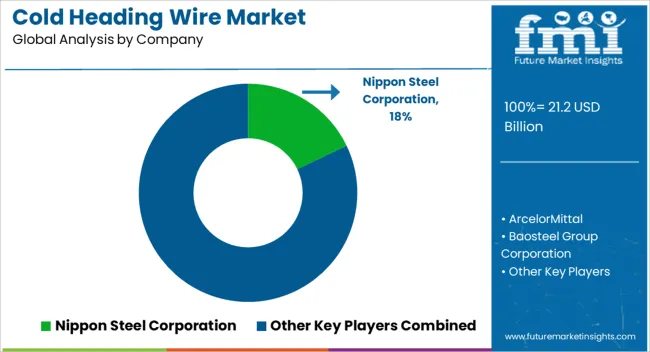

The cold heading wire market is expected to expand from USD 21.2 billion in 2025 to USD 32.6 billion by 2035, advancing at a compound annual growth rate (CAGR) of 4.4%. Between 2025 and 2030, the market will grow steadily from USD 21.2 billion to USD 26.3 billion, highlighting a clear year-on-year progression. This upward trajectory reflects the growing demand for cold heading wire in fastener production, including bolts, screws, rivets, and other industrial components.

Automotive, aerospace, and construction sectors are among the primary drivers, as they rely heavily on precision-engineered fasteners. The early growth stage shows how increasing investments in infrastructure and the rising production of automobiles are shaping demand for high-quality cold heading wire with enhanced strength and performance characteristics. From 2030 to 2035, the market is projected to rise further from USD 26.3 billion to USD 32.6 billion, maintaining a stable growth curve. This second growth phase underscores how industrial expansion and global trade activity will continue to sustain demand for fasteners across machinery, heavy equipment, and consumer goods. The steady curve suggests balanced yet dependable opportunities for suppliers and manufacturers.

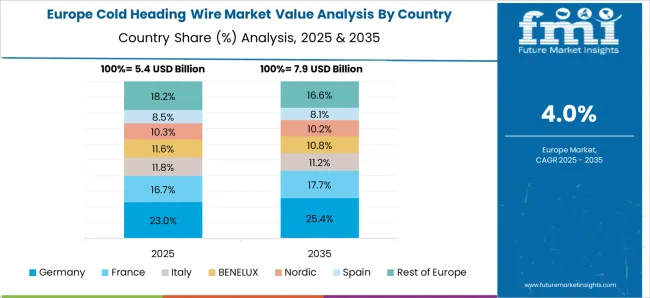

Regional expansion, particularly in Asia-Pacific, will contribute significantly, given its strong automotive and manufacturing base. Moreover, demand from Europe and North America is expected to remain stable due to ongoing replacement needs and the adoption of advanced materials in fastener production. The year-on-year growth pattern demonstrates reliability, making the cold heading wire market an attractive segment for stakeholders seeking long-term, incremental opportunities.

| Metric | Value |

|---|---|

| Cold Heading Wire Market Estimated Value in (2025 E) | USD 21.2 billion |

| Cold Heading Wire Market Forecast Value in (2035 F) | USD 32.6 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The cold heading wire market plays a critical role within several industrial and manufacturing domains, with its share differing based on applications in automotive, construction, and heavy machinery. Within the metal wire and rod market, cold heading wire accounts for about 9%, reflecting its position as a specialized material processed for high-strength applications. In the fasteners and industrial components market, its share is much stronger at nearly 20%, since bolts, screws, rivets, and other fasteners rely heavily on cold heading wire as a primary input.

Within the automotive components manufacturing market, cold heading wire contributes close to 12%, as it is widely used in producing engine fasteners, transmission parts, and safety-critical fittings. In the construction materials and hardware market, cold heading wire represents around 7%, supporting nails, anchors, and reinforcement products that ensure building reliability. Finally, in the aerospace and heavy machinery parts market, its share stands at nearly 6%, reflecting its use in producing precision-engineered fasteners and structural connectors where strength and durability are paramount. Collectively, these percentages show that cold heading wire maintains its strongest footprint in fastener production and automotive components, while holding smaller yet vital shares in construction and aerospace applications. Its role as a base material for high-performance fasteners underlines its importance across industries where reliability, precision, and structural integrity are non-negotiable.

The cold heading wire market is expanding steadily due to rising demand for high-strength fasteners across automotive, industrial machinery, and infrastructure sectors. Cold heading processes enhance mechanical properties such as tensile strength, dimensional accuracy, and fatigue resistance, making it a preferred method for manufacturing precision parts.

Favorable manufacturing economics, including material efficiency and high production throughput, are driving adoption among OEMs and tier suppliers. In parallel, increasing vehicle production and the electrification of mobility are boosting demand for specialized fasteners.

Furthermore, sustainability efforts promoting scrap reduction and energy-efficient production methods are accelerating investment in cold heading technology and materials.

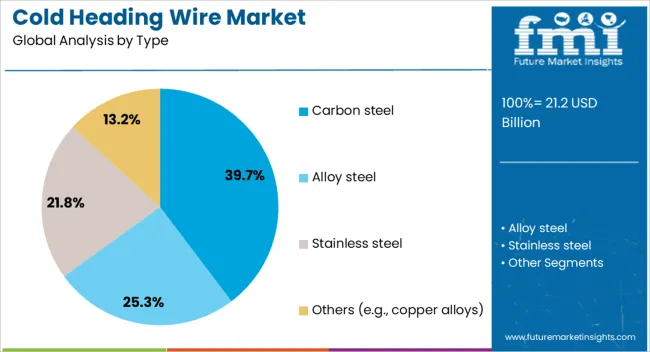

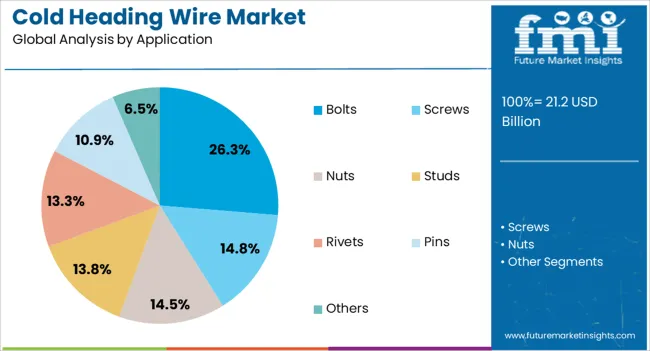

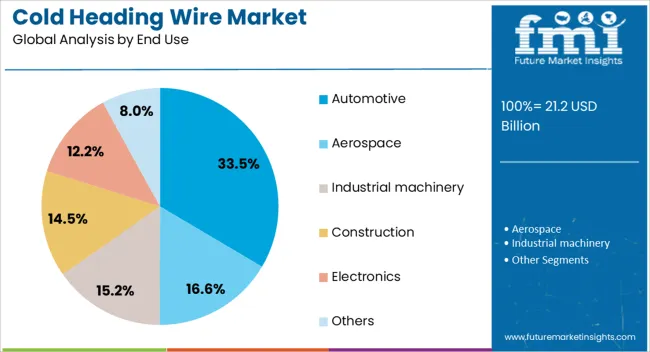

The cold heading wire market is segmented by type, application, end use, distribution channel, and geographic regions. By type, cold heading wire market is divided into Carbon steel, Alloy steel, Stainless steel, and Others (e.g., copper alloys). In terms of application, cold heading wire market is classified into Bolts, Screws, Nuts, Studs, Rivets, Pins, and Others. Based on end use, cold heading wire market is segmented into Automotive, Aerospace, Industrial machinery, Construction, Electronics, and Others. By distribution channel, cold heading wire market is segmented into Direct and Indirect. Regionally, the cold heading wire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Carbon steel is expected to lead the market with a 39.70% share by 2025, driven by its favorable cost-to-strength ratio and versatility across a wide range of cold-formed components. Its widespread availability and adaptability to diverse grades make it suitable for both standard and high-strength fasteners.

Additionally, improvements in heat treatment and coating technologies have enhanced its corrosion resistance and machinability, further reinforcing its dominance.

Manufacturers prefer carbon steel due to its compatibility with automated production lines and reduced tool wear compared to alloy alternatives, making it the most economical and scalable option.

Bolts are projected to contribute 26.30% to the market share in 2025, emerging as the top application segment. Growth in this category is primarily fueled by the increasing usage of bolts in automotive assemblies, construction equipment, and heavy machinery.

Bolts manufactured through cold heading offer superior thread integrity and mechanical performance, aligning with industry demands for durability under load and vibration. The push toward lightweight vehicles and precision engineering has further driven demand for customized bolt designs, which cold heading efficiently supports.

Integration with surface treatment and inspection systems ensures high reliability, solidifying bolts' prominence in critical load-bearing uses.

The automotive industry is anticipated to dominate end-use demand with a 33.50% market share by 2025. This dominance is due to the sector’s high-volume need for performance-critical fasteners, engine components, and structural parts.

Cold heading wires are widely used in producing screws, rivets, and bolts for drivetrain, chassis, and safety systems. The shift toward electric vehicles and increasing complexity of vehicle architectures are also driving demand for tailored, high-tolerance fasteners.

Automakers are increasingly sourcing cold-headed parts due to their reduced defect rates and improved fatigue strength, which contribute to enhanced vehicle reliability and reduced warranty costs.

The cold heading wire market is expanding as automotive, construction, and aerospace industries rely on durable fastener production. Opportunities are strengthening in high-performance alloy grades and certified export markets, while trends emphasize process efficiency, coatings, and customized product offerings. Challenges remain in raw material volatility, high energy requirements, and competition from low-cost suppliers. In my opinion, long-term success will favor companies that invest in reliable sourcing, efficiency-driven production, and differentiated value-added products, ensuring resilience and growth in the highly competitive cold heading wire landscape.

Demand for cold heading wire has been reinforced by its critical role in producing fasteners, bolts, screws, and rivets used across automotive, aerospace, and construction sectors. Manufacturers prefer cold heading wire for its superior ductility, uniformity, and capacity to withstand high-stress applications. Expanding automotive production and infrastructure projects are fueling consumption, particularly in emerging economies. In my opinion, demand will remain strong as industries seek high-strength fastening solutions that deliver durability and efficiency in large-scale assembly and structural applications worldwide.

Opportunities are emerging in advanced alloy wires tailored for aerospace, electronics, and medical device industries. Stainless steel, aluminum, and specialty alloy wires are being increasingly adopted where corrosion resistance, strength, and reliability are crucial. Export markets also present opportunities for suppliers offering certified products that comply with international standards. I believe companies that diversify into niche applications and invest in developing premium alloy wires will capture significant opportunities, particularly as high-value industries demand precision fasteners for critical components and assemblies.

Trends in the cold heading wire market highlight growing interest in surface-treated wires, advanced coatings, and tailored dimensions to improve downstream manufacturing efficiency. Wire drawing and annealing processes are being refined to enhance machinability and consistency. Customized wires designed for specific end-use applications are also gaining prominence. In my opinion, these trends show a decisive movement toward value-added offerings, where manufacturers differentiate through technical expertise and product customization, creating stronger partnerships with fastener producers across global supply chains.

Challenges in this market are centered on fluctuating raw material prices, particularly for steel and specialty alloys, which impact cost stability. Smaller producers face difficulties in maintaining profitability when material costs rise sharply. Energy-intensive production processes and stringent quality compliance add further complexity. Competition from low-cost suppliers in certain regions also pressures margins. In my assessment, only companies that secure reliable raw material sourcing, optimize production efficiency, and deliver consistent quality will overcome these hurdles and sustain long-term competitiveness in the cold heading wire industry.

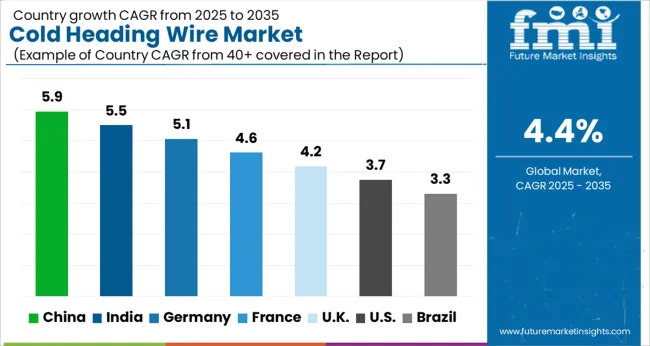

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global cold heading wire market is projected to grow at a CAGR of 4.4% from 2025 to 2035. China leads with a growth rate of 5.9%, followed by India at 5.5%, and France at 4.6%. The United Kingdom records a growth rate of 4.2%, while the United States shows the slowest growth at 3.7%. Rising demand from automotive, construction, and industrial fastener applications continues to drive market expansion. Emerging economies such as China and India are witnessing faster adoption due to growing automotive manufacturing and infrastructure projects, while developed regions like France, the UK, and the USA emphasize advanced alloys, precision fasteners, and innovations in metallurgical processing. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cold heading wire market in China is projected to grow at a CAGR of 5.9%. Strong demand from the automotive sector, which requires high-performance fasteners, is a primary driver. Infrastructure projects and construction activity are also fueling adoption, as cold heading wires are widely used in bolts, nuts, and other fasteners. Domestic manufacturers are investing in advanced steel processing technologies to improve tensile strength and corrosion resistance. With exports of fasteners rising steadily, China’s role in the global supply chain is strengthening, making it one of the most influential markets for cold heading wire production.

The cold heading wire market in India is expected to grow at a CAGR of 5.5%. Rapid expansion in automotive manufacturing, supported by global OEMs and domestic players, is driving demand for precision fasteners. Infrastructure development and industrial projects are creating additional opportunities. Indian manufacturers are focusing on cost-effective production methods while gradually adopting high-grade alloy wires to meet international standards. Government initiatives to expand the country’s manufacturing base and strengthen exports are further boosting market potential, positioning India as a competitive regional player.

The cold heading wire market in France is projected to grow at a CAGR of 4.6%. France’s advanced automotive and aerospace industries are the major consumers of cold heading wires. Demand is supported by the production of high-strength fasteners and components requiring superior metallurgical properties. French manufacturers are focusing on sustainability in production processes, while also adopting innovative alloys for higher performance. The presence of stringent European standards ensures high product quality, strengthening France’s position as a supplier for global automotive and aerospace supply chains.

The cold heading wire market in the UK is projected to grow at a CAGR of 4.2%. Demand is influenced by the country’s automotive and construction industries, where reliable fasteners play a crucial role. Market growth is supported by increasing adoption of specialty wires for high-stress applications in aerospace and defense. UK producers are also focusing on recycling and metallurgical efficiency to remain competitive. Despite slower growth compared to Asia, the UK retains significance due to its focus on premium-grade wires and technologically advanced production.

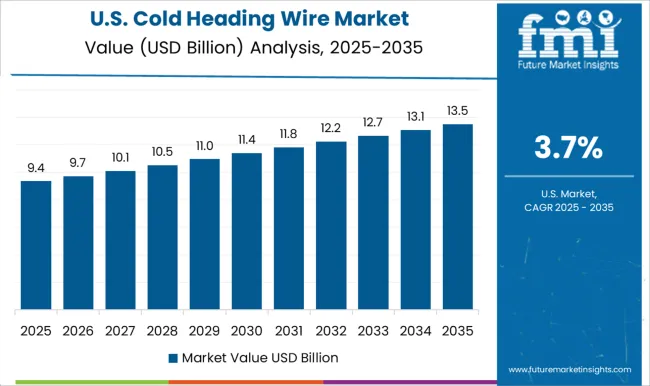

The cold heading wire market in the USA is projected to grow at a CAGR of 3.7%. Growth is supported by steady demand in automotive, aerospace, and heavy machinery industries. Manufacturers are emphasizing the production of advanced alloy wires that meet strict performance standards. The USA market also benefits from technological innovation in metallurgy and investments in domestic manufacturing capacity. However, slower growth compared to emerging economies reflects a mature market with stable demand, driven mainly by replacement and modernization needs across industries.

Competition in the cold heading wire sector is driven by scale in steelmaking, specialty metallurgy, and supply reliability for fastener and automotive production. Nippon Steel, ArcelorMittal, Baosteel, POSCO, and Tata Steel dominate through large-volume manufacturing and global distribution, positioning themselves as key suppliers for OEMs demanding consistent quality. European players such as Voestalpine and Bekaert focus on precision-engineered wire grades and niche automotive partnerships, while Gerdau and Nucor Corporation anchor their strategies in regional dominance and cost efficiency within the Americas. Kobe Steel and Sumitomo Electric Industries emphasize alloy innovation and fatigue-resistant properties, securing contracts in aerospace and high-stress industrial applications. Suzuki Garphyttan AB, WireCo World Group, and SeAH Steel target specialty grades and tailored solutions, appealing to clients with requirements in spring wire, valve train components, and critical fastening systems. This segmentation highlights a blend of volume-driven leaders and technology-focused specialists, each defending share through different levers. Strategies revolve around metallurgy innovation, downstream integration, and global service footprints. Japanese and European suppliers focus on wire grades with superior ductility, corrosion resistance, and dimensional stability to meet stricter automotive and aerospace standards. North American producers stress cost-competitive supply chains and rapid response to cyclical demand in construction and manufacturing. Chinese suppliers like Baosteel and Dongbei Special Steel deploy scale and price competitiveness, expanding into export markets where Western players traditionally held ground. Product brochures often highlight tensile strength ranges, surface finishes, and conversion yields, supported by visuals of drawn wire, heat treatment facilities, and application case studies in bolts, screws, and engine parts. Marketing materials underscore lifecycle reliability, lower defect rates, and compatibility with high-speed cold heading equipment. By blending technical assurance with capacity-driven confidence, these brochures serve both as engineering guides and commercial tools, reinforcing supplier credibility in a fragmented yet highly competitive market.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.2 Billion |

| Type | Carbon steel, Alloy steel, Stainless steel, and Others (e.g., copper alloys) |

| Application | Bolts, Screws, Nuts, Studs, Rivets, Pins, and Others |

| End Use | Automotive, Aerospace, Industrial machinery, Construction, Electronics, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nippon Steel Corporation, ArcelorMittal, Baosteel Group Corporation, Bekaert, Dongbei Special Steel Group, Gerdau, Kobe Steel, Nucor Corporation, POSCO, SeAH Steel Corporation, Sumitomo Electric Industries, Suzuki Garphyttan AB, Tata Steel, Voestalpine, and WireCo World Group |

| Additional Attributes | Dollar sales by product type (stainless steel, carbon steel, alloy steel), Dollar sales by application (automotive, construction, industrial fasteners), Trends in lightweight components and high-strength material demand, Use in bolts, screws, and rivets production, Growth of EV and infrastructure projects, Regional consumption patterns across Asia-Pacific, Europe, and North America. |

The global cold heading wire market is estimated to be valued at USD 21.2 billion in 2025.

The market size for the cold heading wire market is projected to reach USD 32.6 billion by 2035.

The cold heading wire market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in cold heading wire market are carbon steel, alloy steel, stainless steel and others (e.g., copper alloys).

In terms of application, bolts segment to command 26.3% share in the cold heading wire market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA