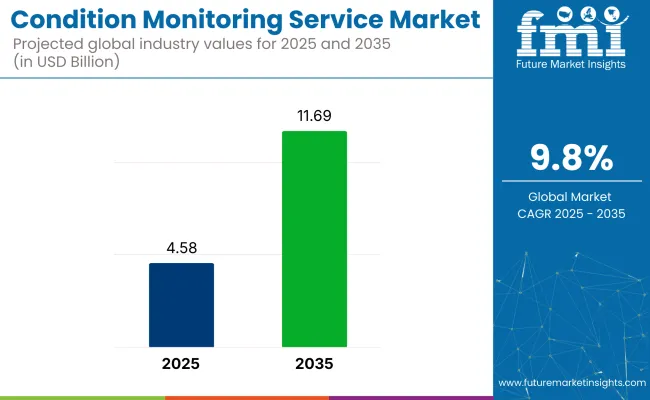

The condition monitoring service industry valuation is likely to expand strongly, with an estimated value of USD 4.58 billion in 2025. It is expected to reach around USD 11.69 billion by 2035, growing at a CAGR of about 9.8%. The requirement for predictive maintenance, equipment reliability, and digitalization in industries leads to growth.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.58 billion |

| Industry Value (2035F) | USD 11.69 billion |

| CAGR (2025 to 2035) | 9.8% |

One of the prime growth drivers is increasing industrial complexity and automation. Faultless continuity is reliant upon advanced manufacturing, energy production, and transport infrastructure. Hence, it is critically important to operational efficiency and safety that faults should be detected at an early stage and preventive maintenance should be applied.

Industry 4.0 and IoT-based condition monitoring systems are also spurring industry growth. Vibration analysis, thermography, ultrasound, and oil analysis services are now being offered on cloud platforms, mobile dashboards, and analytics based on AI-furnishing real-time information to maintenance teams across locations.

Despite the advantages, there are also drawbacks, such as high setup expenses, difficulty in managing data, and the need for skilled personnel. Small and medium enterprises may not be able to pay for full-service monitoring platforms without incurring significant training or outsourced support costs.

Service companies are presenting subscription-based models that are scalable and deliver access to diagnostics, reporting, and alerts with outlays for businesses that won't break the bank. The models give smaller players opportunities to derive condition monitoring value without either homegrown expertise or infrastructure.

North America and Europe take the lead by adopting predictive maintenance technologies at the earliest and the presence of heavy industrial bases. Asia-Pacific is rapidly developing; however, it is powered by industrialization growth, the competitiveness of manufacturing, and upgrading old-fleet equipment to modern technology.

The condition monitoring services market is expanding at a very fast rate, driven by the growing needs for predictive maintenance offerings and embracing the latest technology such as IoT and AI. The services play a vital role for industries desirous to enhance equipment reliability, reduce downtime, and maintain optimized maintenance scheduling.

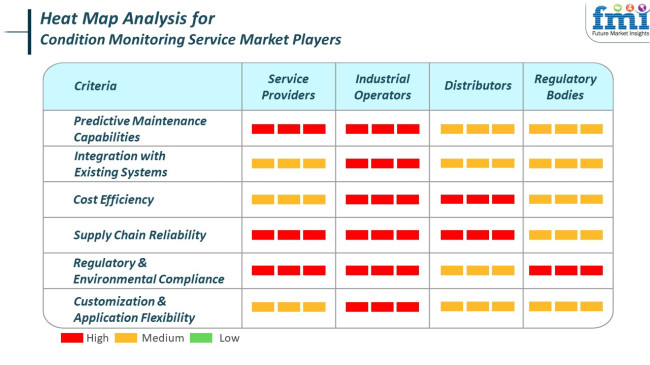

Distributors refer to the need for providing a wide variety of condition monitoring services that suit different industrial applications. They stress maintaining sound relations with the service providers in a manner that ensures delivery and support in time. Regulatory Agencies impose conformity to environmental and safety standards, compelling industry adoption of condition monitoring services to enable industries to comply with these standards. Regulatory agencies are key in influencing the industry by enforcing regulations that promote a proactive maintenance culture.

Between 2020 and 2024, the industry grew strongly due to the rising demand for predictive maintenance in the manufacturing, oil & gas, and automotive sectors. Leading countries were the United States, Germany, and Japan, with industrial automation and advanced analytics being the areas of focus in avoiding equipment breakdowns.

These countries utilized more IoT-driven solutions, such as wireless data transfer, sensors, and predictive models. Economic pressure temporarily slowed global adoption of new technology due to the pandemic. Still, it accelerated the need for remote diagnosis as well as contactless monitoring, particularly across manufacturing and the energy sectors.

From 2025 to 2035, the industry will see a broader uptake of AI-based condition monitoring systems across the world, with India, China, and Brazil as leading players as their industrial bases expand. Demand for cost-effective monitoring in mining, agriculture, and manufacturing industries will spur growth.

Europe and North America will remain at the forefront of technological innovation, with developments such as edge computing and real-time diagnostics, which will be instrumental in enhancing the accuracy and speed of predictive maintenance approaches. In general, digitalization and the drive towards sustainable, efficient operations will define the future of the condition monitoring service market.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industrial automation, IoT uptake, and predictive maintenance in industrialized nations | Global digitalization, AI incorporation, and development of industrial base in emerging markets |

| Cloud monitoring systems, IoT devices, and wireless data analysis | AI-powered systems, edge computing, machine learning, and real-time analysis for enhanced predictive ability |

| Weakening economy, sluggish uptake in emerging markets, and poor visibility in some industries | High initial investment expenses, new economy skill shortages, and computer data protection issues |

| High adoption in North America, Europe, and Japan, and increasing presence in the Middle East and Asia | Adoption growth in Asia-Pacific (India, China) and Latin America (Brazil), growth sustained in North America |

| Industrial safety legislation and preventive maintenance focus in mature economies | Stricter sustainability regulations, e.g., emissions reductions and safety standards in emerging markets |

| Increased application of automation in condition monitoring and remote diagnostics, mainly in the manufacturing and energy sectors | Integration of IP with emerging technology like 5G, blockchain for data security, and advanced-level AI algorithms |

A high cost of initial investment and implementation considerably challenges the condition monitoring service industry. Rolling out sophisticated monitoring systems entails great expense in terms of sensors, specialized software, and skilled technicians. Small and medium enterprises might find such expense too high to bear, precluding extensive implementation.

Legacy system integration is another risk. Most industries have legacy equipment that can be incompatible with new monitoring technology. Incompatibility will cause higher costs and technical challenges to implement, and it can result in delays and diminish the efficacy of the monitoring services.

A lack of skilled data analysis and system management professionals is a critical issue. The success of condition monitoring services is very much dependent on professional analysis of intricate data. With insufficient personnel, businesses are likely to be unable to utilize these services to the maximum and, as a result, have to make substandard maintenance decisions and possible equipment failure.

Dependence on primary sectors such as manufacturing, oil and gas, and power generation has the potential for downtrends within these industries, which have a direct influence on the need for condition monitoring services. Synchronizing multiple customers in other sectors reduces such exposure to possible declines in this particular line.

In summary, the industry has high implementation costs, integrational problems, labor shortages, cybersecurity breaches, and industry-specific economic decline. Anticipatory strategies for these elements are needed to sustain growth and competitiveness in this changing industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

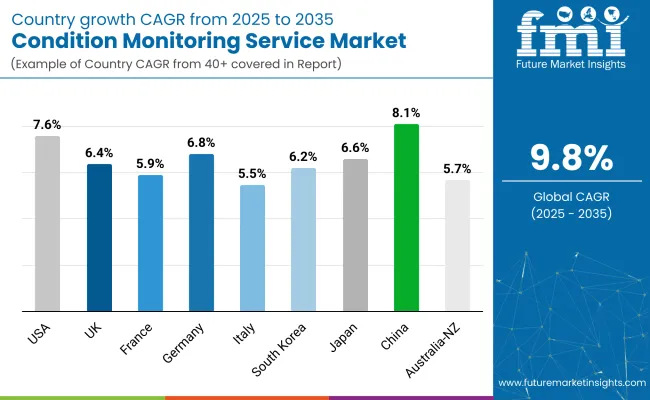

| USA | 7.6% |

| UK | 6.4% |

| France | 5.9% |

| Germany | 6.8% |

| Italy | 5.5% |

| South Korea | 6.2% |

| Japan | 6.6% |

| China | 8.1% |

| Australia-NZ | 5.7% |

The USA is expected to grow at 7.6% CAGR during the forecast period. The USA is experiencing robust growth as a result of increasing investments in predictive maintenance technologies across key industrial sectors such as oil & gas, manufacturing, and energy. A greater focus on minimizing downtime and extending equipment life is fueling demand for advanced condition monitoring services.

The adoption of cloud-based diagnostic and IoT-empowered sensors is gaining traction among American companies, providing real-time testing and effective maintenance planning. Government policies embracing smart manufacturing technologies are acting as growth stimuli.

Additionally, the growing need to meet rigorous safety and performance standards in sectors such as aerospace, defense, and utilities is driving adoption. The USA is being sustained by the presence of prime solution providers and a high level of awareness regarding the cost benefits of predictive maintenance. Continuous R&D efforts and collaborations between industrial players and technology companies are also further enhancing service capabilities.

The UK will grow at 6.4% CAGR during the study period. The UK is witnessing steady growth fueled by innovation in smart infrastructure and industrial automation. The country's manufacturing sector maturity and the push towards energy efficiency are greatly influencing the increased demand for predictive maintenance services.

New horizons are being explored through new applications in renewable energy and utilities. Government regulations for carbon reduction and effective energy consumption are creating opportunities for remote and real-time monitoring solutions.

Industries in the UK are increasingly employing data-driven insights to minimize maintenance expenses and improve equipment reliability. The widening horizon of Industry 4.0 and digital transformation in manufacturing, logistics, and transportation industries is driving investment in condition monitoring systems. Local players are collaborating with technology companies to enhance asset performance management.

France will grow at a 5.9% CAGR over the study period. The industry is developing progressively, influenced by an increased focus on industrial digitization and sustainability. Aerospace, automotive, and utility industries in France are using predictive maintenance to maintain high levels of operational efficiency. The growing uptake of smart factories and IoT-based frameworks is increasing the demand for real-time diagnosis and analytics-driven services.

With a view to reducing operating costs and avoiding unplanned shutdowns, companies are turning to data-driven condition monitoring systems. Government support for industrial innovation and digitization is compelling local industries to invest in monitoring solutions. State-of-the-art infrastructure availability and research organization-industrialist cooperation drive innovation in service delivery. As France transitions to clean energy and decarbonization goals, predictive monitoring will assist in guaranteeing the reliability of energy systems.

Germany is expected to expand at a 6.8% CAGR during the forecast period. Germany's status as an industrial powerhouse is generating enormous demand for condition monitoring services. High emphasis on productivity, quality, and efficiency in industries such as heavy engineering, automotive, and manufacturing is promoting the adoption of predictive maintenance techniques.

The widespread application of Industry 4.0 and digital twin technologies widens the scope of condition monitoring, facilitating precise diagnostics and real-time examination of machinery. German manufacturing industries increasingly employ vibration analysis, thermography, and oil analysis to condition their assets in advance and prevent breakdowns.

Government support for digitalization through initiatives like "Industrie 4.0" is accelerating the adoption of smart condition monitoring solutions. Additionally, Germany's focus on export-driven industrial manufacturing necessitates high production process reliability, thus driving industry growth. Having global industrial giants and R&D-intensive environments boosts innovation in service models.

Italy will grow at 5.5% CAGR over the study period. The industry is gaining momentum due to increasing awareness of the advantages of predictive maintenance in medium to large-scale enterprises. The growth areas are energy, manufacturing, and transportation, where asset performance and safety are most critical.

Remote condition monitoring equipment is being used more and more, particularly in power generation and water treatment plants. While the industry is in its developing stage, demand is being fueled by attempts to reduce equipment downtime.

Government incentives, particularly in the form of EU-funded programs, are providing a stimulus for growth. Italian industry participants seek to integrate condition monitoring into established automation and SCADA-based infrastructures. Building localized, application-oriented solutions is helping to mitigate the barrier of legacy infrastructure and cost constraints.

South Korea will register a 6.2% CAGR during the forecast period. South Korea is expanding steadily due to the country's strong focus on manufacturing excellence and smart industrialization. Electronics, automotive, and energy sectors with high equipment reliability and operational efficiency needs are driving growth. The application of AI and machine learning technologies is improving fault detection capability and supporting predictive maintenance efforts.

The South Korean government's push for digitalization and smart manufacturing is driving huge investments in condition monitoring systems. Infrastructure for high-speed connectivity, enabling untroubled real-time diagnostics and remote monitoring, supports this growth. The domestic market also benefits from the technological strengths of local electronics and sensor manufacturers, allowing the integration of sophisticated monitoring tools. Industry-academic collaborations are driving innovation and upskilling of workers.

Japan is expected to grow at a 6.6% CAGR during the study period. Japan's condition monitoring service industry is expanding as industries implement digital maintenance techniques for increased productivity and equipment longevity. The manufacturing sector, automotive and electronics being major ones, is adopting sophisticated diagnostic technology aggressively to minimize downtime and lifecycle expense.

Condition monitoring integration with robotics and AI analysis provides timely information for maintenance planning. Japan's quality and precision engineering focus is tailor-made for predictive maintenance culture. Government promotion of smart factories and automation is helping the market growth.

The widespread application of sensors and data acquisition technology is making real-time monitoring cost-effective and dependable. Japanese companies are investing more in R&D to enhance system effectiveness and develop novel service models.

The Chinese market is forecast to grow at 8.1% CAGR during the study period. The China condition monitoring service industry is experiencing strong growth driven by fast-paced industrialization and is focused on the modernization of manufacturing in China. Upgrading old industries and government smart manufacturing promotion policies are key drivers.

Demand is strong in sectors such as chemicals, heavy equipment, and energy, where predictive maintenance is picking up pace to help achieve peak performance and reduce operational hazards. Increasing levels of IoT devices and 5G connectivity are boosting the effectiveness of remote monitoring solutions. Local companies are also contributing in their way to delivering scalable, cost-effective services to meet the requirements of the local industry.

In addition to this, increasing investments in smart infrastructure and cities are expanding the area of application for condition monitoring. With the growing focus on energy efficiency and emissions management, predictive maintenance is turning into a strategic necessity as well.

The Australia-NZ region is expected to record a 5.7% CAGR during the study period. The Australian and New Zealand condition monitoring service industry is expanding steadily, driven by the need to enhance operational effectiveness in high-capital sectors such as mining, utilities, and manufacturing. Predictive maintenance is gaining traction as organizations seek to reduce equipment downtime and improve the quality of safety standards.

Government initiatives promoting digitalization and environmentally friendly practices are triggering investment in monitoring technologies. The region's high labor cost relative to the rest of the world is nudging industries towards automating maintenance activities using condition-based monitoring.

Firms are widely using cloud-based solutions and remote diagnostics to cover extensive operational footprints, especially in mining and agriculture. Local players and international technology firms are coming together to drive access to sophisticated analytics and AI-based platforms. High levels of awareness and regulatory support for risk-based maintenance practices also underpin the market.

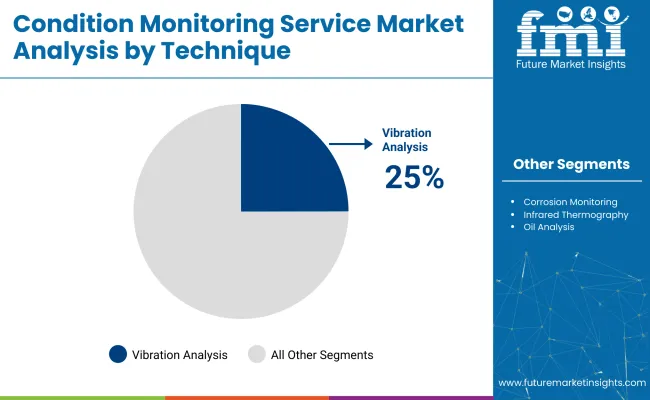

By technique, the vibration analysis segment will account for a share of 25%. Oil analysis would follow with an expected industry share of 18%.

Both methods are extensively used for the predictive maintenance of machinery and equipment in various industries, including manufacturing, automotive, and energy.

Vibration analysis has always been a salient technique for condition monitoring in the early detection of problems such as misalignment, unbalance, and bearing failures. It involves obtaining measurement readings of equipment vibrations to find anomalies indicative of an impending failure.

Companies like SKF and Emerson Electric offer a full suite of solutions in vibration analysis. For example, SKF's machine condition monitoring systems help detect problems with rotating equipment, thus minimizing downtime and improving the operational life of the machinery. Emerson's CSI 6500 Vibration Sensor is also known for its advanced vibration monitoring functions, which allow for the real-time diagnosis of industrial equipment and early failure detection.

Oil analysis remains a viable technique in condition monitoring, especially applicable to engines, hydraulic systems, and compressors. By analyzing the physical and chemical properties of oil, it is possible to detect contaminants, metal wear, and other indicators of mechanical failure.

Companies like WearCheck and Schneider Electric provide oil analysis services that enable their customers to check the condition of their equipment. For example, WearCheck's oil analysis program includes detailed reporting of wear metals, water content, and contaminants in soil samples for timely maintenance action. Schneider Electric uses functional oil analysis through its EcoStruxure™ Asset Advisor to optimize the maintenance schedule for critical equipment.

Machine monitoring accounts for nearly 28% of the overall industry share. The portable machine diagnostics segment accounts for 25%.

Because online machine monitoring offers continuous real-time data on machine conditions, companies can monitor machine conditions and detect problems before they develop into catastrophic failures. In this manner, it provides information on vibrations, temperatures, and several critical parameters.

Major players in this area include Honeywell and General Electric, with Honeywell's SmartLine™ Pressure Transmitters and GE's Predix platform, which provide high-end predictive maintenance services. Such systems can monitor machines continuously and issue alerts whenever the equipment performance deviates from set norms, which goes a long way in avoiding unscheduled downtimes and reducing maintenance expenditures.

Portable machine diagnostics remain among the best-established methodologies of on-site inspection and troubleshooting. In this regard, the main advantage of these tools for field maintenance technicians is that they can diagnose machine health without imposing any restrictions on the assessment time.

Some companies, like Fluke Corporation and SKF, also manufacture several portable advanced diagnostics tools that challenge the Fluke 810 Vibration Tester and SKF portable vibration sensors, which allow workers to conduct fast assessments of the condition of machines. These tools are in particular demand in industries with mobility or for machines that lack fixed monitoring systems.

The condition monitoring service industry is highly competitive, and established companies utilize state-of-the-art diagnostic tools, predictive analytics, and AI-governed monitoring solutions for equipment reliability and performance. Firms such as Schaeffler Technologies, Siemens AG, and Honeywell International focus on fusing Industrial IoT (IIoT) with real-time condition monitoring systems for early fault detection and the minimization of uncharacteristic downtimes in industrial applications.

The advancement of technologies in vibration analysis, thermography, and ultrasonic monitoring are the determinants of the competition strategies used by the leading players. Via cloud and AI-based platforms for diagnostics, ABB Ltd., Emerson Electric, and Rockwell Automation are increasing their prediction maintenance solutions for the remote monitoring of critical assets in the manufacturing, energy, and aerospace sectors.

Strategic partnerships and acquisitions are vital for revenue growth. General Electric and Parker Hannifin have been putting considerable investments into edge computing and smart sensor technology to boost machine learning-based predictive maintenance solutions. With growing concerns related to cybersecurity in remote monitoring services, the companies have integrated secure data transmission protocols into their condition monitoring frameworks.

A few emerging players, such as PCE Instruments and AIMIL Ltd., concentrate on developing affordable, modular, and scalable monitoring solutions for SMEs. The increased demand for automated, non-intrusive monitoring solutions through many sectors, such as oil & gas, automotive, and power generation, has accelerated the competition between players.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Schaeffler Technologies AG & Co. | 15-20% |

| Siemens AG | 12-16% |

| Honeywell International Inc. | 10-14% |

| ABB Ltd. | 8-12% |

| Emerson Electric Co. | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Schaeffler Technologies AG & Co. | Provides IIoT -enabled predictive maintenance solutions with cloud-based diagnostics. |

| Siemens AG | Specializes in AI-driven vibration monitoring and sensor-integrated predictive analytics. |

| Honeywell International Inc. | Focuses on real-time asset health monitoring for critical industrial applications. |

| ABB Ltd. | Develops cloud-based predictive analytics integrated with machine learning algorithms. |

| Emerson Electric Co. | Offers wireless condition monitoring solutions for industrial automation. |

Key Company Insights

Schaeffler Technologies AG & Co. (15-20%)

A key leader in IIoT-powered predictive maintenance, offering machine health analytics, AI-driven diagnostics, and cloud-enabled remote monitoring solutions.

Siemens AG (12-16%)

Siemens leads in AI-based vibration analysis and thermography solutions, integrating real-time industrial asset monitoring into its digital automation ecosystem.

Honeywell International Inc. (10-14%)

Honeywell specializes in remote asset monitoring and predictive analytics, leveraging sensor-based diagnostics and cybersecurity-enhanced data management.

ABB Ltd. (8-12%)

ABB provides edge computing-based condition monitoring solutions, integrating real-time analytics and automation into industrial workflows.

Emerson Electric Co. (5-9%)

Emerson expands its industry presence with smart wireless sensors and AI-powered predictive analytics, catering to power, oil & gas, and manufacturing industries.

Other Key Players

The segmentation is into vibration analysis, corrosion monitoring, infrared thermography, ultrasound testing, motor condition monitoring, and oil analysis.

The segmentation is into route-based monitoring, portable machine diagnostics, online machine monitoring, online machine protection, and factory assurance tests.

The segmentation is into oil & gas, power generation, aerospace & defense, automotive & transportation, marine, mining & metal, food & beverage, and chemical & petrochemical.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to reach USD 4.58 billion by 2025.

The industry is projected to grow significantly, reaching USD 11.69 billion by 2035.

China is expected to experience robust growth with a CAGR of 8.1%, driven by rapid industrialization and expanding manufacturing operations.

Vibration analysis stands out as the leading segment, widely adopted for early detection of equipment faults and enhancing asset reliability.

Key companies include Schaeffler Technologies AG & Co., Siemens AG, Honeywell International Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., General Electric, Parker Hannifin Corp., Fluke Corporation, Festo Group, Eaton Plc, PCE Instruments, and AIMIL Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Conditioning Agents Market Size and Share Forecast Outlook 2025 to 2035

Condition Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Condition Monitoring System Providers

Condition Monitoring Sensors Market

Reconditioned Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Reconditioned IBC Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Reconditioned IBC Providers

Industry Share Analysis for Reconditioned Steel Drum Providers

Reconditioned Drums Market

Reconditioned Packaging Market

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Dough Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Flour Conditioner Market

Power Conditioning Services Market Trends - Growth & Forecast 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Bakery Conditioner Market

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA