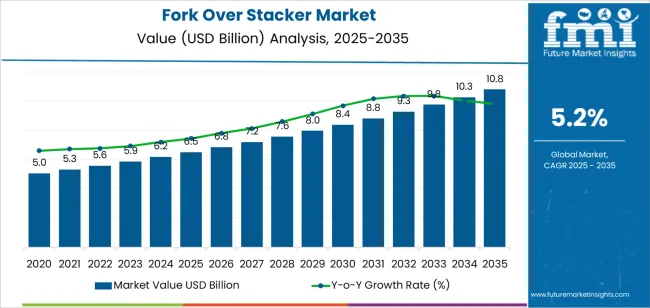

The global fork over stacker market is forecasted to reach USD 10.8 billion by 2035, recording an absolute increase of USD 4.3 billion over the forecast period. The market is valued at USD 6.5 billion in 2025 and is expected to grow at a CAGR of 5.2% over the assessment period. The overall market size is expected to grow by nearly 1.7 times during the same period, supported by increasing demand for material handling efficiency in warehousing operations and logistics centers, driving the adoption of versatile lifting solutions and expanding investments in automated storage facilities and distribution infrastructure globally.

The market expansion reflects growing requirements for flexible material handling capabilities in industrial applications, where forklift over stackers deliver superior load management and operational flexibility compared to conventional handling equipment. Manufacturing facilities across automotive components, consumer goods distribution, and general industrial warehousing are implementing fork over stacker technology to achieve higher storage density and faster material movement cycles. The integration of these specialized material handling units with warehouse management systems enables operators to reduce handling times by 35-50% compared to traditional forklift approaches while maintaining load safety requirements.

The market demonstrates strong momentum across developed and emerging logistics economies, where warehousing industries are transitioning from conventional handling methods to advanced equipment systems that offer superior performance characteristics. Fork over stacker technology addresses critical warehousing challenges including aisle width optimization in high-density storage applications, load stability maintenance during elevated stacking operations, and equipment maneuverability consistency across varied facility layouts.

The e-commerce sector's shift toward rapid fulfillment and dense storage configurations creates sustained demand for handling solutions capable of processing diverse load types, pallet dimensions, and storage heights with minimal operational complexity and consistent performance output. Manufacturing warehouses are adopting fork over stackers for inventory management where vertical space utilization directly impacts facility capacity and operational cost requirements. The technology's ability to handle multiple load configurations with excellent positioning accuracy reduces product damage incidents and accelerates warehouse workflows.

Industrial distribution centers and third-party logistics providers are investing in fork over stacker systems to enhance competitive positioning through improved space utilization metrics and expanded operational capabilities. The integration of advanced power source technologies and optimized mast designs enables these units to achieve lift heights 25-40% greater than conventional systems while maintaining operational stability. Initial capital investment requirements for powered stacker systems and operator training barriers for optimal equipment utilization may pose challenges to market expansion in cost-sensitive warehousing segments and regions with limited access to technical training resources.

Between 2025 and 2030, the fork over stacker market is projected to expand from USD 6.5 billion to USD 8.4 billion, resulting in a value increase of USD 1.9 billion, which represents 43.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for warehouse automation solutions in the e-commerce and manufacturing sectors, product innovation in electric power systems and ergonomic operator interfaces, as well as expanding integration with warehouse management platforms and inventory tracking systems. Companies are establishing competitive positions through investment in advanced mast engineering designs, energy-efficient battery technologies, and strategic market expansion across logistics distribution, manufacturing warehousing, and port terminal handling applications.

From 2030 to 2035, the market is forecast to grow from USD 8.4 billion to USD 10.8 billion, adding another USD 2.4 billion, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized stacker systems, including advanced lithium-ion power configurations and smart connectivity features tailored for specific warehouse environments and load handling requirements, strategic collaborations between material handling equipment manufacturers and warehouse technology providers, and an enhanced focus on operational efficiency and safety enhancement. The growing emphasis on warehouse productivity and space optimization will drive demand for advanced, high-performance fork over stacker solutions across diverse material handling applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.5 billion |

| Market Forecast Value (2035) | USD 10.8 billion |

| Forecast CAGR (2025-2035) | 5.2% |

The fork over stacker market grows by enabling warehouse operators to achieve superior space utilization and material handling productivity while reducing operational costs in high-density storage operations. Warehousing facilities face mounting pressure to maximize storage capacity and throughput efficiency, with fork over stacker systems typically providing 30-45% space savings over conventional wide-aisle forklift configurations, making these specialized units essential for competitive warehouse operations. The e-commerce and manufacturing industries' need for flexible material handling creates demand for advanced stacker solutions that can accommodate varied load dimensions, achieve multiple storage heights, and ensure consistent handling safety across diverse facility layouts and operational volumes.

Warehouse automation initiatives promoting integration with inventory management systems and optimized storage configurations drive adoption in distribution centers, manufacturing facilities, and logistics terminals, where handling efficiency has a direct impact on order fulfillment capacity and operational costs. The global shift toward lean warehousing principles and just-in-time inventory management accelerates fork over stacker demand as logistics facilities seek equipment solutions that minimize footprint requirements and maximize vertical space utilization. Limited operator familiarity with stacker operation techniques and higher equipment costs compared to manual pallet jacks may limit adoption rates among small-scale warehouses and regions with traditional material handling practices and limited training infrastructure.

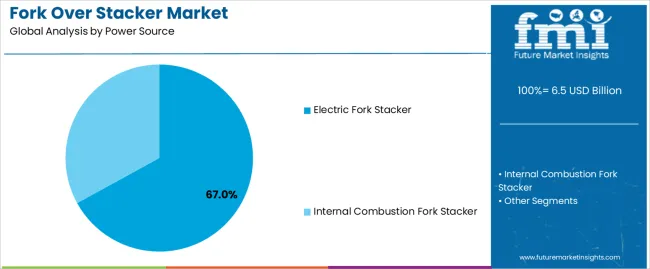

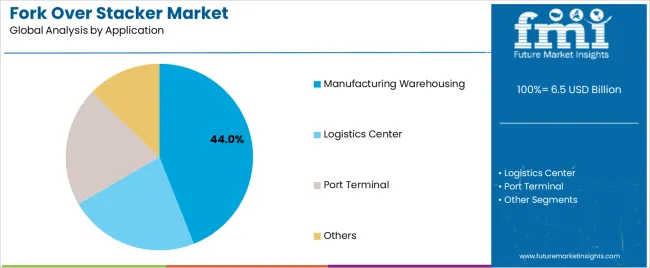

The market is segmented by power source, application, and region. By power source, the market is divided into internal combustion fork stacker and electric fork stacker. Based on application, the market is categorized into manufacturing warehousing, logistics center, port terminal, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

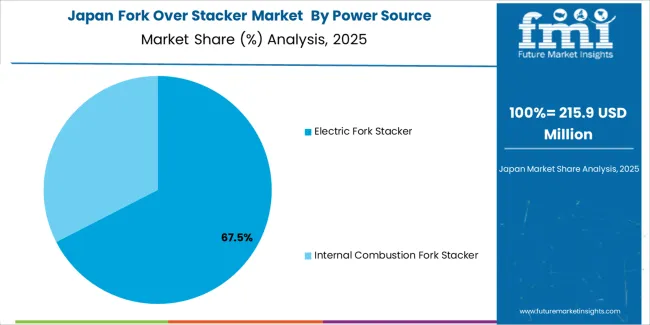

The electric fork stacker segment represents the dominant force in the fork over stacker market, capturing approximately 67% of total market share in 2025. This advanced category encompasses standard battery-powered configurations, lithium-ion variants, and specialized low-emission models optimized for indoor warehouse applications, delivering quiet operation and superior energy efficiency in material handling operations. The electric fork stacker segment's market leadership stems from its zero-emission design architecture, reduced operational costs, and compatibility with standard warehouse environments across distribution centers, manufacturing facilities, and logistics terminals.

The internal combustion fork stacker segment maintains a substantial 33.0% market share, serving operators who require outdoor handling capabilities through gasoline and diesel-powered features, higher load capacities, and specialized designs that accommodate challenging weather conditions and extended operating shifts.

Key advantages driving the electric fork stacker segment include:

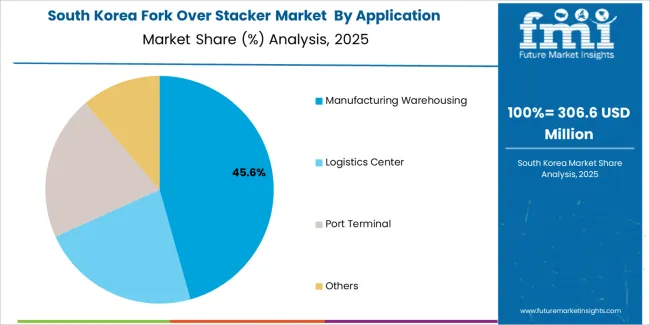

Manufacturing warehousing applications dominate the fork over stacker market with approximately 44% market share in 2025, reflecting the extensive adoption of material handling solutions across automotive component storage, electronics assembly operations, and general industrial inventory management facilities. The manufacturing warehousing segment's market leadership is reinforced by widespread implementation in raw material storage (18.0%), work-in-process handling (15.0%), and finished goods warehousing (11.0%), which provide essential productivity advantages and space optimization in production support environments.

The logistics center segment represents 31.0% market share through specialized applications including distribution hub operations (14.0%), fulfillment center handling (11.0%), and cross-dock facilities (6.0%). Port terminal accounts for 16.0% market share, driven by adoption in container yard operations (8.0%), cargo handling facilities (5.0%), and intermodal transfer operations (3.0%). Other applications constitute 9.0% market share, encompassing retail warehousing, cold storage facilities, and specialized handling requirements.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to warehousing efficiency and operational outcomes. First, e-commerce expansion creates increasing requirements for efficient material handling solutions, with global online retail sales exceeding USD 5 trillion annually in major markets worldwide, requiring reliable fork over stacker systems for order fulfillment, inventory storage, and distribution center operations. Second, warehouse space constraints and rising real estate costs drive adoption of space-saving equipment technology, with fork over stackers improving storage density by 35-45% while reducing aisle width requirements in high-density warehousing environments used extensively across manufacturing and distribution facilities. Third, sustainability initiatives and emission reduction targets accelerate deployment of electric-powered equipment, with fork over stackers integrating seamlessly into green warehouse programs and enabling carbon footprint reduction in material handling operations through zero-emission electric drive systems.

Market restraints include initial investment barriers affecting small-scale warehouse operators and cost-sensitive logistics operations, particularly where manual handling methods remain adequate for less demanding applications and where capital budgets constrain adoption of powered equipment systems. Operator training requirements for safe stacker operation pose adoption challenges for facilities lacking experienced material handling personnel, as fork over stacker performance depends heavily on proper load positioning, lift height management, and equipment maneuvering techniques that vary significantly across warehouse layouts and load characteristics. Limited availability of maintenance support infrastructure in emerging markets creates additional barriers, as warehousing facilities require specialized service technicians, spare parts availability, and troubleshooting expertise to achieve target equipment uptime levels.

Key trends indicate accelerated adoption in Asian logistics hubs, particularly China and India, where e-commerce fulfillment and manufacturing warehousing capabilities are expanding rapidly through government infrastructure programs and foreign direct investment in logistics facilities. Technology advancement trends toward lithium-ion battery systems with faster charging capabilities, integrated telematics for fleet management optimization, and ergonomic operator interfaces with enhanced visibility are driving next-generation product development. The market thesis could face disruption if autonomous mobile robot technologies achieve breakthrough capabilities in handling palletized loads, potentially reducing demand for operator-driven stacker equipment in specific warehousing segments.

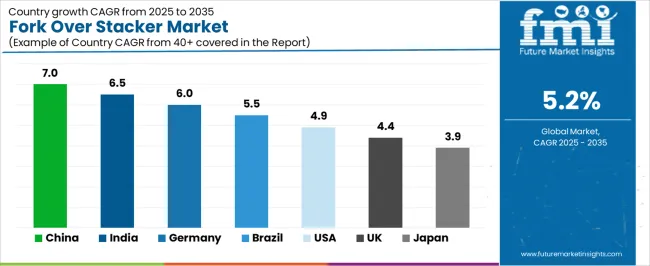

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The fork over stacker market is gaining momentum worldwide, with China taking the lead thanks to aggressive e-commerce expansion and warehouse modernization programs. Close behind, India benefits from growing manufacturing sector investment and government logistics infrastructure initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding distribution networks and retail warehousing infrastructure development strengthen its role in South American logistics supply chains.

The U.S. demonstrates robust growth through advanced warehouse automation initiatives and logistics sector investment, signaling continued adoption in material handling applications. Meanwhile, Japan stands out for its precision warehousing expertise and advanced material handling technology integration, while U.K. and Germany continue to record consistent progress driven by distribution centers and industrial warehousing operations. Together, China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

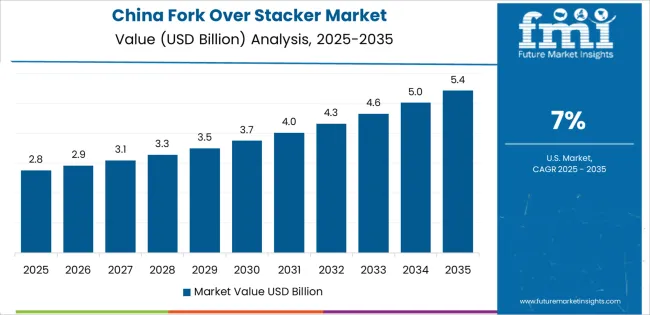

China demonstrates the strongest growth potential in the fork over stacker market with a CAGR of 7.0% through 2035. The country's leadership position stems from comprehensive e-commerce expansion, intensive manufacturing sector development programs, and aggressive logistics infrastructure modernization targets driving adoption of advanced material handling technologies. Growth is concentrated in major logistics regions, including Guangdong, Jiangsu, Zhejiang, and Shanghai, where distribution centers, manufacturing warehouses, and logistics terminals are implementing fork over stacker systems for productivity enhancement and space optimization. Distribution channels through material handling equipment distributors, logistics solution providers, and direct manufacturer relationships expand deployment across e-commerce fulfillment centers, automotive manufacturing facilities, and port terminal operations. The country's logistics development policies provide support for advanced equipment adoption, including subsidies for warehouse automation implementation and material handling technology upgrades.

Key market factors:

In the National Capital Region, Maharashtra, Tamil Nadu, and Gujarat logistics zones, the adoption of fork over stacker systems is accelerating across manufacturing warehousing, distribution centers, and port terminal facilities, driven by Make in India initiatives and increasing focus on logistics competitiveness. The market demonstrates strong growth momentum with a CAGR of 6.5% through 2035, linked to comprehensive e-commerce sector expansion and increasing investment in warehouse automation capabilities. Indian operators are implementing fork over stacker technology and advanced handling equipment to improve operational efficiency while meeting growing throughput requirements in manufacturing and distribution supply chains serving domestic and export markets. The country's logistics infrastructure development programs create sustained demand for advanced material handling solutions, while increasing emphasis on warehouse optimization drives adoption of space-saving equipment systems that enhance storage productivity.

Germany's advanced logistics sector demonstrates sophisticated implementation of fork over stacker systems, with documented case studies showing 30-40% space utilization improvement in distribution center operations through optimized equipment strategies. The country's warehousing infrastructure in major logistics regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Hessen, showcases integration of material handling technologies with existing warehouse management systems, leveraging expertise in automotive logistics and manufacturing supply chain operations. German operators emphasize efficiency standards and process optimization, creating demand for reliable fork over stacker solutions that support productivity commitments and stringent safety requirements. The market maintains strong growth through focus on Industry 4.0 integration and logistics excellence, with a CAGR of 6.0% through 2035.

Key development areas:

The Brazilian market leads in Latin American fork over stacker adoption based on expanding e-commerce operations and growing warehousing infrastructure in major logistics centers. The country shows solid potential with a CAGR of 5.5% through 2035, driven by retail sector investment and increasing domestic demand for efficient material handling across consumer goods distribution, manufacturing warehousing, and logistics terminal operations. Brazilian operators are adopting fork over stacker technology for compliance with warehouse efficiency standards, particularly in distribution center operations requiring space optimization and in manufacturing facilities where handling productivity impacts operational economics. Technology deployment channels through equipment distributors, logistics solution providers, and financing programs expand coverage across retail supply chains and manufacturing warehousing facilities.

Leading market segments:

The US market leads in advanced fork over stacker applications based on integration with sophisticated warehouse management systems and comprehensive automation platforms for enhanced operational efficiency. The country shows solid potential with a CAGR of 4.9% through 2035, driven by e-commerce fulfillment expansion and increasing adoption of advanced material handling technologies across retail distribution, manufacturing warehousing, and third-party logistics operations. American operators are implementing fork over stacker systems for high-productivity handling requirements, particularly in e-commerce fulfillment centers demanding rapid throughput and in manufacturing facilities where space utilization directly impacts facility economics. Technology deployment channels through equipment dealers, logistics integrators, and leasing companies expand coverage across diverse warehousing operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on distribution center operations and retail warehousing, with documented integration of fork over stacker systems achieving 25-35% space utilization improvements in fulfillment operations. The country maintains steady growth momentum with a CAGR of 4.4% through 2035, driven by e-commerce expansion and logistics sector requirements for efficient material handling capabilities in constrained warehouse environments. Major logistics regions, including Midlands, North West England, and South East, showcase deployment of advanced handling technologies that integrate with existing warehouse infrastructure and support throughput requirements in retail and manufacturing supply chains.

Key market characteristics:

Japan's fork over stacker market demonstrates sophisticated implementation focused on manufacturing warehousing and distribution center operations, with documented integration of advanced handling systems achieving 28-32% storage density improvement in precision inventory management operations. The country maintains steady growth momentum with a CAGR of 3.9% through 2035, driven by manufacturing excellence culture and emphasis on warehouse efficiency principles aligned with lean logistics philosophies. Major logistics regions, including Kanto, Kansai, Chubu, and Kyushu, showcase advanced deployment of material handling technologies that integrate seamlessly with warehouse management systems and comprehensive inventory control platforms.

Key market characteristics:

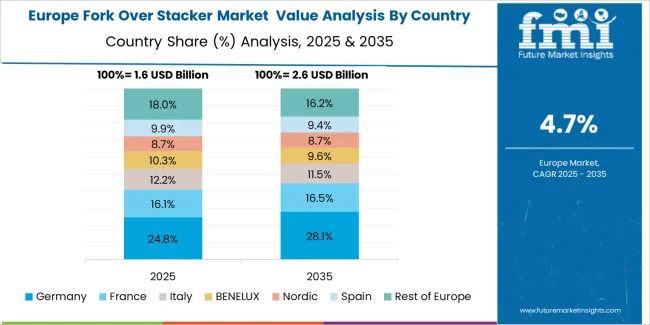

The fork over stacker market in Europe is projected to grow from USD 1,878.8 million in 2025 to USD 3,188.3 million by 2035, registering a CAGR of 5.4% over the forecast period. Germany is expected to maintain its leadership position with a 29.3% market share in 2025, declining slightly to 28.7% by 2035, supported by its extensive logistics infrastructure and major distribution centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg warehousing regions.

France follows with a 19.4% share in 2025, projected to reach 19.7% by 2035, driven by comprehensive distribution center modernization and e-commerce fulfillment programs in major logistics regions. The United Kingdom holds a 16.8% share in 2025, expected to reach 17.1% by 2035 through retail warehousing expansion and logistics center operations. Italy commands a 13.5% share in both 2025 and 2035, backed by manufacturing warehousing and distribution facility operations. Spain accounts for 9.2% in 2025, rising to 9.4% by 2035 on retail distribution growth and logistics sector expansion. The Rest of Europe region is anticipated to hold 11.8% in 2025, expanding to 12.4% by 2035, attributed to increasing fork over stacker adoption in Nordic countries and emerging Central & Eastern European logistics operations.

The Japanese fork over stacker market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of electric-powered stacker systems with existing warehouse automation infrastructure across manufacturing facilities, distribution centers, and logistics terminal operations. Japan's emphasis on operational excellence and process optimization drives demand for material handling equipment that supports efficiency commitments and productivity targets in competitive warehousing environments. The market benefits from strong partnerships between international equipment providers and domestic logistics distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical support and application engineering programs. Logistics centers in Kanto, Kansai, Chubu, and other major warehousing areas showcase advanced material handling implementations where fork over stacker systems achieve 97% equipment uptime through optimized maintenance programs and comprehensive operator training systems.

The South Korean fork over stacker market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and application engineering capabilities for distribution center operations and manufacturing warehousing applications. The market demonstrates increasing emphasis on warehouse automation and productivity enhancement, as Korean operators increasingly demand advanced handling solutions that integrate with domestic warehouse management infrastructure and sophisticated inventory tracking systems deployed across major logistics complexes. Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including operator training programs and application-specific equipment solutions for retail distribution and manufacturing warehousing operations. The competitive landscape shows increasing collaboration between multinational material handling companies and Korean logistics solution specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

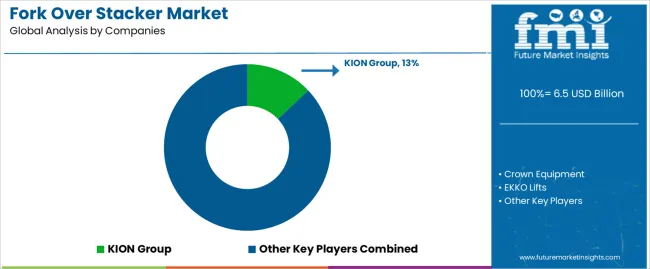

The fork over stacker market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 32-36% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on equipment reliability, operational efficiency, and service support capabilities rather than price competition alone. KION Group leads with approximately 13.0% market share through its comprehensive material handling solutions portfolio and global manufacturing presence.

Market leaders include KION Group, Toyota Material Handling, and Crown Equipment, which maintain competitive advantages through global distribution infrastructure, advanced power system technology, and deep expertise in warehouse application engineering across multiple logistics sectors, creating trust and reliability advantages with distribution center operators and manufacturing warehousing facilities. These companies leverage research and development capabilities in battery technology optimization and ongoing technical support relationships to defend market positions while expanding into emerging logistics markets and specialized application segments.

Challengers encompass Jungheinrich and Hyster-Yale, which compete through specialized product offerings and strong regional presence in key warehousing markets. Product specialists, including Hangcha Group, Anhui Heli, and Doosan Industrial Vehicle, focus on specific equipment configurations or regional markets, offering differentiated capabilities in custom handling solutions, competitive pricing structures, and rapid delivery services.

Regional players and emerging material handling manufacturers create competitive pressure through localized manufacturing advantages and responsive service capabilities, particularly in high-growth markets including China and India, where proximity to logistics hubs provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven equipment performance with comprehensive application engineering offerings that address the complete material handling cycle from warehouse layout optimization through operator training and maintenance support.

Fork over stackers represent advanced material handling solutions that enable warehouse operators to achieve 30-45% space savings compared to conventional wide-aisle equipment, delivering superior storage density and operational flexibility with enhanced vertical reach capability and load positioning accuracy in demanding warehousing applications. With the market projected to grow from USD 6,493.9 million in 2025 to USD 10,781.2 million by 2035 at a 5.2% CAGR, these specialized handling systems offer compelling advantages - space optimization, productivity enhancement, and operational efficiency - making them essential for manufacturing warehousing applications (44.0% market share), logistics center operations (31.0% share), and warehouse facilities seeking alternatives to conventional forklifts that compromise storage density through wider aisle requirements and limited vertical reach capabilities. Scaling market adoption and technology deployment requires coordinated action across logistics policy, warehouse infrastructure development, equipment manufacturers, warehouse operators, and material handling investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 billion |

| Power Source | Internal Combustion Fork Stacker, Electric Fork Stacker |

| Application | Manufacturing Warehousing, Logistics Center, Port Terminal, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Oceaneering International, KION Group, Crown Equipment, EKKO Lifts, Jungheinrich, Toyota Material Handling, Hyster-Yale, Mitsubishi Logisnext, Doosan Industrial Vehicle, Anhui Heli, Hangcha Group, Clark Material Handling, Komatsu |

| Additional Attributes | Dollar sales by power source and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with material handling equipment manufacturers and distribution networks, warehouse facility requirements and specifications, integration with warehouse management systems and inventory tracking platforms, innovations in battery technology and ergonomic design systems, and development of specialized handling solutions with enhanced operational efficiency and safety capabilities. |

The global fork over stacker market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the fork over stacker market is projected to reach USD 10.8 billion by 2035.

The fork over stacker market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in fork over stacker market are electric fork stacker and internal combustion fork stacker.

In terms of application, manufacturing warehousing segment to command 44.0% share in the fork over stacker market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Forklift-Mounted Computers Market

Front forks Market

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Cherry Picker Forklift Market Growth - Trends & Forecast 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

Over-night Hair Treatment Products Market Size and Share Forecast Outlook 2025 to 2035

Over-the-Counter Pain Medication Market Size and Share Forecast Outlook 2025 to 2035

Overload Protection Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Overflow Staffing Services Market Size and Share Forecast Outlook 2025 to 2035

Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Overwrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Over the Top (OTT) Services Market Size and Share Forecast Outlook 2025 to 2035

Overpack Drum Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Overcaps Market Growth - Demand & Trends Forecast 2025 to 2035

Over The Air Engine Control Module Market Growth - Trends & Forecast 2025 to 2035

Market Share Distribution Among Overwrapping Machine Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA