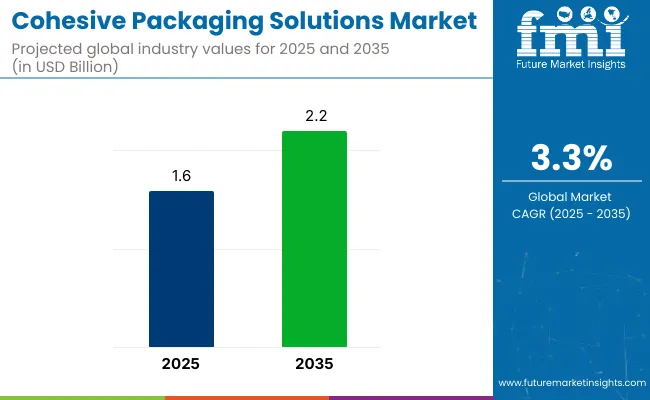

The cohesive packaging solutions market is projected to grow from USD 1.6 billion in 2025 to USD 2.2 billion by 2035, registering a CAGR of 3.3% during the forecast period. Sales in 2024 reached USD 1.5 billion. This growth is primarily driven by the increasing demand for secure, tamper-proof, and efficient packaging solutions in the e-commerce, logistics, and retail sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.6 billion |

| Industry Value (2035F) | USD 2.2 billion |

| CAGR (2025 to 2035) | 3.3% |

The rise in online shopping and global trade has led businesses to seek packaging solutions that offer durability, ease of use, and cost-efficiency while ensuring product safety during transit. Cohesive packaging, which involves pre-coated adhesive materials that bond when pressure is applied, is gaining traction due to its ability to provide secure packaging without requiring additional adhesives or tapes.

The cohesive packaging solutions market has witnessed significant advancements in terms of sustainability and technology. Manufacturers are increasingly utilizing recyclable and biodegradable materials to produce cohesive packaging, addressing environmental concerns and regulatory requirements.

Technological innovations, such as the incorporation of RFID tags and IoT-enabled tracking systems, have enhanced inventory management and traceability. In India, the government's push towards sustainable practices has encouraged local manufacturers to adopt eco-friendly materials and processes. These developments not only contribute to environmental conservation but also offer cost savings and operational efficiencies for businesses.

Cohesive packaging systems are expected to gain increased relevance in the automation-intensive supply chains anticipated by 2035. The growing emphasis on lean warehousing and efficiency-driven operations is expected to expand the total addressable market. Strategic investments in robotic integration, fast-changeover designs, and low-impact materials are creating space for new entrants and innovation-driven incumbents.

Players targeting the Indian market are expected to benefit from warehousing modernization schemes and e-commerce expansion. In North America and Europe, high-volume applications in third-party logistics are projected to account for steady demand.

Customizable formats, low storage footprint, and high-speed packing compatibility are positioning cohesive packaging as a long-term solution. Market share expansion is expected through partnerships across packaging automation ecosystems.

The market is segmented based on material type, product type, end-use industry, and region. By material type, the segmentation includes paper-based cohesive materials, corrugated fiberboard with cohesive coating, polyethylene (PE) films, polypropylene (PP) films, and biodegradable & compostable materials, with PE films leading due to their cost-efficiency and durability in automated packing operations.

Product types include cohesive bubble packaging, cohesive foam packaging, cohesive paper wraps, cohesive mailers & envelopes, and roll stock for custom packaging lines, where cohesive bubble packaging remains the top choice for high-impact protection during transit.

End-use industries comprise e-commerce & retail, electronics, automotive components, pharmaceuticals & medical devices, industrial equipment, and apparel & textiles, with e-commerce & retail dominating due to rising parcel volumes and demand for packaging that eliminates void fill and tape. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

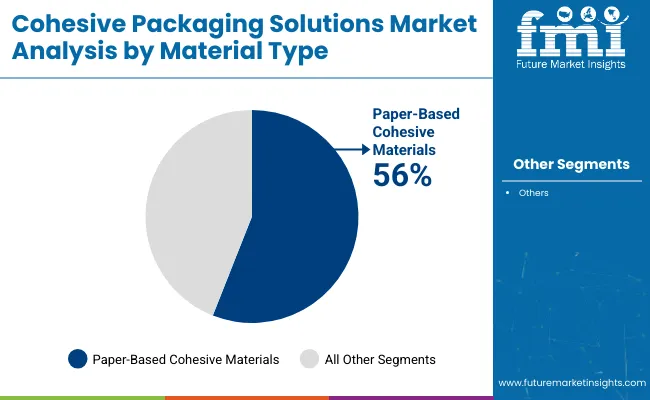

Paper based cohesive materials are projected to account for approximately 56% of the global cohesive packaging solutions market by 2025. Their recyclability and biodegradability have made them a preferred choice for businesses aiming to reduce environmental impact.

These materials have been widely used in applications requiring secure, tamper-evident packaging without additional adhesives. The growing emphasis on sustainable packaging solutions has further propelled their adoption across various industries. The versatility of paper-based cohesive materials has allowed for their use in diverse packaging formats, including envelopes, wraps, and mailing bags.

Their ability to conform to different product shapes and sizes has enhanced packaging efficiency. Additionally, advancements in paper coating technologies have improved the strength and durability of these materials. This has ensured product protection during transit and storage.

In the context of regulatory compliance, paper-based cohesive materials have aligned well with stringent environmental standards. Their adoption has enabled companies to meet sustainability goals and adhere to packaging waste reduction mandates. Moreover, consumer preference for eco-friendly packaging has influenced brands to transition towards paper-based cohesive solutions.

This shift has been evident in sectors such as e-commerce, retail, and food packaging. As the demand for sustainable packaging continues to rise, paper-based cohesive materials are expected to maintain their dominance in the market.

Ongoing innovations in material science are anticipated to further enhance their performance characteristics. The projected market share reflects the material's established position and future growth potential. Consequently, paper-based cohesive materials are poised to remain integral to cohesive packaging solutions.

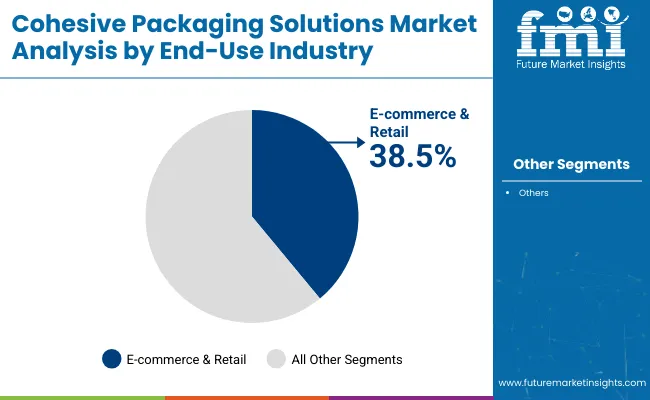

The e-commerce and retail sector is estimated to hold a 38.5% share of the cohesive packaging solutions market by 2025. The surge in online shopping has necessitated packaging solutions that ensure product safety and customer satisfaction.

Cohesive packaging, with its self-sealing properties, has provided an efficient and secure method for packaging goods. This has reduced the need for additional sealing materials, streamlining the packaging process. The tamper-evident nature of cohesive packaging has been crucial in building consumer trust.

It has allowed customers to identify any unauthorized access to their packages easily. Furthermore, the adaptability of cohesive packaging to various product types has made it suitable for a wide range of retail items. This versatility has been particularly beneficial for businesses offering diverse product lines.

In terms of operational efficiency, cohesive packaging has facilitated faster packing times and reduced labor costs. Its compatibility with automated packaging systems has further enhanced productivity in fulfillment centers. Additionally, the lightweight nature of cohesive packaging materials has contributed to lower shipping costs.

These factors have collectively improved the overall logistics and distribution processes. As the e-commerce and retail landscape continues to evolve, the reliance on cohesive packaging solutions is expected to grow. The sector's focus on sustainability and customer experience aligns with the benefits offered by cohesive packaging.

The projected market share underscores its significance in meeting the industry's packaging needs. Therefore, cohesive packaging is anticipated to remain a vital component in the e-commerce and retail sector.

Regulatory Compliance and Sustainability Concerns

The traction of stringent regulatory requirements associated with packaging waste and sustainability presents large hindrance for cohesive packaging solutions industry. There are stricter rules in place all over the world aimed at reducing single use plastics and increasing recyclability.

With this background, companies in the complex packaging chain are facing increasing pressure to promote by the goals achieved sustainability that is not at too high a cost. Development of green packaging materials often involves a high investment on R&D and supply chain transformation which is difficult for the companies. Countries with less established recycling infrastructure also struggle to recycle or properly dispose of cohesive packaging, like plastic-based adhesion, packages.

Growth in E-Commerce and Automation

The increase in e-commerce and automated packaging is a big growth opportunity for the cohesive packaging solutions market. With the rise of online shopping worldwide, companies are looking for packaging that maximizes fulfillment efficiency, minimizes waste, and improves customer experience. Cohesive packaging, with its self-seal and tamper-evident features, is becoming increasingly popular among e-commerce businesses and third-party logistics operators.

In addition, innovations in automated packaging machines, which combine cohesive materials for efficient operations, are likely to fuel demand in warehouses and distribution facilities. Growing acceptance of smart packaging solutions, such as RFID tags and track-and-trace solutions, also strengthens the prospects of cohesive packaging for modern logistics and supply chain management.

The USA cohesive packaging solutions market is growing, owing to the rising need for cost-effective and automated packaging of products across sectors like retail, logistics, and e-commerce. Increasing implementation of frustration-free and tamper-evident packaging in consumer electronics, pharmaceuticals, food delivery, among other verticals, are further contributing to the growth of the market.

Additionally, the trend towards sustainability and the use of environmentally friendly materials has resulted in advancements in biodegradable cohesive coatings and recyclable packaging solutions. Minimization of the packaging waste and upgrading shipping effectiveness is also driving the baked goods packaging demand from key players in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

The UK market for cohesive packaging solutions is experiencing growth in response to the rise of e-commerce, increasing focus on sustainable packaging, and stringent regulations regarding plastic waste. Automated, self-sealing, and protective packaging that makes shipping more efficient, while reducing material waste, are also entering the online stores.

Additionally, to meet consumer demand for easy-to-use, safe, and recyclable packaging, this will stimulate innovations in paper-based cohesive solutions. The other factor contributing to the growth of the market is the market policies of the government for the support of green packaging solutions, therefore cohesive packaging is a preferred choice for the retailers as well.

Market Forecast:

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.1% |

The cohesive packaging solutions market in the European Union is growing due to increasing demand for sustainable and regulations-based compliant packaging solutions. Ever-increasing amounts of single-use plastics in packaging waste are causing a ripple of response among brands, the EU Circular Economy Action Plan sees Germany, France, and the Netherlands leading demand for sustainable and recyclable packaging.

For cost efficiency and better protection of products, cohesive packaging is gaining ground in the e-commerce, pharmaceutical, and electronics sectors in the region. In addition, stringent packaging waste reduction laws are encouraging the manufacturers to produce recyclable and biodegradable cohesive packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

Due to the high demand for lightweight, protective, and sustainable packaging in the electronics, retail, and cosmetics industry, the Japanese cohesive packaging solutions market is expanding. Due to cutting-edge packaging technologies and a growing focus on automation, the country has boosted demand for self-sealing, high-strength cohesive materials for safe transportation.

In addition, growing consumer demand for lightweight and green packaging has led companies to adopt paper-based and biodegradable cohesive packaging solutions. The rise of technological advancements such as smart packaging and anti-counterfeiting technologies are adding to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

Driven by the growth of e-commerce, technological evolution in packaging automation, and rising environmental awareness toward sustainability, South Korea's consolidated packaging solutions market is growing consistently. E-commerce players like major retailers and logistics companies are embracing unified packaging to increase efficiency, reduce consumption and waste.

South Korea's government encouraging the use of plastic-free and recyclable packaging solutions is pushing businesses to have sustainable cohesive packaging innovations. Demand for customizable and convenient packaging continues, driven by the rise of subscription box services and direct-to-consumer brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

The Cohesive Packaging Solutions market is experiencing significant growth due to increasing demand for efficient, cost-effective, and sustainable packaging solutions. Cohesive packaging, which involves the use of self-sealing materials that adhere only to themselves and not to the products inside, is widely adopted across e-commerce, food & beverage, pharmaceuticals, and industrial sectors.

Rising consumer preference for sustainable packaging, coupled with technological advancements in materials and adhesive formulations, is driving market expansion. Leading companies are focusing on innovative product developments, strategic collaborations, and expansion of their manufacturing capabilities to strengthen their market position.

The overall market size for cohesive packaging solutions market was USD 1.6 billion in 2025.

The cohesive packaging solutions market is expected to reach USD 2.2 billion in 2035.

The increasing demand for secure, tamper-proof, and efficient packaging solutions in the e-commerce, logistics, and retail sectors fuels Cohesive packaging solutions Market during the forecast period.

The top 5 countries which drives the development of Cohesive packaging solutions Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of packaging format, envelops to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cohesive Packaging Market Trends - Growth & Forecast 2024 to 2034

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA