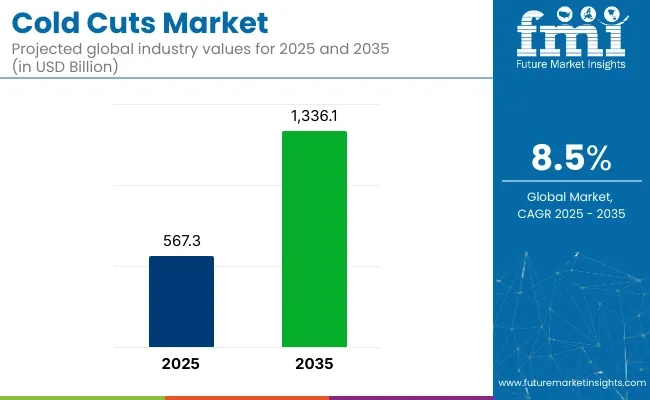

The global cold cuts market has been experiencing significant growth, driven by increasing consumer preference for ready-to-eat meat products, rising urbanization, and changing lifestyles. In 2024, the market was estimated to be valued near USD 525 billion, and it is projected to reach USD 567.3 billion by 2025. Over the next decade, the market is expected to expand rapidly, reaching a value of USD 1,336.1 billion by 2035, exhibiting a robust CAGR of 8.5% during the assessment period from 2025 to 2035.

The growth is supported by increased demand for convenient, high-protein, and nutritious food products, particularly among millennials and working professionals. Innovations in packaging, such as vacuum-sealing and modified atmosphere packaging (MAP), have improved product shelf life and freshness, further stimulating consumption. Additionally, the development of healthier cold cut options, including low-fat, reduced-sodium, and organic variants, has expanded the consumer base.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 567.3 Billion |

| Projected Industry Value (2035F) | USD 1,336.1 Billion |

| Value-based CAGR (2025 to 2035) | 8.5% |

Industry players are increasingly focusing on product diversification, sustainability, and regional flavor adaptations to meet evolving consumer preferences. Leading companies like Hormel Foods Corporation, Tyson Foods, and Smithfield Foods continue to invest heavily in research and development and strategic acquisitions to strengthen their market positions.

Furthermore, advancements in processing technologies such as precision slicing and automated packaging have enhanced production efficiency while maintaining high-quality standards. The rising trend of snacking and ready-to-eat meals globally is expected to continue to drive demand for cold cuts.

The global cold cuts market is witnessing varied consumption patterns across regions, influenced by cultural preferences, economic development, and lifestyle changes. Developed markets in North America and Europe lead in per capita consumption due to their well-established meat processing industries and strong consumer demand for convenient, ready-to-eat protein options. Meanwhile, emerging markets in Asia-Pacific and Latin America are experiencing steady growth driven by increasing urbanization, rising disposable incomes, and shifting dietary habits toward more protein-rich and processed foods.

Countries such as the United States, Germany, Italy, and Spain stand out as leading exporters in the global meat industry, capitalizing on their advanced meat processing technologies and stringent quality standards to serve international markets effectively. On the demand side, regions including North America, Europe, and Asia-Pacific are significant importers, driven by growing consumer preference for convenient and high-quality protein sources.

Key Importers: Regions such as North America, Europe, and Asia-Pacific import substantial quantities to meet growing demand for convenient protein sources. Emerging markets in Asia and Latin America are increasing imports due to rising consumption and limited domestic production.

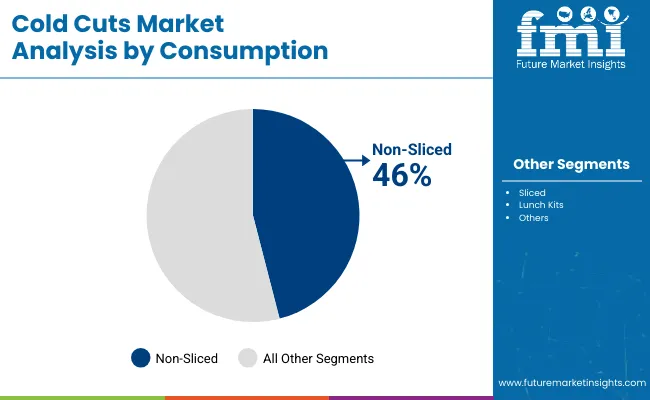

The non-sliced cold cuts segment holds a significant market share, accounting for approximately 46% of consumption in 2025. Non-sliced cold cuts are favored for their versatility and convenience, particularly in home cooking and catering industries. These products are typically sold as whole pieces or large cuts and offer flexibility in usage, ranging from sandwiches and salads to main dishes.

Consumer preference for non-sliced varieties is also influenced by perceptions of freshness and quality, as many believe that non-sliced products retain better texture and flavor. Moreover, the increasing number of foodservice establishments and demand from commercial kitchens have supported growth in this segment.

Packaging innovations that preserve freshness and enhance shelf life have contributed to the growing acceptance of non-sliced cold cuts. Additionally, non-sliced products often appeal to health-conscious consumers looking to avoid additives sometimes found in pre-sliced options.

With expanding urban populations and increasing dual-income households, non-sliced cold cuts are expected to maintain steady demand, supported by their broad application across multiple meal occasions.

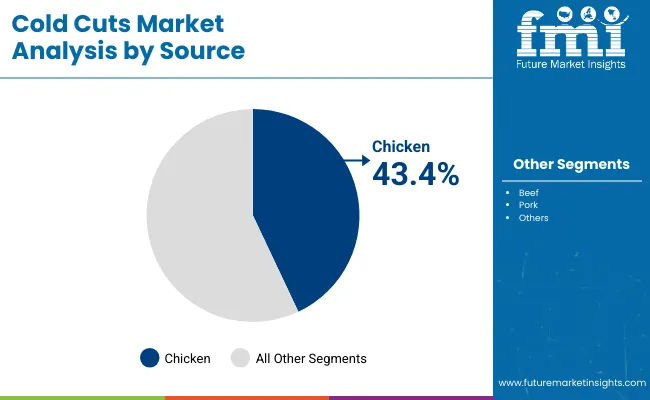

Chicken cold cuts are projected to dominate the source segment, accounting for approximately 43.4% of the market share by 2025. The rising preference for chicken over other meats is driven by its perceived health benefits, including lower fat content, high protein, and affordability compared to beef and pork.

Consumers are increasingly seeking lean protein options, and chicken cold cuts offer a convenient, tasty alternative suitable for sandwiches, salads, and snacks. Additionally, cultural and religious dietary preferences in many regions have contributed to the widespread acceptance of chicken-based products.

Key market players have focused on diversifying their chicken cold cuts offerings by introducing organic, antibiotic-free, and flavored variants to cater to health-conscious and gourmet consumers. Enhanced processing methods such as marination and smoke infusion have further expanded the product appeal.

Moreover, the global rise in fast-food consumption and on-the-go eating habits is expected to bolster demand for chicken cold cuts, particularly in urban markets. Sustainability initiatives by producers, including ethical sourcing and reduced environmental impact, are also positively influencing consumer choices.

The industry is growing steadily, fueled by the rising demand for ready-to-eat, high-protein, and convenient meal solutions. Retail consumers prefer pre-packaged, sliced meats for sandwiches and quick meals, whereas food service operators require bulk packaging to satisfy demand in delis, restaurants, and catering services.

There is a trend towards healthier options, such as nitrate-free, organic, and plant-based cold cuts, appealing to health-oriented consumers. Institutional customers, like schools and hospitals, value cost-effectiveness, food safety, and nutritional content, which drives product formulations.

Consumers are also turning to premium and artisanal cold cuts, including dry-cured and gourmet styles, and pushing flavor and processing innovation. Sustainability is also an issue of importance, with brands highlighting environmentally friendly packaging and responsibly sourced meat. As snacking continues to grow, portion-pack formats and protein-rich formats are increasing in popularity.

The industry is growing, but the main problem is that processed meats, including the association of these foods with heart diseases and cancer, always present a problem. Consumers who are extra-conscious of what they eat have companies to fulfill their needs by being creative with gluten-free, organic, and plant-based item alternatives.

The cost of raw materials generated, especially meat and spices, is not stable, thus increasing the overheads and affecting the pricing strategies. Other factors, such as the variability in feed prices, the supply of livestock animals, and trade regulations, additionally have a negative influence on this issue. In order to survive, companies need to manage the supply chain at the highest level, use multiple sourcing models, and look for cheaper formulas.

The change in food consumption strategies and the growing number of people who prefer plant-based diets will be the big threats to the decline of traditional cold cuts. Adding vegan and flexitarian lifestyles to the list of consumer preferences may affect the growth rate. To keep up with the changes, firms must increase their product lines to include plant-based deli slices and hybrid meats that target the modified consumer taste.

Concerns about the sustainability of meat production have become reputational risks related to greenhouse gas emissions and water consumption.

Companies are required to adopt responsible sourcing, green packaging, and ethical meat processing practices to meet global environmental standards and satisfy the expectations of consumers who care about social issues.

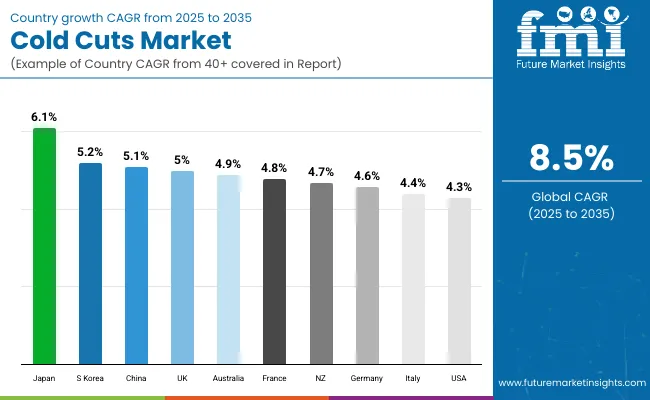

| Countries | CAGR |

|---|---|

| USA | 4.3% |

| UK | 5.0% |

| France | 4.8% |

| Germany | 4.6% |

| Italy | 4.4% |

| South Korea | 5.2% |

| Japan | 6.1% |

| China | 5.1% |

| Australia | 4.9% |

| New Zealand | 4.7% |

The USA has a well-developed food processing industry and a high demand for convenience foods. High-protein and minimally processed foods, premium cold cuts, and ready-to-eat demand are driving growth. Consumers are increasingly choosing high-protein and low-processed foods, which is making manufacturers invest in clean-label and organic products.

In addition, higher growth in home meal replacement and fast-casual food has fueled sliced meat consumption for turkey and chicken since they are seen as healthier options.

The UK cold cuts market is experiencing healthy growth due to shifting consumer demand for premium, packaged deli meat. Increasing consumer demand for locally produced and handcrafted cold meats has been stimulating product development.

UK consumers are taking on more premium meat formats and healthier options such as low-sodium and nitrate-free. Expansion in sandwich chains and delicatessens is also supporting demand for fresh flavors and environmentally friendly sourcing. Expansion in grocery home shopping and direct-to-consumer meat delivery is also supporting expansion.

France is expanding based on strong domestic consumption of customary charcuterie products. Consumption is driven by demand for authentic, locally sourced meat such as saucisson, pâté, and jambon sec. Gourmet and organic cold cuts also fit with customers' aspirations for quality and sustainability.

In addition, there is an increasing demand for vegetarian cold cuts based on shifting food practices. The dominance of high-end retailers and small-scale producers guarantees continued development.

Germany is supported by a long tradition of processed meat, with a strong demand for wursts, hams, and cured sausages. Strong sales growth is driven by growth in on-the-go consumption patterns and by the popularity of cold platters.

There is a growing demand for low-fat and protein-enriched cuts among healthy consumers. Supermarkets and specialty retailers remain dominant distribution channels, with direct-to-consumer delivery services becoming increasingly popular.

The Italian cold-cuts market is characterized by firm consumer demand for traditionally cured high-quality products such as prosciutto, mortadella, and salami. Increasing consumption of artisan and PDO-certified goods has also been reflected in continued growth.

Healthier product offerings, such as lower-sodium and reduced-fat cuts, also see demand rise. The food service industry, particularly the fast-casual food service industry, fuels expansion. Expansion in the Italian export industry for cold cuts also represents potential for future growth.

South Korea is expanding aggressively due to changing eating habits and increased Western-style processed meat consumption. The convenience of cuts as a quick meal solution is driving retail purchasing. Bulk and packaged ham, turkey, and roast beef are in demand.

Apart from this, increased growth in gourmet and premium meat products and increased penetration of e-commerce are also further consolidating the industry. Overseas expansion of deli-style restaurant chains is also contributing to the growth.

The Japanese cold-cut market is experiencing strong growth because of increasing urbanization and increased demand for convenience foods. Ready-to-consume food, such as sandwiches and bento boxes, is gaining increasing popularity.

Locally, there is a strong demand for imported high-quality processed meat. Healthy consumer demand for lean protein food products such as chicken and turkey cold cuts is driving the growth. Japan will experience steady growth due to advances in packaging technology and long-shelf-life products.

China's cold cuts market is growing because consumers' urbanization and lifestyles are driving demand for convenient protein offerings. Growing Westernization of dietary trends has spurred increased consumption of ham, salami, and smoked meat.

Increased incomes and aspirations for imported value-added meat are also driving demand. In addition, modern retail channel expansion and improved cold chain logistics are building markets and supporting continued growth.

Australia's cold cuts market is growing as consumers seek convenient, high-protein meal solutions. The growing popularity of charcuterie boards and upscale deli meats is driving demand for premium cuts.

Consumers are seeking nitrate-free and sustainably produced meats, and manufacturers are producing cleaner-label options. The food service channel, including cafes and sandwich chains, is a key driver of market growth. In addition, increasing e-commerce penetration is expanding access to specialty cuts, driving further expansion.

New Zealand's cold-cut market is expanding with increasing demand from consumers for gourmet and sustainably sourced meat. Locally produced, grass-fed meat products are increasingly sought after, driven by the movement towards a healthier, higher-protein diet. Cold cuts are becoming increasingly popular with meal preparation and convenience food trends, particularly in the urban market.

The retail channel is meeting this with more and more organic and specialty cold cuts, supporting steady market growth. The food service channel is riding the trend, as well, in introducing fresh meat products and driving even higher sales.

Globally, intense competition is fueled by a set of multinational food giants and a range of regional players, all competing for space in offered innovations in products, acquisitions, and wider distribution networks.

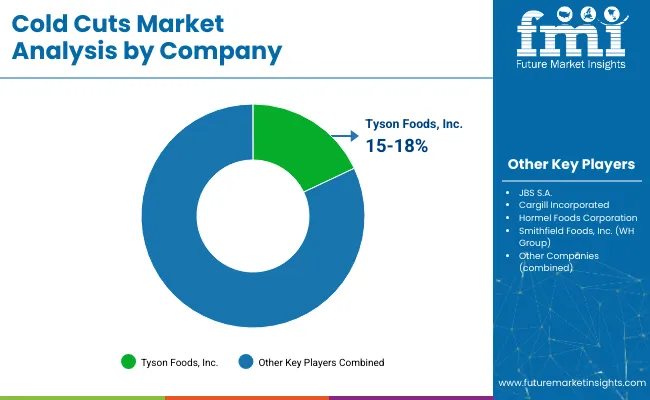

With unparalleled input from the supply chain, vertically integrated operations, and a strong brand portfolio, Tyson Foods, JBS S.A., and Cargill Incorporated front the glutted cold-cut industry. These three companies are inclined toward expanding their processed meat products while investing in packaging technologies for longer shelf life and more convenience for the consumer.

Hormel Foods Corporation, Smithfield Foods, and Conagra Brands have also achieved a stronghold, especially in North America and Europe, where pre-packaged deli meats are still in steep demand. These companies are also active players in acquisition activities to fortify their presence in developing markets and diversify their product portfolio.

For instance, WH Group, the Smithfield Foods parent company, is uniquely positioned in this industry because of its strategic integration across Asia, North America, and Europe. It is now considered one of the global leaders of processed meats.

Companies from Europe and Canada, such as Maple Leaf Foods and Kraft Heinz (Oscar Mayer), are another factor in the intensely competitive cold-cuts environment. These are mainly premium and differentiated varieties. Brands have exploited ever-changing consumer preferences through innovations.

Bar-S Foods, OSI Group, and Seaboard Corporation are among the regional players that maintain a stronghold by supplying both branded and private-label cold cuts to retail or food service channels. With established distribution networks and cost-efficient production models, these companies can compete with multinational giants.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 567.3 billion |

| Projected Market Size (2035) | USD 1,336.1 billion |

| CAGR (2025 to 2035) | 8.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tons for volume |

| Product Types Analyzed (Segment 1) | Ham, Salami, Roast Meat, Meat Loaf, Bierwurst |

| Sources Analyzed (Segment 2) | Beef, Pork, Chicken |

| Consumption Types Analyzed (Segment 3) | Sliced, Non-sliced, Lunch Kits |

| Distribution Channels Analyzed (Segment 4) | Business-to-Business, Business-to-Consumer |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Cold Cuts Market | Tyson Foods, Inc., JBS S.A., Cargill Incorporated, Hormel Foods Corporation, Smithfield Foods, Inc. (WH Group), Conagra Brands, Inc., Maple Leaf Foods Inc., Kraft Heinz (Oscar Mayer), Seaboard Corporation & OSI Group, Bar-S Foods Co., OSI Group, LLCa |

| Additional Attributes | Growth in convenience food consumption, Trends in protein-rich and ready-to-eat meals, Regional differences in meat preferences, Packaging innovations for freshness and sustainability |

| Customization and Pricing | Customization and Pricing Available on Request |

The segmentation is into Ham, Salami, Roast Meat, Meat Loaf, and Bierwurst.

The segmentation is into Beef, Pork, and Chicken.

The segmentation is into Sliced, Non-sliced, and Lunch Kits.

The segmentation is into business-to-business and business-to-consumer.

The regions covered include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and the Pacific, Central Asia, Russia and Belarus, Balkan and Baltic Countries, and the Middle East and Africa.

The industry is expected to reach USD 567.3 billion in 2025.

The market is projected to grow to USD 1,336.1 billion by 2035.

Japan is expected to witness the fastest growth, with a projected CAGR of 6.1% during the forecast period.

The Non-Sliced segment is among the most widely used in the market.

Key companies include Tyson Foods, Inc., JBS S.A., Cargill Incorporated, Hormel Foods Corporation, Smithfield Foods, Inc., Conagra Brands, Inc., WH Group Limited, Maple Leaf Foods Inc., Kraft Heinz Company, Seaboard Corporation, Bar-S Foods Co., and OSI Group, LLC.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Tons) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 4: Global Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 6: Global Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 8: Global Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Tons) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 12: North America Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 14: North America Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 16: North America Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 20: Latin America Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 22: Latin America Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 24: Latin America Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Table 25: Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

Table 27: Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 28: Europe Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 29: Europe Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 30: Europe Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 31: Europe Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 32: Europe Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Table 33: Asia Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2020 to 2035

Table 35: Asia Pacific Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 36: Asia Pacific Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 37: Asia Pacific Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 38: Asia Pacific Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 39: Asia Pacific Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 40: Asia Pacific Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Table 41: MEA Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: MEA Market Volume (Tons) Forecast by Country, 2020 to 2035

Table 43: MEA Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 44: MEA Market Volume (Tons) Forecast by Type, 2020 to 2035

Table 45: MEA Market Value (USD Million) Forecast by Source, 2020 to 2035

Table 46: MEA Market Volume (Tons) Forecast by Source, 2020 to 2035

Table 47: MEA Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 48: MEA Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Type, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Source, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Volume (Tons) Analysis by Region, 2020 to 2035

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 9: Global Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 10: Global Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 14: Global Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 17: Global Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 18: Global Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 21: Global Market Attractiveness by Type, 2025 to 2035

Figure 22: Global Market Attractiveness by Source, 2025 to 2035

Figure 23: Global Market Attractiveness by Sales Channel, 2025 to 2035

Figure 24: Global Market Attractiveness by Region, 2025 to 2035

Figure 25: North America Market Value (USD Million) by Type, 2025 to 2035

Figure 26: North America Market Value (USD Million) by Source, 2025 to 2035

Figure 27: North America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 28: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 29: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 30: North America Market Volume (Tons) Analysis by Country, 2020 to 2035

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 33: North America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 34: North America Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 38: North America Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 41: North America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 42: North America Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 45: North America Market Attractiveness by Type, 2025 to 2035

Figure 46: North America Market Attractiveness by Source, 2025 to 2035

Figure 47: North America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 48: North America Market Attractiveness by Country, 2025 to 2035

Figure 49: Latin America Market Value (USD Million) by Type, 2025 to 2035

Figure 50: Latin America Market Value (USD Million) by Source, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 52: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 53: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 57: Latin America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 58: Latin America Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 62: Latin America Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 66: Latin America Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 69: Latin America Market Attractiveness by Type, 2025 to 2035

Figure 70: Latin America Market Attractiveness by Source, 2025 to 2035

Figure 71: Latin America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 72: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 73: Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 74: Europe Market Value (USD Million) by Source, 2025 to 2035

Figure 75: Europe Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 76: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 77: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2020 to 2035

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 81: Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 82: Europe Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 85: Europe Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 86: Europe Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 89: Europe Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 90: Europe Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 93: Europe Market Attractiveness by Type, 2025 to 2035

Figure 94: Europe Market Attractiveness by Source, 2025 to 2035

Figure 95: Europe Market Attractiveness by Sales Channel, 2025 to 2035

Figure 96: Europe Market Attractiveness by Country, 2025 to 2035

Figure 97: Asia Pacific Market Value (USD Million) by Type, 2025 to 2035

Figure 98: Asia Pacific Market Value (USD Million) by Source, 2025 to 2035

Figure 99: Asia Pacific Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 100: Asia Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 101: Asia Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2020 to 2035

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 105: Asia Pacific Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 109: Asia Pacific Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 113: Asia Pacific Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 117: Asia Pacific Market Attractiveness by Type, 2025 to 2035

Figure 118: Asia Pacific Market Attractiveness by Source, 2025 to 2035

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2025 to 2035

Figure 120: Asia Pacific Market Attractiveness by Country, 2025 to 2035

Figure 121: MEA Market Value (USD Million) by Type, 2025 to 2035

Figure 122: MEA Market Value (USD Million) by Source, 2025 to 2035

Figure 123: MEA Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 124: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 125: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2020 to 2035

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 129: MEA Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 130: MEA Market Volume (Tons) Analysis by Type, 2020 to 2035

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 133: MEA Market Value (USD Million) Analysis by Source, 2020 to 2035

Figure 134: MEA Market Volume (Tons) Analysis by Source, 2020 to 2035

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2025 to 2035

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2025 to 2035

Figure 137: MEA Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 138: MEA Market Volume (Tons) Analysis by Sales Channel, 2020 to 2035

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 141: MEA Market Attractiveness by Type, 2025 to 2035

Figure 142: MEA Market Attractiveness by Source, 2025 to 2035

Figure 143: MEA Market Attractiveness by Sales Channel, 2025 to 2035

Figure 144: MEA Market Attractiveness by Country, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA