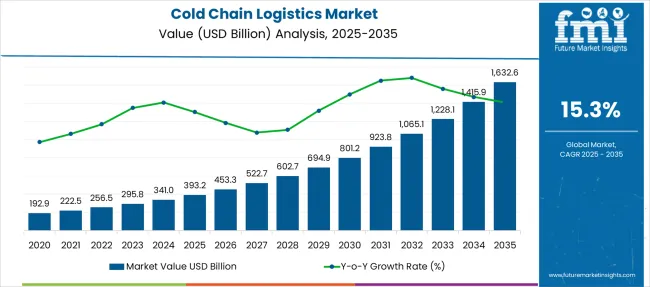

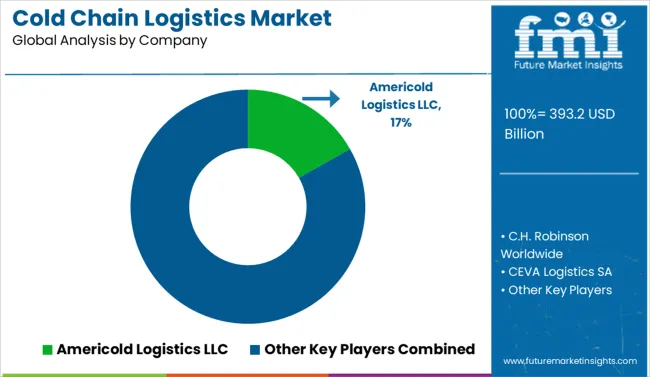

The Cold Chain Logistics Market is estimated to be valued at USD 393.2 billion in 2025 and is projected to reach USD 1632.6 billion by 2035, registering a compound annual growth rate (CAGR) of 15.3% over the forecast period. This growth reflects a 4.15x expansion with a compound annual growth rate of 15.3%. An examination of acceleration and deceleration patterns reveals that the first half of the decade is expected to experience steep capacity growth, particularly in biopharmaceuticals, frozen food transport, and last-mile delivery segments.

By 2030, the market is estimated to reach approximately USD 827.4 billion, contributing nearly USD 434.2 billion in new value. This accounts for 35% of the total increase and reflects a phase of fast acceleration driven by infrastructure investment and regulatory shifts in cold-chain-dependent categories. The latter half from 2030 to 2035 is likely to generate USD 805.2 billion in additional value, accounting for 65% of the opportunity. However, the growth pattern here is expected to stabilize as high-density cold storage nodes mature and economies of scale begin to affect margin strategies.

Companies such as Lineage Logistics and Americold Realty Trust have expanded asset footprints across urban peripheries and export corridors. Supply chain digitalization, traceability enforcement, and route optimization are expected to remain the operational focus in the deceleration phase.

| Metric | Value |

|---|---|

| Cold Chain Logistics Market Estimated Value in (2025 E) | USD 393.2 billion |

| Cold Chain Logistics Market Forecast Value in (2035 F) | USD 1632.6 billion |

| Forecast CAGR (2025 to 2035) | 15.3% |

The market accounts for approximately 45% of the temperature-controlled supply chain market, supported by rising demand for end-to-end refrigeration in food, pharmaceuticals, and chemicals. It contributes nearly 40% to the food and beverage logistics market, where fresh produce, dairy, meat, and frozen goods require controlled transport and storage.

Around 35% of the pharmaceutical logistics market depends on cold chain systems, used for vaccines, biologics, and temperature-sensitive drugs. It holds close to 50% of the perishable goods transportation market, given strict shelf-life requirements and regulatory standards. In the third-party logistics services market, cold chain activities contribute about 20%, where outsourcing of refrigerated transport and warehousing helps clients manage inventory risks and meet global compliance mandates.

The industry is experiencing structural shifts driven by rising demand for temperature-sensitive pharmaceuticals, biologics, and perishable foods. Real-time monitoring using IoT sensors and blockchain integration is enabling traceability and regulatory compliance across the supply chain. Automated cold storage facilities with robotic handling systems are reducing manual labor and enhancing throughput.

Electric refrigerated trucks and solar-powered cold units are being adopted to improve energy efficiency and reduce emissions. Rapid growth in online grocery and meal kit services has intensified investment in last-mile cold chain networks. Regional hubs across Asia and North America are reshaping logistics infrastructure and distribution models.

As supply chains become more globalized and complex, the need for reliable and compliant temperature-controlled logistics has intensified. Key factors such as rising consumption of fresh produce, biologics, and frozen food products are fueling the deployment of advanced cold storage and transportation infrastructure. Regulatory compliance related to food safety and pharmaceutical integrity is further accelerating investment in cold chain capabilities.

The market outlook remains positive, supported by continuous innovation in refrigeration technologies, digital monitoring systems, and automation. Enhanced visibility, traceability, and temperature accuracy are becoming standard requirements, pushing providers to adopt integrated and sustainable cold chain solutions. As consumer expectations around product freshness and safety continue to rise, the cold chain logistics sector is positioned for steady, long-term growth.

The cold chain logistics market is segmented by service, temperature range, application, and region. By service, the market includes refrigerated warehousing, refrigerated transportation, refrigerated road transport, refrigerated rail transport, refrigerated air transport, and refrigerated sea transport, ensuring controlled environments across multiple modes. In terms of temperature range, the segmentation comprises chilled (0°C to 8°C), frozen (-18°C to -25°C), and deep frozen (-25°C to -60°C), supporting varied storage needs. Based on application, the market is categorized into fruits and vegetables, dairy and frozen desserts, bakery and confectionery, meat, fish and seafood, pharmaceuticals, and others. Geographically, it spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

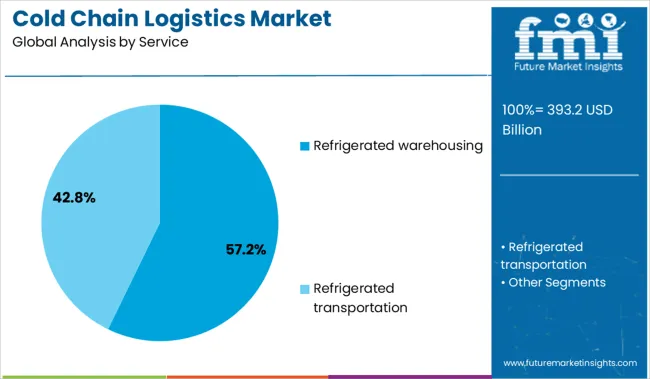

The refrigerated warehousing segment commands a dominant 57.2% share of the cold chain logistics market, highlighting its crucial role in ensuring the safe and efficient storage of perishable goods. This segment supports a wide range of industries by offering temperature-controlled environments that preserve product quality during extended storage periods.

Growth in this area is driven by increasing urban consumption, expansion of organized retail, and heightened demand for online grocery fulfillment. Providers are investing heavily in high-capacity, multi-temperature warehouses equipped with real-time monitoring and energy-efficient systems to meet the evolving needs of manufacturers and retailers.

The rise in contract warehousing and third-party logistics partnerships is also contributing to market expansion. As supply chains strive for resilience and scalability, refrigerated warehousing continues to be a cornerstone of cold chain operations, offering flexibility, inventory management, and compliance assurance across global markets.

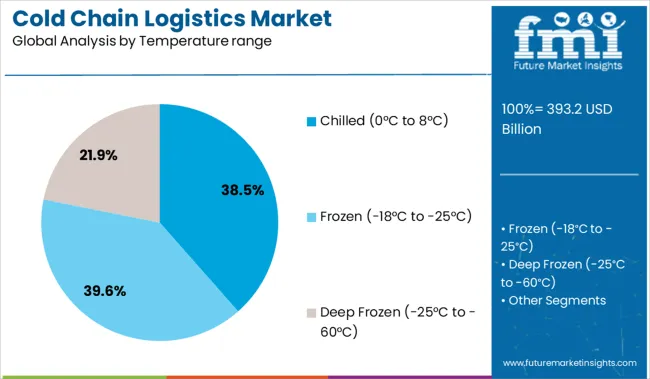

The chilled temperature range segment holds a significant 38.5% share in the cold chain logistics market, reflecting its widespread application in the transportation and storage of fresh food, dairy products, and certain pharmaceuticals. This range is particularly critical for items that are highly perishable yet do not require freezing, making it indispensable to modern food supply chains.

Growth in this segment is supported by changing consumer preferences for fresh and minimally processed food, as well as strict quality control standards in the pharmaceutical industry. Logistics providers are enhancing their fleet capabilities and refrigeration units to maintain consistent chilled environments throughout transit.

Demand is also increasing for dual-compartment vehicles and temperature-tracking solutions that ensure integrity across last-mile deliveries. As urban markets and e-commerce platforms expand, the chilled segment is expected to remain vital in preserving shelf life and minimizing product loss.

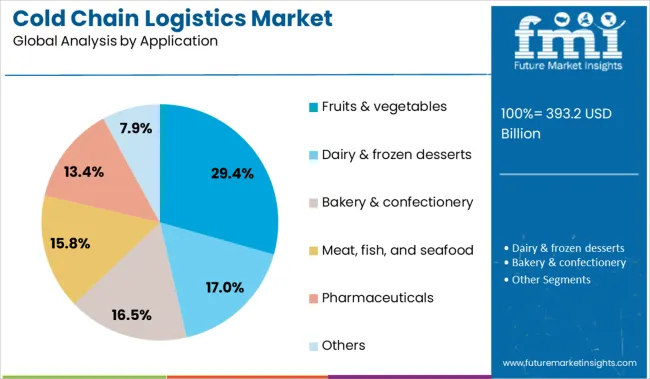

The fruits and vegetables segment accounts for 29.4% of the cold chain logistics market by application, underscoring its reliance on precise temperature control to maintain freshness and nutritional value from farm to shelf. This segment has seen rising demand due to increased global trade of fresh produce, growth in organic and health-focused food consumption, and the proliferation of supermarket chains in emerging markets.

Effective cold chain management is essential to reducing spoilage, extending shelf life, and meeting food safety regulations. Logistics providers are integrating pre-cooling units, controlled atmosphere storage, and route optimization tools to support the high-volume and time-sensitive nature of this segment.

Investments in cold storage facilities near production hubs and urban centers further enhance delivery efficiency. The growing emphasis on reducing food waste and enhancing food security ensures that the fruits and vegetables segment will remain a key driver of innovation and capacity expansion in the cold chain logistics market.

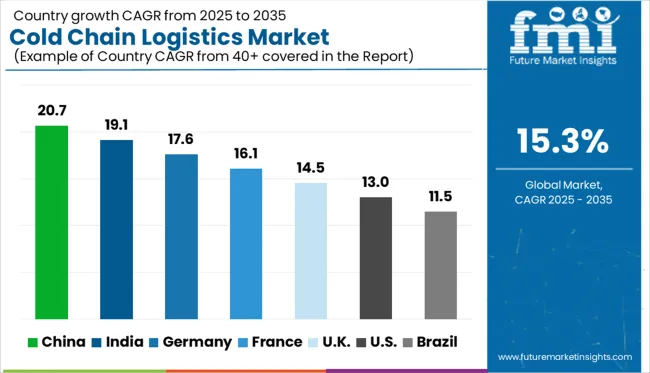

| Country | CAGR |

|---|---|

| China | 20.7% |

| India | 19.1% |

| Germany | 17.6% |

| France | 16.1% |

| UK | 14.5% |

| USA | 13.0% |

| Brazil | 11.5% |

The global cold chain logistics market is projected to grow at a CAGR of 15.3% between 2025 and 2035. China leads with a 20.7% CAGR, followed by India at 19.1% and Germany at 17.6%. France records 16.1%, while the United Kingdom shows 14.5% and the United States posts 13.0%. China and India drive adoption through rising demand for temperature-controlled transport for pharmaceuticals, e-commerce grocery, and meat exports. Germany leverages automation and IoT-based monitoring for compliance in perishable goods. France focuses on upgrading foodservice cold storage networks, while the UK emphasizes retail distribution optimization. The US market expands through pharmaceutical cold chains and advanced refrigeration in last-mile delivery.

China is projected to lead the cold chain logistics market with a 20.7% CAGR, driven by rapid expansion in food delivery platforms, biopharma distribution, and e-commerce fulfillment. Large-scale cold storage hubs integrated with automated guided vehicles (AGVs) are being deployed in major cities. Strategic investments in LNG-powered reefer trucks and rail-integrated cold chains support long-distance transport.

India is forecast to grow at 19.1% CAGR, supported by government subsidies under the Pradhan Mantri Kisan SAMPADA Yojana and private investments in organized food retail. Expansion of cold storage capacity for fruits, dairy, and vaccines accelerates the deployment of reefer trucks and modular cold rooms. Indian startups are adopting solar-powered cold storage units for last-mile delivery in rural markets.

Germany is expected to grow at a 17.6% CAGR, with automation-led upgrades in cold warehouses and integration of digital twin technology for real-time asset tracking. Retail chains and pharmaceutical companies are adopting energy-efficient storage and AI-driven demand forecasting tools. Hydrogen-powered trucks and refrigerated containers are being tested in Germany’s logistics corridors to reduce operational emissions.

France is forecast to grow at a 16.1% CAGR, driven by increased frozen food demand and stricter HACCP compliance in the hospitality sector. Multi-temperature transport systems are being deployed for bakery, dairy, and confectionery products. French logistics firms are building centralized cold storage facilities for quick-service restaurant chains and retail consolidation.

The United Kingdom is expected to expand at a 14.5% CAGR, supported by the growth of omnichannel grocery, pharmaceutical distribution, and premium meal-kit services. Logistics providers are deploying temperature-controlled lockers and hybrid reefer vans for urban delivery. Smart temperature sensors integrated with cloud dashboards improve real-time compliance tracking under post-Brexit regulatory standards.

The global cold chain logistics market is moderately consolidated, with leadership concentrated among a few established companies that combine infrastructure scale with advanced technology integration. Americold Logistics LLC is the dominant player, supported by its extensive temperature-controlled warehousing footprint, integrated multimodal transportation, and innovative automation systems that ensure compliance with pharmaceutical-grade storage standards. Its dominance is reinforced by high entry barriers, including capital-intensive infrastructure and adherence to stringent temperature-control protocols.

Key global players include C.H. Robinson Worldwide, CEVA Logistics SA, DB Schenker, DHL International GmbH, Lineage Logistics Holding LLC, Maersk, NewCold Coöperatief UA, and UPS, all leveraging IoT-enabled real-time monitoring, blockchain-based traceability, and region-specific compliance expertise. These companies differentiate through service breadth, predictive analytics for spoilage reduction, and sustainable cold chain solutions for food and pharma supply chains.

Emerging players face significant challenges due to high operating costs, regulatory compliance, and the need for continuous investment in advanced refrigerated transport and storage technologies. Competitive strategies increasingly focus on digital orchestration platforms, automation in cold storage facilities, and green refrigeration systems to meet evolving regulatory and sustainability demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 393.2 Billion |

| Service | Refrigerated warehousing, Refrigerated transportation, Refrigerated road transport, Refrigerated rail transport, Refrigerated air transport, and Refrigerated sea transport |

| Temperature range | Chilled (0°C to 8°C), Frozen (-18°C to -25°C), and Deep Frozen (-25°C to -60°C) |

| Application | Fruits & vegetables, Dairy & frozen desserts, Bakery & confectionery, Meat, fish, and seafood, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Americold Logistics LLC, C.H. Robinson Worldwide, CEVA Logistics SA, DB Schenker, DHL International GmbH, Lineage Logistics Holding, LLC, Maersk, NewCold Coöperatief UA, USA Cold Storage, and United Parcel Service (UPS) |

| Additional Attributes | Dollar sales by service type and application, regional demand trends, competitive landscape, buyer focus on perishable safety and tech, integration with IoT and AI, innovations in predictive monitoring and automation. |

The global cold chain logistics market is estimated to be valued at USD 393.2 billion in 2025.

The market size for the cold chain logistics market is projected to reach USD 1,632.6 billion by 2035.

The cold chain logistics market is expected to grow at a 15.3% CAGR between 2025 and 2035.

The key product types in cold chain logistics market are refrigerated warehousing, refrigerated transportation, refrigerated road transport, refrigerated rail transport, refrigerated air transport and refrigerated sea transport.

In terms of temperature range, chilled (0°c to 8°c) segment to command 38.5% share in the cold chain logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Cold Form Foil Market Analysis by Aluminum, Plastic Film, and Others Through 2025 to 2035

Cold Seal Plastic Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA