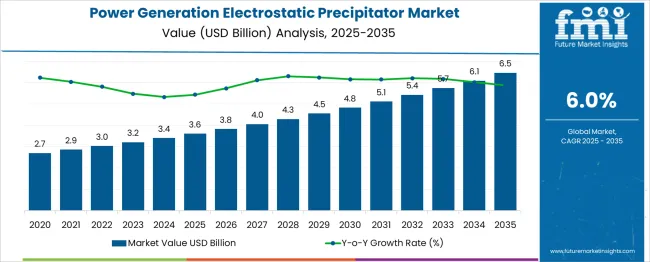

The Power Generation Electrostatic Precipitator Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The initial five-year period from 2020 to 2025 witnesses growth from USD 2.7 billion to USD 3.6 billion, driven by the rising adoption of advanced air pollution control technologies in power generation facilities worldwide. Electrostatic precipitators find widespread application in coal-fired power plants, industrial boilers, and waste-to-energy systems, where regulatory focus on emission control and particulate matter reduction is stringent. Increasing environmental compliance requirements and investments in retrofitting older plants with efficient filtration systems support this steady expansion.

From 2026 to 2030, the market accelerates from USD 3.8 billion to USD 4.8 billion, fueled by technology enhancements that improve collection efficiency and reduce operational costs. Growing demand from emerging economies undergoing rapid industrialization and expansion of power infrastructure further bolsters market growth. The latter half of the forecast period, spanning 2031 to 2035, sees the market rise from USD 5.1 billion to USD 6.5 billion, propelled by continued regulatory tightening, increased deployment in renewable energy sectors with particulate concerns, and innovations in materials and system integration that enhance performance and durability. The Power Generation Electrostatic Precipitator Market is positioned for consistent growth through 2035, supported by environmental mandates, technological progress, and expanding power generation activities globally.

| Metric | Value |

|---|---|

| Power Generation Electrostatic Precipitator Market Estimated Value in (2025 E) | USD 3.6 billion |

| Power Generation Electrostatic Precipitator Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The power generation electrostatic precipitator (ESP) market occupies a critical position within the global emissions control and industrial air quality management sector, accounting for approximately 45–48% share of the ESP industry, primarily due to its indispensable role in coal-based and thermal power plants. Within the wider air pollution control systems market, power generation ESPs represent nearly 30–32%, reflecting stringent emission regulations across developed and emerging economies. In the particulate matter (PM) control solutions segment, these systems hold about 40% share, as utilities prioritize high-efficiency particulate removal to meet compliance standards under tightening environmental norms.

For the global flue gas treatment (FGT) market, ESPs command an estimated 20–22% share, owing to their compatibility with diverse fuel sources and ability to handle high-volume gas streams cost-effectively. Growth is supported by increasing retrofitting activities in aging thermal power infrastructure, particularly across Asia-Pacific, where coal remains a dominant energy source. Technological upgrades such as high-frequency power supplies and hybrid ESP-bag filter systems are enhancing collection efficiency while reducing operational costs. However, the market faces substitution risks from fabric filters in specific regions and rising interest in cleaner energy alternatives. Despite these challenges, long-term relevance is sustained by the persistence of coal and biomass-based power generation in key markets, driving continued demand for ESP solutions that deliver regulatory compliance, operational reliability, and lifecycle cost optimization.

Utilities and power producers are actively pursuing technologies that enable compliance with emissions standards while optimizing cost structures. Electrostatic precipitators are being recognized for their ability to remove particulate matter with high efficiency, particularly in coal-fired and biomass-based power plants.

The market is being further strengthened by retrofitting initiatives, where existing plants are upgrading to high-performance electrostatic solutions to extend operational life. Continued innovation in design, automation, and remote monitoring has reinforced the relevance of electrostatic precipitators in modern power infrastructure.

As renewable integration and transition to low-emission operations accelerate, demand is being driven by the need to manage air quality even during transitional fuel use. The long-term outlook remains positive, with consistent investments in emission control technologies and a focus on energy sector decarbonization contributing to sustained market expansion..

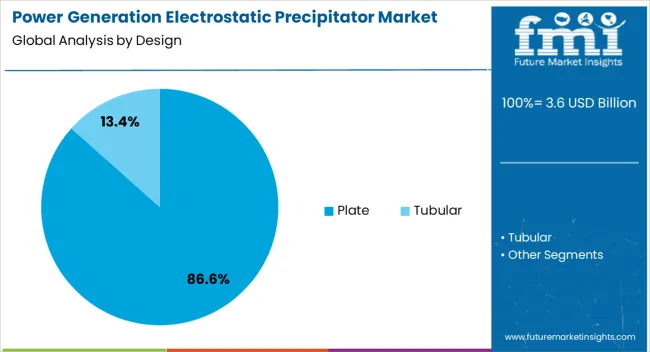

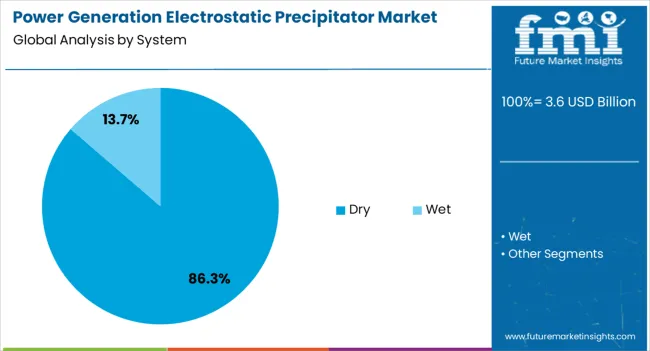

The power generation electrostatic precipitator market is segmented by design, system, and geographic regions. The power generation electrostatic precipitator market is divided into Plate and Tubular. In terms of the system of power generation, the electrostatic precipitator market is classified into Dry and Wet. Regionally, the power generation electrostatic precipitator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plate segment within the design category is expected to hold 86.60% of the Power Generation Electrostatic Precipitator market revenue share in 2025, positioning it as the dominant design choice. Growth in this segment has been supported by the plate configuration’s ability to achieve superior particle collection efficiency due to its large surface area and uniform electric field distribution. The configuration has been widely adopted in large-scale power generation plants where consistent performance, durability, and low maintenance requirements are critical.

Plate-type precipitators have demonstrated high reliability in handling heavy dust loads and continuous operations, which are common in coal and biomass combustion systems. Their structural simplicity has enabled easy integration into both new installations and retrofit projects.

In addition, the uniform spacing in plate arrangements supports efficient gas flow and minimal pressure drop, optimizing overall plant performance. These factors have reinforced the preference for plate designs in emission control strategies, maintaining its leadership in the design segment..

The dry system segment is projected to capture 86.30% of the Power Generation Electrostatic Precipitator market revenue share in 2025, making it the leading system type. This segment’s dominance has been attributed to its widespread use in thermal power plants where flue gas temperatures are high and moisture content is low. Dry electrostatic precipitators have been favored due to their high operational reliability, ease of installation, and lower operational costs compared to alternative systems.

Their ability to handle large gas volumes and maintain consistent performance under varied load conditions has supported their adoption in high-capacity plants. Moreover, dry systems have shown superior adaptability in retrofitting older plants, offering an efficient upgrade path to meet environmental compliance mandates.

Their robustness in managing high-resistance dust and compatibility with automation systems have enhanced long-term performance and cost-effectiveness. These attributes have established the dry system as the preferred solution in emission control across the global power generation sector..

The power generation ESP market grows steadily on the back of coal dependency, regulatory mandates, and retrofitting demand. However, rising costs and the global shift toward cleaner fuels pose significant long-term challenges.

The demand for electrostatic precipitators in power generation is heavily influenced by the continued reliance on coal-fired plants, particularly in Asia-Pacific economies. Despite global efforts toward renewable energy, coal remains a key contributor to electricity generation in countries such as India and China. This dependency drives installations of ESP systems to control particulate emissions and meet national air quality standards. Power utilities are investing in advanced ESP technologies to achieve high collection efficiency and reduce operational downtime. The need for compliance with strict particulate matter regulations, combined with growing energy requirements, ensures sustained demand for these systems, especially in developing regions where thermal power remains dominant.

Regulatory frameworks targeting air quality and emissions are a major factor shaping the power generation ESP market. Governments across Europe, North America, and Asia have imposed stricter standards for particulate matter and hazardous emissions from thermal power plants. These mandates compel utilities to adopt or upgrade electrostatic precipitator systems to avoid penalties and ensure operational continuity. For older plants, retrofitting ESP units is a preferred approach to extend service life and maintain compliance. With environmental agencies increasing surveillance and enforcement, adherence to emission limits remains a primary driver for ESP implementation in coal and biomass-based power stations worldwide.

A significant share of market growth is derived from retrofitting projects and performance enhancement of existing ESP installations. Many power plants operating on legacy systems face challenges in meeting updated emission norms, creating strong demand for high-frequency power supplies, hybrid filtration solutions, and modular ESP designs. Upgrades improve collection efficiency and reduce energy consumption while minimizing operational downtime. Service providers are offering customized solutions to meet plant-specific requirements, particularly in aging infrastructure across Asia-Pacific and parts of Eastern Europe. These retrofitting activities not only address compliance but also optimize plant economics, extending the operational lifespan of thermal power assets.

While the market outlook remains positive, key challenges such as fuel diversification and rising operational costs impact long-term growth. Transition toward cleaner energy sources like natural gas and renewables reduces the share of coal-fired generation, limiting new ESP installations in advanced economies. High maintenance costs, large space requirements, and the need for skilled labor add further complexity. Additionally, competition from fabric filters in high-dust applications creates substitution risks. Despite these constraints, the ESP market in power generation retains strategic importance in regions where thermal power is still the backbone of electricity supply, ensuring its role in meeting stringent emission standards.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

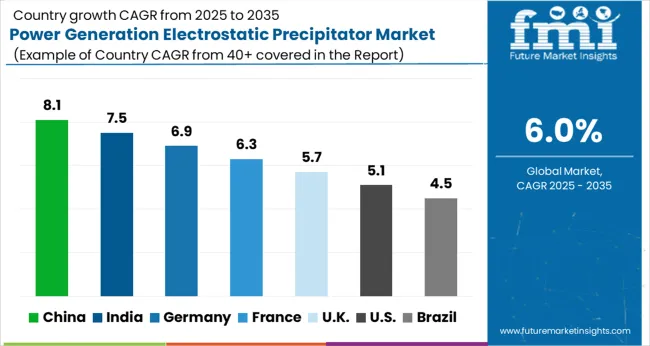

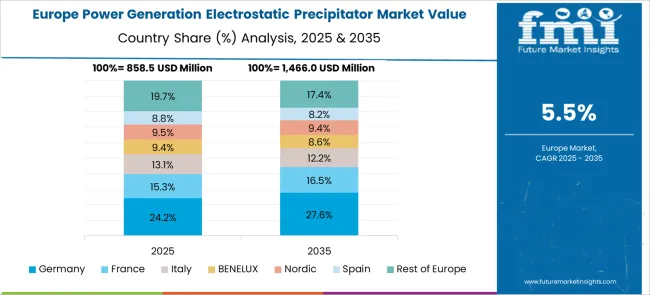

The power generation electrostatic precipitator (ESP) market is projected to grow globally at a CAGR of 6.0% from 2025 to 2035, driven by increasing environmental regulations and ongoing reliance on thermal power plants in key regions. China leads with a CAGR of 8.1%, supported by large-scale coal-fired power generation and stringent emission control mandates under national air quality programs. India follows at 7.5%, driven by expanding power capacity and retrofitting requirements in aging thermal infrastructure. France records a CAGR of 6.3%, reflecting its investments in biomass-based plants and stricter EU emission compliance. The United Kingdom grows at 5.7%, aided by upgrades in existing plants to meet tightened standards, while the United States posts 5.1%, influenced by steady demand for retrofit solutions despite gradual fuel transition toward natural gas and renewables. The analysis covers insights from over 40 countries, with these five markets highlighted as primary benchmarks for ESP adoption strategies and capacity upgrade initiatives in the global power generation sector.

China is expected to post a CAGR of 8.1% during 2025–2035, an increase from nearly 7.2% recorded between 2020–2024. This surge is attributed to large-scale expansion of coal-fired and biomass-based power plants alongside stringent national emission norms. The government’s focus on reducing particulate matter through advanced ESP installations has accelerated retrofitting projects in older thermal stations. Additionally, the integration of high-frequency power supplies and hybrid designs is improving efficiency, making ESP systems indispensable. Growing electricity demand and reliance on thermal power to stabilize renewable energy intermittency further strengthen the market outlook.

India is projected to register a CAGR of 7.5% for 2025–2035, up from around 6.8% during 2020–2024. This growth is driven by expanding thermal power capacity and stricter implementation of particulate emission regulations by the Central Pollution Control Board. The increasing share of coal in the energy mix necessitates robust air quality solutions, positioning ESPs as critical components. Large-scale retrofitting in state-owned utilities and private sector plants adds momentum. India’s focus on affordable yet efficient technologies creates opportunities for local and international ESP suppliers to deliver cost-effective solutions tailored for regional requirements.

France is forecasted to post a CAGR of 6.3% for 2025–2035, higher than its previous growth of nearly 5.5% in 2020–2024. The rise is driven by an increasing shift toward biomass-based energy generation and compliance with stringent EU emission directives. Power producers are investing in ESP retrofits for plants transitioning from coal to mixed-fuel operations, ensuring compliance without compromising operational efficiency. The deployment of advanced high-voltage power systems enhances particle capture performance, supporting the adoption of ESP units in modernized thermal facilities.

The United Kingdom is expected to achieve a CAGR of 5.7% from 2025–2035, rising from approximately 4.9% during 2020–2024. This improvement reflects intensified retrofitting activity in existing thermal assets to meet aggressive emission targets set by national environmental policies. The early phase showed moderate growth due to limited investments and a gradual energy transition strategy. Post-2024, demand is supported by stricter enforcement of particulate standards, modernization programs for backup coal units, and the use of ESP systems in biomass co-firing applications. Performance-based contracting and digital monitoring upgrades are gaining momentum across utility operators.

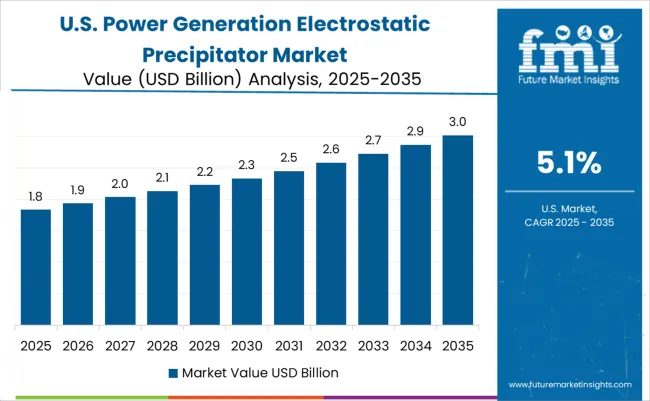

The U.S. CAGR for the power generation ESP market is projected at 5.1% for 2025–2035, up from nearly 4.3% in 2020–2024. Growth is anchored by retrofits in coal-fired power plants that continue to operate despite a gradual fuel transition. Early-stage expansion was subdued by the dominance of fabric filters and declining coal dependency. However, the next decade shows momentum as utilities modernize existing ESP systems to comply with updated EPA particulate regulations. Adoption of predictive maintenance and performance-enhancing components such as high-voltage controllers is improving cost efficiency.

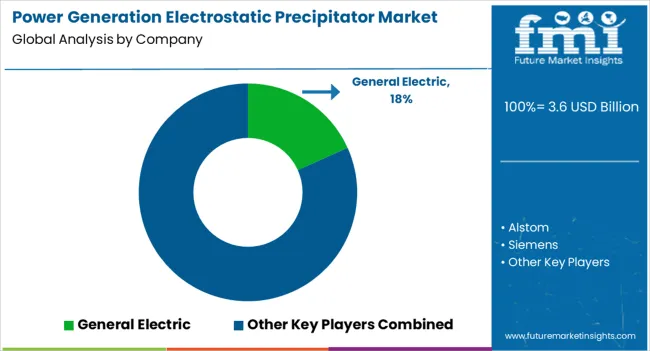

The power generation electrostatic precipitator (ESP) market is dominated by globally established engineering and energy equipment manufacturers such as General Electric (GE), Alstom, Siemens, Babcock & Wilcox, Mitsubishi Hitachi Power Systems, IONFILTRA, and Thermax Limited, alongside regional specialists like Ducon, Lonjing Environment Technology, Hamon Corporation, Trion IAQ / Envirco, Enviropol Engineers Pvt. Ltd., and Bharat Heavy Electricals Limited (BHEL). GE holds an estimated leading share, leveraging its expertise in integrated emission control solutions tailored for large-scale thermal power plants. Alstom and Siemens focus on high-efficiency ESP designs optimized for compliance with stringent emission standards across Europe and Asia.

Mitsubishi Hitachi Power Systems emphasizes advanced hybrid ESP-bag filter technologies for superior particulate removal in coal and biomass-fired plants. Babcock & Wilcox continues to maintain a strong presence in North America with advanced ESP systems supporting both new installations and retrofitting projects. Thermax Limited and IONFILTRA cater to the Asia-Pacific market with cost-effective yet efficient ESP units designed for regional power generation requirements. Competitive differentiation in this industry revolves around high collection efficiency, adaptability to diverse fuel types, and the integration of smart monitoring technologies for predictive maintenance and operational reliability.

Strategic priorities among leading players include investing in hybrid filtration systems, enhancing automation and digital control features, and forming alliances for regional manufacturing to reduce supply chain costs. Growth prospects are centered on retrofitting aging thermal power assets, rising biomass utilization, and compliance with evolving particulate matter emission standards. Players that deliver performance-based solutions combined with lifecycle support services are expected to strengthen their competitive positioning in the global ESP market.

Key strategies and drivers for 2024 and 2025 in the power generation electrostatic precipitator market include retrofitting aging thermal plants with high-efficiency ESP systems to meet strict emission standards, investing in hybrid ESP-bag filter technologies for improved particulate removal, and adopting digital monitoring for predictive maintenance. Regulatory enforcement across Asia-Pacific and Europe is accelerating upgrades, while growth in biomass-based power generation creates fresh installation opportunities. Strategic partnerships for localized manufacturing and cost optimization, along with the development of modular, compact ESP units for flexible integration, are essential to address operational challenges and ensure compliance-driven demand in key markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Design | Plate and Tubular |

| System | Dry and Wet |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric (GE) (estimated leading share), Alstom, Siemens, Babcock & Wilcox, Mitsubishi Hitachi Power Systems, IONFILTRA, Thermax Limited, Ducon, Lonjing Environment Technology, Hamon Corporation, Trion IAQ / Envirco, Enviropol Engineers Pvt. Ltd., and Bharat Heavy Electricals Limited (BHEL) |

| Additional Attributes |

The global power generation electrostatic precipitator market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the power generation electrostatic precipitator market is projected to reach USD 6.5 billion by 2035.

The power generation electrostatic precipitator market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in power generation electrostatic precipitator market are plate and tubular.

In terms of system, dry segment to command 86.3% share in the power generation electrostatic precipitator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA