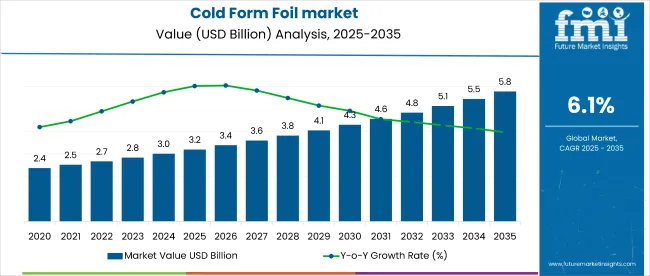

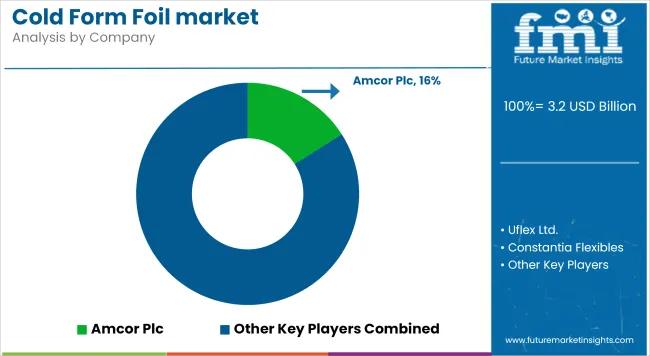

The global cold form foil market is projected to expand from USD 3.2 billion in 2025 to USD 5.7 billion by 2035, registering a CAGR of 6.1% over the forecast period. Demand is concentrated in barrier-grade pharmaceutical packaging, where aluminum-based foils dominate on account of moisture resistance and dosage integrity.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.2 billion |

| Projected Value (2035F) | USD 5.7 billion |

| CAGR (2025 to 2035) | 6.1% |

In 2025, the cold form foil market accounts for approximately 3.4% of the global pharmaceutical packaging market, estimated at USD 94 billion, reflecting its niche yet critical role in primary packaging security.

Market expansion is driven by stringent pharmaceutical serialization mandates and increased demand for unit-dose packaging both contributing to a 12.5% rise in cold form foil usage in regulated markets between 2020 and 2025. However, high raw material dependency on aluminum and its price volatility up 9.3% YoY in 2024 continues to restrain profitability across mid-tier converters.

The market also reflects a visible shift toward multi-layer laminate design and high-barrier structures with predictive seal integrity testing, a trend that has seen adoption rates increase 2.1x since 2021 among large-scale pharmaceutical packagers.

From 2025 onward, regulatory scrutiny is expected to intensify, particularly in pharmaceutical packaging compliance. The USA FDA’s final DSCSA enforcement phase requires full unit-level traceability, prompting a shift toward tamper-evident and serialized cold form foil blisters.

In the EU, Annex 1 revisions to GMP for sterile products now emphasize container closure integrity testing boosting demand for multilayer foil formats. Meanwhile, India’s Ministry of Health has mandated QR coding on top-selling drug formulations starting April 2026, accelerating serialization investments by over 18% across domestic manufacturers.

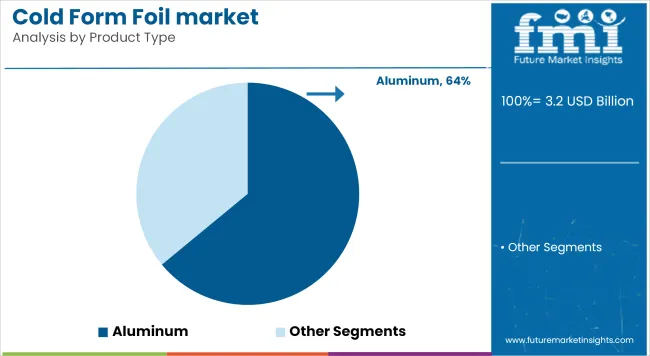

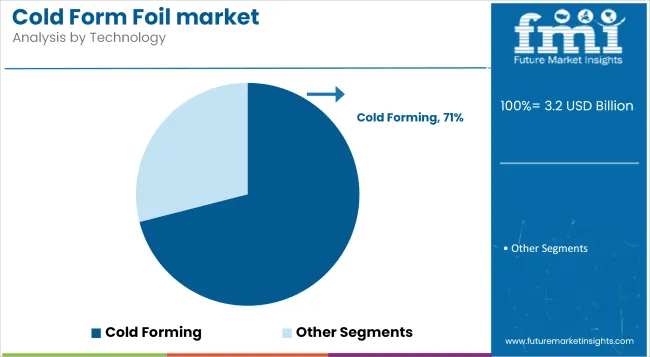

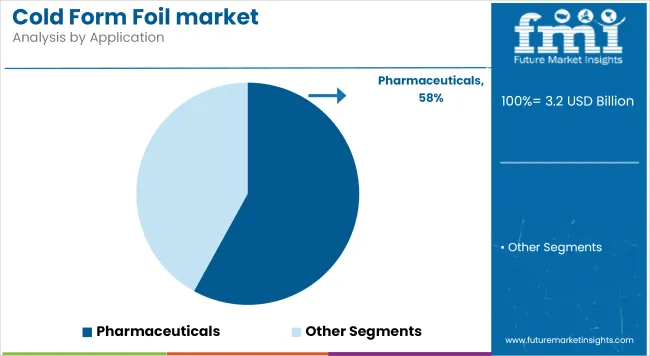

The cold form foil market has been segmented by Product Type (Aluminum, Plastic Film, Others) by Technology (Thermoforming, Cold Forming) and by Application (Food, Pharmaceuticals, Consumer Products, Industrial Goods, Others). Regional analysis covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

In 2025, Aluminum holds the dominant share of 64% in the cold form foil market, supported by its superior barrier properties and compatibility with pharmaceutical-grade laminates. Its edge lies in extending shelf life for high-sensitivity formulations and reducing oxygen ingress below 0.001 cc/m²/day.

Growth is driven by:

Cold forming accounts for 71% of the technology segment in 2025, owing to its superior protection against moisture, oxygen, and light-critical for highly sensitive pharmaceutical actives. This method ensures zero thermal stress, preserving drug stability during blister formation.

Two growth levers are accelerating adoption:

In 2025, Pharmaceuticals dominate the application segment with a commanding 58% share, led by blister packaging for solid oral dosage forms. Its lead stems from regulatory-driven serialization and tamper-evident mandates, particularly in the USA, EU, and India.

A structural challenge lies in disposal logistics:

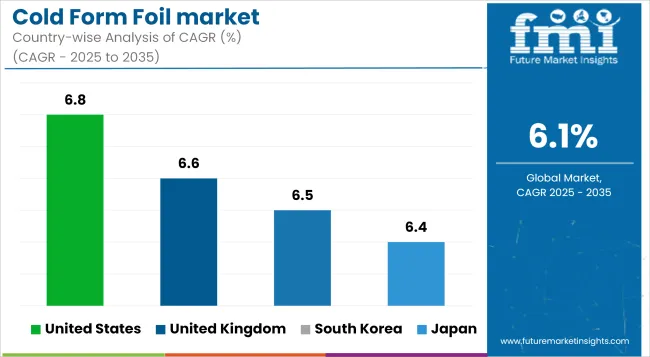

Country-level dynamics in the cold form foil market are shaped by healthcare expenditure intensity, pharmaceutical manufacturing maturity, and national packaging compliance regimes. Markets such as the USA, Germany, and Japan are regulation-led, with higher per capita drug packaging output and earlier adoption of cold form foil for stability-critical drugs.

In contrast, China and India exhibit volume-driven growth, fueled by contract manufacturing scale, government incentives, and expanding domestic generics markets. Meanwhile, the UK and South Korea are transitioning toward traceable, tamper-proof formats in retail and institutional channels alike. Across these economies, growth rates vary, but the pivot to foil-based, barrier-grade pharma packaging is consistent.

The USA market is projected to grow at a CAGR of 6.8% between 2025 and 2035, driven by DSCSA enforcement mandating serialized, tamper-evident packaging across the pharmaceutical supply chain. Demand is primarily concentrated in solid-dose blister formats, with uptake accelerating in chronic care and specialty drugs.

Margins are supported by mass-scale foil laminate production and high private-label penetration, but a friction point remains in tooling retrofits for small-batch CMOs-raising costs by up to 14% per line in 2024. Regulatory alignment has increased serialization compliance to over 92% among branded pharma firms.

Consumer data shows 72% of Americans consider traceability a marker of medicine quality (HDA Survey, 2025), supporting continued cold-form foil adoption in retail and mail-order channels.

The UK cold form foil market is expected to expand at a CAGR of 6.6% through 2035, with stability-led packaging dominating post-Brexit regulatory transitions. NHS procurement now favors serialized, recyclable blister packs, especially in high-volume generics.

While margin gains are seen in multilayer barrier formats, firms face drag from compliance costs with MHRA traceability rules-up 18% YoY in 2024. Direct-to-pharmacy distribution models also require real-time pack-level tracking infrastructure.

South Korea is poised to grow at a CAGR of 6.5%, supported by universal health coverage and strict pharmaceutical stability standards under MFDS oversight. Cold form foil is heavily used in prescription retail packs and hospital-dose formats.

Margins improve via localized foil conversion operations, but dependency on imported base foil stock raises input costs-averaging USD 2,420/ton in 2024. Korea's “Safe Packaging” directive, updated in 2025, mandates multilayer barrier protection for sensitive APIs.

Japan’s cold form foil market is projected to rise at a 6.4% CAGR from 2025 to 2035, driven by a high share of elderly population and increased demand for patient-compliance packaging formats. Reimbursement-linked packaging innovation has incentivized use of foil-based unit-dose packs.

Margins are pressured by high labor and tooling costs, with automated blistering lines requiring retrofits exceeding USD 75,000 per site in 2024. Nonetheless, regulation is supportive PMDA mandates now require moisture transmission rates under 0.001 g/m²/day for several drug classes.

The players in the cold form foil market are focusing on high-barrier laminate innovation and sustainability-aligned designs to meet tightening pharmaceutical packaging regulations. Amcor Plc has prioritized recyclable cold-form laminates and reportedly filed over 12 structural design patents since 2023.

Uflex Ltd. expanded its medical-grade lamination capacity by 22% in 2024, targeting EU- and USA-based CDMOs. Constantia Flexibles continues investing in Europe-based GMP-certified plants, while Tekni-Plex is enhancing foil-to-paper barrier combinations for dual-layer blister packs.

Recent moves reflect near-term cost and capacity recalibration. Tooling upgrades by Winpak Ltd. in Canada and the USA have reduced die-change downtime by 15%, while Huhtamaki Oyj has entered contract agreements with large generics producers in India for dedicated foil runs. Meanwhile, Essentra Plc and Bilcare Limited are aligning with serialization tech vendors to integrate smart-code features into cold-form structures.

Players integrating flexible foil capabilities with serialization infrastructure and recyclability compliance are expected to outpace laggards by capturing both regulatory and brand-driven pharma clients.

| Attribute | Details |

|---|---|

| Market Size 2025 | USD 3.2 Billion |

| Market Size 2035 | USD 5.7 Billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Units | Value (USD Billion) |

| Segments Covered | Product Type, Technology, Application |

| Product Type | Aluminum, Plastic Film, Others |

| Technology | Thermoforming, Cold Forming |

| Application | Food, Pharmaceuticals, Consumer Products, Industrial Goods, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Countries Profiled | United States, United Kingdom, South Korea, Japan |

| Key Companies | Amcor Plc, Uflex Ltd., Constantia Flexibles, Winpak Ltd., Tekni-Plex Inc., Essentra Plc, Rollprint Packaging Products, Carcano Antonio S.p.A, Bilcare Limited, Huhtamaki Oyj |

The cold form foil market is estimated at USD 3.2 billion in 2025.

It is expected to reach USD 5.7 billion by 2035.

The market is projected to grow at a 6.1% CAGR during the forecast period.

Aluminum, with a 64% share of the market leads product type segment.

Pharmaceuticals, accounting for 58% of market demand in 2025.

Top players include Amcor Plc, Uflex Ltd., Constantia Flexibles, and Winpak Ltd., among others.

The United States, with a CAGR of 6.8% between 2025 and 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Cold Form Foil Manufacturers

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Packs Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold Plasma Market – Growth, Demand & Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Cold Plunge Tub Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Competitive Overview of Cold Seal Paper Industry Share

Cold Seal Films Market

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Pressed Soap Market Analysis - Trends, Growth & Forecast 2025 to 2035

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Beverage Cups Market

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA