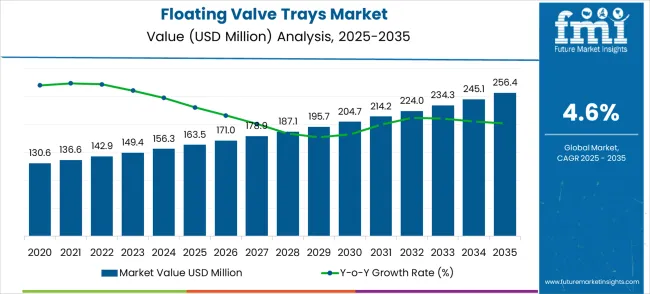

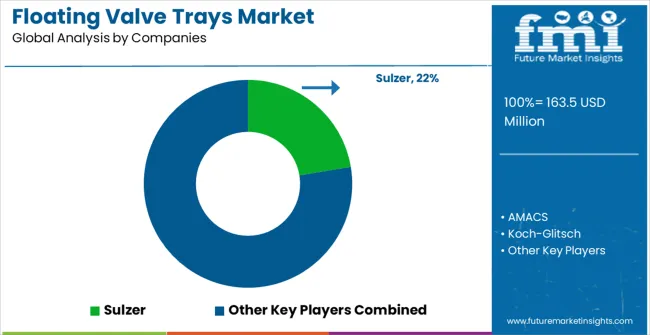

The floating valve trays market is projected to grow from USD 163.5 million in 2025 to USD 256.4 million by 2035, reflecting a forecast CAGR of 4.6%. The market is expected to witness steady expansion driven by consistent demand in chemical processing, petrochemical, and refining applications, where floating valve trays are preferred for their high efficiency in mass transfer operations. Year-on-year growth is anticipated to be moderate, supporting gradual adoption across new installations and retrofits. The market trajectory indicates a balanced upward trend, with incremental increases in capacity and integration into existing distillation and absorption systems. Rising emphasis on process optimization and operational reliability has reinforced the role of floating valve trays in industrial applications, ensuring stable demand. The market’s growth is underpinned by their ability to handle varying vapor and liquid loads effectively, which enhances plant throughput and operational efficiency.

Further development of the floating valve trays market is expected to reach USD 173.9 million in 2026, USD 184.6 million in 2027, and USD 195.8 million in 2028, extending to USD 256.4 million by 2035. This steady rise reflects consistent industrial adoption, incremental plant expansions, and replacement cycles for aging equipment. The market exhibits low volatility with demand primarily influenced by process efficiency requirements and capacity expansion projects in chemical and petrochemical plants. Incremental CAGR indicates a predictable growth path, enabling better investment planning for manufacturers, distributors, and end-users. Operational advantages, such as improved vapor-liquid contact and pressure drop management, reinforce the preference for floating valve trays over conventional trays. Overall, the market is positioned as a strategic component within industrial distillation and absorption processes, demonstrating reliable, long-term growth driven by functional performance and industry-wide process efficiency requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 163.5 million |

| Market Forecast Value (2035) | USD 256.4 million |

| Forecast CAGR (2025-2035) | 4.6% |

The floating valve trays market holds a prominent position within the distillation equipment market, capturing around 12% of the total share, as these trays are essential for efficient vapor-liquid contact in distillation columns. Within the chemical processing equipment market, the market share is approximately 10%, driven by the need for reliable separation components in chemical plants. In the separation technology market, floating valve trays account for about 8%, reflecting their role in enhancing process efficiency and throughput. The industrial process equipment market contributes roughly 7%, due to the integration of these trays in various industrial operations. Finally, in the petrochemical processing market, the share is around 6%, highlighting their application in refining and chemical production. These combined contributions illustrate the critical role of floating valve trays across multiple process industries.

Market expansion is being supported by the increasing petroleum refining and chemical processing activities across global industrial markets and the corresponding need for efficient mass transfer equipment in distillation and separation processes. Modern industrial operations require precise and reliable separation technologies to achieve optimal product quality and energy efficiency in demanding process environments. The superior hydraulic performance and operational flexibility of floating valve trays make them essential components in sophisticated distillation systems where efficiency and reliability are critical for operational success.

The growing emphasis on energy efficiency and process optimization is driving demand for advanced floating valve tray technologies from certified manufacturers with proven track records of industrial equipment excellence. Process engineers and plant operators are increasingly investing in high-performance mass transfer equipment that offers superior separation efficiency and reduced energy consumption while meeting stringent operational and environmental requirements. Industry standards and performance specifications are establishing efficiency benchmarks that favor precision-engineered floating valve trays with advanced hydraulic designs and enhanced operational characteristics.

The chemical and pharmaceutical industries' focus on process intensification is creating substantial demand for reliable mass transfer equipment capable of supporting complex separation processes and product quality requirements. The environmental compliance sector continues to drive innovation in wastewater treatment applications while maintaining cost-effectiveness, leading to development of specialized floating valve trays with enhanced corrosion resistance and improved performance characteristics for demanding industrial applications.

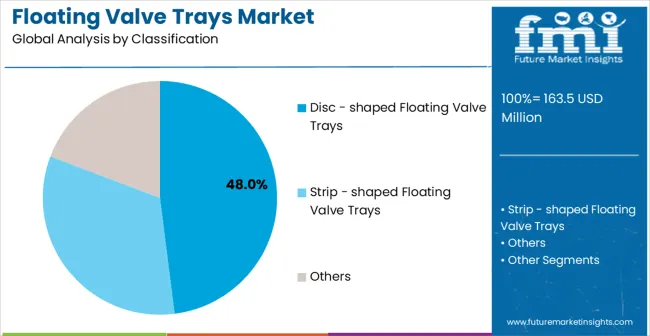

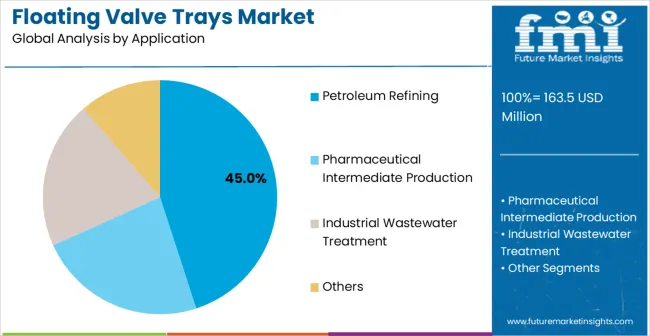

The market is segmented by tray type, application, and region. By tray type, the market is divided into disc-shaped floating valve trays, strip-shaped floating valve trays, and other configurations. Based on application, the market is categorized into petroleum refining, pharmaceutical intermediate production, industrial wastewater treatment, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

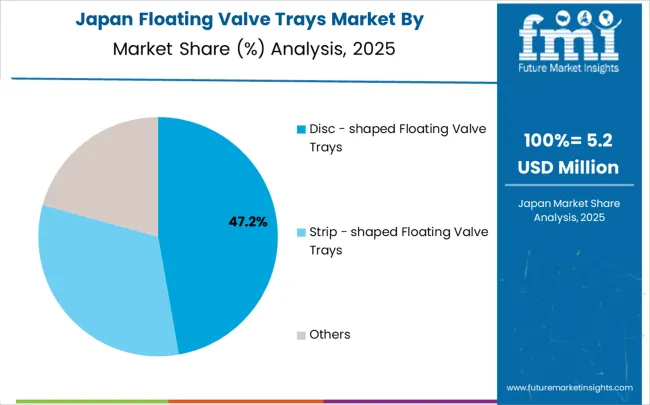

Disc-shaped floating valve trays configurations are projected to account for 48% of the floating valve trays market in 2025. This leading share is supported by the widespread adoption in petroleum refining applications and growing demand for proven mass transfer technology in large-scale distillation operations. Disc-shaped floating valve trays provide superior hydraulic performance and operational flexibility, making them the preferred choice for petroleum refineries, chemical processing plants, and petrochemical facilities. The segment benefits from extensive field experience and technological refinements that have optimized performance while maintaining cost-effectiveness for industrial-scale applications.

Modern disc-shaped floating valve trays incorporate advanced hydraulic design principles and enhanced materials technology that maximize separation efficiency while ensuring reliable operation across varying process conditions. These innovations have significantly improved distillation column performance while reducing pressure drop and energy requirements for industrial separation processes. The petroleum refining industry particularly drives demand for disc-shaped solutions, as these applications require proven performance and operational reliability to meet production targets and product quality specifications.

Additionally, the chemical processing sector increasingly adopts disc-shaped floating valve trays to optimize separation processes and enhance product quality in specialty chemical manufacturing applications. The growing emphasis on process efficiency creates opportunities for specialized disc-shaped floating valve tray designs optimized for specific industrial applications and operating conditions.

Petroleum refining applications are expected to represent 45% of floating valve trays demand in 2025. This dominant share reflects the critical role of floating valve trays in crude oil distillation and product separation processes within petroleum refining operations. Petroleum refineries require reliable and efficient mass transfer equipment capable of handling large throughputs while maintaining product quality and operational efficiency. The segment benefits from continuous refinery capacity expansions and modernization projects that utilize floating valve trays for enhanced distillation performance.

The global petroleum refining industry drives significant demand for industrial-grade floating valve trays that provide exceptional hydraulic performance and operational reliability for crude oil processing and product separation applications. These applications require mass transfer equipment with superior efficiency characteristics and proven durability to ensure continuous operation and product quality consistency. The segment benefits from growing refinery investment in process optimization and increasing demand for energy-efficient separation technologies.

Refinery modernization and capacity expansion projects contribute substantially to market growth as petroleum companies implement advanced floating valve trays in distillation column upgrades and new facility construction. The growing adoption of process intensification creates opportunities for specialized floating valve trays designed for enhanced separation efficiency and reduced energy consumption. Additionally, the trend toward cleaner fuel production and environmental compliance drives demand for advanced mass transfer equipment that enables efficient hydrocarbon separation and processing.

The floating valve trays market is advancing steadily due to increasing industrial processing demand and growing recognition of floating valve trays' importance in efficient separation applications. However, the market faces challenges including intense competition from alternative tray technologies, need for specialized engineering expertise, and varying performance requirements across different industrial applications. Performance standards and industry specifications continue to influence design practices and market development patterns.

The growing adoption of computational fluid dynamics modeling and enhanced materials engineering is enabling significant performance improvements while maintaining operational reliability in floating valve tray applications. Advanced design optimization and corrosion-resistant materials provide better separation efficiency and extended service life, enabling superior industrial performance and enhanced customer satisfaction. These technologies are particularly valuable for demanding applications that require maximum separation efficiency and long-term operational reliability.

Modern floating valve tray manufacturers are developing specialized designs tailored to specific industrial requirements, including high-capacity trays for petroleum refining, corrosion-resistant configurations for chemical processing, and specialized geometries for pharmaceutical and wastewater treatment applications. Advanced engineering techniques enable precise optimization of hydraulic characteristics for targeted applications while maintaining manufacturing scalability and cost-effectiveness.

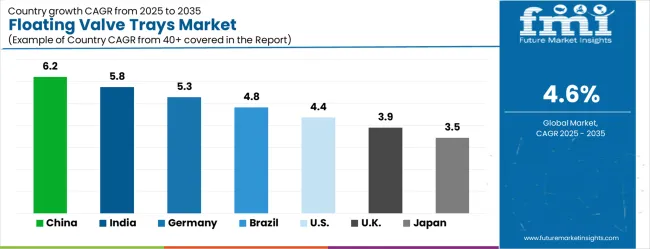

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| United States | 4.4% |

| United Kingdom | 3.9% |

| Japan | 3.5% |

The floating valve trays market is growing robustly, with China leading at a 6.2% CAGR through 2035, driven by massive petrochemical industry expansion and growing refinery capacity additions. India follows at 5.8%, supported by increasing petroleum refining investments and expanding chemical processing infrastructure. Germany records strong growth at 5.3%, emphasizing advanced process engineering and industrial equipment excellence. Brazil grows solidly at 4.8%, developing petroleum refining capabilities and chemical industry expansion. The United States shows steady growth at 4.4%, focusing on refinery modernization and advanced separation technology adoption. The United Kingdom maintains moderate expansion at 3.9%, supported by chemical industry advancement. Japan demonstrates stable growth at 3.5%, emphasizing quality excellence and precision industrial equipment manufacturing.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The floating valve trays market in China is projected to exhibit the highest growth rate with a CAGR of 6.2% through 2035, driven by the country's massive petrochemical industry expansion and rapidly growing refinery capacity additions. The extensive petroleum refining infrastructure development and increasing investment in advanced process equipment technologies are creating substantial opportunities for high-quality floating valve tray adoption. Major petroleum and chemical companies are establishing comprehensive processing capabilities to support both domestic energy demand and international petrochemical market participation while meeting global performance standards.

Petrochemical industry expansion and refinery capacity development are supporting widespread adoption of advanced floating valve tray technologies across commercial processing operations, driving demand for sophisticated mass transfer equipment and separation optimization systems. Industrial modernization and capacity addition programs are creating significant opportunities for Chinese process facilities in global petroleum refining networks requiring efficient separation equipment and proven process technologies.

The floating valve trays market in India is expanding at a CAGR of 5.8%, supported by the country's increasing petroleum refining investments and expanding chemical processing infrastructure under government energy security initiatives. The growing petroleum processing capabilities and increasing investment in modern refinery technologies are driving substantial floating valve tray demand potential. Processing facilities are leveraging strategic location advantages while adopting international performance standards to meet domestic energy requirements and export market opportunities.

Petroleum refining investment growth and chemical industry expansion are creating opportunities for high-quality floating valve tray adoption across diverse processing categories requiring efficient separation capabilities and industrial performance systems. International energy market participation and refinery modernization achievements are driving investments in advanced mass transfer technologies for floating valve tray applications throughout major industrial regions and processing facilities.

The floating valve trays market in Germany is projected to grow at a CAGR of 5.3%, supported by the country's leadership in advanced process engineering and industrial equipment technology applications. German chemical and petroleum processing companies are implementing sophisticated floating valve tray installations that meet stringent efficiency standards and environmental requirements. The market is characterized by focus on process innovation, advanced engineering technologies, and compliance with comprehensive industrial performance and environmental regulations.

Industrial process investments are prioritizing advanced floating valve tray technologies that demonstrate superior separation efficiency and environmental compliance while meeting German industrial performance and sustainability standards for chemical processing applications. Innovation programs and process technology development initiatives are driving adoption of precision-engineered mass transfer systems that support optimal separation performance and enhanced industrial process efficiency.

The floating valve trays market in Brazil is growing at a CAGR of 4.8%, driven by developing petroleum refining capabilities and expanding chemical industry infrastructure across energy and petrochemical sectors. The growing investment in modern refinery infrastructure and increasing focus on domestic petroleum processing are creating opportunities for floating valve tray adoption. Processing facilities are adopting advanced technologies to support growing domestic energy demand and export market requirements while maintaining operational cost competitiveness.

Petroleum refining capability development and chemical industry expansion are facilitating adoption of effective floating valve tray technologies capable of meeting diverse processing requirements and industrial specifications across energy and chemical applications. Regional processing capability enhancement and petroleum industry development are creating demand for standardized floating valve trays that meet industrial processing specifications and performance requirements.

The floating valve trays market in the United States is expanding at a CAGR of 4.4%, driven by the country's refinery modernization leadership and increasing emphasis on advanced separation technology adoption in petroleum processing operations. The sophisticated petroleum refining ecosystem and focus on process optimization technologies create consistent demand for high-quality floating valve tray solutions. The market benefits from refinery upgrade investments and chemical industry innovation across multiple petroleum processing and chemical manufacturing segments.

Refinery modernization programs and advanced separation technology initiatives are driving adoption of premium floating valve trays that offer superior hydraulic performance and operational reliability for advanced petroleum processing applications. Process optimization investments and industrial technology advancement are supporting demand for specialized floating valve trays that meet stringent efficiency requirements and environmental compliance standards.

The floating valve trays market in the United Kingdom is projected to grow at a CAGR of 3.9%, supported by ongoing chemical industry advancement and increasing emphasis on process equipment quality in industrial operations. Chemical processing and petroleum companies are investing in high-quality floating valve trays that provide consistent separation performance and meet operational efficiency requirements for industrial applications. The market is characterized by focus on process quality, operational reliability, and advanced separation technology across chemical processing applications.

Chemical industry advancement and process quality programs are supporting adoption of validated floating valve trays that meet contemporary efficiency and environmental standards for industrial processing applications. Quality enhancement initiatives and operational optimization programs are creating demand for specialized floating valve trays that provide superior separation consistency and industrial process quality verification.

The floating valve trays market in Japan is expanding at a CAGR of 3.5%, driven by the country's emphasis on industrial quality excellence and precision equipment manufacturing development. Japanese chemical and petroleum processing companies are developing advanced floating valve tray applications that incorporate precision engineering and performance optimization principles. The market benefits from focus on industrial precision, equipment reliability, and continuous improvement in separation technology methodologies.

Industrial quality excellence programs and precision manufacturing initiatives are driving advancement of premium floating valve tray applications that demonstrate superior hydraulic characteristics and operational reliability. Equipment manufacturing excellence programs and industrial quality advancement are supporting adoption of precision-engineered floating valve trays that optimize separation performance and ensure consistent operation in demanding chemical processing and petroleum refining applications.

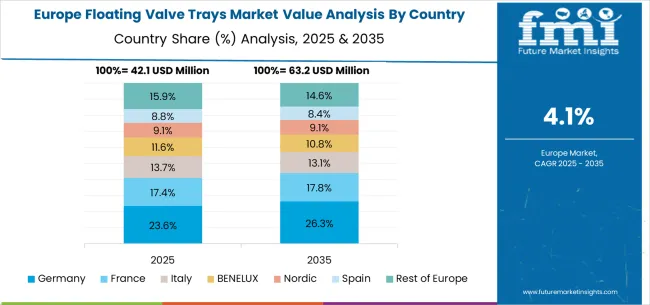

The floating valve trays market in Europe is projected to grow from USD 44.8 million in 2025 to USD 66.2 million by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to maintain its leadership with a 27.9% share in 2025, supported by its advanced chemical processing industry and precision equipment manufacturing excellence. The United Kingdom follows with 19.4% market share, driven by chemical industry advancement and process equipment development. France holds 17.1% of the European market, benefiting from chemical industry expansion and industrial process technology advancement. Italy and Spain collectively represent 20.3% of regional demand, with growing focus on chemical processing development and industrial applications. The Rest of Europe region accounts for 15.3% of the market, supported by chemical industry development in Eastern European countries and Nordic industrial equipment advancement.

The floating valve trays market is defined by competition among established process equipment manufacturers, specialized mass transfer companies, and industrial separation technology suppliers. Companies are investing in advanced hydraulic design technologies, product innovation, performance validation systems, and technical support capabilities to deliver reliable, efficient, and cost-effective floating valve tray solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Sulzer, operating globally, offers comprehensive floating valve tray solutions with focus on industrial separation excellence, hydraulic performance optimization, and technical support services for petroleum refining and chemical processing applications. AMACS, specialized manufacturer, provides advanced mass transfer equipment with emphasis on separation efficiency and application-specific design for industrial processes. Koch-Glitsch delivers established separation technology systems with focus on petroleum refining applications and process optimization. AMT International offers comprehensive industrial equipment solutions with standardized procedures and process facility support.

Kuber Precision Technology provides advanced precision manufacturing capabilities with emphasis on quality engineering and technical expertise for industrial applications. Mass Transfer Limited delivers specialized separation equipment with focus on process efficiency and performance optimization. Finepac offers comprehensive mass transfer solutions with regional manufacturing and industrial support capabilities. Boegger Industech provides advanced industrial equipment with specialized separation technologies and market expertise.

Raschi, PANTAN, TPT Pacific (TPT), Munters, Hanbit, Soltech Corporation, Ambani Metal, Jiangxi Aite Mass Transfer Technology Co., Ltd, and Nantong Sutong Separation Technology offer specialized floating valve tray expertise, regional production capabilities, and technical support across mass transfer and industrial processing networks.

The floating valve trays market underpins industrial separation excellence, petroleum refining efficiency, chemical processing optimization, and environmental compliance advancement. With growing industrial processing demand, energy efficiency requirements, and environmental standards, the sector faces pressure to balance separation performance, operational reliability, and cost-effectiveness. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward high-efficiency, environmentally sustainable, and application-optimized floating valve tray solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 163.5 million |

| Classification Type | Disc-shaped Floating Valve Trays, Strip-shaped Floating Valve Trays, Others |

| Application | Petroleum Refining, Pharmaceutical Intermediate Production, Industrial Wastewater Treatment, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Sulzer, AMACS, Koch-Glitsch, AMT International, Kuber Precision Technology, Mass Transfer Limited, Finepac, Boegger Industech, Raschi, PANTAN, TPT Pacific (TPT), Munters, Hanbit, Soltech Corporation, Ambani Metal, Jiangxi Aite Mass Transfer Technology Co., Ltd, Nantong Sutong Separation Technology |

The global floating valve trays market is estimated to be valued at USD 163.5 million in 2025.

The market size for the floating valve trays market is projected to reach USD 256.4 million by 2035.

The floating valve trays market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in floating valve trays market are disc - shaped floating valve trays, strip - shaped floating valve trays and others.

In terms of application, petroleum refining segment to command 45.0% share in the floating valve trays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floating Microelectrode Array (FMA) Market Size and Share Forecast Outlook 2025 to 2035

Floating Docks Market Size and Share Forecast Outlook 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Floating Solar PV Market Size and Share Forecast Outlook 2025 to 2035

Floating Covers Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Floating Hotel Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region – Forecast for 2025-2035

Market Share Distribution Among Floating Hotel Providers

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Solar Floating Pool Lights Market Insights – Trends, Demand & Growth 2025-2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Valve Driver Market Size and Share Forecast Outlook 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Valve Cover Gasket Market

Valve Sack Market

ESD Valve Market Forecast and Outlook 2025 to 2035

EGR Valve Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA