The market for cold disposable biopsy forceps is constrained to single-use endoscopic instruments of tissues applied during gastrointestinal (GI), pulmonary, and urological methods for the removal of the tissues. This makes electrocautery redundant and minimizes thermal damage to surrounding tissues.

The growing prevalence of gastrointestinal disorders, increasing adoption of minimally-invasive diagnostic procedures, and growing focus on infection control measures during endoscopic procedures are expected to drive the growth of the global endoscopy market. In addition, constant advancements in the biopsy forceps designs, like improved precision and patient well-being capabilities, are also augmenting the growth of the market.

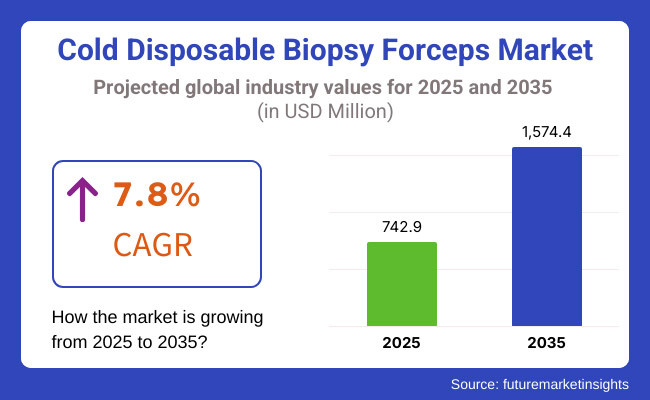

In 2025, the global cold disposable biopsy forceps market is projected to reach approximately USD 742.9 million, with expectations to grow to around USD 1,574.4 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period.

The associated increase in demand for single-use medical devices to prevent cross-contamination, an increase in the number of endoscopic biopsy procedures performed for early diagnosis of cancer diseases, and a growing healthcare infrastructure in developing economies contribute to the projected compound annual growth rate (CAGR). Regulatory guidelines favour disposable biopsy forceps eying infection control, benefitting disposables, which is expected to drive the market growth.

North America is anticipated to continue its hold in the global cold single-use biopsy forceps market and, at the same time, register as the most lucrative cold single-use biopsy forceps market during the forecast period. However, the growing use of the non-communicative endoscopes is expected to act as an industry pain point in the future. It is estimated to be one of the restraining factors to the growth of the ERCP Market. Another driving factor for the growth of the market is increasing awareness about early diagnosis of cancer and preventive diagnostics.

The European continent is accompanied by the market owing to the development of gastrointestinal and respiratory endoscopic procedures in Germany, France, and the UK. The new European Union (EU) medical device regulation (MDR) implemented in May 2021, you can see this trend only continuing; there is a real requirement for manufacturers of such medical devices, both large and small scale, to consider the patient and the prevention of infection from the outset.

This is attributed to the substantial investments being made for endoscopic technologies in the region, along with government initiatives that are enhancing access to healthcare and making it more affordable, thereby promoting market proliferation. Moreover, as the awareness regarding infection control grows in hospitals, disposable medical instruments are preferred over reusable medical instruments.

Challenges

High Initial Costs and Limited Awareness in Emerging Markets

The challenges of the high-pressure processing equipment market are high capital investments and low market penetration in developing areas. In spite of the superiority over surface modification, sterilization, and wound healing, the non-standardization of cold plasma technologies and lack of awareness among end-users limit the large-scale utilization of the practices. Moreover, stringent regulatory clearances, as well in healthcare and food safety applications, impose compliance barriers on the manufacturers.

Opportunity

Expansion in Healthcare, Sterilization, and Sustainable Industrial Applications

Due to its characteristics, such as antimicrobial properties, non-thermal effects on products, and eco-friendly aspects, cold plasma is under development for many usages in medical applications, food processing, and industrial surface modifications. They are esteemed for non-invasive, chemical-free, and cost-effective procedures, which results in the rising demand for cold plasma, thus increasing market revenues for wound healing, cancer therapies, and medical device sterilization. Moreover, its usage in textile finishing, semiconductor manufacturing, and sustainable agriculture presents fresh growth possibilities.

Due to their chemical-free disinfection capabilities, cold plasma technologies emerged as a promising solution for medical sterilization, textile treatment, and food decontamination between 2020 and 2024. However, high costs, limited awareness, and slow regulatory approvals hampered wider adoption in developing regions.

By 2025 to 2035, the use of cold plasma in medical treatments, wearable electronics and sustainable packaging is expected to become common on the market. Market penetration and regulatory acceptance will further increase with advances in portable cold plasma devices, AI engine-based automatic plasma control, and eco-friendly plasma processing technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with medical device sterilization and food safety regulations |

| Technology Innovations | Development of cold plasma sterilization and surface modification techniques |

| Market Adoption | Growth in textile treatment, food decontamination, and electronics surface modifications |

| Sustainability Trends | Initial applications in chemical-free sterilization and industrial coatings |

| Market Competition | Dominated by plasma technology providers and medical device firms |

| Consumer Trends | Increased demand for chemical-free sterilization and food safety solutions |

| Regulatory Landscape | Compliance with medical device sterilization and food safety regulations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on plasma-based therapies, eco-friendly industrial applications, and plasma sterilization in healthcare |

| Technology Innovations | Advancements in portable, AI-integrated cold plasma systems for healthcare, food, and electronics |

| Market Adoption | Expansion into wound healing, cancer therapy, wearable electronics, and sustainable packaging |

| Sustainability Trends | Large-scale adoption of plasma-based sustainable processing in textiles, agriculture, and waste treatment |

| Market Competition | Rise of startups focusing on cold plasma-based regenerative medicine and green energy applications |

| Consumer Trends | Growth in plasma-based medical therapies, cosmetic treatments, and eco-friendly industrial applications |

| Regulatory Landscape | Stricter regulations on plasma-based therapies, eco-friendly industrial applications, and plasma sterilization in healthcare |

The growth of various end-user industries such as logistics, automotive, and retail sectors is driving the demand for United States collaborate sleeve containers, as the end-user industries are adopting collapsible sleeve containers to save on cost and optimize product handling in bulk. Growing emphasis on supply chain optimization and the use of reusable packaging solutions is driving market growth.

The presence of dominant e-commerce companies and strict sustainability regulations are spurring companies to adopt collapsible sleeve containers for minimization of packaging waste and boosting operational efficiency. Moreover, the introduction of innovative materials that are durable and lightweight is complementing the penetration of such containers in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The demand for the UK collapsible sleeve containers market is being boosted by a heightened focus on sustainable efficient, cost-effective packaging solutions. With growing pressures from environmental regulations and the need to minimize the generation of plastic waste, reusable bulk containers are quickly being adopted by the logistics and retail industries.

Collapsible sleeve containers are also witnessing increased demand due to the growth in e-commerce and the rising need for efficient warehouse management. Moreover, the transition towards returnable and reusable packaging solutions is accelerated by the push toward circular economy initiatives and government-backed sustainability programs.

Additionally, the growing food and beverage industry, which needs hygienic and space-efficient bulk packaging, also assists market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

Key drivers of the European Union (EU) 's Collapsible Sleeve Containers Market Growth include stringent sustainability regulations, the implementation of reusable packaging, and the development of border trade in Europe. The EU’s intent to tackle single-use plastic is pushing businesses to move towards collapsible sleeve containers as an environmentally friendly solution.

Rampant awareness regarding the adoption of sustainable bulk packaging solutions, especially in the automotive, pharmaceutical, and industrial sectors, is supporting the growth of the market in Germany, France, and Italy. A strong presence of third-party logistics (3PL) providers using returnable transit packaging is also contributing to the market growth.

Moreover, advancements in lightweight and recyclable materials in sleeve containers can make them cost-efficient and durable for supply chain operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Increasing priorities of automation in Japan, as well as the need for space optimization and sustainable packaging across the region, are likely to build the Japan collapsible sleeve containers market. The market is being propelled by the increasing use of returnable packaging solutions in the automotive and electronics industries.

With a robust logistics infrastructure and stringent waste management policies, Japan is promoting the use of collapsible sleeve containers for efficient and sustainable material handling. Moreover, the rising demand for space-efficient and collapsible warehousing solutions in urban distribution hubs is fostering market expansion.

Japan’s expanding retail and e-commerce industry is also supporting the increasing adoption of collapsible packaging for warehouse and in-transit storage applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The market for collapsible sleeve containers in South Korea is still on the rise, propelled by the growth of the manufacturing, automotive, and logistics industries. A growing emphasis on sustainable packaging solutions in the country, as well as the rising use of smart logistics practices, are driving the demand for collapsible bulk containers.

Government mandates that promote waste prevention and circular economy practices are incentivizing companies to adopt reusable and returnable packaging solutions. Furthermore, the e-commerce industry in South Korea is burgeoning, along with the need for space-saving solutions for warehouse management, which is further accelerating the growth of the market.

The rise of the hygienic and lightweight packaging also in food and pharmaceutical sections, so this is also the factor which drives the collapsible sleeve container market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The cold disposable biopsy forceps market has a growing trend of use of oval cup biopsy forceps as the device of choice in the market due to their accuracy and efficacy in tissue sampling. These nondramatic forceps have a smooth, rounded cup design to minimize traumatic injury to surrounding tissues while still allowing sufficient biopsy material to be obtained. Synchronously used by physicians in GI endoscopic procedures, pulmonology biopsy, and urology applications, the oval cup biopsy forceps is a popular tool as it makes it possible to obtain quality histological specimens.

This is expected to increase the use of oval cup biopsy forceps, which would ultimately contribute towards the growth of the oval cup biopsy forceps market. Their utility in procuring tissue specimens from the upper as well as lower gastrointestinal tract, bronchi, urological structures, etc., has only cemented the foothold in the market. This process continues with cup design innovations helping manufacturers create cups that provide better cutting efficiency and lower surgery complications.

Although those forceps work great for getting biopsies, they're not economical for healthcare systems since they are used only once. Nonetheless, a growing focus on infection control and regulatory guidelines that increasingly favour disposable medical devices has nudged acceptance of cold disposable oval cup biopsy forceps. The irrefutable fact that GI disorders and pulmonary conditions are on the rise is predicted to contribute significantly towards boosting the largest share of this market segment in the ensuing years, resulting in a spur in technological advancements for the products, with factors like higher investment and expertise involved in these devices, which will continue to be inevitable through the years.

Due to their high grip quality, alligator jaw biopsy forceps have also been used as a complementary device for biopsy from deep or fibrotic tissues. Whereas oval cup forceps work by offering a smooth gripping surface for the retrieval of tissue, alligator jaw forceps have serrated edges on their jaws to help with the capture of tissue and greatly reduce the likelihood that tissue will slip from the jaws during procedures. Such biopsies are particularly useful in sampling lesions comprised of fibrous or dense tissue.

This increased tissue engagement improves biopsy yields, therefore alligator jaw biopsy forceps are desired by gastroenterologists, pulmonologists, and otolaryngologists for use in a variety of procedures. Advances in technology in flexible endoscopy and interventional pulmonology have accelerated the demand for alligator jaw forceps used to obtain tissue from the bronchial tree and esophageal strictures.

Alligator jaw biopsy forceps provide more grip and biopsy yield; however, the serrated edges can inflict further crush injury in the more fragile anatomical zones. Manufacturers circumvent this issue by optimizing design edges that trade off delivery efficiency and patient safety, considering the volume of any damageable sample. As biopsy techniques continue to evolve, alligator jaws' biopsy forceps are becoming increasingly popular, particularly for complex endoscopic procedures requiring a firm hold on tissue.

The 1.8mm biopsy forceps segment has captureda significant share in the cold disposable biopsy forceps market attributed to its compatibility with standard & ultra-thin endoscopes. An example of a common BI-OR® bioptome would be stainless steel biopsy forceps which are commonly used in all diagnostic and therapeutic indications in gastroenterology, pulmonology and urology and to take samples of tissues for diagnosis and treatment.

The working statement technologies are, e.g., it is known that with the addition of 300, the distal tip of an embodiment of the normal ear, there 0.8 is no longer significant. However, these would indicate that. the average body still, ultimately, the base of the material must be small to touch the conductor (touch, etc.) soft needle at a sensed Distance of 0.75 within, there are often droplets contained; they only be laid for observation, are opaque, and ripe via a time means the measurement. Being smaller, though still generating high-quality biopsy targets, means they can navigate fine anatomical structures in a less invasive manner, leading to a reduction in patient discomfort. Additionally, their disposability reduces the risk of cross-contamination, aligning with sterilization practices in clinical settings.

Rising cases of gastrointestinal cancers, pulmonary disorders, and Barrett’s esophagus have been driving demand for minimally invasive biopsy instruments, hence leading to a revenue upsurge of 1.8 mm biopsy forceps. Manufacturers are constantly upgrading the ranges that are used in diagnostic applications by reinventing the design of forceps using sophisticated metallurgy and ergonomic handles.

Clinicians use 2.4mm Forceps for upper and lower GI endoscopic biopsies, where deeper tissue samples are indicated for histopathological studies. Their larger diameter compared to needle biopsies improves the adequacy of the samples, therefore decreasing the need for repeat biopsies, making them more diagnostically efficient. The demand for these forceps in routine and specialized biopsy procedures has increased due to a rising emphasis on early cancer detection, as well as precision diagnostics.

Larger-diameter biopsy forceps can also capture pieces of larger tissues, but they need scope with wider working channels, which prevents the ultra-thin scopes from using them. The increased adoption of larger working channel endoscopes in tertiary-managed healthcare facilities supporting the evolution of endoscopic technology is expected to support the demand for the 2.4mm biopsy forceps segment. The demand for multifunctional, high-precision biopsy forceps will, therefore, only increase as endoscopic techniques are adapted to meet the ever-more challenged diagnostic and therapeutic device needs.

The cold disposable biopsy forceps market is segmented into hospitals, pathology laboratories etc. Moreover, advancements in ergonomic designs, precision cutting, and sample retrieval technology are also contributing to the growth of the market. The shift toward minimally invasive diagnostic procedures is also driving demand.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Boston Scientific Corporation | 20-24% |

| Olympus Corporation | 16-20% |

| Cook Medical | 12-16% |

| ConMed Corporation | 10-14% |

| Medline Industries, Inc. | 8-12% |

| Others | 22-28% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Boston Scientific Corporation | Offers Radial Jaw™ Cold Disposable Biopsy Forceps designed for precise tissue sampling with reduced trauma. |

| Olympus Corporation | Develops EndoJaw™ Disposable Biopsy Forceps with high-precision cutting and easy maneuverability. |

| Cook Medical | Provides single-use biopsy forceps with rigid and flexible cup designs for enhanced tissue acquisition. |

| ConMed Corporation | Specializes in cold disposable biopsy forceps for gastrointestinal and pulmonary endoscopic procedures. |

| Medline Industries, Inc. | Manufactures cost-effective, sterile biopsy forceps with a focus on safety and infection control. |

Key Market Insights

Boston Scientific Corporation (20-24%)

Boston Scientific leads the cold disposable biopsy forceps market with its Radial Jaw™ forceps, which offer optimal sample retrieval, reduced mucosal trauma, and high flexibility for endoscopic tissue biopsy procedures.

Olympus Corporation (16-20%)

Olympus is a major player with its EndoJaw™ series, designed for enhanced maneuverability and precise cutting performance in gastrointestinal endoscopy and pulmonary diagnostics.

Cook Medical (12-16%)

Cook Medical provides ergonomic, single-use biopsy forceps that ensure reliable sample collection and low-risk biopsy procedures. The company focuses on customized forceps designs for various endoscopic applications.

ConMed Corporation (10-14%)

ConMed specializes in cold disposable biopsy forceps for pulmonary and gastrointestinal procedures, integrating precision-cutting technology and contamination-free design.

Medline Industries, Inc. (8-12%)

Medline manufactures cost-effective biopsy forceps that focus on infection prevention and affordability for hospitals, clinics, and ambulatory surgery centers.

Other Key Players (22-28% Combined)

Several emerging and regional players are contributing to market growth with affordable and innovative biopsy forceps solutions, including:

The overall market size for cold disposable biopsy forceps market was USD 742.9 million in 2025.

The cold disposable biopsy forceps market is expected to reach USD 1,574.4 million in 2035.

The growth of the Cold Disposable Biopsy Forceps market will be driven by increasing demand for minimally invasive diagnostic procedures, advancements in endoscopic biopsy technologies, and rising adoption of single-use medical devices for infection control and patient safety.

The top 5 countries which drives the development of cold disposable biopsy forceps market are USA, European Union, Japan, South Korea and UK.

1.8mm biopsy forceps to command significant share over the assessment period.

Table 01: Global Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 03: Global Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 04: Global Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 05: Global Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 06: Global Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 07: North America Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 08: North America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 09: North America Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 10: North America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 11: North America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 12: North America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 13: North America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 14: Latin America Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 15: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 17: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 18: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 19: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 20: Latin America Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 21: Europe Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 22: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 23: Europe Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 24: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 25: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 26: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 27: Europe Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 28: South Asia Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 29: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 31: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 32: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 33: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 34: South Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 35: East Asia Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 36: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 38: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 39: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 40: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 41: East Asia Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 42: Oceania Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 43: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 45: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 46: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 47: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 48: Oceania Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Table 49: MEA Market Value (US$ million) Analysis 2016-2022 and Forecast 2023 to 2032, by Country

Table 50: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Product

Table 51: MEA Market Volume (Units) Analysis and Forecast 2016 to 2032, by Product

Table 52: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Diameter Size

Table 53: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Length

Table 54: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2032, by Application

Table 55: MEA Market Value (US$ million) Analysis and Forecast 2016 to 2032, by End-User

Figure 01: Global Market Volume (Units), 2016 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2032

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2032

Figure 05: Global Market Value (US$ million) Analysis, 2016 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2032

Figure 07: Global Market Absolute $ Opportunity (US$ million) Analysis, 2022 to 2032

Figure 08: Global Market Value Share (%) Analysis 2023 and 2032, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2032, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2032, by Diameter Size

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by Diameter Size

Figure 13: Global Market Attractiveness Analysis 2023 to 2032, by Diameter Size

Figure 14: Global Market Value Share (%) Analysis 2023 and 2032, by Length

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by Length

Figure 16: Global Market Attractiveness Analysis 2023 to 2032, by Length

Figure 17: Global Market Value Share (%) Analysis 2023 and 2032, by Application

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by Application

Figure 19: Global Market Attractiveness Analysis 2023 to 2032, by Application

Figure 20: Global Market Value Share (%) Analysis 2023 and 2032, by End-User

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by End-User

Figure 22: Global Market Attractiveness Analysis 2023 to 2032, by End-User

Figure 23: Global Market Value Share (%) Analysis 2023 and 2032, by Region

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2022 to 2032, by Region

Figure 25: Global Market Attractiveness Analysis 2023 to 2032, by Region

Figure 26: North America Market Value (US$ million) Analysis, 2016 to 2022

Figure 27: North America Market Value (US$ million) Forecast, 2023 to 2032

Figure 28: North America Market Value Share, by Product (2023 E)

Figure 29: North America Market Value Share, by Diameter Size (2023 E)

Figure 30: North America Market Value Share, by Length (2023 E)

Figure 31: North America Market Value Share, by Application (2023 E)

Figure 32: North America Market Value Share, by End-User (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Product, 2023 to 2032

Figure 35: North America Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 36: North America Market Attractiveness Analysis by Length, 2023 to 2032

Figure 37: North America Market Attractiveness Analysis by Application, 2023 to 2032

Figure 38: North America Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2032

Figure 40: The USA Market Value Proportion Analysis, 2022

Figure 41: Global Vs. The USA Growth Comparison

Figure 42: The USA Market Share Analysis (%) by Product, 2022 to 2032

Figure 43: The USA Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 44: The USA Market Share Analysis (%) by Length, 2022 to 2032

Figure 45: The USA Market Share Analysis (%) by Application, 2022 to 2032

Figure 46: The USA Market Share Analysis (%) by End-User, 2022 to 2032

Figure 47: Canada Market Value Proportion Analysis, 2022

Figure 48: Global Vs. Canada. Growth Comparison

Figure 49: Canada Market Share Analysis (%) by Product, 2022 to 2032

Figure 50: Canada Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 51: Canada Market Share Analysis (%) by Length, 2022 to 2032

Figure 52: Canada Market Share Analysis (%) by Application, 2022 to 2032

Figure 53: Canada Market Share Analysis (%) by End-User, 2022 to 2032

Figure 54: Latin America Market Value (US$ million) Analysis, 2016 to 2022

Figure 55: Latin America Market Value (US$ million) Forecast, 2023 to 2032

Figure 56: Latin America Market Value Share, by Product (2023 E)

Figure 57: Latin America Market Value Share, by Diameter Size (2023 E)

Figure 58: Latin America Market Value Share, by Length (2023 E)

Figure 59: Latin America Market Value Share, by Application (2023 E)

Figure 60: Latin America Market Value Share, by End-User (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Product, 2023 to 2032

Figure 63: Latin America Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 64: Latin America Market Attractiveness Analysis by Length, 2023 to 2032

Figure 65: Latin America Market Attractiveness Analysis by Application, 2023 to 2032

Figure 66: Latin America Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 67: Latin America Market Attractiveness Analysis by Country, 2023 to 2032

Figure 68: Mexico Market Value Proportion Analysis, 2022

Figure 69: Global Vs Mexico Growth Comparison

Figure 70: Mexico Market Share Analysis (%) by Product, 2022 to 2032

Figure 71: Mexico Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 72: Mexico Market Share Analysis (%) by Length, 2022 to 2032

Figure 73: Mexico Market Share Analysis (%) by Application, 2022 to 2032

Figure 74: Mexico Market Share Analysis (%) by End-User, 2022 to 2032

Figure 75: Brazil Market Value Proportion Analysis, 2022

Figure 76: Global Vs. Brazil. Growth Comparison

Figure 77: Brazil Market Share Analysis (%) by Product, 2022 to 2032

Figure 78: Brazil Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 79: Brazil Market Share Analysis (%) by Length, 2022 to 2032

Figure 80: Brazil Market Share Analysis (%) by Application, 2022 to 2032

Figure 81: Brazil Market Share Analysis (%) by End-User, 2022 to 2032

Figure 82: Argentina Market Value Proportion Analysis, 2022

Figure 83: Global Vs Argentina Growth Comparison

Figure 84: Argentina Market Share Analysis (%) by Product, 2022 to 2032

Figure 85: Argentina Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 86: Argentina Market Share Analysis (%) by Length, 2022 to 2032

Figure 87: Argentina Market Share Analysis (%) by Application, 2022 to 2032

Figure 88: Argentina Market Share Analysis (%) by End-User, 2022 to 2032

Figure 89: Europe Market Value (US$ million) Analysis, 2016 to 2022

Figure 90: Europe Market Value (US$ million) Forecast, 2023 to 2032

Figure 91: Europe Market Value Share, by Product (2023 E)

Figure 92: Europe Market Value Share, by Diameter Size (2023 E)

Figure 93: Europe Market Value Share, by Length (2023 E)

Figure 94: Europe Market Value Share, by Application (2023 E)

Figure 95: Europe Market Value Share, by End-User (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Product, 2023 to 2032

Figure 98: Europe Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 99: Europe Market Attractiveness Analysis by Length, 2023 to 2032

Figure 100: Europe Market Attractiveness Analysis by Application, 2023 to 2032

Figure 101: Europe Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 102: Europe Market Attractiveness Analysis by Country, 2023 to 2032

Figure 103: The United Kingdom Market Value Proportion Analysis, 2022

Figure 104: Global Vs. The United Kingdom Growth Comparison

Figure 105: The United Kingdom Market Share Analysis (%) by Product, 2022 to 2032

Figure 106: The United Kingdom Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 107: The United Kingdom Market Share Analysis (%) by Length, 2022 to 2032

Figure 108: The United Kingdom Market Share Analysis (%) by Application, 2022 to 2032

Figure 109: The United Kingdom Market Share Analysis (%) by End-User, 2022 to 2032

Figure 110: Germany Market Value Proportion Analysis, 2022

Figure 111: Global Vs. Germany Growth Comparison

Figure 112: Germany Market Share Analysis (%) by Product, 2022 to 2032

Figure 113: Germany Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 114: Germany Market Share Analysis (%) by Length, 2022 to 2032

Figure 115: Germany Market Share Analysis (%) by Application, 2022 to 2032

Figure 116: Germany Market Share Analysis (%) by End-User, 2022 to 2032

Figure 117: Italy Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Italy Growth Comparison

Figure 119: Italy Market Share Analysis (%) by Product, 2022 to 2032

Figure 120: Italy Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 121: Italy Market Share Analysis (%) by Length, 2022 to 2032

Figure 122: Italy Market Share Analysis (%) by Application, 2022 to 2032

Figure 123: Italy Market Share Analysis (%) by End-User, 2022 to 2032

Figure 124: France Market Value Proportion Analysis, 2022

Figure 125: Global Vs France Growth Comparison

Figure 126: France Market Share Analysis (%) by Product, 2022 to 2032

Figure 127: France Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 128: France Market Share Analysis (%) by Length, 2022 to 2032

Figure 129: France Market Share Analysis (%) by Application, 2022 to 2032

Figure 130: France Market Share Analysis (%) by End-User, 2022 to 2032

Figure 131: Spain Market Value Proportion Analysis, 2022

Figure 132: Global Vs Spain Growth Comparison

Figure 133: Spain Market Share Analysis (%) by Product, 2022 to 2032

Figure 134: Spain Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 135: Spain Market Share Analysis (%) by Length, 2022 to 2032

Figure 136: Spain Market Share Analysis (%) by Application, 2022 to 2032

Figure 137: Spain Market Share Analysis (%) by End-User, 2022 to 2032

Figure 138: Russia Market Value Proportion Analysis, 2022

Figure 139: Global Vs Russia Growth Comparison

Figure 140: Russia Market Share Analysis (%) by Product, 2022 to 2032

Figure 141: Russia Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 142: Russia Market Share Analysis (%) by Length, 2022 to 2032

Figure 143: Russia Market Share Analysis (%) by Application, 2022 to 2032

Figure 144: Russia Market Share Analysis (%) by End-User, 2022 to 2032

Figure 145: BENELUX Market Value Proportion Analysis, 2022

Figure 146: Global Vs BENELUX Growth Comparison

Figure 147: BENELUX Market Share Analysis (%) by Product, 2022 to 2032

Figure 148: BENELUX Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 149: BENELUX Market Share Analysis (%) by Length, 2022 to 2032

Figure 150: BENELUX Market Share Analysis (%) by Application, 2022 to 2032

Figure 151: BENELUX Market Share Analysis (%) by End-User, 2022 to 2032

Figure 152: East Asia Market Value (US$ million) Analysis, 2016 to 2022

Figure 153: East Asia Market Value (US$ million) Forecast, 2023 to 2032

Figure 154: East Asia Market Value Share, by Product (2023 E)

Figure 155: East Asia Market Value Share, by Diameter Size (2023 E)

Figure 156: East Asia Market Value Share, by Length (2023 E)

Figure 157: East Asia Market Value Share, by Application (2023 E)

Figure 158: East Asia Market Value Share, by End-User (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Product, 2023 to 2032

Figure 161: East Asia Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 162: East Asia Market Attractiveness Analysis by Length, 2023 to 2032

Figure 163: East Asia Market Attractiveness Analysis by Application, 2023 to 2032

Figure 164: East Asia Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 165: East Asia Market Attractiveness Analysis by Country, 2023 to 2032

Figure 166: China Market Value Proportion Analysis, 2022

Figure 167: Global Vs. China Growth Comparison

Figure 168: China Market Share Analysis (%) by Product, 2022 to 2032

Figure 169: China Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 170: China Market Share Analysis (%) by Length, 2022 to 2032

Figure 171: China Market Share Analysis (%) by Application, 2022 to 2032

Figure 172: China Market Share Analysis (%) by End-User, 2022 to 2032

Figure 173: Japan Market Value Proportion Analysis, 2022

Figure 174: Global Vs. Japan Growth Comparison

Figure 175: Japan Market Share Analysis (%) by Product, 2022 to 2032

Figure 176: Japan Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 177: Japan Market Share Analysis (%) by Length, 2022 to 2032

Figure 178: Japan Market Share Analysis (%) by Application, 2022 to 2032

Figure 179: Japan Market Share Analysis (%) by End-User, 2022 to 2032

Figure 180: South Korea Market Value Proportion Analysis, 2022

Figure 181: Global Vs South Korea Growth Comparison

Figure 182: South Korea Market Share Analysis (%) by Product, 2022 to 2032

Figure 183: South Korea Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 184: South Korea Market Share Analysis (%) by Length, 2022 to 2032

Figure 185: South Korea Market Share Analysis (%) by Application, 2022 to 2032

Figure 186: South Korea Market Share Analysis (%) by End-User, 2022 to 2032

Figure 187: South Asia Market Value (US$ million) Analysis, 2016 to 2022

Figure 188: South Asia Market Value (US$ million) Forecast, 2023 to 2032

Figure 189: South Asia Market Value Share, by Product (2023 E)

Figure 190: South Asia Market Value Share, by Diameter Size (2023 E)

Figure 191: South Asia Market Value Share, by Length (2023 E)

Figure 192: South Asia Market Value Share, by Application (2023 E)

Figure 193: South Asia Market Value Share, by End-User (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Product, 2023 to 2032

Figure 196: South Asia Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 197: South Asia Market Attractiveness Analysis by Length, 2023 to 2032

Figure 198: South Asia Market Attractiveness Analysis by Application, 2023 to 2032

Figure 199: South Asia Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 200: South Asia Market Attractiveness Analysis by Country, 2023 to 2032

Figure 201: India Market Value Proportion Analysis, 2022

Figure 202: Global Vs. India Growth Comparison

Figure 203: India Market Share Analysis (%) by Product, 2022 to 2032

Figure 204: India Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 205: India Market Share Analysis (%) by Length, 2022 to 2032

Figure 206: India Market Share Analysis (%) by Application, 2022 to 2032

Figure 207: India Market Share Analysis (%) by End-User, 2022 to 2032

Figure 208: Indonesia Market Value Proportion Analysis, 2022

Figure 209: Global Vs. Indonesia Growth Comparison

Figure 210: Indonesia Market Share Analysis (%) by Product, 2022 to 2032

Figure 211: Indonesia Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 212: Indonesia Market Share Analysis (%) by Length, 2022 to 2032

Figure 213: Indonesia Market Share Analysis (%) by Application, 2022 to 2032

Figure 214: Indonesia Market Share Analysis (%) by End-User, 2022 to 2032

Figure 215: Malaysia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Malaysia Growth Comparison

Figure 217: Malaysia Market Share Analysis (%) by Product, 2022 to 2032

Figure 218: Malaysia Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 219: Malaysia Market Share Analysis (%) by Length, 2022 to 2032

Figure 220: Malaysia Market Share Analysis (%) by Application, 2022 to 2032

Figure 221: Malaysia Market Share Analysis (%) by End-User, 2022 to 2032

Figure 222: Thailand Market Value Proportion Analysis, 2022

Figure 223: Global Vs. Thailand Growth Comparison

Figure 224: Thailand Market Share Analysis (%) by Product, 2022 to 2032

Figure 225: Thailand Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 226: Thailand Market Share Analysis (%) by Length, 2022 to 2032

Figure 227: Thailand Market Share Analysis (%) by Application, 2022 to 2032

Figure 228: Thailand Market Share Analysis (%) by End-User, 2022 to 2032

Figure 229: Oceania Market Value (US$ million) Analysis, 2016 to 2022

Figure 230: Oceania Market Value (US$ million) Forecast, 2023 to 2032

Figure 231: Oceania Market Value Share, by Product (2023 E)

Figure 232: Oceania Market Value Share, by Diameter Size (2023 E)

Figure 233: Oceania Market Value Share, by Length (2023 E)

Figure 234: Oceania Market Value Share, by Application (2023 E)

Figure 235: Oceania Market Value Share, by End-User (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Product, 2023 to 2032

Figure 238: Oceania Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 239: Oceania Market Attractiveness Analysis by Length, 2023 to 2032

Figure 240: Oceania Market Attractiveness Analysis by Application, 2023 to 2032

Figure 241: Oceania Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 242: Oceania Market Attractiveness Analysis by Country, 2023 to 2032

Figure 243: Australia Market Value Proportion Analysis, 2022

Figure 244: Global Vs. Australia Growth Comparison

Figure 245: Australia Market Share Analysis (%) by Product, 2022 to 2032

Figure 246: Australia Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 247: Australia Market Share Analysis (%) by Length, 2022 to 2032

Figure 248: Australia Market Share Analysis (%) by Application, 2022 to 2032

Figure 249: Australia Market Share Analysis (%) by End-User, 2022 to 2032

Figure 250: New Zealand Market Value Proportion Analysis, 2022

Figure 251: Global Vs New Zealand Growth Comparison

Figure 252: New Zealand Market Share Analysis (%) by Product, 2022 to 2032

Figure 253: New Zealand Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 254: New Zealand Market Share Analysis (%) by Length, 2022 to 2032

Figure 255: New Zealand Market Share Analysis (%) by Application, 2022 to 2032

Figure 256: New Zealand Market Share Analysis (%) by End-User, 2022 to 2032

Figure 257: Middle East & Africa Market Value (US$ million) Analysis, 2016 to 2022

Figure 258: Middle East & Africa Market Value (US$ million) Forecast, 2023 to 2032

Figure 259: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Diameter Size (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Length (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 263: Middle East & Africa Market Value Share, by End-User (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2032

Figure 266: Middle East & Africa Market Attractiveness Analysis by Diameter Size, 2023 to 2032

Figure 267: Middle East & Africa Market Attractiveness Analysis by Length, 2023 to 2032

Figure 268: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2032

Figure 269: Middle East & Africa Market Attractiveness Analysis by End-User, 2023 to 2032

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2032

Figure 271: GCC Countries Market Value Proportion Analysis, 2022

Figure 272: Global Vs GCC Countries Growth Comparison

Figure 273: GCC Countries Market Share Analysis (%) by Product, 2022 to 2032

Figure 274: GCC Countries Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 275: GCC Countries Market Share Analysis (%) by Length, 2022 to 2032

Figure 276: GCC Countries Market Share Analysis (%) by Application, 2022 to 2032

Figure 277: GCC Countries Market Share Analysis (%) by End-User, 2022 to 2032

Figure 278: Turkey Market Value Proportion Analysis, 2022

Figure 279: Global Vs. Turkey Growth Comparison

Figure 280: Turkey Market Share Analysis (%) by Product, 2022 to 2032

Figure 281: Turkey Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 282: Turkey Market Share Analysis (%) by Length, 2022 to 2032

Figure 283: Turkey Market Share Analysis (%) by Application, 2022 to 2032

Figure 284: Turkey Market Share Analysis (%) by End-User, 2022 to 2032

Figure 285: South Africa Market Value Proportion Analysis, 2022

Figure 286: Global Vs. South Africa Growth Comparison

Figure 287: South Africa Market Share Analysis (%) by Product, 2022 to 2032

Figure 288: South Africa Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 289: South Africa Market Share Analysis (%) by Length, 2022 to 2032

Figure 290: South Africa Market Share Analysis (%) by Application, 2022 to 2032

Figure 291: South Africa Market Share Analysis (%) by End-User, 2022 to 2032

Figure 292: North Africa Market Value Proportion Analysis, 2022

Figure 293: Global Vs North Africa Growth Comparison

Figure 294: North Africa Market Share Analysis (%) by Product, 2022 to 2032

Figure 295: North Africa Market Share Analysis (%) by Diameter Size, 2022 to 2032

Figure 296: North Africa Market Share Analysis (%) by Length, 2022 to 2032

Figure 297: North Africa Market Share Analysis (%) by Application, 2022 to 2032

Figure 298: North Africa Market Share Analysis (%) by End-User, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA