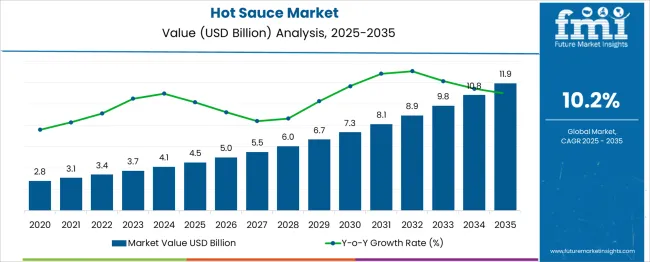

The Hot Sauce Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 11.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period. The growth trajectory shows consistent acceleration in market size, with annual increases in value driven by evolving consumer preferences for bold, spicy flavors across a range of cuisines. Starting at USD 4.5 billion in 2025, the market exhibits an incremental growth of USD 0.5 billion each year for the first five years, reaching USD 6.7 billion by 2030.

The compound annual growth rate during this period is approximately 8.4%, reflecting an initial phase of steady demand expansion. In the latter half of the forecast, from 2030 to 2035, the market experiences stronger growth, with USD 5.2 billion added, reflecting a 10.9% CAGR. This phase sees heightened demand for artisanal and premium hot sauces, as well as a surge in international and regional flavor varieties.

The increasing integration of hot sauces in the foodservice sector, alongside rising consumer interest in international cuisine and spice-based culinary experiences, contributes to this robust expansion. By the final year of the forecast, the market will have nearly tripled its 2025 value, positioning it as a significant player in the global condiment industry.

| Metric | Value |

|---|---|

| Hot Sauce Market Estimated Value in (2025 E) | USD 4.5 billion |

| Hot Sauce Market Forecast Value in (2035 F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The hot sauce market is witnessing steady global expansion, fueled by rising consumer appetite for spicy and ethnic food flavors across both developed and emerging economies. This demand is being supported by shifting culinary preferences, increased cross-border food consumption, and the influence of global cuisines on mainstream diets.

Manufacturers are investing in diversified flavor profiles and natural ingredients to cater to health-conscious consumers, while simultaneously launching region-specific product lines to meet localized taste preferences. Growth in the foodservice industry, paired with growing supermarket shelf space for international condiments, has accelerated visibility and trial of new hot sauce variants.

Furthermore, advancements in preservation technology and packaging innovation are enabling extended shelf life and better heat retention, enhancing market penetration. Looking forward, continued experimentation with fusion ingredients and rising demand for artisanal and clean-label sauces are expected to shape the competitive trajectory of the market.

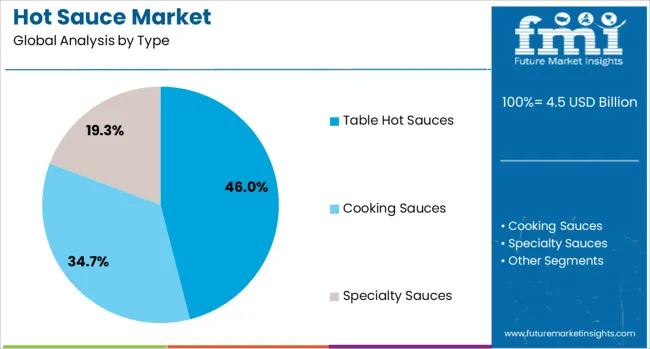

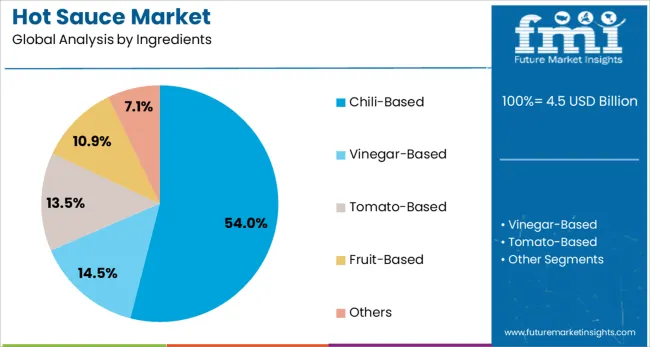

The hot sauce market is segmented by type, ingredients, packaging, distribution channel, and geographic regions. The hot sauce market is divided into Table Hot Sauces, Cooking Sauces, and Specialty Sauces. In terms of ingredients, the hot sauce market is classified into Chili-Based, Vinegar-Based, Tomato-Based, Fruit-Based, and others.

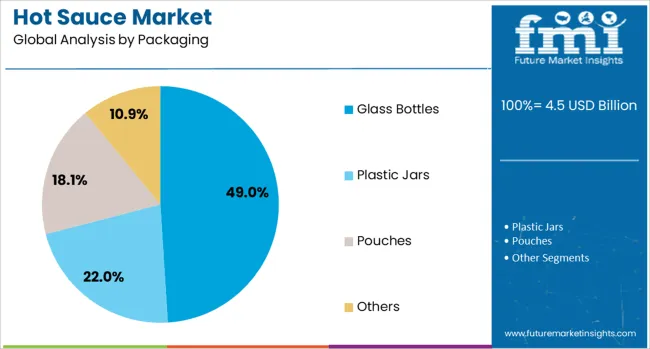

The packaging of the hot sauce market is segmented into Glass Bottles, Plastic Jars, Pouches, and others. The distribution channel of the hot sauce market is segmented into Retail Stores, Online Retail, and Food Service. Regionally, the hot sauce industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Table hot sauces are expected to lead the product type segment with 46.0% of total market revenue in 2025. Their prominence is being driven by consistent usage in household and foodservice settings, where convenience, familiarity, and versatility play a major role in daily consumption.

These sauces are favored for their balanced heat profile, compatibility with a wide variety of dishes, and shelf stability without refrigeration. As dining trends evolve toward customization and flavor enhancement, table hot sauces remain an essential condiment across quick-service restaurants and home kitchens alike.

Their continued presence on dining tables and restaurant counters has reinforced habitual consumption, while brand loyalty and multipack offerings have supported sustained volume growth across regions.

Chili-based variants are projected to account for 54.0% of market share by 2025, establishing them as the dominant ingredient base in hot sauce production. This segment’s growth has been propelled by chili’s wide sensory range, heat versatility, and nutritional attributes including capsaicin content, which is increasingly being linked to metabolic health benefits.

Chili peppers offer regional authenticity, making them essential to culturally rooted recipes and regional product differentiation. The scalability of chili cultivation and the availability of a wide spectrum of heat levels and flavor notes have encouraged product innovation.

Additionally, clean-label movements have favored chili-based sauces due to their simple, recognizable ingredients and minimal processing, further strengthening their market hold.

Glass bottles are anticipated to contribute 49.0% of the total packaging revenue in 2025, making them the preferred packaging format in the hot sauce market. Their popularity is being supported by premium positioning, product visibility, and chemical inertness that preserves flavor and aroma integrity over time.

Glass packaging is perceived as more sustainable and recyclable than plastic alternatives, aligning with increasing consumer and regulatory focus on eco-conscious consumption. The tactile and visual appeal of glass also supports shelf differentiation, especially in gourmet and artisanal product lines.

As branding becomes more design-focused, glass bottles offer a superior canvas for label presentation and embossing, contributing to enhanced brand recall and perceived product quality.

Increasing consumer demand for bold flavors, spiciness, and unique culinary experiences has driven significant growth in hot sauce. With wide applications across foodservice, retail, and home cooking, hot sauce has become a globally favored condiment. The rise in popularity of ethnic cuisines, especially Mexican, Asian, and Caribbean, has further fueled this demand, alongside growing interest in natural and organic food products. Manufacturers continue to innovate with new flavor profiles, varying heat levels, and diverse packaging formats, catering to a broad spectrum of consumer preferences and driving global expansion.

The growing popularity of ethnic cuisines, particularly Mexican, Asian, and Caribbean, has significantly boosted the demand for hot sauce globally. As consumers become more adventurous with their food choices, they are increasingly exploring new and bold flavors. Hot sauce is becoming a staple in many households, used not only as a condiment but also as an ingredient in cooking. The increasing focus on bold flavors and spiciness, along with the rise of global food trends, has positioned hot sauce as a versatile and essential kitchen item. Additionally, health-conscious consumers are seeking natural and organic hot sauce options, which has further accelerated the demand for cleaner, preservative-free ingredients. This evolution in consumer taste and preference continues to drive growth across retail, foodservice, and home cooking segments.

The hot sauce industry faces significant competition with a wide variety of established brands and new entrants offering unique flavors and formulations. Differentiation becomes difficult as many products may overlap in terms of taste profiles, ingredients, and heat levels. Cost pressure from competitors can also lead to price wars, affecting profit margins. Additionally, the complexity of maintaining the consistency of flavor, heat, and quality throughout the shelf life of hot sauces remains a challenge. The need to preserve freshness without using artificial preservatives adds pressure on manufacturers. Also, regional flavor preferences create a fragmented market, with some areas demanding more exotic, bold flavors, while others prefer milder options. These challenges make market penetration and product differentiation difficult, particularly for new brands or smaller players.

Significant opportunities are emerging in the development of new flavor profiles, such as fruit-infused, smoky, or fermented hot sauces, which cater to niche consumer preferences. The increasing consumer demand for organic, low-sodium, and sugar-free hot sauces is driving innovation in healthier alternatives. There’s a growing trend of pairing hot sauce with beverages like cocktails, further diversifying its use. Withe rise of e-commerce and online food communities, direct-to-consumer sales are becoming more accessible for brands. The growing trend of plant-based and vegan diets also provides an opportunity for hot sauce brands to cater to this segment with clean-label, vegan-friendly ingredients. Expansion into international markets where spicy foods are gaining traction presents another avenue for growth, particularly in emerging economies with rising disposable incomes.

A key trend in the hot sauce industry is premiumization, where consumers are willing to pay more for high-quality, artisanal sauces made from unique ingredients or with bold flavor profiles. The demand for sauces with distinctive tastes, such as fermented, smoky, or aged hot sauces, has led to the creation of niche products targeting gourmet food enthusiasts. There’s also an increasing interest in health-conscious variants, with hot sauce brands focusing on organic, low-sodium, and sugar-free formulations to cater to health-conscious consumers. The growing use of social media, food bloggers, and influencers has driven awareness and introduced new flavors to broader audiences. Eco-friendly labeling are becoming a focal point for consumers who prioritize environmental impact, influencing brands to innovate in packaging while maintaining product quality.

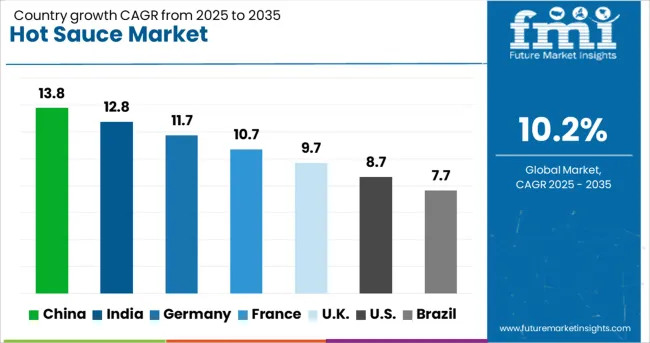

| Country | CAGR |

|---|---|

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| France | 10.7% |

| UK | 9.7% |

| USA | 8.7% |

| Brazil | 7.7% |

The hot sauce market is projected to grow globally at a CAGR of 10.2% from 2025 to 2035. Among the top five profiled markets, China leads at 13.8%, followed by India at 12.8%, while Germany posts 11.7%, France records 10.7%, and the United Kingdom stands at 9.7%. These growth rates reflect a premium of +35% for China and +25% for India compared to the global baseline, while Germany remains slightly ahead at +15%, and the UK and the US trail at -4% and -15%, respectively. The divergence is driven by the rising demand for spicy and bold flavors in emerging markets like China and India, while mature markets such as the USA and the UK show moderate growth due to increased awareness of the health benefits and versatility of hot sauces in culinary applications. The analysis spans over 40 countries, with the leading markets detailed below

China is projected to grow at a CAGR of 13.8% through 2035, driven by the increasing popularity of bold, spicy flavors in local cuisine and an expanding middle class with evolving food preferences. Hot sauce is being widely adopted in both traditional Chinese dishes and modern fusion recipes. The demand for hot sauce is particularly high in regions with a rich culinary tradition of spicy foods, such as Sichuan, Hunan, and Xinjiang. International brands are entering the market to cater to the growing interest in global food trends, while local manufacturers are capitalizing on the demand for regional hot sauce varieties. The younger generation’s increasing exposure to international flavors through online platforms is further fueling the market growth.

India is expected to grow at a CAGR of 12.8% through 2035, supported by a strong demand for spicy condiments across diverse food categories. Hot sauce is becoming an integral part of Indian culinary traditions, particularly in street food, snacks, and international dishes such as pizza and burgers. The growing popularity of fast food, coupled with the rise in disposable incomes, is driving consumption of hot sauce among younger, more adventurous consumers. Indian consumers are increasingly drawn to global hot sauce brands that offer unique flavor profiles, as well as local varieties that complement regional cuisines. Expansion of e-commerce platforms is making hot sauce more accessible across urban and rural areas.

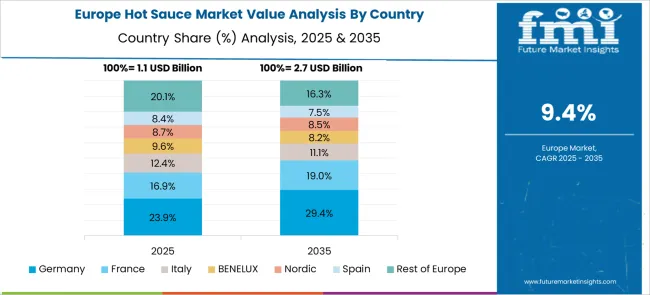

Germany is projected to achieve a CAGR of 11.7% through 2035, supported by growing interest in international cuisines and the rising popularity of spicy condiments in mainstream cooking. Hot sauce is being used more frequently in fusion cuisine, particularly in the grilling and barbecue segments, where bold flavors are increasingly appreciated. German consumers are opting for both traditional and gourmet hot sauces, including organic and artisanal varieties. The market for hot sauce is also benefiting from the expanding health-conscious food trends, with many consumers seeking sauces made with natural ingredients and offering functional benefits such as improved digestion. As awareness of global culinary trends grows, German consumers are experimenting with diverse flavors and heat intensities in their daily meals.

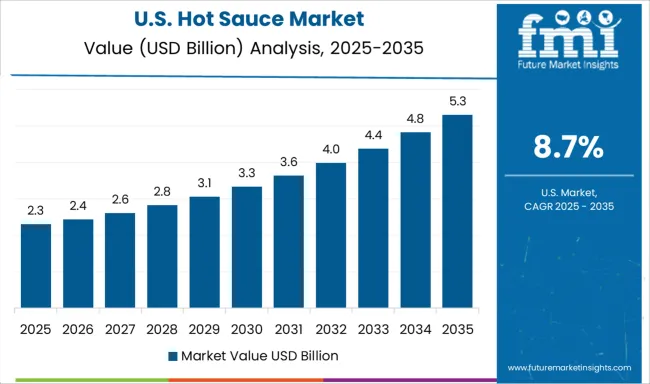

The United States is projected to grow at a CAGR of 8.7% through 2035, driven by the increasing demand for spicy condiments among health-conscious consumers and the popularity of ethnic and gourmet foods. Hot sauce is becoming a staple in many households, especially among millennials and Gen Z, who use it as a flavor enhancer for a wide variety of foods. The growing awareness of hot sauce's health benefits, such as aiding digestion and boosting metabolism, is helping expand its usage beyond traditional Mexican and American dishes. Additionally, the growing trend of clean-label products, combined with the explosion of regional and artisanal varieties, is driving new innovations in the market.

The United Kingdom is projected to grow at a CAGR of 9.7% through 2035, driven by increasing consumer interest in bold and spicy flavors. Hot sauce is gaining popularity among younger consumers, particularly Gen Z and millennials, who are seeking exotic chili-flavored condiments to complement snacks and home-cooked dishes. The rise of food trends such as fusion cuisines and the growing influence of social media on food choices are contributing to the demand for hot sauce. Retailers are responding by offering a wider variety of hot sauce products, including artisanal and gourmet options, to cater to evolving consumer preferences.

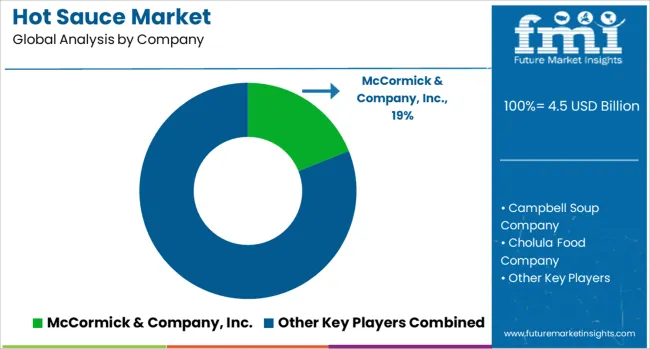

The hot sauce market is highly competitive, with a mix of legacy brands, regional players, and emerging artisanal producers focusing on delivering unique, flavorful, and spicy condiments for diverse culinary preferences. McCormick & Company, Inc. is a dominant player with its popular Frank's RedHot brand, offering a wide variety of hot sauce options for both retail and foodservice sectors.

Conagra Brands, Inc. strengthens its market position through brands like Hunt's and RedHot, focusing on affordability and mass-market distribution. Huy Fong Foods, Inc., known for its iconic Sriracha, continues to lead the niche market for Asian-inspired hot sauces, achieving significant global recognition. Campbell Soup Company and The Kraft Heinz Company cater to a wide consumer base with mainstream hot sauces under the Tabasco and Heinz labels, offering different heat levels and flavor variants to suit a broad range of tastes.

Regional players such as Cholula Food Company and La Costeña specialize in traditional Mexican hot sauces, leveraging strong distribution networks and loyal consumer bases. Emerging brands like Heartbeat Hot Sauce and Torchbearer Sauces offer unique, premium, and small-batch hot sauces, appealing to gourmet consumers and those seeking differentiated flavors.

Grupo Herdez and Marie Sharp’s Fine Foods Ltd. cater to Latin American and Caribbean consumers with authentic, culturally-rooted offerings. New entrants such as Truff have gained traction in the premium market with truffle-infused hot sauces, capitalizing on the growing demand for gourmet, high-quality condiments. Pepper Palace, Inc. and Unilever continue to expand through both mass-market channels and specialty online retail platforms.

In the hot sauce market, companies are focusing on product diversification, cultural engagement, and strategic partnerships. Innovation is key, with brands introducing unique flavors like gourmet, fermented, and truffle-infused hot sauces to cater to premium consumers. Social media and celebrity endorsements are being leveraged to appeal to younger, adventurous consumers seeking bold flavors. Collaborations with foodservice providers and restaurants expand market reach and integrate hot sauces into various dishes. The partnerships with retailers improve availability across both physical and online platforms. These strategies are boosting growth by enhancing brand visibility and responding to shifting consumer preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Type | Table Hot Sauces, Cooking Sauces, and Specialty Sauces |

| Ingredients | Chili-Based, Vinegar-Based, Tomato-Based, Fruit-Based, and Others |

| Packaging | Glass Bottles, Plastic Jars, Pouches, and Others |

| Distribution Channel | Retail Stores, Online Retail, and Food Service |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | McCormick & Company, Inc., Campbell Soup Company, Cholula Food Company, Conagra Brands, Inc., Grupo Herdez, Heartbeat Hot Sauce, Huy Fong Foods, Inc., La Costeña, Marie Sharp’s Fine Foods Ltd., McIlhenny Company, Pepper Palace, Inc., The Kraft Heinz Company, Torchbearer Sauces, Truff, and Unilever |

| Additional Attributes | Dollar sales by product type (mild, medium, hot, super-hot, gourmet) and end-use segments (foodservice, retail, online sales). Demand dynamics across global spicy food trends, increasing popularity of unique and exotic hot sauces, and a growing preference for premium, health-conscious products. Regional trends in North America and Europe show growing demand for diverse heat levels and artisanal hot sauces, while Latin America continues to be the key producer of traditional hot sauces. Innovation trends include novel ingredients, such as exotic peppers and fruits, low-sodium or probiotic-based options, and expanding product lines for gourmet and health-conscious consumers. |

The global hot sauce market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the hot sauce market is projected to reach USD 11.9 billion by 2035.

The hot sauce market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in hot sauce market are table hot sauces, cooking sauces and specialty sauces.

In terms of ingredients, chili-based segment to command 54.0% share in the hot sauce market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Hot Air Sterilization Dust Mite Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot and Cold System Market Forecast and Outlook 2025 to 2035

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Hot Runner Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Hot Fill Packaging Manufacturers

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA