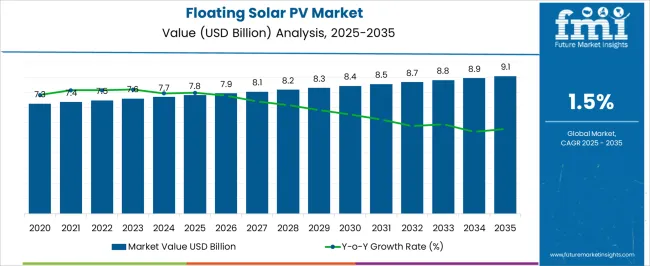

The Floating Solar PV Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 1.5% over the forecast period.

Growth over the period remains gradual, reflecting a stable but cautious adoption pattern compared to faster-moving renewable energy segments. Early in the forecast, the industry progresses modestly, reaching USD 8.1 billion by 2027 and USD 8.4 billion by 2030. Toward 2035, the market advances incrementally, signaling steady uptake supported by niche deployments.

The YoY growth rate shows a gradual decline, indicating early momentum tapering into maturity. Despite slower acceleration, demand is supported by land scarcity for conventional solar installations, water body utilization, and the efficiency benefits of reduced panel heating. Strong government policies in Asia-Pacific, coupled with pilot-scale adoption in Europe and North America, are influencing the outlook. However, high installation costs, maintenance complexities on water, and financing hurdles restrain rapid scale-up.

| Metric | Value |

|---|---|

| Floating Solar PV Market Estimated Value in (2025 E) | USD 7.8 billion |

| Floating Solar PV Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 1.5% |

The floating solar photovoltaic market is expanding rapidly due to growing demand for renewable energy solutions and the limited availability of land for traditional solar installations. Industry trends highlight increased investments in water-based solar projects, which optimize the use of reservoirs, lakes, and other water bodies.

Floating solar systems help reduce water evaporation and improve panel efficiency by cooling effects, adding value beyond electricity generation. Policy support for clean energy and environmental sustainability has encouraged the adoption of floating solar PV, especially in regions facing land scarcity or environmental constraints.

Technological advancements have improved the durability and adaptability of floating solar modules to withstand harsh aquatic conditions. Market growth is expected to be driven by the scalability of mid-sized projects and the integration of floating solar with hydropower facilities. Segmental leadership is anticipated from the 5 MW capacity projects due to their balance of scale and manageability, and stationary products that offer simplicity and reliability.

The floating solar PV market is segmented by capacity, product, and geographic regions. By capacity, the floating solar PV market is divided into 5 MW, 5-15 MW, and >15 MW. In terms of the product, the floating solar PV market is classified into Stationary and Tracking. Regionally, the floating solar PV industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

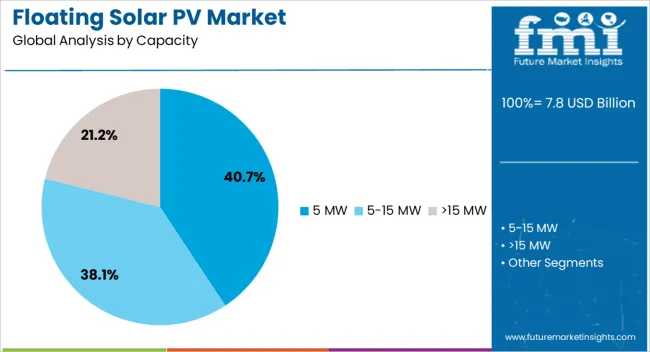

The 5 MW capacity segment is projected to contribute 40.7% of the floating solar PV market revenue in 2025, making it the leading capacity category. This segment has gained popularity because it provides an optimal scale for commercial and industrial installations, balancing investment cost and energy output.

Utilities and private investors prefer mid-sized floating solar projects as they offer manageable deployment timelines and moderate technical complexity. The 5 MW scale is also suitable for integration with existing water bodies without requiring extensive infrastructural modifications.

As the demand for decentralized and flexible renewable energy solutions grows, 5 MW projects are increasingly viewed as a practical option for expanding clean energy capacity.

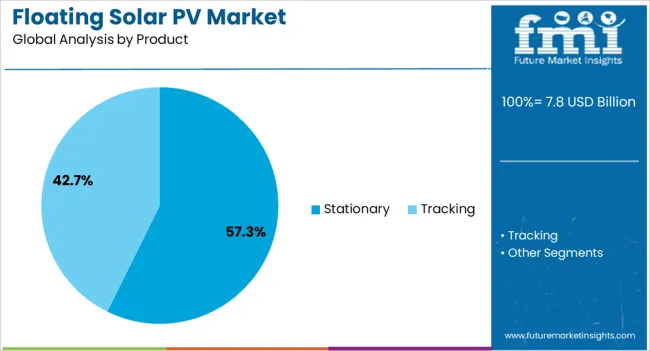

The stationary product segment is expected to hold 57.3% of the floating solar PV market revenue in 2025, securing its position as the dominant product type. Stationary floating solar systems are favored for their simplicity, lower maintenance requirements, and proven reliability.

These systems offer fixed positioning of solar panels, which simplifies structural design and reduces mechanical complexity compared to tracking systems. Investors and operators have favored stationary products for their lower initial capital expenditure and stable power output.

The durability of stationary designs in aquatic environments has been a key factor in their widespread adoption. As floating solar technologies continue to mature, stationary systems are expected to remain the primary choice for many projects seeking cost-effective and robust renewable energy solutions.

Floating solar PV is evolving as a vital renewable segment. Its dual benefits of energy generation and water conservation are propelling adoption worldwide.

Floating solar PV is gaining significance in global energy, holding around 2.5–3.5% share of solar PV installations. Its presence is expanding due to its adaptability to water surfaces such as reservoirs, lakes, and hydropower dams. This approach reduces the burden on land-based projects where space constraints are common. The technology improves efficiency as panels benefit from water cooling, making them more productive than land installations. Governments across Asia Pacific, particularly China, India, Japan, and South Korea, are pushing deployment through incentives and pilot projects. Europe and the United States are catching up, with utilities and developers increasingly considering floating solar as a viable option in large-scale renewable portfolios.

The adoption of floating solar is driven by its ability to support dual benefits of energy generation and water management. Panels placed on water bodies reduce evaporation, offering direct value in water-scarce regions. The infrastructure also integrates well with hydropower facilities, enabling hybrid power plants that provide reliable and efficient supply. In densely populated regions, this advantage of using existing water reservoirs makes floating PV a practical solution. Improved float designs and anchoring systems are enhancing reliability, while project sizes are scaling up from pilot levels to hundreds of megawatts. The balance of efficiency gains and land-use savings positions floating PV as a compelling renewable segment

The financial landscape for floating solar PV is improving with the entry of utilities, private investors, and engineering firms. Green bonds and climate-linked funds are creating pathways for project financing, while regional banks are increasingly recognizing the long-term value of floating solar projects. Partnerships between technology providers and energy companies are driving innovation in design, durability, and installation practices. Asia Pacific continues to dominate investment activity, with governments providing regulatory clarity and favorable frameworks. Emerging markets in Latin America and Africa are also beginning to attract developers interested in floating solutions. As partnerships deepen, competitive costs are expected to improve adoption and scalability worldwide.

Challenges persist in durability, anchoring, and maintenance of floating solar plants in diverse water conditions, but innovation is steadily overcoming these hurdles. Corrosion-resistant materials, modular floatation systems, and advanced monitoring technologies are raising system lifespans and reducing operational risks. The industry is moving toward larger grid-scale projects, often exceeding 100 MW capacity, showing strong investor confidence. Future prospects also lie in offshore floating PV, though harsher marine conditions will require more resilient solutions. With strong government backing and expanding private participation, floating solar is shaping its role as a mainstream renewable energy contributor. Its share is expected to grow consistently, securing long-term importance.

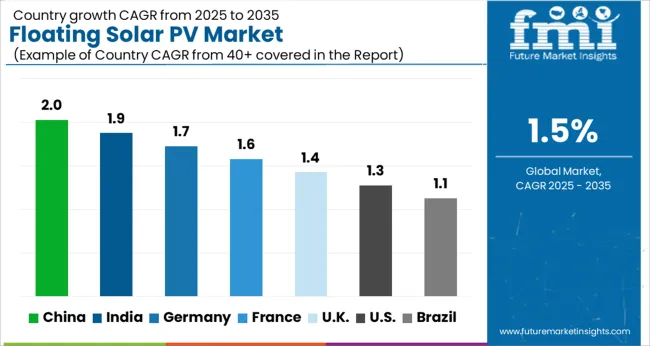

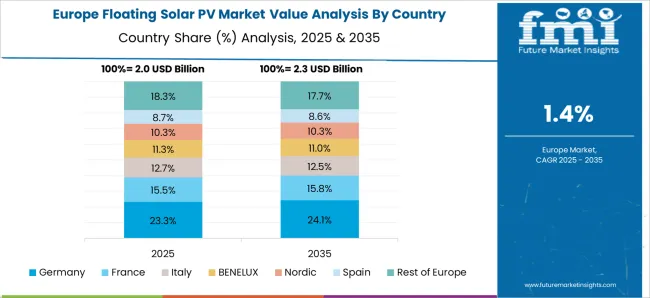

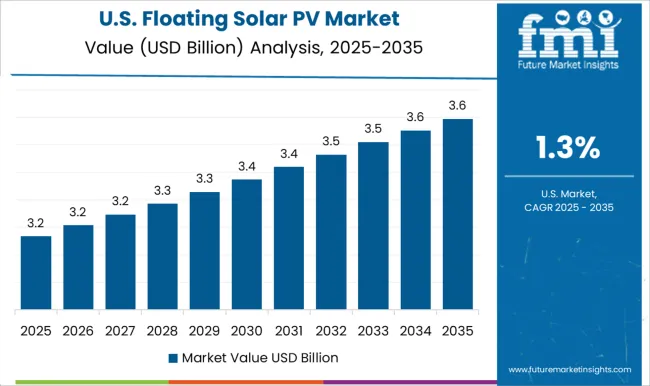

The floating solar PV market is projected to expand globally at a CAGR of 1.5% between 2025 and 2035, driven by the need for efficient land use, water conservation, and hybrid integration with hydropower systems. China leads with 2.0%, supported by large-scale reservoir projects, state-backed financing, and local manufacturing depth that enhances cost efficiency. India follows at 1.9%, with growth shaped by reservoir-based solar tenders, public sector investment, and state-level incentives for hybrid power plants. Germany records 1.7%, with expansion supported by municipal projects, environmental compliance, and water-surface utilization in industrial basins. The United Kingdom stands at 1.4%, driven by commercial reservoir projects, regulatory backing, and pilot installations focused on utility-scale deployment. The United States posts 1.3%, reflecting progress in pilot initiatives, private investments, and gradual adoption across hydropower-linked projects. The analysis spans over 40 countries, with these five serving as benchmarks for policy frameworks, investment focus, and technological adoption priorities in the global floating solar PV industry.

China’s position has been set by large-scale reservoir programs and strong domestic manufacturing depth. A CAGR of 2.0% for 2025–2035 is expected as provincial utilities continue to tender multi-hundred-MW arrays on drinking-water and irrigation reservoirs. The case for China looks compelling because water-borne sites ease land constraints and improve module performance through natural cooling. Grid integration benefits from proximity to existing hydropower, which enables smoother output and better curtailment management. Financing has been supported by state-linked lenders, while EPC integration shortens build cycles. In my view, China will keep outpacing peers as local content policies and standardization drive lower unit costs and faster commissioning across inland provinces.

India’s progress has been anchored in public-sector tenders on dams and water-supply reservoirs. Growth at 1.9% for 2025–2035 has been indicated by recent bids that bundle O&M, warranties, and performance guarantees. State utilities have preferred floating PV at sites where land acquisition raises timelines and costs. Natural cooling raises yield, which improves the tariff-to-IRR equation. Financial closure has become easier as lenders gain comfort with float integrity, anchoring designs, and lifecycle maintenance models. My assessment is that India’s rise will be propelled by hybridization with hydropower and by project clustering on large water bodies that cut balance-of-system costs and simplify logistics.

Germany’s market has been nurtured by municipal utilities and industrial-site reservoirs. A 1.7% CAGR for 2025–2035 appears attainable as Länder-level permitting becomes clearer for quarry lakes, mine pits, and process-water basins. The siting logic is persuasive where shoreline grid access exists and visual impact is manageable. Corporate PPAs from energy-intensive facilities near these water bodies create bankable offtake. As portfolios mature, EPCs have been standardizing floats, moorings, and cabling to meet inland safety codes. My view is that Germany will deliver steady growth through municipal procurement, brownfield water sites, and industrial PPAs that favor predictable construction windows and prudent risk transfer.

The United Kingdom’s floating PV is emerging on drinking-water reservoirs and private estates. A 1.4% CAGR for 2025–2035 has been projected as water utilities seek generation near pump loads and treatment works. The siting rationale is persuasive where shoreline infrastructure and land-use sensitivities exist. Portfolio owners have been testing larger arrays with improved float stability and low-impact anchoring. Insurance comfort has improved with stronger warranties and O&M regimes. It is my judgment that UK projects will scale through repeatable designs on utility-controlled reservoirs, with procurement frameworks that streamline risk allocation and accelerate commissioning across England and Scotland.

The United States has progressed through pilots at reclamation reservoirs and hydropower lakes. A 1.3% CAGR for 2025–2035 is foreseen as procurement pathways mature and water agencies evaluate evaporation-reduction benefits. Counties and municipal utilities have preferred measured expansion tied to grid-interconnection studies and avian-habitat reviews. Private investors have entered where long-term PPAs or utility bilateral contracts exist. My view is that the USA will build momentum through standardized environmental screening, clearer reservoir-use rights, and co-location with small hydro that leverages existing substations and access roads, translating to gradual yet durable capacity additions.

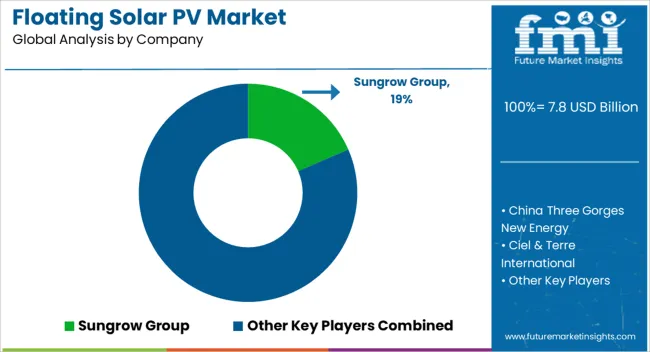

The floating solar PV industry features prominent module manufacturers, engineering firms, and technology developers such as Sungrow Group, China Three Gorges New Energy, Ciel & Terre International, Eni Energy Solutions, FOST, Isifloating, Kyocera Corporation, Longi Solar, Ocean Sun AS, SolarDuck, SolarisFloat, Swimsol, Yingli Solar, and ZIMMERMANN PV-Floating B.V. Competition revolves around cost-efficient design, project scalability, and technical durability in diverse aquatic environments.

Sungrow Group maintains leadership with its large-scale deployments and strong inverter integration. China Three Gorges New Energy leverages hydropower synergies, accelerating hybrid floating solar projects. Ciel & Terre International remains a pioneer, offering patented floating structures widely adopted worldwide. Eni Energy Solutions diversifies into renewable portfolios, positioning floating solar as a clean-energy complement. FOST and Isifloating emphasize modular platforms and mooring systems adapted to reservoirs and coastal basins. Kyocera Corporation develops floating solar tailored to the Japanese market, often integrated with utility-scale distribution. Longi Solar extends its strength in high-efficiency modules toward floating arrays.Ocean Sun AS advances circular float technology for wave-exposed sites, while SolarDuck pursues offshore floating PV with elevated triangular platforms suited for marine deployment. SolarisFloat and Swimsol focus on innovative modular solutions, with Swimsol targeting island microgrids and coastal nations. Yingli Solar continues to adapt its PV modules for floating environments. ZIMMERMANN PV-Floating B.V. provides anchoring, floating, and mounting systems widely adopted across Europe. Competition is driven by the ability to secure long-term partnerships with utilities, reduce lifecycle costs through durable materials, and provide reliable O&M frameworks. Key strategies involve offshore-capable floating structures, integration with hydropower facilities, and collaborations with water authorities. Partnerships between technology developers, EPC contractors, and investors are shaping scale-up efforts and ensuring operational efficiency across reservoirs, lakes, and nearshore basins.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Capacity | 5 MW, 5-15 MW, and >15 MW |

| Product | Stationary and Tracking |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sungrow Group, China Three Gorges New Energy, Ciel & Terre International, Eni Energy Solutions, FOST, Isifloating, Kyocera Corporation, Longi Solar, Ocean Sun AS, SolarDuck, SolarisFloat, Swimsol, Yingli Solar, and ZIMMERMANN PV-Floating B.V. |

| Additional Attributes | Dollar sales, share, technology adoption trends, policy incentives, competitive landscape, regional demand hotspots, cost reduction levers, financing models, and long-term growth outlook. |

The global floating solar PV market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the floating solar PV market is projected to reach USD 9.1 billion by 2035.

The floating solar PV market is expected to grow at a 1.5% CAGR between 2025 and 2035.

The key product types in floating solar PV market are 5 mw, 5-15 mw and >15 mw.

In terms of product, stationary segment to command 57.3% share in the floating solar PV market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floating Docks Market Size and Share Forecast Outlook 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Floating Valve Trays Market Size and Share Forecast Outlook 2025 to 2035

Floating Covers Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Floating Hotel Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region – Forecast for 2025-2035

Market Share Distribution Among Floating Hotel Providers

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Solar Floating Pool Lights Market Insights – Trends, Demand & Growth 2025-2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA