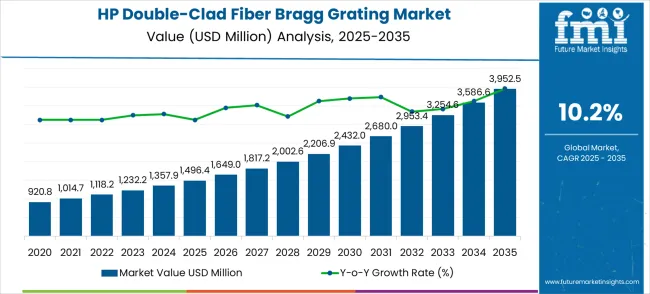

The high power double-clad fiber Bragg grating market, valued at USD 1,496.4 million in 2025 and projected to reach USD 3,952.5 million by 2035 at a CAGR of 10.2%, demonstrates distinct acceleration and deceleration phases over the forecast period. From 2025 to 2028, market expansion is relatively moderate, with incremental growth driven by early adoption in industrial lasers, telecommunications, and sensing applications. This initial phase is characterized by steady but cautious investment, as companies evaluate the technology’s performance and reliability. Production capacity and supply chains are gradually scaled, resulting in a stable growth trajectory with limited volatility in annual revenue increments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,496.4 million |

| Forecast Value (2035) | USD 3,952.5 million |

| Forecast CAGR (2025–2035) | 10.2% |

Between 2029 and 2032, the market enters an acceleration phase, with revenue growth intensifying as technological refinements, increased commercial deployments, and rising demand across high-power laser applications stimulate faster adoption. Annual market gains increase substantially, reflecting stronger investor confidence and expanded industrial integration. Strategic partnerships and innovations in grating design further amplify adoption rates, pushing the market beyond early-stage constraints. This period signifies the peak acceleration phase, where compounded growth outpaces prior years and begins to shape long-term industry dynamics.

From 2033 to 2035, the market experiences a slight deceleration as adoption matures and penetration in primary applications reaches saturation. Although absolute revenue continues to increase, the rate of growth stabilizes, influenced by competitive alternatives, market consolidation, and marginally slower expansion in emerging regions. Incremental gains become more predictable, and stakeholders focus on optimizing efficiency, value-added services, and secondary applications. Understanding these acceleration and deceleration patterns enables manufacturers, investors, and end-users to time production scaling, resource allocation, and technology upgrades effectively, maximizing overall market returns while anticipating long-term growth plateauing.

High Power Double-Clad Fiber Bragg Grating Market Opportunity Pools

The HP-DCFBG market is entering a growth phase, driven by demand for high-power lasers in materials processing, medical technology, defense, and communications. Between 2025 and 2035, the market is set to expand from USD 1.5 billion to USD 3.9 billion, representing a CAGR of 10.2%.

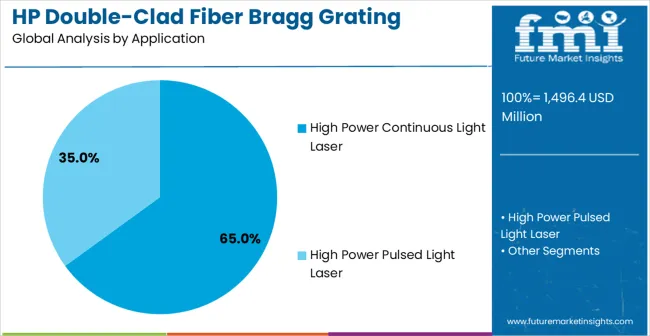

DCFBGs are critical for stabilizing and filtering emission in high-power continuous wave (CW) lasers used in cutting, welding, and additive manufacturing. This segment anchors 65% of current demand, with an incremental pool of USD 1.5–1.8 billion.

Pulsed laser systems for micromachining, drilling, and medical applications rely on precise wavelength locking. Growth in aerospace, healthcare, and electronics drives a pool of USD 0.7–1.0 billion.

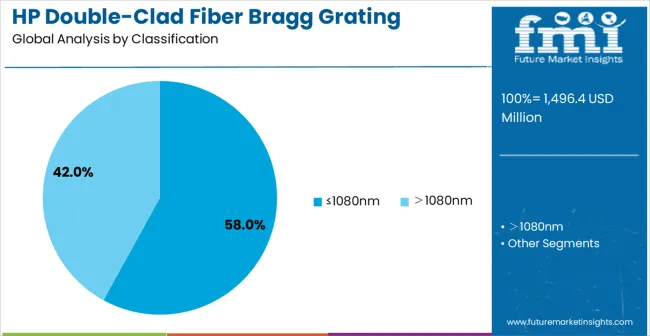

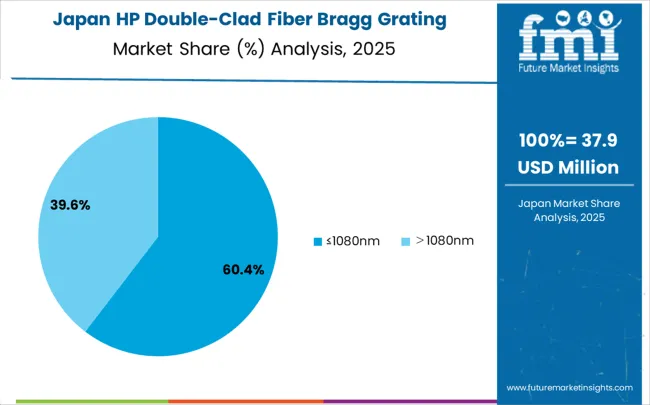

While ≤1080 nm accounts for ~58% of deployments, the shift toward >1080 nm enables tunability for defense, sensing, and medical lasers. This represents an emerging USD 0.6–0.9 billion pool.

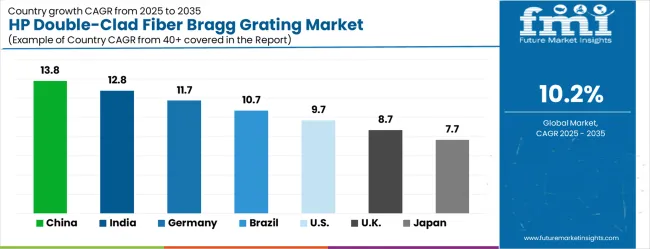

China (13.8% CAGR) and India (12.8% CAGR) dominate with rising demand for industrial lasers in EV, photovoltaics, and infrastructure. Together, they unlock USD 1.2–1.6 billion by 2035.

The USA, Germany, and the UK drive adoption in defense, aerospace, and photonics R&D. Premium niche demand represents USD 0.5–0.7 billion.

Laser-based surgery, diagnostics, and ophthalmology expand reliance on stable fiber Bragg gratings. Expected pool: USD 0.4–0.6 billion.

While industrial lasers dominate, niche opportunities exist for HP-DCFBG in next-gen optical communication backbones requiring ultra-stable sources. Smaller pool of USD 0.2–0.3 billion.

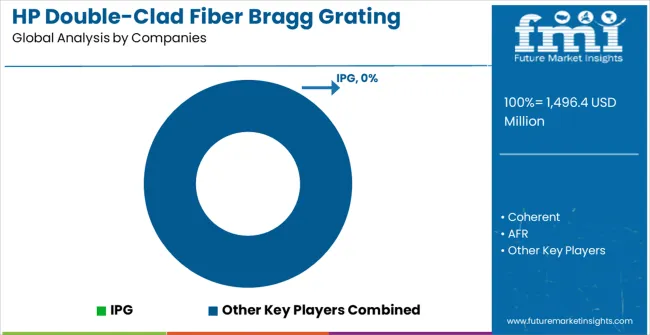

Key players (IPG, Coherent, Yangtze Optical, TeraXion, AFR, ITF, Maxphotonics, Connet Fiber, Raysung, Technica, CINA Laser) pursue in-house grating fabrication, brand differentiation, and digital transparency. Competitive branding represents USD 0.2–0.4 billion in value creation.

Market expansion is being supported by the rapid increase in fiber laser adoption across manufacturing industries and the corresponding need for high-performance optical components capable of handling extreme power levels. Modern industrial applications require precise wavelength control and power management in fiber laser systems, where double-clad fiber Bragg gratings provide essential wavelength stabilization and power coupling functionality. Even minor improvements in optical efficiency and power handling can result in significant productivity gains in industrial cutting, welding, and marking applications.

The growing complexity of high-power laser systems and increasing performance requirements are driving demand for advanced fiber Bragg grating solutions from specialized manufacturers with sophisticated fabrication capabilities. Industrial end-users are increasingly requiring precise wavelength control and thermal management in high-power applications to maintain consistent processing quality and system reliability. Technological advances in fiber optic manufacturing and increasing standardization of high-power laser specifications are establishing new performance benchmarks that require specialized double-clad fiber Bragg gratings with enhanced power handling and thermal stability.

The market is segmented by wavelength wavelength range, application type, and region. By wavelength classification, the market is divided into ≤1080nm and >1080nm segments. Based on application type, the market is categorized into high power continuous light laser and high power pulsed light laser applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The ≤1080nm wavelength classification is projected to capture 58% of the high power double-clad fiber Bragg grating (FBG) market in 2025, maintaining its leadership position. This dominance is largely driven by strong alignment with industrial fiber laser requirements, where lasers in this range provide optimal efficiency, thermal stability, and broad process compatibility. Applications such as metal cutting, precision welding, surface hardening, cladding, and cleaning benefit from the high absorption rates and processing precision offered by ≤1080nm systems.

The segment benefits from a well-established global manufacturing ecosystem, ensuring reliable component availability, supply chain resilience, and economies of scale. Ongoing research into laser-material interactions continues to validate this wavelength as the most versatile range for heavy-duty industrial applications. As industries adopt automated and digitally integrated laser systems, demand for ≤1080nm FBG solutions is expected to remain robust. The combination of operational efficiency, technological maturity, and widespread industrial applicability solidifies the segment’s market dominance.

High power continuous light (CW) laser applications are expected to represent 65% of the high power double-clad FBG market in 2025, maintaining the largest market share. Continuous wave fiber lasers are widely adopted across manufacturing industries because they provide stable, uninterrupted output critical for precision processing tasks. Applications such as additive manufacturing, deep welding, precision cutting, and surface treatment particularly benefit from CW lasers due to uniform energy distribution and high reproducibility, ensuring consistent production quality.

The segment is reinforced by the growing adoption of automated and Industry 4.0-enabled production lines. Automotive, electronics, and advanced metalworking manufacturers increasingly rely on CW lasers for high throughput, minimal defects, and enhanced efficiency. The large installed base of CW systems sustains recurring demand for specialized optical components like double-clad FBGs. Advances in laser scaling, beam quality control, and lightweight material processing create new growth opportunities. The CW segment is expected to remain the dominant driver of FBG market demand well into the next decade.

The High Power Double-Clad Fiber Bragg Grating market is advancing rapidly due to increasing fiber laser adoption and growing recognition of superior optical performance characteristics. However, the market faces challenges including high manufacturing costs, need for specialized fabrication equipment, and varying performance requirements across different laser applications. Standardization efforts and technology development programs continue to influence product specifications and market development patterns.

The growing deployment of kilowatt-class fiber lasers is enabling new industrial applications that require enhanced optical components capable of handling extreme power densities and thermal loads. Advanced fiber laser systems incorporate sophisticated wavelength control and power management capabilities that depend on high-performance double-clad fiber Bragg gratings for optimal operation. These developments are particularly valuable for heavy manufacturing and precision machining applications that require consistent power delivery and wavelength stability.

Modern fiber Bragg grating manufacturers are incorporating intelligent monitoring systems and adaptive control technologies that improve performance reliability and enable predictive maintenance capabilities. Integration of temperature monitoring, strain sensing, and real-time wavelength tracking systems enables more precise control of optical characteristics and comprehensive system optimization. Advanced manufacturing techniques also support development of specialized gratings for next-generation applications including high-power sensing and telecommunications infrastructure.

| Country | CAGR (2025-2035) |

|---|---|

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| Brazil | 10.7% |

| United States | 9.7% |

| United Kingdom | 8.7% |

| Japan | 7.7% |

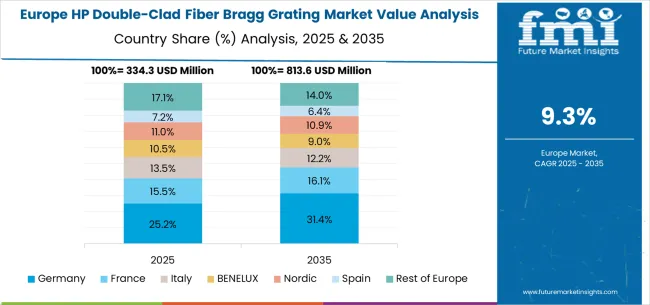

The high power double-clad fiber Bragg grating market is experiencing robust growth globally, with China leading at a 13.8% CAGR through 2035, driven by massive industrial expansion, government support for advanced manufacturing, and rapid adoption of fiber laser technologies. India follows at 12.8%, supported by growing industrial automation initiatives and increasing investment in precision manufacturing capabilities. Germany records 11.7%, emphasizing technological excellence, precision engineering standards, and advanced optical component development. Brazil grows at 10.7%, integrating fiber laser technologies into its expanding manufacturing sector. The United States demonstrates steady expansion at 9.7%, focusing on aerospace applications and advanced material processing. The United Kingdom shows consistent growth at 8.7%, supported by research initiatives and industrial modernization programs. Japan records 7.7%, maintaining its position in high-precision applications and advanced optical technologies.

The high power double-clad fiber Bragg grating market in China is projected to grow at a CAGR of 13.8% through 2035, driven by industrial manufacturing expansion and rising adoption of fiber laser technologies across multiple sectors. Key industrial regions are establishing fiber laser processing centers that demand high-performance double-clad fiber Bragg gratings for precision cutting, welding, and material processing. Government industrial modernization programs and sector expansion initiatives are stimulating adoption of automated production systems utilizing advanced fiber laser solutions. Investments in industrial R&D and workflow integration are enhancing operational efficiency and component reliability, enabling manufacturers to meet evolving precision manufacturing requirements nationwide.

The market in India is expected to grow at a CAGR of 12.8% through 2035, fueled by rapid industrialization and investments in advanced manufacturing technologies. Industrial sectors such as automotive, electronics, and metal fabrication are gradually adopting fiber laser systems that require specialized double-clad fiber Bragg gratings. Industrial development programs are promoting precision manufacturing technologies, while technology transfer initiatives are enabling domestic optical component production to meet growing demand. Professional training and R&D collaborations are enhancing expertise in fiber laser integration, supporting productivity improvements and reliable operation of high-performance optical components across emerging industrial centers.

Germany’s market is projected to grow at a CAGR of 11.7% through 2035, supported by its focus on precision engineering and advanced manufacturing technologies. Industrial companies are implementing sophisticated fiber laser systems requiring high-performance optical components that meet strict quality standards. R&D programs and technology investments are enhancing fiber laser capabilities, improving power handling, reliability, and operational efficiency. Industrial precision manufacturing initiatives are fostering adoption of advanced fiber laser solutions across automotive, electronics, and material processing sectors. Professional training and certification programs are ensuring technical expertise, enabling optimized integration of double-clad fiber Bragg gratings and supporting Germany’s industrial quality and regulatory standards.

The Brazilian market is expected to grow at a CAGR of 10.7% through 2035, driven by expanding manufacturing capabilities and increasing adoption of fiber laser technologies. Automotive, metal fabrication, and machinery sectors are gradually integrating fiber laser systems that require double-clad fiber Bragg gratings. Manufacturing modernization programs are supporting adoption of advanced laser technologies to improve processing efficiency and precision. Industrial development initiatives are fostering establishment of high-power laser systems for cutting, welding, and material processing applications. Investments in workforce training and workflow integration are enhancing operational reliability and supporting comprehensive adoption of fiber laser solutions across Brazil’s growing industrial regions.

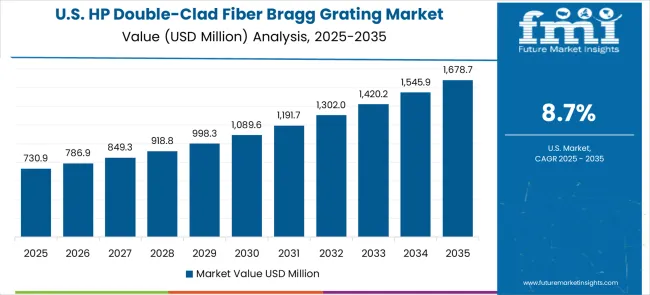

The USA market is projected to grow at a CAGR of 9.7% through 2035, driven by aerospace, defense, and advanced material processing sectors adopting fiber laser technologies. Aerospace and defense industries are implementing high-performance optical components for precision cutting, welding, and additive manufacturing. Industrial R&D programs are advancing fiber laser systems with enhanced power handling, operational reliability, and performance consistency. Workforce training initiatives are building technical expertise to optimize component integration, supporting diverse industrial applications. Investments in industrial modernization and advanced material processing are enabling widespread adoption of double-clad fiber Bragg gratings, strengthening the USA position in high-power fiber laser markets.

The market in the UK is expected to grow at a CAGR of 8.7% through 2035, driven by industrial modernization programs and strong research initiatives. Advanced manufacturing sectors are adopting fiber laser systems for precision machining and material processing, supported by academic-industry partnerships. R&D programs are advancing optical component technologies for next-generation fiber lasers with enhanced performance and reliability. Industrial modernization initiatives are promoting automated production systems using high-power fiber lasers. Workforce training and knowledge transfer programs are enhancing manufacturing capabilities, enabling consistent adoption of double-clad fiber Bragg gratings across specialized industrial and scientific applications.

Japan’s market is projected to grow at a CAGR of 7.7% through 2035, supported by leadership in precision manufacturing and advanced optical technologies. Japanese industrial companies are implementing fiber laser systems requiring high-performance double-clad fiber Bragg gratings for automotive, electronics, and advanced materials processing. Precision manufacturing investments emphasize accuracy, reliability, and operational efficiency. Optical technology R&D programs are advancing component manufacturing to support next-generation fiber laser systems. Workforce skill development programs are ensuring expertise in integration and maintenance of fiber laser solutions, enabling Japanese manufacturers to sustain high-precision production and innovation across specialized industrial applications.

The High Power Double-Clad Fiber Bragg Grating market is defined by competition among specialized optical component manufacturers, fiber laser system providers, and advanced materials companies. Companies are investing in advanced fabrication technologies, specialized manufacturing capabilities, quality control systems, and technical expertise to deliver precise, reliable, and high-performance optical solutions. Strategic partnerships, technological innovation, and manufacturing expansion are central to strengthening product portfolios and market presence.

IPG, globally recognized, offers comprehensive fiber Bragg grating solutions with emphasis on high-power applications, advanced wavelength control, and system integration capabilities. Coherent, operating internationally, provides specialized optical components integrated with laser system development and manufacturing services. AFR focuses on advanced fiber resources and specialized manufacturing capabilities for high-performance applications. ITF delivers precision optical components with emphasis on telecommunications and industrial applications.

TeraXion, Canada-based, offers sophisticated fiber Bragg grating technologies with focus on wavelength control and optical system optimization. Yangtze Optical Fibre and Cable Joint Stock Limited Company provides comprehensive optical fiber solutions and specialized component manufacturing. Maxphotonics Co., Ltd. emphasizes high-power laser applications and integrated optical systems. Aunion Tech Co., Ltd., Connet FIBER Optics Co., Ltd., Raysung Photonics Inc., Technica, LECI, CINA Laser, and Shanghai Precilasers Technology offer specialized manufacturing expertise, advanced fabrication capabilities, and comprehensive optical component solutions across regional and global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,496.4 million |

| Wavelength Classification | ≤1080nm, >1080nm |

| Application Type | High Power Continuous Light Laser, High Power Pulsed Light Laser |

| Technology Type | Standard Double-clad, Advanced Double-clad Configurations |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | IPG, Coherent, AFR, ITF, TeraXion, Yangtze Optical Fibre and Cable Joint Stock Limited Company, Maxphotonics Co., Ltd., Aunion Tech Co., Ltd., Connet FIBER Optics Co., Ltd., Raysung Photonics Inc., Technica, LECI, CINA Laser, Shanghai Precilasers Technology |

| Additional Attributes | Dollar sales by wavelength classification, application type, and technology configuration, regional demand trends across Asia Pacific, North America, and Europe, competitive landscape with established manufacturers and emerging technology providers, performance characteristics for high-power applications versus standard configurations, integration with advanced fiber laser systems and industrial automation platforms, innovations in power handling capabilities and thermal management systems, and adoption of specialized gratings with enhanced wavelength stability and improved reliability for extreme operating conditions. |

The global high power double-clad fiber bragg grating market is estimated to be valued at USD 1,496.4 million in 2025.

The market size for the high power double-clad fiber bragg grating market is projected to reach USD 3,952.5 million by 2035.

The high power double-clad fiber bragg grating market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in high power double-clad fiber bragg grating market are ≤1080nm and >1080nm.

In terms of application, high power continuous light laser segment to command 65.0% share in the high power double-clad fiber bragg grating market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA