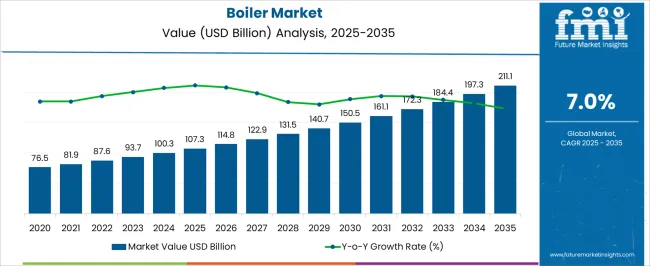

The boiler market is projected to grow from USD 107.3 billion in 2025 to USD 211.1 billion by 2035, reflecting a CAGR of 7.0%. This growth represents an absolute dollar opportunity of USD 103.8 billion over the decade. Starting at USD 76.5 billion in the early years, the market experiences steady expansion, reaching USD 150.5 billion by 2030. For companies in industrial equipment, energy, and manufacturing sectors, this growth indicates significant revenue potential. By aligning production, distribution, and market strategies with this trend, businesses can capture incremental value and strengthen their position in the rapidly expanding boiler market.

The absolute dollar opportunity from 2025 to 2035 highlights consistent annual gains, with the market rising from USD 107.3 billion to USD 211.1 billion over the decade. Incremental growth moves from USD 114.8 billion in 2026 to USD 197.3 billion in 2034, culminating at USD 211.1 billion in 2035. This predictable expansion allows companies to plan capacity, supply chain, and marketing strategies effectively. Capturing market share during this period ensures meaningful revenue gains while reducing investment risk. Companies entering or scaling operations can maximize returns in the evolving boiler market.

| Metric | Value |

|---|---|

| Boiler Market Estimated Value in (2025 E) | USD 107.3 billion |

| Boiler Market Forecast Value in (2035 F) | USD 211.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

A breakpoint analysis of the boiler market highlights periods of steady and accelerated growth. From 2025 to 2028, the market grows from USD 107.3 billion to USD 122.9 billion, with annual increments of around USD 5–6 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate demand trends. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test strategies, and build market presence. Early engagement during this period provides a foundation for capturing higher-value opportunities as the market continues to expand steadily in subsequent years. The next breakpoint occurs between 2030 and 2035, as the market expands from USD 150.5 billion to USD 211.1 billion, reflecting larger annual increments averaging USD 10–12 billion. This stage represents accelerated growth and significant absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture substantial revenue gains while strengthening competitive positioning. Understanding these breakpoints helps stakeholders plan investments, production, and expansion strategies to maximize returns in the evolving boiler market.

The boiler market is experiencing consistent expansion, driven by rising demand for efficient heating systems, tightening emission control regulations, and advancements in boiler technology. Energy efficiency mandates and environmental policies across various regions have spurred the adoption of cleaner fuel options and high-performance designs. Manufacturers are integrating features such as condensing technology, smart controls, and modular configurations to enhance operational efficiency and reduce lifecycle costs.

Urbanization trends, combined with increasing infrastructure development in residential, commercial, and industrial sectors, have further fueled installation rates. In emerging economies, rapid growth in housing projects and district heating networks is contributing to market penetration.

In mature markets, replacement demand for outdated systems is accelerating due to stricter energy performance standards. Looking forward, the market’s growth will be shaped by continued adoption of natural gas-based boilers, strong uptake of lower-capacity units in residential and light commercial setups, and the ongoing shift toward automated, connected heating solutions to meet both environmental and user convenience goals.

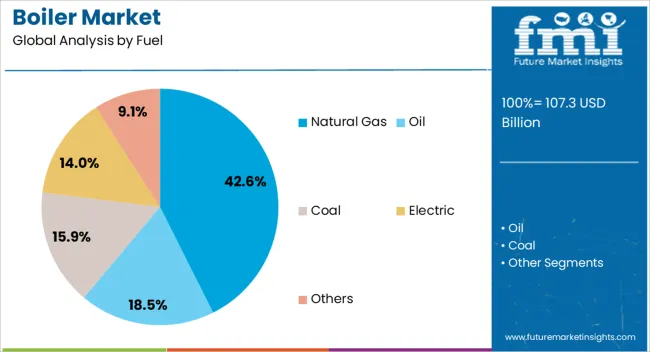

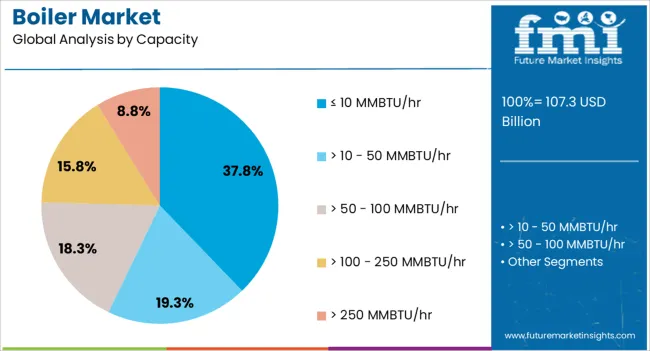

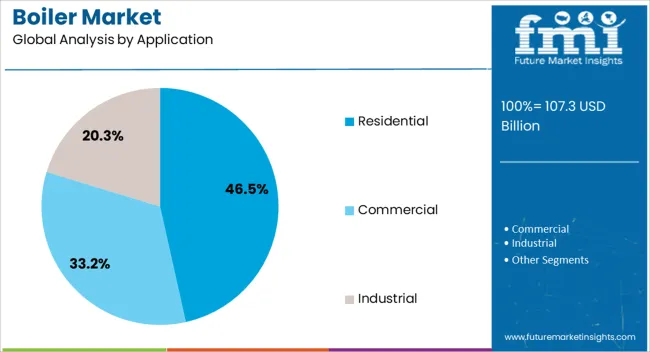

The boiler market is segmented by fuel, capacity, application, and geographic regions. By fuel, boiler market is divided into Natural Gas, Oil, Coal, Electric, and Others. In terms of capacity, boiler market is classified into ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, > 100 - 250 MMBTU/hr, and > 250 MMBTU/hr. Based on application, boiler market is segmented into Residential, Commercial, and Industrial. Regionally, the boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas segment is projected to hold 42.6% of the boiler market revenue in 2025, maintaining its leadership due to its cost-effectiveness, energy efficiency, and lower emission profile compared to other fossil fuels. Energy sector assessments have identified natural gas as the preferred fuel for boilers in regions with established gas distribution infrastructure, offering reliable supply and stable pricing.

Its cleaner combustion characteristics have also made it a preferred choice for meeting stringent emission reduction targets. Technological advancements in condensing natural gas boilers have further improved efficiency, enabling reduced fuel consumption and operating costs for end users.

Additionally, favorable government incentives for switching from coal or oil-fired systems to natural gas have supported market uptake. This combination of environmental, economic, and policy advantages is expected to reinforce the dominance of natural gas in the boiler market.

The ≤ 10 MMBTU/hr segment is projected to account for 37.8% of the boiler market revenue in 2025, leading due to its suitability for residential and small-scale commercial applications. This capacity range offers a balance between energy output and space efficiency, making it ideal for single-family homes, apartment complexes, and small businesses.

Industry reports have highlighted growing demand for compact, easy-to-install boilers that deliver reliable heating without requiring extensive infrastructure upgrades. These units have benefited from advancements in modular design and energy efficiency technologies, which allow for better load matching and operational cost savings.

Additionally, the shift towards energy-efficient retrofits in older buildings has driven demand for this capacity category, as it aligns with the heating requirements of most residential properties while complying with updated efficiency standards.

The residential segment is projected to represent 46.5% of the boiler market revenue in 2025, maintaining its position as the largest application category. Growth in this segment is being fueled by rising housing construction, renovation activity, and increased adoption of energy-efficient home heating systems.

Government programs promoting the replacement of outdated heating equipment with high-efficiency boilers have further encouraged residential adoption. Consumer demand for compact, quiet, and low-maintenance systems has driven manufacturers to develop user-friendly designs with advanced control features for optimal performance.

Seasonal demand patterns, particularly in colder climates, have reinforced the steady replacement cycle for residential boilers. With rising energy prices and consumer focus on lowering utility bills, the residential segment is expected to sustain its leadership, supported by ongoing product innovation and supportive policy frameworks.

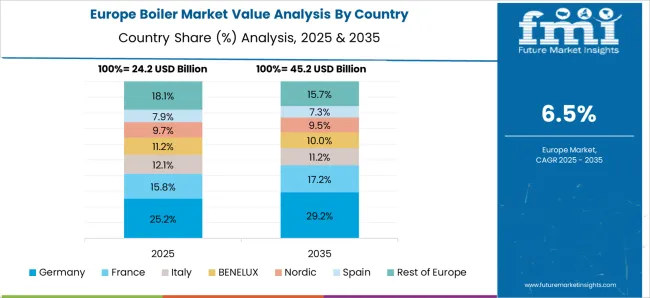

The boiler market is expanding due to rising energy demand, industrialization, and the need for efficient heating systems. Europe and North America lead in adoption of high-efficiency and low-emission boilers for industrial and commercial applications, whereas Asia-Pacific shows rapid growth driven by manufacturing, power generation, and urban infrastructure projects. Key manufacturers differentiate through fuel type, thermal efficiency, and automation features. Market growth is fueled by government energy-efficiency programs, industrial expansion, and increasing adoption of low-carbon and alternative fuel technologies.

Boilers differ by fuel type, including natural gas, biomass, coal, and oil-fired systems. Europe and North America prioritize gas and biomass boilers for low emissions and regulatory compliance, while Asia-Pacific continues to use coal-fired boilers for large-scale industrial energy generation due to cost advantages. Differences in fuel type affect operational efficiency, environmental impact, and long-term cost of ownership. Manufacturers offering multi-fuel or low-emission solutions capture premium markets, while regional producers focus on high-capacity, cost-efficient systems. These contrasts shape adoption, pricing strategies, and supplier competitiveness across mature and emerging markets.

Boiler systems vary in automation, monitoring, and control capabilities. European and North American markets emphasize smart, automated systems with real-time monitoring, remote control, and safety features for industrial and commercial facilities. Asia-Pacific markets often prioritize basic control systems for cost-effective large-scale applications. Differences in automation impact operational efficiency, safety, and maintenance requirements. Leading suppliers provide fully integrated, digitally controlled systems, while smaller regional manufacturers offer standard or semi-automated models. These contrasts influence adoption, long-term reliability, and differentiation in competitive industrial and commercial boiler markets.

Boiler manufacturing depends on steel availability, fabrication capacity, and supply chain efficiency. Europe and North America operate established production facilities with stringent quality controls, while Asia-Pacific emphasizes high-volume, cost-efficient fabrication to meet growing industrial and commercial demand. Supply chain disruptions, material costs, and energy prices influence pricing and delivery timelines. Manufacturers with integrated production and diversified sourcing ensure reliable supply for large-scale projects, while smaller or regional suppliers may face delays during peak demand. These differences impact market competitiveness, project execution, and long-term adoption patterns.

Boiler demand varies across industrial and residential applications. Europe and North America focus on industrial process heating, commercial facilities, and high-efficiency residential boilers for energy conservation. Large-scale industrial installations, power generation, and affordable residential heating solutions drive Asia-Pacific growth. Differences in end-use demand affect boiler specifications, marketing strategies, and supplier selection. Global manufacturers provide tailored solutions for energy-sensitive industrial and commercial sectors, while regional producers cater to high-volume, cost-focused residential and industrial projects. Understanding these contrasts enables suppliers to optimize production, inventory, and market penetration across diverse applications.

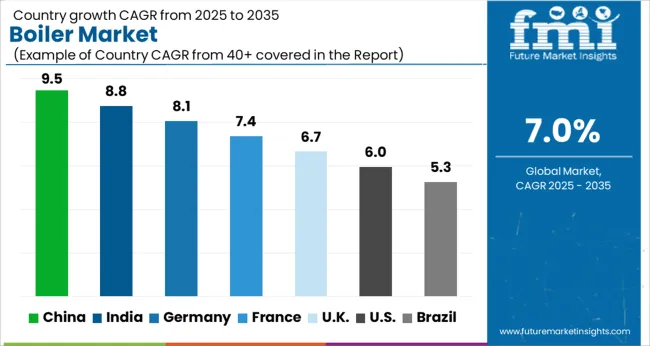

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global boiler market was projected to grow at a 7.0% CAGR through 2035, driven by demand in industrial, commercial, and residential heating applications. Among BRICS nations, China recorded 9.5% growth as large-scale manufacturing and installation facilities were commissioned and compliance with quality and safety standards was enforced, while India at 8.8% growth saw expansion of production units to meet rising regional energy demand. In the OECD region, Germany at 8.1% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 6.7% relied on moderate-scale operations for commercial and residential heating projects. The USA, expanding at 6.0%, remained a mature market with steady demand in industrial, commercial, and residential segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Painting tool market in China is growing at a CAGR of 5.9%. Between 2020 and 2024, growth was driven by rising construction, residential and commercial renovation projects, and demand from automotive and industrial sectors. Manufacturers focused on high quality brushes, rollers, spray guns, and application accessories to improve efficiency and precision. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of advanced painting systems, ergonomic tools, and eco-friendly materials. Urbanization, infrastructure development, and increased DIY painting trends will further support market expansion. China remains a leading market due to large construction sector, industrial activity, and growing demand for high quality painting tools.

Boiler market in India is growing at a CAGR of 8.8%. Historical period 2020 to 2024 saw growth supported by rising demand from power generation, chemical, and food processing industries. Manufacturers focused on efficient, reliable, and cost effective boilers. Expansion of industrial infrastructure and energy intensive sectors created steady demand. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of advanced, automated, and energy efficient boiler solutions. Government programs promoting industrial modernization and emission reduction will further drive market expansion. India is projected to maintain strong growth due to rising industrial activity and energy demand.

Boiler market in Germany is growing at a CAGR of 8.1%. Between 2020 and 2024, growth was supported by industrial demand, energy efficiency regulations, and modernization of power plants. Manufacturers focused on low emission, high performance, and sustainable boilers. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of renewable energy integrated, automated, and eco-friendly boiler systems. Regulatory compliance, technological innovation, and demand for energy efficiency will further support adoption. Germany remains a key European market due to advanced industrial sector and focus on sustainability.

Boiler market in the United Kingdom is growing at a CAGR of 6.7%. During 2020 to 2024, adoption was driven by residential and industrial heating, power generation, and modernization of older plants. Manufacturers focused on energy efficient, low emission, and reliable boiler systems. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of smart, automated, and environmentally compliant solutions. Government policies, energy efficiency programs, and industrial modernization will further support market expansion. The United Kingdom market reflects stable growth with emphasis on sustainability, efficiency, and emission reduction.

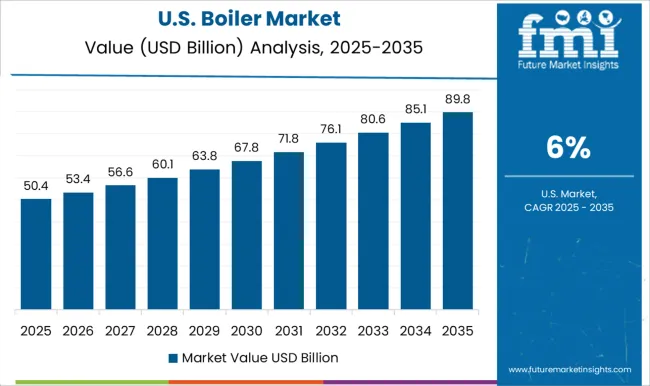

Boiler market in the United States is growing at a CAGR of 6.0%. Historical period 2020 to 2024 saw growth driven by industrial, power generation, and commercial heating applications. Manufacturers focused on high efficiency, low emission, and durable boiler systems. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of automated, energy efficient, and eco-friendly solutions. Industrial modernization, emission regulations, and demand for reliable heating systems will further support market expansion. The United States market demonstrates steady growth with emphasis on performance, sustainability, and technological adoption.

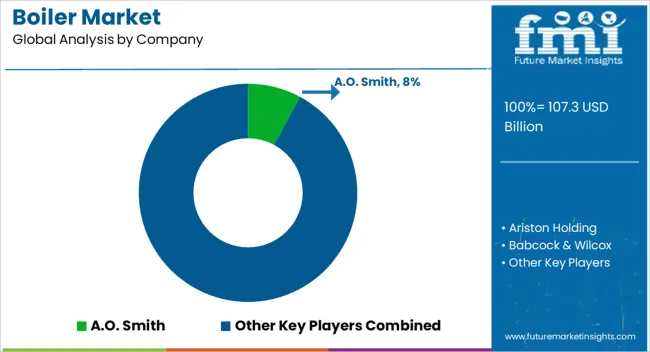

The boiler market is supplied by A.O. Smith, Ariston Holding, Babcock & Wilcox, Babcock Wanson, BDR Thermea Group, Bosch Industriekessel, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Carrier, Clayton Industries, Cleaver-Brooks, DAIKIN INDUSTRIES, FERROLI, Fulton, Hurst Boiler & Welding, IHI Corporation, John Cockerill, John Wood Group, Lennox International, Miura America, P.M. Lattner Manufacturing, PARKER BOILER, Thermax, USA Boiler Company, Vaillant Group, Vattenfall, VIESSMANN, and Weil-McLain, with competition shaped by thermal efficiency, fuel flexibility, and emissions compliance. A.O.

Smith and Viessmann brochures highlight condensing boilers with stainless steel heat exchangers, specifying output capacity, efficiency ratings, and operating pressure. Babcock & Wilcox and Cleaver-Brooks datasheets detail firetube and watertube designs, steam generation rates, and industrial-grade controls. Bosch Industriekessel, Fulton, and John Wood provide technical sheets covering fuel type compatibility, water treatment requirements, and safety certifications. Observed industry patterns indicate demand growth for compact, modular, and high-efficiency units suitable for residential, commercial, and industrial applications. Market strategies focus on differentiation through product range, energy performance, and installation support.

Viessmann and A.O. Smith invest in condensing technology and digital control systems to improve operational efficiency and reduce maintenance. Babcock Wanson, Cleaver-Brooks, and Fulton target commercial and industrial sectors with high-capacity steam and hot water systems. Observed trends show suppliers emphasizing turnkey solutions, rapid deployment, and integration with building management systems. Carrier, Lennox, and Ariston Holding focus on residential and light-commercial applications with compact designs and simplified controls.

Thermmax, IHI Corporation, and John Cockerill highlight custom-engineered boilers for specialized industrial processes. USA Boiler Company and Bradford White emphasize warranty programs, long-life materials, and safety certifications. Product brochures and technical datasheets communicate critical specifications, including boiler type, capacity, efficiency rating, operating pressure, fuel type, heat exchanger material, emissions data, and installation requirements. A.O. Smith and Viessmann provide diagrams for piping layout, control interfaces, and maintenance access.

Babcock & Wilcox, Cleaver-Brooks, and Bosch Industriekessel include performance curves, water quality guidelines, and recommended operating ranges. Fulton, Thermax, and John Wood highlight modularity, expandability, and safety interlocks. Clear technical documentation allows engineers, facility managers, and contractors to evaluate suitability, ensuring adoption based on verified thermal performance, durability, and operational efficiency across residential, commercial, and industrial boiler applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 107.3 Billion |

| Fuel | Natural Gas, Oil, Coal, Electric, and Others |

| Capacity | ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, > 100 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Application | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | A.O. Smith, Ariston Holding, Babcock & Wilcox, Babcock Wanson, BDR Thermea Group, Bosch Industriekessel, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Carrier, Clayton Industries, Cleaver-Brooks, DAIKIN INDUSTRIES, FERROLI, Fulton, Hurst Boiler & Welding, IHI Corporation, John Cockerill, John Wood Group, Lennox International, Miura America, P.M. Lattner Manufacturing, PARKER BOILER, Thermax, USA Boiler Company, Vaillant Group, Vattenfall, VIESSMANN, and Weil-McLain |

| Additional Attributes | Dollar sales vary by boiler type, including fire-tube, water-tube, electric, and biomass boilers; by fuel type, spanning natural gas, coal, oil, and renewable fuels; by application, such as power generation, industrial processing, and residential heating; by end-use industry, covering energy, manufacturing, and commercial sectors; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising energy demand, industrialization, and adoption of energy-efficient boiler technologies. |

The global boiler market is estimated to be valued at USD 107.3 billion in 2025.

The market size for the boiler market is projected to reach USD 211.1 billion by 2035.

The boiler market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in boiler market are natural gas, oil, coal, electric and others.

In terms of capacity, ≤ 10 mmbtu/hr segment to command 37.8% share in the boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Home Brew Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Boiler Market

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Residential Boiler Market Growth – Trends & Forecast 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Field Erected Boiler Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA