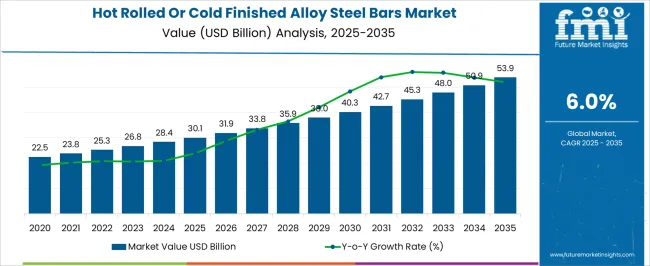

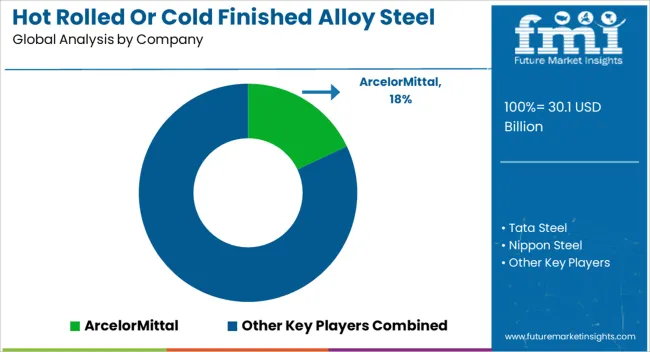

The hot rolled or cold finished alloy steel bars market is estimated to be valued at USD 30.1 billion in 2025 and is projected to reach USD 53.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

Evaluating the Growth Rate Volatility Index (GRVI) for this market indicates moderate yet steady momentum, with the index reflecting a smooth acceleration in yearly increments across the decade. Starting at USD 22.5 billion in 2024, the market demonstrates a progressive climb through USD 25.3 billion in 2026, USD 31.9 billion by 2027, and further to USD 45.3 billion in 2032, underscoring the compounding effect of CAGR-driven expansion. Unlike markets subject to high cyclical swings, the alloy steel bars sector reflects demand stability arising from automotive, construction, energy, and industrial machinery applications. GRVI analysis shows relatively low volatility, suggesting manufacturers can anticipate predictable growth cycles rather than disruptive spikes.

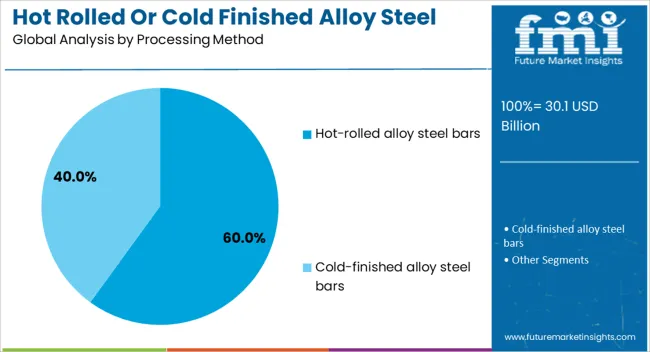

This steadiness also highlights structural demand resilience, supported by infrastructure modernization and lightweighting trends in automotive. The balance between hot rolled and cold finished variants strengthens market stability, with cold finished bars gaining preference in precision engineering, while hot rolled types dominate in construction and heavy machinery. Over the 2025–2035 timeline, the GRVI confirms a disciplined upward path, with steady incremental demand ensuring that producers and stakeholders can align capacity expansions, raw material sourcing strategies, and technology investments in sync with the market’s predictable trajectory.

| Metric | Value |

|---|---|

| Hot Rolled Or Cold Finished Alloy Steel Bars Market Estimated Value in (2025 E) | USD 30.1 billion |

| Hot Rolled Or Cold Finished Alloy Steel Bars Market Forecast Value in (2035 F) | USD 53.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The hot rolled or cold finished alloy steel bars market holds a critical position within the broader steel and metal products sector, accounting for approximately 22–24% of overall long steel sales, highlighting their importance in structural, industrial, and automotive applications. Within construction and infrastructure, these alloy steel bars represent about 18–20% share, driven by use in reinforced frameworks, bridges, and heavy-duty structural components requiring high strength and corrosion resistance. In the automotive and machinery segments, the share stands at roughly 15–17%, fueled by demand for transmission shafts, gears, and high-load mechanical components where dimensional accuracy and toughness are essential.

The share within energy and oilfield applications is close to 10–12%, supported by pipelines, drill rods, and pressure vessels requiring alloyed steels with enhanced performance under extreme conditions. Growth is propelled by increasing industrialization, demand for high-strength materials, and modernization of infrastructure in emerging economies. Product development in heat-treated, quenched, and tempered steel bars enhances fatigue resistance and mechanical properties, while suppliers focus on scaling production, improving quality control, and optimizing supply chains to meet evolving standards. The rise in automotive manufacturing, industrial machinery expansion, and government-backed infrastructure projects across North America, Europe, and Asia-Pacific further underpin market adoption, making hot rolled and cold finished alloy steel bars a backbone of modern engineering and industrial applications.

The market is experiencing steady growth, supported by the rising demand across construction, automotive, heavy machinery, and energy sectors. Advancements in metallurgical processes and precision manufacturing have enhanced the performance, durability, and versatility of alloy steel bars, driving wider adoption. Growing infrastructure investments, along with the need for materials capable of withstanding high stress, extreme temperatures, and corrosive environments, are contributing to market expansion.

The ability to customize composition and mechanical properties through controlled alloying and processing methods is offering manufacturers competitive differentiation. Furthermore, industrial modernization and the adoption of automation in manufacturing facilities are increasing the use of high-performance steel bars in both developed and emerging economies.

Sustainability initiatives promoting recyclable and long-lasting materials are further enhancing market potential. With the integration of advanced testing and quality assurance systems, the sector is poised for continued growth, aligning with evolving industry requirements and global production standards.

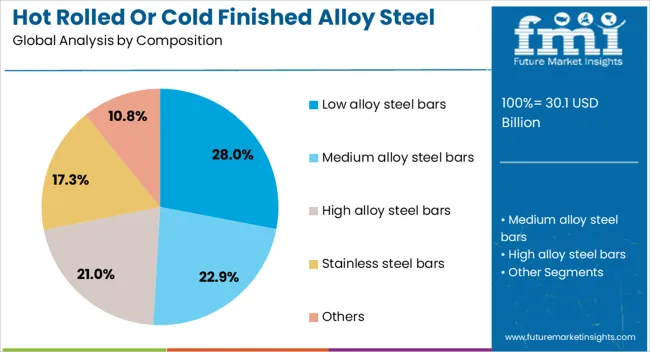

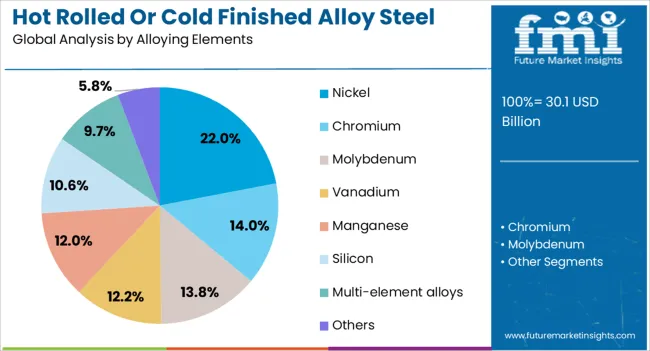

The hot rolled or cold finished alloy steel bars market is segmented by composition, alloying elements, processing method, end use, and geographic regions. By composition, hot rolled or cold finished alloy steel bars market is divided into low alloy steel bars, medium alloy steel bars, high alloy steel bars, stainless steel bars, and others. In terms of alloying elements, hot rolled or cold finished alloy steel bars market is classified into nickel, chromium, molybdenum, vanadium, manganese, silicon, multi-element alloys, and others. Based on processing method, hot rolled or cold finished alloy steel bars market is segmented into hot-rolled alloy steel bars and cold-finished alloy steel bars. By end use, hot rolled or cold finished alloy steel bars market is segmented into automotive industry, aerospace and defense, construction and infrastructure, machinery and equipment, oil and gas industry, power generation, railway and transportation, heavy engineering, tool and die manufacturing, and other applications. Regionally, the hot rolled or cold finished alloy steel bars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low alloy steel bars composition segment is projected to hold 28% of the market revenue share in 2025, making it the leading composition category. Its dominance has been driven by the ability to offer a balance of mechanical strength, toughness, and cost-effectiveness. Low alloy steel bars contain small amounts of alloying elements, allowing manufacturers to tailor properties such as hardness, corrosion resistance, and weldability without significantly increasing production costs. Their wide applicability in construction, machinery, and automotive components has reinforced market demand. The segment’s growth has also been supported by the increasing need for materials that meet high structural performance standards while maintaining ease of fabrication. The adaptability of low alloy steel bars to different heat treatments and forming methods has further strengthened their position As industries prioritize long service life and structural reliability, low alloy steel bars continue to be the preferred choice for a broad range of engineering applications.

The nickel alloying elements segment is expected to account for 22% of the market revenue share in 2025, positioning it as the leading alloying element. Nickel’s inclusion in alloy steel bars has been recognized for its role in significantly enhancing toughness, corrosion resistance, and strength retention at both high and low temperatures. Its use has been instrumental in industries such as marine engineering, energy generation, and aerospace manufacturing, where performance in demanding environments is critical. The segment has benefited from rising demand for materials with high impact resistance and durability, particularly in harsh operational conditions. The stability nickel imparts to steel microstructure during heat treatment has also contributed to superior machinability and consistent quality With increasing emphasis on performance materials in infrastructure and industrial projects, nickel alloying has remained a strategic choice for steel producers, securing its leading share in the alloying elements category.

The hot rolled alloy steel bars processing method segment is anticipated to command 60% of the market revenue share in 2025, making it the dominant processing method. The segment’s leadership has been driven by the cost-efficiency and scalability of hot rolling, which allows for mass production of steel bars with excellent mechanical properties and structural integrity. Hot rolling improves workability and produces bars with refined grain structures, enhancing strength and uniformity. This method has also been favored for its ability to create a wide range of dimensions and shapes, supporting diverse industrial applications. High throughput rates, reduced processing time, and compatibility with subsequent finishing treatments have further boosted its adoption As demand increases for large-volume steel production in construction, manufacturing, and heavy equipment sectors, hot rolling continues to offer a combination of quality, productivity, and economic advantage, securing its dominant position in the processing method category.

Hot rolled and cold finished alloy steel bars are gaining traction across construction, automotive, energy, and industrial sectors due to strength, durability, and versatility. Ongoing production innovations and strategic supply chain management are driving sustained global demand.

Demand for hot rolled and cold finished alloy steel bars is being heavily influenced by large-scale infrastructure and construction projects worldwide. Structural frameworks, bridges, highways, and industrial plants increasingly rely on high-strength steel bars for load-bearing applications. The construction industry prefers alloy steel for its enhanced durability, fatigue resistance, and ability to withstand mechanical stress, leading to greater adoption. Regional infrastructure investments, particularly in emerging economies, are further fueling demand, while renovation and modernization of aging urban and industrial facilities in developed regions sustain market activity. The production of bars tailored to specific project requirements, such as quenched and tempered or high-yield strength grades, also contributes to market momentum. This sectoral reliance highlights the pivotal role of alloy steel bars in ensuring structural integrity and operational safety.

The automotive sector has become a major consumer of alloy steel bars, particularly in transmission shafts, axles, and chassis components where strength, precision, and wear resistance are critical. Heavy machinery and agricultural equipment manufacturers are also adopting quenched, tempered, or cold-finished alloy bars for gear shafts, rollers, and frames. Rising global demand for vehicles and industrial machinery drives higher production volumes, encouraging manufacturers to optimize alloy compositions and heat-treatment processes for performance consistency. The aftermarket and replacement parts segment further sustains demand as vehicle fleets and industrial machines age. Focus on lightweight yet durable alloys ensures higher efficiency and component longevity, creating continuous opportunities for suppliers in both domestic and export markets.

Oilfield and energy sector applications significantly contribute to alloy steel bar demand, as pipelines, drill rods, and pressure vessels require materials with superior strength and corrosion resistance. Bars used in high-pressure, high-temperature, or chemically aggressive environments are carefully engineered to meet stringent performance standards. Power generation facilities, both thermal and hydro, increasingly utilize alloy bars for turbines, structural supports, and heavy-duty machinery components. The adoption of premium alloy grades ensures safety, longevity, and operational efficiency, particularly in critical industrial applications. Strategic stockpiling and long-term supply agreements with energy companies are further strengthening the sector. Continuous exploration and production activity in oil, gas, and power sectors drives a predictable, steady growth trajectory for alloy steel bars globally.

Manufacturers of hot rolled and cold finished alloy steel bars are focusing on process efficiency, quality control, and supply chain optimization to meet global demand. Modern rolling mills, precision cold finishing, and heat-treatment processes enhance mechanical properties, tolerances, and surface quality. Global distribution networks and regional warehouses allow manufacturers to reduce lead times, improve responsiveness, and serve diverse industrial sectors efficiently. Supplier strategies include alloy composition innovation, scrap recovery, and energy-efficient production, contributing to cost optimization. Collaboration with engineering firms ensures product customization for project-specific requirements. These operational improvements are critical to maintain competitiveness in the face of fluctuating raw material costs and varying regional demand across automotive, construction, and industrial machinery sectors.

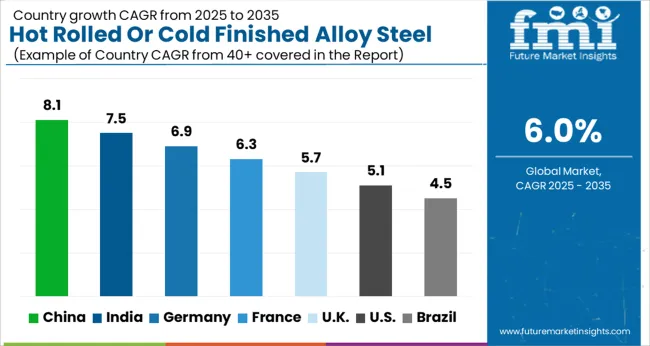

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

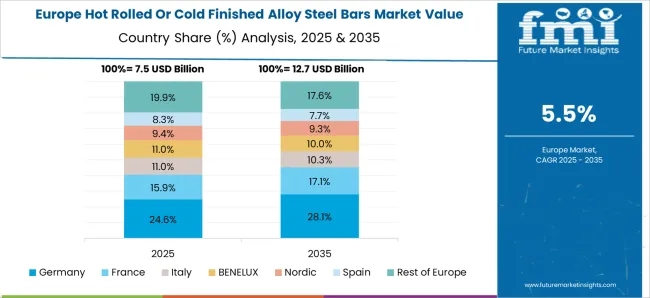

The hot rolled or cold finished alloy steel bars market is projected to grow globally at a CAGR of 6.0% between 2025 and 2035, driven by increasing infrastructure development, industrial machinery expansion, and rising demand from automotive and energy sectors. China leads with a CAGR of 8.1%, supported by large-scale construction projects, booming automotive production, and heavy investments in manufacturing and energy infrastructure. India follows at 7.5%, fueled by industrialization programs, regional manufacturing growth, and increased consumption in automotive, machinery, and energy applications. France posts 6.3%, benefiting from industrial modernization, renovation of aging infrastructure, and replacement of legacy machinery components. The United Kingdom grows at 5.7%, supported by infrastructure upgrades, steel-intensive projects, and heavy machinery expansion, while the United States records 5.1%, reflecting steady demand from construction, automotive, and oil & gas sectors. The analysis spans over 40 countries, with these five markets serving as benchmarks for investment planning, production scaling, and supply chain optimization in the global hot rolled and cold finished alloy steel bars industry.

China is expected to post a CAGR of 8.1% during 2025–2035, higher than the 5.6% recorded between 2020–2024, reflecting rapid industrial expansion, infrastructure projects, and growing automotive and machinery demand. The initial phase saw moderate growth due to slower scaling of production capacity and incremental adoption across construction and energy sectors. The next few years will witness stronger growth driven by large-scale infrastructure investments, increased domestic production of alloy steel bars, and expansion of industrial clusters. Collaborations between domestic manufacturers and international suppliers are expected to improve technology transfer and local capacity. Rising demand from automotive, energy, and heavy machinery applications will further enhance market penetration.

India is projected to register a CAGR of 7.5% between 2025–2035, higher than the 6.2% achieved during 2020–2024, government-backed industrialization programs, infrastructure growth, and rising automotive and machinery demand. Early growth was driven by incremental retrofits and gradual modernization of industrial and construction facilities. Growth over the next decade is supported by large-scale energy projects, adoption of high-strength alloy steel bars in transportation, and expansion of manufacturing clusters. Strategic partnerships with European and American suppliers are expected to improve technology access, while domestic production scaling reduces import dependency. Expansion of industrial machinery and infrastructure investments will further strengthen market growth.

The United Kingdom is projected to post a CAGR of 5.7% during 2025–2035, slightly below the global 6.0% benchmark, reflecting moderate industrial growth, infrastructure upgrades, and steady demand from automotive and energy sectors. During 2020–2024, the CAGR was about 4.3%, shaped by incremental industrial projects and gradual modernization of production facilities. Growth in the coming decade will strengthen as new construction projects, industrial machinery replacement, and automotive sector modernization drive alloy steel consumption. Investments by domestic and international producers are expected to improve production capacity, distribution networks, and project-specific supply capabilities. Demand from energy and infrastructure projects will further bolster market adoption.

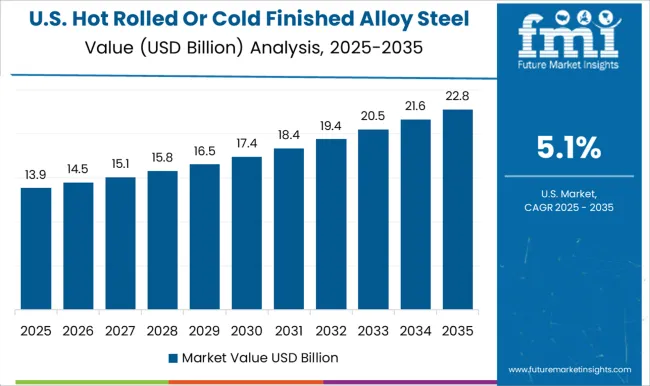

The United States is expected to record a CAGR of 5.1% between 2025–2035, slightly below the global 6.0% average, reflecting steady industrial output, infrastructure revitalization, and automotive sector growth. The CAGR during 2020–2024 stood at roughly 4.0%, constrained by slower replacement of aging machinery and limited expansion of high-capacity production. Growth over the next decade is anticipated to be driven by infrastructure projects, energy sector expansion, and high-strength steel adoption in automotive and industrial applications. Domestic steel producers are expected to scale production while improving logistics and distribution networks to meet regional demand efficiently.

France is expected to post a CAGR of 6.3% during 2025–2035, slightly above the global 6.0% benchmark, reflecting modernization of industrial infrastructure, upgrades in the automotive sector, and steady demand from construction and machinery applications. During 2020–2024, the CAGR was about 5.0%, shaped by gradual replacement of aging industrial equipment and incremental adoption of high-strength alloy steel bars. Growth over the next decade is supported by large-scale infrastructure projects, expansion in precision machinery manufacturing, and increasing use of alloy steel in automotive and energy sectors. Domestic producers are expected to scale production capacity, optimize supply chains, and collaborate with European suppliers to meet rising demand. Investment in high-performance alloy steels for industrial and construction applications will further drive market adoption.

The hot rolled or cold finished alloy steel bars market is defined by strong competition among global steel producers, integrated mills, and regional manufacturers catering to automotive, construction, and industrial machinery sectors. ArcelorMittal leads with a diversified product portfolio, emphasizing high-strength, corrosion-resistant, and specialty alloy steel bars for global infrastructure and automotive applications. Tata Steel focuses on integrated production, offering customized alloy grades and value-added processing, supported by domestic and international supply chains. Nippon Steel and JFE Steel prioritize high-performance steel for precision engineering, energy, and construction sectors, leveraging advanced metallurgical processes.

POSCO and USA Steel deliver high-quality alloy bars with consistent mechanical properties, catering to both industrial and construction demands. Steel Dynamics emphasizes flexible production and regional distribution, targeting fast-turnaround projects and niche applications. Other regional and domestic producers compete on pricing, localized supply, and specialized alloy formulations for industrial, construction, and infrastructure projects. Strategic approaches in the market include scaling production capacity, investing in new alloy grades, improving processing efficiency, forming partnerships with end-users, and expanding regional footprint. Companies are also focusing on enhancing quality certifications, optimizing logistics, and integrating digital supply chain management to ensure timely delivery. Competitive differentiation arises from proprietary steel compositions, process innovation, regional presence, and the ability to cater to industry-specific mechanical and dimensional requirements, ensuring relevance across automotive, construction, and heavy machinery sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.1 billion |

| Composition | Low alloy steel bars, Medium alloy steel bars, High alloy steel bars, Stainless steel bars, and Others |

| Alloying Elements | Nickel, Chromium, Molybdenum, Vanadium, Manganese, Silicon, Multi-element alloys, and Others |

| Processing Method | Hot-rolled alloy steel bars and Cold-finished alloy steel bars |

| End Use | Automotive industry, Aerospace and defense, Construction and infrastructure, Machinery and equipment, Oil and gas industry, Power generation, Railway and transportation, Heavy engineering, Tool and die manufacturing, and Other applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcelorMittal, Tata Steel, Nippon Steel, JFE Steel, POSCO, USA Steel, Steel Dynamics, and Other regional and domestic producers |

| Additional Attributes | Dollar sales, share by product type, segment growth rates, end-use demand, pricing trends, capacity utilization, import-export dynamics, regulatory impact, and competitive positioning. |

The global hot rolled or cold finished alloy steel bars market is estimated to be valued at USD 30.1 billion in 2025.

The market size for the hot rolled or cold finished alloy steel bars market is projected to reach USD 53.9 billion by 2035.

The hot rolled or cold finished alloy steel bars market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in hot rolled or cold finished alloy steel bars market are low alloy steel bars, medium alloy steel bars, high alloy steel bars, stainless steel bars and others.

In terms of alloying elements, nickel segment to command 22.0% share in the hot rolled or cold finished alloy steel bars market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Hot Fill Packaging Manufacturers

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Hot Melt Equipment Market

Hot and Cold System Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA