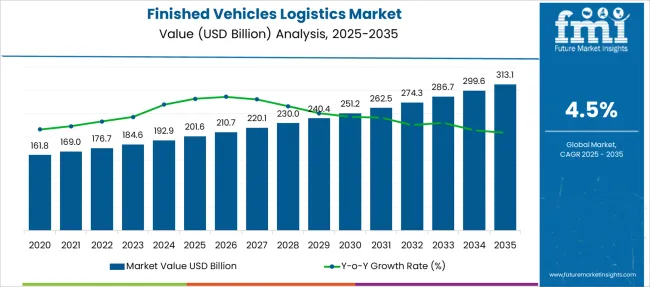

The Finished Vehicles Logistics Market is estimated to be valued at USD 201.6 billion in 2025 and is projected to reach USD 313.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Finished Vehicles Logistics Market Estimated Value in (2025 E) | USD 201.6 billion |

| Finished Vehicles Logistics Market Forecast Value in (2035 F) | USD 313.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The finished vehicles logistics market is undergoing structural evolution, driven by rising global vehicle production, increasing OEM outsourcing, and the strategic expansion of multimodal supply chains. Growth in cross-border vehicle movement, the electrification of transport fleets, and port infrastructure modernization have contributed to a more complex and demand-sensitive logistics environment.

Manufacturers and logistics providers are optimizing asset utilization, route efficiency, and inventory management through digitization and telematics integration. Additionally, stricter emissions regulations and fuel cost volatility are accelerating the shift toward more sustainable transport modes.

With consumer expectations for faster delivery timelines and the increasing use of vehicle tracking and automation technologies, the market is expected to experience a steady increase in value-added services. Strategic partnerships between automakers and third-party logistics firms, along with investment in data-driven network optimization, are likely to shape the next decade of growth in this market

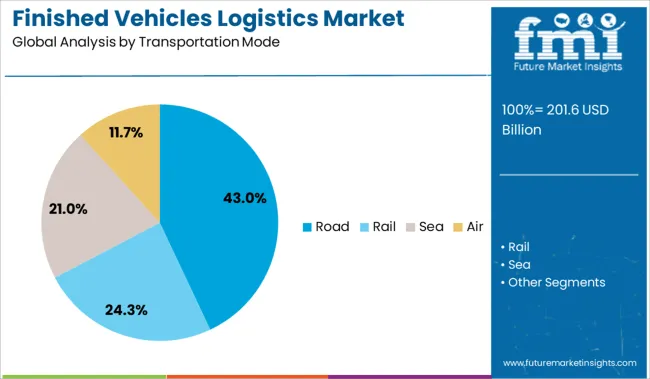

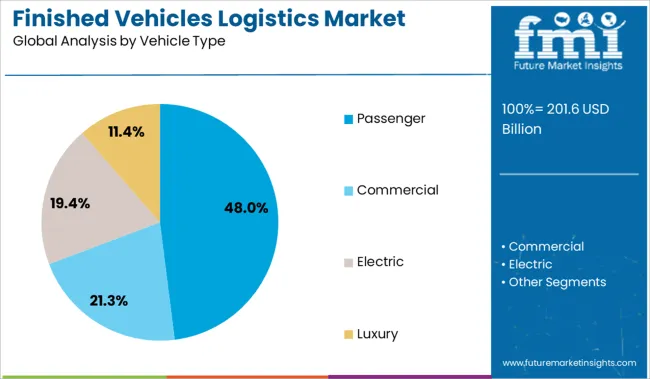

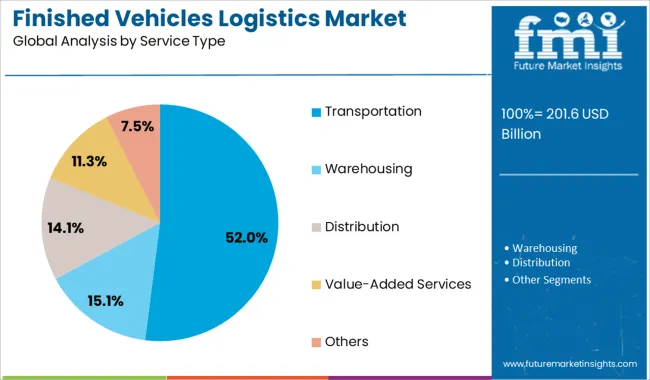

The market is segmented by Transportation Mode, Vehicle Type, Service Type, End-Use, and region. By Transportation Mode, the market is divided into Road, Rail, Sea, and Air. In terms of Vehicle Type, the market is classified into Passenger, Commercial, Electric, and Luxury. Based on Service Type, the market is segmented into Transportation, Warehousing, Distribution, Value-Added Services, and Others. By End-Use, the market is divided into OEMs, Dealerships, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Road transport is projected to account for 43.0% of the total market share in 2025, making it the leading mode in finished vehicles logistics. This dominance is being driven by its operational flexibility, point-to-point connectivity, and high availability across both domestic and cross-border delivery routes.

Road carriers enable last-mile distribution and shorter lead times, which are crucial in fulfilling dealership demand and just-in-time inventory models. Furthermore, the expansion of highway infrastructure and the integration of GPS fleet management systems have improved delivery accuracy and real-time visibility.

Road transport’s adaptability to small-batch deliveries and its compatibility with multi-tiered vehicle loading systems further strengthen its role in the broader automotive logistics ecosystem.

Passenger vehicles are expected to contribute 48.0% of the total revenue in 2025, ranking as the leading vehicle type in the finished vehicles logistics market. The sustained growth in passenger car production, particularly in emerging markets, has resulted in increased outbound logistics demand from assembly plants to regional dealerships.

Higher consumer turnover in vehicle ownership and greater model variety have increased shipment complexity, requiring scalable logistics planning. OEMs have also expanded their export operations, boosting the need for efficient finished vehicle distribution.

Additionally, electric vehicle expansion has added new logistical considerations, including battery handling and safety compliance, further elevating logistics demand in the passenger vehicle segment

Transportation services are expected to capture 52.0% of total market revenue in 2025, positioning them as the dominant service type. This segment’s lead is attributed to the core requirement of physically moving vehicles across national and international markets.

The steady increase in vehicle exports, fleet deliveries, and dealer transfers has solidified the centrality of transportation services within the supply chain. Logistics firms are investing in specialized carriers, including enclosed trailers and EV-compatible transporters, to meet the changing product mix and compliance needs.

As automakers increasingly delegate outbound logistics to third-party providers, transportation service contracts are expanding in volume and complexity. This reinforces the segment’s position as the foundation of value creation in the finished vehicle logistics chain

Raw material price volatility and supply chain disruptions are pressuring manufacturers, prompting shifts toward local sourcing and strategic partnerships. Simultaneously, evolving consumer demand for cleaner, high-performance products is driving functional innovation and market differentiation

Unpredictable swings in raw material prices, especially petrochemical derivatives, metals, and specialty additives, are a major hurdle. Geopolitical conflicts, trade policy changes, and shipping disruptions continue to strain input cost structures and delay deliveries. Manufacturers dependent on a few suppliers or singular regions face elevated risk. However, this scenario encourages diversification strategies and local sourcing opportunities. Strategic alliances with logistics firms and multi-supplier contracts can reduce exposure. Players able to maintain buffer inventory, cost-sharing agreements, or vertically integrate their supply lines can transform these pressures into competitive advantages. Supply chain agility and procurement intelligence have become critical differentiators in maintaining margins and ensuring uninterrupted operations.

There is a clear shift in consumer and buyer preferences toward safer, cleaner, and performance-focused products, especially in segments like personal care, food contact materials, and construction chemicals. This demand reshaping influences not just formulation strategies but also labeling, testing, and marketing approaches. While meeting these evolving needs can be costly, it creates distinct positioning opportunities. Companies that offer tailored, application-specific solutions, such as moisture barrier coatings or fast-curing adhesives, can secure higher margins. Expanding product portfolios with certifications (e.g., FDA-compliant, food-grade, or pharmaceutical-safe) attracts new B2B clients. This changing preference landscape challenges legacy players but provides niche entrants a platform to scale quickly with differentiated value propositions.

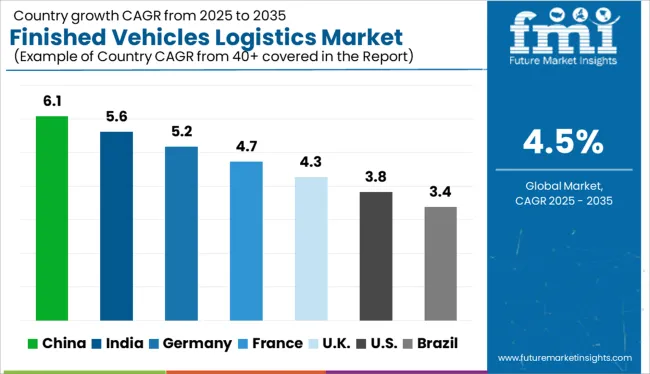

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

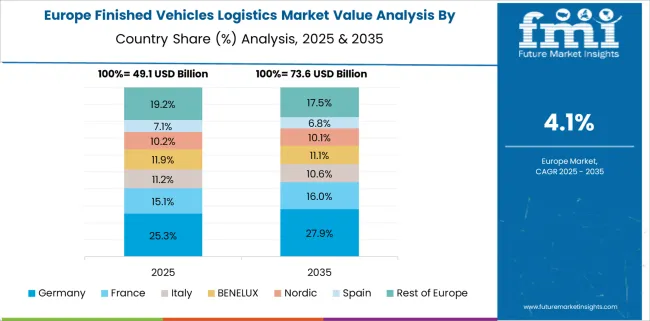

The global finished vehicles logistics market is projected to grow at a CAGR of 4.5% from 2025 to 2035, driven by rising automotive exports, digital fleet tracking systems, and OEM-3PL partnerships optimizing last-mile delivery and intermodal logistics. BRICS economies are outpacing the global average, led by China at 6.1% and India at 5.6%. China’s vehicle exports, including EVs, and its push for smart port integration are strengthening outbound logistics flows. India’s CAGR reflects its growing role as a compact and mid-segment car manufacturing hub, supported by evolving multimodal corridors and port infrastructure. Among OECD countries, Germany is ahead with a 5.2% CAGR, propelled by its strong automotive export engine and rail-road connectivity. The UK (4.3%) and USA (3.8%) show stable growth, with the UK leaning into short-sea shipping and the USA optimizing inland logistics through digitized yard and freight systems. ASEAN countries are becoming key transshipment hubs and tier-1 component consolidation zones in the finished vehicle supply chain.

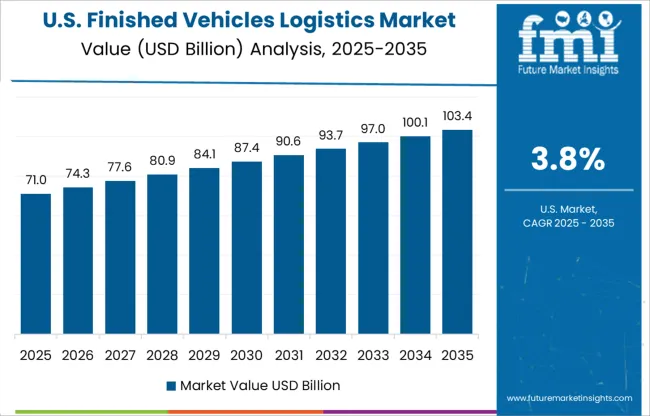

The CAGR for the USA finished vehicle logistics market was around 2.6% during 2020-2024, increasing to 3.8% for 2025-2035, reflecting long-term modernization and volume recovery. During the earlier phase, market growth was impacted by port backlogs, labor shortages, and limited railcar availability. From 2025 onward, opportunities are being driven by renewed federal infrastructure investments and the reshoring of OEM manufacturing. Expansion of intermodal hubs and rising EV production in states like Georgia and Michigan are reshaping outbound logistics flows. Railroad integration and data-driven logistics planning are enabling more efficient delivery operations across North America, offering lucrative contracts to advanced 3PLs and tech-integrated fleet operators.

India’s finished vehicle logistics market saw a CAGR of 4.1% between 2020 and 2024, rising to 5.6% during 2025-2035, reflecting rising vehicle output and logistics modernization. During the earlier phase, demand was mainly supported by growing rural sales, private vehicle ownership, and domestic automaker expansion. From 2025 onward, demand will be further amplified by EV cluster growth in Gujarat and Tamil Nadu, as well as the adoption of multimodal freight through the Gati Shakti initiative. Fast-growing Tier II and III city markets are prompting OEMs to strengthen their outbound logistics infrastructure, creating consistent demand for last-mile and regional haulers.

China’s finished vehicle logistics market registered a CAGR of 4.6% from 2020 to 2024, which is expected to rise to 6.1% during 2025-2035, making it the highest among major economies. The earlier period benefited from post-COVID domestic sales recovery and expansion of automotive hubs in Hubei, Zhejiang, and Jiangsu. From 2025, the rise in EV production and exports, especially to Southeast Asia and Europe, is projected to accelerate logistics demand. Smart vehicle shipments necessitate advanced, battery-safe handling and real-time delivery tracking, prompting the adoption of AI-based fleet platforms. This is transforming China into a leader in tech-enabled, high-throughput logistics solutions.

The UK finished vehicle logistics market grew at a CAGR of 2.9% from 2020 to 2024, increasing to 4.3% for 2025-2035, in line with post-Brexit supply chain stabilization and EV rollout. During the initial period, growth was held back by political uncertainty, limited EU trade fluidity, and fluctuating production output. However, from 2025, expansion is driven by EV model launches and cross-border logistics realignment with the EU. Port upgrades in Southampton and Liverpool, along with EV-optimized fleet investments, are enabling faster, safer vehicle shipments. Growth in B2B leasing and subscription-based car models is also triggering higher logistics frequency.

Germany’s finished vehicle logistics market experienced a CAGR of 3.4% during 2020-2024, growing to 5.2% over 2025-2035, propelled by a recovery in automotive output and EV-related export demand. The initial period reflected muted growth due to chip shortages and slow inventory movements across Bavarian and Saxon factories. From 2025, logistics growth is driven by increased production from BMW, Volkswagen, and Mercedes-Benz EV lines and EU Green Transport mandates. Germany’s transport network is enhancing rail-based distribution and inland port capacity (e.g., Duisburg, Bremerhaven). A push toward greener logistics contracts is also opening up new revenue from sustainability-conscious OEMs.

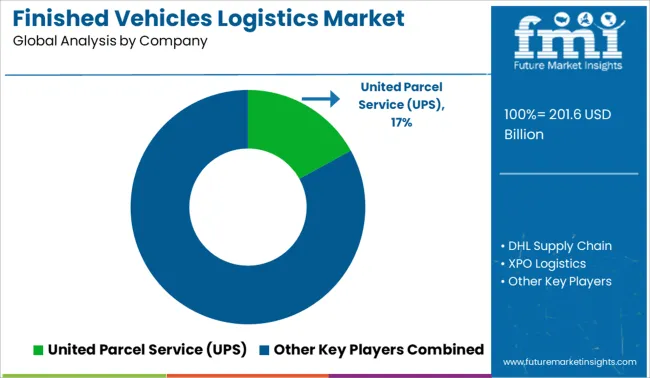

In the global finished vehicle logistics market, valued between USD 8-9 billion in 2024, UPS has secured a leading role by leveraging its vast multi-modal freight network and integrated distribution services across North America and Europe. The company’s scalable transport infrastructure and OEM-aligned contract logistics have strengthened its dominance in the outbound automotive supply chain. Other key players such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, Nippon Express, GEFCO, and Ryder System are investing in Ro-Ro port capabilities, EV-optimized freight fleets, and AI-based vehicle tracking platforms. Their global competitiveness stems from strategic warehousing locations, digitally managed flows, and regional partnerships across ASEAN, the USA, and the EU.

| Item | Value |

|---|---|

| Quantitative Units | USD 201.6 Billion |

| Transportation Mode | Road, Rail, Sea, and Air |

| Vehicle Type | Passenger, Commercial, Electric, and Luxury |

| Service Type | Transportation, Warehousing, Distribution, Value-Added Services, and Others |

| End-Use | OEMs, Dealerships, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | United Parcel Service (UPS), DHL Supply Chain, XPO Logistics, Kuehne + Nagel, Ceva Logistics, DB Schenker, DSV, Nippon Express, GEFCO, and Ryder System, Inc. |

| Additional Attributes | Dollar sales, market share, regional transport cost trends, EV-specific logistics demand, 3PL/4PL partnerships, intermodal capacity, and fleet automation adoption. |

The global finished vehicles logistics market is estimated to be valued at USD 201.6 billion in 2025.

The market size for the finished vehicles logistics market is projected to reach USD 313.1 billion by 2035.

The finished vehicles logistics market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in finished vehicles logistics market are road, rail, sea and air.

In terms of vehicle type, passenger segment to command 48.0% share in the finished vehicles logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

In Vehicles Payment Market Size and Share Forecast Outlook 2025 to 2035

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vehicles Market Trends – Growth & Forecast 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Road-Rail Vehicles Market

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

CNG and LPG Vehicles Market Trends - Growth & Forecast 2025 to 2035

Mild Hybrid Vehicles Market

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Electric Utility Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA