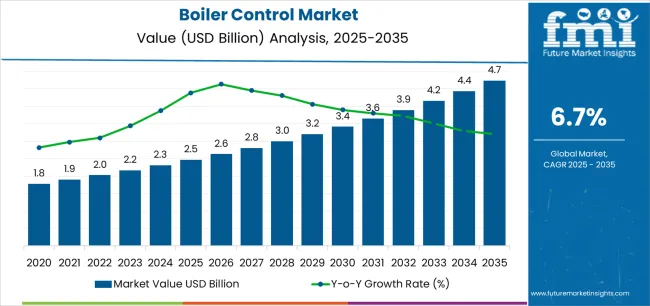

The Boiler Control Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The boiler control market is experiencing steady expansion, primarily driven by rising industrial automation, stringent energy efficiency regulations, and growing demand for reliable heating systems in process industries. Enhanced focus on optimizing boiler performance, reducing operational costs, and minimizing emissions has encouraged adoption of advanced control systems.

The integration of digital monitoring solutions, including IoT-enabled sensors and predictive maintenance software, is reshaping the operational efficiency of modern boilers. Additionally, industries such as chemicals, food processing, and power generation are increasingly investing in intelligent control systems to ensure process stability and safety.

The current market reflects a strong shift toward automation-led solutions, with emphasis on remote operation and real-time data analysis. As global energy demand continues to grow and regulatory standards tighten, the adoption of advanced boiler control technologies is expected to expand significantly, strengthening market resilience and competitiveness in industrial applications.

| Metric | Value |

|---|---|

| Boiler Control Market Estimated Value in (2025 E) | USD 2.5 billion |

| Boiler Control Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

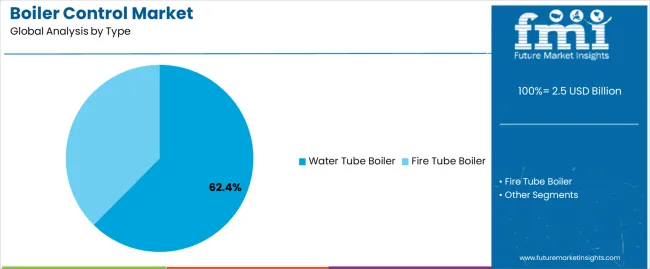

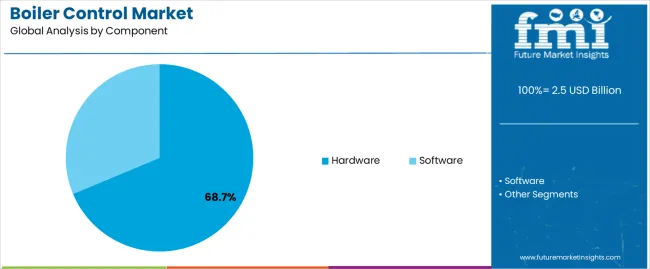

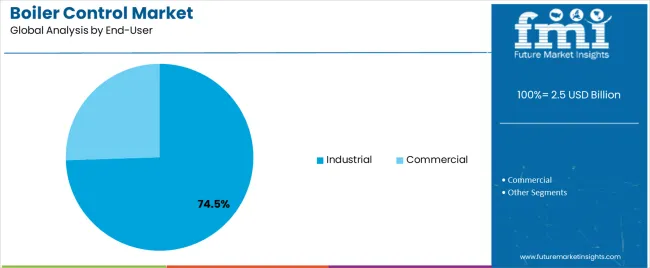

The market is segmented by Type, Component, and End-User and region. By Type, the market is divided into Water Tube Boiler and Fire Tube Boiler. In terms of Component, the market is classified into Hardware and Software. Based on End-User, the market is segmented into Industrial and Commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water tube boiler segment leads the type category, accounting for approximately 62.4% share of the boiler control market. This segment’s dominance is attributed to its higher efficiency, superior heat transfer capabilities, and suitability for high-pressure industrial applications.

Water tube boilers are widely preferred in industries such as power generation, refineries, and chemical processing, where large-scale steam output is essential. The integration of advanced control mechanisms enables precise temperature regulation, fuel optimization, and safety assurance, contributing to improved operational efficiency.

Moreover, the growing adoption of automation and real-time monitoring technologies enhances performance reliability and reduces downtime. With continuous industrial expansion and emphasis on energy-efficient steam systems, the water tube boiler segment is expected to sustain its leading position in the coming years.

The hardware segment dominates the component category with approximately 68.7% share, supported by the widespread use of sensors, controllers, and actuators essential for boiler operation. The segment’s strength lies in the continuous evolution of high-performance components designed to improve accuracy and system responsiveness.

Growing demand for smart instrumentation and digital interfaces has enhanced the role of hardware in ensuring operational safety and process efficiency. Manufacturers are focusing on modular designs and advanced communication protocols that facilitate seamless system integration.

The hardware segment also benefits from retrofitting opportunities in existing plants, where upgrades to control units and field devices are prioritized. With ongoing industrial digitalization and the increasing deployment of automation systems, hardware is expected to remain a crucial and leading segment within the boiler control market.

The industrial segment holds approximately 74.5% share of the end-user category, driven by the widespread deployment of boiler control systems in manufacturing, power, and process industries. Industrial users demand robust and precise control mechanisms to ensure uninterrupted operations, improved fuel efficiency, and compliance with emission standards.

The integration of smart control architectures in industrial boilers has significantly enhanced reliability and monitoring capabilities. Increasing investments in plant modernization and the adoption of Industry 4.0 technologies further support this segment’s dominance.

With continuous emphasis on operational safety, automation, and energy optimization, the industrial segment is expected to maintain its leadership throughout the forecast period.

The global boiler control market exhibited a CAGR of about 7.7% in the historical period. It is estimated to showcase a 7.1% CAGR in the forecast period. The market attained a valuation of USD 2.5 billion in 2025.

| Historical CAGR (2020 to 2025) | 7.7% |

|---|---|

| Historical Valuation (2025) | USD 2.5 billion |

Analyzing Industrial Boiler Control System Market from 2020 to 2025

Remote Boiler Monitoring Market Outlook from 2025 to 2035

The table provides information about significant variations in growth rates and dynamic trends in the boiler control market. Readers can gain insights into changing consumer tastes and evolving market dynamics throughout an array of different periods.

The table offers an explanation of growth potential, scrutinizing the role that actual numbers and predictions have in determining the future path of the market.

| Details | CAGR |

|---|---|

| H1 (2025 to 2035) | 6.5% |

| H2 (2025 to 2035) | 7.7% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 7.6% |

The section below highlights the CAGRs of the leading countries in the boiler control market. The three main countries pushing boiler control demand include Japan, the United Kingdom, and China.

According to the analysis, Japan is set to lead the boiler control market by showcasing a CAGR of 8.3% in the forecast period. The country is anticipated to be followed by the United Kingdom and China, with CAGRs of 8.1% and 7.9%, respectively.

| Countries | CAGR |

|---|---|

| United States | 7.4% |

| United Kingdom | 8.1% |

| China | 7.9% |

| Japan | 8.3% |

| South Korea | 4.2% |

Japan is estimated to showcase a considerable boiler control market share in the forecast period. It is expected to reach a valuation of USD 4.7 million in 2035. It will likely expand at a CAGR of around 8.3% from 2025 to 2035. Factors responsible for the country’s growth are:

The United Kingdom’s boiler control market is expected to showcase a CAGR of 8.1% in the assessment period. The country will likely reach a value of USD 181.8 million by 2035. Key factors propelling boiler control sales in the country are:

China’s boiler control market is projected to rise at a CAGR of 7.9% in the evaluation period. The country is anticipated to attain a value of about USD 719.3 million by 2035. A handful of factors pushing demand in China are:

The below section shows the global trends in the boiler control industry in terms of type, components, and end-user. The water tube boiler segment is expected to lead the boiler control market based on type. It is set to showcase a CAGR of around 6.5% from 2025 to 2035.

Based on the component, the hardware segment is anticipated to exhibit a dominant CAGR of 6.8% through 2035.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Hardware (Component) | 6.8% |

| Water Tube Boiler (Type) | 6.5% |

Based on components, the hardware segment is estimated to lead the global boiler control market. It is expected to witness a CAGR of 6.8% in the forecast period. Factors accelerating the segment’s growth are:

In terms of type, the water tube boiler segment is projected to dominate the boiler control market. It will likely expand at a CAGR of 6.5% from 2025 to 2035. The segment is expected to rise at a fast pace due to the following factors:

Leading companies in the global boiler control market are focusing on research & development activities to discover new application areas and products.

They are participating in mergers & acquisitions, collaborations, and joint ventures to co-develop innovative solutions and gain a competitive edge. A few other market players are aiming to raise their brand loyalty by offering discounts and showcasing their new products across exhibitions.

Recent Boiler Control Market Developments

The global boiler control market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the boiler control market is projected to reach USD 4.7 billion by 2035.

The boiler control market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in boiler control market are water tube boiler and fire tube boiler.

In terms of component, hardware segment to command 68.7% share in the boiler control market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Boiler Market

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Residential Boiler Market Growth – Trends & Forecast 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Field Erected Boiler Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA