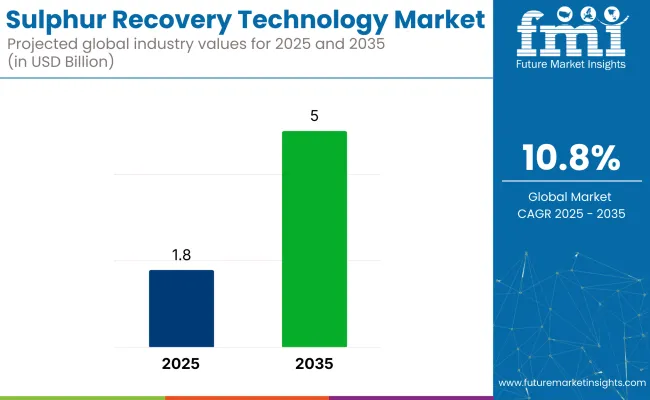

In 2025, the global sulphur recovery technology market has been valued at approximately USD 1.8 billion, with projections estimating a rise to USD 5.0 billion by 2035. Demand for sulphur recovery technology is expected to occur at a compound annual growth rate (CAGR) of 10.8% over the forecast period.

Surge in demand has been primarily driven by regulatory mandates aimed at curbing sulphur emissions from refineries, gas processing plants, and petrochemical facilities. With hydrogen sulphide recognized as a critical pollutant, the adoption of advanced recovery systems-particularly the Claus and tail gas treatment processes-has been prioritized across oil-rich economies and fast-industrializing nations.

As more stricter sulphur emission caps were enforced in regions such as the European Union and the Middle East, particularly under the International Maritime Organization’s (IMO) 2020 sulphur cap and EU Industrial Emissions Directive. Refineries in the Netherlands, Saudi Arabia, and India have been required to upgrade or retrofit their sulphur recovery units (SRUs) to comply with low-emission thresholds.

In Asia, India’s Numaligarh Refinery and Reliance Industries initiated major capacity upgrades in their Claus-based SRUs to meet Bharat Stage VI fuel standards. In the United States, ExxonMobil’s Baton Rouge facility has invested in additional tail gas clean-up systems to meet Louisiana’s environmental compliance targets set for 2026.

The expansion of the natural gas sector has also contributed significantly to the rise in demand for sulphur recovery systems. Sour gas fields in Canada’s Alberta Basin, Qatar’s North Field, and Iran’s South Pars have necessitated the installation of large-scale SRUs due to high H₂S content. In 2025, QatarEnergy awarded engineering contracts to multiple EPC players for the construction of new Claus process units and off-gas treating facilities, aiming to reduce flaring and enhance sulphur conversion rates.

Environmental sustainability goals have further reinforced the need for high-efficiency recovery systems. With Scope 1 and Scope 3 emissions being closely monitored by institutional investors, major oil and gas companies are under increasing pressure to report tangible sulphur mitigation outcomes. Carbon offset programs now include sulphur recovery metrics, especially in projects financed by multilateral development banks. This has elevated the importance of digital monitoring and process optimization technologies within the SRU landscape.

Innovation in process design and catalyst technologies is being increasingly observed in 2025. Modular SRUs with built-in diagnostics and AI-driven control systems are being deployed across Latin America and Sub-Saharan Africa, where refinery upgrades are part of broader energy diversification programs.

Companies like Shell, Technip Energies, and Comprimo are leading innovation by offering modular units with higher sulphur recovery efficiencies (above 99.5%) and low SO₂ emissions. In Chile, ENAP (Empresa Nacional del Petróleo) adopted AI-based SRU optimization software to reduce downtime and improve conversion efficiency across its Aconcagua refinery.

In addition, demand has been supported by the global fertilizer industry, which relies on sulphur as a key input. In 2025, companies in China, Morocco, and Brazil have increasingly adopted sulphur recovery solutions to convert gas-phase sulphur into elemental sulphur for downstream use in phosphate fertilizer production. This cross-sectoral integration has opened new avenues for market growth beyond conventional oil and gas applications.

Government support for clean fuel initiatives has also accelerated market uptake. Under China’s “Blue Sky Protection” initiative and India’s National Clean Air Programme (NCAP), funding incentives and tax benefits have been extended to refineries adopting low-emission sulphur technologies. In Southeast Asia, Indonesia’s Pertamina and Malaysia’s Petronas are implementing multi-train SRU configurations to meet regional emission norms and support downstream fuel exports.

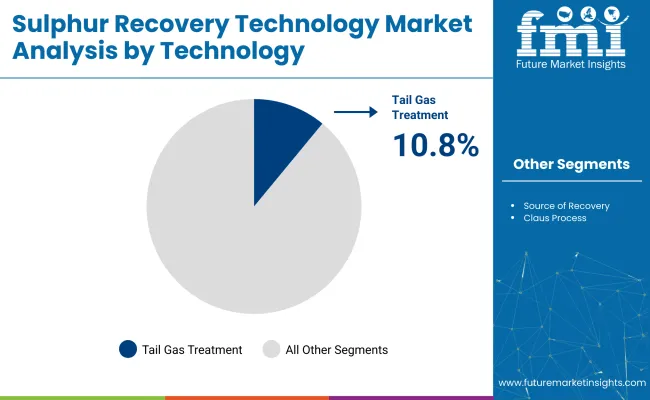

The sulphur recovery technology market is comprehensively segmented by technology type, source of recovery, and capacity type, each playing a vital role in shaping industry dynamics through 2035.

The tail gas treatment segment is projected to lead the sulphur recovery technology market, registering a robust CAGR of 10.8% between 2025 and 2035. This overall increase in demand can be attributed to the critical role tail gas treatment plays in enhancing overall sulphur recovery rates-often boosting efficiency from 95-97% with the Claus process alone to over 99.9% when both processes are integrated. Tail gas treatment technologies have been increasingly adopted in advanced refining and gas processing environments where regulatory pressure is mounting.

In the United States, the Environmental Protection Agency (EPA) has tightened emission standards under the Clean Air Act, pushing refiners like ExxonMobil and Valero to invest in high-performance tail gas cleanup units (TGCU) across facilities in Texas and Louisiana.

Similar initiatives have been observed in China, where national mandates on sulphur dioxide emissions have led Sinopec to retrofit older Claus units with modern tail gas conversion reactors and hydrogenation systems. The Middle East, with its high sulphur-content feedstocks, has also seen widespread deployment of tail gas treatment in mega-refineries operated by ADNOC and SABIC.

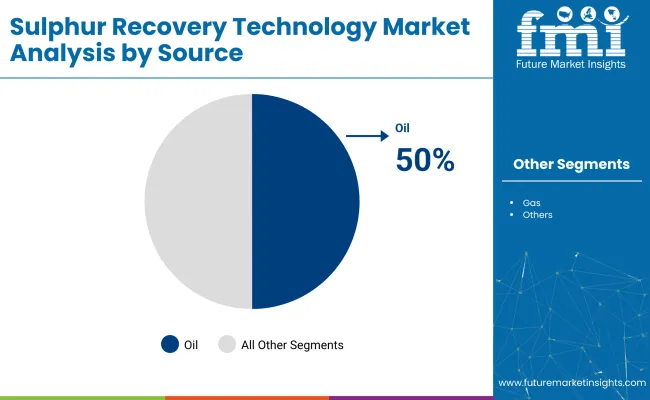

In 2025, the oil segment is expected to generate the highest revenue in the sulphur recovery technology market, accounting for nearly 50% of the total market share. This dominance is justified by the high sulphur content found in crude oil, especially in heavier grades sourced from the Middle East, Venezuela, and parts of Canada. As global energy demand continues to rise, refineries are being pushed to process higher volumes of sour crude, thereby increasing the need for sulphur recovery technologies.

For instance, India’s Jamnagar Refinery-one of the world’s largest-has ramped up its sulphur recovery capabilities in response to domestic and export-driven refining expansion. Similarly, Saudi Aramco has expanded sulphur treatment capacities in its Ras Tanura and Abqaiq plants to align with its broader environmental compliance goals under Vision 2030. These examples illustrate how oil refining remains the primary driver of H₂S-rich emissions, making sulphur recovery systems essential not only for regulatory compliance but also for monetizing sulphur as a secondary product in fertilizer and chemical applications.

As environmental standards become more stringent across North America, Europe, and Asia-Pacific, a steady increase in tail gas processing and sulphur removal from oil-derived sources is anticipated to remain a key market catalyst.

The market has been segmented based on capacity to cater to the differing operational scales of end users-from modular units for small-scale applications to high-throughput systems used in mega-refineries and gas processing hubs. Large-capacity systems are expected to dominate the market through 2035, driven by the need for centralized processing of high-volume sulphur emissions. For example, China's Yanchang Petroleum has deployed high-capacity Claus and tail gas treatment units capable of handling over 100 tonnes/day to comply with national sulphur dioxide emission limits.

In contrast, decentralized or mid-scale facilities in Southeast Asia and Latin America are adopting modular, lower-capacity systems that offer flexible deployment with reduced capex and opex. The trend toward integrating capacity expansion with digital process optimization is also being seen in regions like the USA Gulf Coast, where facilities are increasingly retrofitted with smart monitoring systems for predictive maintenance and throughput efficiency.

This segmentation by capacity type reflects the broader industry trend of adapting recovery infrastructure based on local resource availability, regulatory environments, and downstream integration goals.

Demand for sulphur recovery technology is growing in North America due to strict environmental legislation in the US and Canada. Due to the region's mature oil and gas industry and both legislative requirements as part of, among other things, the Clean Air Act, the demand for state-of-the-art sulphur recovery has continued to grow. In order to comply with strict sulphur dioxide emissions limit state-of-the-art Claus units and tail gas treatment technologies are being installed at refineries and gas processing facilities.

Aside from oil & gas industry, sulphur recovery technologies adoption is also being witnessed for applications in multiple chemical production & fertilizer manufacturing in North America. Against the backdrop of an energy transition underway in the region, strong sulphur recovery systems will be important to maintain its environmental and regulatory compliance obligations.

The market for sulphur recovery technology in Europe benefits from the strong environmental policies and developed industrial infrastructure in the region. Germany, Netherlands and the UK are world leaders in adoption of the best available techniques on emissions control, resulting in deploying high-efficiency sulphur recovery units in refineries and gas treatment plants. Tighter sulphur limits in the European Union’s Industrial Emissions Directive and other regional standards have spurred demand for enhanced recovery systems.

Their market is also being impacted by the growing presence of renewable and low-carbon energy initiatives. Besides traditional refining operations, the implementation of sulphur recovery technology in new biofuels and hydrogen generations are expected to continue consolidating Europe’s market stance. With ongoing progress towards sustainability goals to drive industry practices, Europe’s need for dependable, efficient sulphur recovery solutions is set to steadily.

The sulphur recovery technology market in the Asia-Pacific region is expected to grow at the highest CAGR due to rapidly industrializing economies, increasing oil and gas processing capacities, and stringent regulations regarding emissions reduction. In addition, countries like China, India and nations within Southeast Asia are allotting considerable funds towards developing/upgrading their gas processing and refining plants, creating lucrative prospects for high-end sulphur recovery systems.

Key drivers for the uptake of high-capacity sulphur recovery units include China’s strong petrochemical industry and India’s growing energy demand. Faced with increasingly stringent national and regional emission limits and environmental standards, industries are leveraging state-of-the-art Claus processes, tail gas treatment technologies and integrated monitoring solutions to help ensure compliance while maintaining efficient operations. The Asia-Pacific market will see significant growth as the region undergoes more industrial and economic growth yet focusing on sustainable development.

Challenges

Increased Compliance Expenses and Complicated Recovery Procedures

The sulphur recovery technology market grapples with challenges like strict environmental laws, increasing compliance costs, and complex recovery processes. As governments across the globe have implemented stringent emission control legislation to limit sulphur dioxide (SO₂) emissions from refineries, gas processing plants and the petrochemical industries, such legislations have made it mandatory for companies to adopt state-of-the-art sulphur recovery technology.

Nevertheless, the significant cost of installing and maintaining these systems, as well as the technical issues related to treating feedstock’s with differing sulphur concentrations, are expected to limit market growth. To address these problems companies should use low-cost recovery options and improve process automation with modular systems that can dynamically adjust to changing operational environments. Adoption of predictive maintenance strategies and enhancing the efficiency of the catalyst will lead to further optimization in sulphur recovery process along with an increase in operating cost.

Opportunity

Growing Clean Energy Projects and Sustainable Industrial Practices

Increasing focus towards clean-energy initiatives & sustainability will drive the Sulphur Recovery Technology Market which in turn will offer wide opportunities. As industries progressively shift towards green operations, a demand for efficient sulphur recovery units (SRUs) is rising to comply with regulatory mandates and reduce carbon footprints. Improvements in sulphur recovery, including multi-stage Claus process technology, oxygen enrichment, and tail gas treatment units (TGTUs), are increasing efficiency, with minimum emissions.

Moreover, the real-time gas analytics is increasingly adopted with AI based monitoring to enhance process control and safety in sulphur recovery plants. Investments in advanced recovery technologies, circular economy business models, and green operational policies will present a competitive edge in an ever more regulation-fuelled marketplace.

The period from 2020 to 2024 saw the Sulphur Recovery Technology Market grow as stricter emission regulations and a demand for cleaner industrial processes pushed this technology into more and more production lines. The sulphur recovery capacity was enlarged by oil refineries, gas processing plants and chemical manufacturers to comply with environmental regulations of the respective government authorities leading to wider acceptance of advanced Claus and sub-dew point processes.

Nonetheless, factors like high capital expenditure, complex process optimization, and volatility in raw materials hampered the expansion of the market. Companies are upgrading to be more efficient in recovery, implementing digital process control systems and optimizing plant configurations for lower emissions and higher sulphur yields.

From a 2025 to 2035 perspective, we expect the market to witness game-changing advancements in sulphur recovery efficiency, digital integration, and sustainable refining practices. AI-informed process automation, real-time gas analysis and self-regulating SRU technologies will help to improve recovery levels while decreasing the energy consumed to do so. Green hydrogen projects and CCUS technologies will be increasingly integrated with sulphur recovery systems, driving cleaner industrial operations.

Moreover, these technologies such as alternative desulphurization techniques, bio-based sulphur removal will reshape the market significantly. In the coming decade, the companies shaping the landscape of sulphur recovery will be those that capitalize on smart recovery technologies, sustainability-driven innovations, and process improvements that comply with incoming regulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter sulphur emission limits in refineries and gas plants |

| Technological Advancements | Adoption of Claus process improvements and tail gas treatment units |

| Industry Adoption | Increased compliance with environmental mandates in oil & gas |

| Supply Chain and Sourcing | Dependence on high-purity catalysts and specialized equipment |

| Market Competition | Dominance of established players in oil refining and gas processing |

| Market Growth Drivers | Rising demand for low-sulphur fuels and emission control regulations |

| Sustainability and Energy Efficiency | Adoption of energy-efficient Claus process configurations |

| Integration of Smart Monitoring | Limited digitalization in sulphur recovery operations |

| Advancements in Alternative Sulphur Recovery Techniques | Use of conventional hydrodesulphurization and amine-based separation |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of net-zero policies and integration of sulphur recovery with carbon capture technologies. |

| Technological Advancements | AI-driven process automation, real-time gas monitoring, and enhanced catalytic efficiency. |

| Industry Adoption | Integration of sulphur recovery with green hydrogen and CCUS initiatives. |

| Supply Chain and Sourcing | Localization of sulphur recovery component manufacturing and circular economy adoption. |

| Market Competition | Emergence of sustainable technology providers and digital-first process optimization firms. |

| Market Growth Drivers | Expansion of sustainable refining, renewable energy integration, and waste-to-value sulphur recovery. |

| Sustainability and Energy Efficiency | Large-scale deployment of low-carbon and waste-free sulphur recovery solutions. |

| Integration of Smart Monitoring | AI-powered diagnostics, cloud-based performance tracking, and real-time predictive maintenance. |

| Advancements in Alternative Sulphur Recovery Techniques | Growth in bio-based desulphurization, plasma technology, and hybrid SRU systems for cleaner operations. |

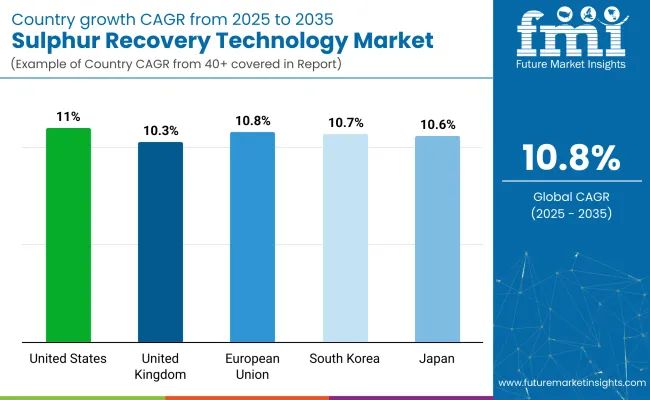

The United States sulphur recovery technology market is rapidly broadening due to the Environmental Protection Agency's strict standards on sulphur emissions, many modernizing refinery projects, and expanding investments in gas handling technologies. The USA Clean Air Act necessitates low sulphur emissions in oil refining and power generation, driving adoption of high-efficiency sulphur recovery units.

The petroleum and natural gas industry, specifically in the massive and expanding markets in Texas, Louisiana, and California, constitutes a major customer of Claus processing technology and tail gas therapy units. Additionally, rising use of hydrogen-based desulfurization in petrochemical plants is cultivating novel growth chances.

With continuous developments in automation and catalytic transformation technologies, experts anticipate that the USA sulphur recovery technology sector will significantly develop over the coming years. Complex conversions and advanced control systems will raise unit efficiencies and lower costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.0% |

The United Kingdom industry for recovering sulphur has steadily advanced, pushed forward by tightening environmental regulations, a rising demand for cleaner energy sources, and a growing installation of sulphur recovery units at refineries all across the country. Both the Environmental Agency and the Clean Air Strategy devised by the UK government impose increasingly stringent standards for low sulphur materials in fuels, inevitably guiding more investment in technologies for desulphurization and recovery to restrain emissions of hazardous sulphur dioxide.

Both the intricate chemical processing sector and the powerful power generation industry have significantly aided growth by concentrating on decreasing emissions of the lung-damaging sulphur dioxide. Additionally, the UK's ambitious pledge to substantially boost hydrogen production and evolve carbon-neutral substitute fuels has strongly buttressed widespread acceptance of pioneering sulphur recovery approaches. Refineries scattered nationwide have diligently installed cutting-edge, technically sophisticated sulphur recovery structures to remain dependably compliant with the country's exacting, rigorous environmental benchmarks.

With steadily mounting regulatory pressures and swelling investment in sustainable, eco-friendly fuel technologies, the dynamic UK sulphur recovery technology market is well-suited for sizeable, meaningful expansion in the coming years. Suppliers of sulphur recovery equipment and specialized services are aptly situated to astutely capture this burgeoning, promising market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.3% |

The European Union sulphur recovery technological market has considerably expanded owing to stringent emissions limitations under MARPOL Annex VI, increasing investments in clean energy endeavours, and broadening of the oil refinement and gas handling industries. Germany, France, and the Netherlands have emerged as pioneers in sulphur reduction across refining and petrochemical enterprises. Complex sulphur extraction strategies and state-of-the-art desulfurization cycles are being integrated to adhere to directions.

EU's Industrial Emissions Directive and Fuel Quality Directive are prompting refineries to invest in innovative sulphur retrieval and desulfurization arrangements to meet tightening guidelines. Moreover, increasing adoption of biofuels and developing demand in hydrogen production throughout Europe is driving request for technologies to remove sulphur. The strict EU regulations have motivated oil and gas companies to search for advanced solutions to extract sulphur.

With continued political support for clean energy progress and initiatives to decrease industrial emissions, it is anticipated the EU sulphur recovery technological market will experience steady growth going ahead. Sophisticated sulphur handling solutions along with customized recovery and treatment systems catering to diverse industry needs are likely to be crucial for compliance. Advanced technologies are being deployed to extract sulphur from solid and gas streams in an efficient and eco-friendly manner.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

Strict regulations on air pollution have fuelled rapid growth in Japan's sulphur recovery industry. The nation's stringent emissions laws mandate exceptionally low thresholds, pushing many facilities to install highly sophisticated extraction units to purge harmful fumes. In particular, large power plants and sprawling chemical works heavily rely on cutting-edge scrubbers for coal gasification and hydrogen generation to minimize impact.

Meanwhile, Japan's ambition to achieve carbon neutrality has stimulated intense demand for revolutionary desulfurization systems capable of eliminating sulphur at unprecedented levels. Continuous refinement has successively boosted effectiveness over decades. Substantial public and private investments in advanced controls should sustain the rise and increasing sophistication of this evolving sector well into the future. While compliance and renewables will continue expansion, maintaining steadfast commitment to innovation through applied research remains integral to longevity.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The stringent environmental policies adopted by South Korea to lower emissions have powerfully driven oil refineries and petrochemical plants to substantially modernize processes, significantly spurring growth in domestic technologies to extract sulphur. South Korea's Clean Air Act places exceptionally strict caps on sulphur dioxide, intensely motivating interest in optimized Claus systems and innovative gas handling units with enhanced abilities to recover more sulphur.

Simultaneously, the emerging focus on hydrogen as a fuel has highlighted the importance of efficiently removing sulphur in production pipelines. Two substantial refinery renovation initiatives currently underway in Ulsan and Busan are helping promote sophisticated methods for reclaiming sulphur. Facing increasingly severe environmental issues and close oversight from regulators, projections foresee the South Korean sulphur recovery technology sector experiencing notable expansion in the coming years supported by these regulations and commercial factors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.7% |

The growing demand for environmental compliance, emission control, and efficient Sulphur extraction processes in oil & gas refineries, chemical plants, and power generation facilities are propelling the Sulphur recovery technology market. Industry participants are concentrating on advanced Claus process alterations, AI-powered process optimization and sustainable Sulphur recovery technologies to increase efficiency, since in-line with strict emission laws, and cost-effective solution. Participants in this space include global suppliers of industrial gas technologies, as well as specialized process device contractors that are all driving innovations in tail gas treatment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger Limited (Cameron) | 15-20% |

| Fluor Corporation | 12-16% |

| Worley Limited | 10-14% |

| Linde plc | 8-12% |

| Air Liquide Engineering & Construction | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger Limited (Cameron) | Develops high-efficiency sulphur recovery units (SRUs), AI-powered tail gas treatment, and sustainable gas processing solutions. |

| Fluor Corporation | Specializes in Claus-based sulphur recovery, proprietary technologies for higher efficiency, and AI-enhanced process optimization. |

| Worley Limited | Manufactures modular sulphur recovery plants, advanced emission reduction solutions, and energy-efficient tail gas treatment. |

| Linde plc | Provides tail gas treatment units, sulphur recovery efficiency optimization, and low-emission process technologies. |

| Air Liquide Engineering & Construction | Offers integrated sulphur recovery and gas treatment systems, including advanced Claus process solutions for refineries. |

Key Company Insights

Schlumberger Limited (Cameron) (15-20%)

Schlumberger is a leading player in sulphur recovery technology with a proven track record for providing reliable sulphur recovery units (SRUs) as well as top-tier AI governance for emission monitoring and tail gas treatment.

Fluor Corporation (12-16%)

Fluor's high-efficiency Claus and Super-Claus sulphur recovery technologies offer low environmental impact and regulatory compliance.

Worley Limited (10-14%)

Worley's sulphur recovery solutions are tailored for refineries, petrochemical and gas processing sites, maximizing energy recovery and emission management.

Linde plc (8-12%)

Focusing on cost savings and improved process efficiency, Linde has been developing AI-integrated sulphur recovery and tail gas treatment units.

Air Liquide Engineering & Construction (5-9%)

Air Liquide designs and builds high-performance sulphur recovery systems to sustain the low-cost recovery of sulphur and the treatment of the resulting tail gas.

Other Key Players (40-50% Combined)

A number of companies specialize in providing next-generation sulphur recovery technologies, AI-enhanced efficiency optimization, and sustainable sulphur recovery solutions in the sector including industrial gas processing and chemical engineering sectors. These include:

The overall market size for Sulphur Recovery Technology Market was USD 1.8 Billion in 2025.

The Sulphur Recovery Technology Market expected to reach USD 5.0 Billion in 2035.

The demand for sulphur recovery technology will be driven by factors such as stricter environmental regulations, the need to reduce sulphur emissions, increasing industrial activities in oil and gas sectors, and growing awareness about sustainable practices for managing sulphur by-products in refineries and petrochemical plants.

The top 5 countries which drives the development of Sulphur Recovery Technology Market are USA, UK, Europe Union, Japan and South Korea.

Claus Process and Tail Gas Treatment Drive Market Growth to command significant share over the assessment per.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sulphur Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Sulphur Coated Urea Market Growth - Trends & Forecast 2025 to 2035

Sulphur Hexafluoride Market Growth 2025 to 2035

Sulphur Chemicals Market

Solid Sulphur Market Size and Share Forecast Outlook 2025 to 2035

Hydrodesulphurization Catalyst Market Trends and Forecast 2025 to 2035

Flue Gas Desulphurization Market Size and Share Forecast Outlook 2025 to 2035

Residue Hydrodesulphurization Catalyst Market

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery Steam Generator Market Growth – Trends & Forecast 2025 to 2035

Vapour Recovery Units Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Vapour Recovery Unit Providers

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Solvent Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Fitness Recovery Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-Enhanced Disaster Recovery – Ensuring Business Continuity

Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

Enhanced Oil Recovery Market Size and Share Forecast Outlook 2025 to 2035

Car Breakdown Recovery Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA