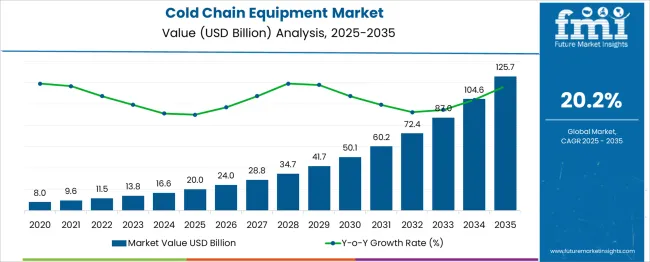

The Cold Chain Equipment Market is estimated to be valued at USD 20.0 billion in 2025 and is projected to reach USD 125.7 billion by 2035, registering a compound annual growth rate (CAGR) of 20.2% over the forecast period.

| Metric | Value |

|---|---|

| Cold Chain Equipment Market Estimated Value in (2025 E) | USD 20.0 billion |

| Cold Chain Equipment Market Forecast Value in (2035 F) | USD 125.7 billion |

| Forecast CAGR (2025 to 2035) | 20.2% |

The cold chain equipment market is growing steadily due to rising global demand for temperature-controlled logistics across food, pharmaceuticals, and biotechnology sectors. With increasing emphasis on reducing post-harvest losses and ensuring product safety, cold chain solutions have become critical in maintaining the integrity of perishable goods throughout the supply chain.

Regulatory mandates on food safety and vaccine storage further accelerate adoption across developing and developed regions. Technological advancements in refrigeration, IoT-enabled monitoring, and energy-efficient solutions are enhancing operational efficiency and real-time visibility.

Looking forward, growth is expected to be driven by expanding global trade in perishables, urbanization of food supply chains, and rising investments in cold storage infrastructure. The ability of cold chain equipment to ensure product longevity and quality is reinforcing its essential role in global distribution networks.

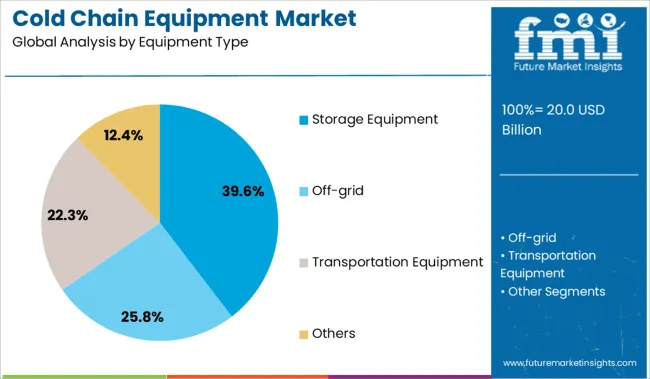

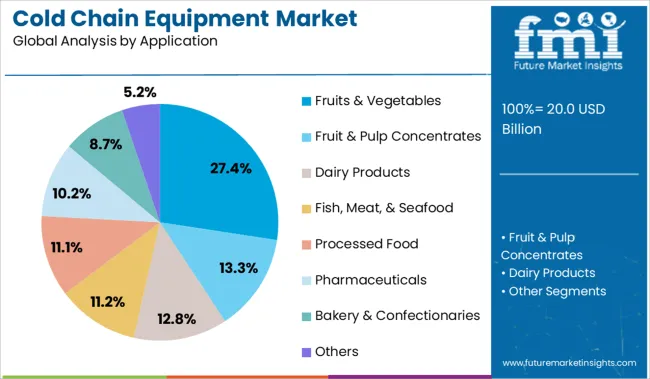

The cold chain equipment market is segmented by equipment type and application, and geographic regions. The cold chain equipment market is divided by equipment type into Storage Equipment, Off-grid, Transportation Equipment, and Others. In terms of application, the cold chain equipment market is classified into Fruits & Vegetables, Fruit & Pulp Concentrates, Dairy Products, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals, Bakery & Confectioneries, and Others. Regionally, the cold chain equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The storage equipment segment leads with a 39.6% market share in the equipment type category, highlighting its fundamental role in preserving temperature-sensitive goods across various industries. Storage units, including cold rooms and walk-in freezers, are essential for ensuring product stability before and after transportation, making them indispensable within the cold chain infrastructure.

This segment is benefiting from increased capacity expansions in warehousing and food distribution centers, particularly in emerging economies where cold storage is being rapidly developed. The demand is also rising for modular, scalable, and energy-efficient storage solutions to support varying volume needs and environmental standards.

As suppliers prioritize flexibility and reliability, investment in advanced storage systems with automated temperature control and remote tracking capabilities is becoming more prevalent. Continued global emphasis on food security and vaccine distribution is expected to drive sustained demand for storage equipment within the market.

The fruits and vegetables segment represents 27.4% of the application category, making it one of the leading drivers of cold chain equipment demand due to the highly perishable nature of fresh produce. This segment relies heavily on consistent temperature and humidity control to maintain freshness, prevent spoilage, and extend shelf life during transport and storage.

The globalization of agricultural trade and rising consumption of fresh produce across urban centers have increased pressure on supply chains to deliver quality products over long distances. Government initiatives aimed at reducing food wastage and ensuring food safety standards are further encouraging the deployment of advanced cold chain solutions for fruits and vegetables.

Technological improvements such as ethylene control systems, smart sensors, and real-time tracking are enhancing the efficiency of cold chain processes in this segment. As consumer preference shifts towards fresh and minimally processed foods, demand for robust cold chain equipment for fruits and vegetables is expected to remain strong.

Cold chain equipment installation is rising across food, pharma, and logistics sectors as demand for temperature-controlled transport and storage increases. In 2024, walk-in coolers, refrigerated trailers, and precision cold-box systems accounted for 29 % of global warehouse upgrades. Integration of IoT-managed units with real-time temperature logging now supports higher compliance and reduced perishable loss.

Deployers are increasingly opting for modular walk-in cold walls, plug-and-play refrigerated trailers, and portable cold boxes to respond rapidly to seasonal demand and localized storage needs. Prefabricated cold rooms equipped with microprocessor-controlled HVAC controllers now represent 35 % of new installations in mid-size distribution centers, enabling same-week commissioning. Refurbishment of conventional freezers with smart retrofit modules has eliminated temperature variance by up to 12 %. IoT connectivity supports remote diagnostics, reducing on-site service calls by 22 %. Deployments in remote or peri-urban zones leverage solar-assisted units to avoid grid dependency and enable low-cost scaling without major infrastructure upgrades.

Despite equipment performance improvements, adoption is limited by energy cost escalation, technical servicing demands, and regulatory certification cycles. Refrigeration increases operating costs by 16% over ambient storage, while compressor losses under high humidity contribute an additional 8%. Units certified for pharmaceutical or food use require extended factory acceptance testing, often adding 6 weeks to delivery timelines. Retrofit deployments face delays of up to 4 weeks for humidity control and data logger integration. Monthly maintenance introduces average service delays of 1.5 days due to calibration and defrost routines. Smaller operators experience 14% downtime in remote zones where certified servicing support is unavailable, constraining equipment utilization and return on investment.

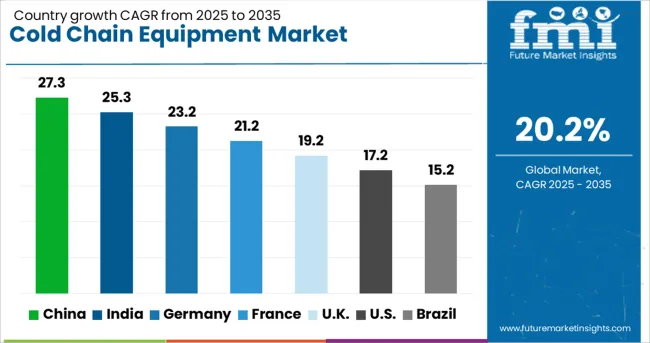

| Country | CAGR |

|---|---|

| China | 27.3% |

| India | 25.3% |

| Germany | 23.2% |

| France | 21.2% |

| UK | 19.2% |

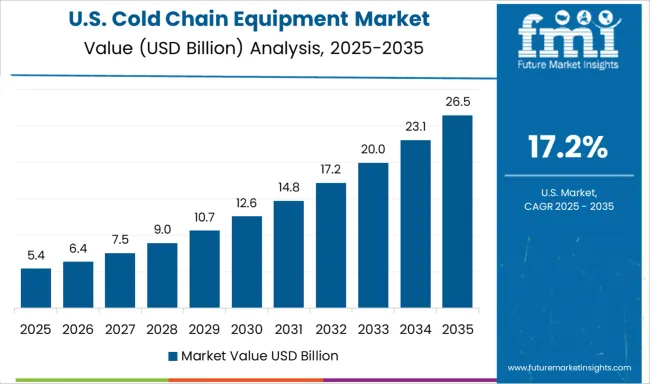

| USA | 17.2% |

| Brazil | 15.2% |

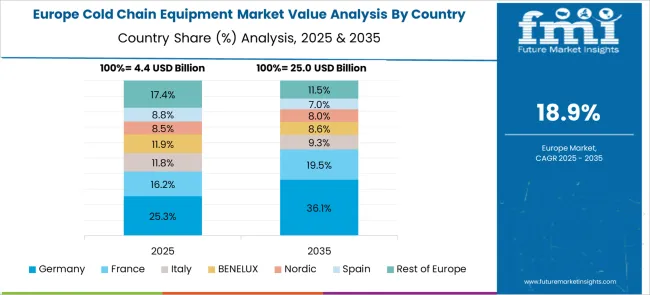

Global cold chain equipment market demand is expected to expand at a 20.2% CAGR from 2025 to 2035. China leads at 27.3%, outperforming the global average by +35%, supported by rising vaccine production and pharmaceutical exports. India follows with a 25.3% CAGR, a +25% premium, due to food distribution infrastructure upgrades. Germany posts 23.2%, a +15% gain, reflecting demand from biotech and dairy sectors. The UK records 19.2%, slightly below the global benchmark (–5%) amid delayed logistics automation. The US trails at 17.2%, a -15% deficit, where aging infrastructure and slower policy alignment weigh on adoption. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The Cold Chain Equipment Market in China is expanding at a CAGR of 27.3% from 2025 to 2035, led by high-value logistics in biopharma and seafood categories. Since 2022, over 900 temperature-controlled hubs have been subsidized by regional authorities. Vaccine handling and monoclonal antibody storage facilities are deploying multi-compartment refrigerated units. Reefer truck fleets among top operators are being fitted with RFID-linked asset tracking. Tier 2 and Tier 3 cities are upgrading hardware for e-commerce-driven perishables.

Demand for Cold Chain Equipment in India is projected to grow at a 25.3% CAGR through 2035, with demand from pharmaceutical warehousing, dairy cooperatives, and quick-commerce grocery networks. Since 2021, 310 integrated projects have received government co-financing. Rural depots are adopting solar-powered chillers and hybrid double-door models. Mid-tier cities are installing modular walk-in units to reduce spoilage and extend the shelf life of processed food categories.

Germany is recording a 23.2% CAGR in the Cold Chain Equipment segment, supported by high-spec thermal protocols in vaccine and bioreagent logistics. EN 60068-compliant freezing units are being installed to replace older systems in life sciences clusters. Cold docks near major ports and airports are expanding capacity. Vendors are supplying automated racking and climate systems for GxP-aligned pharmaceutical chains.

The UK Cold Chain Equipment Market is advancing at a CAGR of 19.2%, driven by frozen food logistics, pharmaceutical shipments, and seafood storage. Fleet procurement is shifting toward hybrid CO₂-based cooling trailers. Warehouse-scale temperature control systems are being deployed in insulin and e-pharmacy distribution. Cold cabinets for last-mile delivery are being adopted in dense city zones.

The Cold Chain Equipment Market in the USA is expected to grow at a CAGR of 17.2% until 2035, supported by biological shipments, frozen retail distribution, and pet food logistics. Government cold-chain resilience programs are upgrading public health storage capacity. Logistics companies are investing in condition-monitoring tools and asset tracking for perishable goods. Multi-temperature storage environments with integrated quality controls are in demand from contract manufacturers.

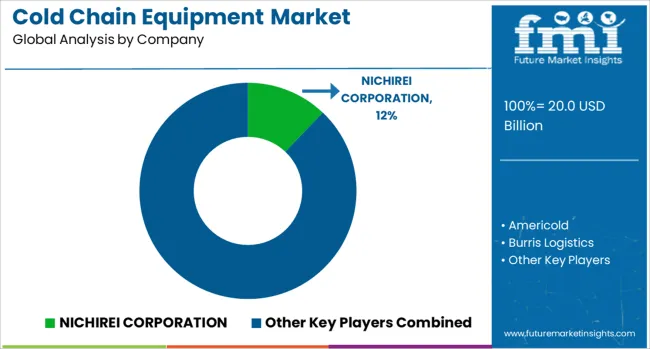

NICHIREI CORPORATION leads the cold chain equipment market. Americold and Lineage Logistics dominate temperature-controlled warehousing, while Thermo King and Carrier Transicold lead in mobile refrigeration systems. Regulatory pressure from food safety and pharmaceutical handling standards is shaping demand patterns. E-commerce grocery growth and refrigerant compliance mandates are influencing design shifts. Manufacturers are adopting Bitzer compressors and Kelvion heat exchangers to improve thermal efficiency. IoT monitoring and AI-based energy optimization are being integrated across logistics chains. Developments include electric transport units, solar-assisted storage modules, and blockchain temperature logs tailored to biologics and high-value food shipments. Growth potential remains strong in Southeast Asia and Africa, where infrastructure gaps coincide with high spoilage rates and unmet pharmaceutical cold-chain needs.

On March 31, 2025, DHL acquired CRYOPDP from Cryoport and simultaneously established a strategic global partnership. This move significantly enhances DHL’s healthcare cold chain infrastructure, especially in ultra-cold logistics, fitting into its 2030 Life Sciences & Healthcare growth strategy.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.0 Billion |

| Equipment Type | Storage Equipment, Off-grid, Transportation Equipment, and Others |

| Application | Fruits & Vegetables, Fruit & Pulp Concentrates, Dairy Products, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals, Bakery & Confectionaries, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NICHIREI CORPORATION, Americold, Burris Logistics, Schmitz Cargobull, Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, and LINEAGE LOGISTICS |

| Additional Attributes | Dollar sales by equipment type (refrigerated transport units, cold rooms, data loggers) and application (pharmaceuticals, dairy, fresh produce), demand dynamics across vaccine distribution, last-mile grocery delivery, and seafood export, regional trends led by Asia‑Pacific with North America upgrading fleet telemetry, innovation in solar-assisted refrigeration and phase change material integration, and environmental impact of refrigerant phase-out mandates and thermal efficiency benchmarks. |

The global cold chain equipment market is estimated to be valued at USD 20.0 billion in 2025.

The market size for the cold chain equipment market is projected to reach USD 125.7 billion by 2035.

The cold chain equipment market is expected to grow at a 20.2% CAGR between 2025 and 2035.

The key product types in cold chain equipment market are storage equipment, off-grid, transportation equipment and others.

In terms of application, fruits & vegetables segment to command 27.4% share in the cold chain equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Seal Paper Market Size and Share Forecast Outlook 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Cold Form Foil Market Analysis by Aluminum, Plastic Film, and Others Through 2025 to 2035

Cold Seal Plastic Films Market Size and Share Forecast Outlook 2025 to 2035

Cold Packs Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Cold Gas Spray Coating Market Insights by Technology, End User, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA