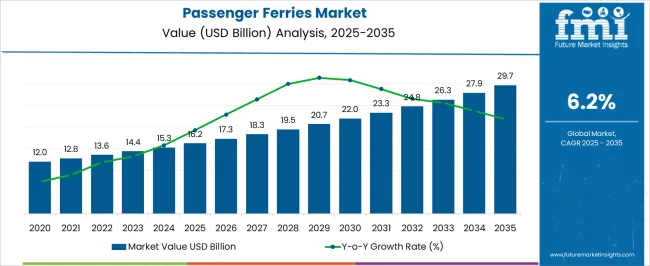

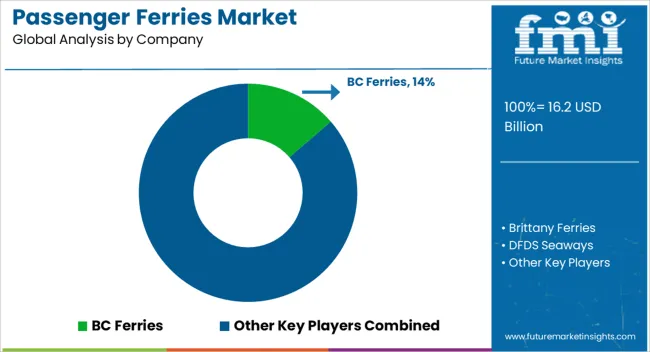

The passenger ferries market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 29.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Growth is driven by increasing urban waterway transport, rising tourism and coastal travel, and the expansion of ferry infrastructure in Europe, the Asia Pacific, and North America. Environmental regulations and fuel efficiency standards are pushing the adoption of electric and hybrid ferries, while advancements in hull design and onboard technology enhance passenger experience and operational efficiency.

Market dynamics indicate a steady upward trajectory over the forecast period. From 2025 to 2028, growth is gradual, supported by fleet replacement in mature markets and moderate expansion in developing regions. Between 2029 and 2032, the market accelerates as coastal tourism, commuter ferry networks, and investment in eco-friendly vessels rise, particularly in the Asia Pacific and Northern Europe.

From 2033 to 2035, growth moderates slightly as early-adopting regions reach higher penetration, with incremental revenue derived from upgrades, retrofits, and premium ferry services. Overall, the USD 13.5 billion opportunity reflects both the expansion of ferry operations in emerging markets and ongoing modernization in established regions, highlighting sustained and consistent growth for the passenger ferries market between 2025 and 2035.

| Metric | Value |

|---|---|

| Passenger Ferries Market Estimated Value in (2025 E) | USD 16.2 billion |

| Passenger Ferries Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The passenger ferries market is driven by five primary parent markets with specific shares. Coastal and intercity transport leads with 40%, providing efficient passenger movement between cities and islands. Tourism and leisure contribute 25%, supporting sightseeing cruises, resort connections, and recreational travel. Urban water transit accounts for 15%, offering ferry services in metropolitan areas to reduce road congestion. Cruise and luxury services represent 10%, targeting premium passenger experiences. Public transportation infrastructure holds 10%, integrating ferries into multimodal transit networks. These parent markets collectively shape global demand, influencing vessel design, capacity, and technological adoption in the passenger ferries market.

Recent developments in the passenger ferries market focus on sustainability, efficiency, and passenger experience. Manufacturers and operators are introducing hybrid and electric ferries to reduce emissions and fuel consumption. Advanced hull designs and lightweight materials are improving speed, stability, and operational efficiency. Digital navigation, automated ticketing, and passenger information systems are enhancing convenience and safety. The expansion of coastal tourism, urban water transport projects, and government initiatives for eco-friendly maritime solutions are driving the adoption of these technologies.

The passenger ferries market is steadily advancing as coastal transport, tourism, and regional connectivity needs rise across developed and emerging economies. Increasing urban congestion, a renewed focus on water-based transportation, and investments in maritime infrastructure have collectively enhanced the role of ferries in the public transport ecosystem.

Government efforts to improve inter-island and cross-border passenger movement have led to fleet modernization and route expansions. Additionally, the integration of passenger comfort features, onboard services, and adherence to safety regulations are improving the appeal of ferry travel.

Despite growing interest in electrification, conventional systems continue to dominate the installed base due to their cost efficiency and compatibility with existing infrastructure. The market is expected to benefit from rising maritime tourism, policy support for sustainable marine mobility, and strategic public-private partnerships aimed at enhancing ferry accessibility and reliability.

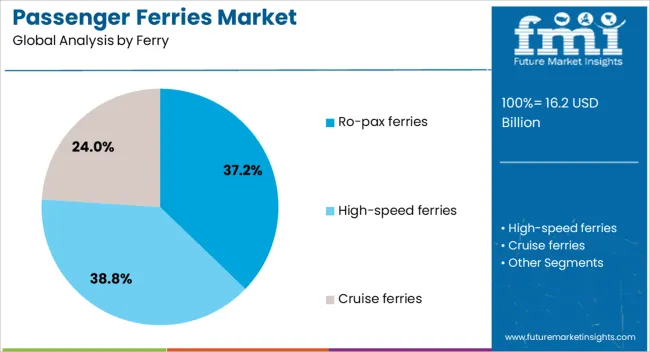

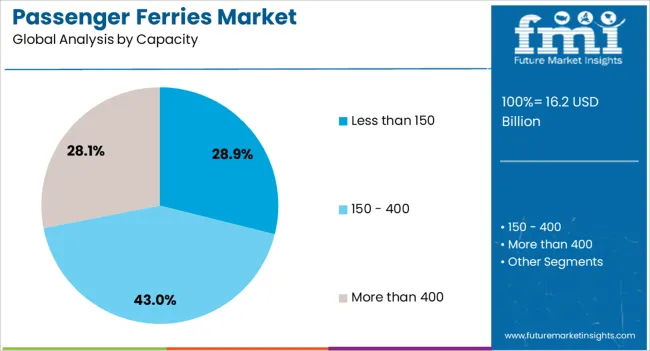

The passenger ferries market is segmented by ferry, capacity, technology, and geographic regions. By ferry, passenger ferries market is divided into Ro-pax ferries, High-speed ferries, and Cruise ferries. In terms of capacity, passenger ferries market is classified into Less than 150, 150 - 400, and More than 400. Based on technology, passenger ferries market is segmented into Conventional diesel-powered ferries, Electric & hybrid ferries, and LNG powered ferries. Regionally, the passenger ferries industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ro-pax ferries segment accounts for 37% of the overall passenger ferries market, driven by its dual capability to transport both passengers and vehicles. These vessels are preferred for their operational flexibility, especially on routes with mixed cargo and commuter needs.

Ro-pax ferries are commonly deployed on regional and cross-border routes where efficiency, capacity, and frequency are critical. Investments in modern hull designs and onboard safety systems have enhanced their performance and regulatory compliance.

The growth of tourism and increasing demand for convenient intermodal transport solutions have reinforced the relevance of this segment. As urban planners and transport authorities seek to improve coastal and island connectivity, the continued use of Ro-pax ferries is expected to rise, particularly in Europe and parts of Asia where multimodal integration is expanding.

Passenger ferries with a capacity of less than 150 represent 29% of the market, reflecting demand for short-haul and low-traffic routes primarily servicing local communities and tourism hotspots. These vessels are valued for their lower operating costs, quick maneuverability, and suitability for narrow waterways or shallow ports.

Their smaller size enables more frequent service intervals, which is essential for commuter-focused ferry operations in dense urban coastal areas. The segment has gained traction due to the rising number of private operators and local government initiatives supporting intra-city maritime transit.

Continued investments in public transport alternatives and the rise of demand-responsive ferry services are expected to support steady growth. This segment remains a practical choice for regions requiring agile, cost-effective transport solutions without the need for large-capacity vessels.

Conventional diesel-powered ferries continue to dominate the technology landscape with a 52% market share, primarily due to their widespread deployment, robust infrastructure compatibility, and lower upfront investment costs. These ferries are favored by operators for their reliable performance on long-distance routes and in regions lacking electric charging or alternative fuel infrastructure.

While environmental concerns and emissions regulations are prompting gradual shifts toward greener propulsion technologies, diesel-powered ferries remain the default option for many existing fleets due to their established supply chains and predictable maintenance requirements. Operators are also retrofitting older vessels with cleaner diesel engines to meet regulatory thresholds without significant capital expenditure.

This segment is expected to maintain dominance in the near term, especially in developing markets where the transition to alternative propulsion remains constrained by budget and infrastructure limitations.

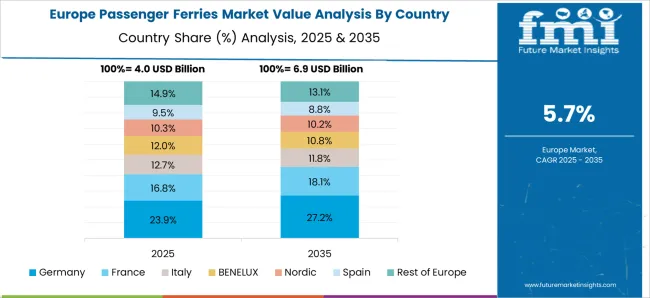

The global passenger ferries market is expanding due to increasing demand for water-based transportation in urban areas, tourism, and intercity travel. Asia Pacific accounts for over 45% of ferry operations, led by China, India, and Indonesia, while Europe and North America focus on high-speed, environmentally friendly vessels. Technological innovations in electric propulsion, hybrid engines, and digital navigation systems are enhancing efficiency and safety. Rising passenger volumes, urban waterway development, and government investment in sustainable maritime transport are creating measurable opportunities for growth worldwide.

The primary driver of the passenger ferries market is growing urbanization and demand for efficient, water-based transportation. High-speed and conventional ferries transport 200–2,000 passengers per trip, reducing road congestion in urban coastal and riverine regions. Asia Pacific growth is fueled by expanding metropolitan waterway networks and tourism activities, while Europe emphasizes hybrid and low-emission ferries to comply with environmental regulations. Increasing adoption of roll-on/roll-off ferries for integrated passenger and vehicle transport improves operational efficiency. Rising intercity and recreational travel, coupled with government investment in port infrastructure and safety protocols, further supports market expansion in commercial and passenger transport sectors.

Opportunities in the passenger ferries market arise from electric and hybrid propulsion technologies, energy-efficient designs, and digital operational systems. North America and Europe are prioritizing ferries with battery or LNG hybrid engines, reducing emissions by 20–30% and operational fuel costs. Asia Pacific presents significant potential due to growing commuter traffic and tourism demand. Integration of automated ticketing, real-time scheduling, and digital fleet management improves service efficiency and passenger satisfaction. Expansion of ferry networks in coastal cities, islands, and riverine regions offers additional growth potential. Manufacturers investing in modular, low-emission, and digitally connected vessels are well-positioned to capture emerging market opportunities globally.

Key trends in the passenger ferries market include high-speed vessels, electric propulsion, and advanced navigation systems. Adoption of ferries with speeds up to 40–50 knots allows rapid intercity and tourist transport, enhancing competitiveness with road and rail networks. Integration of IoT, GPS tracking, and predictive maintenance reduces downtime and improves operational efficiency by 10–15%. Asia Pacific leads adoption due to dense urban coastal regions, while Europe focuses on hybrid and zero-emission ferries to comply with environmental policies. Smart boarding systems, automated ticketing, and digital fleet management are increasingly used, reflecting a trend toward efficient, technologically advanced, and passenger-centric maritime transport solutions globally.

Restraints Limiting Market Growth Due To High Capital Costs And Regulatory Challenges Despite growth, the passenger ferries market faces challenges from high capital investment, operational complexity, and regulatory compliance. Construction costs for high-speed or hybrid ferries range from USD 5 million to USD 50 million per vessel, limiting adoption in smaller markets. Maintenance of propulsion systems, hull integrity, and safety equipment requires skilled labor and specialized facilities. Compliance with environmental regulations, safety standards, and maritime certification varies across regions, creating operational hurdles. Fluctuating fuel prices and port infrastructure limitations may also impact operational efficiency. Manufacturers must focus on cost-effective, energy-efficient, and modular designs to overcome these restraints while supporting global market expansion.

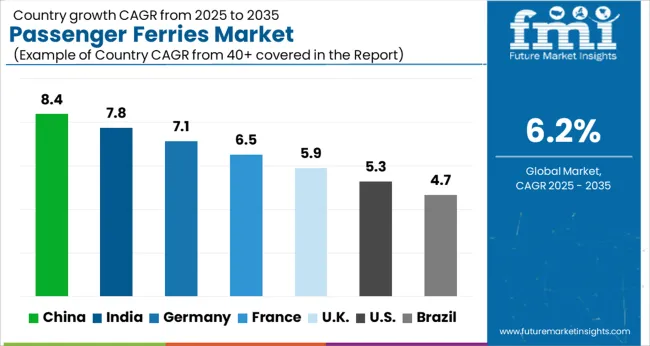

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The passenger ferries market is projected to grow at a global CAGR of 6.2% through 2035, fueled by rising demand for efficient maritime transport, tourism, and intercity connectivity. China leads at 8.4%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion of ferry fleets, urban transport infrastructure, and tourism development. India follows at 7.8%, a 1.26× multiple, reflecting growth in regional transport, coastal connectivity, and commercial ferry services. Germany records 7.1%, a 1.15× multiple, shaped by OECD-backed innovation in vessel efficiency, environmental compliance, and passenger safety. The United Kingdom posts 5.9%, slightly below the global rate, with adoption concentrated in regional ferry operations and tourism. The United States stands at 5.3%, 0.85× the benchmark, with steady uptake in commuter ferry services and coastal transportation. BRICS nations drive the majority of fleet expansion, OECD countries emphasize efficiency and technological upgrades, while ASEAN markets contribute through growing passenger transport networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The passenger ferries market in China is projected to expand at a CAGR of 8.4%, supported by large coastal routes, inland waterways, and island connectivity projects. Strong shipbuilding capacity gives local manufacturers an advantage in producing modern ferries equipped with advanced navigation, fuel efficiency systems, and hybrid-electric propulsion. Rising tourism in coastal regions and island destinations strengthens demand for comfortable passenger movement. Policies aimed at improving maritime transport infrastructure, including green port initiatives, reinforce adoption. Leading companies focus on building large-capacity vessels and electric-powered ferries that meet emission standards. Expansion of ferry terminals and modernization of ports are reshaping the market outlook.

The passenger ferries market in India is forecast to grow at a CAGR of 7.8%, driven by investment in inland water transport, coastal shipping, and island connectivity. Rising demand for cost-effective passenger movement along river systems and inter-island routes has increased government and private operator participation. The Sagarmala program and inland waterways modernization are strengthening infrastructure, while hybrid and solar-powered ferries are gaining momentum. Shipbuilders in India are expanding capabilities to design mid-size ferries with advanced safety features and efficient propulsion. Operators are aligning capacity upgrades with tourism growth in coastal and riverine states. Strong policy support is expected to enhance adoption further.

The passenger ferries market in Germany is set to grow at a CAGR of 7.1%, supported by demand across Baltic Sea routes, river crossings, and short-distance coastal transport. Modernization of ferries with LNG propulsion, electric engines, and digital monitoring systems has become a priority for operators. Shipyards in Germany are building energy-efficient ferries with lightweight materials, optimized hull designs, and advanced navigation. Government-backed climate targets are accelerating the adoption of hybrid-electric ferries, particularly in Northern Germany. Tourism in maritime regions, combined with commuter services, is creating steady demand. The focus remains on replacing aging vessels with high-efficiency, low-emission designs.

The passenger ferries market in the United Kingdom is projected to expand at a CAGR of 5.9%, supported by cross-channel services, island routes, and commuter transport. Operators are investing in ferries with hybrid and alternative fuel propulsion systems to meet emission reduction targets. Upgrades in port facilities and digital ticketing systems enhance operational efficiency. Domestic shipbuilding and refurbishment services are playing an important role in retrofitting existing fleets with energy-efficient technologies. Rising tourism demand in Scotland, Wales, and coastal England is also supporting passenger traffic. Competitive strategies focus on improving customer experience, reliability, and environmental compliance.

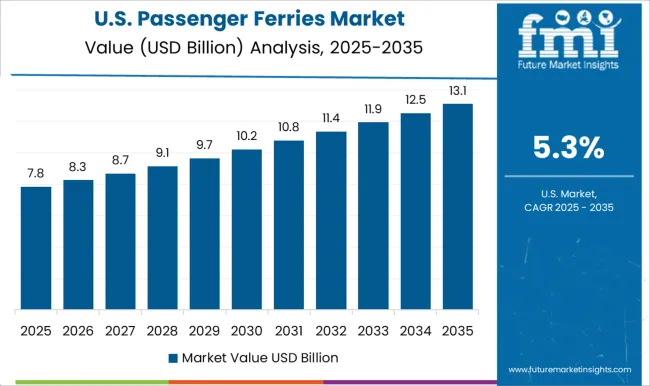

The passenger ferries market in the United States is expected to grow at a CAGR of 5.3%, with demand driven by coastal services, river crossings, and island connections. Key regions such as New York, Washington, California, and Alaska continue to invest in new ferries with hybrid propulsion and advanced safety systems. Government-backed funding programs for sustainable water transport and emission reduction are shaping procurement strategies. Domestic shipbuilders are working on high-speed ferries, commuter services, and electric-powered vessels. Rising commuter traffic in metropolitan areas and tourism-related demand in coastal states support long-term growth. Focus remains on modernizing fleets to improve efficiency and environmental performance.

Competition in the passenger ferries sector is centered on safety, capacity expansion, and fleet modernization to address rising travel demand and inter-island connectivity. BC Ferries operates one of the largest ferry networks in North America, linking remote and urban coastal communities with advanced vessels and sustainable operational practices. Brittany Ferries connects the United Kingdom, France, and Spain, offering passenger and freight services with an emphasis on comfort and maritime reliability. DFDS Seaways is positioned as a strong operator across Northern Europe, with a wide range of passenger and freight routes integrating cross-border mobility.

Irish Ferries focuses on routes between Ireland, the United Kingdom, and continental Europe, operating modern ferries designed to enhance traveler convenience. Jadrolinija, Croatia’s national ferry operator, manages coastal and international routes that support both tourism and local transportation needs, while Minoan Lines, part of the Grimaldi Group, provides essential ferry services across Greece and Italy. P&O Ferries maintains extensive routes across the English Channel, North Sea, and Irish Sea, ensuring high-capacity transport for both passengers and vehicles. Stena Line, one of the largest operators globally, offers advanced ferries with significant capacity and a commitment to operational efficiency. Tallink Grupp plays a crucial role in the Baltic Sea region, integrating tourism and transportation through modern cruise-ferry concepts.

Washington State Ferries, the largest ferry system in the United States, supports regional commuting and tourism, operating a robust fleet designed for daily passenger movement.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.2 Billion |

| Ferry | Ro-pax ferries, High-speed ferries, and Cruise ferries |

| Capacity | Less than 150, 150 - 400, and More than 400 |

| Technology | Conventional diesel-powered ferries, Electric & hybrid ferries, and LNG powered ferries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BC Ferries, Brittany Ferries, DFDS Seaways, Irish Ferries, Jadrolinija, Minoan Lines, P&O Ferries, Stena Line, Tallink Grupp, and Washington State Ferries |

| Additional Attributes | Dollar sales by ferry type and end use, demand dynamics across tourism, urban transport, and inter-island travel, regional trends in coastal and inland waterways, innovation in vessel design, propulsion, and digital ticketing, environmental impact of fuel use and emissions, and emerging use cases in hybrid-electric ferries and sustainable marine transport. |

The global passenger ferries market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the passenger ferries market is projected to reach USD 29.7 billion by 2035.

The passenger ferries market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in passenger ferries market are ro-pax ferries, high-speed ferries and cruise ferries.

In terms of capacity, less than 150 segment to command 28.9% share in the passenger ferries market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Passenger Car Seat Market Forecast and Outlook 2025 to 2035

Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle ADAS Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Passenger Security Market Size and Share Forecast Outlook 2025 to 2035

Passenger Tire Market Size and Share Forecast Outlook 2025 to 2035

Passenger Vessel Propeller Market Size and Share Forecast Outlook 2025 to 2035

Assessing Passenger Boarding Bridge Market Share & Industry Trends

Passenger Car Bearing & Clutch Component Aftermarket Growth – Trends & Forecast 2024-2034

Used Passenger Car Sales Market

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Electric Passenger Car MRO Market Growth – Trends & Forecast 2025 to 2035

Safeguards for Passenger Transfer Area Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA