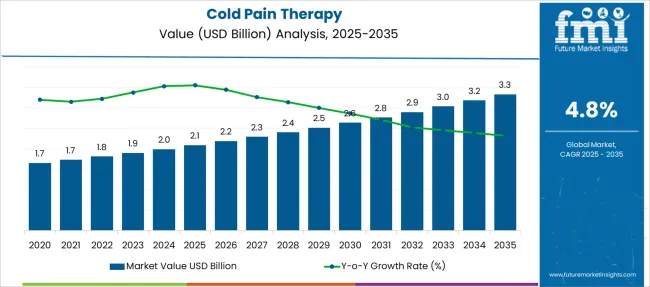

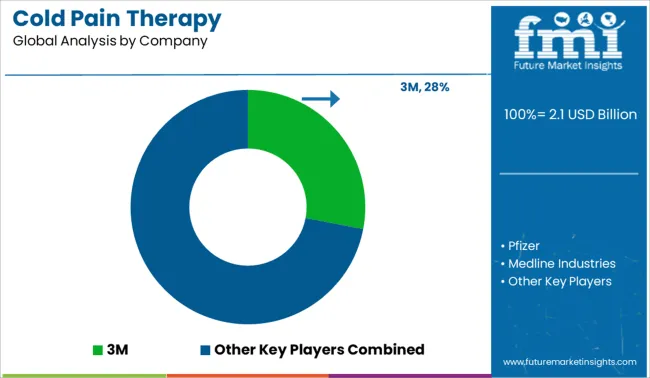

The Cold Pain Therapy Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Cold Pain Therapy Market Estimated Value in (2025 E) | USD 2.1 billion |

| Cold Pain Therapy Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Growing preference for non-invasive, drug-free solutions among both patients and clinicians has driven the adoption of cold therapy across a range of medical and consumer settings. Demand is being sustained by rising awareness of self-care practices, especially among aging populations and physically active individuals.

Technological advancements in reusable and instant cold packs, along with improvements in compressive and wearable devices, are enhancing user convenience and clinical outcomes. Furthermore, cost-effective over-the-counter availability and minimal side effects have made cold pain therapy a compelling alternative to pharmacological interventions.

As healthcare systems worldwide emphasize home-based care and reduced hospitalization, cold therapy products are positioned as essential components in pain management regimens. With growing application in musculoskeletal recovery and a favorable regulatory environment supporting product innovation, the market is expected to continue its upward trajectory over the coming years..

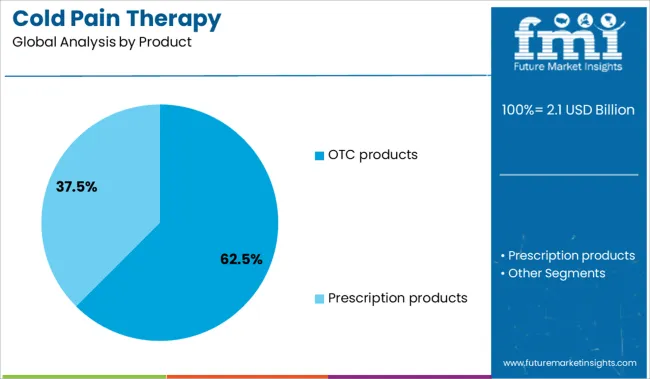

The market is segmented by Product, Applications, and Distribution Channel and region. By Product, the market is divided into OTC products, Cold packs, Creams and gels, Patches, Wraps, Sprays and foams, Other OTC products, Prescription products, Motorized devices, and Non-motorized devices.

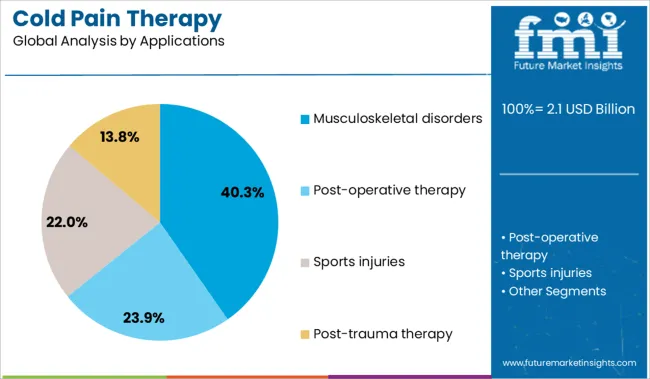

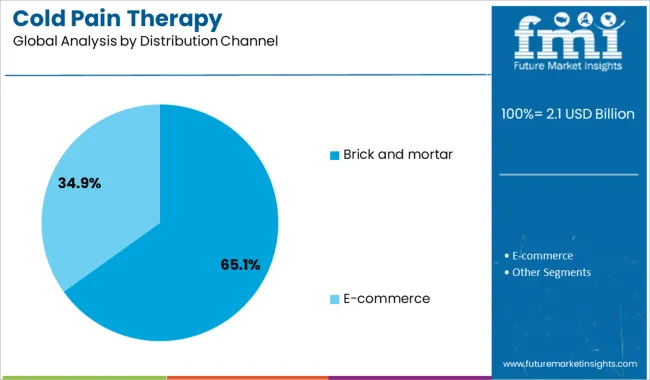

In terms of Applications, the market is classified into Musculoskeletal disorders, Post-operative therapy, Sports injuries, and Post-trauma therapy. Based on Distribution Channel, the market is segmented into brick-and-mortar and E-commerce. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The OTC products subsegment within the product segment is expected to account for 62.50% of the Cold Pain Therapy market revenue share in 2025, establishing its leadership position. This dominance has been driven by the widespread availability and accessibility of over-the-counter solutions across retail pharmacies and e-commerce platforms. The need for immediate pain relief has shaped the preference for OTC products without the requirement for a prescription or medical consultation.

Consumers have increasingly adopted these products for self-managed care, especially for acute conditions such as sprains, strains, and post-exercise soreness. The affordability and convenience of cold patches, sprays, and wraps have further contributed to the expanding consumer base.

Additionally, product innovations offering longer cooling duration and ease of application have improved treatment adherence and outcomes. The emphasis on home-based recovery and the shift away from opioid-based therapies have also reinforced the prominence of OTC products, making them the preferred choice in both developed and emerging markets..

The musculoskeletal disorders subsegment under the application segment is projected to contribute 40.30% of the Cold Pain Therapy market revenue share in 2025, making it the leading application area. This segment's prominence has been driven by the high global prevalence of musculoskeletal conditions such as arthritis, lower back pain, and tendonitis. Cold therapy has been increasingly incorporated into treatment protocols for these disorders due to its anti-inflammatory benefits, immediate analgesic effect, and ability to improve mobility.

Clinicians have relied on cold therapy as a non-invasive option to reduce swelling and manage chronic pain without the risks associated with long-term pharmacologic treatments. Furthermore, as aging populations expand in developed regions, the demand for pain management solutions for degenerative conditions continues to grow.

The availability of targeted cold therapy solutions specifically designed for joints and muscles has enhanced clinical outcomes, while the promotion of early intervention strategies has supported wider adoption. These factors collectively contribute to the leading position of musculoskeletal disorders within the application segment..

The brick and mortar subsegment within the distribution channel segment is forecasted to hold 65.10% of the Cold Pain Therapy market revenue share in 2025, positioning it as the most dominant channel. This segment has retained its lead due to the continued consumer trust in physical retail locations such as pharmacies, drugstores, and specialty health outlets.

Immediate product access, personal consultation from pharmacists, and the ability to evaluate product options in person have played a critical role in shaping purchasing behavior. In regions where e-commerce adoption is slower or where regulatory restrictions limit online sale of certain therapeutic products, brick and mortar outlets have remained the primary source for cold therapy products.

Retailers have also expanded their health and wellness sections, offering a wider array of products and promotional bundling, which has encouraged higher in-store engagement. The credibility associated with purchasing from licensed outlets and the increasing shelf space allocated to non-prescription pain relief products continue to reinforce this channel's significance in the overall market..

Trends show rising demand for non-invasive pain relief solutions. Key drivers include increased incidence of sports injuries, arthritis, and post-operative recovery needs. Opportunities lie in wearable innovations, home-use devices, and aging population care.

A global rise in musculoskeletal disorders, sports injuries, and post-surgical recovery cases drives the cold pain therapy market. As populations age, the prevalence of conditions like arthritis and joint inflammation is increasing, creating sustained demand for drug-free pain management solutions. Cold therapy, including gel packs, wraps, and cryo-devices, offers safe, immediate relief with minimal side effects—appealing to patients avoiding opioids or NSAIDs. Hospitals and rehabilitation centers integrate cold therapy into recovery protocols to reduce swelling and pain after orthopedic procedures. Additionally, awareness campaigns and direct-to-consumer sales channels have made cold pain therapy more accessible for at-home care. This demand is further supported by fitness trends and rising interest in preventive healthcare and non-invasive treatment modalities.

The market presents significant opportunities through innovation in wearable and portable cryotherapy solutions. Compact, rechargeable cold therapy devices integrated with compression features are gaining popularity for their convenience and efficiency in injury recovery and chronic pain management. The shift toward home healthcare and self-managed treatment is expanding the market beyond clinical settings. Smart cold therapy devices with app connectivity and customizable temperature settings offer new value propositions, especially for tech-savvy users. Emerging markets also offer untapped growth potential as awareness of non-drug therapies rises. Furthermore, partnerships between sports organizations, rehab centers, and device manufacturers can help accelerate product adoption. Players investing in ergonomic design, affordability, and digital monitoring are well-positioned to meet evolving consumer and clinical needs.

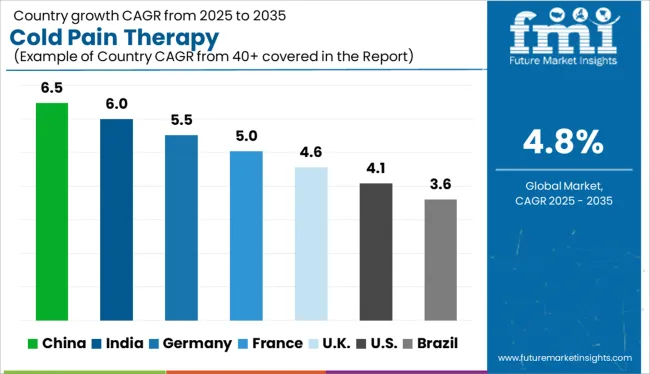

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global cold pain therapy market is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by rising incidences of musculoskeletal disorders, increasing post-operative recovery needs, and growing demand for non-invasive pain relief solutions. China leads with a 6.5% CAGR, fueled by expanding geriatric population, physiotherapy adoption, and local manufacturing of reusable cold packs and cryotherapy systems. India follows at 6.0%, supported by the rise of home healthcare and sports medicine applications. Germany, at 5.5%, reflects steady growth through advanced rehabilitation programs and insurance-backed product accessibility. The United Kingdom (4.6%) and the United States (4.1%) represent mature OECD markets, where innovation focuses on wearable cryo-devices and over-the-counter cold therapy solutions.

Between 2025 and 2035, the cold pain therapy market across China is projected to grow at a CAGR of 6.5%, with year-over-year expansion ranging from 6.1% to 6.9%. This growth is propelled by rising musculoskeletal disorders and a growing preference for non-opioid pain management among both elderly and athletic populations. Urban hospitals and rehabilitation centers are adopting cryotherapy devices for post-surgical and sports-related recovery. Domestic manufacturers are scaling up low-cost, portable cold therapy solutions tailored to home use, further driving accessibility. The country’s digital health initiatives are also fostering online sales and remote patient care integration for cryotherapy products.

With a projected CAGR of 6.0% from 2025 to 2035, and annual growth between 5.6% and 6.4%, the cold pain therapy market in India is showing strong upward momentum. Rising awareness around physiotherapy and post-injury recovery is boosting the demand for cold packs, wraps, and advanced cryotherapy machines. Government health schemes and insurance inclusion for non-invasive treatments are increasing patient access to such therapies in both public and private hospitals. Additionally, demand for cold therapy is rising among the aging population and in rural regions, where traditional hot-cold treatment alternatives are evolving into device-based care solutions.

Germany’s cold pain therapy market is forecast to grow at a CAGR of 5.5% from 2025 to 2035, with year-over-year growth rates between 5.1% and 5.9%. Driven by a strong rehabilitation infrastructure and widespread preference for evidence-based therapies, cold pain treatments are gaining traction in orthopedic and sports medicine clinics. Insurance-backed reimbursements for cryotherapy sessions are increasing patient turnout, particularly in physiotherapy centers. Meanwhile, premium manufacturers are innovating in gel-based and wearable cold packs designed for reusable, adjustable application. With chronic pain on the rise, particularly in the elderly population, cold therapy is emerging as a preferred method for inflammation control and joint recovery.

From 2025 to 2035, the cold pain therapy market in the United Kingdom is projected to grow at a CAGR of 4.6%, with annual growth ranging from 4.2% to 4.9%. Demand is rising as patients seek drug-free, non-invasive solutions for both chronic pain and short-term injuries. NHS-supported physiotherapy programs are incorporating cold therapy as a complementary recovery tool, especially in outpatient care. Innovations in instant cold packs and flexible gel wraps are gaining popularity among home users and athletes alike. E-commerce platforms are also making cold therapy solutions more accessible across remote and underserved regions.

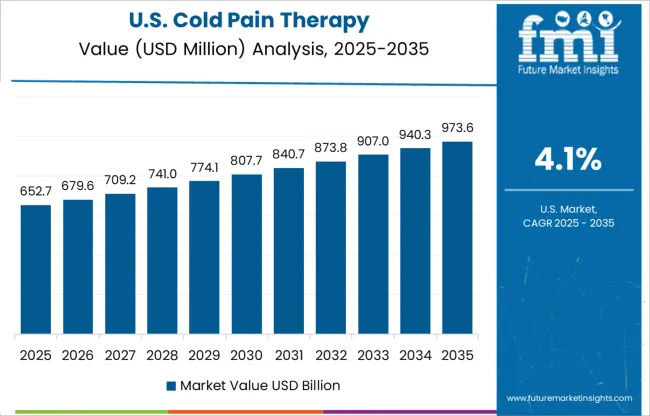

The cold pain therapy market in the United States is expected to grow at a CAGR of 4.1% between 2025 and 2035, with year-over-year increases ranging from 3.8% to 4.4%. Rising concern over opioid dependency is pushing both clinicians and patients toward non-pharmacological pain relief methods. Sports medicine centers, orthopedic clinics, and outpatient surgery units are increasingly utilizing advanced cryotherapy chambers and localized cold treatments. Tech-driven solutions such as app-controlled compression devices and wearable cooling sleeves are becoming popular in consumer and professional segments. Additionally, insurance incentives for physical therapy support the integration of cold treatment in structured rehab programs.

The cold pain therapy market is moderately consolidated, with a few dominant players offering a wide range of products for acute injuries, post-surgical recovery, and chronic pain management. Tier 1 companies such as 3M, Pfizer, and DJO Global lead the market with strong brand recognition, extensive healthcare distribution, and diverse product lines including cold packs, wraps, and topical analgesics. Their dominance is reinforced by clinical backing, hospital partnerships, and OTC availability. Tier 2 players like Medline Industries and Breg Inc focus on orthopedic and sports medicine segments, offering targeted solutions with ergonomic designs and reusable applications. Market growth is driven by increasing musculoskeletal disorders, sports injuries, and demand for non-pharmacological pain relief options.

Breg, Inc. partnered with HealthMe to launch a patient direct pay e-commerce platform, enabling consumers to purchase Polar Care Wave cold therapy systems without insurance mediation.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product | OTC products, Cold packs, Creams and gels, Patches, Wraps, Sprays and foams, Other OTC products, Prescription products, Motorized devices, and Non-motorized devices |

| Applications | Musculoskeletal disorders, Post-operative therapy, Sports injuries, and Post-trauma therapy |

| Distribution Channel | Brick and mortar and E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Pfizer, Medline Industries, Breg Inc, and DJO Global |

| Additional Attributes | Dollar sales by product type (ice packs, cold sprays, cryo chambers, cold wraps), application area (post-operative care, sports injuries, arthritis, musculoskeletal disorders), and distribution channel (hospital pharmacies, retail, e-commerce); demographic trends influencing usage (aging population, athlete base); regulatory impact on product approvals and labeling; regional preferences for at-home vs. clinical use; innovation in wearable cryotherapy devices; environmental concerns related to single-use cold packs; and integration with digital health monitoring platforms. |

The global cold pain therapy market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the cold pain therapy market is projected to reach USD 3.3 billion by 2035.

The cold pain therapy market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in cold pain therapy market are otc products, cold packs, creams and gels, patches, wraps, sprays and foams, other otc products, prescription products, motorized devices and non-motorized devices.

In terms of applications, musculoskeletal disorders segment to command 40.3% share in the cold pain therapy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA