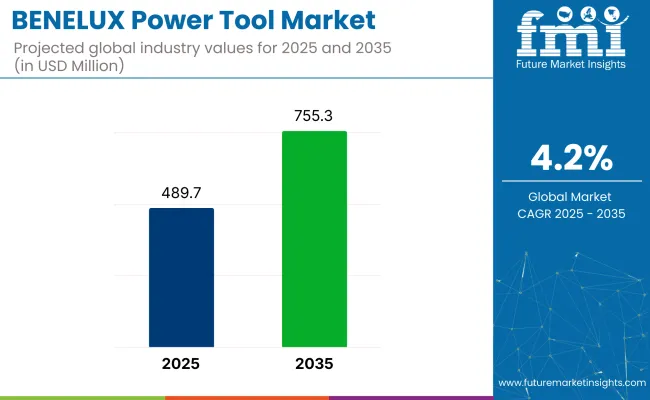

The BENELUX power tool market is projected to witness steady growth over the forecast period, driven by increasing industrialization, rising demand for cordless tools, and advancements in battery technology. With a market size valued at USD 489.7 million in 2025, the industry is expected to expand at a CAGR of 4.2%, reaching USD 755.3 million by 2035. The growth is fuelled by infrastructure development, the expansion of the construction sector, and the increasing adoption of automation in manufacturing. Additionally, the growing preference for ergonomic, high-performance, and energy-efficient tools is shaping market dynamics.

The BENELUX power tool industry is witnessing significant changes as the demand for precision and efficiency increases in different industries. The widespread use of cordless power tools, made possible by technological advancements in lithium-ion batteries, has a strong impact on market trends. The automotive and construction industries continue to be important end-users that utilize power tools to improve productivity and working efficiency. Furthermore, the do-it-yourself (DIY) culture among homeowners is becoming increasingly popular, contributing to higher sales.

Technological improvements, such as brushless motor technology, are increasing the longevity and efficiency of power tools and making them more energy-efficient. Additionally, greater safety standards and ergonomic tool designs are fuelling consumer demand.

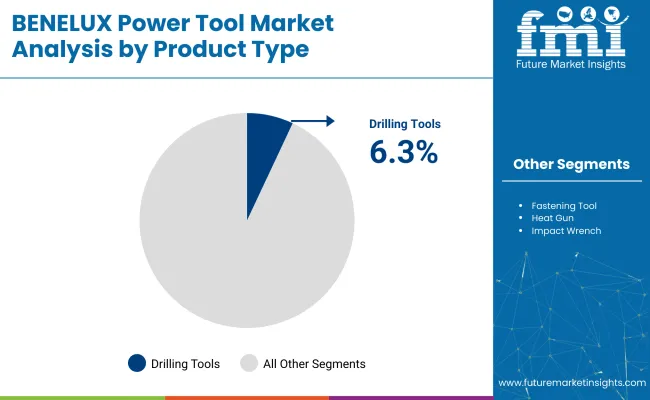

The market is segmented based on product type, application, technology, and region. By product type, the market includes drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw. In terms of application, it is segmented into manufacturing, MRO services, DIY, and construction. By technology, the market is divided into electric and pneumatic tools. Regionally, the market is classified into Belgium, Netherlands, and Luxembourg.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Drilling Tools | 6.3% |

The drilling tool segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2035. This growth is fueled by the tool’s indispensable role across all user groups-DIYers, construction workers, electricians, and maintenance professionals.

In the BENELUX region, drilling tools are increasingly being equipped with brushless motors, enhanced torque control, and battery-swapping compatibility, making them a go-to solution for both heavy-duty industrial needs and home improvement tasks. Compact models with multi-speed settings are also gaining popularity among residential users, especially in urban areas with limited workspace.

Other widely used tools include angle grinders and impact wrenches, which remain essential in metal fabrication, repair shops, and infrastructure maintenance projects. These tools are valued for their raw power and compatibility with various attachments, but their growth is moderate due to niche use cases.

Heat guns, circular saws, and orbital sanders serve surface preparation and cutting needs in construction and woodworking, maintaining steady demand. Fastening tools, chain saws, and jigsaws are seeing selective adoption in specific industries like woodworking, landscaping, and decorative carpentry. While important, these tools grow at a slower pace due to their limited crossover between consumer and industrial applications.

The electric tools segment is projected to grow at the fastest CAGR of 6.1% from 2025 to 2035. This growth is largely driven by increased demand for battery-powered tools across both professional trades and home users. Advancements in lithium-ion batteries, brushless motors, and compact ergonomics have enabled electric tools to outperform traditional pneumatic systems in many light-to-medium duty applications.

As environmental concerns and energy efficiency regulations tighten across the BENELUX region, electric tools are being favored for their quieter operation, lower emissions, and improved energy control. Integrated features such as digital torque adjustment and fast charging are further increasing adoption in urban and indoor construction zones.

Meanwhile, pneumatic tools continue to be preferred in industrial maintenance and heavy-duty workshops where consistent high torque is essential. Their durability and compatibility with centralized compressed air systems still make them suitable for certain manufacturing and MRO applications.

However, growth remains moderate as users migrate toward cordless and plug-in electric alternatives that offer greater flexibility and safety. The electric segment’s compatibility with digital monitoring platforms and its expanding footprint in DIY, professional construction, and industrial repairs make it the standout category across the BENELUX power tool landscape.

| Technology Segment | CAGR (2025 to 2035) |

|---|---|

| Electric Tools | 6.1% |

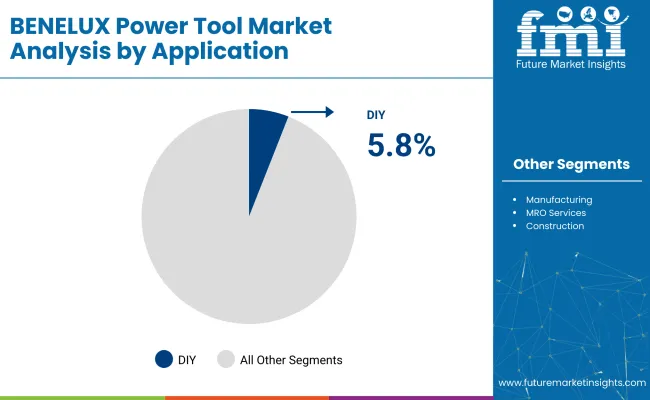

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| DIY | 5.8% |

The DIY (do-it-yourself) segment is forecast to grow at the fastest CAGR of 5.8% from 2025 to 2035. Growth is being propelled by an expanding community of hobbyists, home renovators, and small-scale artisans across Belgium, the Netherlands, and Luxembourg.

The rising popularity of home improvement tutorials, weekend renovation trends, and personalized maker projects has pushed tool ownership among non-professionals to record highs. Retailers and online marketplaces have responded with compact, user-friendly power tools tailored to novice and semi-skilled users, often bundled with safety features, guides, and accessory kits.

In contrast, manufacturing applications remain stable, with demand concentrated in assembly lines and light fabrication environments. Precision tools like fastening devices and drills are used to optimize throughput and consistency. MRO services are driving consistent uptake of durable grinders, impact wrenches, and heat guns across automotive workshops and industrial maintenance teams.

Construction continues to represent a key vertical, especially for high-performance tools used in interior finishing, framing, and surface preparation. However, the shift toward subcontracting and prefabrication has moderated its tool consumption growth. Overall, DIY stands out as the fastest-growing segment due to low entry barriers, rising e-commerce penetration, and strong lifestyle-driven demand.

Challenges

High Initial Costs and Affordability Constraints

One of the main issues facing the BENELUX power tool sector is the initial expense of high-end power tools, especially cordless versions with lithium-ion batteries and brushless motors. Although these power tools provide better efficiency, robustness, and mobility, their higher prices may be a hindrance to take-up, especially among small enterprises, individual contractors, and do-it-yourself users.

Most users continue to stick with conventional corded or pneumatic tools because of their cost-effectiveness and ease of maintenance. Lastly, battery replacement and charging infrastructure costs add to the overall cost of ownership, making it practically challenging for frugal buyers to switch to new, more efficient technologies. Consequently, price sensitivity remains a limiting factor in market growth.

Regulatory Compliance and Environmental Restrictions

The BENELUX power tool industry is subjected to mounting regulatory pressures with stringent EU environmental and safety regulations. Manufacturers are required to meet strict standards on energy efficiency, noise pollution, and the use of hazardous materials, increasing production costs. Battery-powered tools, especially lithium-ion battery tools, have to comply with regulations on battery disposal, recycling, and sustainability. In addition, labour laws mandate that equipment must be designed with additional safety features, including anti-vibration technology and ergonomic design, raising development expenses.

Adhering to these changing standards tends to delay product release and market introduction for new companies. With governments encouraging cleaner and more environmentally friendly industrial processes, businesses need to spend on R&D to keep up with regulatory requirements, which affects overall profitability.

Opportunities

Technological Advancements Driving Innovation

The BENELUX power tool industry is gaining from speedy technological developments, especially in battery technology, brushless motors, and intelligent tool integration. The creation of lithium-ion batteries with longer lifetimes has greatly enhanced the performance of cordless power tools, and they are more appealing to professionals and DIY users. Brushless motor technology also increases durability, minimizes maintenance, and enhances power output, which makes tools more dependable and economical in the long term.

IoT-connected smart power tools with autonomous features are also on the rise, enabling customers to track performance and optimize tool utilization through digital platforms. Not only do these innovations improve productivity but also unlock new revenue sources for manufacturers supplying high-performance and connected tool customers.

Growing Demand for Sustainable and Eco-Friendly Tools

Increased focus on sustainability and environmental legislation is a big opportunity for BENELUX power tool makers. Businesses and consumers are increasingly demanding low-emission, energy-efficient tools in compliance with EU green policies. Those manufacturers who invest in eco-friendly battery technology, recyclable products, and energy-efficient products are taking the competitive lead. The demand for more energy-efficient cordless tools is also on the rise as companies seek to cut carbon footprints. In addition, sustainability-oriented initiatives like tool rental and refurbishment programs provide new business models that serve environmentally aware consumers. Businesses innovating in low-noise, low-vibration, and ergonomic tool designs can also gain further market share by satisfying both regulatory needs and consumer demand for sustainable solutions.

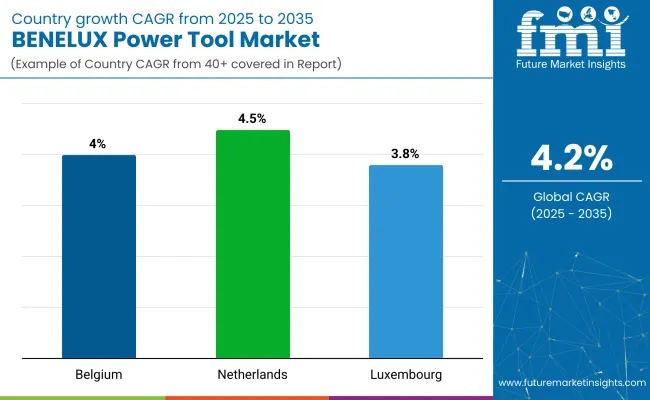

The Belgium power tool industry is growing because of the rise in residential and commercial building projects. Government investments in infrastructure development, as well as the rise in the usage of power tools in manufacturing and automotive industries, are fueling growth. Battery and cordless tools are increasing in popularity, keeping pace with sustainability trends.

Moreover, growth in home improvement and DIY culture also fuels market growth. The availability of important world manufacturers and increasing demand for high-efficiency and ergonomic tools are influencing the market environment. With digitalization and automation improving tool capabilities, Belgium's power tool market will grow at a CAGR of 4.0% during 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Belgium | 4.0% |

The Netherlands is witnessing strong growth in the power tool industry, with the country's booming construction, automotive, and renewable energy industries supporting it. Demand for high-performance power tools is increasing as businesses focus on productivity and efficiency. Strong usage of electric and cordless tools, combined with intelligent technology integration, is also driving market dynamics.

Growing infrastructure construction projects, along with a properly developed logistics framework, facilitate easy distribution of power tools. Apart from this, sustainability efforts are promoting the development of energy-saving and long-lasting tools. As these factors contribute, the Netherlands power tool market is expected to grow at 4.5% CAGR from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Netherlands | 4.5% |

Luxembourg's power tool market is comparatively smaller but increasingly growing, led by urbanization and construction activity. The growing need for quality, long-lasting tools in business and industrial uses is a key driver of growth. The nation's emphasis on green buildings and intelligent infrastructure is propelling the usage of battery-driven and green power tools.

With labor costs escalating, businesses are favoring more investment in automation and power-augmented tools to enhance efficiency. In addition, the availability of sophisticated equipment through online and offline distribution channels is driving market growth. Luxembourg's power tool market will grow at a CAGR of 3.8% during the period 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Luxembourg | 3.8% |

The Benelux Power Tool Market is extremely competitive, with key global brands such as Bosch, Makita, Stanley Black & Decker, Hilti, and Festool dominating the market. The market is experiencing a move towards cordless and intelligent power tools, and there is a growing demand for battery-operated solutions that leverage IoT and automation.

Sustainability is also a focus area, and companies are spending on energy-efficient designs and sustainable materials. Increased e-commerce and direct-to-consumer sales have amplified competition, driving firms to step up digital marketing and distribution practices.

Market consolidation trends are also being witnessed, with strategic alliances and acquisitions enhancing leading players' positions. The professional construction and industrial segments are still the largest end-users, with the DIY segment growing with increasing home improvement trends. With the progress in technology, the sector is poised for more innovation, especially in lightweight, high-efficiency, and AI-based tools, defining the competitive landscape in the next few years.

In terms of technology, Electric tools, Pneumatic tools, Other tools (Hydraulic, IC Engine, Steam)

In terms of products, the industry is divided into drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw.

In terms of application, the industry is segregated into manufacturing, MRO services, DIY, and construction.

The report covers key country, including Belgium, Netherlands, Luxembourg

The BENELUX market is expected to reach USD 755.3 million by 2035, growing from USD 489.7 million in 2025, at a CAGR of 4.2% during the forecast period.

The drilling tool segment is projected to lead the market due to high demand in construction, woodworking, and DIY projects, offering precision, versatility, and efficiency for both professionals and homeowners.

Key drivers include rising renovation activities, increased adoption of cordless technologies, growth in home improvement trends, and the need for efficient, ergonomic tools in industrial and residential settings.

Construction, woodworking, automotive, and maintenance sectors are driving demand, supported by infrastructure upgrades, skilled labor adoption, and expanding repair and remodeling applications.

Top companies include Bosch, Makita, Stanley Black & Decker, Hilti, and Festool, known for delivering innovation, reliability, and strong distribution networks across the region.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Line Communication (PLC) Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA