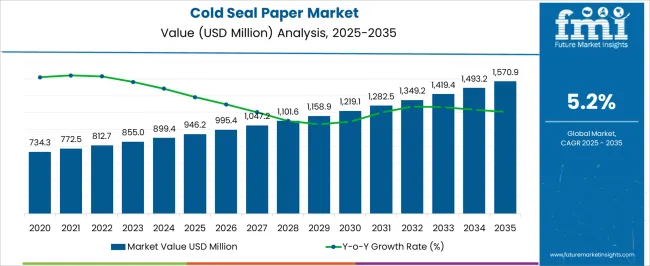

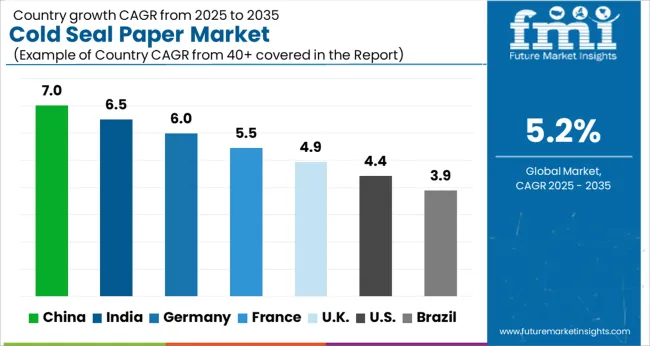

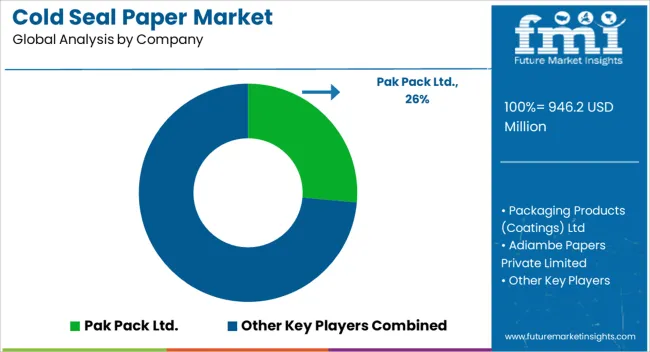

The Cold Seal Paper Market is estimated to be valued at USD 946.2 million in 2025 and is projected to reach USD 1570.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Cold Seal Paper Market Estimated Value in (2025 E) | USD 946.2 million |

| Cold Seal Paper Market Forecast Value in (2035 F) | USD 1570.9 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The cold seal paper market is experiencing sustained growth driven by the rising demand for secure and efficient packaging solutions across industries where heat sealing is either undesirable or impractical. Increased adoption in pharmaceutical, food, and personal care applications is supporting this momentum, as cold seal technology offers faster processing times and enhanced product protection.

The ability to maintain product integrity without thermal stress has made cold seal paper particularly attractive for temperature sensitive contents. Additionally, advancements in coating technologies and adhesive formulations are expanding material compatibility and sealing strength, thereby broadening the scope of use cases.

Regulatory emphasis on sustainable and recyclable packaging is further encouraging manufacturers to adopt paper based cold seal alternatives over plastic laminates. With heightened focus on operational speed, hygienic packaging, and cost effectiveness, the market is poised for continued growth across both developed and emerging markets.

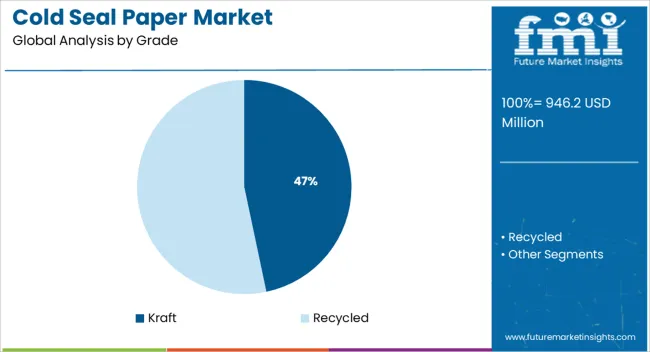

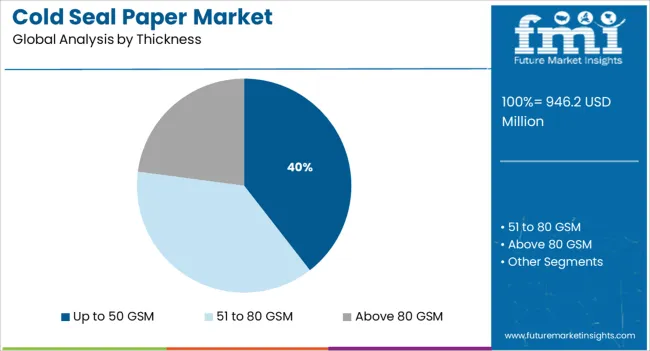

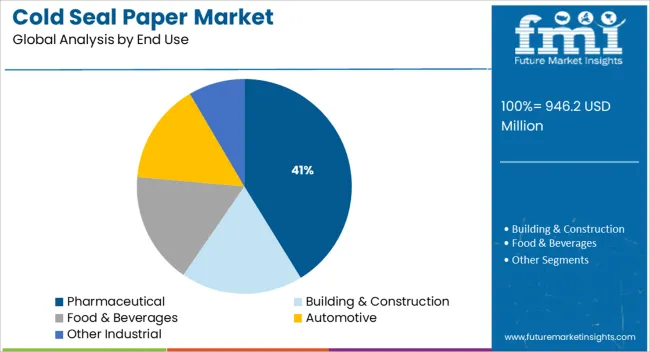

The market is segmented by Grade, Thickness, and End Use and region. By Grade, the market is divided into Kraft and Recycled. In terms of Thickness, the market is classified into Up to 50 GSM, 51 to 80 GSM, and Above 80 GSM. Based on End Use, the market is segmented into Pharmaceutical, Building & Construction, Food & Beverages, Automotive, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The kraft grade segment is projected to account for 46.70% of total market revenue by 2025 within the grade category, establishing it as the most dominant type. Its superior strength, tear resistance, and compatibility with various coatings make it ideal for cold seal applications that demand durability and printability.

Kraft paper is also widely recognized for its recyclability and sustainability profile, aligning well with consumer and industry preferences for environmentally responsible packaging. Its ability to maintain structural integrity during processing and transit has reinforced its position in high volume packaging operations.

As demand grows for reliable and eco conscious packaging materials, kraft grade cold seal paper continues to be the most widely adopted choice.

The up to 50 GSM segment is expected to contribute 39.50% of total market revenue by 2025 under the thickness category, marking it as the leading segment. Its lightweight properties combined with sufficient strength make it optimal for fast seal packaging applications.

This thickness range provides a balance between cost efficiency and functional performance, especially for items that require minimal barrier protection. Its use helps reduce material consumption without compromising on packaging integrity, supporting sustainability goals.

Additionally, the ease of folding, forming, and sealing makes it a preferred choice for automated packaging systems. As packaging requirements evolve toward leaner and greener formats, this thickness segment remains at the forefront of adoption.

The pharmaceutical end use segment is projected to hold 41.20% of total market revenue by 2025, positioning it as the top application area. This dominance is driven by the need for hygienic, tamper evident, and contamination free packaging in the pharmaceutical supply chain.

Cold seal paper offers quick sealing capabilities without heat, which helps preserve product efficacy and reduce thermal risk to sensitive medical items. The material’s compatibility with regulatory standards and its effectiveness in maintaining packaging integrity during transport are key contributors to its growth.

Increasing global healthcare demand, coupled with the rise in over the counter medical product consumption, is further fueling the uptake of cold seal paper in pharmaceutical packaging.

The global cold seal paper market witnessed a CAGR of 4.7% during the historical period and reached a valuation of USD 899.4 Million in 2024. Cold seal paper is a type of packaging paper that is used to create a self-adhesive seal.

It is utilized in a wide variety of applications and is especially useful for shipping items that need to remain sealed from dust, water, and other environmental contaminants. Cold seal paper has a waxy or sticky texture which helps it to create a tight seal and is designed to be used without the need for heat or other forms of energy.

The continuously growing food & beverage and food service industries are projected to drive the demand for cold seal papers. Also, increasing demand for convenience and on-the-go packaging solutions is set to aid sales.

Cold seal paper is extensively used to pack a wide variety of food and beverage products, including snacks, sandwiches, salads, and other prepared foods. Overall, the global market is predicted to boost at a faster pace during the forecast period, as compared to the historical period.

A number of influential factors have been identified to stir the soup in the market. Apart from the proliferating aspects prevailing in the market, analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can pose a challenge to the progression of the market.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Need for Cohesive Pharmaceutical Packaging Solutions to Fuel Sales in India

The market for cold seal papers in India is projected to expand at a CAGR of 5.7% during the forecast period, finds FMI. India’s pharmaceutical industry is expected to drive the demand for cold seal papers due to the increasing need for such packaging solutions for pharmaceutical products.

According to the Government of India’s Department of Pharmaceuticals, the pharmaceutical industry of India has grown rapidly in recent years. India currently ranks third in the world in terms of volume of production and fourteenth in terms of value, accounting for roughly 10% of the global production in terms of volume and 1.5% in terms of value.

India is also considered to be the world's fourth-largest manufacturer of generic drugs and the seventeenth-largest exporter in terms of the value of bulk actives and dosage forms. Thus, the market for cold seal papers in India is expected to benefit from the increasing demand for cohesive packaging solutions in the pharmaceutical industry.

Expansion of E-commerce in the USA to Propel Demand for Cohesive Cold Seal Packaging

FMI states that the USA market for cold seal papers is anticipated to grow 1.5 times the current market value during the forecast period. The USA is considered to be the most attractive market for cold seal papers due to its large population, high disposable income, and strong demand for convenience products.

Additionally, the USA has a large and growing e-commerce sector, which is driving the demand for cold seal papers. These papers are extensively used to package and ship products across the country. Thus, the USA is expected to develop at a rapid pace in the next ten years.

Sales of Kraft Grade Cold Seal Blister Packs to Surge among Companies Worldwide by 2035

The kraft grade segment is set to lead the global cold seal paper market due to its superior strength and high durability. The segment is expected to witness high growth and generate a share of 76% by the end of 2025. Kraft paper is made from wood pulp and is highly resistant to tearing and puncturing. It is also highly resistant to moisture, making it ideal for use in cold seal applications.

Kraft paper is cost-effective and can be easily customized to meet specific needs. According to the European Federation (EUROSAC), kraft paper is a great fiber source for the recycling industry. Its long, strong fibers are recyclable multiple times.

In the paper industry, these are commonly used as secondary raw materials. Thus, the kraft grade segment is set to dominate the market for cold seal papers and is predicted to get a boost during the forecast period owing to its various benefits.

Food and Beverage Companies Extensively Use Cold Seal Blister Packaging to Prevent Contaminants

Based on end use, the food & beverage segment is estimated to grow at a fast pace in the global market. It is projected to create an incremental growth opportunity of USD 249 Million during the forecast period.

Cold seal paper is a cost-effective and efficient packaging solution that provides superior protection against moisture, oxygen, and other contaminants. Additionally, this type is recyclable and biodegradable, thereby making it an environmentally friendly packaging solution.

As a result, the food and beverage end-use industry is increasingly turning to cold seal paper to meet its sustainable packaging needs. This would help to create a lucrative growth opportunity for the cold seal paper market share.

Key players operating in the global cold seal paper market are trying to focus on increasing their sales and revenues by expanding their capabilities to meet the growing demand. These key players are trying to adopt the merger & acquisition strategy to expand their resources.

A few other companies are developing new products to meet the rising customer needs. Also, some of the renowned players are focusing on upgrading their facilities to cater to the surging demand.

Some of the recent key developments by leading players are as follows -

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 946.2 million |

| Projected Market Valuation (2035) | USD 1570.9 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | Value (USD Million) and Volume (Tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Grade, Thickness, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain,Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Pak Pack Ltd; Packaging Products (Coatings) Ltd; Adiambe Papers Private Limited; Angloscand Limited; FFP Packaging Ltd.; Roberts Mart & Co Ltd.; GRAVURE PACKAGING PRODUCTS; American Printpak Inc.; TekniPlex; KOEHLER PAPER; Pregis LLC; Zekun Packaging Technology Co., Ltd.; Artinova Speciality Papers AB |

The global cold seal paper market is estimated to be valued at USD 946.2 million in 2025.

The market size for the cold seal paper market is projected to reach USD 1,570.9 million by 2035.

The cold seal paper market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in cold seal paper market are kraft and recycled.

In terms of thickness, up to 50 gsm segment to command 39.5% share in the cold seal paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Cold Seal Paper Industry Share

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA