The safeguards for the passenger transfer area market begin its journey from a USD 3,534.9 million foundation in 2025, setting the stage for substantial expansion ahead. The first half of the decade witnesses steady momentum building, with market value climbing from USD 3,676.3 million in 2026 to USD 4,472.8 million by 2030. This initial phase reflects growing urbanization trends and increasing safety regulations across global transportation networks.

The latter half will witness accelerated growth dynamics, propelling the market from USD 4,651.7 million in 2031 to reach USD 5,232.5 million by 2035. Dollar additions during 2030-2035 outpace the earlier period, with annual increments averaging USD 152.0 million compared to USD 187.6 million in the first phase. This progression represents a 48.0% total value increase over the forecast decade.

Market maturation factors include expanding metro and rail infrastructure projects, increasing focus on passenger safety standards, and smart transportation system integration. The 4.0% compound annual growth rate positions participants to capitalize on USD 1,697.6 million in additional market value creation. This trajectory signals robust opportunities for technology innovators, infrastructure developers, and safety solution providers across the global transportation landscape.

Market expansion unfolds through two distinct growth periods with different competitive characteristics for each phase. The 2025-2030 foundation period delivers USD 937.9 million in value additions, representing 26.5% growth from the baseline. Market dynamics during this phase center on safety technology standardization, infrastructure development acceleration, and regulatory compliance enhancement.

The 2030-2035 acceleration period generates USD 759.7 million in incremental value, reflecting 17.0% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, advanced safety integration strategies, and geographic expansion initiatives. Dollar contributions shift from foundational infrastructure development to smart technology integration and automation advancement.

Competitive landscape evolution progresses from early market development to established safety solution positioning. The first period emphasizes regulatory compliance and infrastructure modernization. The second period witnesses intensified competition for premium technology segments and integrated solution development across railway, metro, airport, and transit applications.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 3,534.9 million |

| Market Forecast (2035) ↑ | USD 5,232.5 million |

| Growth Rate ★ | 4.0% CAGR |

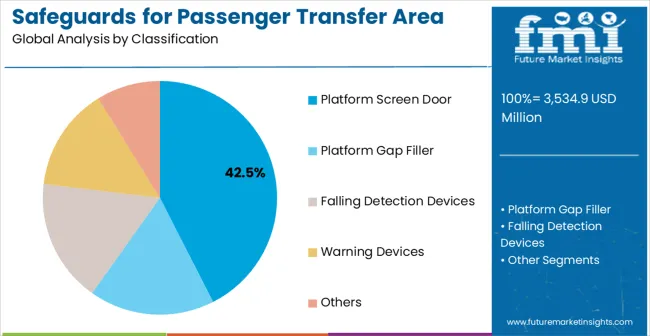

| Leading Segment → | Platform Screen Door |

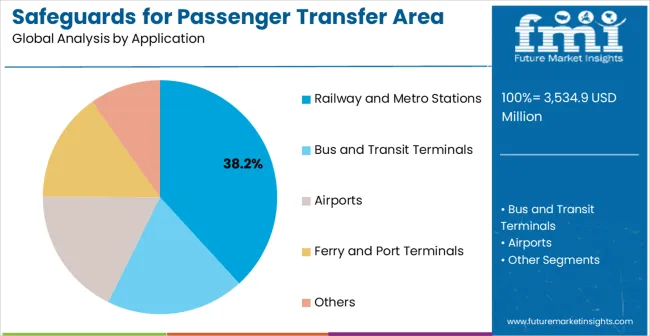

| Primary Application → | Railway and Metro Stations |

Market expansion rests on four fundamental shifts driving transportation safety demand acceleration:

The growth faces headwinds from high implementation costs and complex integration requirements with existing infrastructure. Traditional safety measures maintain cost advantages for smaller transportation facilities. Technical complexity creates adoption barriers for less sophisticated transportation network operations.

Primary Classification: Product Type Distribution

Secondary Breakdown: Application Categories

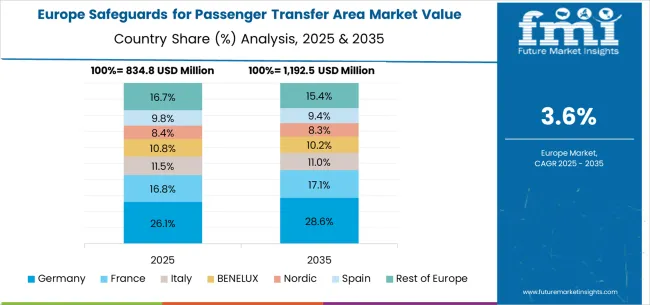

Geographic Segmentation: Regional Market Distribution

Market Position: Platform Screen Door systems establish clear market leadership through comprehensive passenger protection and operational efficiency benefits. Automated barrier systems eliminate platform edge hazards while enabling precise train positioning and passenger flow control. Glass panel configurations provide visual connectivity while maintaining physical separation between platform and track areas.

Value Drivers: Advanced sensor integration enables automated door synchronization with arriving trains and real-time passenger detection capabilities. Climate control benefits include platform temperature regulation and reduced energy consumption through conditioned space separation. Noise reduction features improve passenger comfort while enabling clear audio announcement transmission.

Competitive Advantages: Platform Screen Doors offer complete passenger protection compared to partial barrier alternatives requiring additional safety measures. Integration capabilities enable connection with train control systems for optimized operational coordination. Customizable configurations accommodate various platform layouts and architectural requirements across different transportation facilities.

Market Challenges: High installation costs require significant capital investment compared to traditional platform safety measures. Retrofit applications face technical complexity in integrating with existing infrastructure and operational systems. Maintenance requirements include specialized technical expertise and replacement component availability for operation.

Strategic Market Importance: Railway and metro stations represent the primary demand driver for comprehensive passenger transfer area protection across urban transportation networks. High-volume passenger traffic requires advanced safety systems preventing platform edge incidents and unauthorized track access. Operational efficiency demands necessitate automated passenger flow management during peak travel periods.

Market Dynamics Q&A:

Business Logic: Railway operations prioritize passenger safety and operational efficiency, making comprehensive transfer area protection essential for regulatory compliance and service quality. Automation capabilities reduce staffing requirements while improving safety monitoring and incident response capabilities. Cost justification occurs through accident prevention and insurance premium reduction benefits.

Forward-looking Implications: Autonomous train operations increase precision requirements for platform safety system integration and coordination capabilities. High-speed rail development creates advanced safety system demand for enhanced passenger protection during vehicle operations. Smart transportation initiatives demand connected safety systems enabling centralized monitoring and automated emergency response protocols.

Growth Accelerators

Urbanization acceleration drives metro and railway expansion requiring integrated passenger safety solutions across new transportation infrastructure. Regulatory compliance mandates comprehensive platform protection systems for accident prevention and operational safety standards. Technology advancement enables smart safety system integration with real-time monitoring and automated response capabilities. Passenger experience enhancement initiatives prioritize comfort and security through advanced protection feature implementation.

High capital investment requirements create adoption barriers for smaller transportation operators and budget-constrained public agencies. Technical integration complexity requires specialized expertise and extended implementation timelines for retrofit applications. Maintenance cost considerations include ongoing technical support and component replacement expenses throughout system lifecycle. Infrastructure compatibility challenges limit retrofit application feasibility in existing facilities with space and structural constraints.

IoT integration enables connectivity with transportation management systems for centralized safety monitoring and automated incident response. Sensor technology advancement improves detection accuracy while reducing false alarm rates and operational disruptions. Modular design development facilitates flexible installation configurations, accommodating diverse platform layouts and architectural requirements. Predictive maintenance capabilities utilize data analytics for proactive system optimization and component replacement scheduling.

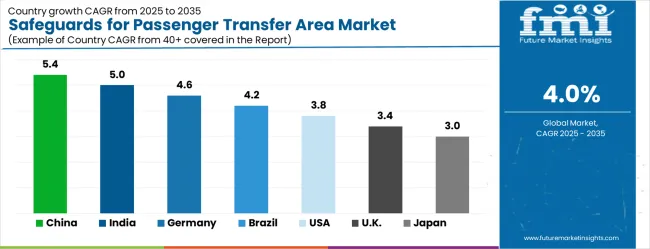

| Country | CAGR (2025- 2035) |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| Brazil | 4.2% |

| USA | 3.8% |

| UK | 3.4% |

| Japan | 3.0% |

Global market dynamics reveal distinct performance tiers reflecting regional transportation development priorities and infrastructure investment levels. Growth Leaders including China (5.4% CAGR) and India (5.0% CAGR) demonstrate aggressive transportation infrastructure expansion with comprehensive safety system integration. Established Markets such as Germany (4.6% CAGR) represent European transportation excellence with advanced safety standard implementation. Steady Performers including Brazil (4.2% CAGR) and the United States (3.8% CAGR) show consistent growth aligned with transportation modernization and urban development requirements. Mature Markets including the United Kingdom (3.4% CAGR) and Japan (3.0% CAGR) display moderate growth rates reflecting established infrastructure with technology upgrade focus.

The safeguards for passenger transfer area market in China are projected to grow at a CAGR of 5.4% from 2025 to 2035. China’s massive investments in metro systems, high-speed rail hubs, and urban transit stations are primary growth drivers for safety infrastructure in transfer areas. With daily passenger volumes in millions across major hubs like Beijing, Shanghai, and Guangzhou, safety barriers, access control systems, fireproof materials, and crowd management solutions are increasingly being deployed. Authorities are adopting smart surveillance, AI-based monitoring, and automated passenger flow controls to enhance safety and efficiency in these high-density spaces. Domestic suppliers are expanding their portfolios with cost-effective yet technologically advanced products, while global suppliers focus on premium systems for international-standard airports and mega stations. Given China’s continued urbanization and large-scale infrastructure development, the safeguards market in transfer areas will witness steady adoption, balancing passenger safety with operational efficiency.

Key drivers include:

The safeguards for passenger transfer area market in India are anticipated to grow at a CAGR of 5.0% between 2025 and 2035. India’s metro projects in Delhi, Mumbai, Bangalore, and Hyderabad, alongside airport expansions, are creating strong demand for passenger safety systems. Safeguards include fire-resistant partitions, glass barriers, platform screen doors, and automated emergency evacuation systems, which are increasingly mandated by regulators. The government’s Smart Cities Mission and heavy investments in public transit modernization further drive adoption of safety-enhancing technologies. Indian suppliers are gradually building capabilities, though advanced systems are still largely imported from Europe and East Asia. Crowd management is a major concern, particularly during peak travel, pushing the need for sensor-enabled flow control and digital signage for safer transfers. Over the forecast period, growth in ongoing infrastructure projects and stronger compliance with international safety norms are expected.

Key drivers include:

The safeguards for passenger transfer area market in Germany are projected to grow at a CAGR of 4.6% from 2025 to 2035. Germany’s extensive intercity rail and metro systems, combined with high passenger throughput at major hubs such as Berlin, Frankfurt, and Munich, necessitate advanced safeguards. Strong emphasis on compliance with EU safety regulations has accelerated adoption of platform screen doors, fire-retardant materials, and integrated access control systems. German engineering firms and global suppliers collaborate to deliver innovative solutions such as biometric-based entry, automated fire suppression, and energy-efficient safety glass. The country’s push for digitalized transport systems also extends to transfer areas, with AI and IoT-enabled safeguards being integrated into infrastructure upgrades. Replacement of outdated safety systems in older stations ensures recurring demand, making Germany a steady and regulated market for passenger transfer area safety solutions.

Key drivers include:

The safeguards for passenger transfer area market in Brazil is forecast to grow at a CAGR of 4.2% from 2025 to 2035. Brazil’s urban mobility projects, especially metro expansions in São Paulo and Rio de Janeiro, are central to growing demand for passenger safety systems. With increasing passenger traffic, safety solutions such as fire-resistant barriers, evacuation signage, crowd flow management systems, and platform screen doors are being adopted gradually. Cost sensitivity and reliance on imports from global suppliers remain challenges. The government is prioritizing infrastructure modernization ahead of international sporting and cultural events, spurring short-term adoption of safety measures. In the long term, Brazil is expected to strengthen local supply chains and establish stronger partnerships with international firms. Steady demand will arise from both new metro projects and upgrades to existing transfer hubs across key cities.

Key drivers include:

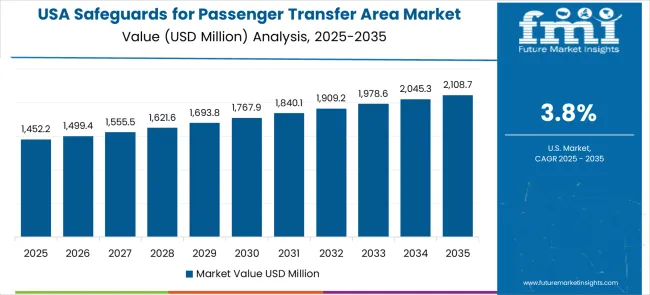

The safeguards for passenger transfer area market in the USA is expected to grow at a CAGR of 3.8% from 2025 to 2035. The country’s airports, metro networks, and commuter rail hubs face increasing passenger volumes, necessitating advanced safety systems. Adoption of platform screen doors, automated fire suppression, access control technologies, and crowd monitoring systems is rising in major cities such as New York, Los Angeles, and Chicago. USA suppliers dominate in surveillance, biometrics, and digital access control, while imports complement with specialized safety glass and platform barriers.

Federal and state-level funding for transportation modernization ensures continued investment in safety infrastructure. The decentralized nature of funding and procurement slows uniform adoption across all regions. Despite this, urban transit and airport modernization projects will steadily support market growth, ensuring ongoing deployment of safeguards in transfer areas.

Key drivers include:

The safeguards for passenger transfer area market in the UK is projected to grow at a CAGR of 3.4% from 2025 to 2035. The country’s urban transit and rail modernization projects, including London Underground upgrades and high-speed rail initiatives, are driving demand for advanced safety systems. Platform screen doors, fire-resistant construction materials, emergency evacuation technologies, and AI-based crowd flow management are becoming more widely adopted.

Compliance with UK safety regulations and alignment with broader European standards ensure steady deployment of safeguards. The UK’s airports, especially Heathrow and Gatwick, are also investing in transfer area safety to enhance passenger experience and operational efficiency. Although market growth is moderate compared to Asia, consistent infrastructure modernization and regulatory enforcement support adoption of advanced safeguards.

Key drivers include:

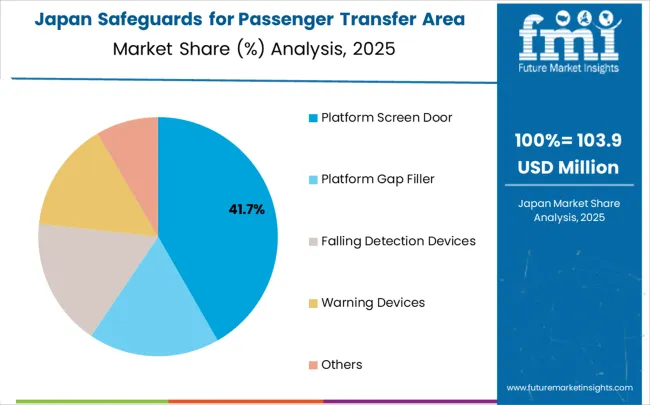

The safeguards for passenger transfer area market in Japan is forecast to grow at a CAGR of 3.0% between 2025 and 2035. Japan’s advanced metro and high-speed rail systems already operate with high safety standards, making the market mature but steadily evolving. The focus is on upgrading existing safeguards with smarter technologies, such as AI-based passenger flow monitoring, advanced fire suppression systems, and smart glass barriers.

High-density transit hubs in Tokyo, Osaka, and Yokohama require sophisticated crowd management systems to prevent congestion and ensure safety. Domestic suppliers are highly advanced, offering innovative and integrated safety solutions, while global suppliers complement with niche technologies. Though growth is relatively slower compared to emerging economies, Japan’s commitment to continuous improvement, precision engineering, and passenger safety ensures steady adoption of next-generation safeguards in transfer areas.

Key drivers include:

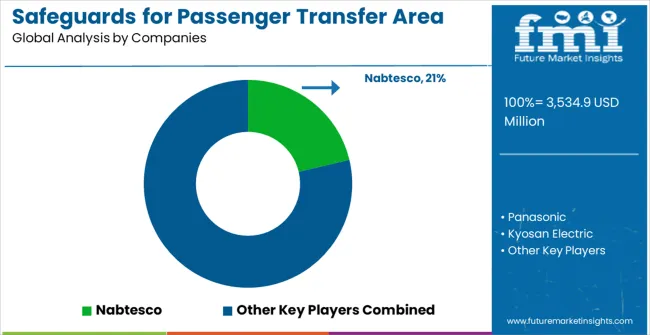

Market structure reflects moderate concentration with established global players maintaining significant positions while specialized technology providers serve specific application segments. Competition emphasizes technological innovation, comprehensive solution integration, and geographic market coverage expansion. Industry dynamics favor companies combining advanced technology development with extensive installation and maintenance service capabilities.

Tier 1 - Global Technology Leaders: Companies like Nabtesco and Panasonic dominate through comprehensive product portfolios, global service networks, and continuous R&D investment in advanced safety technologies. Competitive advantages include established customer relationships, proven installation track records, and integrated solution capabilities spanning multiple transportation applications.

Tier 2 - Specialized Solution Providers: Organizations including Kyosan Electric and Stanley focus on specific technology segments through specialized expertise and targeted market development. Competitive advantages include application-specific knowledge, flexible customization capabilities, and regional market specialization enabling responsive customer service.

Tier 3 - Regional and Integration Specialists: Smaller companies serve local markets through cost-competitive solutions and specialized installation capabilities. Competitive advantages include local market knowledge, flexible project management, and partnership relationships with regional transportation authorities and construction companies.

The passenger transfer area safeguards market is central to public transportation safety, urban mobility efficiency, passenger confidence, and infrastructure resilience. With rapid urbanization, aging transportation networks, and evolving safety regulations, the sector faces pressure to balance comprehensive protection, operational efficiency, and cost-effectiveness. Coordinated action from governments, industry bodies, OEMs/technology players, suppliers, and investors is essential to transition toward smart, integrated, and universally accessible passenger safety systems.

How Governments Could Spur Local Adoption and Infrastructure Development?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate Market Evolution?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 5,232.5 million |

| Product Type | Platform Screen Door, Platform Gap Filler, Falling Detection Devices, Warning Devices, Others |

| Application | Railway and Metro Stations, Bus and Transit Terminals, Airports, Ferry and Port Terminals, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Nabtesco, Panasonic, Kyosan Electric, Stanley, Wabtec, Knorr-Bremse, Gilgen Doors, Portalp Railway, Zhuzhou CRRC, Delkor Rail, SK Polymer, Masats, Alpha Rail, CLEARSY |

| Additional Attributes | Dollar sales by product categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape analysis, adoption patterns across transportation sectors, integration with smart transportation systems, IoT connectivity innovations, predictive maintenance capabilities |

The global safeguards for passenger transfer area market is estimated to be valued at USD 3,534.9 million in 2025.

The market size for the safeguards for passenger transfer area market is projected to reach USD 5,232.5 million by 2035.

The safeguards for passenger transfer area market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in safeguards for passenger transfer area market are platform screen door, platform gap filler, falling detection devices, warning devices and others.

In terms of application, railway and metro stations segment to command 38.2% share in the safeguards for passenger transfer area market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fork Over Stacker Market Size and Share Forecast Outlook 2025 to 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Form Fill Seal Equipment Market by Equipment Type from 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA