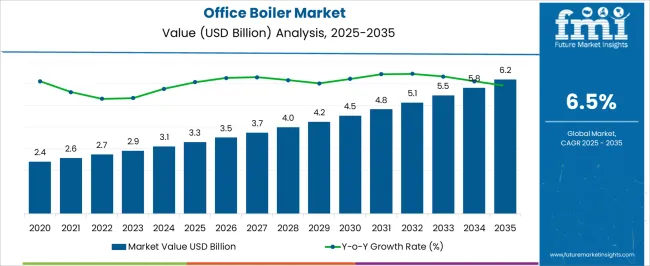

The office boiler market is projected to grow from USD 3.3 billion in 2025 to USD 6.2 billion by 2035, reflecting a CAGR of 6.5%. During the early adoption phase (2020–2024), the market was gradually expanded from USD 2.4 billion to USD 3.3 billion as boilers were installed in pilot office buildings and commercial spaces. Testing and evaluation of operational efficiency, safety, and heating consistency were conducted. By 2025, the market was reached at USD 3.3 billion, and broader deployment was observed as procurement and installation practices were standardized, enabling wider acceptance across mid-sized and large office infrastructure projects.

From 2025 to 2035, the market was observed to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market was surpassed at USD 4.5 billion, driven by expansion in corporate campuses, office complexes, and shared workspaces where boilers were increasingly integrated. During the consolidation phase, growth was moderated toward USD 6.2 billion by 2035 as leading manufacturers reinforced market presence and smaller suppliers were aligned or phased out. The 6.5% CAGR indicated steady expansion, and the market was established as a reliable solution for heating management, operational reliability, and energy distribution across commercial office facilities.

| Metric | Value |

|---|---|

| Office Boiler Market Estimated Value in (2025 E) | USD 3.3 billion |

| Office Boiler Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The office boiler market is influenced by multiple parent markets, each contributing to its growth. The commercial building construction sector is estimated to drive approximately 30%, as boilers are installed to provide heating across office complexes and corporate campuses. The heating, ventilation, and air conditioning (HVAC) equipment market is considered responsible for 20%, as integrated systems are applied for climate control and energy management.

Electrical and plumbing services are assessed to account for 15%, as installation, maintenance, and system integration are provided. Facility management and building operations contribute around 10%, as regular servicing, monitoring, and performance optimization are conducted. Energy distribution and utility services are evaluated at 8%, as connections, metering, and supply reliability are ensured. Government regulations and safety compliance agencies account for 7%, as standards, certifications, and inspections are applied.

Research and development services are estimated at 5%, as performance improvements, materials testing, and operational efficiency are optimized. Commercial equipment aftermarket services are assigned 5%, as replacement, retrofitting, and upgrades are carried out to maintain system functionality.

The Office Boiler market is experiencing steady growth, driven by the increasing demand for energy-efficient heating solutions across commercial office environments. The current market scenario reflects a shift toward systems that offer higher operational efficiency, reduced emissions, and easier integration with building management systems. Investment in energy-efficient infrastructure, regulatory incentives for low-carbon solutions, and rising electricity and fuel costs are influencing the adoption of modern boilers.

The market outlook is shaped by the growing preference for natural gas-fueled systems, which provide reliable performance while minimizing environmental impact. Additionally, demand for boilers capable of handling medium to large heating capacities is increasing as office buildings and campuses expand.

Technological advancements such as intelligent control systems, modular configurations, and remote monitoring capabilities are paving the way for future growth As businesses continue to focus on sustainability, operational efficiency, and regulatory compliance, the Office Boiler market is expected to witness continued expansion, with opportunities for high-performance hot water systems that can be tailored to diverse commercial requirements.

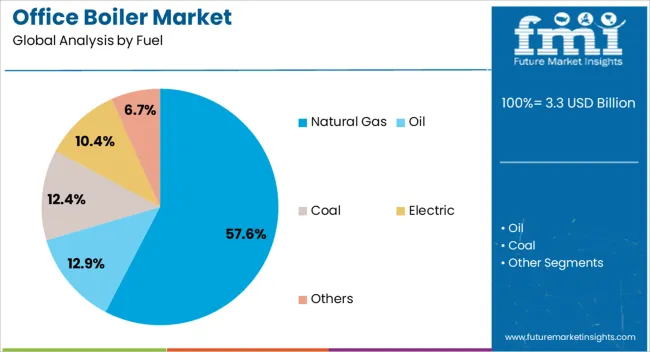

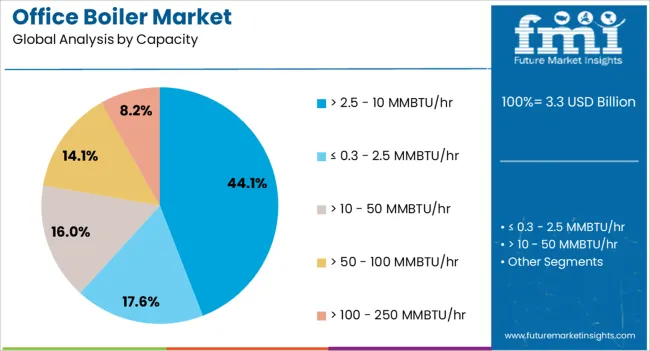

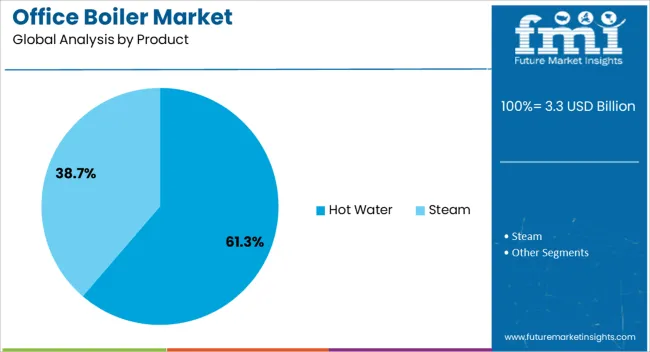

The office boiler market is segmented by fuel, capacity, product, technology, and geographic regions. By fuel, office boiler market is divided into Natural Gas, Oil, Coal, Electric, and Others. In terms of capacity, office boiler market is classified into > 2.5 - 10 MMBTU/hr, ≤ 0.3 - 2.5 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr. Based on product, office boiler market is segmented into Hot Water and Steam. By technology, office boiler market is segmented into Condensing and Non-Condensing. Regionally, the office boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas fuel segment is projected to account for 57.6% of the Office Boiler market revenue in 2025, making it the leading fuel type. This prominence has been attributed to the high energy efficiency, cleaner combustion, and lower operational costs associated with natural gas boilers. Adoption has been facilitated by the availability of robust gas infrastructure in urban centers, which ensures reliable fuel supply for commercial office buildings.

The segment’s growth has been reinforced by the global focus on reducing carbon emissions, as natural gas emits fewer pollutants compared to coal or oil-fired systems. Additionally, natural gas boilers offer rapid response times and stable heat output, which are critical for maintaining comfort in office environments.

Businesses have increasingly favored boilers that allow remote monitoring and automated control while minimizing maintenance downtime As environmental regulations tighten and energy efficiency becomes a priority, the natural gas segment is expected to continue leading the market by offering a balance of performance, reliability, and sustainability.

Boilers with a capacity of greater than 2.5 to 10 MMBTU/hr are estimated to hold 44.1% of the market revenue in 2025, representing the largest capacity segment. This growth is being driven by the need to provide sufficient heating for medium to large office spaces and campuses, where smaller units may be inadequate. The preference for this capacity range has been reinforced by its ability to handle variable loads efficiently while ensuring consistent heat distribution.

Facilities managers have increasingly chosen boilers in this range for their scalability, reliability, and compatibility with modern building management systems. The segment has benefited from technological advancements in modular and high-efficiency heat exchangers, which allow energy savings and lower operating costs.

Furthermore, the flexibility to integrate these boilers into multi-unit systems has facilitated adoption in office buildings requiring zoned heating solutions As commercial spaces continue to expand and the demand for efficient, high-capacity heating solutions grows, this segment is expected to maintain its leading position.

The hot water product segment is projected to capture 61.3% of the Office Boiler market revenue in 2025, making it the dominant product type. This leadership is attributed to the consistent demand for hot water for space heating, sanitary applications, and other office utility needs. The segment’s growth has been reinforced by the operational efficiency of hot water systems, which allow precise temperature control and integration with radiant heating and hydronic distribution networks.

Hot water boilers provide a reliable source of heat with lower maintenance requirements, which is critical in commercial office environments where operational continuity is essential. Additionally, advancements in energy-efficient heat exchangers, low NOx emissions, and automated control systems have further enhanced adoption.

The flexibility to deploy hot water boilers in both single and multi-building configurations has contributed to their market dominance As offices increasingly focus on energy conservation, sustainability, and user comfort, the hot water product segment is expected to continue its leadership in the Office Boiler market.

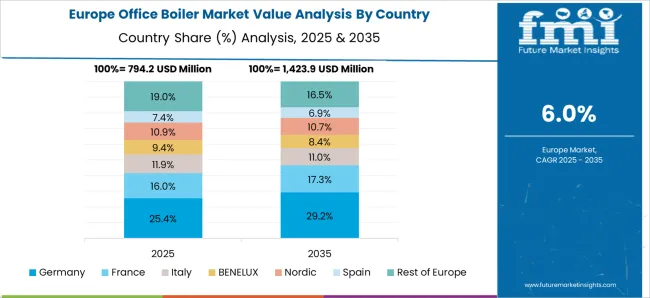

The office boiler market is growing due to increasing commercial construction, rising energy efficiency awareness, and demand for reliable heating systems in workplaces. North America and Europe lead with advanced, low-emission, and high-efficiency boilers suitable for multi-story office buildings. Asia-Pacific is witnessing rapid adoption driven by urbanization, corporate office expansion, and modernization of heating infrastructure. Manufacturers differentiate through compact design, fuel versatility, automation, and compliance with energy and safety standards. Regional variations in energy costs, building codes, and maintenance practices influence adoption and competitive positioning globally.

Adoption of office boilers is heavily influenced by thermal efficiency and fuel versatility. North America and Europe prioritize high-efficiency condensing boilers compatible with natural gas, propane, or biofuels to reduce operational costs and carbon footprint. Asia-Pacific markets emphasize boilers suitable for multiple fuel types, balancing performance with affordability for large office complexes. Differences in efficiency and fuel compatibility affect energy bills, environmental compliance, and system reliability. Leading suppliers invest in advanced heat exchangers, optimized combustion technology, and smart controls, while regional manufacturers focus on durable, cost-effective solutions. Efficiency and fuel flexibility contrasts shape adoption, operational costs, and competitiveness in the global office boiler market.

Space constraints and automation requirements are key factors in adoption. North America and Europe prioritize compact, wall-mounted or modular boilers with automated temperature control, fault diagnostics, and integration with building management systems. Asia-Pacific markets focus on durable, easy-to-install boilers with basic automation suitable for large office buildings. Differences in compactness and automation affect installation feasibility, energy optimization, and operational convenience. Leading suppliers offer smart, integrated solutions with remote monitoring and adaptive controls, while regional manufacturers provide practical, user-friendly systems. Design and automation contrasts drive adoption, operational efficiency, and strategic positioning in the global office boiler market.

Compliance with energy codes, emissions regulations, and workplace safety standards strongly influences office boiler adoption. North America and Europe enforce stringent low-NOx, carbon emission, and energy efficiency standards, impacting boiler design, installation, and maintenance. Asia-Pacific regulations vary; advanced economies align with global norms, while emerging markets focus on practical compliance for commercial applications. Differences in regulatory rigor affect approval timelines, energy performance reporting, and maintenance protocols. Suppliers offering certified, regulation-compliant boilers gain higher adoption, while regional players provide cost-effective alternatives meeting local standards. Regulatory contrasts shape adoption, legal compliance, and competitive positioning across global office boiler markets.

Maintenance reliability, lifecycle cost, and operational uptime are critical adoption factors. North America and Europe demand boilers with long service intervals, predictive diagnostics, and professional maintenance support to ensure uninterrupted office heating. Asia-Pacific markets adopt systems that balance durability, ease of servicing, and affordability to minimize operational disruptions. Differences in maintenance infrastructure and support affect total cost of ownership, downtime risk, and building occupant satisfaction. Leading suppliers provide service contracts, remote monitoring, and lifecycle optimization programs, while regional manufacturers focus on practical, low-maintenance solutions. Maintenance and lifecycle contrasts shape adoption, operational reliability, and market competitiveness in global office boiler applications.

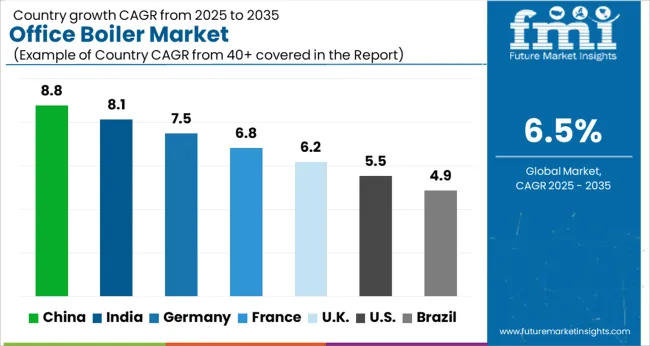

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global office boiler market is projected to grow at a 6.5% CAGR through 2035, driven by demand in commercial buildings, institutional facilities, and energy management applications. Among BRICS nations, China recorded 8.8% growth as large-scale manufacturing and installation facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 8.1% growth saw expansion of production and service units to meet rising regional demand. In the OECD region, Germany at 7.5% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 6.2% relied on moderate-scale operations for commercial and institutional boiler installations. The USA, expanding at 5.5%, remained a mature market with steady demand across office and facility energy systems, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The office boiler market in China is being driven at a CAGR of 8.8% due to increasing demand for energy-efficient heating solutions in commercial buildings. Boilers designed for central heating and hot water supply are being adopted to ensure reliable performance and reduced energy consumption. Manufacturers are being encouraged to deliver durable, high-efficiency, and low-emission boiler systems. Distribution through HVAC suppliers, construction companies, and online platforms is being maintained. Research and development in advanced heat exchange technologies, digital controls, and compact designs is being conducted. Rising commercial construction, government energy efficiency initiatives, and demand for comfortable office environments are being considered key factors driving market growth in China.

The market in India is being expanded at a CAGR of 8.1% with growing installation of energy-efficient boilers in offices and commercial buildings. Boilers are being adopted to provide reliable heating and hot water while optimizing energy consumption. Manufacturers are being focused on producing durable, high-performance, and cost-effective solutions. Distribution through HVAC contractors, authorized dealers, and online suppliers is being ensured. Awareness programs on energy efficiency and building management systems are being conducted. Increasing commercial infrastructure, government support for energy-efficient solutions, and focus on reducing operational costs are being considered primary drivers of market growth in India.

The market in Germany is being driven at a CAGR of 7.5% as demand for energy-efficient and low-emission boilers increases in office and commercial buildings. Advanced systems with improved heat transfer and digital controls are being adopted to optimize energy usage and maintain comfort. Manufacturers are being encouraged to provide durable, high-efficiency, and environmentally friendly solutions. Distribution through HVAC suppliers, contractors, and authorized dealers is being maintained. Research and development in low-emission combustion, heat recovery, and smart controls is being conducted. Germany’s emphasis on sustainability, energy efficiency, and strict building regulations is being considered a major factor supporting market growth.

The United Kingdom market is being expanded at a CAGR of 6.2% with growing adoption of energy-efficient heating systems in commercial offices. Boilers are being adopted to ensure reliable hot water supply, consistent heating, and optimized energy usage. Manufacturers are being focused on delivering durable, high-efficiency, and user-friendly systems. Distribution through HVAC contractors, authorized suppliers, and online platforms is being ensured. Training sessions and awareness campaigns are being conducted to promote proper boiler usage and energy management. Rising demand for modern office infrastructure, operational efficiency, and energy savings are being considered key factors driving market growth in the United Kingdom.

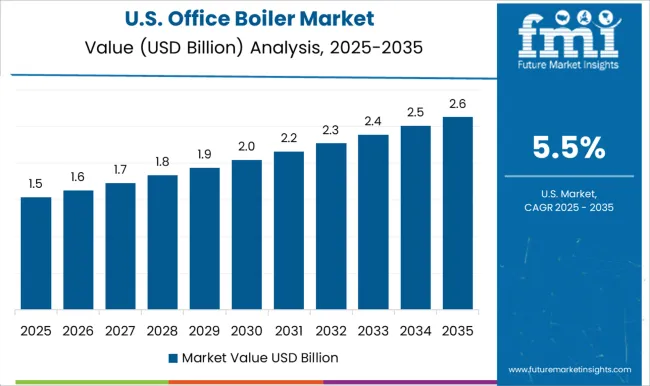

The United States market is being driven at a CAGR of 5.5% due to increasing adoption of energy-efficient heating solutions in office buildings. Boilers designed for reliable hot water and central heating are being adopted to reduce energy costs and maintain workplace comfort. Manufacturers are being encouraged to supply durable, high-performance, and environmentally friendly systems. Distribution through HVAC contractors, commercial suppliers, and online platforms is being maintained. Research and development in smart controls, heat recovery systems, and compact designs is being conducted. Rising demand for operational efficiency, commercial building growth, and sustainability initiatives are being considered major factors supporting market growth in the United States.

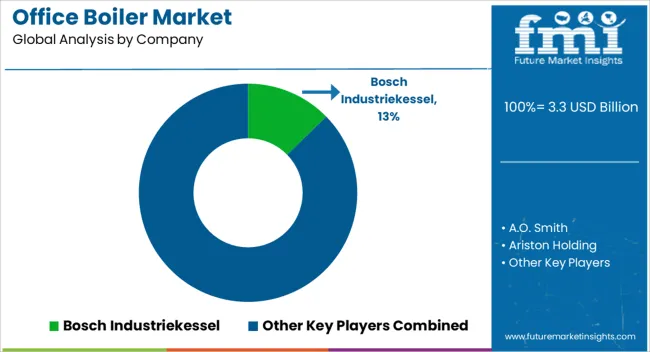

The office boiler market has been witnessing steady growth due to increasing energy efficiency requirements, rising construction activities, and growing emphasis on sustainable heating solutions in commercial buildings. Boilers are essential for providing heating and hot water in office environments, and advancements in technology, such as condensing boilers, low-NOx emissions, and smart control systems, are driving adoption. The demand is also influenced by regulations and incentives encouraging energy conservation and reduction of carbon footprints in commercial establishments. Key players in the office boiler market include Bosch Industriekessel, A.O. Smith, Ariston Holding, Babcock & Wilcox, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Clayton Industries, Cleaver-Brooks, Energy Kinetics, FERROLI, FONDITAL, Fulton, Hurst Boiler & Welding, Miura America, PARKER BOILER, Precision Boilers, Vaillant Group, VIESSMANN, Weil-McLain, and WOLF. These companies focus on delivering high-performance, reliable, and energy-efficient boilers tailored for office and commercial settings. Innovations in digital monitoring, automated control systems, and eco-friendly fuel options are being leveraged to meet the growing demand for low-emission and cost-effective heating solutions. Bosch Industriekessel is recognized for its advanced condensing boilers and sustainable heating solutions that reduce energy consumption and emissions. A.O. Smith and Ariston Holding are offering integrated solutions combining efficiency and user-friendly controls, while Babcock & Wilcox and Cleaver-Brooks emphasize robust industrial-grade office boilers suitable for large commercial buildings. Fulton, Hurst Boiler & Welding, and VIESSMANN focus on smart heating systems with remote monitoring and energy optimization features. Regional players such as FERROLI, FONDITAL, and WOLF contribute with cost-effective, compact boilers suitable for mid-sized office applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Fuel | Natural Gas, Oil, Coal, Electric, and Others |

| Capacity | > 2.5 - 10 MMBTU/hr, ≤ 0.3 - 2.5 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Product | Hot Water and Steam |

| Technology | Condensing and Non-Condensing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Industriekessel, A.O. Smith, Ariston Holding, Babcock & Wilcox, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Clayton Industries, Cleaver-Brooks, Energy Kinetics, FERROLI, FONDITAL, Fulton, Hurst Boiler & Welding, Miura America, PARKER BOILER, Precision Boilers, Vaillant Group, VIESSMANN, Weil-McLain, and WOLF |

| Additional Attributes | Dollar sales vary by boiler type, including gas-fired, electric, and oil-fired boilers; by capacity, spanning small, medium, and large office buildings; by application, such as space heating, hot water supply, and HVAC integration; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising commercial building construction, energy efficiency regulations, and demand for reliable heating solutions. |

The global office boiler market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the office boiler market is projected to reach USD 6.2 billion by 2035.

The office boiler market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in office boiler market are natural gas, oil, coal, electric and others.

In terms of capacity, > 2.5 - 10 mmbtu/hr segment to command 44.1% share in the office boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Office Supply Market Forecast and Outlook 2025 to 2035

Office Seat Cushion Market Analysis - Trends, Growth & Forecast 2025 to 2035

Home Office Spending Market by Solution Deployment, Application & Region Forecast till 2025 to 2035

Home Office Furniture Market

Front Office BPO Services Market Size and Share Forecast Outlook 2025 to 2035

Small Office Home Office (SOHO) Servers Market

Smart Office Market

Art and Office Marker Pen Market Size and Share Forecast Outlook 2025 to 2035

Private office-based clinics Market Size and Share Forecast Outlook 2025 to 2035

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA