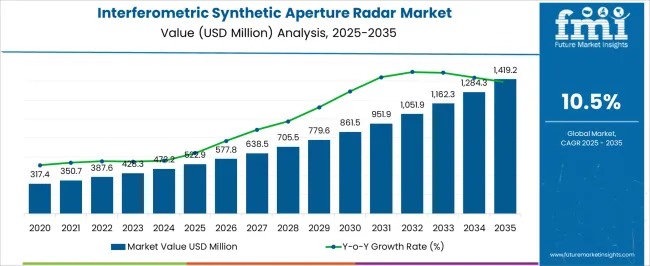

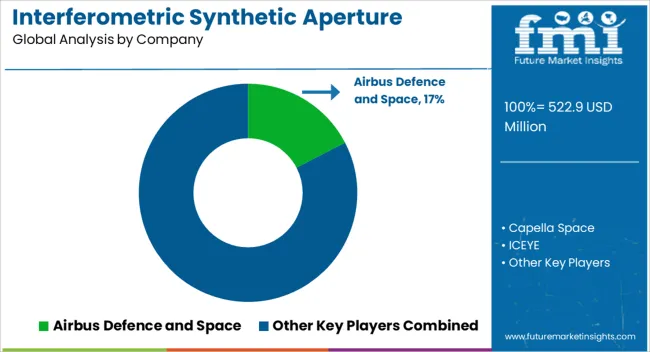

The interferometric synthetic aperture radar market is estimated to be valued at USD 522.9 million in 2025 and is projected to reach USD 1419.2 million by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period. The interferometric synthetic aperture radar (InSAR) market is projected to generate an absolute gain of USD 896.3 million and achieving a growth multiplier of 2.71x over the decade. This growth, supported by a strong CAGR of 10.5%, is driven by increasing demand for high-resolution earth observation, infrastructure monitoring, and environmental applications.

In the first five years (2025–2030), the market is expected to increase from USD 522.9 million to USD 861.5 million, adding USD 338.6 million, or 37.8% of the total incremental growth, with a 5-year multiplier of 1.65x. The second phase (2030–2035) contributes USD 557.7 million, representing 62.2% of incremental growth, signaling a stronger momentum as the adoption of advanced radar technologies expands across defense, agriculture, and urban planning applications. Annual increments will grow from USD 62.2 million in the early years to USD 105.4 million by 2035, indicating accelerating demand driven by technological advancements and increasing applications in climate change studies, flood management, and autonomous vehicle systems. Companies focusing on advanced radar sensor systems, real-time monitoring, and scalable solutions will capture the largest share of this USD 896.3 million opportunity.

System integrators evaluate InSAR capabilities based on measurement precision, temporal resolution, and data processing throughput when specifying solutions for ground deformation monitoring, subsidence analysis, and structural health assessment programs. Equipment procurement involves balancing satellite constellation access costs against ground-based processing infrastructure requirements while considering data latency constraints that influence real-time monitoring applications. Engineering teams prioritize systems capable of detecting millimeter-scale displacement measurements across wide area coverage while maintaining consistent accuracy throughout varying atmospheric conditions and terrain characteristics.

Processing infrastructure requires specialized computing platforms equipped with high-performance graphics processors and extensive storage arrays capable of managing terabyte-scale datasets generated during interferometric analysis workflows. Data center operations coordinate between satellite downlink facilities, cloud processing services, and end-user distribution networks while maintaining security protocols required for government applications and commercial proprietary projects. Quality control procedures address phase unwrapping algorithms, atmospheric correction techniques, and temporal baseline optimization that ensure measurement accuracy across diverse monitoring scenarios including urban subsidence, volcanic activity, and glacier movement tracking.

Cross-functional coordination involves remote sensing specialists, geophysical engineers, and software developers collaborating to customize processing algorithms for specific application requirements including oil field monitoring, earthquake hazard assessment, and critical infrastructure surveillance programs. Satellite mission planning addresses orbital parameters, revisit frequencies, and acquisition geometries that optimize interferometric performance while managing power consumption and data transmission bandwidth constraints inherent in space-based radar systems. Ground station networks coordinate tracking schedules, data reception protocols, and backup contingency procedures that ensure continuous monitoring capability throughout mission lifecycles.

| Metric | Value |

|---|---|

| Interferometric Synthetic Aperture Radar Market Estimated Value in (2025 E) | USD 522.9 million |

| Interferometric Synthetic Aperture Radar Market Forecast Value in (2035 F) | USD 1419.2 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

The interferometric synthetic aperture radar (InSAR) market is advancing steadily, driven by increasing demand for high-resolution terrain data, infrastructure monitoring, and geospatial intelligence. Governments and commercial sectors are leveraging InSAR for precise surface deformation mapping, environmental risk assessment, and long-term subsidence monitoring.

Expansion of satellite constellations and technological advances in SAR imaging have enhanced coverage, temporal resolution, and cost-efficiency, making InSAR more accessible across civil and defense applications. The growing relevance of disaster preparedness and predictive analytics in geotechnical, hydrological, and urban planning domains is accelerating adoption.

Furthermore, integration with AI-driven analytics platforms is expected to optimize data interpretation and operational deployment in time-sensitive scenarios. Future growth is likely to be fueled by public-private partnerships, Earth observation investments, and continuous enhancements in satellite payload design and image processing capabilities.

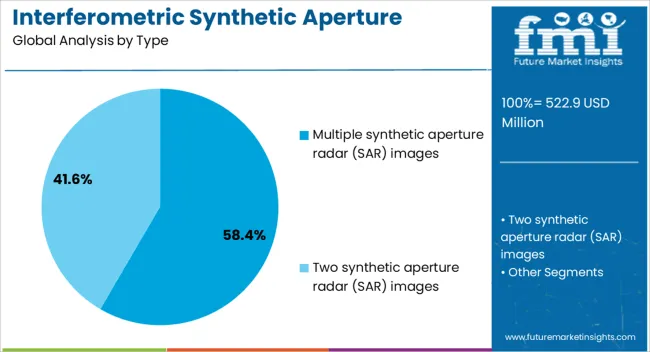

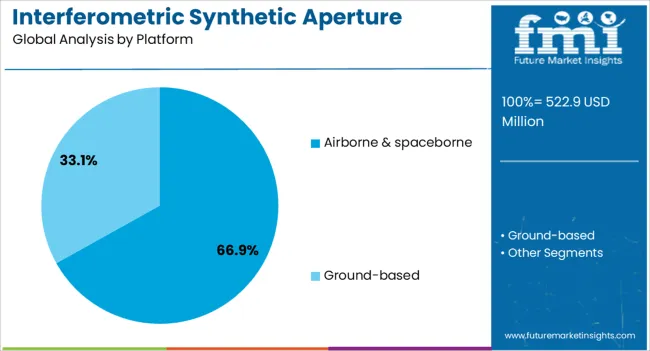

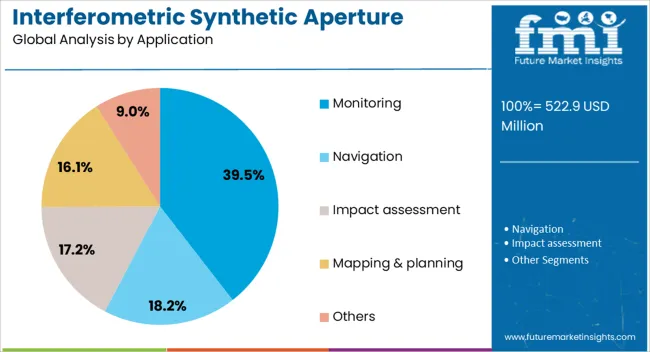

The interferometric synthetic aperture radar market is segmented by type, platform, application, end use, and geographic regions. By type, the interferometric synthetic aperture radar market is divided into Multiple synthetic aperture radar (SAR) images and two synthetic aperture radar (SAR) images. In terms of the platform, the interferometric synthetic aperture radar market is classified into Airborne & spaceborne and Ground-based. Based on the application, the interferometric synthetic aperture radar market is segmented into Monitoring, Navigation, Impact assessment, Mapping & planning, and Others.

The interferometric synthetic aperture radar market is segmented by end use into Aerospace & defense, Agriculture, Civil engineering & construction, Environmental monitoring, Mining, Oil & gas, and Others. Regionally, the interferometric synthetic aperture radar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Multiple SAR images are expected to contribute 58.4% of the overall market revenue in 2025, making them the leading technology type in the InSAR domain. This dominance is being driven by their ability to generate high-precision interferograms and detect minute surface movements over extended periods.

The comparative advantage of multiple image stacking lies in its capacity to enhance signal coherence and reduce atmospheric or temporal noise, enabling improved accuracy in deformation analysis. These capabilities have made the method indispensable for critical applications such as fault detection, mining subsidence studies, and glacier motion tracking.

As the volume of archived SAR data continues to grow, supported by both commercial and government missions, the use of multi-temporal datasets is anticipated to remain the preferred approach for detailed ground movement analytics.

Airborne and spaceborne platforms are projected to hold 66.9% of total market share in 2025, positioning them as the dominant platform segment. The widespread adoption of satellite-based SAR systems and airborne remote sensing programs has significantly expanded access to high-resolution elevation and displacement data.

These platforms provide broad-area, repeatable coverage with minimal environmental constraints, making them ideal for consistent long-term monitoring. Innovations in SAR satellite constellations, along with reduced launch costs and public data-sharing initiatives, have further bolstered their adoption.

The strategic relevance of airborne and spaceborne platforms for defense surveillance, environmental protection, and infrastructure monitoring is reinforcing their leadership position in the global InSAR ecosystem.

Monitoring applications are forecast to account for 39.5% of the InSAR market’s revenue in 2025, emerging as the largest application segment. This growth is being driven by increased reliance on InSAR for real-time tracking of ground deformation, landslide risks, and structural stability across large-scale infrastructure projects.

Industries such as oil & gas, mining, and urban development are integrating InSAR solutions to ensure regulatory compliance and asset safety. Public sector demand has also intensified, particularly in the context of climate resilience, geohazard mitigation, and floodplain mapping.

As risk-based decision-making becomes central to policy and operations, the use of InSAR for continuous and non-invasive monitoring is expected to see continued expansion across both developed and emerging economies.

The interferometric synthetic aperture radar (InSAR) market is expanding, driven by the increasing demand for high-resolution Earth observation data for applications in geospatial intelligence, disaster management, and environmental monitoring. In 2024 and 2025, the market is fueled by the growing adoption of satellite-based remote sensing. Opportunities lie in expanding InSAR use in agriculture and infrastructure monitoring. Emerging trends include the integration of AI and machine learning for data analysis. However, high operational costs and regulatory challenges are limiting market growth.

The major growth driver for the InSAR market is the increasing demand for high-resolution Earth observation data in geospatial intelligence, defense, and disaster management. In 2024, satellite-based InSAR technology became essential for monitoring terrain deformation, identifying potential hazards, and managing natural disasters. The ability to gather accurate, real-time data for various applications, including infrastructure monitoring, has increased the need for InSAR systems, particularly in sectors where precise geospatial intelligence is critical.

Opportunities in the InSAR market are growing due to expanding applications in agriculture and infrastructure monitoring. In 2025, InSAR technology was leveraged to monitor subsidence, landslides, and vegetation changes in agriculture. Additionally, the ability of InSAR to detect structural deformations and assess the stability of large infrastructure projects, such as bridges and dams, presented significant market opportunities. As industries continue to prioritize efficiency and risk mitigation, InSAR’s role in ensuring accurate monitoring and timely interventions is increasingly recognized.

Emerging trends in the InSAR market include the integration of AI and machine learning to enhance data analysis and decision-making. In 2024, AI was used to analyze large volumes of InSAR data, enabling faster, more accurate interpretations of geospatial information. This trend is expected to grow, with AI enhancing the predictive capabilities of InSAR systems, especially in monitoring urban growth, disaster preparedness, and climate change impacts. The increased use of automation in data processing is likely to drive the demand for InSAR technology.

Key market restraints include high operational costs and regulatory challenges. In 2024 and 2025, the high cost of developing and maintaining InSAR systems, along with the expenses related to data acquisition, remained a significant barrier. Additionally, navigating complex regulatory frameworks regarding the use of remote sensing data, especially in sensitive areas such as defense and national security, limited broader market access. These constraints make it difficult for smaller players and developing countries to fully adopt InSAR technologies.

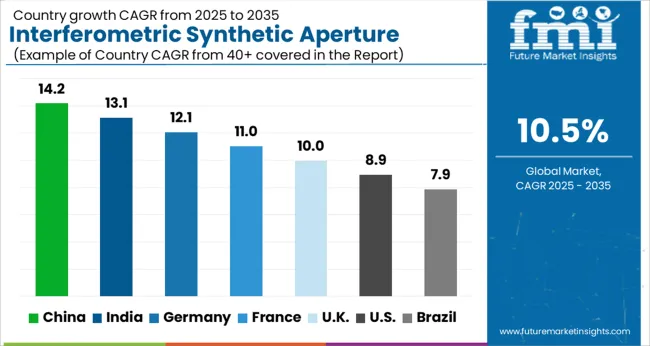

The global interferometric synthetic aperture radar (InSAR) market is projected to grow at 10.5% CAGR from 2025 to 2035. China leads with 14.2% CAGR, driven by significant investments in space exploration, satellite systems, and remote sensing technologies. India follows at 13.1%, supported by rising demand for Earth observation data for agriculture, infrastructure monitoring, and defense applications. Germany records 12.1% CAGR, reflecting strong demand for InSAR technology in environmental monitoring, defense, and infrastructure sectors. The United Kingdom grows at 10.0%, while the United States posts 8.9%, reflecting steady demand in mature markets, with a focus on advanced radar technology for defense and commercial applications. Asia-Pacific leads in market growth due to space technology advancements, while Europe and North America emphasize technological innovation and satellite-based solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The interferometric synthetic aperture radar market in China is forecasted to grow at 14.2% CAGR, driven by the country’s rapidly expanding space exploration programs and increasing demand for Earth observation data. China’s investments in satellite technologies and remote sensing capabilities for military, environmental monitoring, and disaster management applications drive the growth of InSAR technologies. The government’s commitment to space exploration and infrastructure development further accelerates the demand for advanced radar systems.

The interferometric synthetic aperture radar market in India is projected to grow at 13.1% CAGR, driven by the increasing adoption of Earth observation satellites for agriculture, infrastructure monitoring, and national security. As India continues to expand its space programs, the demand for advanced InSAR technology for precision data and remote sensing applications rises. Additionally, the growing focus on environmental sustainability, flood monitoring, and urban planning accelerates the need for InSAR solutions.

The interferometric synthetic aperture radar market in Germany is expected to grow at 12.1% CAGR, supported by the country’s strong demand for InSAR technology in defense, environmental monitoring, and infrastructure sectors. Germany’s commitment to satellite-based remote sensing for urban planning, flood detection, and climate change research drives market growth. The integration of InSAR solutions into Europe’s space programs and defense applications accelerates the adoption of advanced radar technologies.

The interferometric synthetic aperture radar market in the United Kingdom is projected to grow at 10.0% CAGR, supported by growing demand for remote sensing data in environmental monitoring, urban planning, and defense applications. The UK’s strong focus on space innovation and satellite technology, combined with government initiatives to monitor environmental changes, further drives the demand for InSAR solutions. The integration of InSAR technologies in commercial applications also strengthens market growth.

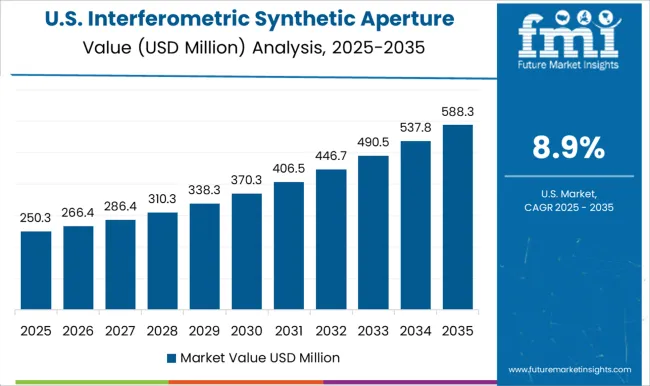

The interferometric synthetic aperture radar market in the United States is projected to grow at 8.9% CAGR, reflecting steady demand in a mature market with a focus on defense, environmental monitoring, and commercial satellite applications. The increasing adoption of InSAR technology for natural disaster monitoring, precision agriculture, and infrastructure inspections further accelerates market growth. Moreover, the United States' investments in space programs and remote sensing applications for national security contribute to the market expansion.

The interferometric synthetic aperture radar (InSAR) market is growing rapidly, driven by the demand for high-resolution Earth observation data across industries such as agriculture, infrastructure, environmental monitoring, and disaster management. Key players include Airbus Defence and Space, Capella Space, ICEYE, MDA Ltd., CGG, L3Harris Technologies, and e‑GEOS, each offering specialized InSAR solutions.

Airbus Defence and Space provides advanced InSAR data services through its satellite fleet, catering to geospatial intelligence and urban planning. Capella Space focuses on high-resolution, real-time radar data, leveraging small satellite constellations for applications like insurance and defense. ICEYE uses its innovative small satellites to offer frequent, high-resolution InSAR imagery for disaster monitoring and land subsidence tracking.

MDA Ltd. provides radar satellite systems and InSAR data for geophysical mapping and environmental monitoring. CGG offers InSAR services for land deformation and subsidence, primarily for energy and infrastructure sectors. L3Harris Technologies integrates InSAR data with geospatial analytics, supporting defense and environmental monitoring needs. e‑GEOS, a joint venture between Telespazio and ASI, focuses on environmental monitoring and civil engineering, with a strong presence in Europe.

| Item | Value |

|---|---|

| Quantitative Units | USD 522.9 Million |

| Type | Multiple synthetic aperture radar (SAR) images and Two synthetic aperture radar (SAR) images |

| Platform | Airborne & spaceborne and Ground-based |

| Application | Monitoring, Navigation, Impact assessment, Mapping & planning, and Others |

| End Use | Aerospace & defense, Agriculture, Civil engineering & construction, Environmental monitoring, Mining, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus Defence and Space; Capella Space; ICEYE; MDA Ltd.; CGG; L3Harris Technologies; e‑GEOS |

| Additional Attributes | Dollar sales by radar type and application, demand dynamics across defense, aerospace, and environmental monitoring sectors, regional trends in interferometric synthetic aperture radar adoption, innovation in high-resolution imaging and real-time data processing, impact of regulatory standards on radar frequency usage, and emerging use cases in disaster management and urban planning. |

The global interferometric synthetic aperture radar market is estimated to be valued at USD 522.9 million in 2025.

The market size for the interferometric synthetic aperture radar market is projected to reach USD 1,419.2 million by 2035.

The interferometric synthetic aperture radar market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in interferometric synthetic aperture radar market are multiple synthetic aperture radar (sar) images and two synthetic aperture radar (sar) images.

In terms of platform, airborne & spaceborne segment to command 66.9% share in the interferometric synthetic aperture radar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synthetic Dye Market Forecast Outlook 2025 to 2035

Synthetic Data Generation Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Biology Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Zeolite Y Adsorbent Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Musk Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Tackifiers Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Polymer Wax Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Diamond Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Turf Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Food Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Polyisoprene Rubber Market Report – Trends & Innovations 2025–2035

Synthetic and Bio Emulsion Polymer Market Size and Share Forecast Outlook 2025 to 2035

Synthetic And Bio Based PMMA Polymethyl Methacrylate Size Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Leather Market Forecast & Growth 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Paper Market Insights - Growth & Trends Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA