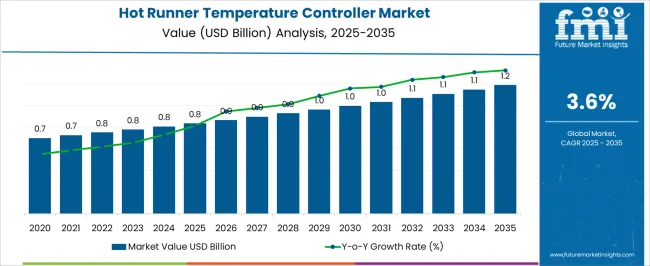

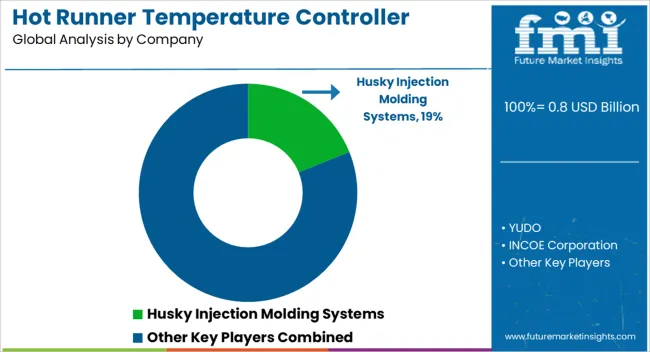

The hot runner temperature controller market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

Growth is being driven by expanding plastic injection molding operations across automotive, packaging, and consumer goods sectors. Manufacturers are increasingly adopting precision temperature controllers to enhance mold efficiency, reduce cycle times, and improve product quality. Demand is further stimulated by the rising integration of automated systems and energy-efficient solutions in injection molding facilities. Asia-Pacific continues to dominate due to large-scale manufacturing hubs in China, India, and Southeast Asia, while North America and Europe focus on high-precision, industrial-grade controllers for specialized applications. The market is characterized by technological differentiation, with multi-zone controllers, real-time monitoring, and digital interface systems gaining prominence.

Competitive strategies include R&D investments, product customization, and strategic partnerships with mold and machinery suppliers to enhance adoption. Challenges such as high initial costs, system compatibility, and maintenance requirements are influencing procurement decisions. Forecasts suggest that increasing adoption in automotive EV components, medical devices, and high-precision packaging molds will drive incremental revenue. Regional expansions, aftermarket services, and integration with smart factory solutions are expected to strengthen market penetration and long-term revenue potential.

| Metric | Value |

|---|---|

| Hot Runner Temperature Controller Market Estimated Value in (2025 E) | USD 0.8 billion |

| Hot Runner Temperature Controller Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The hot runner temperature controller market is strongly influenced by five interconnected parent markets, each contributing distinctly to overall demand and growth. The automotive and transportation market holds the largest share at 30%, driven by the rising use of injection-molded components in vehicles, including bumpers, dashboards, and interior trim, where precise temperature control ensures consistent quality and dimensional accuracy. The packaging market contributes 25%, as food, beverage, and consumer goods manufacturers demand reliable temperature controllers to maintain mold consistency, reduce cycle times, and ensure high-quality molded packaging products.

The electrical and electronics market accounts for 20%, where housings, connectors, and precision components require hot runner systems capable of handling sensitive materials without defects. Industrial machinery and equipment represent 15%, as manufacturers integrate temperature-controlled molds in complex assemblies, gears, and functional parts to improve production efficiency. The medical and healthcare sector holds a 10% share, driven by molded components for medical devices, diagnostic tools, and surgical instruments that require strict compliance with quality and safety standards. Collectively, automotive, packaging, and electronics segments account for 75% of overall demand, emphasizing that high-precision and high-volume manufacturing applications remain the primary growth drivers, while industrial machinery and medical devices provide complementary opportunities for expansion globally.

The hot runner temperature controller market is being driven by the rising adoption of precision molding solutions in sectors demanding high-quality, defect-free plastic components. The current landscape reflects growing integration of multi-zone control systems to ensure uniform heat distribution, reduced cycle times, and enhanced operational efficiency. Manufacturers are focusing on optimizing control accuracy and energy efficiency to meet the evolving requirements of automotive, consumer goods, and packaging industries.

Increasing emphasis on minimizing material waste and improving production repeatability has reinforced the role of advanced temperature control systems. Competitive pricing strategies, coupled with modular and scalable designs, are enabling broader adoption across small to large-scale injection molding operations.

Over the forecast period, technological advancements in sensor accuracy, real-time monitoring, and IoT-enabled systems are expected to enhance production capabilities and drive market penetration, particularly in regions with expanding manufacturing bases Supply chain enhancements and targeted after-sales services are likely to further strengthen long-term customer retention and market growth potential.

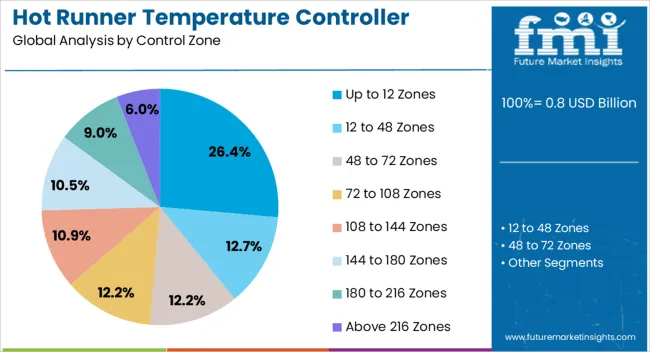

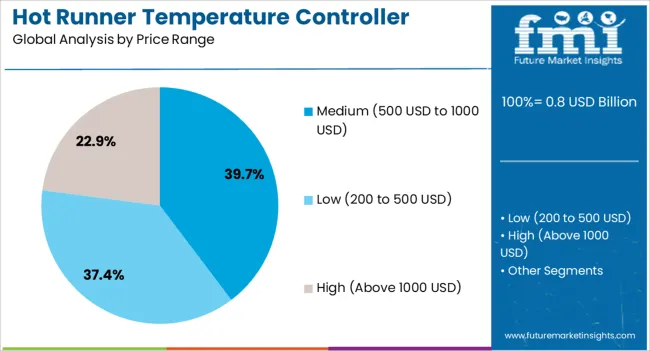

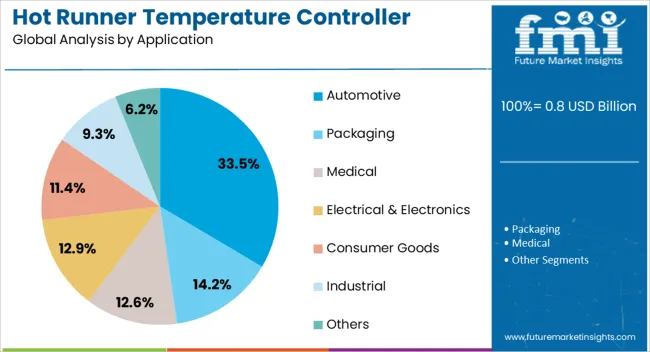

The hot runner temperature controller market is segmented by control zone, price range, application, distribution channel, and geographic regions. By control zone, hot runner temperature controller market is divided into up to 12 zones, 12 to 48 zones, 48 to 72 zones, 72 to 108 zones, 108 to 144 zones, 144 to 180 zones, 180 to 216 zones, and above 216 zones. In terms of price range, hot runner temperature controller market is classified into medium (500 USD to 1000 USD), low (200 to 500 USD), and high (Above 1000 USD). Based on application, hot runner temperature controller market is segmented into automotive, packaging, medical, electrical & electronics, consumer goods, industrial, and others. By distribution channel, hot runner temperature controller market is segmented into direct sales and indirect sales. Regionally, the hot runner temperature controller industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The up to 12 zones category, holding 26.4% of the control zone segment, has maintained its lead due to its cost-effectiveness, versatility, and suitability for a broad range of small to mid-scale molding applications. Its compact design and ability to provide precise temperature regulation across multiple zones without excessive complexity have supported adoption in diverse manufacturing environments.

This configuration is favored for balancing performance and operational simplicity, reducing both setup time and maintenance requirements. Production efficiency improvements, coupled with enhanced compatibility with different hot runner systems, have reinforced its market share.

Demand sustainability is being supported by industries prioritizing consistent part quality while managing operational costs Integration of digital interfaces and alarm systems is further enhancing user control, making the up to 12 zones configuration a preferred choice for manufacturers seeking optimal process stability and cost management within the hot runner temperature controller market.

The medium price range, between USD 500 and USD 1000, commanding 39.7% of the price range category, is leading due to its balance between affordability and advanced functionality. This range caters to buyers who prioritize high performance without incurring the costs associated with premium models.

Products in this segment typically offer robust temperature control precision, multi-zone capacity, and user-friendly interfaces, meeting the operational needs of mid-sized manufacturers. The competitive positioning of this range has been strengthened by the availability of modular systems that can be upgraded as production needs evolve.

Adoption has been further supported by reliable after-sales service and extended warranty offerings, ensuring sustained operational efficiency for end users As manufacturing facilities continue to optimize capital expenditure while seeking advanced technical capabilities, the medium price range is expected to remain a dominant choice, driving steady revenue growth in the hot runner temperature controller market.

The automotive sector, accounting for 33.5% of the application category, is the largest end-use segment due to its stringent quality requirements, high production volumes, and reliance on precision-molded components. Hot runner temperature controllers in this sector are essential for ensuring uniform part quality, reducing cycle times, and supporting complex mold designs used in vehicle interiors, exteriors, and functional components.

The segment’s leadership is reinforced by continuous innovation in electric and hybrid vehicle manufacturing, which demands intricate plastic parts with tight tolerances. The automotive industry’s focus on lightweighting and the use of advanced polymers has further increased reliance on precise temperature control.

Stable investment in tooling and injection molding capabilities by automotive OEMs and tier suppliers is sustaining demand Over the forecast period, ongoing model upgrades, expanding production capacities in emerging markets, and the integration of Industry 4.0 technologies in automotive manufacturing are expected to secure the segment’s dominant role in the hot runner temperature controller market.

The hot runner temperature controller market is primarily driven by automotive, packaging, industrial, and healthcare applications. Precise temperature control, durability, and operational efficiency remain key factors influencing adoption globally.

The automotive sector drives significant demand for hot runner temperature controllers due to the growing production of injection-molded components like dashboards, bumpers, and interior fittings. Precise temperature control ensures consistent product quality, reduces defect rates, and improves cycle efficiency. Manufacturers are integrating multi-zone controllers to manage complex molds and high-volume production lines. Automotive suppliers are seeking controllers that enhance operational reliability, minimize material waste, and optimize energy usage during molding. The shift toward electric vehicles also increases the need for lightweight, high-precision plastic components, further boosting adoption. Expansion of assembly plants, production of EV battery casings, and demand for aesthetic parts create opportunities for high-performance hot runner solutions across global automotive hubs.

The packaging industry significantly contributes to market growth as hot runner temperature controllers are used in the production of food, beverage, and consumer packaging components. Molded trays, caps, bottles, and containers require precise temperature management to ensure structural integrity and aesthetic consistency. Manufacturers focus on reducing cycle times while maintaining product durability and minimizing material waste. Demand for efficient controllers is further fueled by growth in e-commerce and high-volume packaging operations. Multi-cavity molds, flexible polymer materials, and specialized designs necessitate controllers with consistent thermal regulation. Players offering reliable, low-maintenance, and energy-efficient solutions gain higher adoption among packaging converters and large-scale production units.

Industrial machinery and equipment manufacturing contributes significantly to the hot runner temperature controller market, particularly for producing gears, functional parts, and complex assemblies. Controllers are valued for their precision, repeatability, and capacity to manage multi-zone molds in high-volume environments. Manufacturers emphasize durable, low-maintenance, and high-performance systems to reduce downtime and improve productivity. Integration with automated production lines and modular molds supports efficient material flow and optimized cycle times. Demand is especially strong in sectors requiring high-strength plastic components with tight tolerances. Investments in advanced materials, long-lasting components, and reliable temperature regulation solutions are helping companies maintain competitive advantage across machinery, equipment, and automotive supply chains.

Medical and healthcare applications are emerging as key drivers for hot runner temperature controllers. Components for diagnostic tools, surgical instruments, and medical housings require precise molding conditions to meet strict quality and safety standards. High-performance controllers ensure uniform temperature distribution, reducing defects and material inconsistencies. Sterilization compatibility, corrosion resistance, and low-maintenance designs are increasingly prioritized by medical device manufacturers. Growth in medical device production, diagnostic equipment, and surgical consumables creates opportunities for specialized hot runner solutions. Suppliers focusing on reliability, modularity, and compliance with regulatory standards are achieving higher adoption. Hospitals, laboratories, and medical equipment manufacturers continue to drive incremental demand for accurate and consistent molding processes.

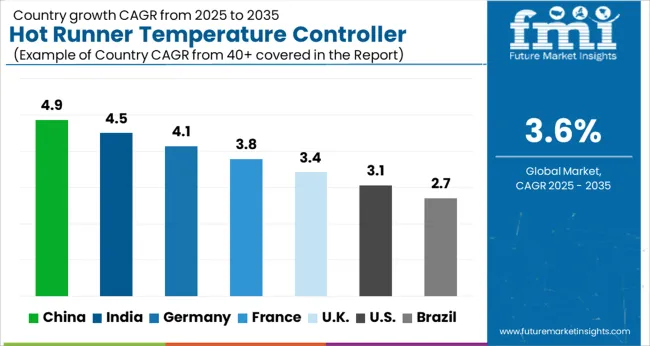

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

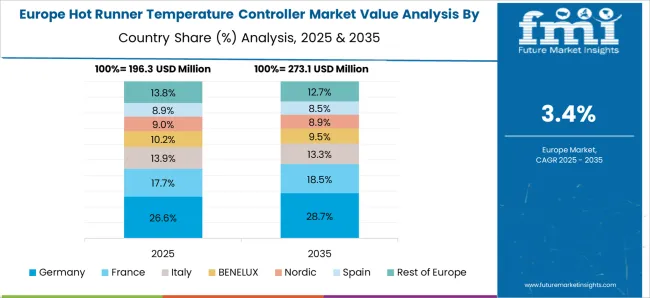

The global hot runner temperature controller market is projected to grow at a CAGR of 3.6% from 2025 to 2035. China leads at 4.9%, followed by India at 4.5%, Germany at 4.1%, the UK at 3.4%, and the USA at 3.1%. Market expansion is driven by automotive, packaging, industrial machinery, and medical device applications requiring precise mold temperature control, high efficiency, and consistent product quality. Adoption is supported by multi-zone controllers, digital monitoring systems, and energy-efficient solutions in injection molding operations. Asia shows rapid growth due to large-scale manufacturing hubs, while Europe and North America emphasize high-precision, specialized applications. Partnerships, R&D, and integration with automated production systems are key enablers for market development. The analysis includes over 40+ countries, with the leading markets detailed below.

The hot runner temperature controller market in China is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by rapid expansion in automotive manufacturing, packaging production, and industrial machinery sectors. Demand is fueled by the need for precise temperature control in injection molding processes for dashboards, bumpers, food packaging, and industrial components. Domestic manufacturers are scaling up production and investing in multi-zone controllers, digital interfaces, and energy-efficient solutions to improve process reliability and reduce cycle times. E-commerce growth and high-volume packaging operations further increase adoption of advanced temperature controllers. Partnerships with European and North American suppliers provide access to specialized components and high-precision systems, enabling local OEMs to meet international quality standards.

The hot runner temperature controller market in India is expected to grow at a CAGR of 4.5% from 2025 to 2035, supported by industrial infrastructure development, automotive production, and expanding packaging operations. The demand for controllers capable of maintaining uniform mold temperature, reducing defects, and enhancing efficiency is increasing across injection molding facilities. Domestic manufacturers focus on durable, modular, and easy-to-maintain controllers for automotive, packaging, and consumer goods applications. E-commerce, cold-chain logistics, and medical device manufacturing are accelerating adoption of precise and reliable temperature control systems. Collaborations with international technology partners are facilitating access to advanced digital control solutions, ensuring compatibility with high-speed molding machines and multi-cavity molds.

The hot runner temperature controller market in Germany is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by high-precision manufacturing in automotive, industrial machinery, and medical device sectors. Demand is rising for controllers capable of handling multi-cavity molds, maintaining consistent temperatures, and improving production efficiency. German manufacturers emphasize robust, low-maintenance, and energy-efficient solutions that comply with stringent quality and safety standards. Adoption is particularly strong in automotive OEMs, precision engineering firms, and medical component manufacturers requiring high repeatability and minimal material waste. Integration with automated production lines and smart factory solutions further supports market expansion. Partnerships with global suppliers provide access to advanced components and software-enabled temperature monitoring.

The hot runner temperature controller market in the UK is expected to grow at a CAGR of 3.4% from 2025 to 2035, driven by demand in automotive, packaging, and medical device manufacturing. Controllers are being adopted to improve mold efficiency, reduce defect rates, and optimize cycle times across injection molding operations. Manufacturers are focusing on versatile, durable, and easy-to-operate temperature control systems suitable for multi-zone molds and high-volume production. Growth in e-commerce packaging, industrial machinery, and precision healthcare components is further supporting demand. Domestic production is complemented by global imports, enabling access to advanced features such as digital monitoring, remote diagnostics, and energy-efficient systems. Strategic partnerships with international technology providers enhance system capabilities and reliability.

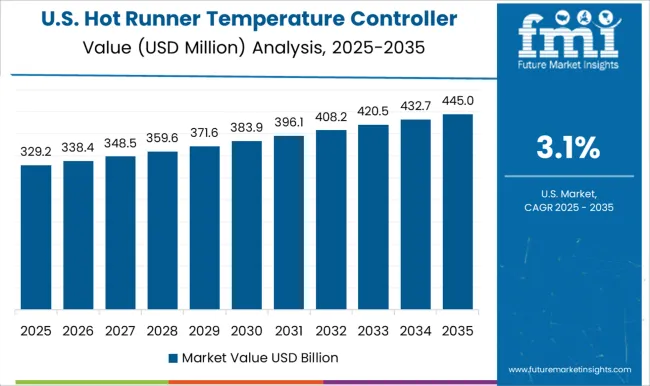

The hot runner temperature controller market in the USA is projected to grow at a CAGR of 3.1% from 2025 to 2035, fueled by automotive manufacturing, medical device production, and packaging operations. Demand is driven by the need for precise temperature regulation, consistent product quality, and reduced cycle times in injection molding facilities. Manufacturers focus on heavy-duty, multi-zone, and energy-efficient controllers capable of handling large molds and high-speed production. Adoption is particularly strong in EV component manufacturing, medical consumables, and consumer packaging applications. Integration with automated production lines and predictive maintenance systems is increasingly emphasized. Collaborations with global technology suppliers provide access to high-performance, durable components and digital monitoring solutions that ensure operational reliability and compliance with industry standards.

Competition in the hot runner temperature controller market is defined by precision, reliability, and efficiency for demanding injection molding applications across automotive, packaging, industrial, and medical sectors. Husky Injection Molding Systems leads with advanced temperature control units offering multi-zone regulation, digital monitoring, and energy-efficient operation suitable for high-volume automotive and packaging production. YUDO differentiates through modular, customizable controllers designed for precision molds and specialized applications, emphasizing durability and operational flexibility.

INCOE Corporation focuses on high-performance systems with rapid response times, accurate temperature management, and integration with automated injection molding lines, catering to automotive, consumer goods, and medical device manufacturers. HRSflow competes with highly responsive and compact controllers engineered for multi-cavity molds, consistent thermal uniformity, and enhanced energy efficiency. FISA Corporation emphasizes reliability, ease of maintenance, and compatibility with various mold designs, targeting high-precision industrial and packaging applications. Other market players, including Mold-Masters, Synventive, and Molds & Hot Runners, compete by offering cost-effective solutions, multi-zone systems, and aftermarket support for existing molding operations.

Strategies focus on reducing cycle times, ensuring consistent product quality, and minimizing energy consumption. Product development emphasizes digital interfaces, remote diagnostics, predictive maintenance, and integration with smart factory operations. Partnerships with OEMs, molders, and technology providers are leveraged to develop tailored solutions and accelerate adoption. Technical support, system calibration, and retrofit services are marketed to maximize uptime and operational efficiency. Brochures highlight controller capacity, number of zones, response time, temperature uniformity, energy consumption, and compatibility with different polymers, reflecting a market focused on precision, efficiency, and high-performance injection molding operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.8 billion |

| Control Zone | Up to 12 Zones, 12 to 48 Zones, 48 to 72 Zones, 72 to 108 Zones, 108 to 144 Zones, 144 to 180 Zones, 180 to 216 Zones, and Above 216 Zones |

| Price Range | Medium (500 USD to 1000 USD), Low (200 to 500 USD), and High (Above 1000 USD) |

| Application | Automotive, Packaging, Medical, Electrical & Electronics, Consumer Goods, Industrial, and Others |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Husky Injection Molding Systems, YUDO, INCOE Corporation, HRSflow, and FISA Corporation |

| Additional Attributes | Dollar sales, market share, CAGR trends, key applications, end-user demand, competitive landscape, material compatibility, price benchmarks, growth drivers, distribution channels, and regulatory standards. |

The global hot runner temperature controller market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the hot runner temperature controller market is projected to reach USD 1.2 billion by 2035.

The hot runner temperature controller market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in hot runner temperature controller market are up to 12 zones, 12 to 48 zones, 48 to 72 zones, 72 to 108 zones, 108 to 144 zones, 144 to 180 zones, 180 to 216 zones and above 216 zones.

In terms of price range, medium (500 usd to 1000 usd) segment to command 39.7% share in the hot runner temperature controller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot and Cold System Market Forecast and Outlook 2025 to 2035

Hot Melt Intermediate Joint Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Hot And Cold Therapy Packs Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesive Tapes Market Size and Share Forecast Outlook 2025 to 2035

Hotplate Stirrers Market Size and Share Forecast Outlook 2025 to 2035

Hot Fill Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Hot Fill Packaging Manufacturers

Hot and Cold Therapy Market Trends – Size, Share & Forecast 2025-2035

Hotel Channel Management Market Analysis – Growth & Forecast 2024-2034

Hot Melt Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA