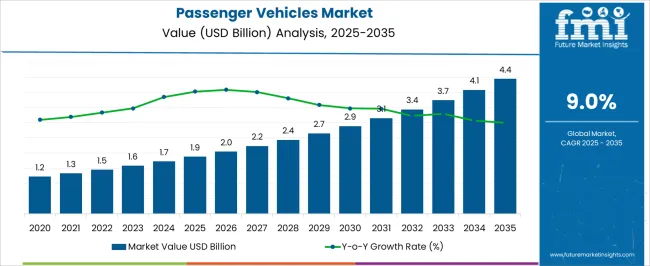

The passenger vehicles market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

This growth is driven by increasing consumer demand for efficient, reliable, and feature-rich vehicles. The market expansion is being fueled by rising investments in advanced manufacturing processes, enhanced safety standards, and diversified model offerings. Over the decade, year-on-year growth is anticipated to maintain a consistent upward trajectory, with market players capitalizing on evolving consumer preferences and regional demand shifts to expand their footprint. During the forecast period, the passenger vehicles market is likely to experience fluctuations in growth rates across different regions, reflecting changing consumer patterns, regulatory influences, and competitive dynamics.

From 2025 to 2035, incremental market opportunities are expected to emerge as manufacturers introduce new vehicle variants, optimize production capacities, and strengthen distribution networks. The overall market outlook indicates a sustained increase in demand, with the cumulative market value rising steadily and capturing a larger share of the global automotive sector. This growth trajectory underscores the continued importance of innovation in design, performance, and market strategy to attract consumers and enhance market positioning.

| Metric | Value |

|---|---|

| Passenger Vehicles Market Estimated Value in (2025 E) | USD 1.9 billion |

| Passenger Vehicles Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The passenger vehicles market is estimated to hold a notable proportion within its parent markets, representing approximately 40-45% of the automotive market, around 70-75% of the light vehicles market, close to 20-25% of the electric vehicles market, about 35-40% of the automotive manufacturing market, and roughly 30-35% of the vehicle sales and distribution market. Collectively, the cumulative share across these parent segments is observed in the range of 195-220%, highlighting the central role of passenger vehicles in the broader automotive ecosystem. The market has been driven by the rising demand for personal mobility, enhanced safety features, comfort, and performance, where consumer preferences for fuel efficiency, design, and reliability are prioritized.

Adoption is influenced by trends in urban commuting, lifestyle choices, and the increasing penetration of electric and hybrid passenger vehicles. Market participants have focused on offering diverse models and optimizing production and distribution channels to capture consumer demand across regions. As a result, the passenger vehicles market has not only captured a significant share within light vehicles and automotive manufacturing but has also shaped the dynamics of the electric vehicles sector and vehicle sales networks, underlining its importance in defining automotive trends, revenue generation, and manufacturing priorities globally.

The passenger vehicles market is experiencing steady growth, supported by the rising global demand for mobility solutions and increasing urbanization. Growth is being driven by expanding middle-class populations, increasing disposable income, and favorable financing options that encourage vehicle ownership. Consumers are placing higher emphasis on safety, comfort, and fuel efficiency, prompting manufacturers to invest in new technologies and diversified vehicle offerings.

The market is being influenced by stringent regulatory frameworks related to emissions and fuel economy, which are shaping product design and propulsion choices. Electrification and hybridization trends are also contributing to the evolution of the market, encouraging innovation in vehicle propulsion systems.

In addition, growing demand for personal mobility driven by lifestyle changes and urban transport challenges is reinforcing sales in personal and small vehicle segments Continuous technological developments in manufacturing, connected vehicle technologies, and vehicle safety systems are expected to enhance the overall passenger vehicles market, providing opportunities for both established automakers and new entrants to capture market share across diverse geographies.

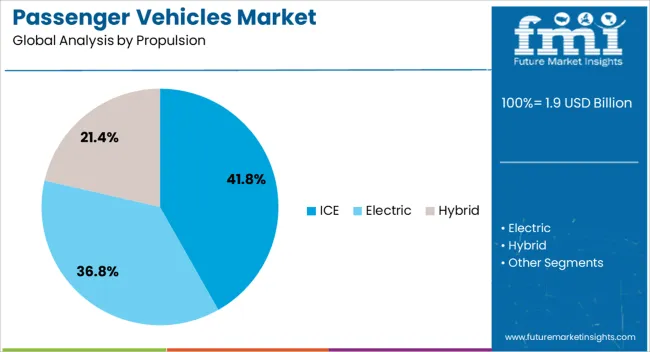

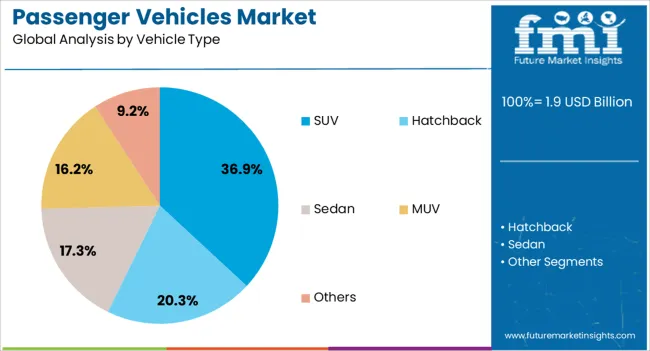

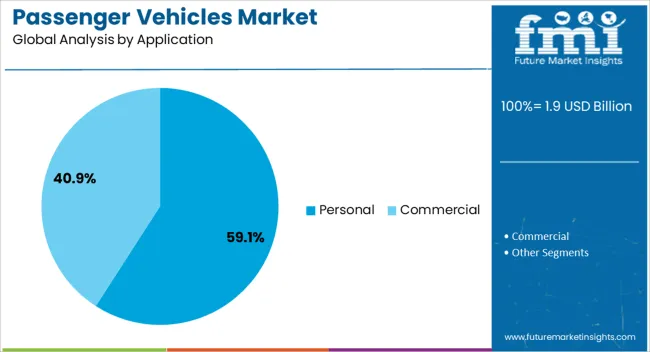

The passenger vehicles market is segmented by propulsion, vehicle type, application, drive type, and geographic regions. By propulsion, passenger vehicles market is divided into ICE, electric, and hybrid. In terms of vehicle type, passenger vehicles market is classified into SUV, hatchback, sedan, MUV, and others. Based on application, passenger vehicles market is segmented into personal and commercial. By drive type, passenger vehicles market is segmented into front-wheel drive, rear-wheel drive, and all-wheel drive. Regionally, the passenger vehicles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The internal combustion engine propulsion segment is projected to hold 41.8% of the passenger vehicles market revenue share in 2025, positioning it as the leading propulsion type. Its dominance is being supported by the extensive global infrastructure for fuel distribution and long-standing consumer familiarity with ICE technology. Reliability, ease of maintenance, and lower initial purchase costs are reinforcing adoption in emerging and developed markets alike.

The segment is benefiting from continuous improvements in engine efficiency, emissions reduction, and performance optimization, which allow ICE vehicles to remain competitive against hybrid and electric alternatives. Rising demand for long-range travel vehicles and high-performance models is also contributing to the sustained preference for ICE propulsion.

Additionally, automakers are increasingly integrating advanced software, turbocharging, and fuel-saving technologies to improve the efficiency and environmental compliance of ICE vehicles This combination of infrastructure support, technological improvements, and cost advantages is ensuring that ICE propulsion continues to dominate the passenger vehicles market in the near term.

The SUV vehicle type segment is expected to account for 36.9% of the passenger vehicles market revenue share in 2025, establishing it as the leading vehicle category. Its growth is being driven by consumer preference for spacious, versatile, and high-utility vehicles capable of handling diverse road conditions. Safety features, elevated seating positions, and enhanced comfort are increasing the attractiveness of SUVs among personal vehicle buyers.

The segment is further benefiting from automakers expanding product offerings with a range of size, design, and fuel efficiency options to cater to different demographics. Rising urban and suburban demand, along with the popularity of lifestyle-oriented vehicles, is reinforcing adoption.

Additionally, SUVs are being increasingly equipped with advanced driver-assistance systems, infotainment, and connectivity features, enhancing their appeal in competitive markets The versatility and perceived value for both family and recreational use continue to make SUVs a dominant segment within the global passenger vehicles market.

The personal application segment is projected to hold 59.1% of the passenger vehicles market revenue share in 2025, positioning it as the largest application area. Its dominance is being reinforced by growing consumer demand for private mobility solutions that offer convenience, flexibility, and comfort. Rising disposable income, urban population growth, and changing lifestyles are increasing the preference for personal vehicles over shared or public transport options.

The segment is also benefiting from technological advancements such as connected car features, safety enhancements, and fuel-efficient powertrains, which improve the ownership experience. Personal vehicle buyers are seeking vehicles that cater to both daily commuting and leisure purposes, driving demand across multiple categories including sedans, hatchbacks, and SUVs.

In addition, government policies promoting vehicle ownership through financing schemes and incentives are further supporting the segment The combination of convenience, personalization, and technological advancements ensures that the personal application segment remains the dominant driver of passenger vehicle market growth.

The passenger vehicles market is expanding due to rising consumer demand, particularly for vehicles offering comfort, efficiency, and connectivity. Opportunities in electrification, connected technologies, and smart mobility are redefining market growth, while digitalization and safety innovations continue to enhance consumer appeal. However, challenges related to regulatory compliance, supply chain disruptions, and competitive pressures persist. Overall, the market is being shaped by a combination of consumer expectations, emerging vehicle technologies, and strategic responses by manufacturers, positioning passenger vehicles as essential mobility solutions and lifestyle choices.

The passenger vehicles market has been significantly influenced by rising consumer demand across developed and emerging regions. Increased disposable income, easier access to financing, and the expansion of road infrastructure have contributed to the growing preference for personal vehicles. Customers are increasingly seeking models that offer enhanced comfort, fuel efficiency, and connectivity features, which has led manufacturers to diversify their portfolios. The market is also being shaped by shifting consumer preferences toward hybrid and electric models as fuel costs and environmental awareness influence purchasing decisions. In addition, regional trends such as growing urban commuting and intercity travel are boosting demand for compact and midsize passenger cars. Government incentives in several regions for vehicle ownership and registration are further reinforcing demand patterns. Overall, passenger vehicles are being positioned not merely as transportation means but also as lifestyle symbols, driving strategic decisions in production, marketing, and distribution across the automotive industry.

The passenger vehicles market is increasingly being shaped by opportunities in vehicle electrification and connectivity features. Electric vehicles (EVs) are being integrated into mainstream portfolios as regulatory policies favor low-emission transport, while connected vehicles provide infotainment, telematics, and navigation solutions that attract tech-savvy consumers. These trends are allowing manufacturers to tap into premium segments and differentiate offerings with smart mobility features, enhancing driver experience and vehicle performance. The convergence of energy storage, battery management, and vehicle-to-grid solutions is opening new revenue streams. Further, collaborations with charging infrastructure providers, software developers, and mobility platforms are creating avenues for enhanced customer engagement and long-term loyalty. These opportunities indicate that the market is not only evolving in response to consumer needs but is also being reshaped by technological adoption that improves operational efficiency, driving growth in both urban and semi-urban passenger vehicle segments.

The passenger vehicles market is increasingly influenced by the trend of digitalization, encompassing advanced driver assistance systems (ADAS), smart infotainment, and AI-based safety monitoring. Automakers are being compelled to integrate features such as adaptive cruise control, lane-keeping assist, collision detection, and automatic braking systems into new models to meet consumer expectations and regulatory requirements. Additionally, infotainment systems with smartphone integration and cloud connectivity are being positioned as key selling points, improving customer experience and engagement. Manufacturers are leveraging digital platforms for remote diagnostics, predictive maintenance, and enhanced fleet management, which is contributing to vehicle longevity and operational efficiency. Safety features, in particular, are influencing purchase decisions as consumers prioritize protection and reliability. Collectively, digitalization and enhanced safety mechanisms are reshaping vehicle design, boosting market competitiveness, and fostering a perception of value beyond traditional engine performance.

The passenger vehicles market is facing several challenges that could influence growth trajectories. Strict emission and fuel efficiency standards imposed by governments across regions are compelling manufacturers to invest heavily in research, development, and reengineering of powertrains, which increases production costs. Simultaneously, supply chain disruptions, particularly in semiconductor and raw material availability, are causing delays in production schedules and rising vehicle prices. Fluctuating fuel prices and trade restrictions also affect market stability, influencing both consumer purchasing behavior and profitability. Additionally, intense competition in both conventional and electric vehicle segments is pressuring margins and requiring innovative marketing strategies. Addressing these challenges requires coordinated efforts in risk management, supply chain optimization, and regulatory compliance, while maintaining consumer-focused product innovation to sustain market growth over the medium to long term.

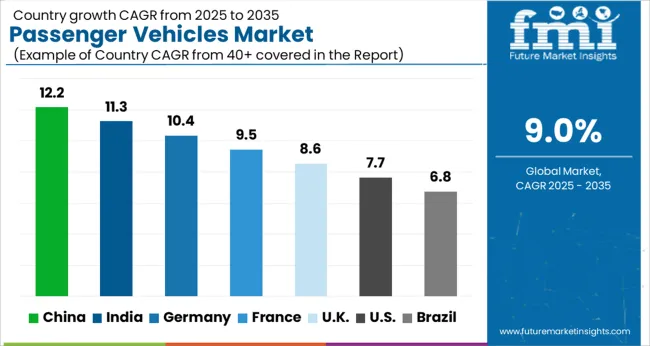

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global passenger vehicles market is projected to grow at a CAGR of 9% from 2025 to 2035. China leads with a growth rate of 12.2%, followed by India at 11.3%, and Germany at 10.4%. The United Kingdom records a growth rate of 8.6%, while the United States shows the slowest growth at 7.7%. Growth is driven by increasing urban mobility demands, rising disposable incomes, and a growing preference for private transportation. Emerging markets like China and India benefit from expanding automotive production and vehicle sales, while developed economies focus on fuel-efficient, electric, and connected vehicle offerings. The market evolution is shaped by regulatory frameworks, consumer demand shifts, and innovations in automotive technology, ensuring steady expansion in passenger vehicle adoption globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

The passenger vehicles market in China is expanding rapidly, registering a CAGR of 12.2%. As the largest automotive market globally, China’s growth is fueled by rising disposable incomes, urbanization, and increasing vehicle ownership across tier 1 and tier 2 cities. Chinese consumers are also increasingly favoring electric and hybrid vehicles due to government incentives and environmental policies. The demand for premium and mid-range passenger vehicles is growing, reflecting the country’s rising middle-class population. Furthermore, domestic automakers are scaling production capacity and introducing advanced models with improved safety and connectivity features, driving overall market expansion.

The passenger vehicles market in India is growing at a CAGR of 11.3%. Rapid urbanization, rising incomes, and government initiatives promoting automotive sector growth are key drivers. India’s expanding middle-class population is creating strong demand for compact, fuel-efficient, and mid-range passenger vehicles. Electric vehicle adoption is slowly increasing, supported by national policies and incentives for EV manufacturing and sales. The country’s growing road infrastructure and increasing financing options are also facilitating vehicle ownership. Additionally, Indian manufacturers are investing in advanced technologies, safety features, and improved design, which are enhancing consumer confidence and fueling market expansion.

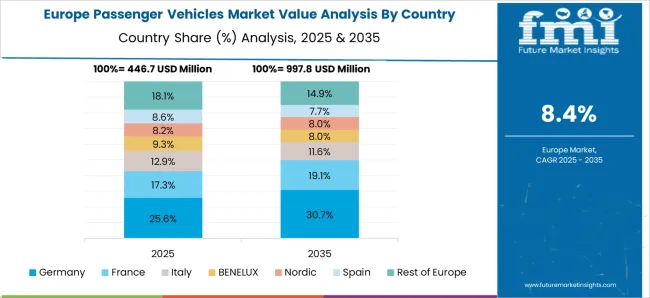

The passenger vehicles market in Germany is expanding at a CAGR of 10.4%. Germany’s market growth is supported by strong automotive manufacturing, consumer preference for high-quality vehicles, and advancements in electric and hybrid vehicle technology. German consumers are increasingly favoring sustainable and fuel-efficient models, and government incentives for EV adoption are further stimulating the market. The presence of leading automakers such as Volkswagen, BMW, and Mercedes-Benz ensures continuous innovation and the introduction of premium and technologically advanced vehicles. Moreover, export opportunities contribute to production growth, solidifying Germany’s position as a key player in the global passenger vehicles market.

The passenger vehicles market in the United Kingdom is growing at a CAGR of 8.6%. Growth is driven by rising demand for electric and hybrid vehicles, fuel-efficient cars, and connected vehicle technologies. Government regulations encouraging low-emission vehicles are shaping the adoption of electric and hybrid passenger vehicles. Consumer interest in premium and mid-range models continues to expand, supported by financing options and credit availability. Additionally, British automakers and international brands are investing in research and development to introduce innovative vehicle features, enhancing safety, comfort, and connectivity. Infrastructure improvements, such as the expansion of EV charging networks, are further facilitating market growth.

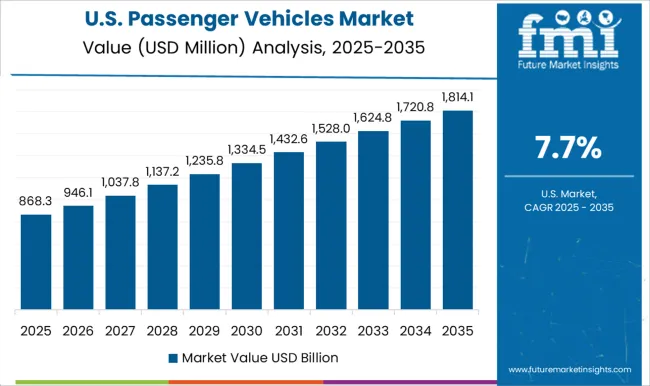

The passenger vehicles market in the United States is growing at a CAGR of 7.7%. The USA market is driven by rising demand for SUVs, pickup trucks, and electric vehicles, along with consumers’ preference for premium and technologically advanced models. Federal and state-level incentives for EV adoption, along with increasing environmental awareness, are encouraging a shift towards electric and hybrid vehicles. Additionally, USA manufacturers are investing heavily in connected vehicle technologies, autonomous driving, and smart mobility solutions, which are enhancing vehicle appeal and performance. Infrastructure development, financing options, and rising disposable incomes are supporting steady growth in passenger vehicle sales.

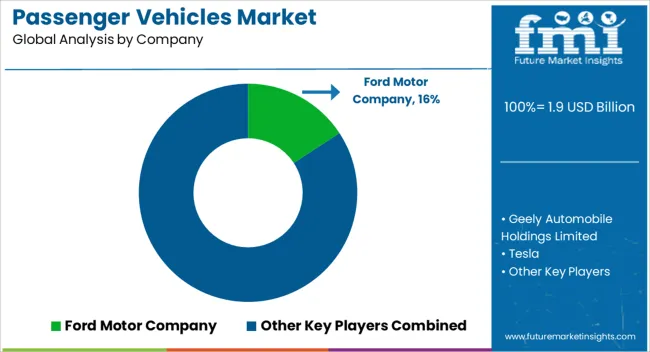

The passenger vehicles market has been experiencing significant transformation driven by changing consumer preferences, environmental regulations, and technological advancements in mobility. Leading automakers such as Ford Motor Company, Geely Automobile Holdings Limited, and Tesla have been at the forefront, introducing vehicles with improved fuel efficiency, electric drivetrains, and advanced safety features. Companies like SAIC Motor Corporation Limited, Kia, and Changan Automobile have been expanding their portfolios with a mix of traditional internal combustion engine (ICE) vehicles and electric vehicles (EVs), responding to increasing global demand for sustainable transportation solutions.

BYD Company Ltd. has strengthened its position through electric vehicle innovation, capturing a growing share of the market, particularly in Asia, where urbanization and rising disposable incomes continue to drive vehicle adoption. The competitive landscape is characterized by aggressive product launches, strategic alliances, and investments in research and development to enhance vehicle performance, connectivity, and autonomy. Manufacturers are also focusing on improving aftersales services and customer experience, contributing to brand loyalty and sustained growth in key markets. The market trajectory is further shaped by government incentives for electric vehicles, stricter emission norms, and the rising popularity of connected and autonomous vehicle technologies. Changan Automotive and SAIC are leveraging these trends by investing in smart vehicle platforms and expanding their EV production capabilities, enabling them to meet evolving regulatory and consumer expectations.

Tesla continues to disrupt the market with its innovative approach, particularly in battery technology, self-driving features, and direct-to-consumer sales models. The passenger vehicles market is projected to witness robust growth over the coming years, fueled by the increasing demand for electric and hybrid vehicles, urban mobility solutions, and the integration of advanced driver-assistance systems. With continuous innovation and market expansion strategies, players like Ford, Geely, and Kia are well-positioned to capitalize on emerging opportunities, ensuring that the passenger vehicles market remains dynamic and highly competitive across global regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Propulsion | ICE, Electric, and Hybrid |

| Vehicle Type | SUV, Hatchback, Sedan, MUV, and Others |

| Application | Personal and Commercial |

| Drive Type | Front-wheel drive, Rear-wheel drive, and All-wheel drive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford Motor Company, Geely Automobile Holdings Limited, Tesla, SAIC Motor Corporation Limited, Kia, Changan Automobile, BYD Company Ltd., Changan Automotive, SAIC, and Tesla |

| Additional Attributes | Dollar sales by vehicle type (sedan, SUV, hatchback, electric, hybrid) and fuel type (petrol, diesel, electric, hybrid) are key metrics. Trends include rising demand for electric and hybrid vehicles, growth in urban mobility, and increasing focus on safety and connectivity features. Regional adoption, regulatory standards, and consumer preferences are driving market growth. |

The global passenger vehicles market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the passenger vehicles market is projected to reach USD 4.4 billion by 2035.

The passenger vehicles market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in passenger vehicles market are ice, _petrol, _cng, _diesel, electric, hybrid, _pcev and _fcev.

In terms of vehicle type, suv segment to command 36.9% share in the passenger vehicles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Car Seat Market Forecast and Outlook 2025 to 2035

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Ferries Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Passenger Security Market Size and Share Forecast Outlook 2025 to 2035

Passenger Tire Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

In Vehicles Payment Market Size and Share Forecast Outlook 2025 to 2035

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vehicles Market Trends – Growth & Forecast 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Finished Vehicles Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA