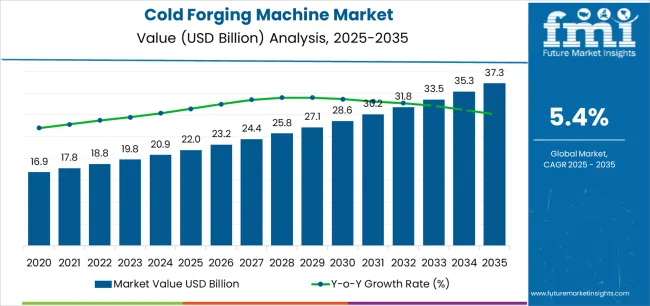

The Cold Forging Machine Market is estimated to be valued at USD 22.0 billion in 2025 and is projected to reach USD 37.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Cold Forging Machine market is experiencing significant growth driven by the rising demand for precision-engineered components across automotive, aerospace, and industrial machinery sectors. The future outlook for this market is shaped by the increasing adoption of high-efficiency manufacturing processes that reduce material waste and energy consumption. Continuous advancements in cold forging technologies have improved product quality, operational speed, and reliability, enabling manufacturers to meet stringent industry standards.

Growing emphasis on lightweight and high-strength components in the automotive and mechanical industries has further accelerated the adoption of cold forging machines. Additionally, the integration of automation and digital monitoring systems is enhancing process control and predictive maintenance capabilities, making these machines more attractive to large-scale industrial operations.

Expansion in emerging markets, coupled with investments in modern production infrastructure, supports sustained growth The market is also benefiting from the shift towards environmentally friendly and cost-efficient manufacturing processes, positioning cold forging machines as key enablers for modern precision engineering applications.

| Metric | Value |

|---|---|

| Cold Forging Machine Market Estimated Value in (2025 E) | USD 22.0 billion |

| Cold Forging Machine Market Forecast Value in (2035 F) | USD 37.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

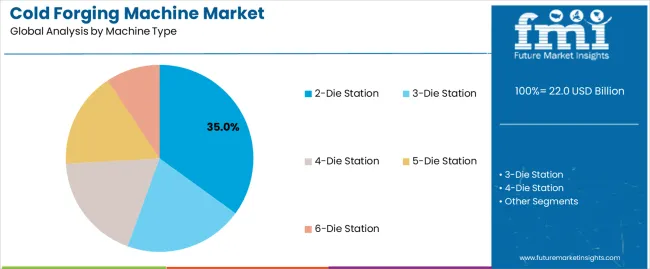

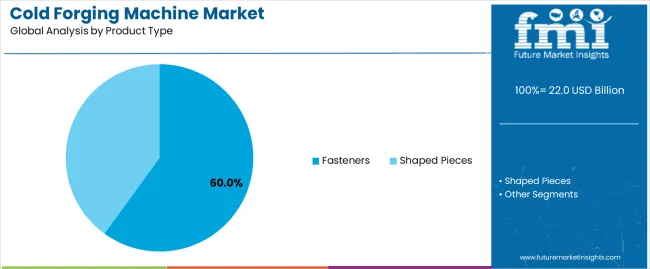

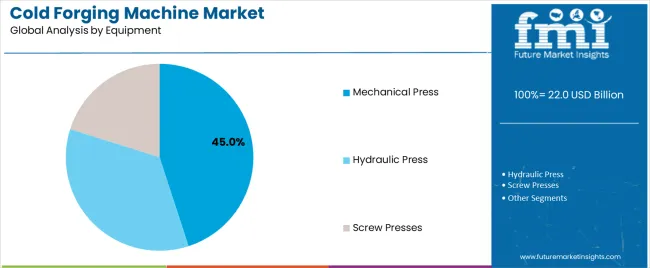

The market is segmented by Machine Type, Product Type, Equipment, and End Use and region. By Machine Type, the market is divided into 2-Die Station, 3-Die Station, 4-Die Station, 5-Die Station, and 6-Die Station. In terms of Product Type, the market is classified into Fasteners and Shaped Pieces. Based on Equipment, the market is segmented into Mechanical Press, Hydraulic Press, and Screw Presses. By End Use, the market is divided into Automotive, Aerospace, Construction, Wind Energy, Power Generation, Defence, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2-Die Station machine type segment is projected to hold 35.0% of the Cold Forging Machine market revenue share in 2025, making it the leading machine type. This segment’s growth has been driven by its capability to handle complex forming operations while maintaining high dimensional accuracy.

The configuration allows for increased operational flexibility and efficiency in producing intricate components. Advancements in control systems and automation have enhanced the precision and repeatability of 2-Die Station machines, which is critical for industries requiring high-quality outputs.

The segment has also benefited from rising demand in automotive and mechanical component manufacturing, where consistent production and reduced material wastage are highly valued The scalability and reliability of these machines make them a preferred choice for manufacturers seeking both high throughput and cost efficiency, thereby solidifying their dominant position in the market.

The fasteners product type segment is expected to account for 60.0% of the Cold Forging Machine market revenue share in 2025, positioning it as the leading product category. The growth of this segment is driven by the increasing need for precision fasteners in automotive, construction, and machinery applications.

Fasteners produced through cold forging offer superior mechanical properties, dimensional accuracy, and consistency compared to conventional manufacturing methods. The segment has also benefited from advancements in material processing and machine automation, which improve production speed and quality control.

High adoption rates in sectors emphasizing safety, reliability, and structural integrity have reinforced the demand for cold-forged fasteners The ability to produce a wide range of fastener types efficiently supports manufacturers in meeting large-scale industrial requirements, thereby sustaining the dominance of this product type in the market.

The mechanical press equipment segment is anticipated to capture 45.0% of the Cold Forging Machine market revenue share in 2025, making it the leading equipment type. The growth of this segment has been driven by its high efficiency, robust performance, and suitability for mass production of cold-forged components.

Mechanical presses provide consistent force application, ensuring dimensional accuracy and structural integrity of the manufactured parts. Continuous improvements in drive systems and automation capabilities have enhanced operational precision and minimized downtime.

The segment’s prominence is further supported by rising industrial demand for reliable, high-speed forming solutions that reduce production costs and material waste The widespread adoption of mechanical press equipment across automotive and industrial machinery sectors reinforces its leading position in the market.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for the business. This analysis reveals developments in industry performance and indicates revenue realization patterns, thus providing key stakeholders with a better scene about the growth trajectory over the year. In the first half (H1) from 2025 to 2035, the sector is predicted to showcase a CAGR of 4.8%, followed by a higher growth rate of 5.6% in the second half (H2) of 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 2025 | 4.8% (2025 to 2035) |

| H2 2025 | 5.6% (2025 to 2035) |

| H1 2025 | 5% (2025 to 2035) |

| H2 2025 | 5.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to be slightly around 5% in the first half and remain relatively moderate at 5.3% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), there was a slight decrease of 30 BPS.

Demand for Titanium in Aerospace Drives Growth of Cold Forging Machines

Use of titanium in the aerospace industry is a significant driver for cold forging machines. Titanium alloys are prized in aerospace applications for their high strength-to-weight ratio, corrosion resistance, and ability to withstand extreme temperatures. Cold forging offers a viable solution for manufacturers to process difficult alloys by producing components close to the final dimension, overcoming traditional processing challenges.

Cold forging, a cost-efficient method for producing titanium alloy shapes, reduces material waste due to less machining and cutting. This precision ensures aerospace industry quality and performance standards, with titanium-forged components exhibiting increased strength and corrosion resistance, making them vital for aerospace applications.

Rising Use of Magnesium Alloys in Automotive and Aerospace Sectors to Boost Growth

Increasing use of magnesium alloy in the automotive and aircraft industries is providing a significant boost for cold forging machines. Magnesium has been valued for its great lightness, making it an ideal material for constructing lightweight components.

Shift towards magnesium alloy has been driven by the need to enhance fuel efficiency and meet stringent environmental regulations in the automotive and aerospace sectors. Renowned automotive manufacturers such as Audi, Daimler, Ford, Jaguar, Fiat, and a few others have started replacing traditional steel and aluminum components with magnesium.

Material Limitation in Cold Forging Process Restrict Usage to Softer Metals

Material limitation presents a significant restraint for the cold forging machines. Cold forging is less suitable for harder metals such as certain steel alloys. These materials possess lower ductility and higher resistance to deformation making them difficult to shape using cold forging process.

Several challenges of working with a limited range of materials restricts the applicability of forging machines across certain specific industries. Industries that require components made from harder metals are compelled to invest in different forging technologies, causing a decrease in the share of cold forging machines globally.

The market recorded a CAGR of 4.1% during the historical period between 2020 and 2025. The growth of the cold forging industry was positive as it reached a value of USD 22 billion in 2025 from USD 16.9 billion in 2020.

From 2020 to 2025, the cold forging sector experienced significant growth and development due to technological advancements, industry demands, and global economic factors. Technological advancements like precision forging, advanced materials, and automated processes have enhanced manufacturing efficiency, reduced costs, and expanded the ability to shape complex geometries.

Demand for cold forging grew across automotive, aerospace, construction, and industrial sectors, with high-strength components in automotive manufacturing and lightweight structures in aerospace. The Asia-Pacific region, particularly China and India, emerged as key growth drivers due to rising automotive and manufacturing sectors. North America and Europe also saw steady growth due to technological investments and increasing adoption of lightweight materials in these industries.

Environmental sustainability became a key focus, prompting manufacturers to adopt cold forging for its efficiency in material usage and energy consumption compared to traditional manufacturing methods. Economic factors like fluctuating raw material prices and geopolitical tensions influenced dynamics, prompting companies to optimize supply chains and explore alternative sourcing strategies. The cold forging business is poised for continued growth driven by ongoing technological innovations, rising applications, and increasing environmental awareness.

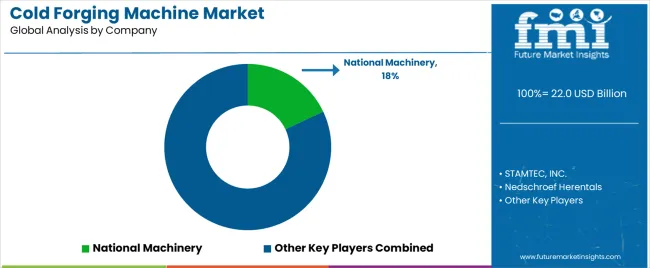

Tier 1 companies comprise manufacturers with a revenue of above USD 100 million capturing a share of 5% to 10% globally. These players are characterized by significant large product offering. These companies are distinguished by their extensive expertise in manufacturing.

Tier 1 companies provide a wide range of series including forging machines of different die types utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Stamtec, Inc., Nedschroef Herentals, Sacma, Jern Yao, Innor Machinery and few others.

Tier 2 companies include mid-size firms with revenue of USD 50 million having presence in specific regions and highly influencing the local landscape. These are characterized by a strong presence overseas and strong knowledge.

Tier 2 companies have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Sijin Intelligent Forming Machinery Co. Ltd., Zhejiang Dongrui Machinery Industrial, Zhejiang Shengtuo Machinery Co Ltd., Ningbo Sijin Machinery and among others

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 20 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. The business is characterized to be fragmented and there are large number of companies in tier 3 category.

The section below covers the industry analysis for the cold forging machine business for different countries. Demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

China is anticipated to remain at the front in East Asia, surging at a CAGR of 6.9% through 2035. In South Asia Pacific, India is projected to witness a CAGR of 6.2% by 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 6.9% |

| Japan | 6.5% |

| India | 6.2% |

| United States | 5.3% |

| Germany | 4.9% |

| France | 4.3% |

China dominates the cold forging machine sector due to its strong manufacturing capabilities and robust industrial base, paving the way for the production and adoption of such machines. The country’s strong infrastructure development allows it to offer competitive machine prices, making it a preferred supplier for both domestic and global consumption.

China's automotive and construction sectors are key consumers of cold forging machines, with high demand for components for vehicle assembly. The country's global manufacturing hub and efficient supply chain enable efficient distribution and export of cold forging equipment for international consumption and usage.

India is expected to rise at a CAGR of 6.2% throughout the forecast period. Rise in the cold forging machine industry is attributed to its growing manufacturing sector and strategic geographic position of the country.

Government initiative of “Make in India” has been a substantial push towards boosting local manufacturing capabilities of forging machines. Increasing manufacturing presence in India has attracted both domestic and international companies, creating a favorable environment for the production of forging machines.

Government is prioritizing infrastructure development to support industrial growth, including transportation systems, energy grids, technological hubs, and industrial complexes. This supports forging machine manufacturing units and other manufacturing opportunities, leveraging the country's skilled and cost-effective workforce for competitive production costs and high-quality manufacturing.

Germany is a leading player in the cold forging machine market in Western Europe due to its exceptional engineering capabilities and focus on product innovations. The country's established network of specialized suppliers, manufacturers, and research hubs drives advancements in cold forging machines.

Germany's automotive sector is a significant consumer of cold forged fasteners components, contributing to the growth of cold forged machines. The country's engineering-driven industrial bases require precious forged parts for various applications, boosting sales of advanced cold forging machines.

The section contains information about the leading segments in the industry. By machine type, the 6-die station segment is estimated to account for 35.5% share in 2035. By end use, the automotive segment is set to hold a value share of 29.3% by 2035.

| Segment | 6-Die Station (Machine Type) |

|---|---|

| Value Share (2035) | 35.5% |

The 6-die station segment dominates the machine type, accounting for around 35.5% of the share in 2035. The 6-die station's significant revenue share is attributed to its lower prices and efficient compared to other die-system machines. The 6-die station segment is expected to rise at a 6.5% value CAGR due to increasing demand from automotive and aerospace industries.

| Segment | Automotive (End Use) |

|---|---|

| Value Share (2035) | 29.3% |

The automotive segment is forecast to account for a revenue of around USD 37.3 billion in the forging machine market by 2035. It is also poised to surge at a CAGR of 7.4% through the forecast period.

The automotive sector depends heavily on cold forging for producing high-strength and precision components such as fasteners and shaped pieces. The cold forging process increases the mechanical property of the metal and make them ideal for various applications. Shift towards electric vehicle and lightweight vehicle designs has prompted the growth of cold forged products, indicating an growth in the business.

Key manufacturers operating in the cold forging machine market are investing in new product development and offerings and also entering into partnerships. Leading companies are looking to offer machines with high efficiency and increasing production of components.

Key companies are focusing on developing innovative solutions to meet evolving end-user demands and are adopting acquisitions, alliances, facility growth, collaborations, mergers, and partnerships to solidify market positions. The global business is competitive, with both large and small-scale companies and manufacturers.

Local companies compete with global firms based on personalized products and services. They are set to deliver personalized customization services and provide standardized goods to key industrial machinery manufacturers, automotive companies, and home electronics manufacturers. The segment provides comprehensive assessments and insights on current opportunities and emerging trends for companies in developed and developing countries.

Industry Updates

In terms of machine types, the industry is divided into 2-die station, 3-die station, 4-die station, 5-die station and 6-die station.

Based on product types, the business is segregated into fasteners and shaped pieces.

The business is classified by equipment as mechanical press, hydraulic press and screw presses.

As per end-use, the segment is split into aerospace, automotive, construction, wind energy, power generation, defence and others (medical, sports, tools and etc.)

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa, and Oceania have been covered in the report.

The global cold forging machine market is estimated to be valued at USD 22.0 billion in 2025.

The market size for the cold forging machine market is projected to reach USD 37.3 billion by 2035.

The cold forging machine market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in cold forging machine market are 2-die station, 3-die station, 4-die station, 5-die station and 6-die station.

In terms of product type, fasteners segment to command 60.0% share in the cold forging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA