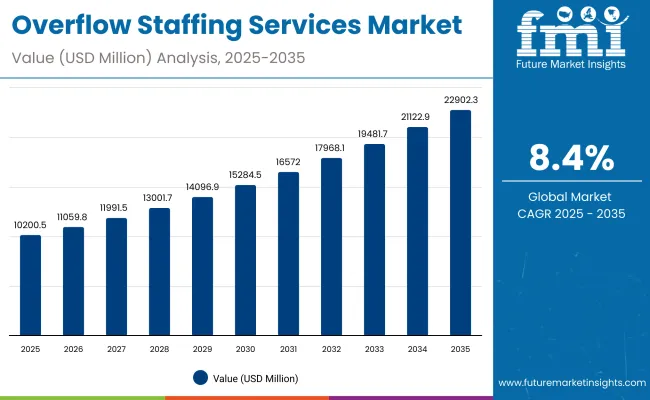

The Overflow Staffing Services Market is expected to record a valuation of USD 10,200.5 million in 2025 and USD 22,902.3 million in 2035, with an increase of USD 12,701.8 million, which equals a growth of approximately 124.5% over the decade. The overall expansion represents a CAGR of 8.4% and more than a 2X increase in market size.

Overflow Staffing Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 10,200.5 million |

| Market Forecast Value in (2035F) | USD 22,902.3 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

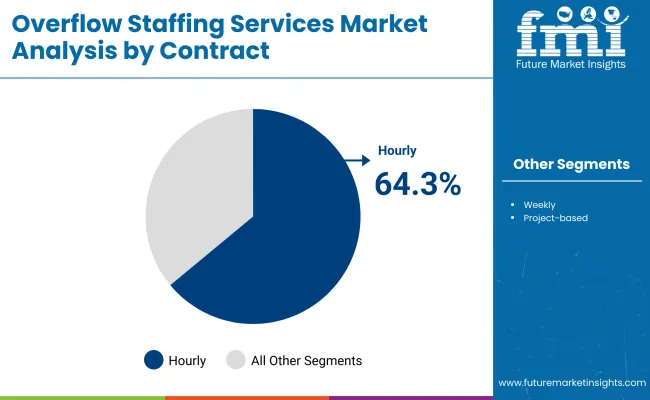

During the first five-year period from 2025 to 2030, the market increases from USD 10,200.5 million to USD 15,284.5 million, adding USD 5,084 million, which accounts for 40% of the total decade growth. This phase records steady adoption of on-demand workforce models, particularly in logistics, retail, and IT services, driven by labor flexibility and cost control. Hourly contracts dominate this period, comprising 64.3% of market value in 2025, due to their suitability for short-term and surge staffing needs.

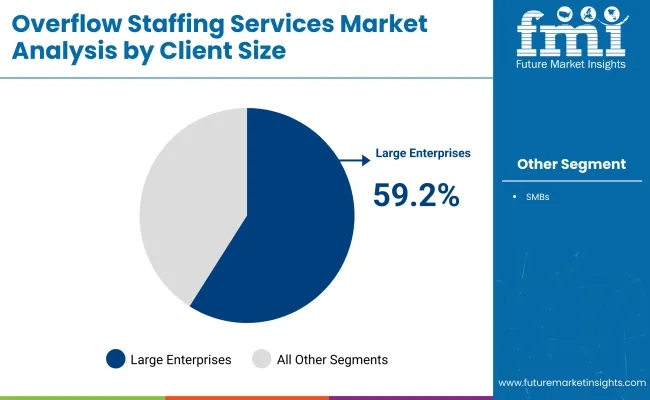

The second half from 2030 to 2035 contributes USD 7,617.8 million, equal to 60% of total growth, as the market jumps from USD 15,284.5 million to USD 22,902.3 million. This acceleration is powered by the rising integration of automation in workforce management, AI-driven staff scheduling, and remote staffing platforms. Large enterprises increasingly rely on hybrid staffing solutions, pushing their share to over 59% by the end of the decade. Value-added services and digital workforce platforms expand recurring revenue streams, contributing to a more service-centric revenue mix.

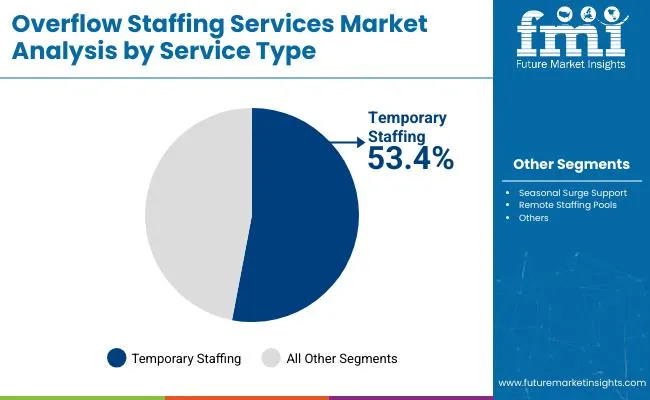

From 2020 to 2024, the Overflow Staffing Services Market saw steady expansion as companies increasingly adopted flexible hiring models to manage fluctuating labor needs. Although detailed pre-2025 values are not shown, the 2025 baseline of USD 10.2 billion reflects strong pent-up demand and structural changes in workforce strategies post-COVID-19. During this period, the market was led by major staffing providers like Adecco, Randstad, and Manpower Group, with temporary staffing accounting for over half (53.4%) of total market revenue. Competitive differentiation was driven by speed of talent deployment, scalability, and sector specialization, particularly in logistics, healthcare, and IT.

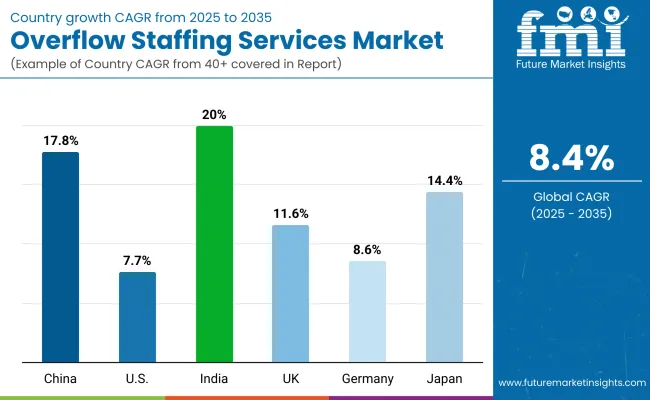

By 2025, demand is accelerating due to the rise of gig platforms, on-demand staffing pools, and remote-ready workforce solutions. While traditional players maintain leadership, they face growing competition from tech-driven staffing platforms and workforce automation providers. Companies are shifting toward hybrid staffing models, blending hourly and project-based contracts, with a growing emphasis on data-driven workforce planning. Asia-Pacific emerges as the fastest-growing region, led by India (20.0% CAGR) and China (17.8% CAGR), driven by large enterprise demand and digital workforce transformation. Meanwhile, North America and Europe continue to represent mature, high-value markets with strong adoption across healthcare, IT, and logistics sectors.

The rapid growth of e-commerce and omni-channel retail has created unpredictable fluctuations in demand for labor, especially in warehousing, order fulfillment, and last-mile delivery. Overflow staffing services enable logistics companies to quickly scale their workforce during peak seasons and special sales events without long-term commitments. This flexibility reduces operational costs and mitigates risks associated with labor shortages, driving the increased adoption of temporary and surge staffing solutions in the sector.

Advancements in digital workforce management platforms and AI-powered talent matching have revolutionized how companies source and manage overflow staff. Remote staffing pools now allow enterprises to tap into geographically dispersed talent on demand, supporting business continuity and reducing dependency on local labor markets. Hybrid workforce models that blend onsite and remote staff provide companies with greater agility, especially in IT and back-office functions, significantly fueling the growth of overflow staffing services.

The Overflow Staffing Services Market is segmented by service type, industry, client size, contract type, and region. Service types include temporary staffing, seasonal surge support, and remote staffing pools, with temporary staffing leading due to demand for flexible short-term labor. Key industries served are retail & e-commerce, healthcare, logistics, IT & back office, and events, reflecting diverse workforce needs across sectors. Large enterprises hold a dominant share in client size, though SMBs are increasingly adopting overflow staffing. Contract types span hourly, weekly, and project-based engagements, with hourly contracts prevailing for immediate labor flexibility. Regionally, North America remains a mature market, Asia-Pacific leads in growth driven by India and China, and Europe continues steady expansion supported by robust staffing infrastructures.

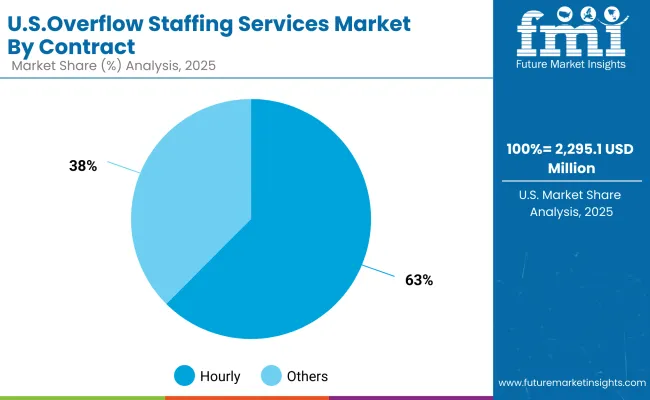

| Contract | Value Share% 2025 |

|---|---|

| Hourly | 64.3% |

| Others | 35.7% |

Hourly contracts are projected to account for 64.3% of the Overflow Staffing Services Market revenue, establishing themselves as the dominant contract type. This preference is driven by businesses' need for flexible, short-term labor solutions that allow rapid workforce scaling to meet fluctuating demands across industries such as logistics, retail, and healthcare. Hourly contracts offer employers agility in managing peak workloads without long-term commitments.

The growth of the hourly contract segment is further supported by the increasing adoption of digital workforce platforms, enabling efficient scheduling and real-time management of temporary staff. Meanwhile, other contract types, including weekly and project-based engagements, are gaining traction as companies look to optimize staffing strategies for longer-term and specialized projects. Overall, hourly contracts will continue to be the backbone of overflow staffing services, reflecting market priorities for flexibility and responsiveness.

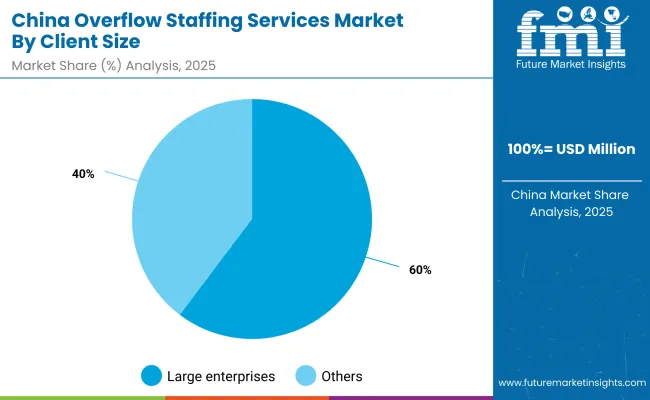

| Client Size | Value Share% 2025 |

|---|---|

| Large enterprises | 59.2% |

| Others | 40.8% |

Large enterprises are projected to hold 59.2% of the Overflow Staffing Services Market share, driving the majority of demand for overflow staffing solutions. These organizations require scalable and flexible workforce solutions to manage complex operations across multiple locations, often facing fluctuating labor needs in sectors like logistics, healthcare, and IT services. Large enterprises benefit from established partnerships with staffing providers that can rapidly deploy skilled temporary workers at scale.

The significant market share held by large enterprises is supported by their increasing adoption of hybrid workforce models, combining permanent staff with flexible temporary and remote workers to optimize costs and agility. Meanwhile, small and medium-sized businesses (SMBs) continue to grow their adoption rates, but large enterprises remain the primary market drivers due to their volume and operational complexity.

| Service Type | Value Share% 2025 |

|---|---|

| Temporary staffing | 53.4% |

| Others | 46.6% |

Temporary staffing is projected to hold 53.4% of the Overflow Staffing Services Market revenue, making it the leading service type segment. This dominance is driven by organizations’ increasing reliance on temporary workers to address short-term labor needs, seasonal demand spikes, and project-specific workforce requirements. Temporary staffing provides companies with the flexibility to scale their labor force quickly without the long-term obligations associated with permanent hires.

The preference for temporary staffing is especially strong in industries such as retail, logistics, and healthcare, where demand volatility and rapid response times are critical. Meanwhile, other service types, including seasonal surge support and remote staffing pools, are growing as businesses seek more diversified and agile workforce solutions to meet evolving operational challenges.

Rising Demand for Flexible Labor in Seasonal and Peak Periods

The growing unpredictability of consumer demand, especially in retail, logistics, and healthcare sectors, is driving the need for flexible labor solutions. Overflow staffing services allow companies to swiftly scale their workforce during seasonal surges, promotional events, and unexpected demand spikes without the burden of permanent hiring. This flexibility helps optimize labor costs and maintain service levels, making temporary staffing an essential strategy for businesses aiming to stay agile in volatile markets.

Advancements in Digital Workforce Management Technologies

The adoption of AI-powered talent platforms, cloud-based scheduling, and remote staffing tools is revolutionizing the overflow staffing landscape. These technologies enable efficient candidate matching, real-time workforce tracking, and seamless integration of remote and onsite labor pools. By enhancing operational efficiency and reducing time-to-hire, digital platforms empower organizations to deploy overflow staff quickly and cost-effectively, fostering broader acceptance of overflow staffing services across industries like IT, healthcare, and manufacturing.

Restraint: Regulatory and Compliance Challenges Across Geographies

Stringent and often inconsistent labor regulations present a significant hurdle for overflow staffing providers. Variations in worker classification laws, minimum wage standards, and contractual obligations increase the complexity and cost of compliance. This regulatory uncertainty can delay staffing deployments, discourage flexible workforce arrangements, and limit market penetration in regions with rigid labor laws. Consequently, companies may be hesitant to fully leverage overflow staffing, restraining market growth and innovation in certain markets.

Trend: Emergence of Hybrid Workforce Models Integrating Onsite and Remote Staff

Organizations are increasingly adopting hybrid workforce models that blend temporary onsite workers with remote and project-based staff. This approach addresses both immediate labor shortages and long-term skill gaps, enhancing operational agility and workforce resilience. Enabled by digital collaboration tools and flexible contract structures, hybrid staffing supports diverse work preferences and geographic dispersal. As a result, companies can optimize costs, improve productivity, and better respond to fluctuating business demands, driving broader acceptance of overflow staffing solutions.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.8% |

| USA | 7.7% |

| India | 20.0% |

| UK | 11.6% |

| Germany | 8.6% |

| Japan | 14.4% |

The Overflow Staffing Services Market is set to witness diverse growth rates across key regions over the next decade. India is forecasted to lead with the highest CAGR of 20.0%, driven by rapid industrialization and an expanding service sector demanding flexible workforce solutions. China follows closely at 17.8%, supported by digital transformation initiatives and growing e-commerce logistics. Japan (14.4%) and the UK (11.6%) also show strong growth, propelled by technological adoption and evolving labor models. Germany and the U.S. display moderate growth at 8.6% and 7.7%, respectively, reflecting mature markets with steady demand for overflow staffing services.

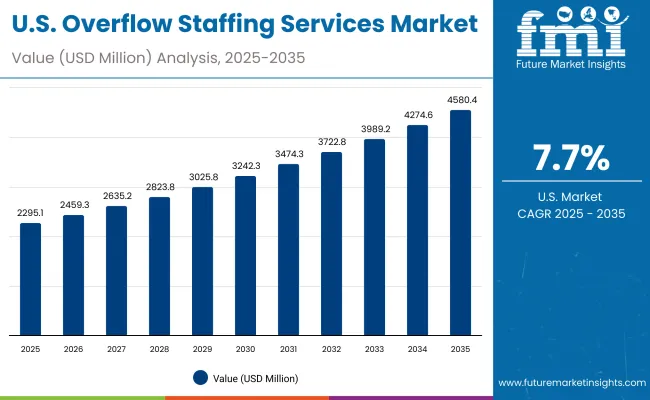

| Year | USA Overflow Staffing Services Market (USD Million) |

|---|---|

| 2025 | 2295.11 |

| 2026 | 2459.32 |

| 2027 | 2635.27 |

| 2028 | 2823.81 |

| 2029 | 3025.84 |

| 2030 | 3242.32 |

| 2031 | 3474.30 |

| 2032 | 3722.87 |

| 2033 | 3989.22 |

| 2034 | 4274.63 |

| 2035 | 4580.46 |

The U.S. Overflow Staffing Services Market is projected to nearly double in value, growing from USD 2,295.11 million in 2025 to USD 4,580.46 million by 2035. This growth is driven by rising demand for flexible and specialized workforce solutions across technology-driven and high-precision industries such as aerospace, automotive, and defense. Companies increasingly rely on overflow staffing to handle project surges, maintain operational efficiency, and meet tight deadlines.

Healthcare, particularly hospitals and dental laboratories, represents a growing segment, with temporary staffing solutions helping manage fluctuating workloads efficiently. Additionally, the IT, entertainment, and education sectors are leveraging skilled temporary staff for short-term projects and digital modeling initiatives, creating new opportunities for overflow staffing providers.

The trend toward integrated service models, where staffing providers bundle personnel with training, technology support, or project management services, is encouraging closer collaboration between staffing firms and client organizations, optimizing workforce utilization and operational outcomes.

The Overflow Staffing Services Market in the United Kingdom is expected to grow at a CAGR of 11.6%, supported by rising demand across engineering design, advanced manufacturing, and project-based industries requiring flexible workforce solutions. Motorsport and automotive engineering firms are increasingly leveraging overflow staffing to manage prototype development, testing, and race-part validation efficiently. Cultural institutions, museums, and heritage organizations are using temporary skilled staff for digitization and preservation projects. In retail and e-commerce, temporary talent is being deployed for AR-based design, virtual try-ons, and product visualization projects. Support from government innovation programs, public-private partnerships, and academic collaborations continues to drive enterprise and public-sector adoption of flexible staffing models.

India is witnessing rapid growth in the Overflow Staffing Services Market, which is forecast to expand at a CAGR of 20.0% through 2035. Growth is being driven by increased adoption across tier-2 and tier-3 cities due to cost efficiencies and rising awareness among MSMEs. Automotive suppliers are leveraging temporary skilled staff to validate component geometry and ensure alignment of CAD files with production processes. Educational institutes and vocational centers are incorporating scanning technologies into digital manufacturing and workforce training programs. Public infrastructure and archaeology departments are also investing in 3D scans for digital documentation of national monuments and historic sites.

The Overflow Staffing Services Market in China is expected to grow at a CAGR of 17.8%, the highest among leading economies. This strong growth is driven by smart factory implementations, city modeling programs, and competitive innovation from domestic technology firms. Industrial demand for automated inspection, rapid prototyping, and specialized project staffing has surged across electronics and automotive sectors. Municipal governments are increasingly leveraging skilled temporary staff for LiDAR-based city modeling, digital twin creation, and infrastructure planning. Affordable local solutions are also enabling widespread adoption of staffing for technology-driven projects in education, fashion, and e-commerce. Cross-sector digitization continues to be a primary growth driver.

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.5% |

| UK | 8.0% |

| India | 4.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.6% |

| China | 12.2% |

| Japan | 7.9% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 5.6% |

The Overflow Staffing Services Market in Germany is projected to grow at a CAGR of 8.6, driven by the country’s leadership in precision engineering, industrial automation, and high-end manufacturing. Factory floors are increasingly integrating skilled temporary staff to manage inline 3D scanning operations paired with robotic arms for dimensional inspection and live quality assurance monitoring. CNC workshops are utilizing structured light scanning specialists to validate complex geometries during milling and production processes. Dental and orthopedic laboratories are hiring skilled staff to implement digital modeling using intraoral and handheld scanners. Compliance with EU manufacturing standards, along with the rising emphasis on sustainable prototyping, continues to fuel the demand for specialized overflow staffing in traditional and additive manufacturing sectors.

| USA by Contract | Value Share% 2025 |

|---|---|

| Hourly | 62.5% |

| Others | 37.5% |

The Overflow Staffing Services Market in the United States is projected at USD 2,295.11 million in 2025. Temporary staffing for high-skill roles dominates, with hourly contracts accounting for 62.5% of the market, reflecting demand for flexible, project-based workforce solutions. Specialized staffing services are increasingly bundled with digital platforms, training, and workflow integration, highlighting a shift toward value-added, data-driven workforce solutions.

Growth is fueled by industries such as aerospace, automotive, and IT, where continuous data modeling, digital twin implementation, and AI-driven predictive analytics require temporary deployment of skilled personnel. Companies are prioritizing seamless integration of project staff into digital workflows, enabling faster ramp-up times, enhanced productivity, and reduced operational risk.

| China by Client Size | Value Share% 2025 |

|---|---|

| Large enterprises | 60.3% |

| Others | 39.7% |

The Overflow Staffing Services Market in China is projected to see strong growth in 2025, driven primarily by large enterprises, which account for 60.3% of the market. These companies require specialized temporary staff to manage high-volume, technology-intensive projects in sectors such as electronics, automotive, and advanced manufacturing. Short-term staffing solutions enable rapid scale-up for prototyping, production line optimization, and quality assurance workflows.

Smaller firms are increasingly adopting skilled overflow staffing for flexible project execution, particularly in emerging sectors like e-commerce, education, and smart city initiatives. The combination of government incentives, local talent availability, and competitive pricing from domestic providers supports widespread adoption across client segments.

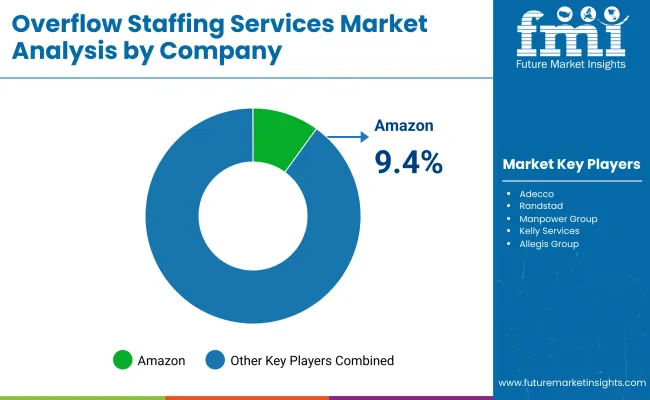

The Overflow Staffing Services Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across multiple industries. The top 10 players Adecco, Randstad, ManpowerGroup, Kelly Services, Allegis Group, TrueBlue, Robert Half, Express Employment, Hays, and Aerotek hold significant market presence, offering specialized temporary staffing solutions for high-demand sectors such as automotive, aerospace, healthcare, and IT.

These companies focus on delivering flexible workforce solutions, project-based talent deployment, and value-added services, including training, digital workflow integration, and workforce analytics. Mid-sized and specialized providers complement these offerings by catering to niche industries, regional markets, or highly skilled temporary roles.

Competitive differentiation is increasingly shifting from simply providing personnel to offering integrated staffing ecosystems, combining predictive analytics, AR/VR-enabled training, digital workflow support, and subscription-based talent services to enhance client outcomes.

Key Developments in Overflow Staffing Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 10,200.5 Million |

| Service Type | Temporary staffing, Seasonal surge support, Remote staffing pools |

| Industry | Retail & e-commerce, Healthcare, Logistics, IT & back office, Events |

| Client Size | SMBs, Large enterprises |

| Contract | Hourly, Weekly, Project-based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adecco, Randstad, Manpower Group, Kelly Services, Allegis Group, TrueBlue, Robert Half, Express Employment, Hays, Aerotek |

| Additional Attributes | Dollar revenue by service type and industry vertical, adoption trends in temporary and project-based staffing, rising demand for remote and hybrid workforce solutions, sector-specific growth in IT, healthcare, automotive, retail, and logistics, revenue segmentation by contract type (hourly, weekly, project-based), integration with digital workforce management platforms and AI-driven staffing analytics, regional trends influenced by labor regulations and digitization initiatives, and innovations in workforce optimization, skill-based deployment, and flexible staffing models. |

The global Overflow Staffing Services Market is estimated to be valued at USD 2,295.11 million in 2025.

The market size for the Overflow Staffing Services Market is projected to reach USD 4,580.46 million by 2035.

The Overflow Staffing Services Market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in Overflow Staffing Services Market are Temporary staffing, Seasonal surge support, Remote staffing pools.

In terms of client size, Large enterprises will command 59.2% share in the Overflow Staffing Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Staffing Software Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

AI-Driven BFSI Staffing – Optimizing Hiring & Workforce Growth

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Podiatry Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catering Services Market Analysis by Service Type, Application and End User and Region Through 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA