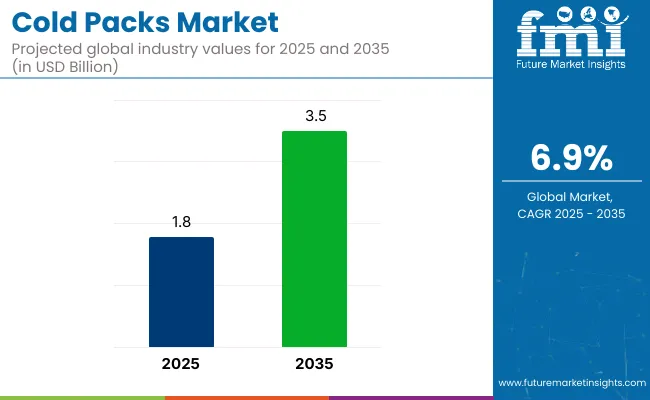

The cold packs industry is set to grow from USD 1.8 billion in 2025 to USD 3.5 billion by 2035, progressing at a steady CAGR of 6.9% throughout the forecast period. The global industry is poised for constant expansion, largely driven by the growing demand for temperature-controlled solutions in pharmaceutical logistics.

The demand surge is fueled by the growing distribution of temperature-sensitive biologics, specialty drugs, and injectable therapies. As healthcare systems worldwide enhance their cold chain infrastructure to meet stricter regulatory standards and rising demand for biologics. Cooling packs are an important component in ensuring drug integrity during storage and transport.

The cold packs industry holds varying shares within its parent industries. Within the hot and cold therapy packs industry, cold packs account for around 40-50% of the segment, with hot packs also contributing. In the cold pain therapy industry, cooling packs are recognized as a major player, representing about 30-40% due to their effectiveness in reducing pain and inflammation.

In the reusable ice packs industry, cooling packs dominate, comprising over 60% of the industry, given their extensive use in therapeutic, sports, and home settings. In the broader medical devices industry, a small yet vital percentage of 2-3% is made up by cooling packs, as a specialized therapeutic tool. In the consumer healthcare products industry, cooling packs are included in the broader wellness category, contributing 5-8% to the segment.

At DCAT Week 2025, Tjoapack US confirmed its strategic investments in customizable cold-pack solutions designed to meet the complex needs of temperature-sensitive pharmaceutical products such as prefilled syringes, vials, and auto-injectors.

In an exclusive interview with Pharmaceutical Technology (PharmTech, March 2025), Peter Belden, President of Tjoapack US, announced the company's expansion of advanced cold packaging lines and enhanced cold storage capabilities at its facilities in Clinton, Tennessee, and Etten-Leur, Netherlands. These improvements aim to bolster the firm's compliance with global pharmaceutical logistics standards and strengthen its role in delivering complex, temperature-controlled therapies.

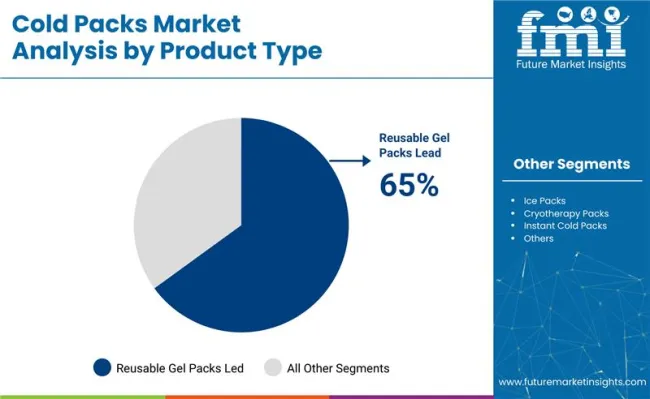

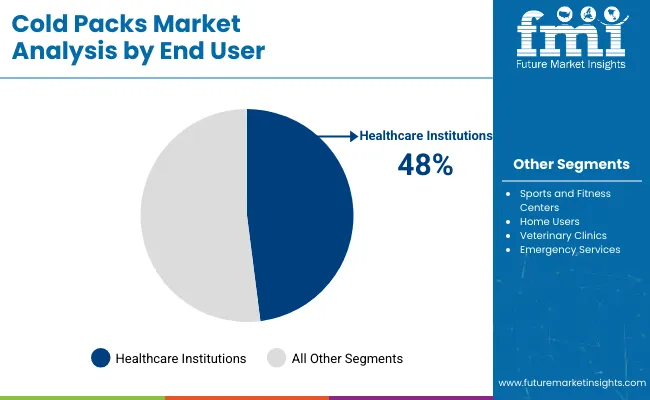

Reusable gel packs, healthcare institutions, pain relief applications, polyethylene materials, and online retailers are collectively expected to dominate the industry in 2025, driven by growing demand in the medical, personal care, and home-use sectors.

Reusable gel packs are projected to account for nearly 65% industry share by 2025, driven by their cost-effectiveness, durability, and adaptability across various applications.

Healthcare institutions are expected to hold 48% of the industry share in 2025, making them the largest end-user.

Pain relief applications are projected to account for over 42% of the share in 2025, making them the largest application category. Cooling packs are widely used in alleviating muscle soreness, joint stiffness, and localized swelling caused by injury or chronic conditions like arthritis.

Polyethylene is poised to dominate the material composition segment, with a projected 53% share in 2025, due to its durability, flexibility, and cost-effectiveness. It is widely used in the outer casing of gel and ice packs because of its puncture resistance and ability to maintain seal integrity under variable temperatures.

Online retailers are projected to capture over 36% industry share in 2025, emerging as the leading distribution channel. Growth is fueled by the convenience of direct-to-consumer delivery and the rising trend of e-commerce for personal health products.

The industry is growing due to increased use in healthcare, sports, and consumer wellness. Manufacturers are emphasizing safety, convenience, and multi-use functionality. Strong demand from physical therapy and first-aid segments is shaping product innovation.

Expanding Demand from Medical and Sports Applications

Cooling packs are widely used in healthcare for injury management. Reusable and instant packs are relied upon by physical therapists and sports trainers to reduce swelling and pain. Ready-to-use cooling packs are now included in first-aid kits as necessary items. Bulk purchases are made by clinics, hospitals, and athletic facilities, and specialized sizes and shapes are adopted by pediatric and veterinary sectors.

Innovation in Materials and Packaging Enhancing User Experience

Innovations in materials and packaging are improving cold pack usability. Non-toxic gel formulas are being introduced for enhanced safety, while biodegradable and eco-friendly wrappers are adopted to reduce waste. Vacuum-sealed designs are used to improve compact storage and portability. Faster activation mechanisms, such as pinch-to-activate and break-to-use systems, are being launched, and flexible fabric wraps are combined with cold pack inserts for improved user comfort.

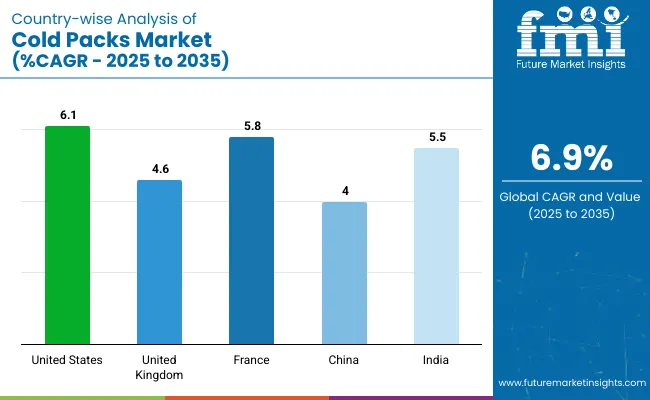

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| United Kingdom | 4.6% |

| France | 5.8% |

| China | 4.0% |

| India | 5.5% |

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference. The cold packs industry, expected to grow at a global CAGR of 6.9% from 2025 to 2035, is experiencing varied performance across key countries. A 6.1% CAGR is being led by the United States, a member of the OECD, driven by strong demand in the medical and recreational sectors.

A 5.8% CAGR is being observed in France, also an OECD member, where moderate growth is being seen within established healthcare systems. A 5.5% CAGR is being exhibited by India, a member of the BRICS group, reflecting an emerging industry with increasing healthcare access and awareness.

Slower growth rates are being recorded in the United Kingdom, an OECD member, and China, a member of the BRICS group, with 4.6% and 4.0% CAGRs, respectively, due to stable industry and alternative technologies. Stable demand is being seen in developed countries in the OECD, while a high-growth opportunity is being represented by India, a member of the BRICS group, due to its expanding healthcare infrastructure.

Demand for cooling packs in India is anticipated to grow at a robust CAGR of 5.5% through 2035, driven by a rising urban population and increased interest in fitness and sports. Grassroots sports initiatives and the growing popularity of personal fitness routines are expected to drive demand across gyms, sports academies, and homes.

Affordable, reusable cooling packs are gaining popularity in India’s cost-sensitive market, with mass production being emphasized by domestic manufacturers. The position of India as one of the fastest-growing industry is expected to be solidified by improvements in healthcare infrastructure and increased awareness regarding injury management.

The USA cooling packs industry is expected to grow at a CAGR of 6.1% from 2025 to 2035. Growth is being supported by the country’s well-established healthcare infrastructure and the widespread use of cold therapy in post-surgical recovery and sports medicine. Rising participation in fitness activities and the aging population are contributing to the adoption of cooling packs.

Eco-friendly, reusable cooling packs are being prioritized by manufacturers in response to environmental concerns. The USA’s dominant position in the global cold therapy industry is reinforced by strong domestic production capabilities and continuous innovation.

The UK market is projected to grow at a steady CAGR of 4.6%. Increased demand in elderly care, home healthcare, and sports injury management is driving the growth. Awareness of cold therapy has been raised by NHS endorsements of non-pharmacological treatments.

The shift toward home-based recovery solutions is expected to be further supported, especially among aging populations and fitness enthusiasts. Accessibility through retail pharmacy chains and e-commerce platforms is ensuring that cooling packs are readily available to consumers.

Sales of cooling packs in France are growing at a CAGR of 5.8% from 2025 to 2035. Growth is being driven by the country’s expanding fitness culture and increased sports participation. The need for cold therapy products is rising among athletes due to popular sports like cycling, running, and soccer.

Partnerships are being formed between manufacturers and gyms/sports clubs to reach fitness-conscious consumers. A growing preference for reusable cooling packs is aligning with national ecological goals, further supporting industry growth.

China cooling pack industry is expected to grow at a moderate 4% CAGR from 2025 to 2035. The rise in health consciousness and the aging population’s need for pain relief solutions are supporting growth. Cooling packs are increasingly used in clinics, hospitals, and home healthcare settings to manage sports injuries, arthritis, and muscle strains.

The demand for cooling packs is being boosted by government-led sports development programs and expanded elderly care services. Competitive pricing by domestic manufacturers is ensuring product penetration across urban and rural markets, positioning China as a major industry for cooling pack in the Asia-Pacific region.

The industry is driven by established players and rising innovators focused on cold chain logistics, medical cold therapy, and temperature-sensitive shipping. Key companies like Nortech Labs, Inc., Pelton Shepherd Industries, and CryoMAX lead with advanced gel ice packs and instant cooling packs tailored for first aid and healthcare applications.

Rapid Aid is known for patent-backed hot and cold therapy packs, while Cooler Shock and G-Gel Ice Packs cater to the growing demand for reusable cooling packs in food delivery and e-commerce packaging. In Europe, Dispotech (Italy), Tempack (France), and Sercalia (Spain) innovate with green packaging solutions for pharmaceuticals and perishable goods.

Recent Cold Packs Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 3.5 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Reusable Gel Packs, Ice Packs, Cryotherapy Packs, Instant Cold Packs, Thermal Packs |

| End Users Analyzed (Segment 2) | Healthcare Institutions, Sports and Fitness Centers, Home Users, Veterinary Clinics, Emergency Services |

| Applications Analyzed (Segment 3) | Pain Relief, Post-Surgery Recovery, Sports Injuries, Muscle Therapy, Inflammation Reduction |

| Material Compositions Analyzed (Segment 4) | Polyethylene, Gel Material, Clay-Based Compositions, Synthetic Materials, Natural Materials |

| Distribution Channels Analyzed (Segment 5) | Online Retailers, Pharmacies and Drug Stores, Specialty Health Stores, Medical Supply Stores, Wholesale Distributors |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Nortech Labs, Inc., Pelton Shepherd Industries, Rapid Aid, CryoMAX, IPC Packaging, Dispotech, Tempack, Sercalia, Cooler Shock, G-Gel Ice Packs. |

| Additional Attributes | Dollar sales, share by type and end user, rising demand in post-surgery recovery, growth in sports medicine and physiotherapy sectors, development of eco-friendly and biodegradable cold packs, regional usage variations |

The industry is segmented into reusable gel packs, ice packs, cryotherapy packs, instant cold packs, and thermal packs.

The key end users include healthcare institutions, sports and fitness centers, home users, veterinary clinics, and emergency services.

The industry finds applications in pain relief, post-surgery recovery, sports injuries, muscle therapy, and inflammation reduction.

The materials used in cooling packs include polyethylene, gel material, clay-based compositions, synthetic materials, and natural materials.

Cooling packs are distributed through online retailers, pharmacies and drug stores, specialty health stores, medical supply stores, and wholesale distributors.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 1.8 billion in 2025.

It is forecasted to reach USD 3.5 billion by 2035.

The industry is anticipated to grow at a CAGR of 6.9% during this period.

Reusable gel packs are projected to lead the market with a 65% share in 2035.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 6.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA