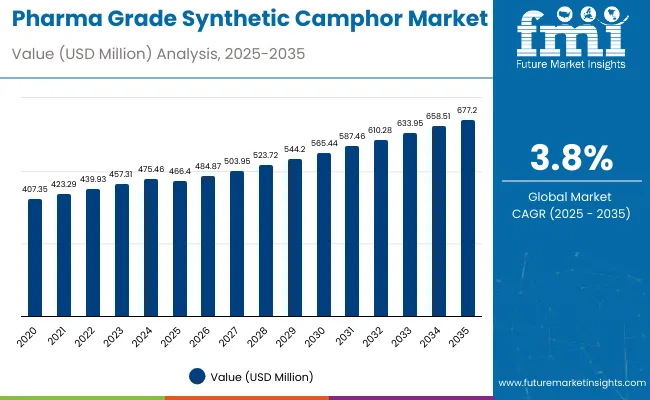

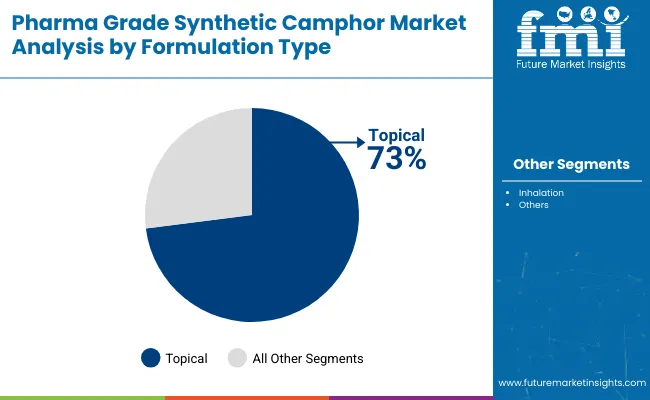

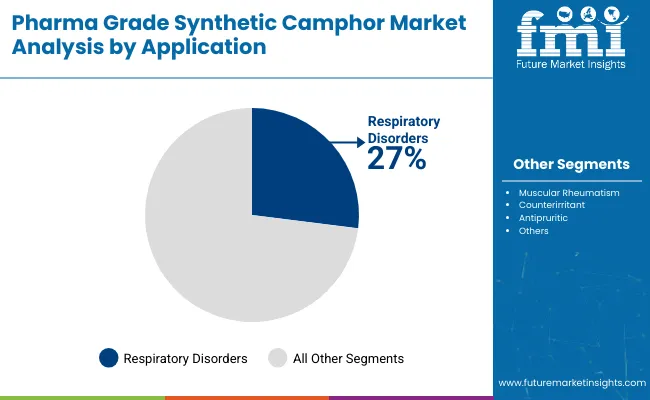

The pharma grade synthetic camphor market is expected to expand steadily from USD 466.4 million in 2025 to USD 677.2 million by 2035, advancing at a CAGR of 3.8%. This growth reflects increasing demand in pharmaceutical and therapeutic applications, driven by rising awareness of effective remedies and broader use of topical formulations. The market demonstrates a consistent upward trajectory, supported by the dominance of topical applications accounting for 73% of the market, and significant use in respiratory disorders, which hold a 27% share.

By 2030, the market is forecasted to reach USD 573.0 million, showing a steady increase across the first half of the period. The absolute dollar growth between 2025 and 2035 is USD 210.8 million, indicating steady and reliable expansion. Growth remains balanced throughout the period, supported by increased pharmaceutical adoption, expanding treatments for muscular rheumatism, and rising demand for counterirritant and antipruritic applications.

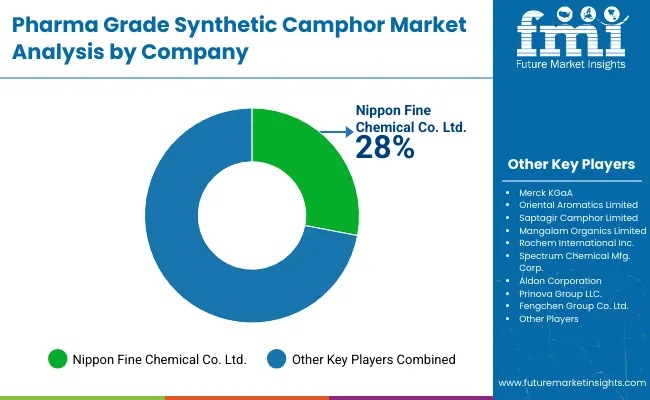

Key companies such as Nippon Fine Chemical Co., Ltd., Oriental Aromatics Limited, and Merck KGaA are consolidating their positions through expanding production capacities and innovation in synthetic camphor formulations for enhanced efficacy and safety. Their product development pipelines emphasize pharmaceutical-grade purity, regulatory compliance, and novel applications in respiratory and topical therapies. Market performance will remain closely linked to quality standards, regional regulatory frameworks, and the ability to meet growing demand in major markets including the USA, Japan, China, and India.

The market holds a significant share in pharmaceutical and topical formulation segments, with topical applications commanding 73% in 2025. It also supports critical segments such as respiratory disorder treatments, which account for approximately 27% of the application share, reflecting its essential role in cough suppressants, inhalants, and anti-inflammatory therapies. The market also contributes notably to the muscular rheumatism and counterirritant & antipruritic segments, highlighting its versatility in therapeutic uses.

The market is undergoing transformation through advances in synthetic purity and pharmaceutical-grade certification, improving safety and efficacy profiles. Producers are expanding product portfolios to meet increasing demand in topical treatments and respiratory care, while innovation in formulations and regulatory compliance is enhancing market access. Collaborations between manufacturers, pharmaceutical companies, and healthcare providers, along with rising consumer preference for trusted synthetic alternatives, are broadening application reach and reshaping competitive dynamics.

The technological landscape encompasses diverse synthesis pathways including traditional turpentine oil-based production methods and advanced chemical synthesis routes that can produce high-purity synthetic camphor with consistent quality characteristics and reduced environmental impact. Manufacturing operations must balance production efficiency against quality requirements while managing raw material price volatility, particularly for turpentine oil and alpha-pinene precursors that can experience significant cost fluctuations due to supply chain disruptions, geopolitical tensions, or environmental factors affecting forestry operations. These technical requirements create operational complexity where process optimization, quality assurance, and cost management must be balanced against regulatory compliance and customer quality expectations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 466.4 million |

| Market Forecast Value (2035) | USD 677.2 million |

| CAGR (2025 to 2035) | 3.8% |

The market is growing due to several key factors driving increased demand across pharmaceutical and therapeutic applications. First, rising awareness and preference for effective topical therapies have boosted the use of synthetic camphor in pain relief and anti-inflammatory formulations, particularly for muscular rheumatism and respiratory disorders. Its proven efficacy as a counterirritant and antipruritic agent further solidifies its importance in pharmaceutical products.

Secondly, advances in synthetic manufacturing have improved camphor's purity and consistency, making it safer and more reliable for pharmaceutical-grade applications. This has expanded its acceptance by regulatory bodies and healthcare providers, fostering wider utilization in mainstream medicine.

The increasing prevalence of respiratory issues worldwide, coupled with growing demand for inhalation and topical products, has also driven the market. Additionally, synthetic camphor serves as a preferred alternative to natural sources, ensuring sustainable supply amidst challenges associated with natural camphor extraction.

The market is segmented by formulation type, application, distribution channel, and region. By formulation type, the market is bifurcated into topical and inhalation. Based on application, the market is divided into respiratory disorders, muscular rheumatism, counterirritant and antipruritic, and others (pain relief, skin care, and miscellaneous therapeutic uses). In terms of distribution channel, the market is bifurcated into conventional B2B (tenders, direct procurement, wholesalers & distributors) and online B2B (internal and external channel). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The topical formulation segment dominates the market with a 73% share in 2025, driven by the broad therapeutic benefits of synthetic camphor in creams, ointments, balms, and gels. These products provide effective pain relief, muscle relaxation, anti-inflammatory effects, and cooling sensations, which are valuable for treating conditions such as arthritis, muscular pain, backaches, sprains, and minor injuries. The ability of camphor to penetrate the skin and act as a counterirritant, stimulating blood flow and reducing pain and inflammation, significantly enhances its appeal in topical applications.

Synthetic camphor’s antiseptic and antipruritic properties expand its use in treating skin irritations, eczema, rashes, and insect bites, enhancing its versatility in dermatological products. The topical segment benefits from rising consumer demand for over-the-counter, natural-inspired, and effective analgesic solutions, especially in regions like North America, Europe, and Asia Pacific. This segment’s steady growth is also driven by ongoing product innovations, regulatory approvals, and a shift toward non-invasive pain management therapies in pharmaceutical markets.

The respiratory disorders segment is the most lucrative, accounting for approximately 27% of the market in 2025. Its strong position is attributed to camphor’s established use in treating conditions like cough, colds, nasal congestion, bronchitis, and asthma. Synthetic camphor is a key ingredient in widely used inhalants, vapor rubs, and topical decongestants, which provide fast relief by opening airways and soothing irritation.

The global increase in respiratory illnesses, driven by pollution, allergies, and viral infections, has heightened demand for effective, over-the-counter (OTC) respiratory treatments containing camphor. Additionally, the growing preference for natural and traditional remedies that deliver proven efficacy supports market expansion. Regions like North America, Europe, and Asia Pacific exhibit robust growth, fueled by healthcare infrastructure advances, rising consumer awareness, and increasing adoption of camphor-based respiratory products in self-care regimens.

From 2025 to 2035, the market is experiencing significant growth driven by increasing demand for high-purity, effective therapeutic products in pharmaceutical and personal care industries. Growing consumer awareness regarding the benefits of synthetic camphor, along with rising prevalence of respiratory disorders and chronic pain conditions, has fueled demand for camphor-based analgesics, inhalants, and topical products. Manufacturers are investing in advanced synthetic production technologies to enhance product quality, consistency, and safety, thereby meeting stringent regulatory standards and expanding application scopes.

Increasing Health Consciousness and Formulation Innovations

Rising health consciousness and preference for scientifically validated natural ingredients have driven innovations in formulation techniques and drug delivery systems, including inhalation and topical platforms. The expanding pharmaceutical sector, particularly in North America, Asia Pacific, and Europe, supports robust growth by embracing camphor for its analgesic, anti-inflammatory, and antimicrobial properties.

Innovations Enhancing Product Quality and Therapeutic Delivery

Recent innovations in synthetic camphor production and formulation technologies have significantly expanded opportunities in the pharma grade synthetic camphor sector. Advances in manufacturing processes have enabled the production of higher-purity camphor, meeting stringent pharmaceutical standards for safety and efficacy. This has opened new avenues for its application in analgesic, anti-inflammatory, and respiratory products. Key players are focusing on developing novel delivery systems such as patches, gels, and combination inhalers, improving bioavailability and patient compliance.

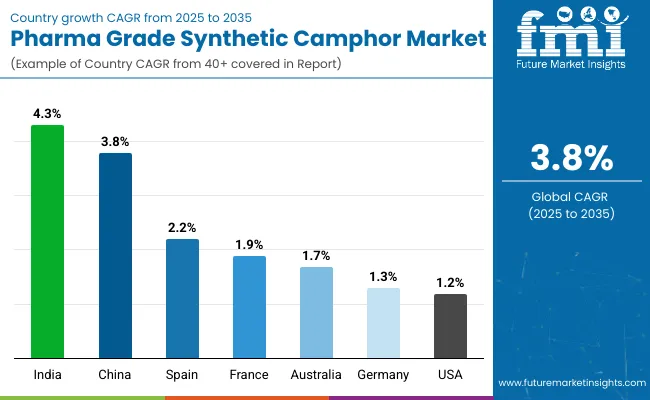

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.3% |

| China | 3.8% |

| Spain | 2.2% |

| France | 1.9% |

| Australia | 1.7% |

| Germany | 1.3% |

| United States | 1.2% |

India leads with a CAGR of 4.3% from 2025 to 2035, driven by strong pharmaceutical manufacturing, rising domestic and export demand, and government support for innovation. China follows with a strong CAGR of 3.8%, supported by cost-effective production and increasing healthcare needs. Spain and France show moderate growth at 2.2% and 1.9%, benefiting from aging populations and strict regulations. Australia and Germany have more measured growth rates of 1.7% and 1.3%, respectively, emphasizing quality and research-driven innovation. The United States experiences the slowest growth at 1.2%, representing a mature market focused on non-opioid analgesics and advanced drug delivery innovations.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for pharma grade synthetic camphor in India is projected to grow at a CAGR of 4.3% from 2025 to 2035. This growth is supported by India’s strong pharmaceutical manufacturing infrastructure and increasing domestic demand for camphor-based topical and respiratory products. The country benefits from government initiatives promoting pharmaceutical sector growth and investments in R&D aimed at developing innovative camphor formulations. Manufacturers leverage cost advantages and strict quality controls to maintain competitiveness. India’s expanding exports amplify its global influence, making it a key player in the market. Rising healthcare awareness and increasing demand for non-opioid pain relief options further boost growth in India.

Demand for pharma grade synthetic camphor in China is projected to grow at a CAGR of 3.8%, supported by cost-efficient mass production and rapid healthcare sector expansion. The country's growing prevalence of chronic diseases fuels demand for camphor in respiratory and pain relief therapies. Continuous regulatory reforms improve manufacturing standards, assuring product safety and efficacy, which increases global acceptance. Chinese manufacturers benefit from technological advancements in synthesis, enhancing product purity and consistency. The expanding e-commerce and online pharmaceutical sales channels facilitate broader consumer access. China’s strategic export focus plays a pivotal role in advancing its market position.

Revenue from pharma grade synthetic camphor in Spain is expected to grow steadily with a CAGR of 2.2% over the forecast period. The country’s aging population drives increasing demand for topical analgesics, addressing musculoskeletal and chronic pain conditions. Spain's pharmaceutical sector is characterized by strict regulatory compliance, ensuring high product quality and safety. Local companies increasingly collaborate with multinational corporations to enhance formulation development and distribution networks. Sustainable manufacturing practices are gaining importance to meet environmental standards and consumer expectations. Clinical research investments validate the therapeutic efficacy and safety of camphor formulations. Spain's balance of innovation and regulation positions it well within the European pharma landscape.

Sales of pharma grade synthetic camphor in France are projected to grow at a CAGR of 1.9%, supported by a mature healthcare system and consumer preference for premium pharmaceutical ingredients. The demand for natural and effective alternatives is boosting camphor-based topical and inhalation products. French companies prioritize research and development focused on product innovation to enhance efficacy and patient outcomes. Strict regulatory oversight ensures high-quality standards, strengthening consumer confidence. Sustainable synthesis and environmentally conscious practices are increasingly adopted. The rising incidence of respiratory and musculoskeletal ailments underlines the need for effective therapies, supporting market expansion.

Demand for pharma grade synthetic camphor in Australia is anticipated to grow at a CAGR of 1.7%, driven by its advanced medical infrastructure and increasing adoption of camphor in analgesic and respiratory applications. Rising consumer focus on natural remedies and wellness supports steady demand. Australian manufacturers emphasize quality assurance and regulatory compliance to meet healthcare standards. Investments in research and development promote continuous product improvements and innovation in drug delivery systems. The growing healthcare expenditure also contributes to market growth, while sustainability efforts align with global pharmaceutical trends.

Sales of pharma grade synthetic camphor in Germany are forecasted to grow at a CAGR of 1.3%, emphasizing high standards in pharmaceutical quality and safety. The country’s aging population and increased chronic pain and respiratory conditions contribute to steady demand. German manufacturers engage extensively in research collaborations to develop innovative delivery systems like patches and inhalers. Compliance with stringent EU regulatory requirements ensures product efficacy and consumer trust. Germany is also focusing on sustainable manufacturing and transparent supply chains, enhancing its reputation as a responsible pharmaceutical market.

Revenue from pharma grade synthetic camphor in the U.S. is projected to grow at a CAGR of 1.2%, supported by a mature pharmaceutical market and advanced healthcare infrastructure. Consumers increasingly prefer high-quality, non-opioid analgesics, promoting demand for camphor-based products. The U.S. pharmaceutical sector is active in research and development, focusing on improved drug delivery technologies and formulations to enhance patient compliance. Regulations ensure product safety and efficacy, fostering market confidence. Expansion in online pharmaceutical retail channels improves product accessibility and sales. Rising respiratory and musculoskeletal disorders contribute to relatively steady market growth.

The Pharma Grade Synthetic Camphor Market is expanding steadily as demand grows across pharmaceutical, personal care, and topical analgesic applications. Synthetic camphor, known for its antimicrobial, anti-inflammatory, and counterirritant properties, is widely used in ointments, inhalants, rubs, and antiseptic formulations. Leading producers such as Nippon Fine Chemical Co. Ltd. and Merck KGaA are at the forefront of high-purity camphor production, utilizing advanced chemical synthesis and purification processes to meet stringent pharmacopoeia standards. Their focus on consistent quality, purity assurance, and regulatory compliance underpins their leadership in supplying global pharmaceutical manufacturers.

Oriental Aromatics Ltd., Saptagir Camphor Ltd., and Mangalam Organics Ltd. are key contributors in Asia, producing pharma-grade camphor derived from turpentine-based intermediates and expanding capacity to serve both domestic and export markets. These companies are strengthening vertical integration to ensure steady raw material availability and supply chain resilience. Their R&D initiatives center on improving crystallization techniques, refining particle uniformity, and enhancing odor stability for pharmaceutical-grade formulations.

The market’s growth is being driven by rising use of camphor in topical pain relief, cold and cough preparations, and antiseptic creams, alongside expanding applications in personal care and dermatological treatments. Increasing regulatory emphasis on purity and controlled synthesis is prompting manufacturers to adopt eco-efficient, closed-loop production systems to reduce emissions and impurities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 466.4 Million |

| Formulation Type | Topical and Inhalation |

| Application | Respiratory Disorders, Muscular Rheumatism, Counterirritant and Antipruritic, Others ( Cosmetic a nd Personal Care Uses ) |

| Distribution Channel | Conventional B2B, which comprises tenders, direct procurement, and wholesalers & distributors; and Online B2B, which includes internal channels and external channels. |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, China, India, Japan, Australia, South Korea, Brazil, and 40+ other countries |

| Key Companies Profiled |

Nippon Fine Chemical Co. Ltd., Oriental Aromatics Ltd., Saptagir Camphor Ltd., Mangalam Organics Ltd., Merck KGaA |

| Additional Attributes | Revenue by formulation type , and application; demand for high-purity and specialty products; innovations in synthesis and formulations; expansion in pharmaceutical and personal care sectors; emphasis on supply chain efficiency and quality assurance |

In terms of formulation type, the industry is divided into topical and inhalation.

In terms of application, the industry is segregated into respiratory disorders, muscular rheumatism, counterirritant and antipruritic and others

In terms of distribution channels, the industry is segregated into conventional B2B (tenders, direct procurement, wholesalers & distributors) and online B2B (internal channel, external channel)

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global pharma grade synthetic camphor market is estimated to be valued at USD 466.4 million in 2025.

The market size for pharma grade synthetic camphor is projected to reach USD 677.2 million by 2035.

The pharma grade synthetic camphor market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The topical formulation segment is projected to lead in the pharma grade synthetic camphor market with 73% market share in 2025.

In terms of application, the respiratory disorders segment is expected to command 27% share in the pharma grade synthetic camphor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Pharma Grade Paper Providers

Pharma Grade Paper Market Growth & Trends 2025 to 2035

Pharma Grade Plastic Packaging Market Growth – Forecast 2024-2034

Pharma Grade Sodium Bicarbonate Market 2024-2034

Synthetic Camphor Market Size & Trends 2022 to 2032

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Washer Market Trends – Insights & Forecast 2024-2034

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharma Moisture Barrier Film Coating Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA