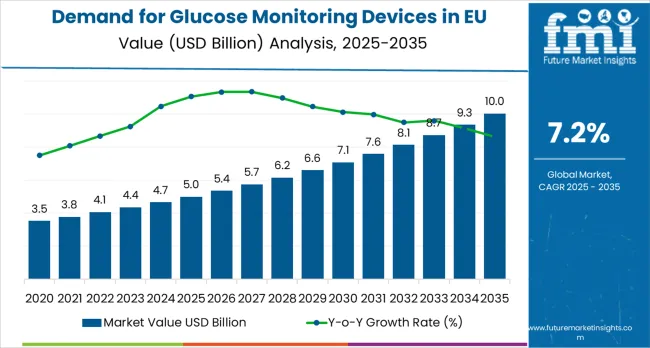

The Demand for Glucose Monitoring Devices in EU in EU is likely to reach from USD 5.0 billion in 2025 to approximately USD 10.0 billion by 2035, recording an absolute increase of USD 5.0 billion over the forecast period. This translates into a total growth of 100.0%, with the market forecast to expand at a CAGR of 7.2% between 2025 and 2035.

The market size is expected to grow by nearly 2.0X during the same period, supported by the rising prevalence of diabetes across European populations, increasing adoption of continuous glucose monitoring technologies, growing emphasis on preventive healthcare and self-management, and expanding digital health infrastructure and reimbursement coverage across EU member states.

Between 2025 and 2030, the Demand for Glucose Monitoring Devices in EU is projected to expand from USD 5.0 billion to USD 6.7 billion, resulting in a value increase of USD 1.7 billion, which represents 34.0% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating diabetes management trends across European healthcare systems, increasing awareness of continuous glucose monitoring benefits and patient outcomes, growing adoption of digital health technologies for diabetes care, and expansion of healthcare infrastructure in Eastern European economies.

Manufacturers are developing innovative product formulations, including enhanced sensor technologies, smartphone integration capabilities, AI-powered analytics, and improved patient comfort solutions to address evolving European healthcare preferences for accuracy, connectivity, user experience, and clinical effectiveness.

From 2030 to 2035, the market is forecast to grow from USD 6.7 billion to USD 10.0 billion, adding another USD 3.3 billion, which constitutes 66.0% of the ten-year expansion. This period is expected to be characterized by widespread adoption of next-generation glucose monitoring technologies across mainstream European healthcare channels, integration of artificial intelligence and predictive analytics for enhanced diabetes management, development of condition-specific monitoring solutions targeting different diabetes types, and expansion of premium continuous monitoring and digital health segments.

The growing emphasis on personalized medicine in European healthcare systems, increasing healthcare professional recommendations for advanced monitoring technologies, stringent EU regulations supporting medical device safety and efficacy, and rising digital health consciousness across European patient populations will drive sustained demand for technologically advanced, clinically validated, and user-friendly glucose monitoring device solutions.

Between 2020 and 2025, the Demand for Glucose Monitoring Devices in EU experienced robust expansion, driven by accelerating digital health trends that positioned glucose monitoring devices as essential components for comprehensive diabetes management, preventive healthcare, and patient empowerment.

The market developed as European healthcare providers and diabetes patients recognized technological opportunities in advanced, connected, and user-friendly glucose monitoring formats that appealed to tech-savvy patients and healthcare professionals seeking optimal clinical outcomes and patient engagement for their diabetes management applications.

Major multinational medical device companies expanded production capacity through strategic capital investments in European facilities, while regional players developed specialized technologies addressing specific patient requirements and healthcare protocols across diverse national healthcare systems within the European Union.

Market expansion is being supported by the fundamental shift in healthcare attitudes toward patient-centred diabetes management and preventive care across European societies, with glucose monitoring devices increasingly regarded as essential medical technologies deserving premium clinical performance, advanced connectivity features, and patient outcomes comparable to hospital-grade monitoring systems while providing unique home-based management advantages.

Modern European patients and healthcare professionals consistently prioritize device accuracy, ease of use, connectivity capabilities, and clinical integration when selecting glucose monitoring systems, driving demand for advanced monitoring device formulations that deliver superior clinical performance, seamless digital integration, exceptional user experience, and healthcare system connectivity compared to traditional blood glucose meters.

Even minor concerns about diabetes management, glucose control, or clinical monitoring requirements can drive comprehensive adoption of specialized premium glucose monitoring devices designed to maintain optimal glycemic control, support specific clinical applications, and enhance patient satisfaction throughout all diabetes management categories.

The growing complexity of diabetes care and increasing awareness of continuous monitoring benefits are driving demand for technologically advanced glucose monitoring devices from certified European manufacturers with appropriate medical device certifications, clinical validation capabilities, technical expertise, and compliance with stringent EU medical device regulations.

Regulatory authorities across European Union member states are increasingly establishing comprehensive guidelines for glucose monitoring device manufacturing, clinical accuracy standards, data security requirements, and medical device safety protocols to ensure device effectiveness and patient safety.

Clinical research studies and real-world evidence conducted at European diabetes research institutions are providing evidence supporting advanced glucose monitoring interventions for common diabetes management challenges including glycemic variability reduction, hypoglycemia prevention, treatment optimization, and clinical outcome improvement, requiring specialized technology expertise and clinically-validated manufacturing processes that meet EU medical device standards.

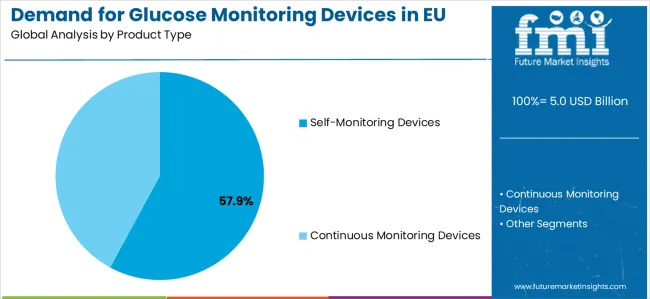

The market is segmented by product type, indication, distribution channel, and sales region. By product type, the market is divided into self-monitoring devices (including blood glucose meters, test strips, and lancets) and continuous monitoring devices (including sensors, transmitters, and receiver systems).

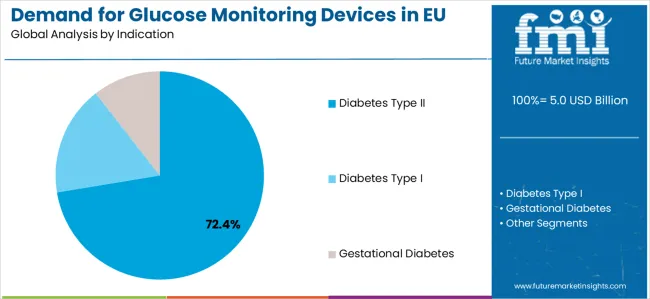

Based on indication, the market is categorized into diabetes type II (including adult-onset diabetes and metabolic syndrome subsegments), diabetes types I (including juvenile diabetes and autoimmune diabetes subsegments), and gestational diabetes applications.

By distribution channel, the market spans hospitals & clinics (healthcare facilities, diabetes centers), pharmacies (community pharmacies, hospital pharmacies), and online retail (e-commerce platforms, direct-to-consumer websites). Regionally, the market covers Germany, France, Italy, Spain, Netherlands, and Rest of Europe.

Self-monitoring devices segment is likely to account for 57.9% of the Demand for Glucose Monitoring Devices in EU in 2025, establishing itself as the dominant product category across European healthcare and patient care facilities. This commanding market position is fundamentally supported by the widespread adoption of blood glucose meters for routine diabetes management, cost-effective monitoring solutions, and established clinical protocols that deliver reliable accuracy, proven clinical performance, and superior accessibility throughout large-scale healthcare operations across EU member states.

Self-monitoring device products provide European patients with unparalleled monitoring flexibility, precise glucose measurement during daily management routines, proven clinical reliability, and seamless integration with diabetes management protocols that comply with stringent EU medical device safety directives.

This product sophistication enables European medical device manufacturers to achieve optimal production economics while maintaining rigorous quality protocols mandated by European Medicines Agency (EMA) regulations, comprehensive clinical validation systems required under EU law, and consistent clinical performance across millions of individual diabetes management applications produced annually.

The segment derives substantial competitive advantages from established European medical device manufacturing infrastructure offering specialized production solutions, comprehensive clinical support services, and continuous product innovation that incorporates enhanced accuracy technologies, improved user interface design, and advanced connectivity capabilities aligned with digital health standards. The self-monitoring systems deliver superior cost-effectiveness particularly important in value-based healthcare markets, enhanced patient accessibility, improved reimbursement coverage, and superior regulatory compliance with EU medical device manufacturing standards.

Diabetes Type II applications are positioned to represent 72.4% of total European glucose monitoring device demand in 2025, reflecting the segment's dominant position within the market ecosystem and the substantially larger patient population compared to other indication categories across most European countries. This substantial market share directly demonstrates the exceptionally high prevalence of Type II diabetes among European patients and the continuously expanding population of diabetes management programs across both Western and Eastern European healthcare systems.

Modern European Diabetes Type II glucose monitoring applications are increasingly featuring sophisticated technologies that deliver enhanced monitoring accuracy, extended monitoring duration, and specialized clinical features specifically designed to address common Type II diabetes management challenges including postprandial glucose monitoring, medication adherence support, lifestyle modification guidance, and long-term glycemic control optimization.

European healthcare providers consistently demonstrate commitment to investing substantially in advanced glucose monitoring devices that deliver visible clinical outcomes, support optimal patient management, comply with EU healthcare quality standards, and provide consistent results for both healthcare facility operations and home-based patient care. Within the diabetes Type II segment, adult-onset diabetes applications command 50% share, metabolic syndrome represents 15%, and lifestyle-related diabetes accounts for 7.4%, reflecting comprehensive clinical segmentation strategies tailored to European diabetes care preferences.

The Demand for Glucose Monitoring Devices in EU is advancing steadily due to intensifying diabetes prevalence trends and growing recognition of continuous monitoring benefits across EU member states. The market faces challenges, including high device costs and reimbursement limitations, complex regulatory requirements for medical device approvals across diverse European jurisdictions, varying patient adoption rates across different monitoring technologies, competition from emerging digital health solutions including smartphone-based monitoring and wearable devices, and varying healthcare system integration capabilities across different EU countries despite digital health advancement efforts. Innovation initiatives, reimbursement expansion programs, patient education solutions, and digital health platforms continue to influence product development strategies and market evolution patterns across European healthcare markets.

The rapidly accelerating adoption of digital health technologies and connected care solutions is fundamentally enabling broader healthcare integration across European countries, enhanced clinical outcomes among patients particularly regarding real-time monitoring and data analytics, and significantly improved healthcare provider engagement through advanced monitoring platforms.

Advanced digital health platforms operated by specialized healthcare technology companies, professional diabetes care providers, and major medical device manufacturers equipped with comprehensive data analytics in multiple European languages, clinical decision support tools, patient education resources, and personalized care recommendations provide extensive healthcare solutions while dramatically expanding clinical visibility across diverse patient segments and geographic healthcare markets throughout the European Union.

These digital health trends prove particularly valuable for glucose monitoring devices that require comprehensive clinical integration, real-time data transmission, and targeted healthcare approaches to effectively demonstrate clinical benefits and justify technology investments across sophisticated European healthcare systems.

Digital health integration also enables sophisticated patient data analytics, personalized diabetes management recommendations based on individual glucose patterns and lifestyle factors, direct healthcare provider feedback collection that informs clinical protocols, and connected care models that ensure continuous clinical oversight while reducing healthcare delivery costs across fragmented European healthcare systems.

Progressive European glucose monitoring device manufacturers are systematically incorporating innovative artificial intelligence technologies including predictive glucose analytics, hypoglycemia prediction, treatment optimization algorithms, and personalized care recommendations that address growing European healthcare demands for proactive diabetes management, clinical decision support, and improved patient outcomes in diabetes care technologies.

Strategic integration of these AI technologies, combined with rigorous clinical validation and real-world evidence protocols conducted at European diabetes research institutions, enables manufacturers to develop differentiated clinical propositions that appeal to evidence-based European healthcare providers while maintaining essential clinical accuracy and patient safety characteristics.

These technological initiatives also support development of specialized applications for specific diabetes management scenarios increasingly recognized across European healthcare systems, enhanced predictive capabilities for clinical complications recommended by European endocrinologists, and clinically-proven technologies that resonate with outcome-focused healthcare segments particularly prevalent in Nordic and Western European countries.

Technology investments in AI development facilities established in Netherlands and Germany, precision clinical analytics capabilities, and advanced glucose monitoring technologies enable European manufacturers to explore next-generation diabetes care while maintaining competitive positioning in premium and clinical-grade market segments.

European patients and healthcare providers are increasingly prioritizing patient-centered design and enhanced user experience when selecting glucose monitoring devices, driving fundamental changes in product development strategies across the European medical device industry. Companies are implementing comprehensive user experience design systems focusing on intuitive device interfaces, reducing complexity through simplified operation procedures, and developing patient-friendly technologies that align with EU accessibility directives and patient safety regulations.

This trend is particularly pronounced across Nordic countries, Germany, Netherlands, and France where patients demonstrate exceptional technology adoption capabilities and healthcare systems emphasize patient empowerment and self-management approaches.

Manufacturers are responding by developing partnerships with patient advocacy organizations, implementing user-centered design programs, obtaining patient experience certifications and usability standards, and providing comprehensive patient support information that differentiates their products in increasingly competitive European markets emphasizing patient satisfaction and clinical outcomes optimization.

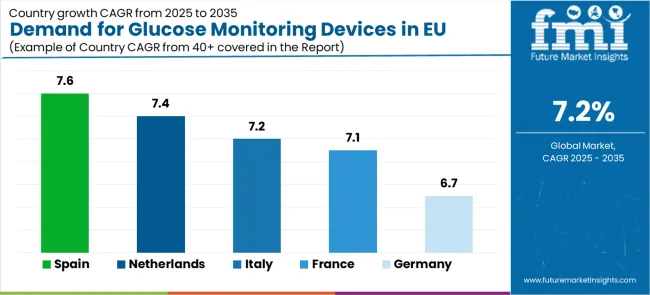

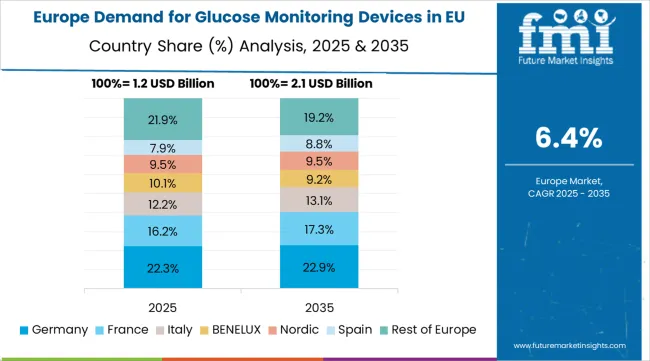

The Demand for Glucose Monitoring Devices in EU is projected to grow from USD 5.0 billion in 2025 to USD 10.0 billion by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to maintain its leadership with a 28.0% share in 2025, supported by its expansive healthcare infrastructure and strong tradition of advanced medical technology adoption.

France follows with a 22.0% market share, attributed to growing demand for digital health solutions and comprehensive diabetes care programs. Italy contributes 18.0% of the market, driven by increasing diabetes prevalence and healthcare modernization initiatives. Spain accounts for 12.0% of the market, while Netherlands represents 8.0%. The Rest of Europe region holds the remaining market share, encompassing Nordic countries, Eastern Europe, and other EU member states with emerging demand for glucose monitoring technologies.

| Country | CAGR (2025-2035) |

|---|---|

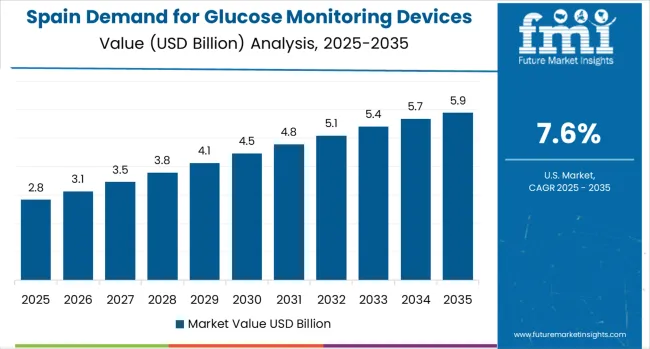

| Spain | 7.6% |

| Netherlands | 7.4% |

| Italy | 7.2% |

| France | 7.1% |

| Germany | 6.7% |

The Demand for Glucose Monitoring Devices in EU demonstrates strong growth across major economies, with Rest of Europe leading at a 7.8% CAGR through 2035, driven by expanding healthcare infrastructure and growing diabetes awareness. Spain follows at 7.6%, supported by healthcare modernization and increasing chronic disease management focus. Netherlands grows at 7.4%, integrating glucose monitoring into advanced digital health practices. Italy and France record 7.2% and 7.1% respectively, emphasizing healthcare system improvements and patient care optimization. Germany maintains steady growth at 6.7%, leveraging its established medical device infrastructure.

The glucose monitoring devices industry in Germany is projected to exhibit steady growth with a CAGR of 6.7% through 2035, driven by exceptionally strong healthcare system infrastructure and medical technology adoption, comprehensively well-established distribution networks for medical devices and diabetes care products, and sophisticated regulatory frameworks supporting medical device quality standards throughout the country.

Germany's advanced medical device regulations and internationally recognized clinical standards through organizations including German Diabetes Association are creating substantial demand for certified advanced glucose monitoring devices across diverse healthcare and patient segments.

Major healthcare systems including German hospitals, specialized diabetes centers including university medical centers, and professional medical device distribution networks are systematically establishing extensive technology portfolios serving both healthcare professionals and diabetes patients throughout German healthcare facilities, medical centers, and home care environments.

The German market benefits from exceptionally high healthcare professional adoption of advanced medical technologies, substantial diabetes care infrastructure presence, strong health insurance coverage programs delivering accessibility at reasonable patient costs, and healthcare system emphasis on clinical excellence that naturally support premium glucose monitoring device adoption.

The glucose monitoring devices industry in France is expanding at a steady CAGR of 7.1%, substantially supported by increasing French healthcare system focus on digital health solutions and comprehensive diabetes care programs, growing adoption of connected medical technologies, and sophisticated healthcare infrastructure reflecting French medical excellence traditions.

France's well-established healthcare system and premium positioning strategies across medical sectors are systematically driving demand for high-quality glucose monitoring devices across diverse healthcare and patient care segments.

Specialized medical device suppliers including French healthcare technology companies, traditional medical distributors, major hospital systems (Assistance Publique-Hôpitaux de Paris, regional health networks), and professional diabetes care centers are establishing comprehensive product ranges featuring advanced imported and French-distributed glucose monitoring devices emphasizing clinical validation and digital connectivity. The French market particularly benefits from strong healthcare system emphasis on clinical quality traditions, digital health integration techniques, and evidence-based care methods that align perfectly with glucose monitoring devices positioning as essential clinical components for superior diabetes management results.

The glucose monitoring devices industry in Italy is growing at a consistent CAGR of 7.2%, fundamentally driven by increasing healthcare system modernization and diabetes care improvement initiatives, growing recognition of advanced monitoring technology benefits, and strong Italian healthcare system commitment to patient care enhancement and clinical outcome optimization.

Italy's established healthcare infrastructure is systematically incorporating advanced glucose monitoring devices to enhance patient care protocols, improve clinical outcomes, and modernize diabetes management approaches while maintaining comprehensive healthcare coverage characteristics.

Professional healthcare systems, specialized medical device distributors including Italian suppliers, leading healthcare networks (regional health authorities), and traditional medical device suppliers are strategically investing in technology adoption programs and clinical training addressing growing Italian healthcare interest in advanced glucose monitoring solutions.

The Italian market particularly benefits from strong healthcare system appreciation for clinical effectiveness, traditional patient-centered care approaches reflecting established Italian healthcare values, and growing healthcare technology capacity particularly in Northern Italian regions supporting advanced medical device adoption.

Demand for Glucose Monitoring Devices in EU in Spain is projected to grow at a strong CAGR of 7.6%, substantially supported by rapidly expanding healthcare modernization initiatives that actively promote advanced diabetes care technologies, increasing Spanish healthcare system focus on chronic disease management, and growing healthcare infrastructure particularly in major metropolitan areas including Madrid, Barcelona, Valencia, and Seville.

Spanish healthcare system is experiencing significant technological advancement with expansion of diabetes care centers, advanced medical device adoption, and major healthcare networks systematically increasing glucose monitoring device investments and introducing premium clinical capabilities.

The Spanish market is increasingly characterized by healthcare modernization trends reflecting broader European patterns, growing interest in glucose monitoring device applications addressing specific clinical requirements, and increasing healthcare system acceptance of advanced technology investments for devices delivering visible clinical benefits. Spain's substantial healthcare development focus, strong healthcare system commitment to clinical innovation reflecting Mediterranean healthcare values, and expanding diabetes care infrastructure create favorable conditions for glucose monitoring device market expansion.

Demand for Glucose Monitoring Devices in EU in the Netherlands is expanding at a robust CAGR of 7.4%, fundamentally driven by exceptionally strong Dutch commitment to digital health innovation, premium medical technology solutions, and healthcare consciousness that positions Netherlands among European digital health leaders.

Dutch healthcare providers and diabetes care specialists are increasingly selecting glucose monitoring devices based on comprehensive digital integration credentials, verified clinical outcomes through European standards, and complete documentation demonstrating patient benefits and clinical effectiveness throughout healthcare delivery processes.

The Netherlands market significantly benefits from exceptionally well-developed digital health research infrastructure including major healthcare innovation companies, specialized medical device suppliers, and professional healthcare technology distributors, combined with demonstrated healthcare system willingness to invest substantial resources in glucose monitoring devices with verified clinical certifications and digital health integration standards.

Dutch regulatory environment actively supports medical device innovation, digital health development, transparent clinical outcome requirements, and evidence-based validation initiatives that enhance healthcare provider confidence and market development.

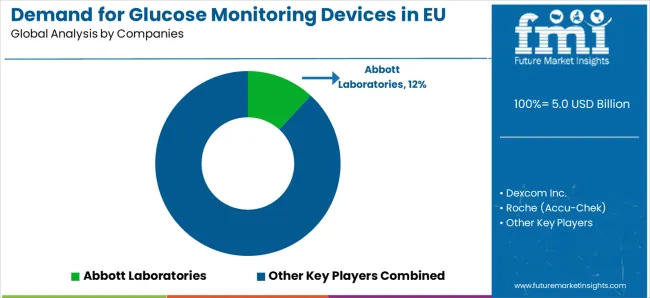

The Demand for Glucose Monitoring Devices in EU is defined by intense competition among multinational medical device corporations, regional European manufacturers, specialized diabetes care technology producers, and digital health companies from major healthcare technology suppliers.

Companies are investing in European manufacturing capacity expansion, advanced sensor technologies, digital health platform development through European innovation centers, clinical validation solutions aligned with EU medical device directives, and direct-to-patient distribution platforms serving diverse European diabetes patient populations. Strategic acquisitions, product portfolio expansion, geographic market penetration across Eastern European growth markets, healthcare professional partnership programs, and clinical certifications are central to strengthening market position and capturing share in this dynamic European category.

Major market participants include Abbott Laboratories with significant European market presence through FreeStyle Libre leadership and comprehensive continuous glucose monitoring solutions distributed through European healthcare channels. Dexcom Inc. maintains substantial European market leadership through CGM integration and AI-focused applications across advanced diabetes care sectors including professional and patient markets.

Roche (Accu-Chek) emphasizes SMBG and digital solution technologies with technical support services for professional healthcare providers across European markets. Medtronic represents significant European diabetes technology integration with specialized CGM plus insulin pump systems and comprehensive diabetes management technologies.

Regional European producers and specialized digital health brands are establishing significant market presence through premium technology positioning, CE marking certifications, specialty glucose monitoring device formulations including enhanced connectivity alternatives and patient-focused options, and direct-to-patient business models.

Digital health programs from major European healthcare initiatives including established diabetes care programs provide technologically advanced alternatives supporting market development, capturing meaningful market share particularly in innovation-driven healthcare markets. European co-manufacturing specialists including specialized medical device processors operate comprehensive production facilities serving both branded manufacturers and healthcare customers, representing critical infrastructure enabling market expansion and product innovation across European healthcare technology markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 billion |

| Product Type | Self-Monitoring Devices, Continuous Monitoring Devices |

| Indication | Diabetes Type II, Diabetes Type I, Gestational Diabetes |

| Distribution Channel | Hospitals & Clinics, Pharmacies, Online Retail |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Abbott Laboratories, Dexcom Inc., Roche (Accu-Chek), Medtronic, LifeScan (OneTouch), Ascensia Diabetes Care, Senseonics, AgaMatrix, Ypsomed, European Regional Manufacturers |

| Additional Attributes | Dollar sales by product type, indication, and distribution channel, regional demand trends across Western and Eastern European healthcare markets, competitive landscape analysis with multinational corporations and specialized European medical device brands, patient preferences for self-monitoring versus continuous monitoring technologies and clinical integration requirements, integration with European digital health trends and diabetes care strategies, innovations in sensor technologies and AI-powered analytics solutions aligned with EU medical device regulations, adoption of direct-to-patient models and healthcare professional distribution networks across EU markets, regulatory framework analysis and medical device safety standards, clinical validation strategies including real-world evidence partnerships, and market penetration analysis for diverse diabetes care segments and geographic regions throughout European Union member states. |

The global demand for glucose monitoring devices in EU is estimated to be valued at USD 5.0 billion in 2025.

The market size for the demand for glucose monitoring devices in EU is projected to reach USD 10.0 billion by 2035.

The demand for glucose monitoring devices in EU is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in demand for glucose monitoring devices in EU are self-monitoring devices and continuous monitoring devices .

In terms of indication, diabetes type ii segment to command 72.4% share in the demand for glucose monitoring devices in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Intraoperative Neuromonitoring Devices Market

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Glucose Monitoring Device Market Overview – Growth, Trends & Forecast 2024-2034

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Global Neuroendoscopy Devices Market Analysis – Size, Share & Forecast 2023-2033

Neuromodulation Devices Market

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Dynamic Glucose Monitoring Patch Market Size and Share Forecast Outlook 2025 to 2035

Lactate Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Epilepsy Monitoring Devices Market Growth - Trends & Forecast 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Continuous Glucose Monitoring Systems Market is segmented by transmitters and monitors, sensors and insulin pump from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA